-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China's Unswerving Commitment To ZCS Supports USD

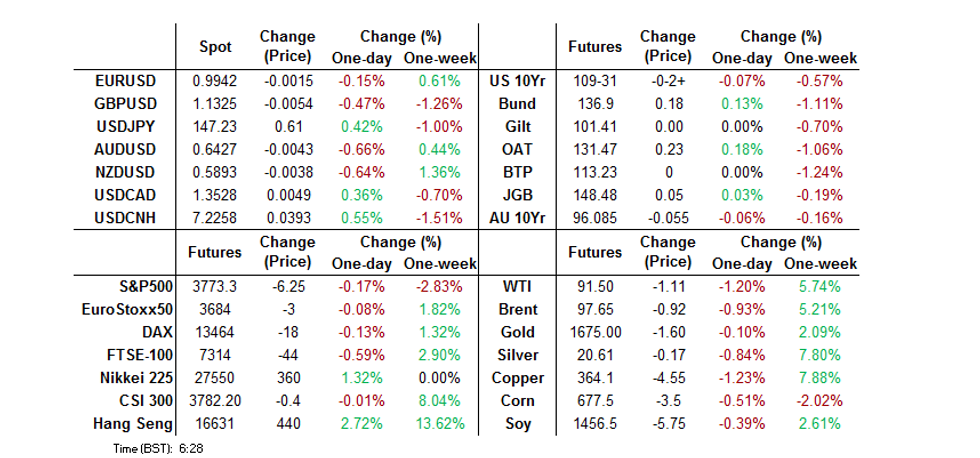

- Cash Tsys twist flattened during Monday’s Asia-Pac session after Chinese health officials pointed to unswerving commitment to the country’s dynamic COVID zero system over the weekend. The USD sits atop the G10 FX table on the back of those headlines.

- The initial reaction to that headline flow for Tsys was to trade with a bid, although that impulse faded a little as participants weighed up the global inflationary and GDP growth impact of China’s ZCS. Meanwhile, source reports pointing to background U.S.-Russia discussions re: the prevention of further escalation in the Ukrainian war, as well as a bid in Hong Kong & Chinese equities (as participants continued to push that particular envelope after last week’s rally, even as re-opening names struggled in the wake of the weekend comments from Chinese health officials), applied some pressure.

- Focus turns to German & Norwegian industrial output figures, as well as comments from Fed's Collins & Barkin, ECB's Lagarde & Panetta.

US TSYS: Twist Flattening On Latest China Pushback To COVID Restriction Relaxation

Cash Tsys twist flattened during Monday’s Asia-Pac session after Chinese health officials pointed to unswerving commitment to the country’s dynamic COVID zero system over the weekend.

- The initial reaction to that headline flow for Tsys was to trade with a bid, although that impulse faded a little as participants weighed up the global inflationary and GDP growth impact of China’s ZCS.

- Meanwhile, source reports pointing to background U.S.-Russia discussions re: the prevention of further escalation in the Ukrainian war, as well as a bid in Hong Kong & Chinese equities (as participants continued to push that particular envelope after last week’s rally, even as re-opening names struggled in the wake of the weekend comments from Chinese health officials), applied some pressure.

- That leaves cash Tsys 2bp cheaper to 2bp richer across the curve, twist flattening (after Friday’s twist steepening) with a pivot seen around 7s. Meanwhile, TY futures print -0-02+ at 109-31, 0-02 off the base of its 0-09 overnight session range after that particular extreme held on a retest during Asia-Pac dealing. A block sale of TU futures (-2.4K) headlined on the flow side, with TY volume fairly limited at ~70K lots into Europe.

- A narrower than expected Chinese trade balance, compounded by softer than expected internals, had little impact on Tsys.

- Monday’s NY docket includes Fedspeak from Mester, Collins and Barkin (although comes in the latter rounds of NY trade and the NY-Asia crossover).

JGBS: Steeper To Start The Week

JGB futures nudged higher during the Tokyo session, after an initial downtick in reaction to weekend headline flow surrounding the Chinese ZCS situation and source reports pointing to back-channel U.S.-Russia talks re: the prevention of further escalation when it comes to the Ukrainian war.

- Still, the contract’s trading band was contained, with any rally limited by super-long end weakness on catch-up to the twist steepening pressure seen in U.S. Tsys on Friday (which has moderated from extremes during Monday’s Asia-Pac session).

- Futures print +6 into the bell, off best levels. The major cash JGB benchmarks run 1bp richer to 1.5bp cheaper across the curve, with 7s outperforming as the curve pivots around 20s.

- In local news, RTRS sources noted that 2-Year JGB issuance will increase by Y100bn during the current FY, along with a boost for 6-month bill issuance, as part of the government’s plan to fund its latest fiscal support package.

- 10-Year JGBi supply passed smoothly. The BoJ’s desire to attempt to generate meaningful wage growth via the maintenance of ultra-loose policy settings, in a bid to garner demand-pull inflationary pressure, likely facilitated smooth takedown.

- Looking ahead, Tuesday’s local docket will be headlined by the latest round of household spending and wage data, with BoJ Rinban operations covering 1- to 10-Year JGBs also due.

AUSSIE BONDS: Cheaper On The Day As Local Issuance Matters Mix With Wider Headlines

Aussie bond futures go out a little off worst levels after the initial impact of weekend comments from Chinese health officials, which pointed to the country’s unswerving commitment to its dynamic zero COVID strategy, faded.

- The initial impulse on the back of those comments provided a modest bid, before the knock-on global inflationary impact that those policy settings contribute towards, plus local issuance dynamics (the new ACGB May-34 tender via syndication was launched, set to price tomorrow) and source reports from a couple of outlets pointing to back-channel U.S.-Russia talks re: the prevention of further escalation when it comes to the Ukrainian war weighed on prices.

- Elsewhere, a bid in Chinese & Hong Kong equities helped keep the pressure on the space.

- That left YM -2.0 & XM -5.5 at the bell, with wider cash ACGB trade seeing 1.0-6.5bp of cheapening as the curve bear steepened. EFPs were little changed on the day.

- Bills run -1 to +3 through the reds, with terminal RBA cash rate pricing little changed on the day, hovering around 4%, per RBA dated OIS.

- Outside of the pricing of the new ACGB May-34, Tuesday’s local docket will be headlined by CBA household spending data as well as the latest Westpac consumer & NAB business confidence surveys.

RBA: Higher Inflation Forecasts Push Up Rate Outlook Estimation

The RBA increased its CPI inflation projections across its forecast horizon but downgraded growth in its November Statement on Monetary Policy. This revised outlook in our RBA policy reaction function suggests that the pace of tightening was slowed too soon.

- Our rate equation accounts for the fact that the RBA is forward and as well as backward looking by including a lead of the inflation gap. Thus, the RBA’s forecasts are an important input into the estimation’s results. See MNI Insight: Economics Pointing To Rate Hikes Into 2023 for details.

- The impact of the upward revision to the CPI forecasts outweighed the downward revision to GDP and thus to the output gap (now expected to close in H1 2023 rather than in H2) on the estimated cash rate.

- The average estimated cash rate for Q4 2022 now stands 25bp higher than the end of October update and implies that if inflation and capacity pressures were the only considerations then the RBA should not have pivoted until the December meeting. The Q1 2023 estimate is now suggesting close to 75bp of tightening (up 15bp) and Q2 is now also around 75bp (up 25bp).

- The estimated average Q2 2023 rate now stands at 4.7% from 4% previously and well above AUD OIS average pricing for the quarter (see chart below).

- When dwelling price developments are taken into account the impact of the revised RBA forecasts on the estimated cash rate is a lot more muted with only the current quarter higher and by 25bp, but it still suggests that tightening slowed too soon.

- It is worth noting that these are just estimates from a simple equation and are not predictions.

Source: MNI - Market News/Bloomberg/Refinitiv/RBA

NZGBS: Early NZGB Bid Eases As Payside Flows Emerge In Swaps

Much like the wider core global FI space, NZGBs saw a move away from Monday’s richest levels after the space initially rallied on the back of weekend headlines covering comments from Chinese health officials pointing to unwavering support for the country’s dynamic zero COVID system.

- Some weakness in ACGBs helped (with impending supply factoring into price action across the Tasman), the knock-on inflationary impact of an elongated ZCS situation in China and source reports flagging back-channel U.S.-Russia talks aimed at preventing a further escalation of the war in Ukraine were seemingly at the fore when it came to the adjustment away from richest levels.

- Elsewhere, global equities moved away from worst levels, with Hong Kong equities leading the charge, lodging firm gains during the morning session, adding a further layer of pressure.

- As a result, payside flows came to the fore in swaps, while the major cash NZGBs richened by ~1bp on the day, resulting in swap spread widening after the post-NZGB inclusion in the FTSE Russell WGBI streak of narrowing.

- The payside flows in swaps came alongside an uptick in RBNZ dated OIS, which now prices a terminal rate of just under 5.30%, with a little over 65bp of tightening priced for this month’s meeting.

- Looking ahead, inflation expectations data headlines the domestic docket on Tuesday.

FOREX: USD Lures Participants With Risk Appetite Damped By China's Commitment To COVID Zero

Risk aversion took hold as China's National Health Commission vowed to "unswervingly" stick to the COVID Zero Strategy, pushing back against re-opening speculation from last week. Spot USD/CNH traded on a firmer footing as the greenback outperformed. The BBDXY index added 0.2% as U.S. Tsy yield curve twist flattened.

- The PBOC paused a streak of stronger-than-expected USD/CNY mid-point fixings after a nearly 2% drop in USD/CNH last Friday. The pair's reaction to the re-introduction of weakening bias into the fixing for the first time since late August was limited, with the redback already pressured by COVID Zero musings.

- The Antipodeans led the high-beta FX bloc lower on a negative lead from China, even as the aggregate BBG Commodity Index lodged some marginal gains, breaking above its 100-DMA. AUD/NZD see-sawed, having a look above Friday's high in the process, before stabilising near neutral levels.

- The yen lagged its safe haven peers USD and CHF, with U.S./Japan 2-year yield differential widening 1.8bp. Spot USD/JPY returned above the Y147 mark, with local media flagging continued political headwinds for PM Kishida's government.

- Focus turns to German & Norwegian industrial output figures, as well as comments from Fed's Collins & Barkin, ECB's Lagarde & Panetta.

FX OPTIONS: Expiries for Nov07 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750(E1.2bln), $0.9800(E1.9bln), $0.9850-60(E631mln), $0.9935-55(E1.2bln)

- USD/JPY: Y148.60($650mln)

- GBP/USD: $1.1460-75(Gbp524mln)

- AUD/USD: $0.6425-30(A$872mln), $0.6450(A$750mln)

- USD/CNY: Cny7.1500($1.5bln), Cny7.2000($1.9bln)

ASIA FX: Some Catch Up With Weaker USD Sentiment

USD/Asia NDF levels are away from lows seen on Friday, but the general tone is for a weaker USD in spot markets. Positive regional equity market sentiment is helping, which some offset is coming from a rebounding USD against the majors. Tomorrow, Taiwan trade figures for October are due, along with Malaysia IP and Philippines unemployment figures.

- USD/CNH is up for the session, last just above 7.2180, which is around +0.45% above previous closing levels. Still, earlier moves into the 7.2400/7.2500 region were faded by the market. The CNY fixing was very close to market expectations, ending a run of stronger than expected outcomes going back to August. October trade figures were disappointing, but the market is focused more on the prospect of re-opening plans (even as the health authorities continue to push back against any significant changes).

- Upticks in USD/KRW have generally been faded by the market. The 1 month NDF got above 1413 in early trade but is now back to 1402.00, close to NY lows from late last week. Note the simple 50-day MA comes in 1408.23, which we haven't been below in a meaningful way since early June of this year. The Kospi is tracking higher, near +1% to 2370.

- USD/IDR is back below 15700, last at 15692, slightly up on lows for the session. The Q3 GDP report was better than expected, +1.8% q/q. Bank Indonesia reported that the nation's foreign reserves fell to $130.2bn last month, the lowest level since Apr 2020, due to the payment of the government's external debt and interventions to stabilise the rupiah.

- Spot USD/THB trades -0.20 at 37.37 at typing, catching up with Friday's greenback sell-off. Bears look for a clean break of the 50-DMA at 37.345, which would open up Oct 6 low of 37.125. Bulls set their sights on Oct 20 high of THB38.465. Both core and headline CPI inflation in Thailand were as expected for October. The CPI moderated to 6% y/y from 6.4% the previous month due to lower food and oil prices. This should be reassuring to the Bank of Thailand, who began its tightening cycle only in August with a 25bp hike.

- Spot USD/PHP changes hands -0.060 at 58.505, with bears looking for a renewed test of the 50-DMA (57.992) and bulls keeping an eye on the all-time high of 59.000. FinSec Diokno noted that "addressing high inflation is the number one priority of the economic team," while the government said it has earmarked around PHP206.5bn for subsidies and cash assistance in 2023. Runaway inflation and peer pressure are cornering Bangko Sentral ng Pilipinas into turning more aggressive when it comes to monetary rightening, with Governor Medalla vowing to replicate the Fed's recent 75bp rate hike at the BSP's next rate review.

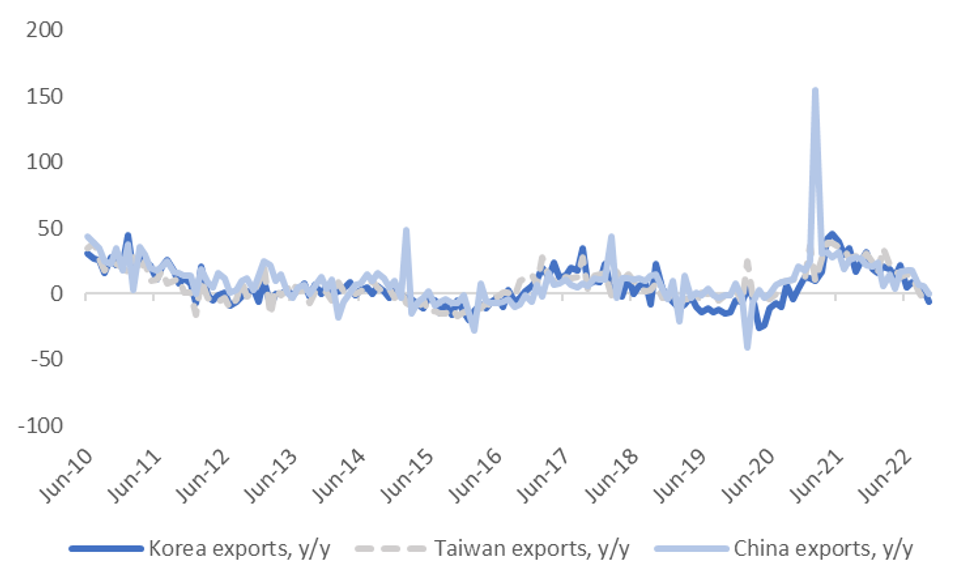

CHINA DATA: Downside Export Surprise, But Limited Market Impact

The China trade data for October disappointed relative to expectations. Export growth came in at -0.3% y/y, versus +4.5% expected, while imports fell -0.7%, against a flat expectation from the market. The trade surplus was also below consensus, $85.15bn, against a $95.97bn forecast.

- Export growth has steadily lost altitude through 2022, particularly in recent months, which is in line with trends in other North East Asian economies, see the chart below. This is also the first y/y drop for China exports since the first half of 2020.

Fig 1: Export Growth Trends, China, South Korea & Taiwan, Y/Y

Source: MNI - Market News/Bloomberg

- It complicates the China growth backdrop, as last year and in the first half of this year, exports were performing more strongly. This slowdown is also another sign that the global economy is losing some momentum.

- The weaker import trend suggests the overall domestic demand backdrop remains fairly subdued. The import growth picture has been around flat since March of this year.

- The trade balance miss is only modest, and the underlying surplus position remains intact.

- The market impact from the trade figures has been modest though (little move in the likes of USD/CNH, AUD/USD etc), with higher China/HK equities an offset as market focus remains on potential shift away from CZS.

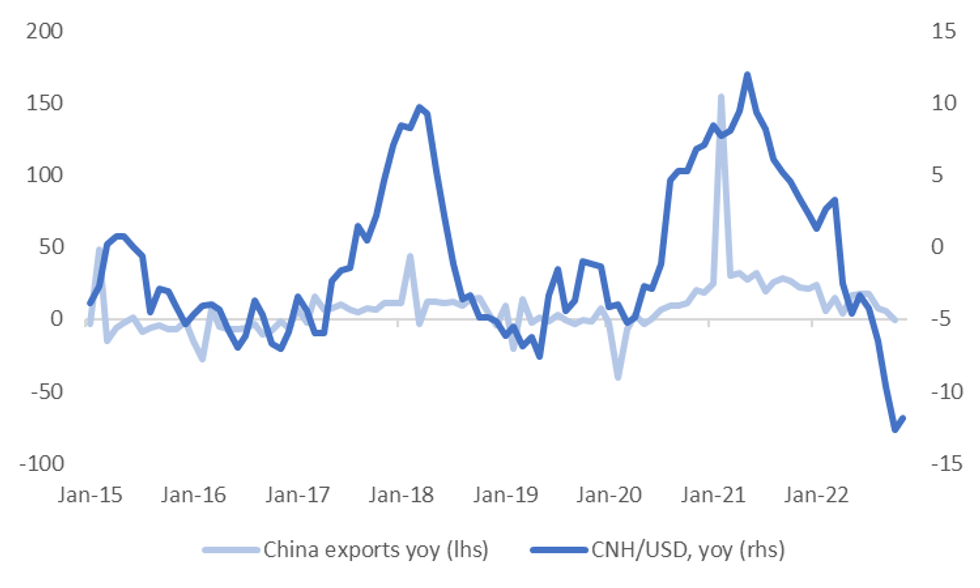

- It's also fair to say weaker CNH levels have priced in a slower export picture, see the second chart below, although this has not been a key driver of CNH trends in 2022 to date.

Fig 2: CNH/USD Y/Y Versus China Export Growth

Source: MNI - Market News/Bloomberg

EQUITIES: China/HK Equities Recover Further, Despite Push-Back On Change To Covid Stance

After a shaky start, Hong Kong shares are comfortably in positive territory, helping to drag the rest of the region higher. Lower US equity futures is providing some offset, although we are away from worst levels. Eminis and Nasdag futures sit -0.10-0.20% lower. Apple stated it would trim new Iphone output by 3m units due to moderating demand. Supply disruptions in China, due to Covid related lockdowns, was also reported earlier.

- The HSI is +3.4% at this stage, with the underlying tech index up just over 5%. China H shares are up +3.5%. These moves come despite the China health authorities pushing back fairly firmly over the weekend on any imminent shift away from the Covid zero stance. No doubt some investors are mindful that when any formal announcement does emerge, markets may have already recovered considerably.

- The rough sell-side consensus also suggests full re-opening is more likely from late Q1/early Q2 next year, while domestic covid case numbers continue to trend higher.

- Mainland China shares are also up, but only by around 0.50% for the CSI 300 and Shanghai Composite. China trade figures continue to point to near term downside economic risks, with both export and import growth below 0% in y/y terms.

- Elsewhere, the Kospi is +1%, continuing to recover, while the Taiex is +1.50% and the Nikkei 225 +1.30% at this stage. None of these markets are showing too much impact from the weaker US futures picture at this stage.

- The ASX 200 is up a little over 0.50%, lagging some of the broader tech gains seen in the region.

GOLD: Attempting A Break Above The Simple 50-Day MA

Gold is off NY closing levels by around 0.50%, unwinding a small proportion of Friday's +3.2% gain. This puts the precious metal back near $1673.50, which is line with some recovery in broader USD sentiment through the first part of today's session.

- Gold currently sits close to the simple 50-day MA ($1673.8), which has proven a reasonable resistant point going back to mid-April.

- A clean break above this level and through Friday's highs above $1680 would leave us targeting the 100-day MA around $1718.80. The recent bounce in gold has outperformed the trend in US real yields, although we remain closely aligned with USD sentiment.

- On the downside, support has been evident today ahead of the $1670 level, which is where a number of earlier highs in October/early November were recorded.

OIL: Prices Being Driven By Demand News As Supply Situation To Stay Tight

Oil prices started the session down on confirmation from the Chinese National Health Commission that the current zero-Covid policies remain in place while Covid cases reported are at a 6-month high. With limited transport possible in China currently, a reopening of the country would be a considerable boost to demand for oil.

- Prices have recovered slightly over the day with WTI currently trading close to $91.50 after Friday’s high of $92.87/bbl and Brent around $97.50 after $98.81. Supply in the sector remains tight, a trend which is likely to continue in 2023, and so demand concerns because of global growth uncertainty are currently driving volatility in prices.

- China’s October imports of crude oil fell 2.7% y/y year-to-date and in USD -0.5% y/y. Oil product imports fell 10.9% y/y% YTD and exports -24.5% y/y.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/11/2022 | 0645/0745 | ** |  | CH | Unemployment |

| 07/11/2022 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/11/2022 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/11/2022 | 0730/0730 |  | UK | DMO Announces Second H2-Nov Linker Synd | |

| 07/11/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/11/2022 | 0830/0930 |  | DE | S&P Global Germany Construction PMI | |

| 07/11/2022 | 0840/0940 |  | EU | ECB Lagarde Video Message for EC/ECB Conference | |

| 07/11/2022 | 0930/1030 | * |  | EU | Sentix Economic Index |

| 07/11/2022 | 0930/1030 |  | EU | ECB Panetta Panels EC/ECB Conference | |

| 07/11/2022 | - |  | EU | COP 27 Begins | |

| 07/11/2022 | - | *** |  | CN | Trade |

| 07/11/2022 | - |  | EU | ECB Panetta at Eurogroup meeting | |

| 07/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 07/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/11/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 07/11/2022 | 2040/1540 |  | US | Fed's Loretta Mester and Susan Collins | |

| 07/11/2022 | 2300/1800 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.