-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Asia Starts New Week On Low Gear

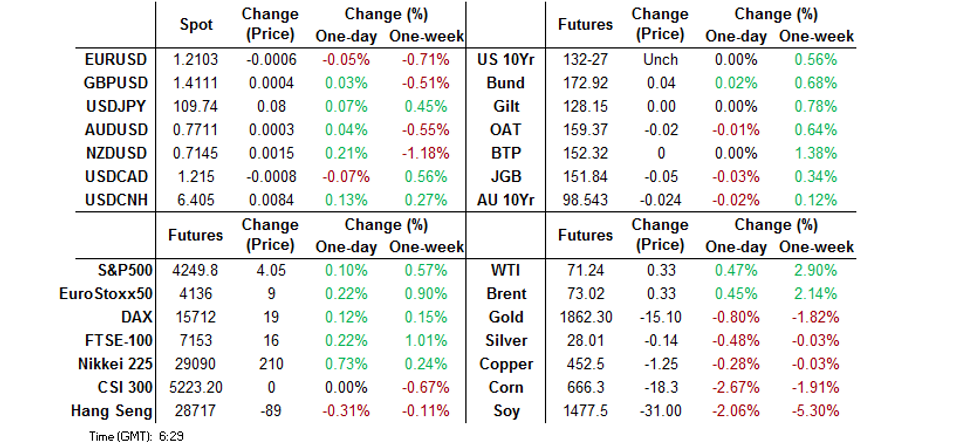

- Market holidays in Australia, China, Hong Kong and Taiwan limit activity across the Asia-Pacific region

- Core FI are rangebound, NZD leads gains in G10 FX space

- Thursday's FOMC monetary policy decision headlines the broader docket this week

BOND SUMMARY: Core FI Tread Water, Holidays Limit Activity In The Region

Core FI tread water as the weekend news flow failed to provide any meaningful impetus, while activity was limited by public holidays in Australia, China, Hong Kong and Taiwan. T-Notes were rangebound and last change hands at 132-27. Cash U.S. Tsy curve bear steepened, with yields last seen 0.4-1.2bp higher. Eurodollar futures trade +0.25 to -0.5 tick through the reds. There is little of note on the U.S. docket today, with Fed officials already in their blackout period ahead of Thursday's FOMC monetary policy decision.

- JGB futures reopened on a slightly softer footing, but traded sideways thereafter. The contract last operates at 151.85, 4 ticks shy of prior settlement. Cash JGB yields were marginally mixed across the curve. The BoJ are set to deliver their latest monetary policy decision this Friday, with national CPI data also due on that day.

FOREX: Market Holidays Limit Activity In Asia

Market holidays in Australia, China, Hong Kong and Taiwan limited activity in the region, with NZD leading gains in G10 FX space, even as New Zealand's PSI fell from a record high. CAD also edged higher, as crude oil traded on a slightly firmer footing, but AUD and NOK struggled to pick up any momentum.

- The DXY inched higher, as participants prepared for Thursday's announcement of the latest monetary policy decision from the FOMC. Despite firming a tad, the index rejected Friday's high.

- USD/CNH rose past the CNH6.4000 mark, which capped gains last Friday, reaching its best levels since Jun 4.

- Sterling looked through a number of press reports noting that PM Johnson will today announce a four-week delay of the lifting of Covid-19 restrictions in England.

- The global data docket is very light today, with ECB's Schnabel & de Cos, BoE's Bailey & Riksbank's Floden set to deliver speeches.

FOREX OPTIONS: Expiries for Jun14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2150(E1.1bln). $1.2200(E1.3bln-EUR puts)

- USD/CHF: Chf0.8800($600mln-USD puts)

- AUD/USD: $0.7750-65(A$943mln), $0.7940(A$1.3bln-AUD puts)

ASIA FX: Holiday Thinned Trade

Markets in Australia, China, Hong Kong and Taiwan were closed today which kept liquidity thin and the economic docket light.

- CNH: Offshore yuan is slightly weaker having moved in a narrow range. The G7 communique over the weekend criticised China over human rights violations and other sensitive issues such as Hong Kong and Taiwan.

- SGD: Singapore dollar is flat, moving in a narrow range. The pair retook a key resistance level on Friday and now targets 1.3300 before 50-DMA and 100-DMA.

- KRW: Won is weaker, giving back Friday's gains. South Korea reported 399 new coronavirus cases in the past 24 hours, the lowest in over two months.

- IDR: The rupiah is weaker, the gov't is proposing a hike to personal income tax on people earning more than IDR5bn a year.

- MYR: Ringgit fell. Defence Min Ismail Sabri said that the gov't is looking into the possibility of easing some restrictions if the national daily Covid-19 case count falls under the 4,000 threshold.

- PHP: Peso dreclined. CNN Philippines reported that "the Senate Committee of the Whole will resume its hearing to raise questions on the budget allocation for the pandemic response, following the request to add PHP25 billion more on top of the PHP82.5 billion already intended for the purchase of vaccines."

- THB: Baht fell. PM Prayuth announced Saturday that some aesthetics-related businesses in Bangkok will reopen from Monday, as the rollout of the Covid-19 vaccine progresses

ASIA RATES: Inflation In Focus For Indian Bonds

Market closures in several markets, including China, kept liquidity and news flow thin during the session. In India focus turns to inflation data later today after another poorly received auction last week.

- INDIA: Yields higher in early trade, Friday's auctions were poorly received, the RBI devolved INR 99.75b of the benchmark 5.85% 2030 bond on primary dealers. Elsewhere there were reports that the RBI is exploring the possibility of investing in top rated foreign corporate bonds to generate higher yields. Focus will turn today to inflation data later in the session, CPI is expected to overshoot again, but the RBI are expected to look through this in order to help the recovery and have pledged to maintain an accommodative stance.

- SOUTH KOREA: Futures lower in South Korea, dropping at the open then hugging a narrow range. Comments from BoK Governor Lee on Friday led markets to believe that the bank could be considering an interest rate hike and saw yields rise. 10-year yield now around 4.5bps below its 2021 high. Lee said "the current accommodative monetary policy should start to be normalized at an appropriate timing in an orderly fashion if the economy is forecast to continue its solid recovery." The MOF sold 10-year paper, the sale went down smoothly with a sale size around KRW 37bn bigger than announced. Bid/cover was in line with the previous auction despite lower yield.

- INDONESIA: Yields mixed in Indonesia. Indonesia has extended luxury tax relief on vehicles with smaller engines, as it seeks to support demand amid the outbreak of Covid-19. Meanwhile, the gov't is proposing a hike to personal income tax on people earning more than IDR5bn a year. Indonesia's latest monthly trade report will be released tomorrow, while Bank Indonesia are set to deliver their monetary policy decision on Thursday. All analysts surveyed by BBG expect Indonesian policymakers to stand pat on benchmark interest rate.

EQUITIES: Market Closures Subdue Proceedings

Markets in Australia, China, Hong Kong and Taiwan were closed today which kept liquidity thin and the economic docket light. Markets that were open were higher though moves were muted. Bourses in Japan rose around 0.3% while in South Korea markets hovered around neutral. In the US futures are in positive territory, creeping higher as US yields inch up ahead of the FOMC rate announcement later this week.

GOLD: Falls Further

The yellow metal has lost further ground on Monday after declining throughout the session on Friday. Gold last trades down $12.89 at $1,864.63 as US yields inch higher ahead of the FOMC rate announcement later this week. The decline brings into focus the $1856.2, Jun 4 low, a break of the level would reinforce recent bearish concerns following the strong selling pressure on Jun 3. Below opens the 50-day EMA at $1840.1, also seen as a key support area.

OIL: Adds To Recent Gains

After a positive day on Friday oil has added to gains to start the week, breaking above Friday's highs. WTI is up $0.32 from settlement at $71.23/bbl while Brent is up $0.32 at $73.01/bbl. Crude futures rose just shy of 2% last week as markets assessed positive demand cues from the US and Europe. This week focus will fall on talks over the Iran nuclear deal ahead of an Iranian election on June 18.

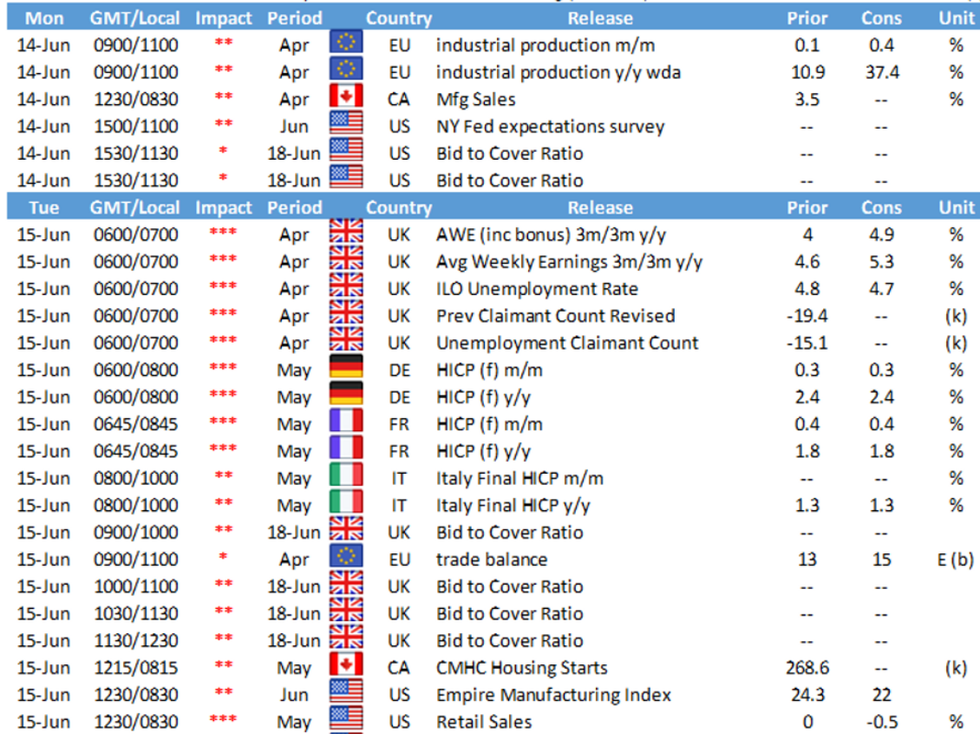

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.