-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN MARKETS ANALYSIS: Equities Struggle, DXY Rallies

- Apple earnings don't provide enough support for broader risk sentiment, with equities offered and DXY bid overnight.

- Block trade continues to catch the eye in the U.S. Tsy space.

- The first FOMC decision of '21 saw Fed Chair Powell stress that it is too soon for policy makers to start debating the timing of an eventual reduction of bond buying.

BOND SUMMARY: U.S. Tsy Block Flow The Standout

T-Notes extend to best levels of the day into European hours, with several flurries of activity noted overnight. The contract sits 0-01+ off highs at 137-17+ at typing, 0-00+ better off on the day. The early modest cheapening in the Tsy space unwound as we ground through Asia-Pac hours, aided by a 13K block buy of TYH1 at 137-17. A 2.5K block buyer of the USH1 171.00 calls was also seen overnight. Cash Tsys now sit unchanged to ~1.5bp richer across the curve, bull flattening, with headline flow on the light side in Asia-Pac hours. We should flag that Pfizer & BioNTech noted that the results of their studies indicate that their vaccine is effective against both the UK & South African variants of COVID-19. Q4 advance GDP, weekly jobless claims data and 7-Year supply headline locally on Thursday.

- Tokyo trade saw JGB futures stick to the range witnessed during the overnight session, closing -1, with a solid round of 2-Year JGB supply seen. Cash trade saw some light outperformance for the long end for most of the day, although shorter dated paper started to play catch up into the bell. There wasn't much of any real note on the local news flow front, with the latest round of retail sales data showing little in the way of deviation vs. expectations. Friday's local docket brings the release of the monthly labour market report, Tokyo CPI and prelim industrial production, in addition to the latest round of BoJ Rinban operations.

- Australian bond futures held to a narrow range on Thursday, with YM closing +0.5 and XM +1.5, taking the lead of broader markets since yesterday's close. Most of the focus fell on the launch of a new benchmark round of Aug '32 issuance from QTC. A$2.5bn of ACGB 0.25% 21 November 2024 supply headlines tomorrow's local docket. Friday will also see the latest round of local PPI and private sector credit data, in addition to the release of next week's AOFM issuance slate.

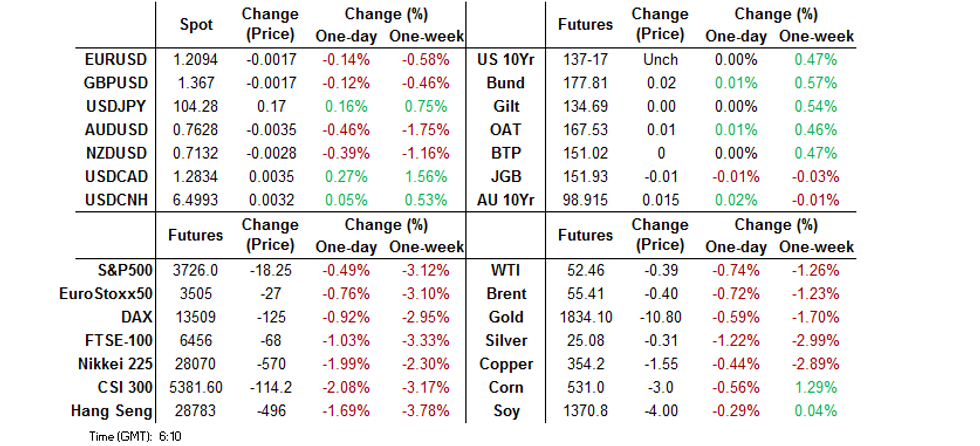

FOREX: Risk Aversion Spills Over Into Asia, Greenback Catches Bid

Risk aversion carried over into the Asia-Pac session, with the greenback retaining bid tone as equity markets were flashing red. Headline flow was relatively light, focus remained on some disappointing earnings reports and lingering Covid-19 worry. The DXY crept higher but fell short of attacking the prior intraday high.

- Antipodean currencies led losses in G10 FX space. AUD/USD shed ~40 pips and printed fresh YtD lows as the Aussie landed at the bottom of the pile. NZD/USD narrowed in on its 50-DMA, but failed to test the moving average. AUD/NZD extended its current losing streak, sliding through the 100-DMA.

- USD/JPY rallied further above the Y104.00 mark breached yesterday, but resistance from Jan 11 high/100-DMA at Y104.40/42 proved resilient. The yen struggled to benefit from broader demand for safe haven currencies.

- PBOC fixed USD/CNY at CNY6.4845, another miss lower for sell side estimates and drained CNY 150bn via OMOs, even as overnight repo rates hit multi-year highs. There was a piece in the Securities Journal that posited China will offer additional liquidity ahead of LNY.

- KRW underperformed in Asia after the IMF suggested that South Korea should ramp up fiscal and monetary support, while Samsung's Q4 earnings missed expectations & outlook for Q1 was fairly pessimistic. USD/KRW touched best levels since Nov and charted a double bottom pattern.

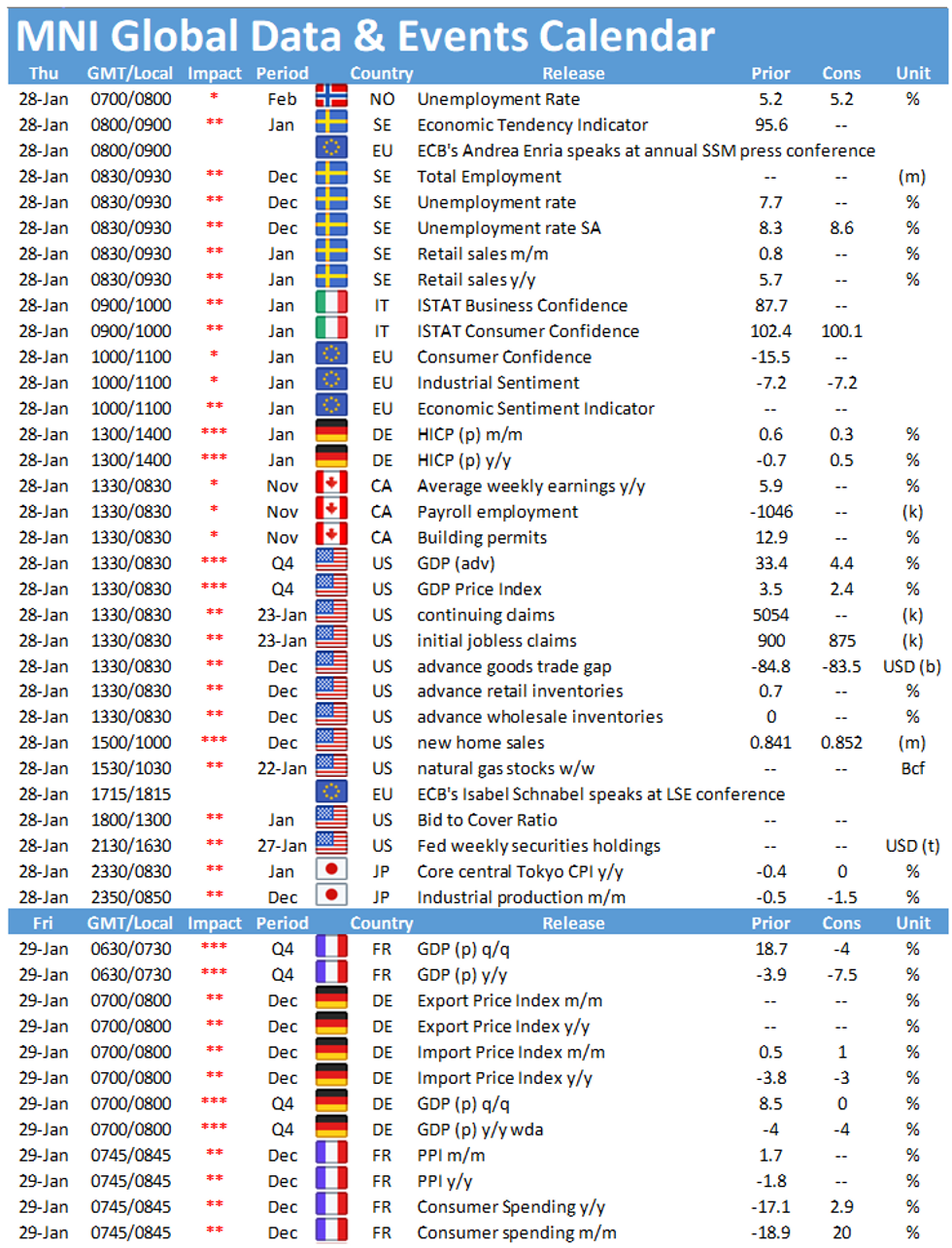

- On the radar today: U.S. initial jobless claims, new home sales & advance GDP, EZ sentiment gauges, flash German CPI, Swedish unemployment & retail sales as well as comments from ECB's Schnabel.

FOREX OPTIONS: Expiries for Jan28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2200-20(E658mln)

- USD/JPY: Y103.45-60($595mln-USD puts), Y103.80-95($560mln-USD puts)

- EUR/GBP: 0.8900(E705mln-EUR puts)

- AUD/NZD: N$1.0665(A$530mln)

- NZD/USD: $0.7050(N$645mln)

- USD/CNY: Cny6.37($500mln), Cny6.4200($590mln)

ASIA FX: Most USD/Asia EM Crosses Higher Amid Risk Off Trade

Risk off sentiment took hold in Asia on Thursday as the greenback rose and stocks slipped.

- CNH: Yuan defied prevailing sentiment to strengthen, though USD/CNH did briefly make it above 6.50. The PBOC drained a net CNY 150bn today, bringing net drain this week to around CNY 325bn.

- SGD: Singapore's December resident unemployment rate was 4.4%, down from 4.6% in November. The pick-up in employment was attributed to higher business activity. USD/SGD higher though, taking out resistance at the 50-day MA which hasn't been challenged since November.

- TWD: Taiwan dollar is one of the best performers in Asia, markets await minutes of the December CBC meeting later today.

- KRW: Won fell to the lowest since November after the IMF said the BoK had more room to ease.

- THB: Thai baht lower after weak manufacturing data. Investors look ahead to the release of the economic forecasts from the finance ministry later today.

- PHP: Lingering risk aversion pushed spot USD/PHP above its 50-DMA in early Asia-Pac trade, while below-forecast Q4 GDP report has failed to provoke any meaningful reaction.

- IDR: Bank Indonesia's intervention helped reign in rupiah depreciation. Bank Indonesia's Hendarsah commented that the central bank stepped into FX spot & domestic NDF markets to stem rupiah volatility.

EQUITIES: Stocks Slammed After Negative Lead From Wall Street

Asia-Pac equity markets have endured a negative session on Thursday, taking their lead from the US where indices saw their worst day of losses since October. The KOSPI is down over 2% after Samsung gave disappointing guidance in their earnings report. In Australia the ASX 200 is down ~2% as iron ore futures decline again.

- US futures are lower, but have come of session lows hit at the start of the Asia-Pac session. A reversal of fortunes for the Nasdaq, the index is the underperformer today after earnings reports from Apple and Tesla saw shares sliding after market. Focus remains on retail traders after another day of outsized gains for the likes of GME and AMC, WallStreetBets Reddit forum was briefly made private overnight.

GOLD: DXY Uptick Creates Some Pressure

The uptick in the DXY and steady real U.S. Tsy yields have allowed some light pressure to creep in over the last 24 hours, with spot gold having a brief look below initial support on Wednesday. A break below yesterday's trough would open the way to key support, which comes in the form of the Jan 18 low, located at $1,804.7/oz. Spot last deals just below $1,840/oz, ~$5/oz softer on the day.

OIL: Benchmarks Lower

Oil has slipped in Asia-Pac trade; with WTI & Brent sitting ~$0.40 below settlement. The commodity complex was dragged lower by a broad wave of negative sentiment that exerted influence across the asset classes.

- Developments in inventory data helped to stem the downside. Data from the DoE yesterday showed headline inventories saw a draw of near 10mln bbls, but a build in gasoline stocks and a decent rally in the greenback countered any oil strength. It should be noted that at these levels supplies are about 5% higher than the five-year average for this time of year.

- Some concerns over fuel consumption have also weighed on oil, China has urged residents to limit travel for LNY while figures yesterday showed traffic in LA has fallen in the past month.

- Comments from the IMF added to downward pressure. In their report the IMF said slow vaccine distribution and vaccine shortages could threaten financial stability. This combined with talk of vaccine shortages has cast doubt on a swift recovery.

- It is not all negative though, JP Morgan says brent could rise above $70/bb by the end of the year, citing tighter supply. The note predicted global oil market should tighten rapidly from February and supply will remain very tight through mid-2022.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.