MNI EUROPEAN MARKETS ANALYSIS: BOJ Opinions Show Need To Mull Rate Hikes Cautiously

- Yen has underperformed in the G10 FX space, with a cautious BoJ Summary of Opinions from the last policy meeting a headwind. JGB futures are holding in positive territory, +6 compared to settlement levels.

- Tsys futures have reversed earlier gains and now trade near session lows although still well off the lows made overnight. U.S. Equity futures are little changed today. Investors remain cautious following headlines that Israel had begun “targeted ground raids” in southern Lebanon, escalating a campaign to root out Hezbollah. The US Dockworkers strike is also set to go ahead

- Australian retail sales were better than expected, although other data was mixed. The A$ has outperformed JPY and NZD. RBA-dated OIS pricing sits 1-4bps firmer across meetings. Notably, pricing for 2025 meetings is now 2-4bps higher than pre-RBA levels on September 24.

- Later today we have flash PMI, JOLTS and ISMs and more Fed speak from Bostic, Barkin and Cook in the US. Before that, EU final PMI prints and inflation prints are due.

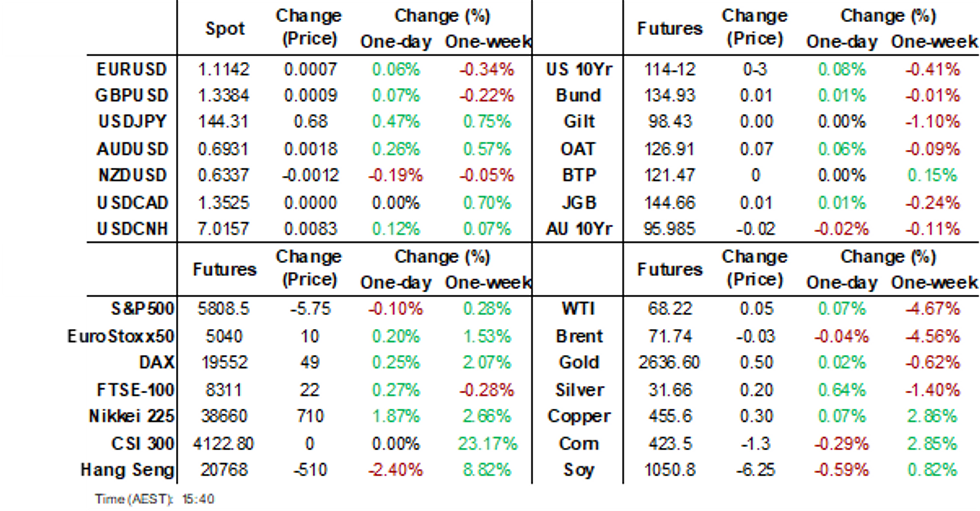

MARKETS

US TSYS: Tsys Futures Erase Earlier Gains, PMIs & More Fed Speak Later Today

- Tsys futures have reversed earlier gains and now trade near session lows although still well off the lows made overnight, as headlines out of the middle east have seem to slow while the USD saw buying following dovish comments from the BoJ.

- US Dockworkers strike set to go ahead after no deal announced, equities ticked slightly lower on these headlines but so far moves have been limited.

- TU is trading +00⅞ at 104-04¾, vs lows of 104-04⅜, while TY is now unchanged for the Asian session at 114-13, vs lows of 114-12

- The Fed's Powell reaffirmed that interest rates will be lowered "over time" as inflation continues to move toward the 2% target, while emphasizing that future rate decisions will depend on incoming economic data and the pace of labor market cooling. Powell noted the Fed is not rushing rate cuts, leaving the door open for gradual easing depending on economic conditions.

- Cash tsys curves have reversed their earlier flattening move and are twist steepening with the front-end outperforming, yields are +0.5bps to -1bps with the 2yr -0.6bps at 3.635%, while 10yr is +0.2bp at 3.783%.

- Later today we have flash PMI, JOLTS and ISMs and more Fed speak from Bostic, Barkin and Cook.

BOJ: Cash Curve Twist-Flattening After BoJ’s SoO

JGB futures are holding in positive territory, +6 compared to settlement levels.

- Several Bank of Japan board members emphasised the need to consider raising the policy interest rate cautiously amid unstable markets and uncertainty over the US economy at the Sept 19-20 meeting, the summary of opinions showed.

- “The Bank's basic thinking remains that if the outlook for economic activity and prices will be realised, the Bank will adjust the degree of monetary accommodation accordingly,” one member noted. “That said, financial markets have remained unstable. In making policy decisions, it is important for the Bank to carefully assess not only developments in financial markets at home and abroad but also the factors underlying these developments, such as the situation in overseas economies, particularly the U.S. economy.”

- Cash US tsys are flat to 1bp richer in today’s Asia-Pac session.

- The cash JGB curve continues to hold a twist-flattening, pivoting at the 2-year, with yields 4bps higher to 4bps lower.

- Swap rates are 2bps lower to 3bps higher, with a steepening bias. Swap spreads are tighter out to the 10-year and mixed beyond.

- Tomorrow, the local calendar will see Monetary Base and Consumer Confidence data alongside BoJ Rinban Operations covering 1-5-year and 25-year+ JGBs.

BOJ: CPI Trend, Wages, US Economy Key BoJ Watch Points

The BoJ Summary of Opinions from the September policy meeting gave a cautious outlook in terms of future policy adjustments. One of the key sentences we took away when talking about the economy was "In considering any further policy interest rate hike, attention is warranted for the time being on consumer prices, the momentum toward next year's annual spring labor-management wage negotiations, and developments in the U.S. economy." See this link here.

- The Summary of Opinions expressed broader confidence in the outlook and that further policy adjustments can be made. One member advocating tightening to 1% in the second half of the fiscal 2025 year (at the earliest).

- Still, there seems no rush to move to this point rapidly for most other board members. The heightened uncertainty around the US outlook, how aggressive the Fed easing cycle will be and what impact this will have on the yen were also cited as watchpoints.

- The other big focus point from the opinions was the need to make communications more clearer, particularly if BoJ/market views diverged.

JAPAN DATA: Tankan Results Mostly Firmer Than Forecast, Resilient Backdrop

Japan's Q3 Tankan survey results were mostly firmer than expected. The table below, from BBG, presents the actual and expected outcomes. For large manufacturers, the current index and outlook metrics both ticked higher. The outlook for this segment is close to cycle highs.

- For large non-manufactures it was similar although the outlook didn't rise as much as markets expected. Capex intentions didn't rise as much as consensus forecasts implied but are still holding up well, albeit off 2022 cycle highs.

- For smaller firmer, we were ahead of expectations, albeit at lower absolute levels compared to larger firms. This was the first improvement in sentiment for smaller firms since the end of 2023.

- All in all the data paints a resilient picture for Japan's economy, albeit one that is not running away rapidly.

Table 1: Q3 Japan Tankan Results

| Survey | Actual | Prior | ||

| Tankan Large Mfg Index | 3Q | 12 | 13 | 13 |

| Tankan Large Mfg Outlook | 3Q | 12 | 14 | 14 |

| Tankan Large Non-Mfg Index | 3Q | 32 | 34 | 33 |

| Tankan Large Non-Mfg Outlook | 3Q | 30 | 28 | 27 |

| Tankan Large All Industry Capex | 3Q | 11.90% | 10.60% | 11.10% |

| Tankan Small Mfg Index | 3Q | -1 | 0 | -1 |

| Tankan Small Mfg Outlook | 3Q | -1 | 0 | 0 |

| Tankan Small Non-Mfg Index | 3Q | 11 | 14 | 12 |

| Tankan Small Non-Mfg Outlook | 3Q | 9 | 11 | 8 |

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Cheaper & At Worst Levels, Mixed Domestic Data

ACGBs (YM -2.0 & XM -0.5) are weaker and near session cheaps after today’s mixed domestic data.

- At face value, the retail sales data suggested some positive impact from the government's tax cuts/costs of living relief measures. The ABS also noted: “This year was the warmest August since 1910, which saw more spending on items typically purchased in spring.”

- Concerning building approvals: "The movements in dwellings excluding houses continue to be the result of volatility in apartment approvals, with the broad environment around apartments remaining subdued," said Daniel Rossi, ABS.

- Cash US tsys are flat to 1bp richer in today’s Asia-Pac session.

- Cash ACGBs are cheaper with the belly underperforming. The AU-US 10-year yield differential at +22bps.

- Swap rates are 1-3bps higher, with the 3s10s curve flatter.

- The bills strip is cheaper, with pricing -3 to -5 across contracts.

- RBA-dated OIS pricing sits 1-4bps firmer across meetings. Notably, pricing for 2025 meetings is now 2-4bps higher than pre-RBA levels on September 24.

- For context, these same meetings were 6-10bps softer compared to pre-RBA levels the day after the decision.

- Tomorrow, the local calendar is empty, apart from the AOFM’s planned sale of A$800mn of the 2.75% 21 June 2035 bond.

AUSTRALIA DATA: Retail Sales Stronger Than Forecast, Aided By Weather/Tax Cuts

Australian August retail sales were above expectations. We rose 0.7%m/m, against a 0.4% forecast, while the prior month was revised up to +0.1%m/m, versus flat initially. The August rise was the strongest since Jan of this year (+1.0%).

- At face value the data suggests some positive impact coming through from the government's tax cuts/costs of living relief measures. The ABS also noted that: “This year was the warmest August on record since 1910, which saw more spending on items typically purchased in spring. This included summer clothing, liquor, outdoor dining, hardware, gardening items, camping goods and outdoor equipment.”

- In terms of the detail by sub-industry, food rose 0.6%m/m, after a 0.2% gain in July. Household goods were down -0.3%m/m, after a July -0.1% dip. This was the only sub category to fall.

- Apparel rose 1.5%, department stores up 1.6%, after both categories fell in July. Cafes were up 1.0%m/m, while other 1.3%m/m. This fits with the ABS's point outlined above.

- In y/y terms spending rose 3.1%, this was the strongest pace since mid 2023, see the chart below. Base effects may help keep y/y momentum resilient in the next few months. Focus is likely to rest on spending trends in coming month, with the resilient y/y trend unlikely to give the RBA cause to shift its policy bias (at least on this backdrop alone).

Fig 1: Australian Retail Sales Y/Y Trend Improving

Source: MNI - MarketNews/Bloomberg

STIR: RBA Dated OIS Pricing Now Firmer Than Pre-RBA Levels

RBA-dated OIS pricing sits 1-4bps firmer across meetings after today’s mixed domestic data—retail sales exceeded expectations, while building approvals fell short.

- Notably, pricing for 2025 meetings is now 2-4bps higher than pre-RBA levels on September 24.

- For context, these same meetings were 6-10bps softer compared to pre-RBA levels the day after the decision. The softening seemed to stem from the RBA board's lack of explicit discussion about a potential rate hike.

- Despite today’s firming, a cumulative 13bps of easing is still priced in by year-end.

Figure 1: RBA-Dated OIS – Today Vs. Pre-CPI

Source: MNI – Market News / Bloomberg

NZGBS: Closed On A Strong Note, NZIER Pricing Intentions Soften

NZGBs closed on a strong note, with benchmark yields 1-2bps lower, after being as much as 3bps higher earlier. This came despite a strengthening in business confidence.

- The NZIER Q3 Business Opinion Survey showed, after seasonal adjustment, a net 5% of businesses expect the economy to deteriorate versus a revised 40% in Q2. This was the strongest reading since Q2 2021.

- With cash US tsys little changed in today’s Asia-Pac session, the local market’s change in direction during the session appeared linked to NZIER pricing intentions.

- A net 3% of firms raised prices in Q3, which was the lowest reading since Q4 2020. Just 7% see price increases in Q4.

- NZIER expects a 25bp cut in the OCR next week but a case can be made for a bigger move given the decline in pricing expectations. BNZ has shifted to a 50bp cut next week.

- Swap rates closed 1-2bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed 1-3bps softer across meetings. A cumulative 91bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

- Later today the US calendar flash PMI, JOLTS and ISMs data, and more Fed speak from Bostic, Barkin and Cook.

FOREX: Yen & NZD Lose Ground, A$ Outperformance Aided By Retail Sales Beat

The USD is firmer against JPY and NZD as the Tuesday session unfolds. Both currencies are down around 0.45% against the USD at this stage. The USD BBDXY index is slightly higher last near 1223.5.

- USD/JPY has spent most of the session tracking higher, the pair last 144.25/30, just off session highs (144.33). Whilst we are still comfortably below intra-session highs from Friday (146.49), it is still an impressive rebound from yesterday's lows at 141.65.

- Today's data pointed to a resilient economic backdrop, with the unemployment rate edging down, while the Q3 Tankan survey painted a positive outlook. The BoJ Summary Of Opinions from the September meeting didn't suggest there was any need to rush further rate hikes, with the central bank stating that CPI trends, wages and US developments are key watch points.

- This backdrop has weighed on yen at the margins, whilst onshore equity gains and a tick up in US equity futures have been other yen headwinds. US yields sit close to unchanged at this stage.

- NZD/USD has faltered back to 0.6325. Local bank BNZ calling for a 50bps cut in light of the softer NZIER survey figures earlier today.

- AUD/USD has outperformed, aided by a retail sales data beat, which has weighed on RBA easing expectations into 2025, albeit at the margin. The pair got to highs of 0.6935, but sits back at 0.6915 in latest dealings.

- Looking ahead, we have final EU PMI reads for September, as well as CPI as well. In the US it is the ISM print and the JOLTS job openings data.

ASIA: Asian Equities Mostly Higher, Japan Leads As Yen Falls

Global equities are mostly higher today as investors navigate central bank policy signals, political developments, and geopolitical risks. In Japan, stocks posted gains fueled by a weaker yen, boosting exporters like technology and automotive firms. The Topix +1.70% and Nikkei 225 +1.90% driven by positive sentiment following the BoJs dovish stance, even as the Tankan report bolstered confidence in the economy. U.S. Equity futures are little changed today. Investors remain cautious following headlines that Israel had begun “targeted ground raids” in southern Lebanon, escalating a campaign to root out Hezbollah despite international appeals for restraint and US Dockworkers strike is set to go ahead following now deal being reached.

- It has been a slow session, with very light trading as China, Hong Kong & South Korean markets are closed.

- Japanese equities are ticking higher post lunch, tech stocks particularly semiconductor names are the top performing sector with the likes of Tokyo Electron +3.2% & Disco Corp +4.30%, exporters are also trading well while Consumer Staples & Discretionary stocks are lagging today.

- Australia's ASX200 is -0.90% retreating from record highs with mining and banking stocks leading the decline BHP, Rio Tinto, and Fortescue dropping over 2%, while all major banks were also lower. Despite the market downturn, REA Group rose 5.2% after abandoning its Rightmove acquisition, Sigma Health surged 15.6% on acquisition news, and Appen continued its rally, up 10.2%.

- Asian EM is higher today, with Philippines's PSEi +1.20%, Indonesia's JCI +0.70%, Thailand's SET +0.85% while India's Nifty 50 is Flat.

ASIA: Foreign Investors Selling Asian Equities, Tech Worst Hit

Decent outflows from the tech heavy markets in Taiwan & South Korea on Monday, while investors look to be booking profits after the JCI hit ATH on Sep 19th.

- South Korea: Saw outflows of $799m Monday, with the past 5 sessions reaching -$774m, while YTD flows are +$10.56b. The 5-day average is -$155m, below both the 20-day average of -$310m and the 100-day average of -$34m.

- Taiwan: Saw outflows of $1.4b Monday, with the past 5 sessions netting +$1.31b, while YTD flows are -$11.99b. The 5-day average is +$262m, above the 20-day average of -$115m, but below the 100-day average of -$128m.

- India: Saw inflows of $44m Monday, with the past 5 sessions netting +$1.06b, while YTD flows are +$24.8b. The 5-day average is +$203m, below both the 20-day average of +$363m and the 100-day average of +$117m.

- Indonesia: Saw outflows of $205m Monday, with the past 5 sessions netting -$509m, while YTD flows are +$3.25b. The 5-day average is -$102m, below the 20-day average of +$71m, but above the 100-day average of +$29m.

- Thailand: Saw outflows of $30m Monday, with the past 5 sessions totaling -$65m, while YTD flows are -$2.58b. The 5-day average is -$13m, below the 20-day average of +$46m, but above the 100-day average of -$7m.

- Malaysia: Saw outflows of $61m Monday, with the past 5 sessions netting -$160m, while YTD flows are +$806m. The 5-day average is -$32m, below both the 20-day average of +$5m and the 100-day average of +$11m.

- Philippines: Saw inflows of $2m Monday, with the past 5 sessions totaling +$160m, while YTD flows are +$22m. The 5-day average is +$32m, above both the 20-day average of +$17m and the 100-day average of +$3m.

OIL: Middle East Tensions Offset by Expected Supply Increase from Libya.

- West Texas Intermediate has stabilized for now above $68 as news breaks of the potential ground raids by Israel into Lebanon.

- As the markets digests the impending supply coming on line from Libya, it comes at a time when the ever evolving situation in the Middle East conflict evolves further.

- WTI is trading at $68.24 in the Asia morning session, with Brent at $71.78.

- Alongside the anticipated return of supply from Libya (following a compromise reached by regional governments over the new Central Bank Head for the country) OPEC has indicated that it will stick to its original plan to bring back online further production.

- All of this occurs against a backdrop of slowing global growth with China slowing down and the US cutting rates to avoid a rapid slowdown.

- For September, West Texas saw a decline of 7.30% and Brent 5.95%.

GOLD: Fed Chair Powell’s Comments Weigh

Gold is slightly higher in today’s Asia-Pac session, after closing 0.9% lower at $2634.58 on Monday.

- Bullion was pressured yesterday by Fed Chair Powell’s remarks at the NABE conference, where he stressed the Fed is not in a hurry to cut rates. He also emphasised that the overall US economy remains on solid footing.

- The US 2-year rate was up 8bps to 3.64%, while the 10-year was 3bps cheaper at 3.78%.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- Today's US calendar will see flash PMI, JOLTS and ISMs data, and more Fed speak from Bostic, Barkin and Cook.

- According to MNI’s technicals team, last week’s move 0.9% move higher confirmed a resumption of the primary uptrend, with a focus on $2675.5 next, a Fibonacci projection. Firm support lies at $2583.9, the 20-day EMA.

SOUTH KOREA: Trade Data Supports BOK Stance.

- Stronger than expected Exports and softening imports left South Korea with a $6.6bn Trade surplus for September, surpassing expectations.

- Exports for September rose 7.5%, above market expectations of a 6.4% increase.

- Imports rose 2.2%, down from the prior month of +6.0% and market expectations of 5.0%.

- When combined with the decline in PPI released earlier, this data point provides support to the BOK’s view of keeping rates on hold whilst focusing on the housing market and the associated debt levels that go with it, at a time when the politicians are focused on the consumer in general given these competing forces.

- As one of the largest exporters of technology, South Korea’s market is considered an indicator of global trade, particularly in memory chips used in AI technology.

- Today’s data release may indicate that trade is recovering in the region.

ASIA FX: TWD Weakens, China & S Korea Closed Today

With both China and South Korea markets closed today, it has been reasonably quiet in North East Asia FX.

- USD/CNH has drifted a little higher, in line with weaker yen trends, but overall beta with respect to such moves remains modest. The pair was last near 7.0160 so not too far off where onshore spot finished up for Monday's session (7.0187). China markets are closed today and re-open next Tuesday post the National Day break. Focus is likely to be spending trends during this holiday period, particularly in light of the stimulus initiatives announced in recent weeks.

- The 1 month USD/KRW has drifted a little higher, the pair last near 1319.5, around 0.20% weaker in won terms. This is a decent rebound from earlier Monday lows close to 1300. Whilst onshore markets are closed today, we still got full month September trade data. Export growth was stronger at 7.5%y/y, versus the 6.4% forecast but still down on the 11.2% August pace. Imports printed weaker than forecast, which drove the trade surplus to just over $6.6bn. This is just off cycle highs.

- USD/TWD has rebounded strongly. The pair has pushed back towards 31.80/85, around 0.60% weaker in TWD terms. Broader USD gains, amidst higher US yields from Monday will be weighing. We also saw a surge in equity outflows at month end on Monday, with $1.4bn in foreign selling.

ASIA FX: MYR & THB Unwind Some Recent Outperformance

South East Asia currencies have mostly faltered against the USD in the first part of Tuesday trade. The biggest losses have been seen for MYR and THB, not surprisingly given the recent strong outperformance for both currencies. Losses have been more modest elsewhere.

- USD/MYR has rebounded close to 4.1700, after getting under 4.1000 in terms of intra-session lows on Monday. Being clear of month end may have reduced USD selling pressure, whilst the pair was oversold based off the RSI (14) for much of the second half of September. On the topside we have the 20-day EMA back at 4.2400. On the data front we had the Sep PMI ease to 49.5 from 49.7 prior (per S&P).

- USD/THB has followed a similar trajectory, the pair last in the 32.40/45 region, around 0.80% weaker in baht terms. We did see BoT rhetoric around baht strength pick up on Monday warning of the impact on exports and tourism revenues. This may mean a test of 32.00 won't come without broader USD weakness or a better economic signs locally. The THB TWI (per Goldman Sachs) has surged higher in recent months and is back close to pre Covid levels.

- USD/IDR is firmer, the pair last near 15200, levels we haven't seen for nearly 2 weeks. The firmer US yield backdrop, coupled with firmer USD trends elsewhere have weighed. USD/PHP is also firmer, the pair above 56.15, in latest dealings.

INDIA: PMI’s Remain Strong, But Off the Highs.

- HSBC and S&P India PMI for September was released today at 56.5.

- August reading was 57.5 and September 2023 57.5.

- The PMI has been moderating slowly, driven primarily by a moderation of output.

- New orders have slowed since last month and are at the lowest level since December 2023.

- PMI’s above 50 represent economic expansion.

INDONESIA: CPI Opens Door to Rate Cut for Central Bank

- Today’s CPI release came in lower than expected, opening the door for a cut in interest rates by the Bank Indonesia at its next meeting on October 16.

- Bank Indonesia has a target range of 2-4%

- Today’s print of 1.84% is the first time since 2021 that the CPI has dipped below 2.00%.

- Back in 2021, the bottom in CPI print had been preceded by a rate cutting cycle that had begun in 2019.

- Today’s cycle sees interest rates much higher at 6.00% and Central Bank forecasts of GDP growth to be 5.00%.

- Given the Central Bank's forecast for inflation is at 2.70%, today’s CPI print makes October 16 ‘live’ in expectations for a rate cut.

ASIA: PMI’s: Philippines Bucks the Declining Trend in Regional PMI’s.

- This morning’s data release for the region shows a declining trend for PMI’s, the exception being Philippines.

- Indonesia’s PMI continues to evidence contraction at 49.2, a small improvement from last month’s 48.9.

- Malaysia’s PMI was 49.5 a modest decline from previous.

- Thailand’s PMI barely remains in expansion territory at 50.4 but was a material contraction from +52.0 prior.

- Taiwan also is declining down to 50.8 from 51.5 prior.

- The standout in the release was Philippines that jumped 53.7, following 51.2 prior and is possibly impacted by the surprise cut in rates in August by the BSP.

- The Philippines result will be watched closely by other regions as potential reasons to pressure their respective Central Banks for a rate cut.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Period | Country | Release | Prior | Consensus | |

| 01/10/2024 | 0630/0830 | ** | Aug |  CH CH | Retail Sales m/m | 1.4 | -- | % |

| 01/10/2024 | 0630/0830 | ** | Aug |  CH CH | Retail Sales wda y/y | 2.7 | -- | % |

| 01/10/2024 | 0715/0915 | ** | Sep |  ES ES | S&P Global Manufacturing PMI | -- | -- | |

| 01/10/2024 | 0745/0945 | ** | Sep |  IT IT | S&P Global Manufacturing PMI | -- | -- | |

| 01/10/2024 | 0750/0950 | ** | Sep |  FR FR | S&P Global Manufacturing PMI (f) | -- | -- | |

| 01/10/2024 | 0755/0955 | ** | Sep |  DE DE | S&P Global Manufacturing PMI (f) | -- | -- | |

| 01/10/2024 | 0800/1000 | ** | Sep |  EU EU | S&P Global Manufacturing PMI (f) | -- | -- | |

| 01/10/2024 | 0830/0930 | ** | Sep |  GB GB | S&P Global Manufacturing PMI (f) | -- | -- | |

| 01/10/2024 | 0900/1100 | *** | Sep |  EU EU | HICP (p) 'Core' y/y | 2.8 | 2.7 | % |

| 01/10/2024 | 0900/1100 | *** | Sep |  EU EU | HICP (p) y/y | 2.2 | 1.9 | % |

| 01/10/2024 | 0900/1100 | *** | Sep |  EU EU | HICP core m/m | 0.3 | -- | % |

| 01/10/2024 | 0900/1100 | *** | Sep |  EU EU | HICP m/m | 0.1 | 0.1 | % |

| 01/10/2024 | 0900/1000 | ** | 04-Oct |  GB GB | Bid to Cover Ratio | -- | -- | |

| 01/10/2024 | - | *** | Sep |  US US | NA-made light vehicle sales SAAR | -- | -- | (m) |

| 01/10/2024 | 1255/0855 | ** | 28-Sep |  US US | Redbook Retail Sales y/y (month) | 5.2 | -- | % |

| 01/10/2024 | 1255/0855 | ** | 28-Sep |  US US | Redbook Retail Sales y/y (week) | 4.4 | -- | % |

| 01/10/2024 | 1345/0945 | *** | Sep |  US US | S&P Global Manufacturing PMI (f) | 47 | 47 | |

| 01/10/2024 | 1400/1000 | *** | Sep |  US US | ISM Man. Employment Index | 46 | -- | |

| 01/10/2024 | 1400/1000 | *** | Sep |  US US | ISM Manufacturing Index | 47.2 | 47.7 | |

| 01/10/2024 | 1400/1000 | *** | Sep |  US US | ISM Manufacturing New Orders | 44.6 | -- | |

| 01/10/2024 | 1400/1000 | *** | Sep |  US US | ISM Manufacturing Prices Index | 54 | -- | |

| 01/10/2024 | 1400/1000 | * | Aug |  US US | Construction Spending m/m | -0.3 | 0.1 | % |

| 01/10/2024 | 1400/1000 | *** | Aug |  US US | JOLTS job openings level | 7673 | 7693 | (k) |

| 01/10/2024 | 1400/1000 | *** | Aug |  US US | JOLTS quits rate | 2.1 | -- | % |

| 01/10/2024 | 1430/1030 | ** | Oct |  US US | Dallas Fed services index | -7.7 | -- | |

| 01/10/2024 | 1530/1130 | * | 04-Oct |  US US | Bid to Cover Ratio | -- | -- | |

| 01/10/2024 | 1530/1130 | ** | Sep |  US US | Bid to Cover Ratio | -- | -- |