-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI EUROPEAN MARKETS ANALYSIS: Chinese & HK Equities Surge, USD Softens

- Some have pointed to the verified and unverified re-opening headlines/whispers out of China that we have flagged in previous bullets as a driving factor for the bid in Chinese & Hong Kong equity indices the Chinese yuan.

- The RBA deployed the widely expected 25bp rate hike, after stepping down to that increment at last month’s meeting. The Bank made reference to the “material” tightening now deployed in the current cycle and a more overt reference to the lagged impact of monetary policy. Focus now moves to the impending address from RBA Governor Lowe at the Bank’s Board dinner with the business community. Participants will be on the lookout for commentary around the scenarios that were discussed at today’s decision (with anywhere between no move in the cash rate to a 50bp rate hike having the potential to feature).

- A slew of manufacturing PMI readings from across the globe take focus from here. Speeches are due from BoC's Macklem & Riksbank's Ingves, in addition to the previously alluded to appearance from RBA Governor Lowe.

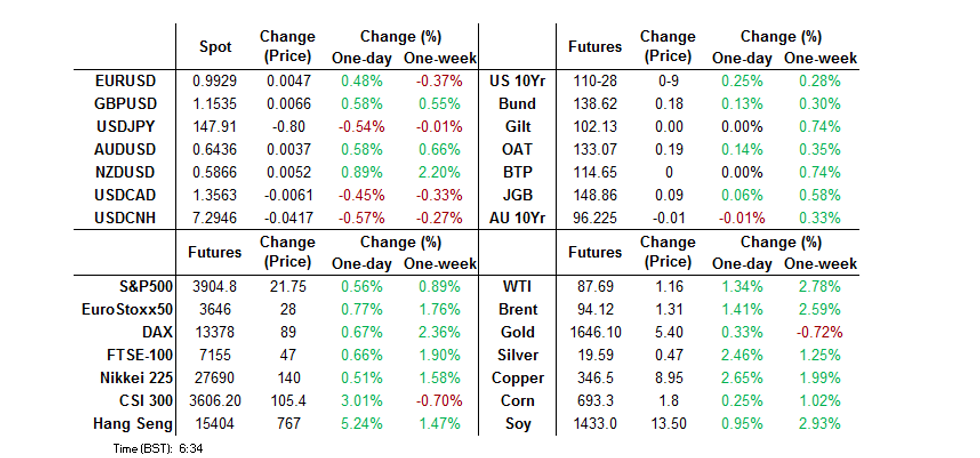

US TSYS: Firmer In Asia, Although Chinese Equity Bounce Caps Rally

Cash Tsys added to Monday’s late bounce from NY lows during Asia-Pac trade, with a move lower in the broader USD and then spill over from the ACGB space in the wake of the latest RBA decision helping the bid.

- The space has moved away from highs in recent dealing as Hong Kong & Chinese added to their already notable morning gains. Some have pointed to the verified and unverified re-opening headlines/whispers out of China that we have flagged in previous bullets as a driving factor for the bid in those equity indices.

- That leaves cash Tsys running 1.5-3.0bp richer across the curve, bull steepening. Meanwhile, TYZ2 deals +0-09 at 110-28, 0-03+ off the peak of its 0-11+ session range as volume in the contract nears 100K.

- The major flow in the space happened in the first half of Asia-Pac dealing, consisting of a 1.6K block sale of TY futures and a 5K screen lift of TYZ2 112.75 calls.

- NY hours will see the release of the ISM manufacturing survey and JOLTs job opening data, although participants are of course more focused on Wednesday’s FOMC decision.

JGBS: Notable Steepening Of The Curve Despite Solid 10-Year Auction

The JGB curve has extended its early steepening move during the Tokyo afternoon, with the major cash JGB benchmarks running 0.5bp richer to 7.5bp cheaper ahead of the bell. The pivot has occurred around the 10-Year zone, which continued to be capped by the upper boundary of the trading range permitted by the BoJ’s YCC mechanism.

- 20+-Year paper has more than unwound yesterday’s richening.

- JGB futures are +6 ahead of the bell, a little shy of best levels after drawing support from the latest 10-Year JGB auction, which went well. We would suggest that short covering and outright plays based on the BoJ’s YCC mechanism being successfully defended were the key drivers of demand at today’s auction.

- Domestic headline flow saw familiar rhetoric re: the aim and stance of BoJ monetary policy, as BoJ Governor Kuroda made his latest appearance in front of parliament.

- Elsewhere, familiar language was deployed by Finance Minister Suzuki when it comes to FX intervention matters.

- Looking ahead, Wednesday’s local docket will be headlined the latest round of BoJ Rinban operations.

AUSSIE BONDS: Curve Twist Steepens, Bonds Firm After RBA’s 25bp Hike

Aussie bonds firmed in the wake of the latest RBA decision, as the Bank deployed the widely expected 25bp rate hike, after stepping down to that increment at last month’s meeting. This came after some overnight/early Sydney cheapening.

- The fact that 32bp of tightening was priced into OIS for today’s decision, coupled with the Bank’s reference to the “material” tightening now deployed in the current cycle and a more overt reference to the lagged impact of monetary policy, allowed Aussie bonds to firm post-decision.

- The major cash ACGB benchmarks were 4bp richer to 4bp cheaper at the close, twist steepening, with a pivot around 7s. YM was +4.0 & XM was -1.0. EFPs were wider again today, with the 3-/10-Year box flattening. Bills were 9bp richer to 5bp cheaper through the reds, as the strip twist steepened, pivoting around the front of the reds. Terminal cash rate pricing eased to ~3.95%.

- Focus now moves to the impending address from RBA Governor Lowe at the Bank’s Board dinner with the business community. Participants will be on the lookout for commentary around the scenarios that were discussed at today’s decision (with anywhere between no move in the cash rate to a 50bp rate hike having the potential to feature).

NZGBS: Bear Flattening On Tuesday

Weakness in NZGBs extended throughout the day as the space more than unwound yesterday’s WGBI inclusion-related bid.

- The major benchmarks finished 7.5-12.5bp cheaper across the curve, bear flattening, going out around cheapest levels of the session.

- Swap spreads were mixed, narrowing a touch at the shorter end, while they were wider to flat further out.

- RBNZ dated OIS pricing was little changed on the day.

- We suggest that some trans-Tasman spill over from the weaker ACGB complex ahead of today’s RBA decision may have aided today’s cheapening.

- Looking ahead, Wednesday’s local docket will see the release of the latest quarterly labour market report, CoreLogic house price data and the RBNZ’s FSR.

FOREX: Greenback Sags Amid Positive Risk Tone, Aussie Trims Gains Post-RBA

The BBDXY dropped back towards the 1,330 level, roughly halving yesterday's advance, with U.S. Tsy yields easing across the curve. Pre-FOMC musings took centre stage, albeit another 75bp rate hike remains fully priced for this week's monetary policy review.

- Greenback underperformance was accentuated by the broader risk-on tone, which saw major safe haven currencies (JPY & CHF) trade on the back foot. E-mini futures crept higher, with the three main contracts last 0.32%-0.35% higher on the day, while strong performance from Hong Kong tech shares supported equity sentiment.

- The Aussie dollar pulled back from highs as the RBA raised the cash rate target by the expected 25bp, disappointing observers with more hawkish leanings (32bp of tightening was priced into dated OIS pre-decision). The central bank lowered its GDP outlook, while revising its CPI forecast higher.

- Post-RBA impetus helped AUD/NZD stage a clean breach of its 200-DMA, which provided support over the past 10 months. The spot rate sank in tandem with Australia/New Zealand 2-year swap spread amid the RBNZ's relatively hawkish posture. The kiwi tops the G10 scoreboard, leading the commodity-tied FX bloc higher.

- Offshore yuan weakened after the PBOC set the USD/CNY mid-point at a new cyclical high going back to early 2008, but recovered thereafter amid broad-based USD weakness. China's Caixin M'fing PMI rose to 49.2 last month, beating the consensus forecast of 48.5.

- A slew of manufacturing PMI readings from across the globe take focus from here. Speeches are due from RBA's Lowe, BoC's Macklem & Riksbank's Ingves.

FX OPTIONS: Expiries for Nov01 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9625(E1.2bln), $0.9700(E1.1bln), $0.9735-50(E724mln), $0.9800(E1.5bln), $0.9950(E2.0bln), $1.0000(E1.2bln)

- USD/CAD: C$1.3600($921mln)

- NZD/USD: $0.5685(N$619mln)

- AUD/NZD: N$1.1100(A$948mln), N$1.1300(A$1.3bln)

- USD/CNY: Cny7.2500($637mln)

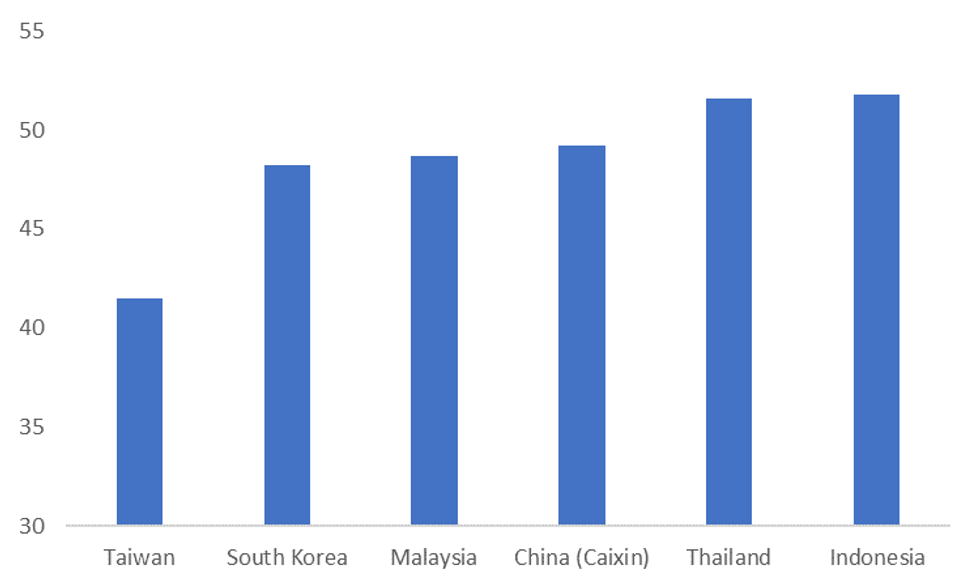

ASIA FX: USD/Asia Pairs Mostly Lower

USD/Asia pairs are mostly lower, in line with the dollar pull back against the majors. Higher regional equities have helped sentiment. Regional PMIs generally lost ground, although the China Caixin manufacturing PMI beat expectations. Tomorrow the focus will be on South Korean CPI, while the Philippines PMI also prints.

- USD/CNH was firmer in early trade, but after touching a high near 7.3560 post another rise in the USD/CNY fixing, the pair has generally been offered. We were last around 7.3200. Onshore spot is also away from earlier highs, last around 7.3050. Broader USD sentiment is softer, although CNH has lagged higher beta moves in this space. The Caixin PMI came in at 49.2 versus 48.5 expected, helping at the margin.

- USD/KRW dipped sub 1420, as higher equities helped offset lower export growth and a wider trade deficit. Still, the pair has found support sub this level, we were last back closer to 1421. The South Korean PMI improved in October, but remains in contractionary territory.

- TWD has lagged the broader USD sell-off. Spot USD/TWD remains elevated near 32.26, as the Taiwan PMI fell to fresh lows (41.5 from 42.2 last month). Details were also soft, suggesting continued headwinds for external demand into year-end. Taiwan equities have lagged the tech rebound as well.

- USD/INR sits just below recent highs under 82.80 (last at 82.65). The October manufacturing PMI printed at 55.3 versus 55.1 in September. Support may be evident for the pair in the 82.40/50 zone.

- USD/IDR is down slightly from fresh highs recorded earlier in the session. The pair was last back at 15629, versus 15658 earlier. Indonesia's PMI slipped to 51.8 from 53.7, but remains above trends in the rest of the region. CPI data was weaker than expected for October. Headline to 5.71% y/y, core 3.31% y/y.

- USD/THB is lower, back sub 38.00 to 37.935. Thailand's BoP current account balance unexpectedly flipped into a surplus in September, according to data released Monday. BoT Asst Gov Chayawadee said current account balance is expected to improve towards the year-end in line with rising tourist arrivals. Expansion in Thailand's manufacturing sector slowed, the latest S&P Global PMI survey showed. Headline index fell to 51.6 last month from 55.7 prior, with deterioration in demand cited as the main negative factor.

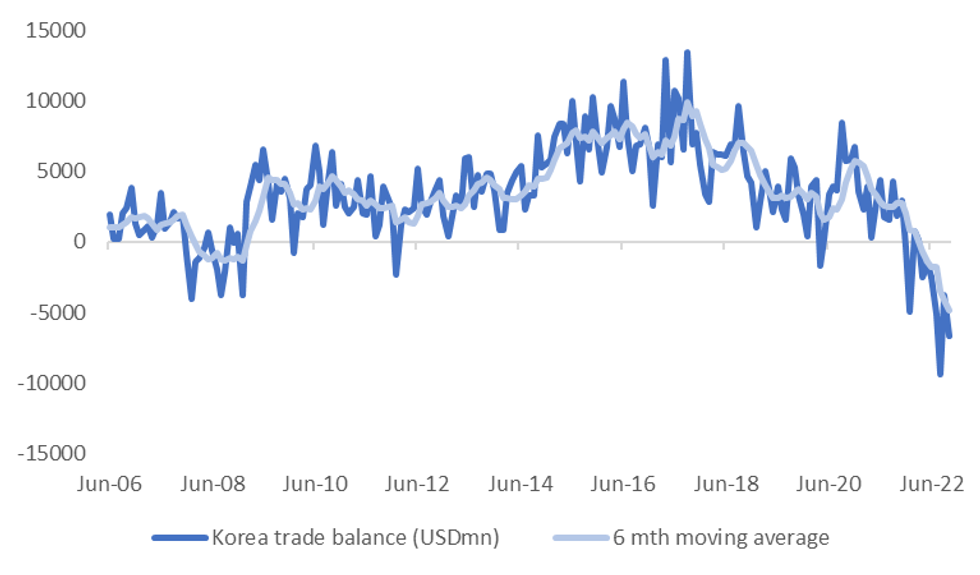

SOUTH KOREA: Disappointing October Trade Update

South Korean trade data disappointed on the downside. Export growth fell to -5.7% y/y, versus -2.1% expected. Import growth was firmer, +9.9% y/y, against a +6.6% expectation. This saw the trade deficit balloon back out to -$6.7bn, nearly double the consensus estimate of -$3.5bn.

- This is the weakest y/y export print since August 2020, when the global economy was emerging from the Covid induced recession. Accounting for working day effects didn't improve the picture, with this number down -7.9% y/y.

- The detail showed export growth to China down -15.7%, while chip exports fell by 17.4% y/y. Exports to the US held up better, +6.6%.

Fig 1: South Korean Export Growth - Total & To China Y/Y

Source: MNI - Market News/Bloomberg

- Energy imports surged to +42% y/y, driving the upside import surprise. This unwound some of the recent improvement in the trade deficit and comes despite the further improvement in the Citi Korean ToT proxy, which we highlighted yesterday.

- USD/KRW moved higher post the release, spot got above 1429, but we are now back to the low 1427 region, as firmer local equities (+0.90% for the Kospi) is helping sentiment.

Fig 2: South Korea Trade Deficit Improvement Proves Short-Lived

Source: MNI - Market News/Bloomberg

TAIWAN: TWD Lagging USD Sell-Off, PMI To Fresh Cyclical Lows

TWD FX is lagging the broader USD sell-off today. Spot USD/TWD is down from earlier highs above 32.30, last around 32.25, but this is still up on yesterday's closing levels. The 1 month USD/TWD NDF is -0.15% on NY closing levels, last at 32.21, but this is being shaded by moves elsewhere. Notably, USD/KRW 1 month is down 0.53% (sub 1420).

- Earlier, the Taiwan October PMI slipped to 41.5 from 42.2 prior. This is well below the next lowest in the region, South Korea (48.2). The detail of the Taiwan PMI print was weaker as well, output down to 34.5, from 37.4, while new orders are back to early 2020 lows.

- Taiwan's greater exposure to the tech sector, coupled with weaker demand from China, is likely weighing on domestic manufacturing sentiment.

- This is impacting net equity flows as well. October saw just over $3bn outflows from offshore investors, although the trend was better towards the end of the month. In contrast, South Korea saw +$2.1bn in net inflows for last month.

- The TWD NEER is just off YTD lows (last at 120.56 per the J.P. Morgan Index).

Fig 1: Taiwan PMI At Depressed Levels

Source: MNI - Market News/Bloomberg

EQUITIES: Tracking Higher Led By HSI Rebound

Asia Pac stock indices are mostly higher. Focus remains on HK, where volatility continues, today to the upside. US equity futures are higher, but have not drifted too far from the +0.30/+0.40% range this afternoon.

- Dip buyers look to have emerged again to support the HSI. The index is up over 2.3% at this stage. We are down from earlier highs. The tech sub index was up +6% at one stage, but is now back to +4%. H shares are up by 2.24%.

- China mainland shares are higher, the CSI 300 +1.5%, the Shanghai Composite +0.86%. The Caixin manufacturing PMI surprised on the upside (49.2 versus 48.5 expected), which has helped at the margin. The property sub-index has underperformed though, down 1.42%. Debt payments were suspended by CIFI holdings, weighing on broader sentiment in the sector.

- The Kospi is up over 1.3%, with the index up over the 2300 level. The Taiex has lagged up 0.40%. TSMC is higher, but noted that it had cut procurement orders to some suppliers by up to 50%.

- The ASX 200 is up +1.28%, led by a mixture of names - finance and resource related.

- Indonesia (-0.65%) and Malaysia have been the two laggards today (-1.00%).

GOLD: Rebounds Amid Broad USD Pull Back

Gold is recouping some losses from the overnight session, up around 0.25% so far. This puts us back near $1638 for the precious metal, after the overnight 0.70% fall.

- Directional correlation with USD moves remains strong, with the BBDXY off by close to 0.20% so far today. Range for the session has been just under $1631 to $1640.

- The rebound in UST yields has us back in the bottom half of the recent range though. A move sub $1630 could see recent lows below $1620 targeted.

- Interestingly, the World Gold Council stated central bank demand for gold was quite strong in Q3, hitting record purchases. Countries like Turkey and Qatar raised holdings, although there also significant purchases which were not reported at the country level (see this link).

- This is likely to reflect FX reserve diversification flows.

- Elsewhere though, gold ETF holdings continue to trend lower.

OIL: Softer USD Boosts Oil Prices Ahead Of Fed

Oil prices are slightly stronger today with WTI up 0.7% to just over $87/bbl and Brent + 0.8% to around $93.50 on the back of a weaker USD.

- WTI remains just above its 20-day moving average and continues to trade in the $85-$95/bbl range that it’s been in since the middle of the year.

- The market is awaiting the Fed decision on Wednesday, as another outsized 75bp hike is likely to worsen already heightened supply concerns. However, OPEC+ would probably reduce production further at any signs of weakening demand.

- The US tried to calm supply fears in the market by allowing ships that loaded Russian oil before December 5 until January 19 to unload.

- US President Biden made comments overnight that if oil and gas companies don’t use their excess profits from high prices to increase investment in increasing production, then the government would look at its options including increased taxation. In reality, this would be very difficult to achieve.

- OPEC expects demand for oil to remain strong into the mid-2000s and as a result called for more investment in the industry.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/11/2022 | 0800/0900 |  | CH | SECO Consumer Confidence | |

| 01/11/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/11/2022 | - |  | DK | Danish General Election | |

| 01/11/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/11/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/11/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/11/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/11/2022 | 1400/1000 | * |  | US | Construction Spending |

| 01/11/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 01/11/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 01/11/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 01/11/2022 | 2230/1830 |  | CA | BOC Governor Macklem at Senate bank committee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.