-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN MARKETS ANALYSIS: JPY More Sensitive To BoJ Speculation Than JGBs

- Tsys opened cheaper as Asia-Pac participants digested Friday's stronger-than-expected NFP print, as well as a piece from WSJ's Timiraos which noted "fresh signs of a hot U.S. labor market leave the Federal Reserve on course to raise interest rates by a quarter percentage point at its meeting next month and to signal another increase is likely after that."

- USD/JPY gapped higher at the open in thin liquidity as a Nikkei report noted BoJ Deputy Gov Amamiya being approached to head up the central bank. USD/JPY climbed as much as 1% before paring gains as Japan's Deputy Chief Cabinet Secretary Isozaki noted there was no truth to the Nikkei report. Finance Minister Suzuki earlier said he hasn’t heard such discussions, although he conceded that he is “out of the loop” on the matter.

- Eurozone retail sales and BoE speak from Pill & Mann provide the highlights on Monday.

US TSYS: Early Cheapening Holds In Asia

TYH3 deals at 114-08, -0-05+, in the middle of its 0-08+ range on heavy volume of ~162K

- Cash Tsys sit 1-5bps cheaper across the major benchmarks with the curve bear flattening.

- Tsys opened cheaper as Asia-Pac participants digested Friday's stronger-than-expected NFP print, as well as a piece from WSJ's Timiraos which noted "fresh signs of a hot U.S. labor market leave the Federal Reserve on course to raise interest rates by a quarter percentage point at its meeting next month and to signal another increase is likely after that."

- BoJ matters were also in focus. Japan's Deputy Chief Cabinet Secretary Isozaki noted there was no truth to a Nikkei report re: BoJ Deputy Gov Amamiya being approached to head up the central bank. Finance Minister Suzuki earlier said he hasn’t heard such discussions, although he conceded that he is “out of the loop” on the matter. Isozaki's comments resulted in some light screen selling of TY, however the momentum quickly faded.

- The early cheapening has held through the session, although Tsys have ticked away from session lows.

- It has been a particularly heavy volume session for both Tsys and STIR futures. Early flow was dominated by sellers and exposure to downside, although flows have been more mixed since then. TU blocks headlined on the Tsy side (-3,393 & +3.5K), while a block buy of SFRU3 (+5.3K) and some chunky screen flow in SFRH3 headlined in the shorter end.

- European focus will fall on Eurozone retail sales and BoE speak from Pill & Mann. Further out, lower tier data is all that we get on the NY docket. Fed Chair Powell's first remarks since the Fed meeting (Tuesday) provide the highlight this week.

JGBS: Contained Vol. On BoJ Speculation & Subsequent Gov’t Rebuttal

JGBs have moved away from worst levels into the Tokyo close, leaving futures -19, while cash JGBs run 0.5bp richer to 2bp cheaper as the curve twist steepens, with a pivot around 5s. 10-Year JGB yields hover just below the upper limit permitetd under the BoJ’s current YCC parameters.

- An early bid triggered by a Nikkei article pointing to the government tapping current BoJ Deputy Governor Amamiya as outgoing Governor Kuroda’s successor was quickly unwound, before the richening into the bell was observed.

- While Amamiya is considered the most dovish of the three assumed candidates for the role, the Nikkei piece reiterated that policy normalisation will be the key focus for the next Governor (which allowed the initial richening to be unwound).

- Government pushback then came to the fore, as the lunch break saw Deputy Chief Cabinet Secretary Isozaki note that there is no truth to the Nikkei report. This came after Finance Minister Suzuki said he hasn’t heard such discussions, although he conceded that he is “out of the loop” on the BoJ governor matter.

- The BoJ & Amamiya issued ‘no comment’ responses to questions surrounding the article.

- Looking ahead, tomorrow will see the latest round of 30-Year JGB supply, in addition to household wage and spending data.

AUSSIE BONDS: Off Worst Levels At The Bell, RBA Up Next

Aussie bonds were fairly unreactive to the latest round of comments pointing to a further thawing of Sino-Aussie relations (see earlier bullet for more colour on that matter), seeing an incremental uptick post-headlines, but they were already moving away from cheapest levels of the day alongside U.S. Tsys.

- That left YM –9.0 & XM -8.0 at the close, with wider cash ACGBs running 5-9bp cheaper across the curve, as the early bear flattening bias was maintained, albeit moderating from session extremes.

- Aussie 10s have outperformed their U.S. counterpart in the time since Friday’s Sydney close, given the impulse derived from U.S. data & Fedspeak (and WSJ Fed report Timiraos’ latest article), with the spread between the two compressing by a little over 9bp, hovering just above -10bp.

- Bills are 4-13bp cheaper through the reds.

- EFPs finished around session wides.

- The latest RBA monetary policy decision headlines tomorrow’s domestic docket, with a 25bp hike the consensus view, as well as being an outcome that is essentially fully priced by markets. Terminal cash rate pricing has pushed back above 3.70%, in lieu of repricing surrounding the Federal Reserve post-NFPs. Expect the usual early release of the key SoMP projections to be embedded into the post-meeting statement. Our full RBA preview will be published shortly.

AUSTRALIA: Retail Sales Volumes Down In Q4, Pressures Impacting Budgets

Inflation adjusted retail sales fell less than expected in Q4. They were down 0.2% q/q and up 1.8% y/y, after an upwardly revised +0.3% q/q in Q3.This was the first drop since the Covid-affected Q3 2021 and the first since Q4 2018 pre-pandemic. It is another piece of evidence that price pressures and rate hikes are impacting consumer behaviour. The RBA will be pleased to see demand coming off the boil but will be monitoring developments closely.

- This data is particularly informative given the volatility around the November and December monthly retail sales data and the impact of high inflation on sales values.

- Retail prices rose 1.1% q/q, which is still high but the slowest rate of increase for 2022. It was held down by flat food prices and large Black Friday discounts. The CPI exceeded retail prices due to robust services price increases.

- The weakness in real retail sales was broadbased across non-food categories and the ABS noted that it reflected a slowdown in discretionary spending in the face of the rising cost of living.

- The ABS also observed that “the fall in the December quarter sales volumes suggests that the robust post-lockdown spending that fuelled much of the growth in 2022 has come to an end.”

Source: MNI - Market News/Refinitiv

AUSTRALIA: Inflation Gauge Signals Further Step Up In Inflation In January

The January Melbourne Institute inflation gauge rose strongly to 6.4% y/y from 5.9%, a new series high. The trimmed mean was also higher at 5.3% y/y from 4.2%. Both series rose 0.9% m/m, which is a concern. After the new monthly CPI rose to 8.4% y/y in December, this increase in the MI inflation gauge for January is not good news and may signal that inflation is yet to peak and could be proving sticky. In addition, MI inflation expectations are off their peak but seem stuck above 5%. Thus, the inflation situation continues to put pressure on the RBA to tighten further beyond the February meeting. A 25bp hike is widely expected for tomorrow.

Fig. 1: Australia CPI vs MI inflation gauge y/y%

Source: MNI - Market News/Refinitiv/ABS

FOREX: JPY Pressured on BoJ Speculation, AUD Outperforming

JPY was pressured through the Asian session today as BoJ matters were in focus.

- USD/JPY gapped higher at the open in thin liquidity as a Nikkei report noted BoJ Deputy Gov Amamiya being approached to head up the central bank. USD/JPY climbed as much as 1% before paring gains as Japan's Deputy Chief Cabinet Secretary Isozaki noted there was no truth to the Nikkei report. Finance Minister Suzuki earlier said he hasn’t heard such discussions, although he conceded that he is “out of the loop” on the matter.

- USD/JPY pared gains through the day to sit ~0.4% firmer at ¥131.65/70.

- AUD is the standout performer in G-10 space at the margins, despite weaker commodities (Iron Ore ~1% softer). AUD/USD firmed as Trade Minister Farrell noted he will travel to Beijing revealing a call with his counterpart struck an agreement for enhanced dialogue at all levels of government. A $17bn offer for miner Newcrest also potentially aided AUD at the margins.

- AUD/USD prints $0.6940/50, ~0.3% firmer today.

- NZD/USD was range bound for the majority of the session (onshore markets were closed for a local holdiay). The early bid in USD/JPY weighed, before support ahead of the 200-day EMA saw the pair par losses to last print $0.6330/35, little changed from opening levels.

- EUR and GBP are flat, having mostly observed tight ranges through the Asian session.

- Cross asset wise; e-minis are down ~0.3% and BBDXY is ~0.1% firmer. US 10 Year Treasury Yields are ~2bps firmer.

- Eurozone Retail Sales headlines an otherwise limited docket today.

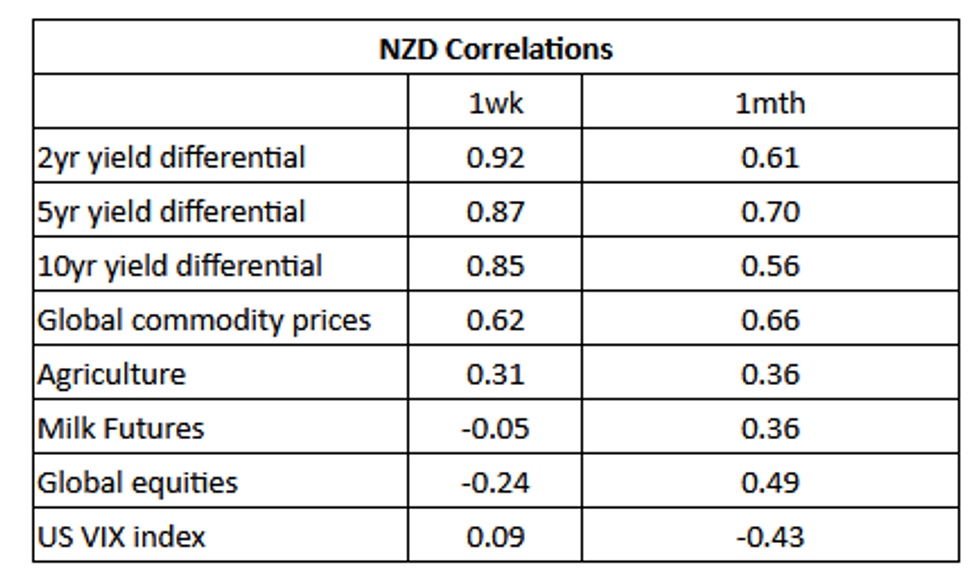

NZD: Yield Differentials Key Macro Driver For NZD

NZD/USD correlations with 2,5 and 10 year yield differentials have strengthened over the past week. Yields stood out as the core driver in NZD/USD in recent trading, with commodity prices also a notable driver. The table below presents levels of correlations between NZD and key macro drivers (note the yield differential reflects swap rates).

- In a week heavy on Central Bank decisions and key data releases, 2-year yield spreads were the dominant driver of the NZD/USD. The 2-year spread narrowed from ~54bps to ~27bps, as the NZD/USD fell ~2.5% through the week.

- Weakness in global commodity prices also weighed on the NZD, with the monthly correlation also remaining strong.

- The recent outperformance in global equities last week, compared to other assets, didn't aid the NZD, although longer term correlations does remain strong.

Source: Market News International (MNI)/Bloomberg

FX OPTIONS: Expiries for Feb06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E623mln), $1.0875-80(E1.0bln), $1.0900(E745mln)

- USD/JPY: Y130.25-50($1.5bln), Y131.00($1.1bln)

- AUD/USD: $0.6940($1.4bln)

- USD/CAD: C$1.3350($545mln), C$1.3500($690mln)

- USD/CNY: Cny6.7500($500mln)

ASIA FX: USD/Asia Pairs Higher, But USD/CNH Finds Sellers Above 6.8000

Most USD/Asia pairs are higher, with weaker yen levels and lower equities weighing. USD/CNH saw a decent retrace lower though from earlier highs (from +6.8300 back to 6.78). Tomorrow, China FX reserves for Jan are out, along with Taiwan Jan trade figures. Philippines CPI figures are also out, along with IP figures for Malaysia.

- USD/CNH spiked above 6.8300 amid yen weakness and US-China tensions. This drew selling interest though, with the pair moving back towards the 6.7800 level. A stronger than expected CNY fixing helped, (the firmest relative to expectations since late Nov), while a Reuters story focused on more support measures for growth this year (although not a massive stimulus), likely helped at the margins. We are slightly higher now, last around 6.7900.

- 1 month USD/KRW has mostly traded with a positive bias. Dips towards 1242/43 have been supported, with the pair pushing towards 1250 this afternoon. Spot has already broken this level. Local equities are weaker, off 1.3%, while offshore investors have sold -$181.6mn of local equities so far today.

- Pressure continues on INR as broad-based USD strength continues to help USD/INR firm. The pair has opened dealing 82.40/50, dropping ~0.7% today. Last week through to Thursday Foreign Investors sold ~$1.4bn of Indian equities, as the Hindenburg report on Adani continued to weigh on domestic markets. USD/INR is now at its highest level since 10 Jan. The cross is dealing above all its key EMAs, bulls next target is 83 handle. Bears first look to sustain a break of 82 to turn the tide.

- Spot USD/IDR has gaped higher, up a little over 1% to 15050/55. This puts the pair back to mid-Jan levels. Note the 20-day EMA comes in just above 15100, while the 200-day is around the 15130 level. On the downside, recent lows come in closer to 14830. The 1-month NDF is back around 15075/80, with some resistance ahead of 15100, although an earlier move to 15050 saw some USD demand emerge. Q4 GDP came out slightly better than expected (5.01% y/y, versus 4.92% expected, 5.73% prior).

- USD/THB is the strongest gainer within the USD/Asia space so far today, with the pair up over 1.7%, last near 33.52. A large part of this reflects catch up to broader USD gains after onshore markets closed on Friday. Earlier highs for the pair came in close to 33.63. We are now back to early Jan levels. On the upside, the 34.00 level presents as a target, while the 50-day EMA also just comes in above this level. On the downside, note the 20-day EMA is around 33.15. On the data front, Jan CPI figures came in a touch below expectations. Headline at 5.02% y/y, versus 5.10% expected, while core was at 3.04% y/y, 3.10% forecast. The Commerce Ministry expects headline pressures to ease further in Feb (sub 5%), which would be consistent with the trend move lower since pressures peaked in August last year.

EQUITIES: Soft Start To The Week, Japan Stocks Outperform

Regional equities are mostly on the backfoot, with Japan bourses the exception. Headwinds have come from the negative Wall St lead on Friday, along with lower US futures through the first part of the Monday session. Eminis and Nasdaq futures are off by -0.35% to -0.45% at this stage.

- China and Hong Kong markets have again seen decent losses. The HSI is off by 2.3% at this stage, with the tech sub-index down 3.70%. The China Golden Dragon index fell sharply in US trade on Friday (-3.87%).

- The CSI 300 is off 1.67%, the Shanghai Composite -1%. Northbound stock connections flows have been negative for the second straight session. Tensions with US over the downing of an alleged spy balloon have weighed, although China comments don't suggest any further near term escalation.

- The China authorities also disagreed with the IMF on the China housing outlook and called the organization's 5.2% growth forecast this year too conservative.

- Japan stocks are higher, with the Nikkei 225 up 0.75% at this stage. Reports that the government have approached Deputy Governor Amamiya as a potential successor to Kuroda has likely helped, as Amamiya is seen as more on the dovish side relative to other candidates.

- The Kospi & Taiex are lower (-1.25% & -0.95% respectively). The ASX 200 is down -0.25%, with lower commodity prices note helping.

EQUITIES: MNI US EARNINGS SCHEDULE - US Firms Beating Forecast at Halfway Point

EXECUTIVE SUMMARY

- As of February 3rd , over 67% of the S&P 500 by market cap has now reported for the quarter

- In the coming week, another 9.5% of the index are due, with highlights including Walt Disney Co, Abbvie, PepsiCo, Linde, Philip Morris International and S&P Global, among others.

- On average, US firms are generally beating expectations across both EPS and sales metrics, with 70.4% of firms beating EPS forecasts and 65.6% beating on sales.

- Focus for this week edges away from large-cap firms and toward smaller companies, with the average market cap per report considerably smaller for the rest of the quarter.

- Full schedule including timings, EPS and Sales expectations here: MNIUSEARNINGS030223.pdf

GOLD: Prices Stabilise After Sinking On Payrolls

Gold prices fell 2.5% on Friday following extremely strong payrolls data. The 517k rise in jobs plus the drop in the unemployment rate increased the prospects of more Fed tightening and boosted Treasury yields and the USD. Gold prices are up 0.6% during APAC trading to $1876.50/oz, close to the intraday high. The USD DXY is up 0.2% today.

- Gold was down 3.3% on the week and fell through the 20-day EMA of $1907.40 and the January 11 low of $1867.20 on Friday. It is currently holding above that support again.

- There is little scheduled later with January euro area retail sales the most significant release. It is a relatively quiet week in the US with Tuesday’s trade balance and Fed Powell’s speech the likely highlights.

OIL: Crude Trading Sideways After Friday’s Sharp Drop

Oil prices have been trading sideways during Monday’s APAC session after falling sharply on Friday. Prices were down on fears that China’s recovery would not be as robust as expected and the prospect of further US rate hikes while stockpiles are high. WTI is currently trading around $73.50/bbl and Brent $80.15.

- WTI broke through support at $74.97, the February 2 low, on Friday and now the level to watch is $72.74, the January 5 low. The bear trigger is at $70.56, the December 9 low. For Brent, watch support at $77.77, the January 5 low.

- The G7 and EU and Australia agreed to introduce a price cap of $100/bbl on Russian seaborne exports of high quality products such as diesel and $45 for the lower end ones such as fuel oil. The market expects other countries to import Russian product thus there’s unlikely to be a supply disruption. The Saudi energy minister warned that sanctions against Russia could result in an energy shortage but that they remain very cautious about increasing output despite this and the improved oil demand outlook from China.

- There is little scheduled later with January euro area retail sales the most significant release. It is a relatively quiet week in the US with Tuesday’s trade balance and Fed Powell’s speech the likely highlights.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/02/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/02/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/02/2023 | 0840/0840 |  | UK | BOE Mann at Lamfalussy Lectures Conference | |

| 06/02/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/02/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/02/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 06/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 06/02/2023 | 1700/1700 |  | UK | BOE Pill Monetary Policy Report Live Q&A |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.