-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessKey Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN MARKETS ANALYSIS: China Related Assets Still Under Pressure

- The RBNZ hiked 25bp to 5.5%, which aligned with its previous projection for the OCR peak. 5 members opted for the hike while 2 advocated for a pause. Ahead of the RBNZ Decision, the market had been pricing 37bp of tightening for today's meeting and a terminal rate of 5.93%. Post-Decision, the terminal rate has softened to 5.60%.

- NZD/USD prints at $0.6170/80 and is down ~1.2%. Support at $0.6182 (low from May 11) has been broken, on the downside the next support level is low from 26 April at $0.6112. AUD/NZD is ~1% firmer, the cross has broken the 20-Day EMA ($1.0668). The next upside target for bulls is the 200-Day EMA.

- Elsewhere, China related assets remain under pressure. China stocks continue to weaken, tech headwinds amid clamps on investment in China from outside countries, coupled with economic woes continue to drive equity underperformance. USD/CNH got to fresh highs above 7.0800, but has now retraced back to 7.0500/50.

- On the docket today we have UK CPI & PPI and the minutes from the May FOMC meeting.

MARKETS

US TSYS: Marginally Firmer In Asia

TYM3 deals at 115-01+, +0-04, a touch off the top of the observed 0-06 range on volume of ~62k

- Cash tsys sit 1-2bps richer across the major benchmarks, some light bull steepening is apparent.

- Tsys firmed after Asia participants digested this morning's Fedspeak, Goolsbee and Bostic think that the Fed should pause at its June 14 meeting to allow time to assess the impact of previous tightening but also the effect of higher banking funding costs on the economy.

- Spillover from a rally in JGBs, after a strong 20 Year auction, added a layer of support.

- Tsys held marginally richer for the remainder of the session with little follow through on moves dealing in narrow ranges.

- President Biden has cut short his scheduled trip to Asia this week as discussions over the US debt ceiling remain ongoing. Biden noted that the latest round of talk was productive.

- In Europe today we have the final print of Eurozone CPI, further out US Housing Starts crosses. We also have the latest 20-Year supply.

JGBS: Futures Little Changed, Narrow Range, Awaits FOMC Minutes

JGB futures are unchanged versus settlement levels in afternoon Tokyo trade.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined news from the Yomiuri newspaper that the government plans to issue bridge bonds for about 2 years to finance childcare policies.

- In the absence of other domestic catalysts, market participants have likely been on headlines and US tsys watch ahead of the release of FOMC Minutes later today. US tsys have witnessed a bull steepening in Asia-Pac trade, with the 2-year yield decreasing by 7bp while the 10-year yield by 1bp.

- Cash JGBs are little changed with yield changes ranging from +0.8bp (1-year) to -0.4bp (5-year). The benchmark 10-year yield is 0.1bp higher at 0.405%, below the BoJ's YCC limit of 0.50%.

- The 40-year zone sees its yield 0.1bp higher ahead of the scheduled supply on tomorrow.

- Swap curve bull flattens out to the 10-year zone with rates 0.1 to 0.6bp lower. Rates for the 20-year zone and beyond are flat to 0.4bp lower. Swap spreads tighter across the curve.

- Later today sees the release of Machine Tool Orders (April final) ahead of Weekly Security Investment Flow data and 40-year JGB supply tomorrow.

AUSSIE BONDS: Richer, Spillover Bid From NZGBs

ACGBs are richer (YM +6.0 & XM +2.5) with the curve steeper as the local market enjoyed spillover from the bid in NZGBs following the RBNZ indicating that the current OCR level would be the peak.

- Cash ACGBs are 3-6bp richer with the 3/10 curve 3bp steeper and the AU/US 10-year yield differential +1bp at -6bp.

- The first round of ACGB Dec-34 supply, following its syndicated opening on April 19, showed solid demand with the average yield printing through prevailing mids and a cover ratio of 3.6250x. The outcome aligned with the recent trend of robust pricing observed at ACGB auctions.

- Swap rates are 3-6bp lower with EFPs little changed.

- The bill strip bull flattens with pricing +2 to +7.

- RBA dated OIS is 1-7bp softer across meetings with a 17% chance of a 25bp rate hike in June priced.

- The local calendar is light ahead of April Sales on Friday. While the official ABS retail estimates account for regular seasonal fluctuations, they can encounter challenges during the Easter period. This is primarily due to the variable timing of the holiday and its proximity to other holidays, which can disrupt the accuracy of the adjustments.

AUSTRALIAN DATA: Westpac Leading Index Points To Below Trend Growth Into 2024

Westpac’s leading indicator fell 0.03% m/m in April to be down 0.78% on a 6-month annualised basis after -0.69% in March. This latter measure has been negative since August 2022 and signals below trend growth continuing 3 to 9 months ahead and thus into 2024.

- The stronger equity market was a positive for the index. There was also a more stable yield gap as monetary tightening has slowed. But there was a substantial weakening of building activity and a drop in commodity prices which weighed on the index.

- Westpac expects the RBA to be on hold at its June 6 meeting.

- See Westpac’s report here.

Source: MNI - Market News/Refinitiv

NZGBS: Yields Sharply Lower, RBNZ Signals OCR At Peak

NZGB yields have closed 11-33bp lower after the RBNZ Decision proved to be a dovish hike.

- The RBNZ hiked 25bp to 5.5%, which aligned with its previous projection for the OCR peak. 5 members opted for the hike while 2 advocated for a pause.

- The statement released by the RBNZ primarily focused on the impact of restrictive policies and acknowledged the presence of transmission lags. Notably, the Committee appeared unconcerned about the near-term fiscal expansion and the rise in immigration.

- Based on the current scenario, it appears increasingly likely that the RBNZ will keep rates unchanged at its upcoming meeting on July 12.

- Ahead of the RBNZ Decision, the market had been pricing 37bp of tightening for today's meeting and a terminal rate of 5.93%. Post-Decision, the terminal rate has softened to 5.60%.

- Swap rates are 11-34bp lower with the 2s10s curve 23bp steeper.

- Q1 retail sales volumes fell a larger-than-expected 1.4% q/q in Q1 to be down 4.1% y/y, as significant tightening and cost-of-living pressures weighed on spending.

- The local calendar is light tomorrow.

- The NZ Treasury announced that they plan to sell NZ$200mn of the May-28 bond, NZ$150mn of the Apr-33 bond and NZ$50mn of the May-51 bond tomorrow.

RBNZ: 25bp Hike But RBNZ Moves To Neutral

The RBNZ hiked rates 25bp to 5.5%, its forecasted peak in the OCR, which was unchanged. The discussion shifted down a step to whether to hike 25bp or pause. In the vote that followed 5 chose the hike and 2 a pause. The statement focused on the slowing impact of restrictive policy and the transmission lags. The Committee also didn’t seem concerned by the near-term fiscal expansion or the increase in immigration. It now looks likely that the RBNZ will be on hold at its July 12 meeting.

- The RBNZ felt that both options wouldn’t be destabilising but it didn’t mention that further tightening is needed, consistent with its forecasts, just that policy will need to “remain at a restrictive level for the foreseeable future”. Thus, its stance seems to have moved to neutral while also quashing any expectations of near-term easing.

- The 2023 OCR forecasts have been revised up but the peak remains at 5.5% with the first easing in H2 2024. Rate cuts are now expected to be faster than assumed in February from H2 2025 with Q4 now at 4.1% from 4.3%.

- CPI inflation forecasts have been revised down in 2023 to 4.9% in Q4 while Q4 2024 is almost unchanged at 2.5%, thus signalling that the RBNZ isn’t concerned about the inflationary impact from rebuilding. 2025 is unchanged. It noted that while business’ inflation expectations are lower, households’ are higher, which it thinks is due to past inflation and could be adding to the “persistence of domestic inflationary pressure”.

- Restrictive policy is driving a slowdown in demand across sectors but spending will need to slow further to return inflation to target. The 2023 recession is still in the forecast but is shallower and 2024 growth has been revised up helped by rebuilding. The bank estimated that recovery from the flooding will add about 1.5% to GDP over a number of years. Upside risks from migration were seen as “mixed”.

- It noted that while the labour market remains very tight, there are indicators pointing to an easing in pressures helped by increased labour supply. But it did revise down its unemployment rate expectations across the forecast horizon.

- See statement here.

FOREX: Kiwi Pressured As RBNZ Signal Rates Peak After 25bp Hike

Kiwi is pressured in Asia today as the RBNZ hiked rates 25bps to 5.50%. The bank stated the cash rate is now likely at its peak (5.50% post today's outcome), the market was expecting a peak of close to 6% before the meeting.

- NZD/USD prints at $0.6170/80 and is down ~1.2%. Support at $0.6182 (low from May 11) has been broken, on the downside the next support level is low from 26 April at $0.6112. AUD/NZD is ~1% firmer, the cross has broken the 20-Day EMA ($1.0668). The next upside target for bulls is the 200-Day EMA.

- AUD was pressured on spillover from the move in NZD however support was seen below $0.6590 and losses were pared. AUD/USD sits a touch above $0.66. Early in the session the Westpac Leading Index for April fell -0.03%.

- Yen is a touch firmer, USD/JPY is down ~0.1%. Ranges have been narrow with little follow through on moves.

- Elsewhere in G-10 EUR and GBP are a touch firmer.

- Cross asset wise; BBDXY is down ~0.1% and e-minis are ~0.1% firmer. 2 Year US Treasury Yields are ~2bps lower.

- On the docket today we have UK CPI & PPI and the minutes from the May FOMC meeting.

EQUITIES: Major Indices Tracking Lower, Post Wall St Losses

Regional equity markets have mostly tracked lower in Asia Pac today, in line with US and EU losses from Tuesday's session. The US debt impasse continues to hang over markets, with little fresh news late Tuesday evening in the US. US futures are a touch higher though, eminis last +0.15% near 4165, while Nasdaq futures were up by around the same amount.

- China stocks continue to weaken, the CSI 300 down a further 0.52% at this stage, albeit up from session lows. YTD gains for the index are just about wiped out, while we have seen a further 1.75bn yuan in stock outflows so far today (coming after yesterday's chunky ~8bn yuan in outflows). Tech headwinds amid clamps on investment in China from outside countries, coupled with economic woes continue to drive equity underperformance.

- The HSI is also weaker, down close to 1% at this stage. Similar drivers are at play, with the HS TECH index off by a little over 1%. The index is back close to 2023 lows. Alibaba is cutting staff following the recent earnings disappointment.

- Japan stocks are also giving back some of their recent gains, the Topix down a further 0.25% at this stage, following yesterday's 0.66% dip. Electronic related plays are the main drag on the index.

- The Kospi rally has stalled, although the index is only down a touch, while the Taiex is -0.60% at this stage.

- There are some better trends in SEA, but only at the margin. Thai's SET is +0.45%, recovering further from recent lows.

OIL: Saudi Comments Push Prices Higher During APAC Session

Oil prices are up around a percent during APAC trading today with WTI around $73.75/bbl and Brent $77.60, both close to intraday lows. They rose strongly on Tuesday following Saudi comments that it wouldn’t tolerate speculators. OPEC+ meets June 3-4. The USD index is slightly lower.

- The threat of OPEC+ taking more output action at its June meeting to push up prices is currently supporting crude. However, the market remains troubled by the unresolved US debt-ceiling issue, Fed tightening and lacklustre growth in China.

- The US EIA releases fuel inventory data later. Bloomberg reported that there was a large drawdown of crude stocks in the US of 6.8mn, according to people familiar with the API data. Gasoline inventories fell 6.4mn, as demand ramps up, and distillate -1.77mn.

- Later today the Fed’s Waller discusses the economic outlook and the May 3 minutes are published. There is also UK April CPI and the German IFO for May.

GOLD: Bounces Off Two-Month Lows

Gold is trading with minimal movement in the Asia-Pacific session following a slight uptick on Tuesday, closing at 1975.23 (+0.2%). The precious metal rebounded from its two-month lows as investors evaluated the developments in US debt-ceiling negotiations. While Republicans maintained their steadfast stance against any tax changes, rendering a potential deal elusive as emphasized by McCarthy, Democrats persistently pursued initiatives to enhance revenues and reduce spending.

- Amid the looming risk of a potential default, the demand for safe-haven assets surged, propelling gold to its highest price since March 2022 earlier this month. However, gold has experienced a decline of approximately 4% since reaching its peak on May 4th and is currently hovering around levels observed in late March.

- Rising bond yields, a stronger dollar and hawkish comments from Federal Reserve officials have recently put a lid on bullion prices.

- Bloomberg noted that a team of JPMorgan strategists led by Kolanovic trimmed their allocation to stocks and corporate bonds while boosting its stake in cash by 2%. Within the commodities portfolio, the firm also rotated out of energy and into gold on haven demand and as a debt-ceiling hedge. (link)

ASIA FX: USD/CNH Hits Fresh Highs Before Retracing

USD/Asia pairs have mostly been sold on upticks today. USD/CNH made a fresh high above 7.0800 before correcting lower. Most other pairs have also tracked lower, albeit to varying degrees. THB is the standout in SEA. Tomorrow, the main focus will be on central bank decisions in both South Korea and Indonesia, no change is expected from either CB.

- USD/CNH got to fresh highs above 7.0800 post the CNY fixing outcome, which again was close to expectations. However, we have steadily lost ground since, last back under 7.0600, not too far away from early levels on Tuesday. USD/CNY also spiked higher, but now sits back under 7.0500. There didn't appear a direct catalyst for the move, although China equities are away from earlier session lows.

- 1 month USD/KRW has broadly followed USD/CNH so far today. The pair got to 1318 in early trade, but we now sit back at 1314. Yesterday's lows came in around 1306, so we remain above those levels for now. Onshore equities have recovered from earlier losses and now sit slightly higher for the session.

- USD/THB has moved away from recent highs. The pair slipped to a low just under 34.45, before stabilizing somewhat, last around 34.50. Yesterday's highs came in just above 34.70. Baht gains so far in the session are around 0.50%.• There don't appear any fresh catalysts for today's pull back. In terms of the local political backdrop, Move Forward have stated they will tone down its push to reform the monarchy to get the support they need in parliament to get Pita chosen as PM. Current PM Prayut Chan-o-cha also said assured the nation of a smooth transition from the caretaker government to the new government.

- The SGD NEER (per Goldman Sachs estimates) is little changed this morning, we remain within recent ranges. We now sit ~0.8% below the upper end of the band. USD/SGD prints at $1.3460/70, the pair is ~0.1% softer today. Rallies in recent sessions have met resistance ahead of $1.35 handle with the 200-Day EMA coming in at $1.3511. Core CPI held steady at 5.0% M/M in April, a rise of 4.7% M/M was expected, and is above the MAS forecast for 2023. Headline CPI ticked higher to 5.7% M/M, the prior read was 5.5% M/M.

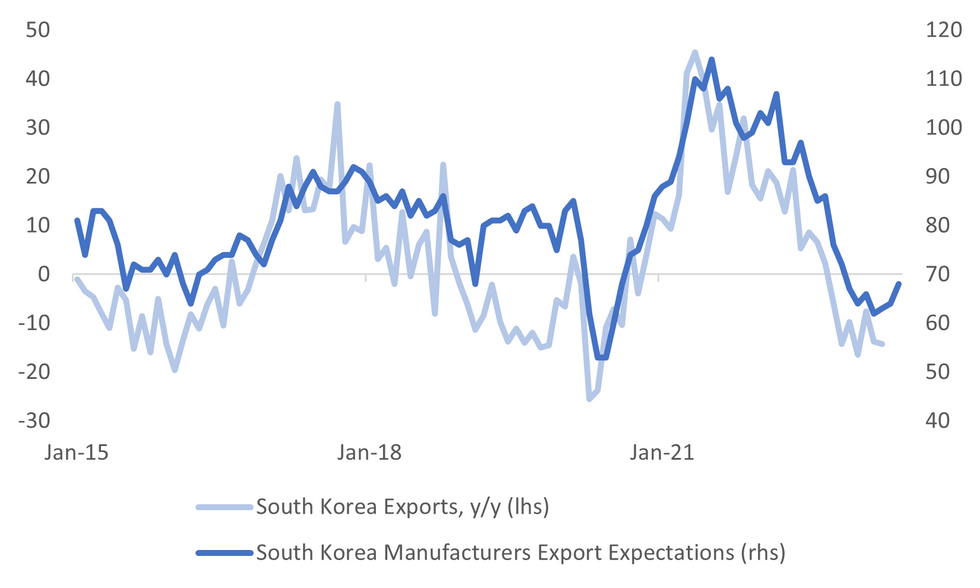

SOUTH KOREA: Further Improvement In Manufacturing Sentiment & Export Outlook

South Korean manufacturing and non-manufacturing sentiment continued to improve in terms of the latest BoK survey results. The headline manufacturing result edging up to 73 for the June reading, from 72 prior. This is the firmest read since November last year. We saw a similar improvement in the seasonally adjusted result. On the non-manufacturing it was a similar story, the headline rising to 78 from 76.

- The first chart below overlays the manufacturing headline result against y/y GDP. The series is suggesting we shouldn't see too much more downside momentum in y/y GDP. Still, the sub-components showed mixed results, with sales, production and orders, all ticking down from May readings.

- The detail on the non-manufacturing side were generally more positive, with improvement in the sub-components.

Fig 1: South Korea Manufacturing Sentiment & Y/Y GDP

Source: MNI - Market News/Bloomberg/BoK

- One positive on the manufacturing side, was the export outlook, rising to 68 from 64 prior. Again, this is suggesting a less adverse export growth outlook, albeit coming from low levels, see the second chart below.

Fig 2: South Korean Manufacturers Export Outlook & Export Growth

Source: MNI - Market News/Bloomberg/BoK

BoK: MNI BoK Preview - May 2023: On Hold Again

- None of the 17 economists surveyed by Bloomberg expect a change from the BoK at tomorrow’s policy meeting. The policy rate is expected to be held steady at 3.50%, which is also our firm bias. This would leave the policy rate on hold for the third straight meeting, no doubt leading to speculation the tightening cycle is now complete.

- Since the last policy meeting, headline inflation pressures have continued to ease. The latest y/y headline print was 3.7% (for April), well down from the peak of 6.3% in July last year. Base effects, coupled with a more benign to softer commodity price backdrop, suggest a further easing in y/y momentum as progress into the second half of the year. Inflation expectations, of households, also continue to track lower.

- Some indicators for growth are on the improve, but fresh uncertainty around the outlook for external demand from both China and the US may leave the BoK cautious. Governor Rhee may push back against any talk of near term rate cuts though, given core inflation is coming down at a slower pace than headline.

- Full preview here:

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/05/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 24/05/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 24/05/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/05/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 24/05/2023 | 0930/1030 |  | UK | BOE Bailey Keynote Speech at Mansion House Net Zero Summit | |

| 24/05/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/05/2023 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/05/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/05/2023 | 1300/1400 |  | UK | BOE Bailey Frieside Chat at WSJ CEO Council Summit | |

| 24/05/2023 | 1405/1005 |  | US | Treasury Secretary Janet Yellen | |

| 24/05/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 24/05/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/05/2023 | 1610/1210 |  | US | Fed Governor Christopher Waller | |

| 24/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 24/05/2023 | 1745/1945 |  | EU | ECB Lagarde Opens Anniversary of ECB Event | |

| 24/05/2023 | 1800/1400 | * |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.