-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: End Of The Month Flows Eyed

- OPEC+ JMMC fails to reach agreement on production pact ahead of ministerial meetings, weighing on crude & broader risk appetite.

- Talk of month-end extension/rebalancing support for U.S. Tsys dominates in a macro-light Asia-Pac session.

- Crude's impetus and the potential for month-end related flow sees equities pressured into European hours.

BOND SUMMARY: Caught In The Middle Of Cross Currents

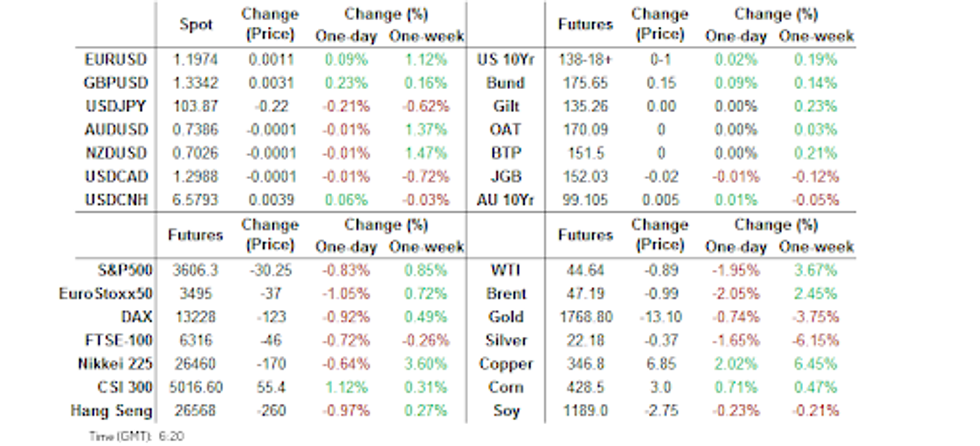

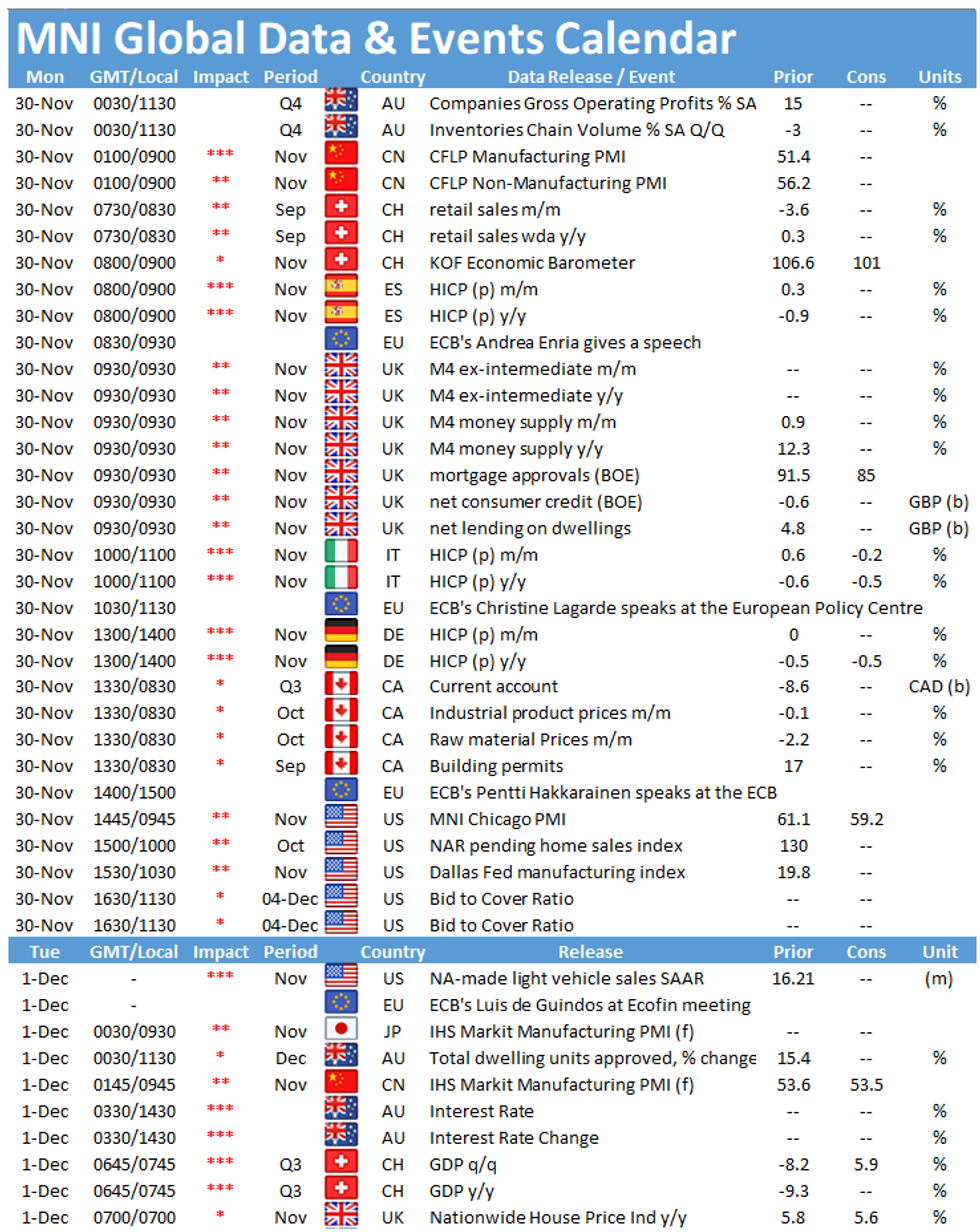

Core FI generally stuck to tight ranges in the Asia-Pac session, with sizeable month-end extensions/Tsy +ve rebalancing flows, a downtick in e-minis (after an initial move higher) and soft crude oil prices providing some cover vs. stronger than expected official PMI readings out of China. That leaves T-Notes +0-00+ at 138-06+, with the contract holding within a 0-03 range. Yields are marginally mixed across the curve, with light volumes observed across the space. As a reminder, the same sizeable U.S. Tsy month-end duration extension/rebalancing estimates came to the fore in a holiday thinned/shortened Friday trading session, allowing 30s to richen by over 5.0bp come the bell amid bull flattening of the curve. Chicago PMI data headlines the local docket on Monday, with Fedspeak from Barkin also due.

- JGBs futures edged lower as we moved through the Tokyo morning, as participants looked to the upcoming JGB supply schedule, before recovering from worst levels in the afternoon. Cash JGBs were unchanged to ~1.0bp richer in what proved to be a fairly limited session. Local data saw industrial production come in a touch better vs. exp., while the retail sales readings were largely in line with the broader consensus. The BoJ left the size of its 3-5 & 25+ Year Rinban purchases unchanged. The breakdown of the Rinban ops had little impact on the space, with the long end seeing some marginal outperformance on the day despite a jump in the 25+ Year Rinban offer/cover.

- Mixed local data did little to move the needle for Aussie bonds, while broader macro headline flow remained light, making for a rangebound start to this week's Sydney trade as participants look to a busy local docket over the coming days. YM finished -0.5, with XM +0.5. Swap spreads edged wider across most of the curve. Monday also heralded the first 5-Year bond future daytime session (BBG code VTA), which holds a March '21 expiry. The underlying bond basket for that contract is comprised of ACGB Nov '25, Apr '26, Sep '26 & Apr '27. Elsewhere, Sino-Aussie tensions continued to boil with a focus on the ongoing dispute surrounding Australian wine exports and a doctored image of alleged Australian war crimes in Afghanistan shared on social media.

FOREX: JPY Bid On Equity Sell-Off, CHF Buoyed By Referendum Results, GBP Gains On Brexit Sentiment

Initial pressure on safe haven currencies faded away as e-minis and equity benchmarks in Japan, Australia, Hong Kong & South Korea shed gains and turned red, with focus on the proximity of all-time highs in e-minis, heavy start to the week for crude oil and month-end flows. JPY recovered, further aided by a round of purchases vs. the greenback into the Tokyo fix, even as it is a Gotobi day in Japan. USD struggled to shake off its earlier weakness, after the DXY printed worst levels since mid-2018.

- CHF was the best G10 performer after Swiss voters taking part in the weekend referendums rejected two proposals to (1) make multinational companies liable for human rights/environmental abuses committed abroad & (2) ban funding of weapons producers. The allowed the SNB to avoid shedding ~CHF20bn in equities held as part of its reserves.

- GBP garnered strength with Brexit sentiment swaying towards the positives. Over the weekend, UK Foreign Sec Raab said that a Brexit deal could be struck as soon as this week, even as fishing rights remain a key sticking point.

- Oil-tied CAD & NOK came under pressure as oil traded on a softer footing. The Antipodeans firmed up in early trade, with NZD/USD printing best levels since mid-2018 & AUD/USD narrowing in on a key bull trigger/Sep 1 high. Both crosses shed gains later in the session, with the rapidly escalating Sino-Australian friction weighing on local sentiment. Worth noting that in the absence of notable headline flow the $0.7400 level in AUD/USD may display a degree of magnetism, with A$777mn worth of options with strikes at that figure due to expire today.

- CNH strength evaporated despite the release of above-forecast official PMI readings out of China, with the m'fing gauge indicating that expansion in the sector accelerated to the fastest pace since Sep 2017.

- USD/KRW edged away from cycle lows after South Korea raised the level of social restrictions outside of greater Seoul area, while local industrial output unexpectedly shrank on a M/M basis.

- Today's data highlights include U.S. MNI Chicago PMI, flash German & Italian CPIs, Canadian building permits & current a/c balance. Central bank speaker slate features ECB's Lagarde, Fed's Barkin & BoE's Tenreyro.

FOREX OPTIONS: Expiries for Nov30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E502mln), $1.1900(E808mln), $1.1950-65(E511mln), $1.2000(E402mln)

- USD/JPY: Y102.00($790mln-USD puts), Y103.00($882mln-USD puts), Y104.00($572mln), Y105.25($576mln)

- AUD/USD: $0.7400(A$777mln-AUD calls)

- USD/CNY: Cny6.50($515mln)

EQUITIES: Struggling For Clear Direction At Month End

A mixed round of inputs re: COVID matters, stronger than expected Chinese PMI data, a surprise round of liquidity injections from the PBoC (via MLF), month-end related flow and mixed Brexit mood music left the broader equity space struggling for a clear sense of direction in early Asia-Pac trade.

- Monday represents the final session of a record-breaking month for global equities (in terms of gains), which means potential headwinds from rebalancing flows and hedging activity.

- E-minis initially focused on the positives from the weekend, before running out of steam given their proximity to their respective all-time highs, while a heavy Asia-Pac session for crude oil markets also provided a source of pressure. This saw the space more than reverse its early gains, trading lower as we moved through overnight dealing.

- The CSI 300 outperformed its regional peers, aided by the aforementioned liquidity injection from the PBoC and stronger than expected PMI prints, which allowed the broader index to push higher, even after RTRS sources reported that "the Trump administration is poised to add China's top chipmaker SMIC and national offshore oil and gas producer CNOOC to a blacklist of alleged Chinese military companies."

- Nikkei 225 -0.8%, Hang Seng -1.6%, CSI 300 unch.%, ASX 200 -1.3%.

- S&P 500 futures -30, DJIA futures -333, NASDAQ 100 futures -52.

GOLD: Next Support Eyed, With ETFs Shedding Exposure

The recent pressure on bullion extended into the first trading session of the new week, with spot shedding ~$16/oz to last deal around $1,770/oz after bottoming out just above the 50% retracement of the March to August rally, located at $1,763.5/oz. The continued leg lower in known ETF gold holdings has been the dominant theme in recent sessions, even with the DXY trading on the backfoot and limited movement for U.S. real yields.

OIL: Oil Struggles As Cracks Appear In OPEC+ Pact Discussions

WTI & Brent are over $1.00 lower vs. their respective settlement levels as we move towards European hours.

- The OPEC+ JMMC meeting, held on Sunday, seemingly resulted in a lack of cohesion among participating nations, with source reports pointing to the failure of Russia, Kazakhstan & the UAE re: backing an extension of the current production quotas through the early part of '21.

- Reporters have noted that the full OPEC ministerial gathering will begin at 14:00 Vienna time on Monday, with the OPEC+ ministerial meeting set to get underway on Tuesday (providing the existing timetable holds).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.