-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Caution Remains Evident

- UK COVID-19 worry and a sense that plenty more fiscal support will be needed in the U.S. provided a defensive feel in Asia.

- The UK seems to have made Brexit concessions re: fisheries, but the EU is set to hold firm for more.

- The PBoC continued to provide calendar new year liquidity provisions.

BOND SUMMARY: Core FI Lightly Bid In Asia, Familiar Risks Eyed Into Christmas

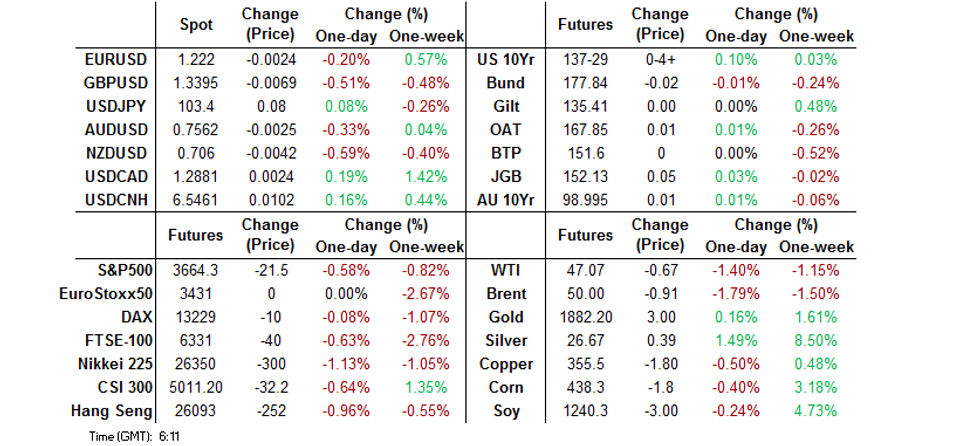

All in all there was little to report during Asia-Pac trade, with tight ranges in play for U.S. Tsys. T-Notes stuck to the confines of a 0-04+ range, last +0-04+ at 137-29, while cash yields sit within 1.5bp of closing levels across the curve, with very modest richening/bull flattening seen. Continued worry surrounding the COVID-19 situation in the UK and a sense of more being needed re: U.S. fiscal support (despite the passage of the latest fiscal support scheme through Congress) blunted any lingering risk appetite in what proved to be a headline light overnight session.

- There was little to rock the boat for the JGB space, with futures mostly sticking to their overnight range, finishing +5, while cash traded marginally mixed across the curve for most of the session, before a light bid crept into the longer end. The latest liquidity enhancement auction for off-the-run 15.5-39 Year JGBs came and went without much fanfare but wasn't particularly strong. Elsewhere, the government's economic assessment maintained the overall view of the economy i.e. in a severe situation, although there were upgrades for its views on exports, imports, corporate earnings and bankruptcies.

- Several desks that we have spoken to pointed to today's record low fixing for 3-Month BBSW as the supportive factor for the shorter end of the Aussie curve during Sydney dealing, and a possible driver of receiver side flows in the swap space, all of which stems from the RBA's ultra-loose monetary policy settings pumping liquidity into the system (surplus funds lodged on E/S accounts at the RBA have moved towards all-time highs in recent days), with 3-Year ACGB yields registering a fresh all-time low in the process, at 0.091% (per BBG generics). YM finished +2.0, with XM +1.0 as result, while swaps were generally narrower across the curve.

FOREX: Caution Prevails Ahead Of Holiday Season, Sterling Struggles On Familiar Risks

Headline flow was subdued overnight, providing little in the way of major catalysts. The greenback gained on the back of broader cautious feel and demand for USD ahead of the holiday season/year-end, with participants assessing familiar risks.

- GBP traded on a softer footing, with focus on UK Covid-19 matters/Brexit saga. The Telegraph reported that UK MPs have been told to be ready for voting on a Brexit deal next Wednesday, but the article also cited sources from both sides of the English Channel downplaying yesterday's reports re: fresh UK offer on fishing rights. MNI sources noted that the offer improves odds of reaching a deal, yet "Brussels is exp. to hold out for further concessions."

- Antipodean currencies faltered amid sour risk appetite, with most regional equity benchmarks trading in the red. The Covid-19 outbreak in NSW/Sydney continued to undermine sentiment, but an above-forecast flash reading of Australian November retail sales allowed AUD to outperform its cousin from across the ditch. AUD/NZD extended its winning streak to four consecutive sessions and crossed above the NZ$1.0700 mark.

- The PBOC fixed USD/CNY at 6.5387, stronger than yesterday's fix of 6.5507. The PBOC injected CNY 120bn of liquidity, bringing total injections this week to CNY 210bn – observers note the central bank are ensuring ample liquidity into year-end. USD/CNH added ~100 pips, but failed to test Monday highs as of yet.

- USD/Asia mostly edged higher, though TWD bucked the trend and firmed up after a beat in Taiwanese export orders. KRW faltered under pressure from local coronavirus worry, THB struggled as PM Prayuth mulled introducing nationwide Covid-19 restrictions, while IDR was heavy after FinMin Indrawati said Indonesia may experience a deeper econ contraction than exp. Bank Indonesia intervened in FX spot interbank mkt to maintain rupiah stability.

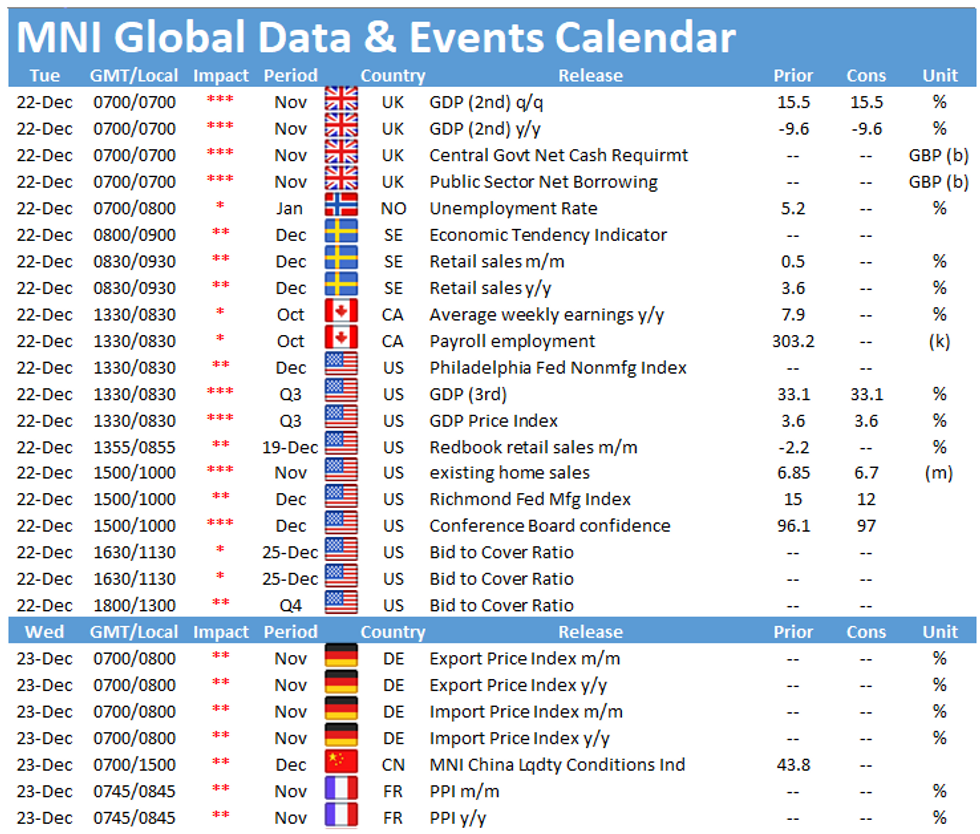

- Final GDP from the UK, Conf. Board Consumer Confidence, existing home sales & third GDP reading out of the U.S. & Swedish retail sales take focus today.

FOREX OPTIONS: Expiries for Dec22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-02(E1.5bln), $1.2070-75(E538mln), $1.2100(E1.1bln), $1.2120-25(E814mln-EUR puts), $1.2150-55(E1.4bln-EUR puts), $1.2200(E2.3bln), $1.2225-35(E903mln-EUR puts), $1.2250(E410mln-EUR puts), $1.2275(E477mln-EUR puts), $1.2300-10(E1.0bln)

- USD/JPY: Y103.00($1.2bln-USD puts), Y103.50-60($1.1bln), Y103.70-90($1.2bln), Y104.00($550mln), Y104.20-40($639mln), Y105.00-05($807mln)

- EUR/JPY: Y127.10(E598mln-EUR puts)

- EUR/GBP: Gbp0.9000-10(E670mln-EUR puts)

- USD/NOK: Nok8.75($695mln-USD puts)

- AUD/USD: $0.7440-50(A$1.1bln), $0.7500(A$630mln-AUD puts), $0.7530-50(A$711mln-AUD puts), $0.7570-80(A$1.4bln-AUD puts)

- USD/CNY: Cny6.50($1.1bln-USD puts), Cny6.55($536mln-USD puts), Cny6.65($560mln-USD puts)

- USD/MXN: Mxn19.50($673mln), Mxn20.00($1.3bln-USD puts), Mxn20.50($535mln)

EQUITIES: COVID Worry & Need For More Fiscal Support In The U.S. Seen

The major equity indices were generally biased lower during Asia-Pac dealing, even though the Wall St. benchmarks managed to recover from their intraday lows on Monday.

- Continued worry surrounding the COVID-19 situation in the UK and a sense of more being needed re: U.S. fiscal support blunted any lingering risk appetite in what proved to be a headline light session.

- Nikkei 225 -1.0%, Hang Seng -1.0%, CSI 300 -0.9%, ASX 200 -1.1%.

- S&P 500 futures -18, DJIA futures -156, NASDAQ 100 futures -30.

GOLD: Settling Down After Monday's Chop

Spot has settled around the $1,880/oz mark in Asia-Pac hours.

- Yesterday's broad-reaching choppy price action saw spot gold operate in a ~$50/oz range, after failure to hold above the $1,900/oz mark as U.S. real yields recovered from intraday lows and early risk-off flows reversed, resulting in a sharp pullback for gold, before a bounce from worst levels

- ETF gold holdings have flatlined in December after the pullback from the all-time highs witnessed in October, although the metric remains at historically elevated levels.

- The initial lines in the sand now lie at $1,844.9/oz, the Dec 16 low, which acts as support, while resistance is seen at the 76.4% retracement of the Nov 9-30 dip, located at $1,918.2/oz.

OIL: Tight, But Biased Lower In Asia

WTI & Brent sit ~$1.10 below their respective settlement levels, with the move accelerating through Asia-Pac dealing, building on yesterday's losses, which were primarily driven by worry re: the COVID-19 mutation in the UK and the potential knock-on impact re: fuel demand. Still, the benchmarks operate well within the confines of their Monday ranges, owing to the recovery from worst levels that became apparent as we moved through the day (which had no overt headline trigger, but likely centred on hope re: U.S. fiscal matters and the efficacy of existing vaccines re: treating the new COVID strain).

- In terms of crude market specifics, Monday saw focus fall on comments from Russian Energy Minister Novak, who suggested that oil production should be restored to meet rising demand, but any rise in output should not result in oversupply issues. This was followed up by a BBG source report which suggested that "Moscow believes it makes sense to raise output from the Organization of Petroleum Exporting Countries and its allies by 500,000 barrels a day in February, matching the hike already agreed for January." Such a move would represent the maximum increase allowed at the meeting. The comments/source reports were followed up by rhetoric from the Iranian Oil Minister, who noted that the views of both parties (Russia & Iran) are close re: OPEC+ matters.

- The latest round of weekly API crude inventory estimates will hit late on Tuesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.