-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

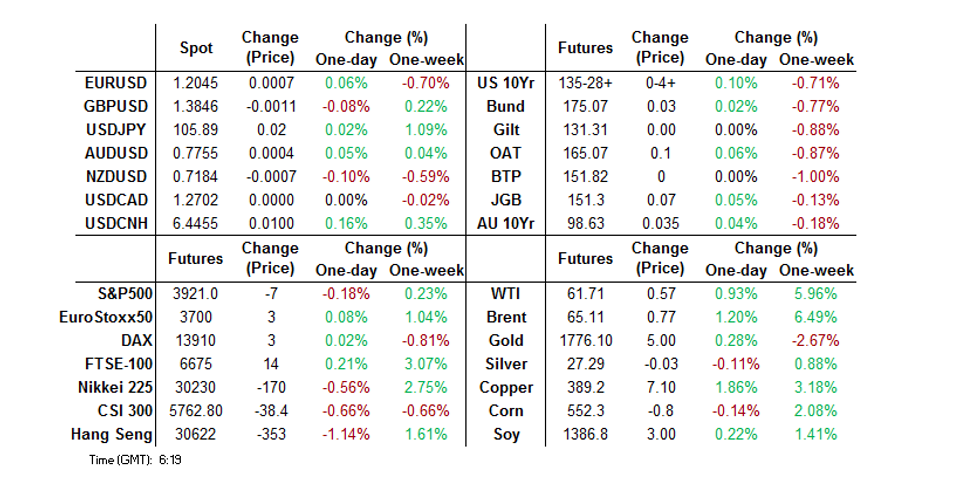

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese Equities Fade From Early Highs

- China's CSI 300 index pulled back from fresh all-time highs lodged after the LNY break, as early consumer driven impetus fades.

- DXY & Tsys little changed from Wednesday's closing levels.

- Crude oil continues to draw support from supply side factors.

BOND SUMMARY: Core FI Lacks Sense Of Direction In Asia

T-Notes traded either side of their late NY levels during Asia-Pac hours, with little in the way of market moving headlines witnessed, which went alongside relatively sedate core market trade as China returned from the LNY break. T-Notes last +0-04+ at 135-28+ on healthy volume of ~190K, with cash Tsys sitting unchanged to marginally cheaper on the day. The latest round of vaccine related headline flow (which was negative at first glance, although some of the details were a little more upbeat) saw no tangible market reaction. The uptick from yesterday's lows resulted in some downside interest in Asia-Pac hours, with the TYJ1 134.50/133.50 put spread lifted via a 3.0K block trade. We also saw a FV/TY flattener block (3,630 FVH1 vs. 2,260 TYH1). Eurodollar futures print unch. to 1.5 ticks higher through the reds, with a sizable 50K screen buyer of EDZ2 seen in Asia-Pac hours. Weekly jobless claims, housing starts & building permits data, the latest Philly Fed business survey, Fedspeak from Brainard & Bostic, 30-Year TIPS supply and the Tsy announcement re: end-of-month issuance headline on Thursday.

- JGBs firmed in the Tokyo morning, but drifted away from best levels on the back of soft 20-Year supply, with futures closing 7 ticks above yesterday's settlement levels, a little below the overnight close. A meeting between BoJ Governor Kuroda and Japanese PM Suga provided no deviation from familiar BoJ rhetoric re: the BoJ's ongoing monetary policy review. Elsewhere, the latest round of weekly international security flows data from the Japanese MoF revealed that foreign investors were net sellers of Japanese bonds after 4 consecutive weeks of net purchases. This resulted in the 4-week rolling sum of the measure retracing to near enough flat levels.

- Aussie Bonds mostly tracked the broader impetus, as opposed to local issues, YM unch., XM +3.5 at the close. The latest Australian labour market report was virtually as expected, with a nudge lower in the unemployment, underemployment and underutilisation measures. The RBA chose not to step in to enforce its 3-Year yield target, even with the benchmark hovering around levels that triggered the most recent round of 3-Year ACGB purchases back in December. A Dow Jones interview with ex-RBA board member John Edwards revealed little in the way of fresh ideas, with Edwards suggesting that the Bank will likely have to "extend its bond buying program beyond September to take some steam out of the Australian dollar." On the local issuance front Aurizon mandated banks for a potential 7+-Year round of A$ MTN issuance, while ADB launched a new minimum A$300mn round of 7-Year issuance.

JAPAN: Limited Flows In Weekly International Securities Flow Data

Little to really flag in terms of notable net headline flows in the latest round of weekly Japanese international security flow data.

- Japanese net purchases of offshore bonds moderated, while foreign investors were net sellers of Japanese bonds after 4 consecutive weeks of net purchases. The latter resulted in the 4-week rolling sum of the measure retracing to near enough flat levels, while there was no major movement in the 4-week rolling sums of the 3 remaining metrics.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 477.1 | 1028.6 | 2989.6 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -23.8 | -509.4 | -1366.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -747.7 | 589.1 | 46.8 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 330.1 | 463.2 | 815.5 |

Source: MNI - Market News/Japanese Ministry Of Finance

FOREX: Greenback Rally Pauses, Commodity Currencies Supported

China's return to markets after a five-day break was underwhelming, equities were lower while fixed income was supported by broad risk aversion, the greenback paused a two-day rally while oil prices continued to rise.

- The NOK was the best performer among its G10 peers, supported by the rally in crude which has seen brent over $65/bbl.

- AUD initially rose as high as 0.7770 after labour market data was broadly in-line with estimates but the breakdown showed a lower participation rate and less hours worked, the rate later pared the gains to trade around neutral levels. NZD moved in sympathy with its Antipodean counterpart.

- JPY pairs are slightly weaker after BoJ Gov Kuroda reportedly told PM Suga that a BoJ review is aimed at sustaining monetary easing over a longer period, as opposed to tightening policy.

- An inside day for offshore yuan, USD/CNH has moved slightly higher from opening levels as equity markets sold off. A fairly uneventful yuan fixing, the PBOC fixed USD/CNY at 6.4536, just marginally higher than sell side estimates of 6.4529.

FOREX OPTIONS: Expiries for Feb18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E527mln), $1.1895-05(E859mln), $1.1940-41(E663mln), $1.2000-10(E2.0bln), $1.2050(E652mln), $1.2065-75(E1.1bln), $1.2080-85(E536mln), $1.2100(E1.3bln), $1.2125-35(E831mln), $1.2150-60(E811mln), $1.2200(E1.5bln), $1.2300(E910mln)

- USD/JPY: Y104.50-70($826mln), Y104.95-00(E596mln), Y105.95-00($950mln), Y107.75($1bln)

- GBP/USD: $1.3550-60(Gbp673mln)

- EUR/GBP: Gbp0.8700(E546mln-EUR puts)

- AUD/USD: $0.7400(A$1.2bln), $0.7575(A$851mln), $0.7700-10(A$674mln)

- AUD/NZD: N$1.0735-40(A$720mln), N$1.0790(A$515mln), N$1.0820-30(A$769mln)

- USD/CNY: Cny6.35($1.8bln), Cny6.45($1.1bln), Cny6.50($1.25bln)

- USD/MXN: Mxn19.75($785mln), Mxn20.34-35($666mln)

- USD/ZAR: Zar14.40-43($797mln)

ASIA FX: USD Rally Pauses But Cautious Tone Limits Gains In EM Asia FX

China's return to markets after a five-day break was underwhelming, equities were lower while fixed income was supported by broad risk aversion, the greenback paused a two-day rally.

- CNH: An inside day for offshore yuan, USD/CNH has moved slightly higher from opening levels as equity markets sold off. A fairly uneventful yuan fixing, the PBOC fixed USD/CNY at 6.4536, just marginally higher than sell side estimates of 6.4529.

- SGD: Singapore dollar strengthened marginally, USD/SGD last down 6 pips at 1.3281, downside is capped by $860m of options expiring at 1.3250 today.

- TWD: Taiwan dollar strengthened, the Taiex outperformed again after reports that the US has enlisted Taiwan's help to ease auto chip shortage.

- KRW: Won edged higher, but upside was limited by some coronavirus caution with cases over 600 for the second day.

- INR: Rupee is flat, oscillating around neutral levels in broadly directionless trade. Equity markets in India are also struggling for direction. At 72.75 USD/INR is within touching distance of cycle lows at 72.57

- IDR: Rupiah weakened ahead of the BI rate announcement later today, a cut is expected. Elsewhere Indonesia has mandated Covid-19 vaccines for eligible citizens.

- MYR: Ringgitt has weakened slightly, moving in a tight range through the session. Market looks ahead to inflation data next week.

- PHP: Peso weakened, USD/PHP last trades at 48.40, below yesterday's highs but on track for its third day of gains. Implied volatility rose to the highest in a month.

- THB: Baht weakened slightly but USD/THB failed to make it through resistance at 30.20. The BoT downgraded growth forecasts yesterday.

ASIA RATES: Mixed Day As Reflation Trade Gives Pause For Thought

The reflation trade extended on Wednesday, which spilled over to Asia fixed income and kept downward pressure on bonds. Some local dynamics in play with China returning from LNY and South Korea contemplating an uptick in virus cases.

- CHINA: Upon the return from a five day LNY break the PBOC conducted a net drain of CNY 260bn, injecting CNY 20bn into the system, and matching CNY 200bn of MLF maturities. The overnight repo rate has risen 40bps in response to the drain, especially considering the PBOC refrained from mass liquidity injections heading into LNY. Still, at 2.23% the overnight repo rate is some way off highs seen at the end of January on fears of a liquidity crunch. China's bond futures sank to a 21-month low, playing catch up with global bonds, even as equity markets retreated.

- INDIA: Cash curve cheapened ahead of INR 310bn of supply today, 10-year yield above 6.00% - the RBI rejected all bids at auction last week due to yields being too high. Some chatter supply could be pushed to second half of the year to help absorption.

- SOUTH KOREA: Bond futures in South Korea are higher, an uptick on coronavirus cases post-LNY has sparked risk aversion, South Korea reported 621 new coronavirus cases over the last 24 hours. Demand in the cash curve was impacted by a record ESG issuance for IBK.

- INDONESIA: Yields mostly higher across the curve, bear steepening seen ahead of the BI announcement later where a 25bps cut is expected. Some buying seen in the benchmark 10-year after a sell off saw yields rise around 20bps yesterday.

EQUITIES: China's Return Can't Stop Selloff

Another negative day for Asia-Pac equity markets, markets in the US finished mixed with the Dow eking out a small gain but other major indices finishing with minor losses.

- Chinese markets returned to the fray after LNY, initial gains were quickly wiped out and major indices now trade in negative territory. The negative sentiment quickly spread to other bourses in the region, most of which were already under pressure. The KOSPI and the Hang Seng lead the way lower, with Hong Kong officials scheduled to give a briefing on vaccination programme later today. Taiwan is the exception, up around 0.4% after rallying strongly in its first session back yesterday, there were also some reports that the US has enlisted Taiwan's help to ease auto chip shortage.

- Futures in the US are slightly lower, but off their lows as a bid in e-minis coincided with a sell off in treasuries.

GOLD: Still Below Bear Trigger

Gold has softened over the last 24 hours or so, but recovered from Wednesday's worst levels (around $1,770/oz), to last print $7/oz higher vs. settlement levels at $1,783/oz. Longer dated real U.S. yields are little changed over a 24 hour horizon, with the DXY a touch firmer. Wednesday's move represented a breach and close below the bear trigger in the form of the Feb 4 low, allowing those of a bearish disposition to switch focus to key support at $1,764.8/oz, which represents the Nov 30 '20 low.

OIL: Crude Rises As Supply Shock Roils Global Traders

Crude futures are extending their impressive rally, in positive territory and on track for the twelfth gain in thirteen sessions. Brent is above $65/bbl. The adverse weather conditions in the US have now resulted in a shock to global supplies and helped push WTI to levels not seen since late 2018.

- According to analyst estimates the big freeze in the US has taken 4mnl bpd of oil supply offline, there are growing fears the extreme weather will last longer than the few days originally thought, with another storm forecast to hit eastern and central US later in the week.

- The rally drew strength in Asia after API inventory data showed a 5.m bbl draw, above estimates. Downstream figures did show gain in stocks, gasoline inventories rose 3.9m bbls. Markets now look ahead to US DOE figures later today.

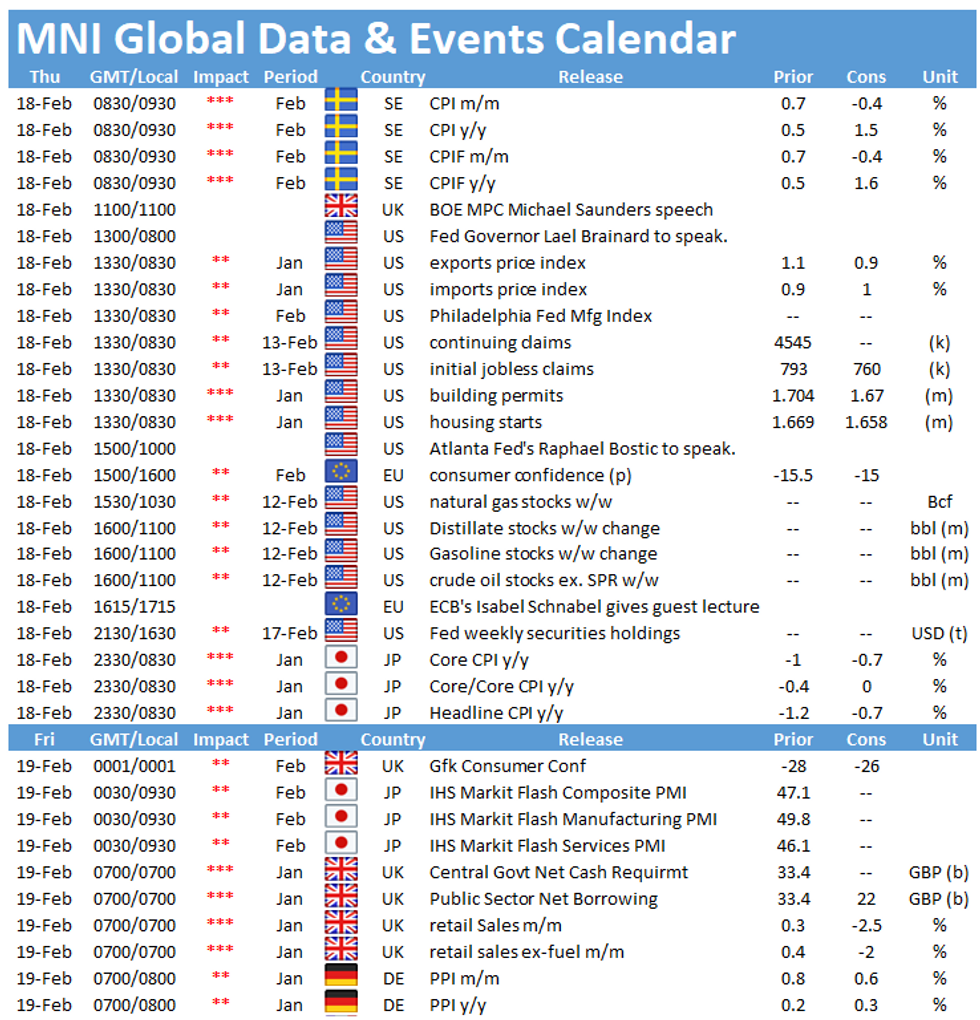

UP TODAY (TIMES GMT/LOCAL)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.