-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: A COVID-Filled Winter Beckons

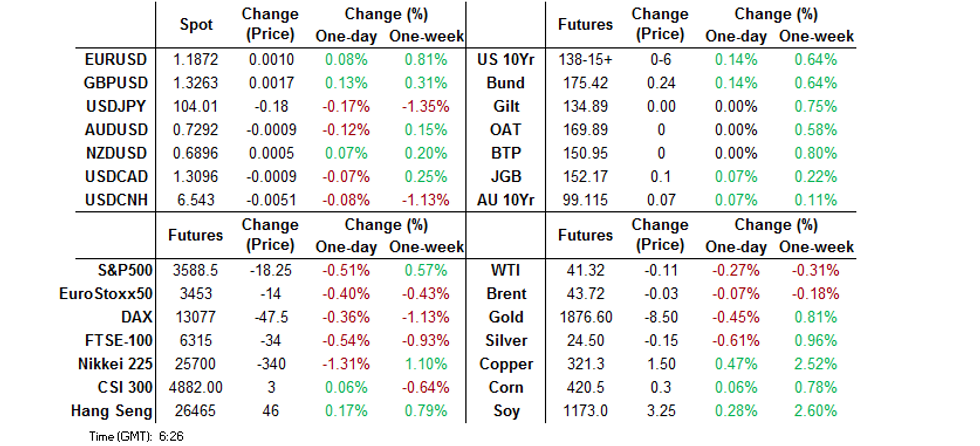

- Equities mixed, bonds firm with global COVID matters dominating headline flow, offsetting vaccine hopes.

- DXY edges lower with USD/CNH hitting another fresh multi-year low.

- Brexit mood music continues to sound positive, but no decisive breakthrough seen yet.

BOND SUMMARY: Cash Flow & COVID Eyed

T-Notes nudged higher during Asia-Pac hours, last +0-05 at 138-14+, through Tuesday's best levels. Cash Tsys saw some light bull flattening, with yields sitting unchanged to ~2.0bp richer across the curve, building on the momentum seen on Tuesday. President Trump continued to provide election-related unrest and fired the Director of the Cybersecurity and Infrastructure Security Agency from his post on election related matters. Flow-wise 40.0K of FVF1 126.00 call sales were quasi-hedged via 10.0K of TYZ0 lifts, split across 2 block trades. Eurodollar futures sit unchanged to +0.5 through the reds, with a flurry (~19.0K) of EDZ0 sales noted at 99.750.

- JGB futures held a tight range during Tokyo dealing. The long end has outperformed in cash JGB trade (receiving in 30+ Year swaps seemingly helped), even with a slightly weaker than prior 20-Year JGB offering, which saw the cover ratio nudge lower and price tail edge wider. The cover ratio represented the lowest such reading seen at a 20-Year auction since April's 20-Year offering. Still, the low price topped dealer expectations (proxied by the BBG dealer poll). Local COVID matters were front and centre, which outweighed the aforementioned supply matters, with Tokyo reporting a record uptick in new COVID cases. Elsewhere, the Nikkei reported that the Tokyo Metropolitan Government is making final arrangements to raise its alert to the highest of four levels to warn the coronavirus is spreading. Another Nikkei report suggested that Japan's ruling government is considering a plan to spend a combined Y12tn in five years from FY21 for "disaster-proof infrastructure." Japanese Finance Minister Aso later noted that the country will continue to target a balanced budget by the end of FY25.

- The dynamic in U.S. Tsys and earlier flagged "pause" (social restrictions) implemented in South Australia on the back of the local COVID situation has provided some support for the Aussie bond space in a fairly lacklustre Sydney session, allowing the overnight flattening impetus to extend at the margin. YM finished +1.0, with XM +7.0.As we have flagged previously, ACGB cash flow dynamics were likely supportive given the impending coupon/maturity schedule and the fact that the AOFM's A$6.0bn tap of ACGB May '41 has now passed.

FOREX: Calm & Cautious

The Asia-Pac session was calm, dominated by a moderate sense of caution. AUD was the worst G10 performer, albeit trailing its peers from the basket by relatively narrow margins. RBA Gov Lowe offered little in the way of fresh insight in his latest address, as he warned against uneven economic recovery. AUD/JPY ground lower printing a one-week trough and threatening to attack its100-DMA, but backed off before testing that moving average. Sales in AUD/NZD helped the pair move closer to its recent cycle low, but stabilised seeing the key level ~25 pips away. JPY firmed up a tad, with USD/JPY shedding a handful of pips into the Tokyo fix.

- The redback touched best levels against the greenback in more than two years. USD/CNH edged higher after a slightly weaker than expected PBoC fix, but then turned its tail and dipped to fresh session lows.

- USD/KRW inched lower later in the session, despite a worrying acceleration in the spread of new Covid-19 infections in South Korea. The rate tested the round figure of KRW1,105.00, virtually coinciding with the low print of Dec 4, 2018.

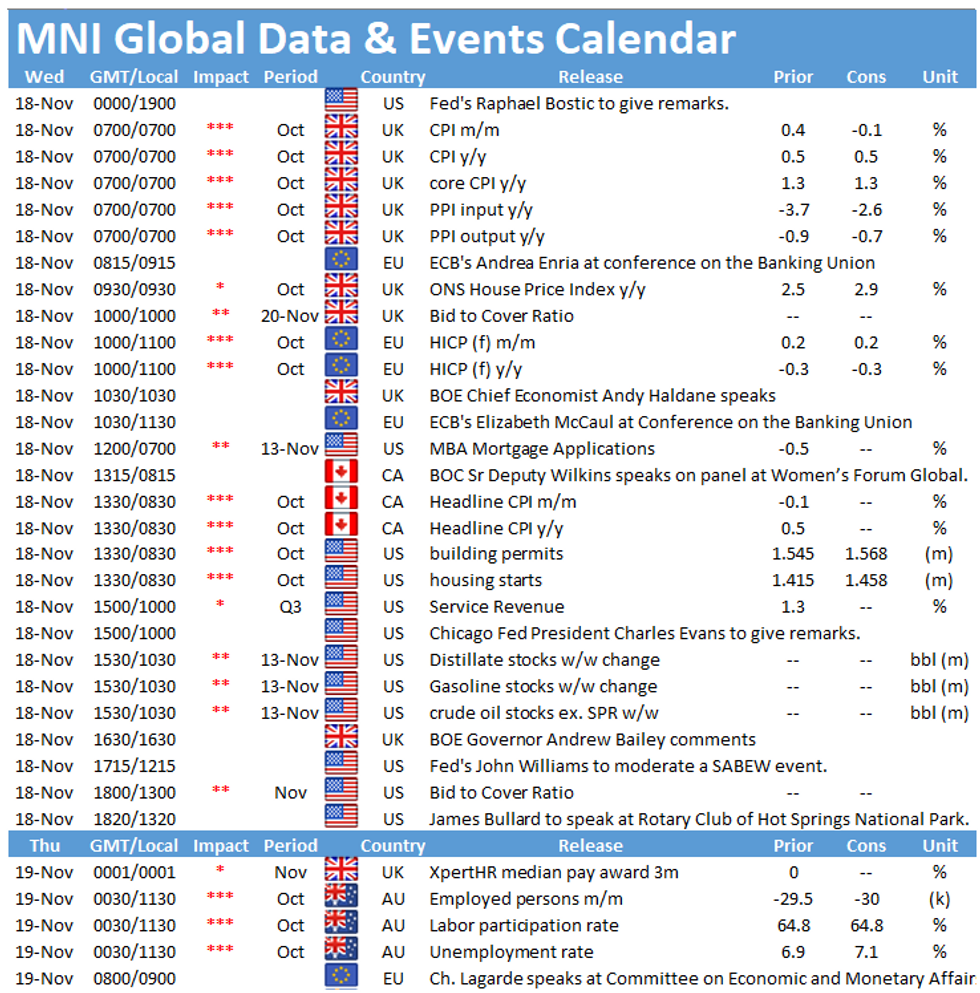

- Focus turns to inflation data from the UK, EZ and Canada, U.S. housing starts & building permits, as well as comments from Fed's Williams, Bullard and Kaplan, BoE's Bailey & Haldane, ECB's Enria & BoC's Wilkins.

FOREX OPTIONS: Expiries for Nov18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1770-90(E1.3bln), $1.1995-1.2000(E996mln-EUR calls)

- USD/JPY: Y104.95-00($580mln)

- USD/CAD: C$1.3000($1.1bln), C$1.3195-00($645mln)

GOLD: Familiar Range, ETF Holdings Nudge Lower

Bullion continues to operate in familiar territory, dealing little changed at ~$1,880/oz at typing, with the well-defined technical lines in the sand remaining untouched. We should also flag that total known ETF holdings of gold have fallen for 4 consecutive days, with recent weeks seeing that particular metric edge back from the latest all-time high, which was logged in mid-October.

OIL: Little Changed In Wake Of Mixed API Inventory Estimates

WTI & Brent sit a handful of cents below their respective settlement levels at typing. This comes after the benchmarks finished little changed on Tuesday.

- Late Tuesday saw the latest API crude inventory estimates reveal a surprise headline build in crude stocks, alongside a slightly wider than expected build in gasoline stocks. Still, this was tempered by a deeper than expected drawdown in distillate stocks. Elsewhere, there was a modest build in stocks at the Cushing hub.

- A reminder that the latest OPEC+ JMMC gathering heralded nothing in the way of formal recommendations, with participants pointing to the need for adherence to the current production quotas. That came after source reports pointed to much wider than previous excess supply calculations for '21. Uncertainty surrounding COVID, despite the recent developments on the vaccine front, were front and centre in public communique.

No Clear Direction In Asia

It was a mixed Asia-Pac session for the major regional equity markets, with a lack of macro headline flow apparent.

- A reminder that Tuesday's Wall St. session saw market sentiment turn a little more defensive, with focus on the soft retail sales data and swelling COVID-19 count/social mobility restrictions in the U.S. Still, the major indices managed to recover from worst levels come the closing bell on Wall St.

- E-minis were generally biased lower during Asia-Pac hours, and weren't helped by news that U.S. President Trump has fired as Director of the Cybersecurity and Infrastructure Security Agency on the back of matters surrounding the election. However, the contracts did manage to recover from worst levels during the overnight session.

- Nikkei 225 -1.1%, Hang Seng +0.2%, CSI 300 -0.3%, ASX 200 +0.5%.

- S&P 500 futures -18, DJIA futures -133, NASDAQ 100 futures -45.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.