-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Sets Yuan Parity Higher At 7.1942 Fri; -1.48% Y/Y

MNI BRIEF: Japan Oct Core CPI Rises 2.3%, Services Rise

MNI EUROPEAN MARKETS ANALYSIS: AUD Pressured On Dovish Tweaks To Wording Alongside RBA's Latest Hike

- The RBA increased the cash rate by 25bp, as widely expected, but watered down the hawkish message contained in the February statement by dropping the reference to “increases” in interest rates over coming months and replacing it with “further tightening of monetary policy will be needed”. The RBA also noted that recent data suggested a lower risk of a wage-price spiral and the rather bold claim that “inflation had peaked”, referencing the monthly CPI.

- This pressured the AUD and resulted in outperformance for the AUD FI space.

- Fed Chair Powell's semi-annual Monetary Policy report to the Senate Banking Committee provides Tuesday's macro highlight.

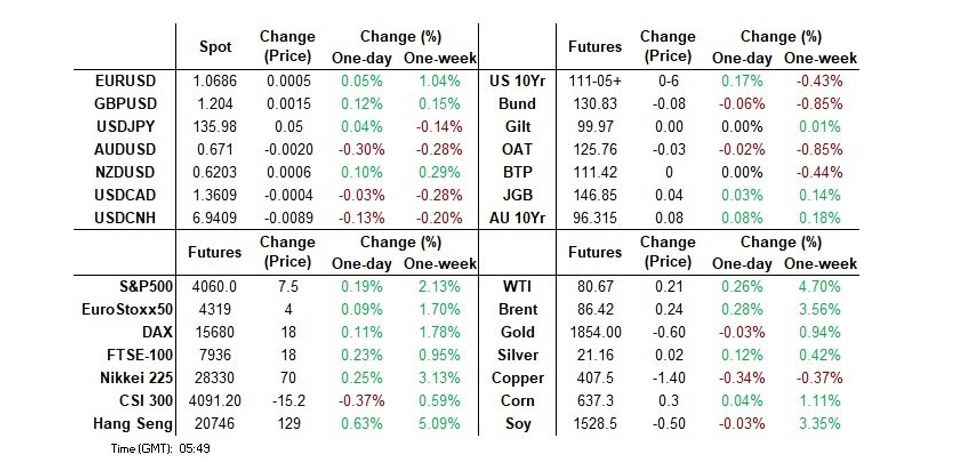

US TSYS: Narrow Ranges In Asia, Powell In Focus

TYM3 deals at 111-05+, +0-06, a touch off the top of the 0-06 range on volume of ~70K.

- Cash Tsys sit 0.5-1bp richer across the major benchmarks.

- Moderate pressure was seen in early trade as Asia-Pac participants focused on the core FI pressure seen on Monday in the wake of particularly hawkish ECB speak from ECB's Holzmann.

- Amid light headline flow Tsys then ticked away from session cheaps, before a bid in ACGBs spilled over seeing Tsys firm to session highs. The RBA hiked the cash rate 25bps, however there was a dovish feel to the post-meeting statement.

- There was little follow through to the move, with notable underperformance noted vs. ACGBs. Tsys then respected narrow ranges for the remainder of the session.

- Fed Chair Powell's semi-annual Monetary Policy report to the Senate Banking Committee provides the highlight of the broader macro Tuesday. Also on the wires we have Wholesale Inventories and Consumer Credit. There is also the latest 3-Year Tsy supply.

JGBS: Curve Twist Steepens, 30-Year Auction Only Generates Tepid Demand

JGB futures ticked higher during the Tokyo session, more than unwinding overnight weakness, leaving the contract +4 ahead of the close, just shy of best levels. A bid in wider core global FI markets provided further support in the Tokyo afternoon after a morning uptick.

- Wider cash JGBs run 1.5bp richer to 2bp cheaper, pivoting around 10s as the curve twist steepens. 10s continue to operate effectively on the upper boundary of the range allowed under the BoJ’s YCC parameters (0.50%).

- Weakness in the longer end seemed to be related to the weakness seen in core global FI markets on Monday, while the twist steepening felt a bit like a further unwind of hawkish flattener plays given a growing feel that there will not be a tweak deployed at this week’s BoJ monetary policy decision (Governor Kuroda’s final meeting atop the central bank).

- Elsewhere, 30-Year JGB supply saw a tepid reception, although there wasn’t much in the way of post-auction follow through in price action.

- Current account data and BoJ Rinban operations headline the domestic docket tomorrow.

AUSSIE BONDS: RBA's Dovish Shift Sparks A Rally

The RBA increased the cash rate by 25bp, as widely expected, but watered down the hawkish message contained in the February statement by dropping the reference to “increases” in interest rates over coming months and replacing it with “further tightening of monetary policy will be needed”. The bid tone was also supported by the assertion from the RBA that recent data suggested a lower risk of a wage-price spiral and the rather bold claim that “inflation had peaked”, referencing the monthly CPI.

- ACGBs futures richen as much as 12bp and 18bp respectively after the decision with YM +14.0 and XM +8.0 at the close, a few bp back from their respective post-decision highs. Cash ACGB yields close 8-14bp lower with the 3/10 curve 6bp steeper.

- A similar move in swaps with little movement in EFP. Earlier today a 1y Vs. 1y1y flattener was deemed to have offered a good risk-return play on the RBA pivoting towards a less hawkish stance. At the close, the 1y1y rate was 13bp lower with the 1y Vs. 1y1y 5bp flatter than morning levels.

- Bill strip closed 6-17bp richer led by the late whites and front reds.

- RBA-dated OIS pricing softened by 4-13bp led by meetings beyond June. Terminal rate expectations drop to around 4.00% versus 4.13% prior to the RBA decision.

- RBA Governor Lowe is to deliver a speech at the AFR Business Summit tomorrow.

Fig 1: RBA-Dated OIS Pre- & Post-RBA

Source: Bloomberg / MNI - Market News

NZGBS: Richen After New Supply Syndication

NZGBs reverse morning underperformance versus $-Bloc peers after pressure surrounding the issue of the new NZGB May-30 via syndication passed (NZ$4bn vs. the range of NZ$3-5bn, likely limited by a want to avoid the cheap extreme of the initial pricing range).

- After cheapening as much as 6-7bp pre-issuance, NZGBs closed flat to 2bp cheaper with the NZ/US and NZ/AU 10-year differentials 3bp and 1bp tighter, respectively (pre-RBA decision).

- Swaps closed 4-5bp cheaper with the 2s10s curve unchanged.

- RBNZ dated OIS were +2-6bp firmer across meetings with Nov-23 and Feb-24 leading. April meeting pricing remained around 40bp of tightening with terminal OCR pricing back at the RBNZ’s projected peak of 5.50%.

- YtD NZ deficit readings were marginally deeper than expected, while Finance Minister Robertson noted the impending headwinds on the fiscal front re: the cyclone rebuild, but stressed that government finances are well placed to deal with both that and the cost of living pressures households are facing.

- With the local data calendar light until February’s card spending data (Thu), the market will be fixed on the raft of central bank events over the coming days, starting with this evening's speech on monetary policy by RBNZ Governor Orr at a private event in London and Fed Chair Powell’s semi-annual testimony to Congress.

- A reminder that the delayed impulse from the RBA decision will be felt tomorrow morning, when NZGBs re-open.

FOREX: AUD Pressured After RBA Dovish Shift

AUD is the weakest performer in the G-10 space at the margins as there was a dovish tone to the RBA's post-meeting statement as they raised the cash rate 25bps.

- The RBA removed language about the need for hikes in the months ahead, as well as noting that inflation pressures may have peaked. AUD/USD fell ~0.8% from peak to trough, support was seen below $0.67 as the pair pared losses to sit at $0.6710/15. Earlier in the session the trade balance for January was a touch narrower than expected, a surplus of $11.7bn was recorded vs $12.25bn exp however there was little reaction in the AUD.

- NZD/USD is a touch firmer, up ~0.1% from yesterday's closing price. Kiwi has observed narrow ranges for the most part, with little follow through on moves. AUD/NZD is softer, down ~0.4%, last printing at $1.0820/30.

- Yen is little changed today, USD/JPY has observed a ¥135.85/136.15 range for the most part with little in meaningful moves. January's Labor Cash Earnings printed at 0.8% below the expected 1.8%, Real Cash Earnings fell 4.1% vs -3.2% exp.

- EUR and GBP are marginally firmer, however ranges have been tight in Asia.

- BBDXY is down ~0.1%. 10 Year US Treasury Yields are little changed, e-minis are up ~0.2%.

- Fed Chair Powell's semi-annual Monetary Policy report to the Senate Banking Committee provides Tuesday's highlight.

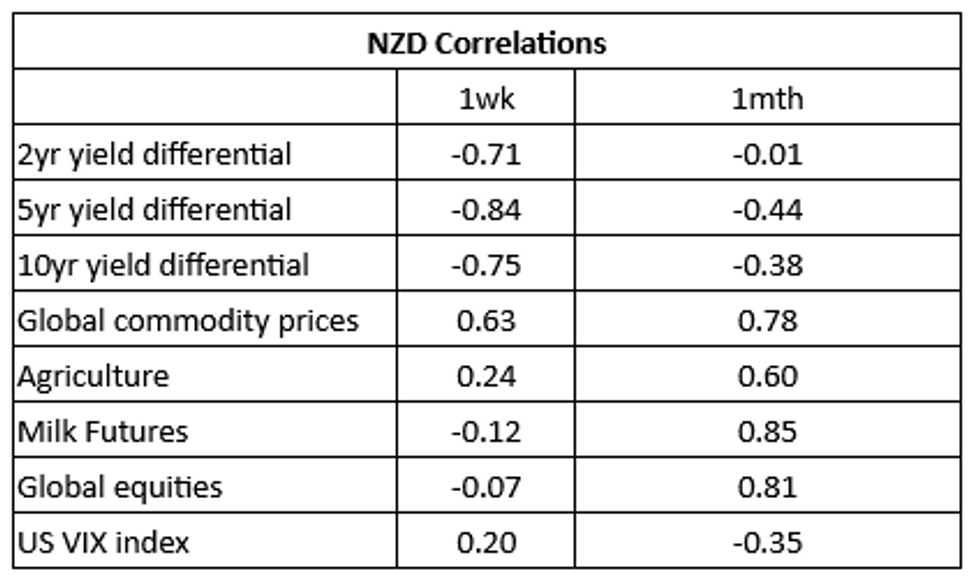

NZD: Commodities Main Driver Of NZD Last Week

NZD/USD was marginally firmer over the past week, dealing in a ~2% range. The table below presents levels of correlations between NZD and key macro drivers (note the yield differential reflects swap rates).

- Global commodity prices were the main driver for the NZD last week, a moderate widening in NZ US rate differentials couldn't lift the NZD late in the week.

- Over the longer time frame, global commodities, milk futures and global equities are driving the NZD.

- The correlations with rate differentials have weakened over the longer time frame.

Fig 1: NZD/USD Correlation with Global Macro Drivers:

Source: MNI/Bloomberg

EUROZONE: Recession Risk Continues To Ease

Recent data in the euro area has been improving as the warmer winter has reduced the potential impact of the shift away from Russian energy. The economic sentiment indicator is 4.6% q/q higher in Q1 to date and the unemployment rate remains close to its historical low. But rates continue to rise as inflation is proving stubbornly high. However given the improving economic backdrop, the risk of recession fell further in January.

- We run two probability models – one from 1985 (includes 4 recessions) and one from 1998 (3 recessions). The 1985 estimation has seen the risk of recession 6-months ahead fall from 61% to 29% in the most recent run. The shorter calculation has seen it moderate to 53% from 72%.

- Previous estimates from both models tell us that there is a non-negligible chance of a recession in Q1 and Q2 of 2023 but going into Q3 it becomes less of a likelihood. Since the probability estimates of a recession 6-months ahead haven’t approached the 90-100% mark, a slump in H1 2023 is not a given and any recession may be shallow or it may be a period of stagnation.

- While it is quite possible the euro area will avoid a recession, some of it members may not, such as Germany and Italy.

Source: MNI - Market News/Refinitiv/EABCN

FX OPTIONS: Expiries for Mar07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0570-85(E1.3bln), $1.0620-30(E1.0bln), $1.0675-85(E922mln), $1.0710-30(E938mln), $1.0740-45(E1.0bln), $1.1000(E1.4bln)

- USD/JPY: Y136.00-10($783mln), Y136.50-65($774mln)

- GBP/USD: $1.1950(Gbp572mln), $1.1975(Gbp721mln), $1.1994-00(Gbp1.0bln)

- USD/CAD: C$1.3600-15($1.3bln)

- USD/CNY: Cny6.9500($1.4bln)

ASIA FX: Mixed Trends, THB Outperforms PHP & IDR In SEA

USD/Asia pairs have traded in a mixed fashion today. CNH is slightly firmer, with the Jan-Feb trade data mixed, while the won has been relatively steady. The baht has outperformed, while PHP and IDR have underperformed. Still to come is Taiwan trade and inflation data. Tomorrow the data calendar is light within the region.

- After closing in NY around the 6.9500 level, USD/CNH sits modestly lower (last near 6.9435). Firmer HK equities have helped, but this hasn't aided mainland sentiment in this space. Jan-Feb trade figures showed a strong trade surplus, but import growth undershot expectations. The CNY fixing was slightly on the firmer side.

- 1 month USD/KRW has tracked recent ranges, finding selling interest closer to 1300 but not able to move sub 1295. Onshore equities are higher, but only modestly at +0.30%. BoK Governor Rhee reiterated that the authorities will curb FX volatility if needed.

- USD/IDR has remained on the front foot. The pair is +0.40% to the 15355/60 region. This is fresh highs back to mid-January. This comes despite a pull back in US real yields from recent highs. Some offset has come from higher core EU yields. Indonesian equities remain softer compared to the rest of SEA, with the JCI down 0.33% today.

- USD/PHP is firmer, the pair back in the 55.05/10 region. This is around 0.40% weaker in PHP terms versus yesterday's close. Some of this is catch up to USD strength post this close, with the 1 month USD/PHP NDF last at 55.10/15, little change for the session. Feb inflation data crossed earlier, coming in below expectations, 8.6% y/y, 8.9% was forecast and 8.7% was the prior print. Some easing in food and transport costs helped but inflation pressures remained firm elsewhere. Core prices were 7.8% y/y, the strongest pace since 1999. BSP Governor Medalla stated recently, a 9% handle on today's print could mean 50bps hike at the next BSP meeting, later in March. Given today's outcome was sub this level and towards the lower end of the BSP expectations (8.5% -9.3%), it tilts the risks towards a 25bps move.

- The baht is the best performer in the Asia FX today. USD/THB is down around 0.70%, with the pair sub 34.45. Thai markets were closed yesterday, so this may reflect some catch up, but the baht is outperforming broader currency trends in the region at the margin, i.e. relative to the ADXY, which has shown a steady trend this week in large part due to the USD/CNY rebound. On the downside the 20-day EMA isn't too far away at 34.40. We haven't been sub this support point since early Feb. Equities have been aided by the downside CPI miss. Headline fell -0.12% m/m, which left the y/y pace at 3.79%, versus 4.10% expected and 5.02% prior. Core slipped to 1.93% (2.00% forecast), which is back sub the mid point the BoT's target band.

EQUITIES: Most Regional Markets Higher, But HK & China Diverge

Most regional markets are tracking higher, led by the HSI and China Enterprise index, although mainland shares are struggling. US futures are firmer, while SEA markets in terms of the Thailand and Philippines bourses have benefited from downside inflation outcomes today.

- The HSI opened flat but quickly rose to +1%, with gains fairly broad based. On the sidelines of the NPC, the general manager of the Shanghai Stock Exchange reportedly called for better funding access from the market, particularly for SoEs. The HS China Enterprise Index is also up over 1%.

- Mainland shares are still struggling though, with the CSI 300 off by 0.2% at this stage.

- Elsewhere the Nikkei 225 is +0.30%, while the Kospi (+0.40%) and Taiex (+0.70%) are also in positive territory.

- The SET in Thailand is +0.90%, heading for its first gain since the 21st of Feb. Lower inflation aided sentiment. A similar dynamic was in play for Philippines stock, up by the same amount, although inflation rates remain much higher compared to Thailand.

GOLD: Bullion Waiting For Fed’s Powell To Appear Later

Gold has been trading in a narrow range during the APAC session after falling 0.5% on Monday due to higher US yields. It is currently in a holding pattern ahead of Fed Chairman Powell’s appearance later and is around $1848.15/oz having reached a high of $1850.52 following a low of $1844.15. The USD index is 0.1% lower.

- Gold is trading below its 50-day moving average. Initial resistance sits at $1858.26, while support is at $1804.90, the February 28 low, which is also the bear trigger.

- Later Fed Chairman Powell appears before the Senate banking panel. His comments will be watched closely for clarification on the monetary policy outlook but he is expected to say that the terminal rate will be higher than expected at the last meeting. This would be negative for bullion. He appears before the House on Wednesday. The data calendar is light with only US wholesale inventories and consumer credit scheduled.

OIL: Crude Continues Trending Higher, Focus On Fed’s Powell

Oil prices are higher for the sixth consecutive day in line with better equity sentiment. WTI rose 1% on Monday and is now up a further 0.3% during APAC trading to around $80.66/bbl, while Brent is also up 0.3% at $86.41. Hawkish comments from Fed Chairman Powell later could weigh on crude though. The USD index is currently down 0.1%.

- WTI reached a peak of $80.94 earlier following a low of $80.40. It broke resistance at $80.78 but couldn’t hold it. Key resistance is at $82.89, the January 23 high. It is above its 100-day moving average.

- Brent hit a high of $86.75 following a low of $86.19, while off the highs it is still approaching its 200-day moving average. It broke resistance of $86 but couldn’t sustain a break of $86.55, the February 13 high.

- Reports are indicating that Russia’s announcement to cut output by 500kbd in March has not yet impacted shipments.

- Later Fed Chairman Powell appears before the Senate banking panel. His comments will be watched closely for clarification on the monetary policy outlook but he is expected to say that the terminal rate will be higher than expected at the last meeting. This would be negative for crude. He appears before the House on Wednesday. The data calendar is light with only API inventory data, US wholesale inventories and consumer credit scheduled.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/03/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 07/03/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 07/03/2023 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/03/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/03/2023 | - | *** |  | CN | Trade |

| 07/03/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/03/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 07/03/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/03/2023 | 1500/1000 |  | US | Fed Chair Jerome Powell | |

| 07/03/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/03/2023 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.