-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Global Trade & IP Growth Gradually Recovering

- Japan 2yr JGB yields made fresh highs back to 2011, aided by a stronger than expected CPI print. Still there remains a large wedge with US yields, hence spill over to yen has been limited. NZD has trimmed recent gains further ahead of tomorrow's RBNZ outcome.

- For Treasuries, we have had a very uneventful day as we head into a busy second half of the week for data. Earlier Kansas City Feb Pres Jeff Schmid, spoke on economic and monetary policy, reiterating that there is no rush to cut rates.

- Elsewhere, Global merchandise trade contracted almost 2% in 2023 after rising 3.3% the previous year but global organisations expect it to normalise this year, see below for more details.

- Looking ahead, in terms of data, there are US preliminary durable orders for January, December house prices and February consumer confidence. The Fed's Barr also speaks, as well as the ECB’s Elderson and BoE’s Ramsden.

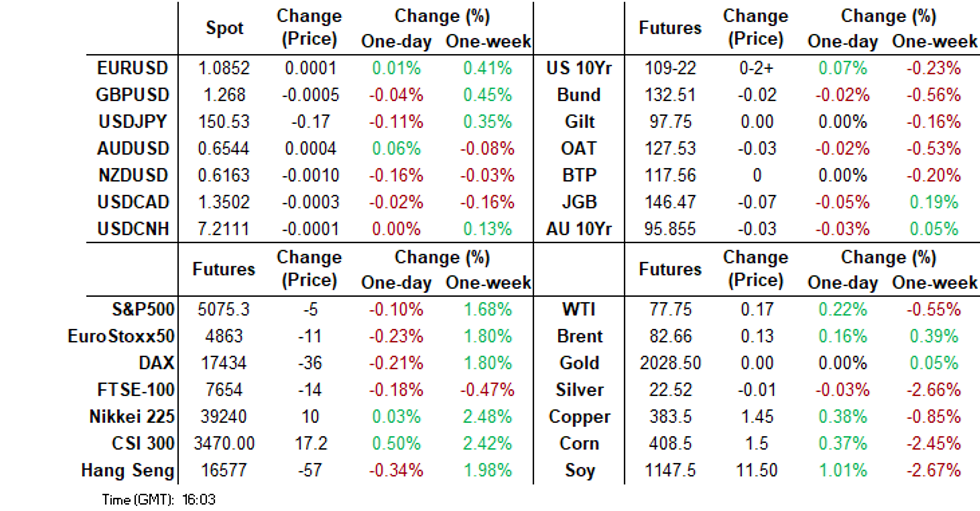

MARKETS

US TSYS: Treasuries Steady, Trade Tight Ranges Ahead of US Data

TYH4 is currently trading at 109-23, up + 04 from New York closing levels

Treasuries have had a very uneventful day as we head into a busy second half of the week for data.

- Mar'24 10Y futures have continue to trade in a very tight ranges during the Asia session, lows of 109-21 and highs of 109-25+. Futures remain in a downtrend and key levels to watch would be a retest of Mondays lows at 109-16, break of those levels would strengthen the bearish condition and signal scope for an extension towards 108-19+, the 61.8% Fibonacci level.

- Treasury curves are slightly flatter today, with the 2Y yield +0.3bp higher at 4.721%, 10Y -0.6bp lower at 4.274%, while the 2y10y is off yearly lows now -42.795.

- Earlier Kansas City Feb Pres Jeff Schmid, spoke on economic and monetary policy, reiterating that there is no rush to cut rates, and that the Fed needs convincing evidence before easing (MNI)

- Looking ahead: Durable Goods Orders, FHFA House Price Index, Conf. Board Consumer Confidence & Richmond Fed Manufact. Index out later today.

GLOBAL: Trade & IP Growth Gradually Recovering

Global merchandise trade contracted almost 2% in 2023 after rising 3.3% the previous year but global organisations expect it to normalise this year. Exports fell 0.7% and IP slowed but remained positive at 0.9%, according to the Dutch CPB. Trade improved over H2 though with it rising in 4 of the last 5 months, same with IP. The global manufacturing PMI returned to the breakeven-50 level in January and so this gradual recovery should continue into Q1 of this year.

Global growth %

Source: MNI - Market News/Refinitiv/Bloomberg/CPB

- The signs are that global goods trade and growth will remain lacklustre over H1 2024 but should continue to pick up gradually with a collapse unlikely, in line with the outlook in Asian PMIs. This is consistent with the improvement in the 3-month measure of momentum for both trade and IP in December.

- Global exports rose 0.5% m/m in December driven by developed countries. Annual growth turned positive at 1.2% y/y after -0.3% with EM exports rising 4.7% y/y from 2.7% and DM improving to -0.6% y/y from -1.8%.

- Trends within each grouping are not uniform though with exports from the euro area, UK, Africa and emerging Asia still contracting but US, Japan, China, eastern Europe and Latin America all growing. China’s export growth recovered strongly over H2 2023 to 12.4% y/y in December.

Source: MNI - Market News/Refinitiv/CPB

JGBS: Choppy Trading After CPI Data, BoJ Rinban Operations Tomorrow

In the Tokyo afternoon session, JGB futures are sitting weaker, -16 compared to settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined upside surprise for January’s National CPI.

- The MoF sold Y799.8bn of 5-year Climate Transition Bonds today. The bonds were sold for 99.81, had a yield of 0.339% and will settle on Feb. 28. Daiwa bought 20.89% of the issue.

- (Bloomberg) -- The sustainability of investor demand for Japan’s climate-transition debt is in question even after the five-year note sale beat estimates, according to Shoki Omori, chief desk strategist at Mizuho Securities in Tokyo. (See link)

- Cash JGBs are cheaper across the curve, with the 7-20-year zone (1.1-1.6bps cheaper) leading. The benchmark 10-year yield is 1.1bps higher at 0.697% versus the Nov-Dec rally low of 0.555% and the Feb high of 0.770%.

- The swaps curve has slightly bear-steepened, with rates flat to 2bps higher. Swap spreads are tighter out to the 20-year.

- Tomorrow, the local calendar is light, with Leading & Coincident Indices as the highlight.

- The BoJ will also conduct Rinban operations covering 5- to 25-year+ JGBs tomorrow.

JAPAN DATA: Jan National CPI Stronger Than Forecast, Services Inflation Rises 0.4% M/M

Japan Jan CPI was stronger than expected in y/y terms. National CPI printed 2.2% y/y versus 1.9% est. and 2.6% prior. The Core and Core-Core measures also surprised on the high side, printing 2.0% y/y and 3.5% y/y respectively versus expectations of 1.9% and 3.3% and prior 2.3% and 3.7%.

- In m/m terms, the headline was flat, while ex fresh food was 0.1%, and ex fresh-food and energy was 0.2%, Good prices fell -0.1%, while services rose 0.4%, after a flat Dec outcome (all of these prints are in seasonally adjusted terms).

- In terms of the sub sectors, food prices rebounded (+0.4% from -0.4% prior), while most other categories were either flat or rose 0.1-0.2% m/m. The main exception being a continued drag from clothing and footwear (-1.6%).

- In y/y terms, most sub indices saw lower y/y momentum in line with the headline result. Sticky or elevated pressures are evident for food (near 6% y/y), along with household goods, +6.5% and entertainment (+6.8%). The biggest drag is from utilities still, -13.9% y/y.

- At the margin, the data will be hawkish for the BoJ outlook, given the uptick in services inflation for the month.

AUSSIE BONDS: Narrow Ranges Ahead OF CPI Monthly Data Tomorrow

ACGBs (YM -1.0 & XM -3.5) are sitting cheaper and in the middle of today’s relatively narrow ranges. Without domestic data to drive the market, local participants have been content to keep their powder dry ahead of January CPI data tomorrow and Retail Sales on Thursday.

- January CPI is expected to increase moderately to 3.6% y/y from 3.4% in December with forecasts between 3.4% and 4%. As it is the first month of the quarter it will contain limited updated information on services and will mainly cover goods prices.

- On Thursday retail sales for January print and are expected to rise 1.6% m/m after falling 2.7%. The series has been volatile due to changes in the timing of seasonal discounts.

- US tsy dealings during today’s Asia-Pac session have also failed to provide any directional guidance. Cash US tsys are little changed across benchmarks.

- Cash ACGBs are 1-4bps cheaper with the AU-US 10-year yield differential 1bp lower at -14bps.

- Swap rates are 1-3bps higher, with the 3s10s curve steeper.

- The bills strip has bear-flattened, with pricing -1 to -3.

- RBA-dated OIS pricing is flat to 2bps firmer for meetings beyond June leading.

- The AOFM plans to sell A$800mn of the 3.75% 21 May 2034 bond on Friday rather than its usual issuance tomorrow.

RBNZ: MNI RBNZ Preview – February 2024: Watching, Waiting & Worrying

- The RBNZ is probably still “watching, worrying and waiting” thus there is no incentive to change rates in either direction and while we don’t expect a rate hike, we believe it will want to keep policy and thus financial conditions restrictive until it is confident that inflation will or has returned sustainably to the 1-3% target band.

- There's a 27% probability priced in for a 25bp hike during this week's meeting, with an anticipated terminal OCR of 5.65% (reflecting a 60% probability of a 25bp hike) by the May meeting. By year-end, a cumulative 41bps of easing is factored into the pricing.

- Given we expect the tightening bias to be retained, we also expect that the MPC will discuss a rate hike but then opt for no change. Updated staff forecasts will be presented and will be monitored for changes to the OCR path and CPI forecasts, especially upward revisions.

- The RBNZ is likely to sound cautious and push back against rate cut expectations by saying it is too soon to talk about easing, discussing a rate hike or possibly pushing out the first cut in its OCR path. Given the high degree of uncertainty, the hold could be prolonged for most of this year.

- See full preview here.

NZ STIR: RBNZ Dated OIS Gives A Hike Tomorrow A 30% Chance

RBNZ dated OIS pricing closed 2-5bps softer across meetings. Specifically:

- There's a 28% probability priced in for a 25bp hike during this week's meeting, with an anticipated terminal OCR of 5.65% (reflecting a 58% probability of a 25bp hike) by the May meeting.

- By year-end, a cumulative 43bps of easing is factored into the pricing. To provide context, it's worth noting that in late December, the market had expected over 100bps of easing by year-end, stemming from an anticipated terminal OCR of 5.53%.

Figure 1: RBNZ Dated OIS Expected Terminal & End-24 OCR (%)

Source: MNI – Market News / Bloomberg

NZGBS: Closed Slightly Cheaper Ahead Of Tomorrow’s RBNZ Policy Decision

NZGBs closed 2bps cheaper after dealing in relatively narrow ranges in today's local session. In the absence of domestic data, local participants have been content to sit on the sidelines ahead of tomorrow’s RBNZ Policy Decision.

- The RBNZ is probably still “watching, worrying and waiting” thus there is no incentive to change rates in either direction. While we don’t expect a rate hike, we believe the RBNZ will want to keep policy and thus financial conditions restrictive until it is confident that inflation will or has returned sustainably to the 1-3% target band.

- Given we expect the tightening bias to be retained, we also expect that the MPC will discuss a rate hike but then opt for no change. Updated staff forecasts will be presented and will be monitored for changes to the OCR path and CPI forecasts, especially upward revisions.

- There's a 27% probability priced in for a 25bp hike at this week's meeting, with an anticipated terminal OCR of 5.65% (reflecting a 60% probability of a 25bp hike) by the May meeting. By year-end, a cumulative 41bps of easing is factored into the pricing.

- See the full preview here.

- Swap rates closed flat to 4bp lower, with implied swap spreads sharply narrower.

FOREX: NZD Slips Ahead of RBNZ, Yen Gains Ground Post CPI

The USD BBDXY index sits lower compared to end Monday levels in NY, but only modestly. The BBDXY last near 1241.10, against earlier lows of 1240.9.

- The first part of the Tuesday session has unfolded in a similar fashion to yesterday's session, with NZD generally underperforming. This may reflect position squaring ahead of tomorrow's RBNZ decision.

- NZD/USD hit lows of 0.6151, but we now track back near 0.6160, still 0.20% weaker. NZD/USD overnight vol has spiked, now at 17.69. This is the highest levels since Dec 7th. The implied range for the cross in the next session is 0.6099-0.6227 based off a 74% probability.

- AUD/USD was dragged lower initially, but now sits unchanged for the session, last near 0.6540. A modest recovery in China/HK equities has likely helped, while iron ore has recovered a touch from recent lows, last near $116.35/ton. The AUD/NZD cross is back above 1.0600.

- USD/JPY has generally tracked lower, aided at the margins by stronger than expected national CPI data for Jan. We got to lows near 150.40, but sit slightly higher now.

- Japan 2yr government bond yields hit fresh highs back to 2011, but at 0.17% still leaves a large yield wedge with the USD.

- In the cross asset space, US equity futures sit down a touch, while US yields are close to unchanged.

- Looking ahead, in terms of data, there are US preliminary durable orders for January, December house prices and February consumer confidence. The Fed's Barr also speaks, as well as the ECB’s Elderson and BoE’s Ramsden.

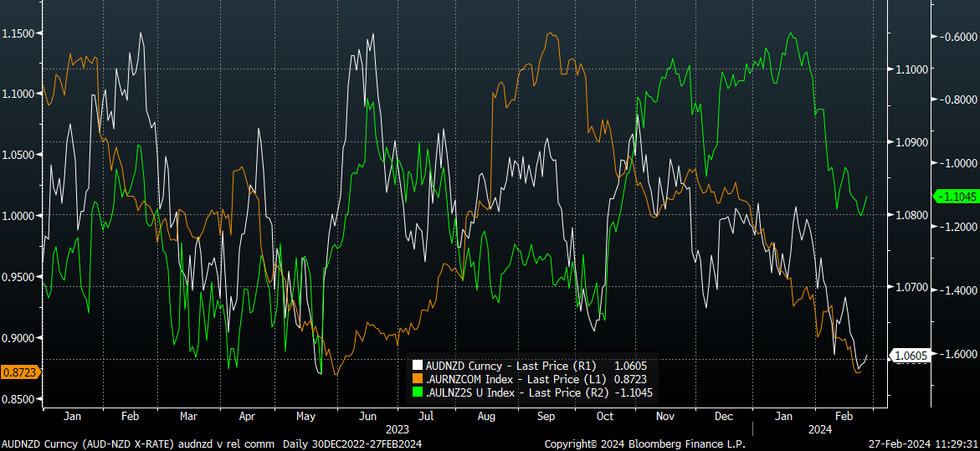

AUD/NZD FX: Implied Overnight Vol Spikes To 12m Highs, Ahead OF Key Event Risks Tomorrow

The AUD/NZD cross continues to oscillate around the 1.0600 level ahead of key event risks tomorrow. We have the RBNZ decision, along with Jan monthly CPI in Australia.

- The RBNZ outcome should have the bigger sway on the cross. An on hold outcome may see a knee jerk move higher in the pair, given some very modest pricing of a hike. Still, the RBNZ outlook will be very important as well, given cuts priced towards the end of this year.

- The AU-NZ 2sy swap spread sits at -110bps, slightly up from recent lows (-117bps), see the chart below.

- Not surprisingly, AUD/NZD overnight vol has spiked, now at 16.6%. This is the highest levels since early 2023. The implied range for the cross in the next session is 1.0504-1.0713 based off a 75% probability.

- Outside of tomorrow central bank driven risk, relative commodity price trends will another watch point for the cross. Since the start of the year such trends have favored NZD over AUD, with metal prices, particularly iron ore weakness in focus amid on-going China demand concerns. In contrast, dairy prices have generally trended higher.

- The other line on the chart is the ratio of AU to NZ commodity prices, proxied with a DB series for AU and CBA series for NZ.

- Key levels to watch include 1.0560/70 (YTD lows Feb 22/May 23, Yearly Lows) a break here could signal a move to 1.0474 (Dec 22 lows), to the upside are 1.0612 highs from Feb 22, above there 1.0650/55 (Feb 20 highs/ 20-day EMA). Currently, the 20 and 50-day EMAs are positioned at 1.0655/1.0705.

Source: MNI - Market News/DB/CBA/Bloomberg

ASIA EQUITES: China & HK Equity Mixed, Property Lower After Vanke Looks To Extend

Hong Kong and China equities have opened mixed on Tuesday, with property underperforming. China northbound flows have mark two days of outflows, while investors may still hold concerns around China's willingness to support the market adequately. The iron ore price is also signally some concern around the Chinese economy, now 20% off highs from Jan 1.

- Hong Kong equities are lower today, underperforming Mainland China equities. The HSI bounced off the 100-day EMA, a level it has been unable to trade above since August 2023 and now trades down 0.36%, HSTech has see-sawed today, at one point down 0.80% to now trade up 1.00%, while property continues to underperform down 2.00% after China Vanke Co, the nations second-largest developer after reports emerged that they were in talks to extend near term maturities.

- China Equities are mostly higher today with the with the CSI300 up 0.10% while the CSI1000 is up 1.22%

- China Northbound flows were -1.30b yuan on Monday, as traders looked to book profits ahead of a busy week for global data and strong recent performance. The 5-day average of 3.15b sits above the 20-day at 2.37B.

- The number of private funds each managing more than 10 billion yuan ($1.4 billion) shrank to 98 as of Feb. 26 from 104 at the beginning of the year, with a particular downsizing in quant funds, the Shanghai Securities News reports (BBG)

- HK Financial Secretary Paul Chan is expected to ease curbs on property transactions and announce moves to lift tourism and attract more investment inflows when he releases the budget on Wednesday.

- Looking ahead, Hong Kong has Trade Balance Data out later today.

ASIA PAC EQUITIES: Asian Equities Take A Break, Equity Flow Momentum Slows

Regional Asian Equities are mostly lower today, Japan is out-performer the wider region but off highs from earlier to now trade mixed. There has been little in the way of market headlines, earlier South Korea had store sales out showing a decline from the previous month, while retail sales came in at 8.2% vs 7.5% prior.

- Japan equities are mixed today, bank stocks are the top performer after Warren Buffet commentary around strong corporate governance and shareholder friendly policies has been seen to be boosting the sector, while the 2Y JGBs hit their highest levels since 2011, boosting expectations for higher profitability, the Topix Bank index is up 1.77% today and 1.38% for the past month. The Nikkei 225 has turned negative now down 0.11%, while the Topix is up 0.18%

- South Korean equities are lower today, investors remain cautious after the "Corporate Value-up" program fell short of expectations yesterday. Foreign equity inflows are slowly with the 5-day average is now at $65m Vs $322m a week ago, while the 20-day sits at $302m, the Kospi is 0.75% lower.

- Taiwan Equities are lower today, after initial opening higher and making fresh All-time highs. Investors may be looking to book profit ahead of a busy end to the week for global data. Equity inflows are slowing, although still comfortably in positive territory as the 5-day average is now at $242m while the 20-day sits at $482m, the Taiex is down 0.36%.

- Australian equities turned positive late in the session after miners were able to find a bid, this could be on the back of iron ore trading higher. the ASX Metals and Mining Index closed down 0.48% after being as low as 1.60%. The ASX200 closed 0.13% higher.

- Elsewhere in SEA, Malaysia equities are the out-performer as the weaker MYR is seen to be supportive to equities up 0.41%, NZ equities down 0.13%, Indonesia down 0.22% while Singapore equities are 0.90% lower.

OIL: Crude Holds Onto Monday’s Gains But Range Trading

Oil prices have been moving in a narrow range and are down slightly and off the intraday highs during today’s APAC session but have held onto Monday’s gains. Brent is around $82.43/bbl after a high of $82.72 earlier and WTI $77.51 after a high of $77.77.Increased demand from US and China refiners plus continued geopolitical issues have offset higher non-OPEC output. The USD index is little changed.

- US refining rates are increasing and the stock build seen over the last few weeks is expected to be run down as a result. There is data later today on US crude and product inventories.

- Offsetting factors have been keeping oil range bound through most of the year and Goldman Sachs and Bank of America both expect this to continue over the short term. Goldmans is forecasting prices to be $20 either side of $80 and BoA in the $60-$80 range, according to Bloomberg.

- Brent’s prompt spread has widened signalling that the market continues to tighten.

- Later the Fed’s Barr and Schmid speak, as well as the ECB’s Elderson and BoE’s Ramsden. In terms of data, there are US preliminary durable orders for January, December house prices and February consumer confidence.

GOLD: Steady After A Small Pullback On Monday

Gold is slightly higher in the Asia-Pac session, after closing 0.2% lower at $2031.24 on Monday.

- Monday’s move represented a further pullback from Friday’s spike to $2041.37 and came despite net USD index weakness on the day.

- Nevertheless, bullion continues to trade in a narrow range ahead of key US inflation on Thursday. The PCE Deflator, the Fed’s preferred inflation gauge, is expected to rise, highlighting the challenge for the US central bank of returning inflation back to target. Fed speakers continue to flag the need for more benign inflation data as a precursor to it lowering borrowing costs.

- According to MNI’s technical team, recent price activity has defined key resistance at $2065.5, the Feb 1 high, and key support at $1984.3, the Feb 14 low - both levels represent important short-term directional triggers.

ASIA FX: USD Firms On Mixed Equity Trends, Less Supportive Flows

The USD has drifted marginally higher against Asia FX. Overall dollar gains have been modest but supported by a more mixed regional equity backdrop and inflow picture. Spot THB has bucked this broader trend but is away from best levels. Still to come later today is Taiwan Jan export orders, along with the Q4 BOP. Tomorrow, the data calendar is very light for the region.

- USD/CNH has maintained tight ranges, not drifting far from the 7.2100 level. Local equities are higher, albeit amidst a volatile trend. Volatility continues to decline ahead of the upcoming 'Two Sessions'. Later on in the week we get official PMI prints for March.

- 1 month USD/KRW has been equally range bound. The pair last near 1329.5, little changed from end NY levels on Monday. Local equities are weaker, but this hasn't weighed on the won materially. Data out has focused on retail sales and short term external debt, both of which haven't shifted the sentiment needle.

- 1 month USD/IDR has drifted higher, albeit to sit slightly below session highs in latest dealings. The pair was last near 15670. For the 1 month NDF we are now back above all key EMAs. The 20-day is nearby at 15655, but hasn't been an important inflection point. The 100-day near 15575 has seen support emerge on dips close this level back to early Jan this year. Cross asset headwinds have emerged somewhat for the rupiah, with global equity momentum stalling somewhat in recent sessions, while US real yields hold sticky, the 10yr close to +2.00%. 5yr CDS has edged up from recent lows, last close to +70bps.

- Spot USD/PHP sits within Feb ranges, last tracking near 56.06. This leaves Peso little changed for the session. We are comfortably above recent lows 55.70, but late Jan highs, just above 56.50 are some distance away. Key EMAs are all clustered close to spot, 55.90 to 56.02. It's a similar story for simple MAs as well. More broadly, PHP remains the third best performer in the EM Asia space 2024 to date, after HKD and INR. The BSP's high policy rate likely aiding the currency relative to others in the region as Fed cut expectations have been pushed out.

- Spot USD/THB is 35.92 in recent dealings, up from session lows, but still 0.50% stronger in baht terms. Onshore markets were closed yesterday, and we ended last Friday at 36.11. Moves above 36.00 have not been sustained in Feb. There may be official resistance to moves above this level. Since last Friday, the USD index has moved off recent highs, which has likely helped at the margin. Gold prices, which have tracked higher as well is another positive. We aren't too far away from the 20-day EMA, which sits near 35.816.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/02/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 27/02/2024 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/02/2024 | 0900/1000 | ** |  | EU | M3 |

| 27/02/2024 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/02/2024 | 1330/0830 | * |  | CA | Capital and repair expenditure survey |

| 27/02/2024 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 27/02/2024 | 1340/1340 |  | UK | BOE's Ramsden at Association for Financial Markets | |

| 27/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/02/2024 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/02/2024 | 1405/0905 |  | US | Fed Vice Chair Michael Barr | |

| 27/02/2024 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/02/2024 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 27/02/2024 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 27/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.