-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

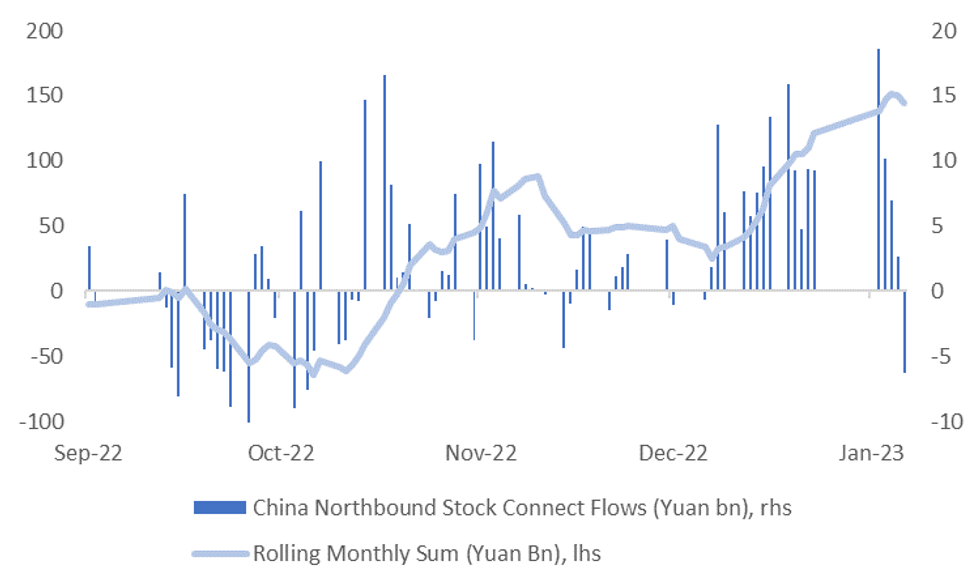

Free AccessMNI EUROPEAN MARKETS ANALYSIS: DXY Remains On The Front Foot In Asia

- The USD is trading on the front foot in the Asian session.

- China/HK equities remain a weak point, with sharper losses recorded so far for today's session. Sentiment hasn't been aided by a weaker US futures backdrop. This came after disappointing Amazon/Apple earnings results post the close.

- In Europe today we have final Eurozone Services and Composite PMIs and PPI. Further out NFP headlines, with the ISM Services survey also due. SF President Daly is the first Fed speaker post blackout period.

MNI US Payrolls Preview: Watching AHE For Rate Cut Direction

EXECUTIVE SUMMARY

- As has been the case for many months now, consensus looks for a slight moderation in payrolls growth in January to a still stronger than sustainable pace after last month’s broadly in line outcome.

- Annual benchmark revisions could make the initial read more complicated, but barring large surprises we suspect focus will be on AHE, which has abated a bit in the words of Powell after its own large revisions.

- Primary dealer analysts have an unusually distinct skew to a hawkish surprise from both AHE growth and the unemployment rate.

- That’s against a post-FOMC backdrop of 20bp priced for the Mar 22nd decision and one final hike fully priced for May despite Powell indicating a desire to see a couple more hikes to a restrictive level.

- PLEASE FIND FULL NOTE HERE:USNFPFeb2023Preview.pdf

US DATA PREVIEW: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

| TD Securities | +350K | Amherst Pierpoint | +270K |

| RBC | +245K | Societe Generale | +245K |

| BMO | +240K | BNP Paribas | +240K |

| HSBC | +240K | Credit Suisse | +225K |

| Goldman Sachs | +225K | Scotiabank | +220K |

| Bank of America | +215K | UBS | +210K |

| Wells Fargo | +205K | Barclays | +200K |

| J.P.Morgan | +200K | Citi | +195K |

| Mizuho | +190K | Morgan Stanley | +185K |

| Jefferies | +175K | Nomura | +130K |

| Median | +217.5K | BBG Whisper | +241K |

US TSYS: Richer In Asia

TYH3 deals at 115-19, +0-01+, just off the top of its 0-07+ range on volume of ~79K.

- Cash Tsys sit 1-2bps richer across the major benchmarks.

- Tsys firmed vs. levels seen late in the NY session, after some cheapening into the NY close, with regional participants focused on yesterday's BoE & ECB meetings/guidance.

- The space looked through a firmer than forecast Caixin Services PMI print.

- There was little meaningful macro headline flow.

- Asia-Pac flow saw a block buyer of TY futures (+2.5K) and a block seller of WN futures (-750).

- In Europe today we have final Eurozone Services and Composite PMIs and PPI. Further out NFP headlines (our preview is here), with the ISM Services survey also due. SF President Daly is the first Fed speaker post blackout period.

JGBS: Firmer, Led By Futures

The early bid, as Tokyo reacted to Thursday’s major central bank meetings and seemingly elevated chances of BoJ Deputy Governor Amamiya succeeding current Governor Kuroda, has held, leaving futures 39 ticks better off into the close. Wider cash JGBs are flat to 3.5bp richer, with 7s leading on the curve owing to the bid in futures. Futures breached their overnight peak on the push higher.

- Swaps have generally lagged the move in JGBs, leading to wider swap spreads in the main. Local headline flow has been fairly subdued, with continued rhetoric re: Sino-Japan relations and BoJ Governor Kuroda outlining the current paper loss of the BoJ’s bond holdings providing the highlights.

- Elsewhere, Kuroda reiterated the need for maintaining ultra-easy policy settings to stimulate wage growth, with various other comments/themes reiterated in his latest address in front of parliament.

- Offer/cover ratios in the latest round of BoJ Rinban operations (covering 1- to 5- & 10- to 25+-Year JGBs) were subdued printing at 1.6-2.0x, this may have provided a slight bid in the Tokyo afternoon.

AUSSIE BONDS: Holding Firm In Wake Of ECB & BoE

Bond futures finished a little shy of their Sydney session peaks, after reaction to Thursday’s key central bank meetings drove a bid in the early rounds of Friday trade (with a late pullback in the overnight session providing an opportunity for slightly better entry points).

- YM was +14.0, while XM finished +16.0, with both breaching overnight highs, although lacking meaningful momentum thereafter. The 10- to 12-Year zone outperformed on the wider ACGB curve, with the major benchmarks running 10-16bp richer on the day.

- Bills were 5-17bp richer through the reds, as the strip bull flattened. Meanwhile, RBA dated OIS continues to near-enough fully price in a 25bp hike for next week’s meeting, although terminal rate pricing has come in and is showing back below 3.65% after finishing just above 3.70% yesterday.

- There wasn’t anything in the way of meaningful reaction to firmer than expected Caixin services PMI data out of China.

- Participants are now looking ahead to the U.S. NFP print, which will cross in the overnight session.

- Further out, next week’s key domestic risk events include the RBA monetary policy decision mentioned above, the subsequent release of the RBA SoMP, Q4 retail sales volume, trade balance data and the Melbourne Institute inflation metrics.

- Note that next week’s AOFM issuance slate sees a continued A$1.5bn run rate for ACGB issuance, albeit over 2 auctions (ACGB May-28 & Nov-33), as opposed to this week’s 3.

NZGBS: Early Richening Extends In Wake Of Major Central Bank Meetings

NZGBs firmed as Friday trade wore on, with core global FI markets remaining underpinned in Asia-Pac hours, as the region looked to Thursday’s key central bank meetings/guidance, which triggered some adjustments ahead of Friday’s NFP release.

- That left the major NZZGB benchmarks running 10-14bp richer, as the curve flattened. Meanwhile, swap rates were 6-13bp lower across the major benchmarks, leaving swap spreads a touch wider on the day.

- RBNZ dated OIS continued to indicate just over 50bp of tightening for next month’s meeting after the well-documented pullback observed YtD (with domestic labour market and CPI data, as well as the readthrough from the major global central banks, in the driving seat in recent weeks). Meanwhile, terminal OCR pricing is showing below 5.20%, as the global central bank impulse made itself felt.

- There wasn’t much in the way of meaningful domestic headlines to trade off of.

- Any follow through from the impending U.S. NFP release will dominate early Asia-Pac trade on Monday, although NZ markets are closed. Meanwhile, next week’s local docket sees card spending data, the manufacturing PMI & REINZ house price data.

FOREX: USD Firmer In Asia

The USD is trading on the front foot in the Asian session, BBDXY is up ~0.2%.

- JPY is marginally outperforming its G-10 peers, USD/JPY is down ~0.1%. Support was seen in the pair below ¥128.50.

- AUD/USD is down ~0.2%, AUD is the weakest performer in G-10 space at the margins. Aussie was pressured after a stronger than forecast Caixin Services PMI print, before paring losses after falling as much as 0.5% to last deal $0.7060/65.

- NZD/USD was also pressured post the Caixin Services PMI print, Kiwi pared losses as support came in ahead of $0.6460 and currently deals close to unchanged from NY closing levels.

- EUR/USD is down ~0.2% and is below the 1.09 handle. GBP/USD is ~0.1% softer.

- Cross asset wise; US Equities futures are lower, NASDAQ futures down ~1.5% after earnings from Apple, Amazon and Alphabet were below expectations. US Treasury yields are marginally lower, 10YY are down 2bps.

- In Europe today we have Eurozone Services and Composite PMIs and PPI. Further out January NFP headlines, also on the wires is ISM Services Survey and US Composite and Services PMIs.

FX OPTIONS: Expiries for Feb03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0770-75(E739mln), $1.0850-60(E1.4bln), $1.0950(E1.6bln), $1.0975-80(E640mln), $1.1000(E1.5bln)

- GBP/USD: $1.2325(Gbp1.5bln)

- EUR/GBP: Gbp0.8840(E673mln)

- USD/JPY: Y127.00($545mln), Y129.50-55($1.1bln), Y130.00($1.0bln)

- EUR/JPY: Y138.15(E500mln)

- USD/CAD: C$1.3300($960mln), C$1.3400-05($670mln), C$1.3500($3.0bln)

- USD/CNY: Cny6.8000($1.1bln)

ASIA FX: Most USD/Asia Pairs Higher, But TWD & PHP Strong Outperformers For The Week

Asian FX is mostly lower for today's session, unwinding all post Fed gains for some pairs. USD/CNH is higher, last near 6.7500, as onshore equities weaken and foreign investors sell local stocks. This has weighed on other currencies within the region, although PHP and TWD have remained outperformers. On Monday next week Thailand CPI prints, along with Indonesian GDP.

- USD/CNH remains within recent ranges and has seen some selling interest above 6.7500 emerge. However, the air out of the re-opening trade has deflated somewhat. The market largely ignored the better Caixin services print, which like the official services PMI, printed better than expected (52.9, 51.0 forecast). Weaker equities and stock connect outflows (the first since the start of the year) have weighed.

- 1 month USD/KRW has tracked higher, in sympathy with USD/CNH. The pair last at 1227.50. Onshore equities are still higher, +0.50%, while offshore investors have added a further $274.1mn to local shares.

- TWD has fared better. Spot USD/TWD is only slightly higher at 29.70, while the 1 month NDF is near 29.50, down -0.20% for the session. Carry over from near $4bn in net equity flows this week has helped TWD play some catch up.

- For USD/INR, the pair dealt through 82 level yesterday, printing its highest level since early January (82.21) before marginally paring gains into the close. Bulls now target the January high of 82.94, bears look to break the 50-day EMA at 81.52 to turn the tide. We were last near 82.20, with services PMI data showing a resilient growth picture (57.2, 58.5 prior). Onshore equities are higher despite further Adani weakness.

- USD/THB is among the strongest performers within the USD/Asia space today. The pair reached a high of 33.095, but is now back around the 32.95 level. This is highs in the pair back to Jan 19. Through the middle part of Jan we saw offers emerge on moves close to 33.20. On the downside, support is evident between 32.60/32.80. This consolidation appears to represent some caution around the China re-opening theme, or at least a lot of good news was already in the price. Onshore concern around the pace of baht gains, particularly from a competitiveness standpoint, is the other headwind.

- USD/PHP is bucking the broader USD/Asia trend. The pair is down a further 0.40% to sub 53.65 so far today. This is fresh cycle lows, and brings PHP gains for the week to 1.50%. Beyond the 53.50 level, early June 2022 lows around 53.00 could be targeted by peso bulls. On the upside, the 54.25/30 region should draw some selling interest.

CHINA: China Related Assets Consolidate - A Bump In The Road Or Something More Threatening?

The market reaction to the Caixin China PMI beat has been limited in China related assets. USD/CNH continues to drift higher, last around 6.7475, while local equities struggle.

- This is similar to the reaction to the official PMIs from earlier in the week, which showed services much better than expected, but with little positive follow through to China related assets.

- It may the case we are entering a consolidation phase post the strong rally we saw from Nov through to end January. The CSI 300 is off over 3% from its recent peak, but this comes after a 22% rally in the previous 3 months. The China Dragon index has also stabilized somewhat, while the HSI is off ~5% post a 55% rally through Nov-Jan.

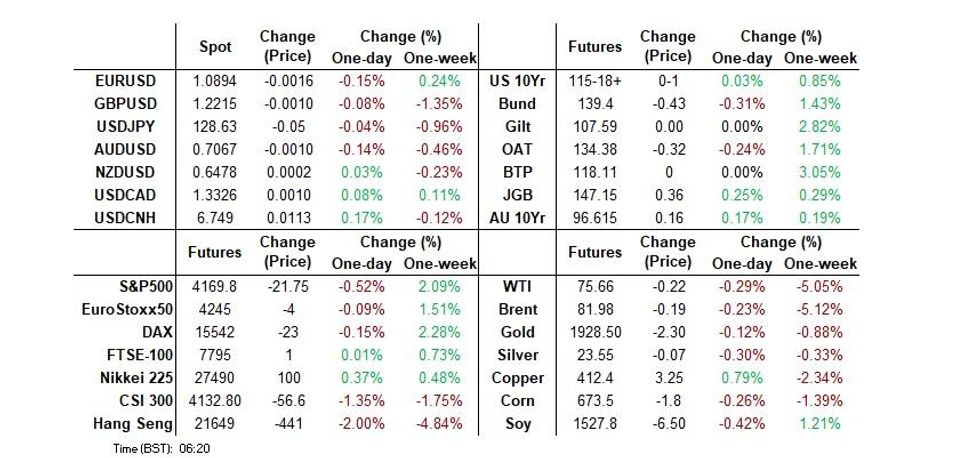

- Consolidation is also evident elsewhere, the first chart below plots USD/CNH and copper prices. Note copper is inverted on the chart. The two series have moved closely in recent months, which is not surprising given they serve as proxies (to some degree) for the re-opening theme. The broader Bloomberg metals index is off recent highs, while iron ore has also slipped, albeit after a very impressive rally.

Fig 1: USD/CNH & Copper Prices

Source: MNI - Market News/Bloomberg

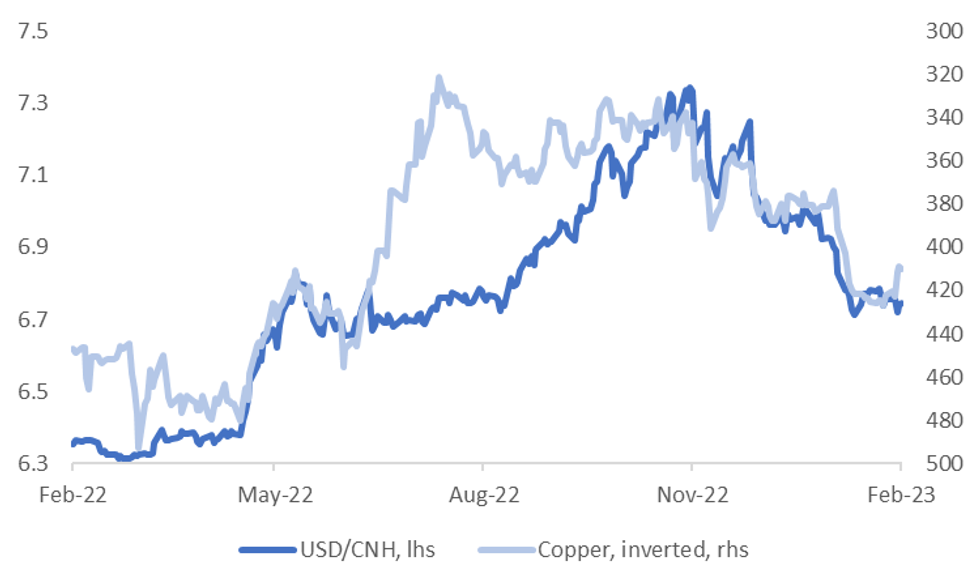

- It's also noteworthy commodity prices haven't seen much upside post this week's Fed outcome, compared to other risk assets. The second chart below overlays global equities versus base metal prices.

- The nature of the China rebound may also be a factor, with services indicators performing better relative to manufacturing. Also earlier in the week, housing data for China showed new home sales down 32.5% y/y for Jan, with few signs of a near term turnaround.

- Our policy team noted yesterday the challenges the China faces as well, see this link for more details.

- These moves may just represent a consolidation/speed hump as part of the broader recovery, but the trends outlined will be worth monitoring. The softer commodity price backdrop is taking the shine off the A$, while USD/Asia pairs are recovering in sympathy with USD/CNH.

Fig 2: Global Equities Versus Base Metals

Source: MNI - Market News/Bloomberg

EQUITIES: China/HK Weaken, Firmer Trends Elsewhere

China/HK equities remain a weak point, with sharper losses recorded so far for today's session. Sentiment hasn't been aided by a weaker US futures backdrop, Eminis down near -0.50% at this stage, while the Nasdaq is off by -1.4%. This came after disappointing Amazon/Apple earnings results post the close. It is only unwinding some of the impressive gains from Thursday's session in US trade (S&P500 +1.47%, Nasdaq +3.25%).

- For Hong Kong, the HSI is off by near 1.75% at this stage, leaving the market down nearly 5% for the week. However, this would be the first weekly loss since mid December last year.

- The CSI 300 is down 1.5% at this stage, with northbound stock connect outflows evident for the first session since the beginning of the year. The Caixin services PMI came in stronger than expected, 52.9, versus 48.0 prior and the 51.0 forecast.

- Trends are more positive elsewhere, the Nikkei 225 up 0.35%, while the ASX200 gained 0.6%. The Kospi is up 0.50%, but the Taiex is down 0.10% at this stage.

- Philippine equities continue the recent volatile patter, down 1% today, while Indian shares are slightly higher, despite further sharp falls for Adani.

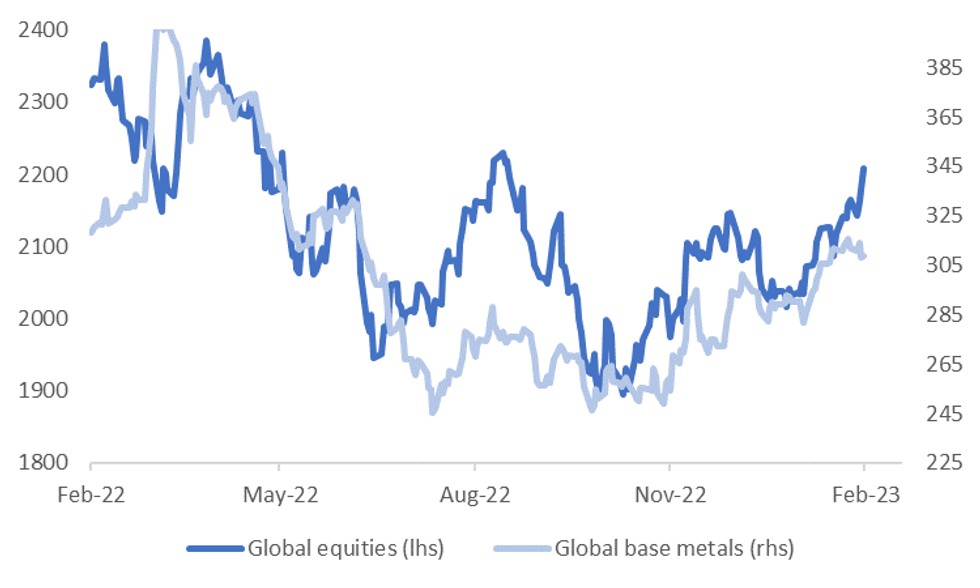

CHINA STOCKS: Northbound Flow Momentum Softening

China's CSI 300 index was down 1.67% at the break. If maintained this would be the steepest fall since the end of October last year, although we have to see how sentiment unfolds post the break. This is seeing some northbound outflows via the stock connect, see the chart below. At this stage we have seen close to 6.3bn yuan in outflows. The last outflow day was recorded on the first trading day of the year, although in recent sessions, while flows have remained positive, momentum has been slowing. January saw a bumper of 141bn yuan of northbound flows on the re-opening theme.

Fig 1: China Stock Connect Northbound Flow Trends

GOLD: Tracking Lower For The Week, Although Payrolls Still To Come

Gold has consolidated today after Thursday's sharp near 2% pull back. After closing in NY just under $1913, we last tracked around $1915. At this stage we are tracking lower for the week (last Friday's close was $1928.04), despite the Fed outcome mid week.

- The near term technical set up is not great, with such a sharp reversal from Thursday's fresh cycle highs around $1960. Still, support should be evident around the $1900 level.

- Gold continues to track broader USD trends as well. So, we may see range trading ahead of the US non-farm payrolls report later.

- Gold ETF holdings remain close to recent lows.

OIL: Tracking 5.5% Lower For The Week

Brent crude is close to session lows, last near $82/bbl, while WTI sat around $75.60/bbl. For Brent we remain above Thursday session lows near $81/bbl, but we are still well down for the week, off by 5.5% at this stage. Oil, along with other commodities haven't enjoyed the same risk bounce that equities saw post the Fed.

- Brent is back below all key EMAs, with the 20 and 50 day sitting back between $84-$85/bbl respectively. A break below $80/bbl would leave the market targeting $77.77 (Jan 5 low).

- Some air has come out the China re-opening trade this week, while swelling US crude stockpiles also remains a cap on near term upside.

- Looking ahead, over the weekend the EU's ban on seaborne imports of diesel comes into effect on Sunday, while US Secretary of State Blinken visits China on the same day. Then next week we have the usual weekly US inventory reports.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/02/2023 | 0700/0800 | * |  | NO | Norway Unemployment Rate |

| 03/02/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 03/02/2023 | 0815/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 03/02/2023 | 0845/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 03/02/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/02/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/02/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/02/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/02/2023 | 1000/1100 | ** |  | EU | PPI |

| 03/02/2023 | 1215/1215 |  | UK | BOE Pill & Shortall MPR National Agency Briefing | |

| 03/02/2023 | 1300/1400 |  | EU | ECB Elderson Speech at Climate Outreach Event | |

| 03/02/2023 | 1330/0830 | *** |  | US | Employment Report |

| 03/02/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/02/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.