-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY195.3 Bln via OMO Wednesday

MNI ASIA OPEN: Late Rate & Stock Rally, 5Y Sale Well Received

MNI ASIA MARKETS ANALYSIS: Tsys Rebound Late Session Highs

US TREASURY AUCTION CALENDAR: 5Y Stops Through

MNI EUROPEAN MARKETS ANALYSIS: China 10yr Yield Close To 2022 Lows

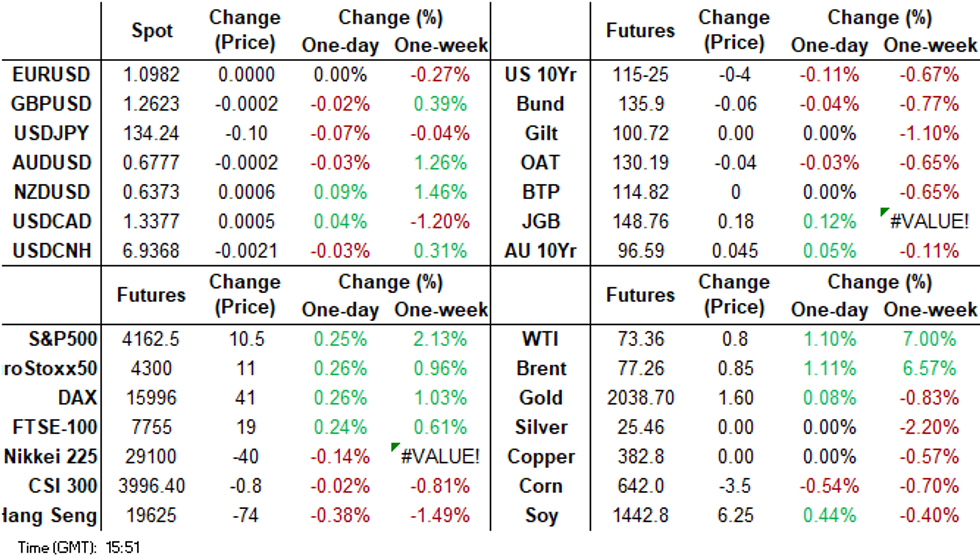

- Much of the focus was on China's April inflation prints today, with both CPI and PPI coming in weaker than expected. Easing calls are likely to persist post these prints, particularly given recent deposit cuts by the major banks. China bond yields are at recent lows, with the 10yr around 10bps off 2022 lows. USD/CNH spiked higher, but there wasn't much follow through, with selling interest above 6.9500.

- Elsewhere, the USD sits little changed in Asia, ranges have been narrow with little follow through on moves. BBDXY is unchanged from Wednesday's closing levels. Cash tsys sit 2bps cheaper to flat across the major benchmarks, the curve has bear flattened.

- The release of FOI documents that revealed the RBA had considered alternative scenarios with a peak cash rate of 4.8% also didn’t spark a notable market reaction.

- The latest monetary policy decision from the Bank of England is the highlight in Europe today. Further out we have US PPI and Initial Jobless Claims.

MARKETS

US TSYS: Marginally Pressured In Asia

TYM3 deals at 115-25, -0-04, with a narrow 0-05 range observed on volume of ~56k.

- Cash tsys sit 2bps cheaper to flat across the major benchmarks, the curve has bear flattened.

- Tsys have been marginally pressured ticking away from early session highs, however moves have been limited thus far and ranges narrow.

- Chinese CPI and PPI data was softer than expected and WTI futures have firmed ~0.8% in Asia today.

- FOMC dated OIS have ~75bps of cuts priced for 2023.

- The latest monetary policy decision from the Bank of England is the highlight in Europe today. Further out we have US PPI and Initial Jobless Claims. Fedspeak from Minneapolis Fed President Kashkari and Fed Governor Waller will cross. We also have the latest 30 Year supply.

JGBS: Futures Back To Overnight Highs After Smooth Digestion Of 30-Year Supply

JGB futures move back towards overnight highs, +15 Vs. settlement levels, after the 30-year supply sees smooth digestion. The JGB 30-year has richened 2.0bp in post-auction trade, taking out the morning’s best level, to be 2.8bp lower on the day at 1.242%. Local participants adjusting portfolios out of hedged offshore debt in Yen bond holdings may have proved to be a supportive factor, although it didn’t play heavily at this week’s 10-year auction.

- There hasn’t been much in the way of domestic drivers to flag, outside of the BoJ Summary of Opinions for the April meeting. One member said the bank needs to humbly monitor developments in wages and inflation and respond to them at the right moment.

- At 148.74, JBM3 is still positioned within a range of 147.92 (the upper limit of April's trading range) and 149.53 (the high point of March 22).

- The cash JGB curve twist flattens with yields at session bests, 0.6bp higher (1-year) to 3.5bp lower (40-year). The benchmark 10-year yield is 2.1bp lower at 0.404%, below the BoJ's YCC limit of 0.50%.

- Swap rates are lower across the curve with swap spreads wider, other than for the 1-year zone.

- The local calendar is slated to release tomorrow Money Stock (M2 & M3) data and with 3-month bank bill supply and BoJ Rinban Purchase Offer for 1–3-year, 5-10-year, 10-25-year, and 25-year+ JGBs.

AUSSIE BONDS: Richer, Off Bests, Underperforms US Tsys

ACGBs are holding firmer (YM +3.0 & XM +3.5) but off session bests as US tsys give up early Asia-Pac trade strength. With the local calendar light, local participants were on headline watch ahead of US PPI data later today. China’s inflation misses failed to provide a lasting positive impact on the local market. The release of FOI documents that revealed the RBA had considered alternative scenarios with a peak cash rate of 4.8% also didn’t spark a notable market reaction.

- Cash ACGBs are 4bp richer with the AU-US 10-year yield differential +4bp at -2bp.

- Swap rates are 5bp lower with EFPs slightly tighter.

- The bills strip twist flattens with pricing -2 to +9.

- RBA-dated OIS pricing is flat to 1bp firmer out to November, but 2-5bp softer for early ’24 meetings. Terminal rate expectations are at 3.91% (August).

- There is no local data slated for tomorrow.

- The global calendar sees the BoE Rate Decision, with a 25bp hike expected, ahead of April’s US PPI data.

RBA: Documents Show RBA Considered Impact Of 4.8% Rates

In documents released under a Freedom of Information request from Bloomberg, the details of the alternative scenarios mentioned in the minutes are now available. They date from March. Even with rates at 4.8% an unemployment recession was avoided.

- One scenario had the cash rate rising 25bp at every meeting until it reached 4.8%, which is considered by the RBA as 1pp above neutral. An alternative had rates rising 50bp until 4.8%. The final scenario had rates steady at 3.35%, the February level, until mid-2024. All options resulted in inflation reaching the target band by mid-2025 but the first two achieved it by late 2024.

- Unemployment would rise 1pp to 4.5%, the estimated NAIRU, if rates were 4.8%, but it would rise by less than 0.75pp within a year (Sahm recession).

- Each scenario was run using the RBA’s February forecasts. The May forecasts also show inflation returning to the top of the target band by mid-2025 and are based on a 3.75% rate assumption declining to 3% in two years.

NZGBS: Richer, Solid Takedown of Weekly Supply

NZGBs closed 3-4bp richer, well off session cheaps, as this week’s NZ$400 supply shows solid demand, particularly for the May-51 bond (cover ratio of 4.42x). The cash lines in the auction were 3-5bp lower in post-auction trading.

- In contrast to cash NZGBs, swap rates closed flat to 3bp lower with 10-year outpeforming.

- RBNZ dated OIS closed 1-5bp softer across meetings with 23bp of tightening priced for the upcoming May 24 meeting.

- REINZ House Price Index falls 12% y/y but showed some tentative signs of stabilisation.

- April Food Prices printed a relatively small increase of 0.5% m/m in April but the annual rate accelerated to +12.5% from 12.1%. The monthly increase was pulled lower by a 2.9% m/m decline in fruit and vegetable prices.

- Tomorrow sees the local calendar release April's Manufacturing PMI and March's Net Migration with the former likely to remain weak and the latter continuing to show post-border opening strength.

- The highlight however is likely to be the RBNZ’s Q2 Inflation Expectations. A lower-than-expected reading in Q1 saw RBNZ dated OIS scale back terminal OCR expectations.

- The global calendar delivers the BoE Rate Decision ahead of April’s US PPI data.

FOREX: Greenback Little Changed In Asia

The USD sits little changed in Asia, ranges have been narrow with little follow through on moves. BBDXY is unchanged from Wednesday's closing levels.

- AUD/USD is marginally pressured, the pair sits at $0.6770/75 down ~0.1% today. The pair briefly firmed as reports crossed that the RBA has considered a scenario of the cash rate rising to 4.8% however gains were pared and pressured marginally extended as Chinese inflation figures were softer than expected.

- Kiwi is little changed from yesterday's closing levels. NZD/USD briefly broke Wednesday's high however there was little follow through on the move and gains were pared.

- Yen firmed in early dealing with USD/JPY down as much as 0.3% dealing below the ¥134 handle. However JPY couldn't hold its gains and we now sit at ¥134.20/30. There is little reaction to the BoJ Summary of Opinions from the April meeting.

- Elsewhere in the G-10 space EUR and GBP are a touch lower. SEK is the weakest performer at the margins however liquidity is generally poor in Asia.

- Cross asset wise; e-minis are ~0.2% firmer and 2 Year US Treasury Yields are ~2bps firmer.

- The latest monetary policy decision from the Bank of England is the highlight in Europe today. Further out we have US PPI and Initial Jobless Claims.

EQUITIES: Most Major Indices Modestly Lower

(MNI Australia) Asian equities are mostly lower, albeit with losses being fairly modest across the major indices. Japan and HK indices are down around 0.2%, while China stocks are mixed. South Korea is one of the few bright spots. US equities futures are around 0.20/0.25% higher at this stage.

- The CSI 300 is tracking around +0.10% firmer at this stage, but the Shanghai Composite is off by a similar amount. China Apr inflation data came in weaker than expected, weighing on the recovery theme, whilst fresh concerns around additional restrictions on cross-broader data flows is another headwind, amid China's expansion of its anti-espionage laws.

- The HSI opened up firmer but couldn't sustain positive gains. The headline index back to -0.20%. We were +0.40% higher at the open. Some of the factors outlined above may be weighing on sentiment at the margins.

- The Topix is down 0.20%, with transportation stocks lower. The Kospi is doing better, +0.30% after firm tech related gains in US trade on Wed. Still, this is doing little for Taiwan stocks, the Taiex down 0.75% at this stage, with TSMC the main source of weakness.

- The ASX 200 is off by 0.15%. Lower iron ore prices likely weighing at the margins.

- In SEA, the JCI is off 1.30% in Indonesia, the index is now back to late Mar levels.

OIL: Crude Higher On Sustained USD Weakness And Supply Disruptions

Oil prices are up 0.8% during APAC trading after falling over 1% on Wednesday. They fell sharply following the weak China CPI data for April but have rebounded since, as the greenback held onto its post-US CPI weakness. The USD has been flat today but is still down 0.2% from Wednesday’s close.

- WTI is close to its intraday high at $73.11/bbl after reaching a low of $72.73 following China’s CPI. Resistance is at $73.93. Brent is trading around $77.00, but has struggled during the session to hold onto gains above this level. The intraday high was $77.07 and the low $76.54. Resistance is $78.49, the 20-day EMA.

- Supply continues to be interrupted by wildfires in Alberta, Canada. In addition, Iraq has reported that exports from the Turkish port of Ceyhan are yet to resume in a dispute that has been ongoing for a number of months. But the US reported a significant crude inventory build.

- On the demand side, the market is worried that demand from China won’t increase as expected following a 0.1% y/y CPI read but in the other direction, the US announced this week that it will refill the SPR towards the end of the year.

- OPEC+ releases its monthly outlook report later on Thursday. The Fed’s Kashkari and Waller also speak and there are US jobless claims and April PPI data. The PPI is forecast to rise around 0.3% m/m resulting in a moderate easing of the annual rates. The BoE meets later and another 25bp rate hike is expected.

GOLD: Gains In Early APAC Trading Unwound Post China CPI

After finishing Wednesday down 0.2%, gold has been range bound during APAC trading today and is currently around $2031.65, close to the intraday low but off the high of $2036.40. Bullion fell again following China’s CPI for April printing below expectations and close to zero. The USD index is flat.

- Gold has spent most of May above $2000 as expectations of a pause in monetary tightening grew and markets became more nervous regarding the US debt ceiling impasse. It rose to a high of $2048.19/oz yesterday on the back of the US CPI data, which showed the annual headline rate slightly below expectations but the other key components as expected. The spike was only brief and bullion fell again reaching a low of $2021.62 despite lower US Treasury yields. Resistance is at $2063, the May 4 high.

- The Fed’s Kaskari and Waller speak later and there are also US jobless claims and April PPI data. The PPI is forecast to rise around 0.3% m/m resulting in a moderate easing of the annual rates. The BoE meets later and another 25bp rate hike is expected.

CHINA DATA: Inflation Outcomes Likely To See Easing Expectations Persist

China headline inflation results were weaker for both CPI and PPI. Headline CPI printed at 0.1% y/y, versus 0.3% forecast and 0.7% prior. Base effects from 2022 weren't favorable, still this is the softest headline inflation outcome since early 2021. This was also the third straight month of m/m falls. At face value, this doesn't give a sense of a robust domestic demand backdrop.

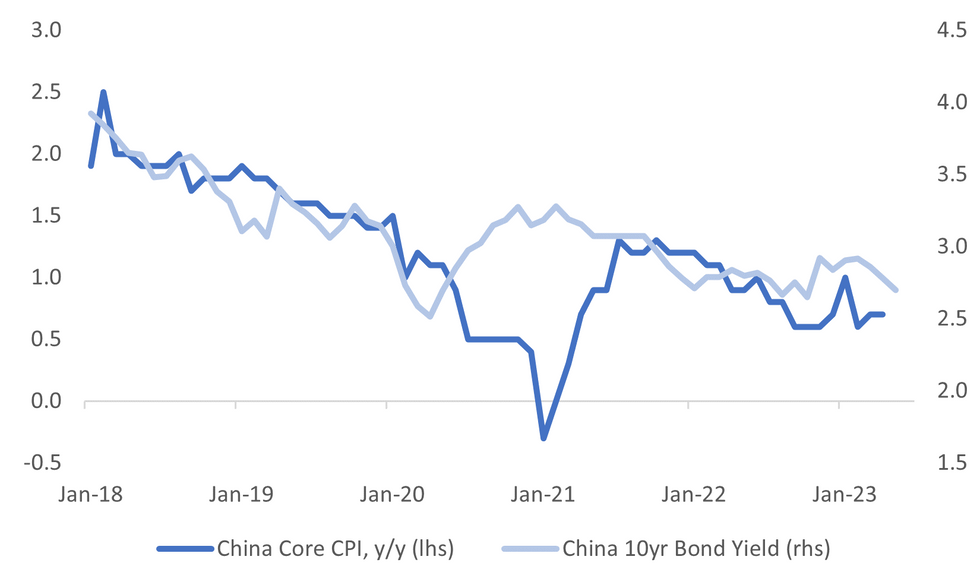

- Non-food inflation was a benign 0.1% y/y, although core (ex food and energy) was unchanged on Mar levels at 0.7% y/y. The first chart below plots the core measures against the 10yr government bond yield.

- The other detail was mixed, with transport -3.3%y/y (prior -1.9%) offset by firmer recreation at 1.9% (1.4% prior) and the others category (+3.5%, prior 2.5%).

Fig 1: China Core Inflation Versus 10yr Bond Yield

Source: MNI- Market News/Bloomberg

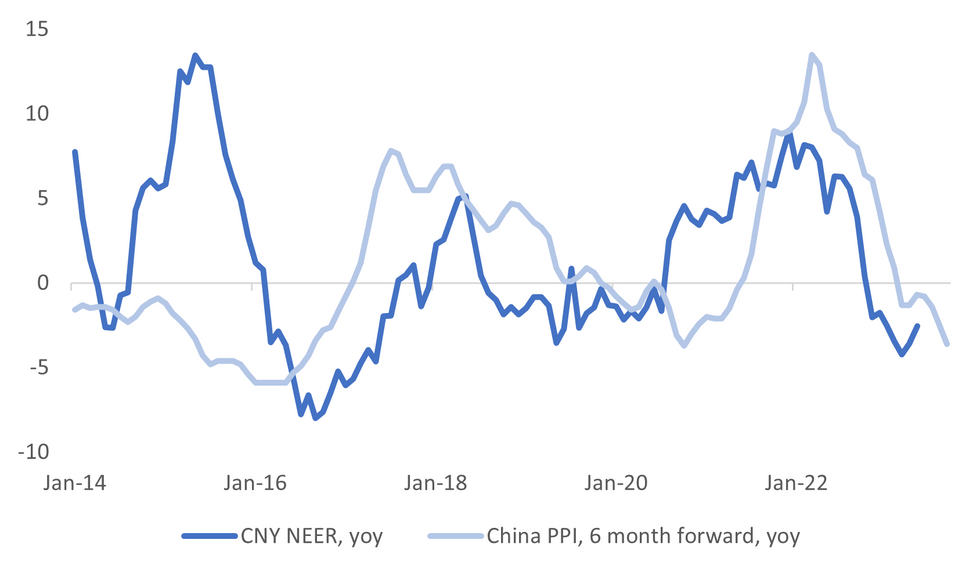

- For the PPI, we came in at -3.6% y/y, versus -3.3% forecast and -2.5% prior. Weakness was broad based, with manufacturing at -3.6% y/y, -2.8% prior. Consumer goods were 1.0% y/y (from 2.0%), weighed by durables at -0.6% y/y. Mining slipped to -8.5% y/y from -4.7%.

- The chart below overlays the CNY NEER versus the PPI y/y, which is pushed forward 6 months. The weaker PPI trend is consistent with a softer NEER backdrop. Note the CNY NEER has slipped to multi-month lows in recent sessions (per the J.P. Morgan index).

Fig 2: China PPI & CNY NEER

Source: J.P. Morgan/MNI - Market News/Bloomberg

CHINA RATES: Bond Yields Holding Lower Post Inflation Data

China bond yields are tracking lower post the inflation misses, albeit with some carry over from weaker core yields in US trade. The chart below the generic 10yr bond yield (off a further 2bps to 2.69%), now back to mid Nov lows. As the chart highlights, yields bottomed out between 2.60/2.65% between Aug/Sep last year.

- Market speculation of potential easier policy settings in the wake of the inflation figures may be more heightened, while recent deposit cuts at major banks is also a driver of lower yields.

- 2 yr yields are sub 2.24% -1.5bps, while the 5yr is back to ~2.50%, -2.8bps so far.

Fig 1: China 10yr Bond Yield Back Close To 2022 Lows

Source: MNI - Market News/Bloomberg

ASIA: Inflation Moderates In April But Core Looking Stickier

Today China reported its April CPI with headline declining more than expected to 0.1% y/y from 0.7% but the core stable at 0.7% y/y (see Inflation Outcomes Likely To see Easing Expectations Persist). While base effects provided headwinds, the monthly change was negative for the third consecutive month. Our non-Japan Asian aggregate for April has moderated to 2.2% y/y from 2.6%, as most of the region to date has recorded lower April inflation. The underlying measure looks stickier as it held steady at 1.6% but off the 1.9% peak in January.

- China’s inflation has been lower than the rest of the region and if we exclude China then Asian inflation moderated to 4.7% in April from 4.9% and again core was steady but at 3.8%.

- The moderation in headline inflation has allowed a number of Asian central banks to pause their tightening cycles and April developments look to be justifying their decisions (see Inflation Continues Moderation In April Giving Central Banks Flexibility). Inflation in the Philippines though remains the biggest problem, although it moderated in April to 6.6%, thus pointing to continued tightening from its central bank.

- In March, non-Japan Asian ex China inflation was well below the OECD’s at 4.7% compared with 7.7% and 3.8% versus 7.2% for core. Asia has a lot less of an inflation problem, which is reflected in their less aggressive hiking.

Source: MNI - Market News/Refinitiv

THAILAND: Likely Two Largest Parties Open To Forming Coalition Post Election

Here are some of the latest developments ahead of the election to be held on Sunday May 14.

- Pheu Thai PM candidate Paetongtarn has laid down three rules for her party, which is leading opinion polls, to form a governing coalition. The PM must be from Pheu Thai, the party must oversee all major ministries and coalition parties must accept its policies. She also said that her party wouldn’t cooperate with the current PM Prayut and his deputy Prawit. (See link)

- A senior member of Move Forward said that a coalition with Pheu Thai could form a government with more than 300 seats. Pheu Thai’s Paetongtarn confirmed that an alliance with Move Forward is still possible, which is now more likely as Move Forward has said it doesn’t want to oversee any particular ministry.

- Paetongtarn from Pheu Thai said that her party is not planning to scrap the controversial lese majeste law regarding insulting the royal family, but that it would be debated in parliament under her government.

- The Election Commission is expecting an 80% voter turnout.

- A candidate from the military-aligned PPRP has asked the Election Commission to look into prohibiting Move Forward PM candidate Pita from politics as he allegedly didn’t disclose ownership in a media company that closed in 2007, according to the Bangkok Post. Pita has been ahead in the polls as preferred PM in recent weeks.

ASIA FX: Weaker Inflation Sees CNH Gains Reverse

USD/Asia pairs are mostly higher, although dollar gains are fairly modest at this stage. USD/CNH was offered early, but rebounded post the weaker than expected inflation data. We saw offers above 6.9500 though. Ranges elsewhere have been reasonably tight and within recent history. Tomorrow, we get India IP for Mar and CPI for Apr. Malaysia Q1 GDP is out, along with South Korea money supply. Note also China aggregate financing figures for Apr are also due out any day between now and the 15th.

- USD/CNH was near 6.9300 prior to the inflation data but rebounded on the miss for both headline CPI and PPI. We are likely to see continued calls for easing from the PBoC. We got to 6.9500/05, but now sit back at 6.9400, so within recent ranges, albeit with an upside bias. China equities are struggling to stay positive, while the 10yr bond yield isn't too far away from 2022 lows.

- 1 month USD/KRW couldn't get sub 1314 in early trade and rebounded towards 1322, as the pair was dragged higher by USD/CNH. The first 10-days of trade data for May continued to show negative export growth and an on-going trade deficit. Overall, USD/KRW remains wedged between its 50-day and 200-day MAs.

- Philippines Q1 GDP was better than expected at 6.4% y/y, versus 6.2% forecast (7.1% prior), with growth fairly broad based. The authorities see growth momentum continuing, while inflation pressures should come down from here. USD/PHP recovered from early lows, last tracking in the 55.65/70 region (55.55 was the low).

- USD/THB has shown a similar trajectory, with early dips sub 33.60 supported, the pair last 33.70/75. Apr consumer confidence climbed to 55.0 from 53.8 in Mar. The election is also coming into focus, which is held this Sunday (see this link and this link for more details). The recent break below 34.00 may offer some resistance on the topside if we see a further USD rebound.

- USD/IDR is holding above 14700, last near 14720. Onshore equities are down by more than 1%, but this hasn't weighed materially on FX sentiment today. Better cross-asset support has come from lower CDS levels and the tick lower in US real yields from Wednesday's session. Still, palm prices continue to track lower.

SOUTH KOREA: Highlights From Local News Wires

Below is a collection of news wires reports from English versions of South Korean Newspapers and some other major news outlets from the past day or so.

Health: Yoon announces end to nearly all COVID-19 restrictions (link)

Economy: Yoon pledges to focus on economy, speed up reforms in 2nd year (link)

Economy: Exports down 10.1 % during first 10 days of May (link)

Economy: KDI cuts S. Korea's economic outlook to 1.5 pct for 2023 (link)

Economy: Service output in all provinces, major cities up in Q1 (link)

Economy: Banks' household loans snap 3-month fall in April amid high borrowing costs (link)

Economy: Korea’s foreign labor shortage intact despite quota increase for E-9 visas (link)

Economy: Korea confirms first foot-and-mouth disease cases in 4 years (link)

Economy: Most Koreans Want More Flexible Labor Laws (link)

Tech: S. Korea needs to diversify chips portfolio to address industry cycle: KDI (link)

Tech: OLED displays: another axis in S. Korea-US alliance (link)

Tech: US eyes new rules for Samsung, SK to bring chip machines to China (link)

South Korea/Japan: Uncertainty remains over contributions by Japanese war crime firms to 'partnership fund' (link)

Markets: Korean investors flock to Japanese stocks for foreign exchange gains (link)

Markets: Foreigners turn net buyers of local stocks in April (link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/05/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 11/05/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 11/05/2023 | 1200/1400 |  | EU | ECB Schnabel Talk at Federal Ministry of Finance | |

| 11/05/2023 | - |  | EU | ECB Lagarde & Panetta in G7 Finance Meeting | |

| 11/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 11/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/05/2023 | 1230/0830 | *** |  | US | PPI |

| 11/05/2023 | 1245/0845 |  | US | Minneapolis Fed's Neel Kashkari | |

| 11/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/05/2023 | 1430/1030 |  | US | Fed Governor Christopher Waller | |

| 11/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/05/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 11/05/2023 | 1730/1930 |  | EU | ECB de Guindos Panels Diario Madrid Foundation Event |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.