-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Import Surprise Hints At Better Domestic Demand

- A$ bulls were left disappointed by the RBA 25bps hike. The currency sits off ~0.80%, last near 0.6435. The RBA's CPI projection sees inflation returning to the top of the target band by the end of 2025 rather than “within” it. Despite this the tightening bias has been toned down but each decision remains highly data dependent. ACGBs sit ~1bp richer across the major benchmarks. We were ~4bps cheaper pre announcement.

- Elsewhere, TYZ3 deals at 107-25, +0-06, a narrow 0-04+ range was observed on volume of ~64k. JGB futures have been equally range bound, with September wages data printing close to expectations.

- China October trade figures hint at better domestic demand (post the import surprise). However, regional equities are mostly weaker and USD/Asia pairs higher post Monday's US yield rebound.

- Looking ahead, later the Fed’s Kashkari, Goolsbee, Barr, Schmid, Waller and Logan speak. ECB’s de Guindos, Enria and McCaul also appear. On the data front there is only the September US trade balance and German IP.

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 107-25, +0-06, a narrow 0-04+ range was observed on volume of ~64k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- The space has observed narrow ranges in Asia with little follow through on moves.

- Tsys looked through comments from Minneapolis Fed President Kashkari who said it’s too soon to declare victory over inflation, despite positive signs that price pressures are easing.

- There was also little spillover from ACGBs which firmed after a dovish 25bp hike from the RBA.

- German Industrial Production provides the highlight in Europe today. Further out we have Trade Balance and the latest 3-Year Supply. There are a slew of Fed speeches due.

JGBS: Futures Range Bound, Domestic Focus Remains On Wages Growth

JGBs have drifted higher post the lunch time break, but at 144.33, -.09, remain well within this week's range. We have modestly outperformed US Tsy futures, which sit off session highs, but equally have displayed a fairly narrow range for the session.

- The main macro news today was the close to expected September wages data (see this link). The Economic Minister stated the country needs +5% wage growth for a number of years to play catch up after such a long period of deflation (see this BBG link).

- Still, the data won't shift views that the BoJ is unlikely to move away from accommodative policy settings before year end, something that Governor Ueda hinted at yesterday.

- In the cash JGB space, moves have been modest, the 10yr yield not drifting too far from 0.88%. The 20-40yr part of the curve are 1bps lower in yield terms. The 10yr swap rate sits at 1.0625%.

- The MoF sold 10yr inflation linker bonds, but the auction drew the lowest bid-to-cover ratio since 2017.

JAPAN DATA: Real Wages Growth Still Comfortably Negative In Y/Y Terms

Japan September labor earnings were close to expectations. The nominal outcome at 1.2%, as forecast, and a modest step up from the revised 0.8% pace recorded in August. We are well down from earlier 2023 highs, but displaying more of a modest trend in recent months.

- Bonus payments were still a drag (-6.0%y/y). While contracted and regular earnings were similar to August outcomes.

- In real terms, wages remain comfortably in negative territory at -2.4% y/y, a slight improvement on August's -2.8% outcome.

- Wages are a key focus point in terms of the BoJ outlook and driving sustainable inflation gains, but also politically. PM Kishida's approval rating has been hit amid cost of living pressures. Note it was reported late yesterday by Nikkei that the government will meet with labor groups and businesses later this month to discuss continued wage increases (see this BBG link).

- Household spending was also close to expectations at -2.8% y/y (-2.9% forecast). We are up from recent lows near -5 y/y, but trend improvement is not yet evident.

AUSSIE BONDS: Marginally Richer After RBA Hikes 25bps

ACGBs sit ~1bp richer across the major benchmarks. The space firmed after the RBA hiked the cash rate but revised forecasts including the peak in unemployment and CPI inflation returning to the top of the target band by the end of 2025 rather than “within” it. We were ~4bps cheaper pre announcement.

- Futures have observed narrow ranges with little follow through ticking marginally higher after the RBA meeting. XM and YM are both 0.01 higher.

- RBA dated futures price a terminal rate of ~4.45% in March 24 with 15bps of cuts by Oct 24.

- Pre-RBA the local docket was empty and there was little in the way of meaningful headline flow in a mostly muted session.

- Looking ahead the local docket is empty until Friday the Statement on Monetary Policy crosses.

RBA: RBA Hikes But Inflation Not At Top Of Band Until End 2025

The RBA hiked rates 25bp to 4.35% after leaving them unchanged for four consecutive months. The meeting included revised staff forecasts which included the peak in unemployment within the time horizon revised down 0.25pp to 4.25% and CPI inflation returning to the top of the target band by the end of 2025 rather than “within” it. Despite this the tightening bias has been toned down but each decision remains highly data dependent.

- The persistence of inflation and its “slower than earlier expected” decline, plus the upward revision to the CPI forecasts meant that the Board hiked to be “more assured that inflation would return to target in a reasonable timeframe”. Q4 2024 inflation is now expected to be 0.2pp higher at 3.5%.

- The first line in the final paragraph was changed to “whether further tightening of monetary policy is required” from “some further tightening of monetary policy may be required”, plus the extension of “a reasonable timeframe” is reading dovish despite the Board remaining “resolute” in returning inflation to target.

- The statement notes that the information since the last meeting points to an increased risk that inflation will remain “higher for longer”. Given its data dependency, any further indications that that remains the case may be the catalyst for another hike.

- The RBA remains focussed on the same four things, but consumption has been broadened to domestic demand. There was no indication of the GDP trajectory apart from that there will be a “period of below-trend growth”.

- The paragraphs on uncertainties and the risks of high inflation have few changes, except the addition of the “implications of the conflicts abroad” to the former.

- See statement here.

NZGBS: Short End Firms Into Close

The short end of the NZGB curve firmed into the close on spillover from the RBA's dovish 25bp hike. NZGBs finishing dealing 1bp richer to 4bps cheaper across the major benchmarks, the curve twist steepened pivoting on 5s.

- The 10-Year US NZ Swap Spread remains well within recent ranges, on Tuesday we sit at +55bps.

- RBNZ dated OIS remain stable; a terminal rate of ~5.55% is seen in Feb 24, there are ~35bps of cuts by Oct 24.

- Ranges were narrow for the most part today, little meaningful domestic news flow crossed and the local docket was empty.

- Due tomorrow we have Q4 2-Year Inflation Expectations. There is no estimate and the prior read was 2.83%.

FOREX: AUD Pressured After RBA Hikes Cash Rate 25bps

The AUD has been pressured in Asia today, extending falls after the RBA hiked the cash rate 25bps. The bank revised forecasts which included the peak in unemployment within the time horizon revised down 0.25pp to 4.25% and CPI inflation returning to the top of the target band by the end of 2025 rather than “within” it.

- AUD/USD sits at $0.6440/50 the pair is down ~0.7% today. Despite todays fall technically the corrective cycle has extended. Resistance comes in at $0.6523, high from Nov 6 and key resistance, and $0.6562, 3.0% 10-DMA envelope. Support is at the 20-Day EMA ($0.6378).

- Spillover pressure from the RBA decision has seen Kiwi erase its post-NFP gains, NZD/USD prints at $0.5935/40 ~0.4% lower today. AUD/NZD is ~0.3% lower.

- Yen has ticked away from the ¥150 handle in early dealing this morning. Japan September labor earnings were close to expectations. The nominal outcome at 1.2%, as forecast, and a modest step up from the revised 0.8% pace recorded in August.

- Elsewhere in G-10 the Scandies are lower however liquidity is generally poor in Asia.

- Cross asset wise; lower US Equity futures and regional equities have weighed on risk sentiment. BBDXY is up ~0.2%.

- In Europe today we ahve German Industrial Production and Eurozone PPI.

EQUITIES: Regional Equity Rebound Falters

The recent rebound in regional equity market sentiment has paused today. All the major markets are weaker, while US futures are also down, albeit modestly at this stage. Eminis were last off 0.25% to 4374, Nasdaq futures are off by slightly less, -0.19%. Cash trading was mixed on Monday, US markets finishing a touch higher, but EU markets were mostly down.

- US yields remain a key watch point for equity sentiment. We are slightly lower today in yield terms, but this gives back only part of Monday's gains.

- South Korean markets have been in focus, with the Kospi and Kosdaq both down around 2.5-3% at this stage. This follows yesterday's strong gains inspired in large part by the short selling ban. Today, offshore and institutional investors have been net sellers, but retail investors are buying local shares.

- Elsewhere, Japan markets are off by around 1%, while the Taiex is outperforming at around flat.

- At the break, the HSI is off 1.5%, the CSI 300 down by 0.70%. China October trade figures were mixed, with exports weaker but the import bounce suggesting an improved domestic demand backdrop.

- Earlier the PBoC Deputy Governor stated he isn't too worried about China's current economic state, but that the old growth model driven by property is not sustainable (BBG). Government debt levels are manageably, particularly compared to international standards.

- The ASX 200 is up 0.20%, as the RBA raised rates as expected, although the statement was interpreted as dovish.

- In SEA, markets are down modestly for the most part.

OIL: Crude At Bottom Of Recent Range As Demand Worries At Fore

Oil prices are down moderately today as the greenback strengthened (USD index +0.2%). Demand concerns drove markets with speculation that the Fed isn’t finished and weak China exports in October. There was also a general pullback in risk sentiment.

- WTI is 0.5% lower at $80.41/bbl and while it has trended down throughout the session, it has held above $80. Brent is down 0.6% to $84.69. Prices are at the lower end of the range they have been in November so far. Recent range trading reflects little change in market fundamentals.

- Today Minneapolis Fed President Kashkari, who is on the FOMC this year, said that it is too soon to say that inflation is contained and that more data is needed, thus raising the prospect of further tightening.

- China’s imports of crude rose 14.4% y/y in September YTD. Product exports increased 33.2% y/y and imports +93.6%.

- API data on crude and product inventories are released today. Later the Fed’s Kashkari, Goolsbee, Barr, Schmid, Waller and Logan speak. ECB’s de Guindos, Enria and McCaul also appear. On the data front there is only the September US trade balance and German IP.

GOLD: Bullion Trending Down As War Premium Unwinds

Bullion continued Monday’s trend lower during APAC trading today. Minneapolis Fed President Kashkari raised the prospect of further tightening. Also as the Middle East conflict looks contained to Israel/Gaza, gold’s war premium is gradually unwinding. It is down 0.3% to around $1971.40/oz, close to the intraday low, after falling 0.75% yesterday. The USD index is up 0.2%.

- FOMC member Kashkari said that it is too soon to say that inflation is contained and that more data is needed, thus raising the possibility of further tightening. Any further US rate hikes are likely to weigh on zero yielding gold.

- Bullion continues to trade well above support at $1957.50, the 20-day EMA. The trend outlook appears bullish.

- Later the Fed’s Kashkari, Goolsbee, Barr, Schmid, Waller and Logan speak, with their comments likely to impact gold trading. ECB’s de Guindos, Enria and McCaul also appear. On the data front there is only the September US trade balance and German IP.

CHINA DATA: October Trade Mixed Bag, Import Recovery Hints At Firming Domestic Demand

China Oct trade figures presented a mixed bag. Exports were weaker than expected at -6.4% y/y (-3.5% forecast and prior -6.2%). Imports surprised on the upside though, +3.0%y/y, versus -5.0% forecast and -6.3% prior. This left the trade surplus much narrower than forecast at $56.53bn ($82bn forecast).

- The export result follows tentative signs of improving external demand, particularly in economies like South Korea and Taiwan. Export headwinds come at a time when domestic demand is not on a firm footing (although import data suggests some improvement on this front, see below).

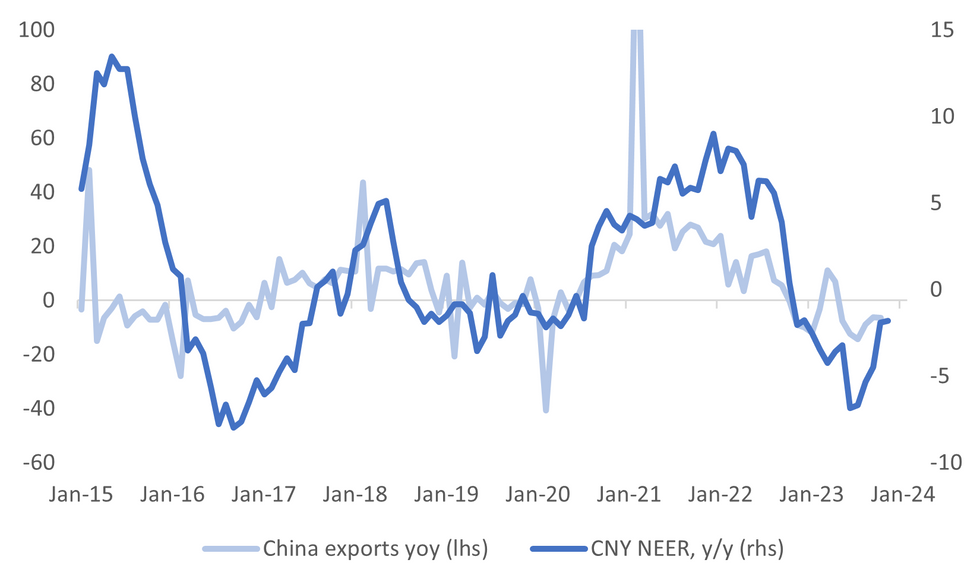

- All else equal the authorities are likely to be cautious around CNY NEER. However, as the chart below highlights, the y/y change in the NEER and export growth are reasonably well aligned at this stage.

Fig 1: CNY NEER Y/Y Versus China Export Growth

Source: MNI - Market News/Bloomberg

- On the import side we comfortably surprised on the upside. All else equal this bodes well for the domestic demand backdrop. BBG noted that October monthly imports only fell modestly, which was a resilient result given holidays in the month.

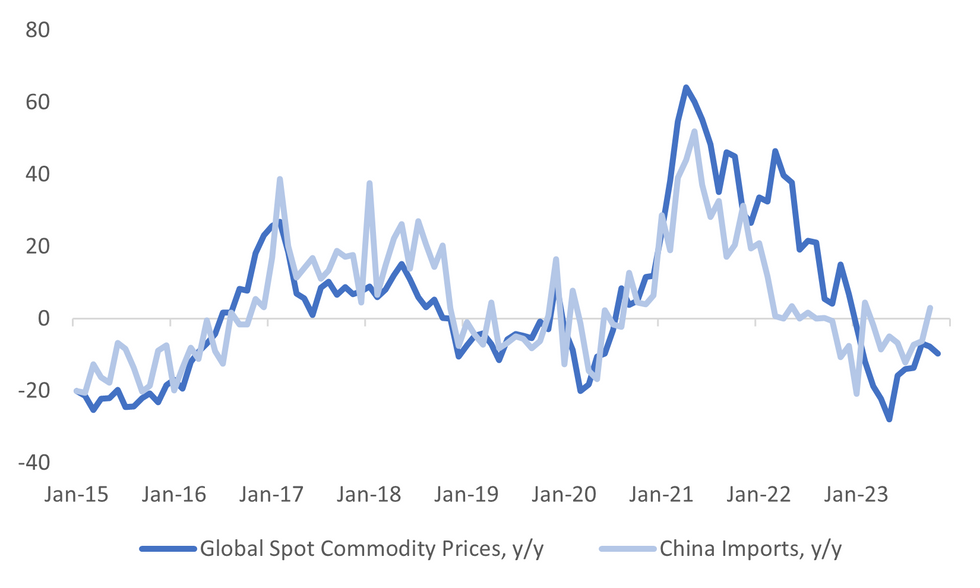

- The second chart below overlays import growth against spot commodity prices moves in y/y terms.

- In terms of commodity import volumes, oil and copper rose, but were down for iron ore, coal and natural gas.

Fig 2: China Import Growth & Global Spot Commodity Prices Y/Y

Source: MNI - Market News/Bloomberg

PHILIPPINES DATA: Inflation Surprises To The Downside, Amid Colling Food, Recreation Prices

October inflation data was weaker than expected. We printed at 4.9% y/y (5.6% forecast and 6.1% prior). The m/m outcome was -0.2%, versus 0.4% forecast and 1.1% in Sep. Note we were also below the bottom end of the BSP's forecast range from a y/y standpoint (5.1% to 5.9%).

- Core inflation was at 5.3%y/y, versus 5.9% prior. This is back to early Q4 levels from 2022.

- In terms of the detail, 9 out of the 12 sub categories saw either a lower y/y pace or the same print. Only 3 categories saw a rise (clothing, housing and IT). Food inflation eased back to 7.0% y/y from 9.7%. Rice inflation was 13.2%, down from recent highs above 17%. Restaurants and accommodation also stepped lower to 6.3%y/y from 7.1%.

- This data should give some comfort to BSP hawks. Note the next policy meeting is on Nov 16.

- Yesterday we had comments from Finance Chief Diokno (who also sits on the BSP board) that the policy rate has reached a peak (see this BBG link for more details).

- Other data for Sep trade, showed a slightly narrower trade deficit (-$3511mn against a -$4100mn forecast). This reflected weaker imports (-14.7%y/y), while exports also slowed noticeably -6.3% y/y (prior +4.2%).

ASIA FX: Dollar Claws Back Some Recent Losses

USD/Asia pairs are higher across the board, albeit to varying degrees. The won's recent outperformance has reversed somewhat today, down nearly 1% amid a broad regional equity pull back. PHP and MYR have lost ground as well. THB has been an outperformer though. Still to come today is Taiwan inflation and trade data for October. Tomorrow, we get South Korea current account data, as well as Philippines unemployment figures.

- USD/CNH sits a little higher in recent dealings last near 7.2860. Onshore spot has risen back to 7.2800 (after closing yesterday around 7.2700). Onshore equities are weaker in line with the rest of the region. Oct trade data was mixed, with exports falling slightly more than expected, but imports surprised by rebounding back into positive y/y territory.

- After outperforming strongly in recent sessions, the Korean won rally has paused. It is the weakest performer in EM Asia FX so far today. After opening sub 1300, we sit back near 1307/08 for the 1 month USD/KRW NDF, 0.75% down in won terms. Spot is back near 1310, 1% weaker. Onshore equity indices are down near 3% at this stage, giving back around half of yesterday's gains. Sentiment has been tempered by higher US yields, while significant short covered was reported yesterday post the short selling ban.

- USD/PHP has spent much of the session gravitating higher. The pair was last near 56.26, around 0.60% weaker in PHP terms. Recent lows rest just under 55.80. Weaker than expected Oct inflation data has reduced the likelihood of a further BSP hike later this month.

- The Ringgit is trimming some of its post-NFP gains on Tuesday, the move higher in USD/MYR has been observed alongside an uptick in US Tsy Yields in the NY session yesterday. USD/MYR prints at 4.6660/90, the pair is ~0.6% higher today.

- The SGD NEER (per Goldman Sachs estimates) is sitting a touch off yesterday's cycle highs, the measure is little changed in early dealing today. We sit ~0.3% below the top of the band. USD/SGD is holding below the 200-Day EMA ($1.3640) for now, the pair broke below the measure yesterday as broader USD trends continue to dominate flows. Due this evening is October Foreign Reserves, there is no estimate and the prior read was $337.40bn. The release rounds off the week's docket.

- USD/THB sits close to unchanged, last near 35.50. This is outperforming stronger USD trends elsewhere. Local equities are only down modestly. A government official also stated the authorities plan more easing policies to boost growth. The government needs to inject cash to revive economic growth (see this BBG link for more details).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/11/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 07/11/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/11/2023 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/11/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/11/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/11/2023 | 0835/0935 |  | EU | ECB's de Guindos fireside organised by Deloitte | |

| 07/11/2023 | 1000/1100 | ** |  | EU | PPI |

| 07/11/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/11/2023 | - | *** |  | CN | Trade |

| 07/11/2023 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/11/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 07/11/2023 | 1345/0845 |  | CA | BOC Governor Macklem conference opening remarks | |

| 07/11/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/11/2023 | 1415/0915 |  | US | Fed Vice Chair Michael Barr | |

| 07/11/2023 | 1450/0950 |  | US | Kansas City Fed's Jeff Schmid | |

| 07/11/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/11/2023 | 1500/1000 |  | US | Fed Governor Christopher Waller | |

| 07/11/2023 | 1600/1100 |  | CA | BOC Deputy Kozicki opening remarks for lecture by IMF's Pierre-Olivier Gourinchas | |

| 07/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 07/11/2023 | 1700/1200 |  | US | New York Fed's John Williams | |

| 07/11/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/11/2023 | 1825/1325 |  | US | Dallas Fed's Lorie Logan | |

| 07/11/2023 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.