-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Equity Rally Loses Steam

- Early risk-on moves pared back, risk aversion creeps in

- Nikkei 225 hits best levels since 1991 after Dow Jones eclipsed 30,000 but trims gains into the London morning

- China's Premier Li says growth to return to "proper range" in 2021

- UK Cll'r is set to deliver spending review and unveil GBP4.3bn support to help the jobless find employment

- ECB's Mersch suggests ban on bank dividends will be lifted next year

BOND SUMMARY: Core FI Get Reprieve As Early Risk-On Impulse Abates

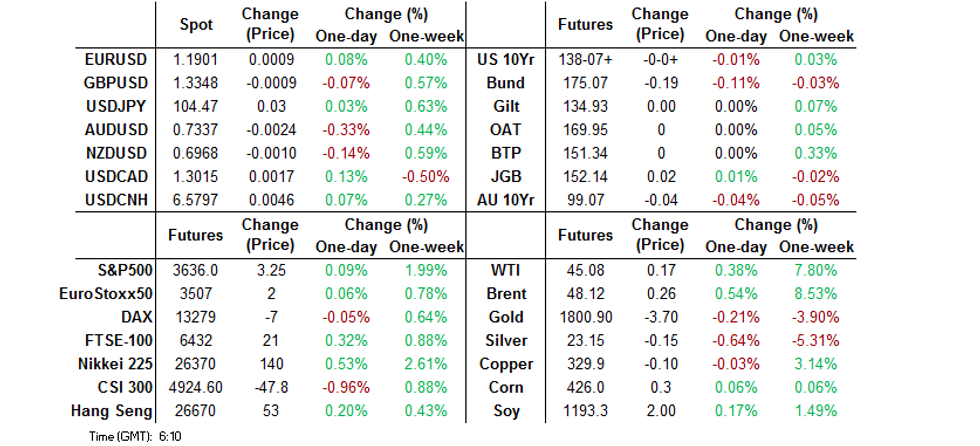

Upbeat comments from Chinese Premier Li re: China's growth outlook combined with familiar positives applied some pressure to core FI in early trade, but the risk-on feel gradually dissipated, with equity markets giving away gains as we headed towards the London open. T-Notes had a look through Tuesday lows, but recoiled from 138-04 as e-minis pared gains. The contract deals +0-00+ at 138-08+ as we type. Cash Tsy curve moved off steeps and now runs marginally flatter, with yields sitting a tad lower. Eurodollar futures trade -0.5 to +0.5 tick through the reds. There is a U.S. data dump coming up today, with some releases front-loaded ahead of Thursday's Thanksgiving Day. Minutes from the latest FOMC MonPol meeting are also due.

- JGB futures dipped under overnight lows after the re-open, but recovered thereafter and wrapped up above neutral levels. The initial decline coincided with a rally in the Nikkei 225, which hit best levels since 1991, which was weighed against concerns over the local coronavirus situation. Cash JGB yields generally finished lower, save for the super-long end (40s underperformed), with 2s outperforming. Japanese MoF auctioned Y500bn worth of 40-Year JGBs, drawing a cover ratio of 2.67x, with highest yield missing expectations. Japanese news flow revolved around local virus containment measures, with Tokyo metropolitan gov't poised to ask restaurants to close early & urge citizens to limit outing.

- Aussie bonds were pressured from the off amid the aforementioned risk-on impulse, with some pointing to a potential spill-over from NZGBs. 10-Year NZGB yield jumped to a multi-month high after the RBNZ's QE ops saw one big seller. Elsewhere, the RBA offered to buy A$1.0bn worth of semi-gov't bonds, while the AOFM auctioned A$2.0bn worth of ACGB 21 May '32. YM & XM pared losses into the London morning. ACGB yield curve moved off steeps, but remained bear-steepened on the day.

JGBS AUCTION: Japanese MOF sells Y499.6bn 40-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y499.6bn 40-Year JGBs:

- High Yield: 0.665% (prev. 0.610%)

- Low Price 94.30 (prev. 96.15)

- % Allotted At High Yield: 21.4007% (prev. 86.3557%)

- Bid/Cover: 2.670x (prev. 2.653x)

AUSSIE BONDS: The AOFM sells A$2.0bn of the 1.25% 21 May '32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$2.0bn of the 1.25% 21 May 2032 Bond, issue #TB158:

- Average Yield: 1.0446% (prev. 0.9241%)

- High Yield: 1.0475% (prev. 0.9250%)

- Bid/Cover: 2.5235x (prev. 4.4424x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 23.0% (prev. 88.8%)

- bidders 46 (prev. 58), successful 25 (prev. 17), allocated in full 16 (prev. 8)

FOREX: Mixed Trade In Asia

Early Asia-Pac trade saw a light risk-on impetus, as Chinese Premier Li said that China's economic development will return to a "proper range" next year, while participants digested familiar risk-supportive developments. The initial impulse faded away amid little in the way of fresh macro headline flow, with G10 FX space slowly moving into a defensive mode. JPY traded on a softer footing in the Asian morning, as the Nikkei 225 printed best levels since 1991 while Gotobi demand may have lent some support to USD/JPY, but recovered as risk-on feel evaporated.

- NOK likely drew some modest support from an uptick in oil prices and largely withstood deterioration in risk appetite, unlike its commodity-tied peers. GBP was rangebound ahead of today's UK spending review, with Cll'r Sunak set to announce GBP4.3bn in funding to support the unemployed in seeking new jobs.

- NZD shrugged off the RBNZ's Financial Stability Review and subsequent central bank speak. Gov Orr said the MPC wants to have the banking system operationally ready for negative interest rates, but never promised to deploy this tool. His colleague Hawkesby noted that the NZD would trade 5-10% higher, if the central bank had not eased policy further.

- KRW rallied, catching up with yesterday's improvement in risk sentiment to become the best performer in Asia, before trimming gains later in the session.

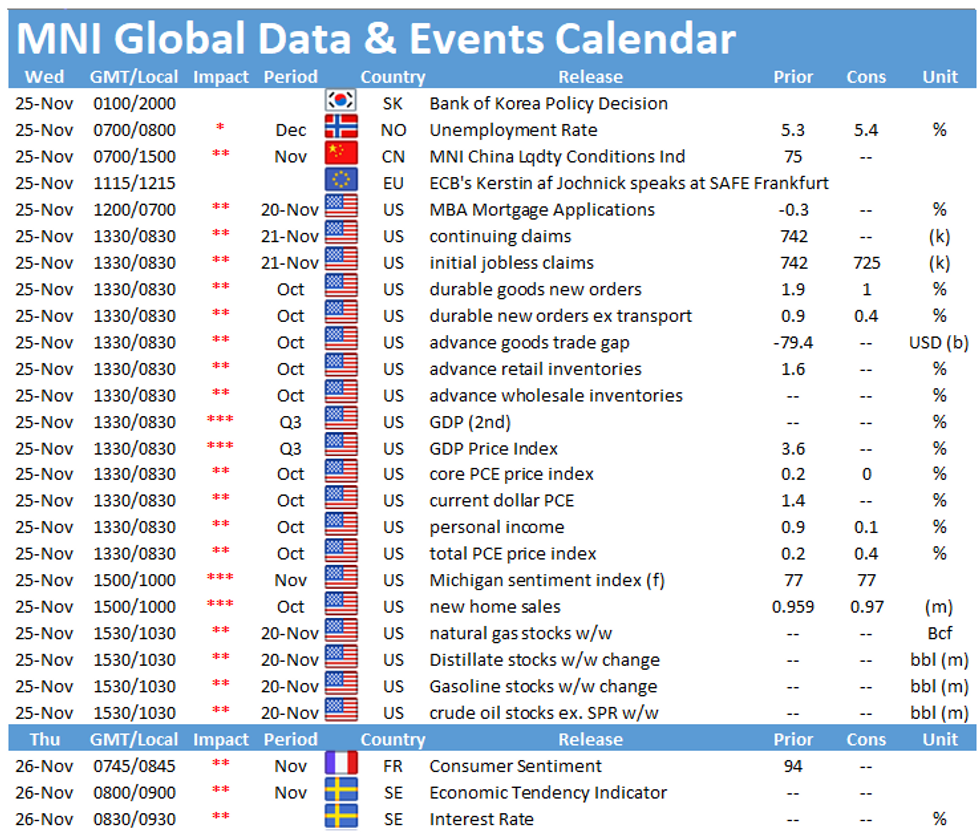

- Today's heavy calendar features some front-loaded U.S. releases, moved from Thursday's Thanksgiving. Initial jobless claims, second GDP reading, personal income/spending, final U. of Mich. Sentiment, flash durable goods orders, new home sales and FOMC Nov MonPol meeting minutes are all due. Elsewhere, focus turns to remarks from ECB's Holzmann & Riksbank's Ingves, as well as the ECB's FSR.

FOREX OPTIONS: Expiries for Nov25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E773mln), $1.1750-65(E725mln), $1.1800-10(E554mln), $1.1835-50(E719mln), $1.1870-75(E785mln), $1.2000(E835mln)

- USD/JPY: Y102.90-103.00($1.9bln-USD puts), Y104.00($965mln), Y105.50($630mln), Y105.96($500mln)

- EUR/GBP: Gbp0.8875-0.8900(E1.1bln-EUR puts)

- AUD/USD: $0.7390-0.7400(A$736mln-AUD calls)

- AUD/JPY: Y73.60-65(A$2.75bln)

- AUD/NZD: N$1.0620(A$508mln)

- USD/CNY: Cny6.6136($500mln-USD puts)

FOREX OPTIONS: Option Expiry Highlights For Nov25

- EUR/USD has nothing particularly standout for today's NY cut(1500GMT) although noticeable that the $1.2000 level has attracted EUR call interest through next week. Today sees E832mln of EUR calls rolling off at $1.2000. (current level $1.1905)

- USD/JPY calendar shows a propensity toward USD puts at and below Y103.00 from today and through next week, though the main stand out is the Y104.00 expiry on Dec3 for $3.35bln USD puts. (current level Y104.48)

- Hopes remain for a Brexit trade agreement which is keeping sterling buoyed. With this in mind EUR/GBP continues to attract EUR put interest at and below Gbp0.8900. For today the calendar shows a total of E1.1bln rolling off between Gbp0.8900-0.8875. (current level Gbp0.8915)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.