-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Australian CPI Beat Pushes Up Terminal RBA Rate Projections

- Focus has once again rested on HK/China equity market sentiment. Gains today have helped soothe broader risk appetite. Dip buyers will be a factor, although recent comments from a host of China regulators around ensuring on-going development/reform of China financial markets has also likely helped.

- Australian Q3 CPI comfortably beat expectations, firming expectations for a 25bps hike next week, although some sell-side analysts give a small probability to a 50bps move. Market pricing hasn't shifted beyond a 25bps move. Terminal RBA rate expectations are being revised higher for 2023. The A$ has outperformed against, aided by higher yield and better regional equity sentiment.

- This evening's data calendar is fairly quiet, with just a few US releases. Debate is likely to continue around any potential Fed pivot, given the softer tone to data this week. UK fiscal matters could also be in focus.

US TSYS: T-Notes Round Trip, Cash Curve Continues To Bull Flatten

T-Notes round tripped from a session high of 110-24 as headwinds for U.S. tech shares lent support to core FI, while spillover from Australia's expectation-beating CPI data kept a lid on gains.

- NASDAQ 100 e-minis led U.S. equity-index futures lower on the back of post-market slumps in Alphabet and Microsoft. Google's parent company reported weaker-than-expected revenue, while Windows provided an underwhelming revenue forecast. Still, Asia-Pac equity benchmarks were broadly firmer, with stabilisation in Chinese indices aiding sentiment.

- The release of Australia's Q3 CPI figures reverberated across markets, sealing the case for a 25bp cash rate target next week, which is now fully priced by the swaps market.

- The market still sees the FOMC raising the fed funds rate by 75bp next month, pricing is little changed on the day.

- T-Notes last deals +0-01 at 110-19, with eurodollar future running +0.5 to -1.0 tick through the reds. Cash Tsy curve bull flattened, building on overnight impetus generated by weaker than expected U.S. house price & consumer confidence data. Yields last sit 0.6-4.0bp lower across the curve.

- U.S. 5-Year/30-Year spread returned to inversion territory, last sitting at -2.91bp; 2-Year premium over 10-Year debt has tightened at the margin.

- Local data highlights include wholesale inventories and new home sales, with 5-Year Tsy auction also coming up.

JGBS: Benchmark Futures Unwind Upswing Driven By Upsized Rinban Purchase Sizes

JGBs turned bid into the Tokyo lunch break as the BoJ increased purchase sizes in a scheduled round of Rinban operations, signalling its determination to defend its YCC framework ahead of a monetary policy review this Friday.

- The central bank boosted the sizes of its bond-purchase operations by Y100bn in the 10-25 Year basket & by Y50bn in the 25+ Year basket. Purchase sizes across the 3-5 Year & 5-10 Year baskets had already been revised higher versus the planned amounts last Friday. Today's operations drew the following offer/cover ratios:

- 3-5 Year JGBs: 1.36x (prev. 1.89x)

- 5-10 Year JGBs: 2.61x (prev. 3.00x)

- 10-25 Year JGBs: 2.55x (prev. 1.58x)

- 25+ Year JGBs: 2.28x (prev. 4.04x)

- 10-Year futures lost ground after the lunch break, erasing all earlier gains. JBZ2 last changes hands at 148.33, 33 ticks above previous settlement. The pullback in benchmark JGB futures coincided with a rebound in Japan's 10-Year swaps amid the ongoing debate on the sustainability of BoJ policy course.

- Cash JGB curve shifted lower and runs flatter, even as the earlier bull-flattening impetus moderated to a notable extent. The yield on 10-Year JGB targeted by the BoJ's YCC framework remained in the vicinity of the 0.25% cap.

AUSSIE BONDS: Aussie Bonds Firm On Above-Forecast CPI Data, Curve Flattening Deepens

Aussie bonds went offered on the release of expectation-beating Q3 CPI data, which cemented the case for a 25bp hike to the cash rate target next week. Headline consumer inflation accelerated to a 32-year high of +7.3% Y/Y, beating the +7.1% median estimate. Trimmed mean CPI also rose faster than forecast, printing at +6.1% Y/Y versus the +5.5% consensus forecast.

- The data inspired a light boost to hawkish RBA rate-hike bets for next week's meeting. Swaps now fully price a scenario, whereby policymakers would raise the cash rate target by 25bp.

- Australia's Q3 CPI report helped mitigate the impact of tech-led weakness in U.S. equity-index futures & overnight sell-off in U.S. Tsys. Cash ACGBs trimmed their opening losses as a result and the RBA-sensitive 3-Year yield returned to neutral levels, yet the flatter yield structure remained, with 3-Year/10-Year tightening post-CPI. Cash ACGB yields sit unch. to -12.8bp as we type.

- Aussie bond futures showed a similar response to the data, taking nosedives as CPI figures crossed. YM last trades +1.0 & XM +10.5, both off reaction lows as e-minis still operate in the red. Bills run -7 to +5 ticks through the reds.

RBA: Sell-side Revise Up Peak RBA Rate Forecasts In Response To Higher Inflation

The Australian is reporting on the changes to RBA forecasts by sell-side analysts. Here is a summary:

- ANZ now expects an additional 25bp hike in December bringing its terminal rate to 3.85% in May 2023. The RBA is expected to tighten more frequently rather than return to 50bp moves. Inflation should also be stronger going into 2023 with upside risks stemming from floods, the weaker AUD and global inflation pressures.

- CBA has revised up its RBA rate forecasts to include 25bp for December as well as November bringing its terminal rate forecast to 3.1%. Head of Australian economics Aird noted that inflation is a “lagging indicator” and that tightening should impact inflation in 2023.

- NAB now expects not only 25bp rate rises in November and December but also February and March 2023 with rates peaking at 3.6%. While 25bp is the most likely scenario in November, they see 50bp as a possibility.

- Goldman Sachs now sees a 30% chance of a 50bp hike in November up from 10%. It expects 25bp hikes at the next four meetings with rates to peak at 3.6% but the risks are “skewed to the upside”. The RBA is also likely to revise trimmed mean inflation for Q4 2022 to 6.5% from 6%.

- AMP also doesn’t expect another 50bp hike but has revised up its terminal rate forecast to 3.1% (+25bp). Senior economist Mousina noted that services inflation was too high and so the risk is for more tightening in 2023.

- Citi sees upside risks to its terminal rate of 3.35% in Q1 2023. Citi economist Williamson noted that “sticky inflation” items remain “too high”. He doesn’t expect the RBA to return to 50bp increases.

MNI INSIGHT: Australian Q3 CPI Beat Sees Tightening Cycle Extend Into 2023

Executive Summary:

- Q3 Australian headline CPI data came in higher than expected but in line with the previous month but the trimmed mean underlying measure not only was higher than expected but also up on Q2 (1.8% q/q and 6.1% y/y, a new series high). Inflation momentum also remains strong. The proportion of major sub-indices with inflation stronger than 2.5% y/y (the mid-point of the RBA’s target band) rose to over 90%, fresh highs back to the early 2000s.

- Still, this data is unlikely to be high enough to push the RBA off its 25bps hiking pace, but it now looks likely to extend its tightening cycle into 2023.

- RBA commentary also points in the direction of a 25bps move rather than 50bps on November 1. In the October minutes, the Board said that one reason the pace of tightening was slowed was that it would be “drawing out policy adjustments” which could “help to keep public attention focused for a longer period” on the Board’s determination to bring inflation back to target. Deputy Governor Bullock also commented recently that the RBA has more meetings than other central banks and so can do less per meeting but achieve the same result. Also, many of the reasons for pivoting haven’t changed, such as global and domestic uncertainties, the lags involved, considerable tightening this year and wages still being consistent with the target.

- For the full piece, see here: AU CPI (Oct 26) final.pdf

FOREX: Antipodeans Outperform On Firmer Equities/AU CPI Beat

The tone in FX markets has seen modest outperformance from the antipodeans relative to the majors, particularly the yen. This largely owes to a more resilient equity picture in the region, particularly relative to the sharp falls in US futures. Overall ranges have been quite modest though, the BBDXY up slightly to 1330.00/50.

- AUD/USD is back above 0.6400, so above the 20-day EMA (0.6386) and threatening recent highs above 0.6410. Q3 CPI came out stronger than expected, boosting local yields. The 3yr spiked towards 3.62%, but we are now back to 3.55%. The impact was limited on the A$ though initially. The currency has also received some support from the better regional equity tone, particularly China/Hong Kong. Iron ore prices have also firmed, but remain sub $90/tonne.

- NZD/USD is back to 0.5750, trailing A$ performance, the AUD/NZD cross back towards 1.1150. The ANZ activity outlook slipped to -2.5 from -1.8 last month, while confidence fell to -42.7 (against -36.7). Note RBNZ Governor Orr speaks early tomorrow.

- USD/JPY is back above 148.00, last 148.15, +0.15%, seeing slight underperformance against AUD & NZD.

- GBP/USD is near 1.1455, while EUR/USD is just above 0.9950.

- The offshore data calendar is fairly quiet, with just US wholesale inventories and new home sales on tap.

ASIA FX: Sentiment Stabilizes, Helped By Higher Equities

It has been a better day for Asian FX, with most currencies up against the USD. Equities remain the focus point, with other cross-asset signals not significant for the session. Gains in HK/China equities have helped stabilize sentiment from a broader risk appetite standpoint. Tomorrow, China industrial profits are on tap for September, along with South Korean Q3 GDP.

- USD/CNH is back sub 7.3100, down from earlier highs above 7.3400. Reuters reported that state banks sold dollars in both the onshore and offshore market late yesterday. While this isn't a trend changer, it does signal increased resolve to slow the pace of depreciation. Onshore spot is back sub 7.2900.

- 1 month USD/KRW found selling interest above 1430 in early trade. Onshore equities are firmer (+0.80%) despite mixed earnings results. Offshore inflows have been nearly $190mn so far today. The pair couldn't sustain a move sub 1425 though, last back near 1427.

- Spot USD/IDR last seen -20 figs at 15,603, in line with regional trends, although familiar technical levels remain in play, as the pair holds yesterday's range. INDOGB 5-Year/10-Year yield spread keeps tightening to fresh cyclical narrows as the curve flattens. Indonesia's 10-Year yield premium over U.S. Tsys has rebounded from smallest levels this cycle over the course of this week.

- Spot USD/THB is lower, down nearly -0.80%, as a catch up play from overnight USD weakness. We last sat close to 38.00. Monthly customs-based trade data are expected to cross the wires this afternoon. The deficit may have shrunk to $3.050bn in September from $4.215bn prior.

- Spot USD/PHP operates -0.16 at 58.638, coming under pressure from lower U.S. Tsy yields/overnight greenback weakness. BSP Gov Medalla calibrated his recent messaging, noting that while he does see the case for steeper monetary tightening, the central bank will not raise interest rates excessively just for the sole purpose of preventing the peso from breaking a certain level.

CNH: USD/CNH Moves Lower On Reported Intervention From Tuesday's Session

USD/CNH has made fresh intra-day lows post a Reuters headline that state banks sold dollars in both onshore and offshore markets late Tuesday (see this link). Note the MNI policy team noted the risks of intervention with an ex-SAFE official earlier this week, see this link for more details.

- USD/CNH has edged back above 7.3100, slightly above earlier lows of 7.3058, which were around overnight lows. If we break 7.3000 the next target area could be 7.2800/50, highs from late last week.

- USD/CNY is also off earlier session highs, back close to the 7.2900 level. The pair couldn't get above 7.3000 in early trade.

- While intervention risks don’t change the fundamentals facing the China currency, it may leave the market more cautious around the risks of greater volatility, particularly on an intra-day basis.

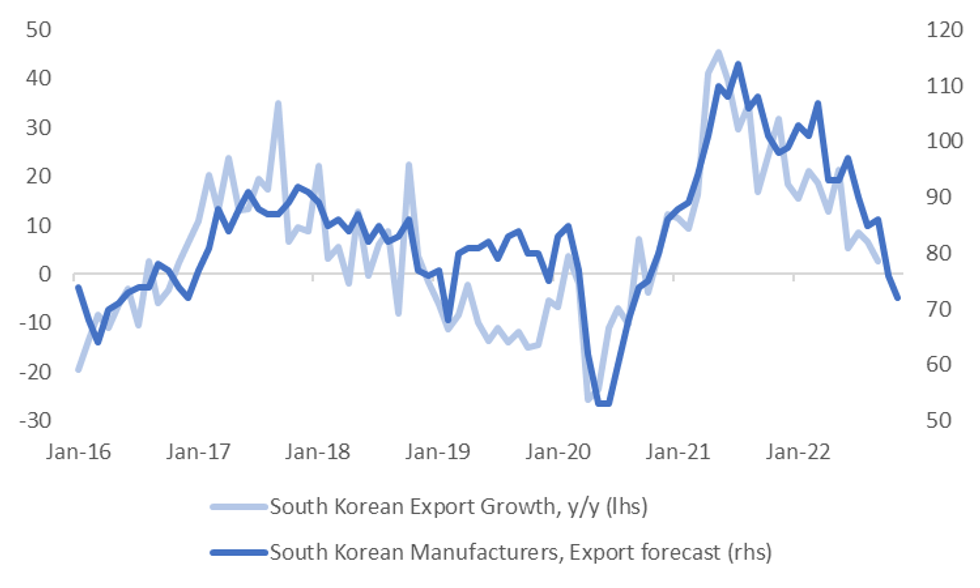

SOUTH KOREA: Manufacturers Expecting Slower Export Growth

One of the sub-components from the South Korean business survey (conducted by the BoK & released this morning) gauges manufacturers expectations for exports. The chart below plots these expectations against Korean headline y/y export growth. The two series share a reasonable correlation, with a further loss of export momentum expected based off the outlook from manufacturers.

- This fits with the broader backdrop of softer global growth expectations. We have also had disappointing earnings updates from names in the tech space. This came through from US names late in the NY session, but also South Korean chipmaker SK Hynix noted this morning an 'unprecedented' slowdown in demand in its Q3 earnings update (see this Bloomberg story for more details). Samsung SDI just reported better than expected earnings and profits for Q3, providing some offset.

Fig 1: South Korean Manufacturers Expecting A Further Slowdown In Export Growth

Source: BoK/MNI - Market News/Bloomberg

EQUITIES: HK/China Gains Offset Weaker Lead From US Futures

Regional equities are higher, led by gains in HK/China. Markets in the region are outperforming a negative lead from US futures, particularly in the tech space, after disappointing earning updates post the NY close. Nasdaq futures are off close to 1.9% at this stage, Eminis near -0.90%.

- The HSI is up around 2.2%, with dips buyers likely supporting sentiment. Gains have been led by the tech sector, which is up by 4% at this stage.

- Comments from China regulators, including PBoC, SAFE, CBIRC and CSRC around ensuring a healthy development of China's financial markets, from late yesterday, has likely aided moves. The CBIRC stated local capital markets have 'long-term investment value’, as reported by Bloomberg.

- The CSI 300 is up 1.60%, while the Shanghai Composite is up 1.40%.

- South Korean shares have shrugged off a negative US tech lead to be up close to 1% for the Kospi. Samsung posted better than expected earnings, while SK Hynix disappointed, although shares in the company were still higher, as the market embraced investment cut plans for next year. The Taiex is up 0.60%, led by TSMC gains.

- The ASX 200, is up smalls (+0.10%), lagging better regional sentiment.

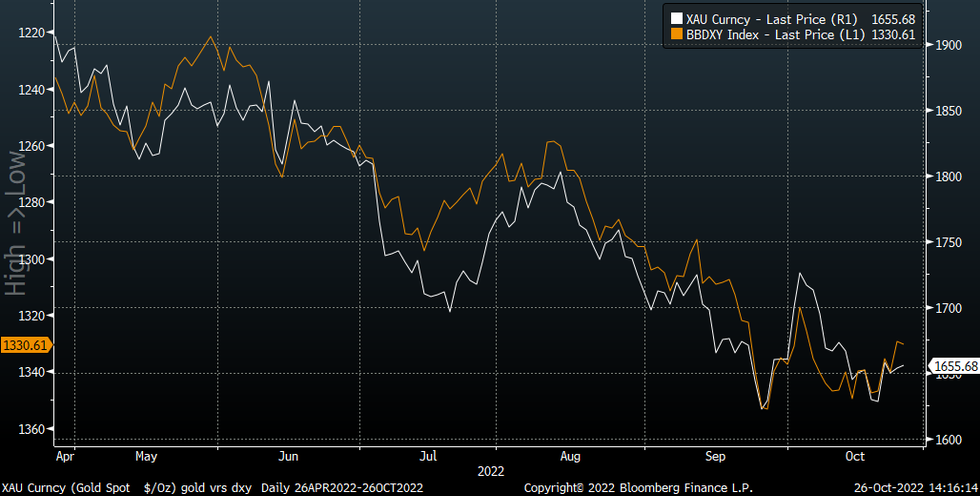

GOLD: Catching Up With Lower USD Levels

Gold is up modestly versus NY closing levels. The precious metal was last at $1655.70, +0.15% for the session, despite the USD finding some stability (BBDXY +0.10%).

- Today's resilience in gold may reflect some catch up with overnight USD weakness. On a short term chart basis, gold should be at higher levels based off the dollar correction overnight. Still, the disconnect is not large by historical standards, see the chart below (note the BBDXY is inverted on the chart).

- Flows may be benefiting higher beta risk assets as well, with regional equities doing better today, led by China/HK.

- Gold remains comfortably within recent ranges, with recent highs between $1660/1670 still intact. Further downside in US real yields should help keep dips to $1640 supported though.

Fig 1: Gold & BBDXY (Inverted) Trends

Source: MNI - Market News/Bloomberg

OIL: Prices Continue To Range Trade As Demand And Supply Uncertainties Continue

Oil prices dropped during today’s session after US API data showed an increase in crude oil stocks of 4.52mn barrels. They have now edged back towards session highs on better sentiment in Asian equity markets.

- Oil continues to range trade with WTI now trading just under $85 after falling to $84.38 and Brent is around $93 after reaching $92.33. Both benchmarks are off their closing levels overnight.

- The details of the API report on US inventories are published tonight and should shed some light on distillate stocks, which are very low.

- The spread between the two nearest Brent contracts, the prompt spread, has declined to $1.71/bbl from over $2 on Monday. This is still indicates a bullish market but less so than it was.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/10/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 26/10/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/10/2022 | 0800/1000 | ** |  | EU | M3 |

| 26/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/10/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/10/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 26/10/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 26/10/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 26/10/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 26/10/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/10/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.