-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Lacking Momentum Overnight

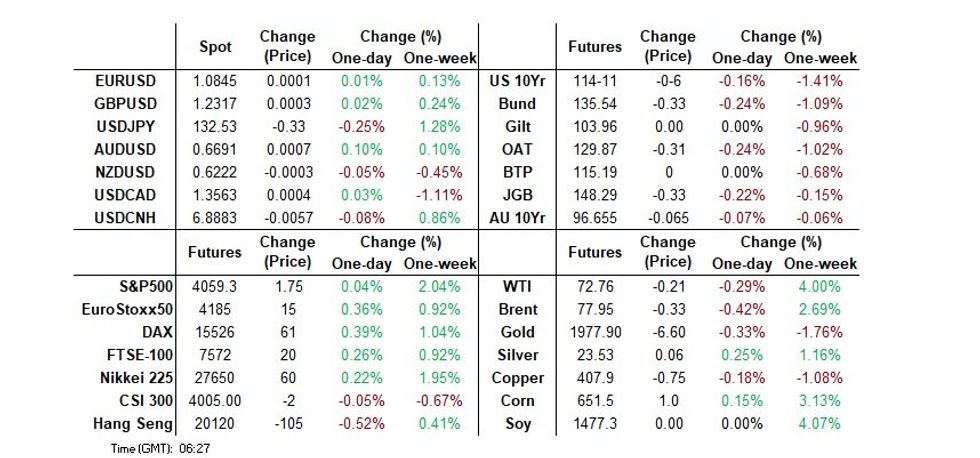

- Core global FI markets cheapened at the margin overnight.

- USD indices are back close to flat to the session. The BBDXY is not too far away from 1232.00, the DXY is under 102.70. Dollar gains earlier in the session had little follow through.

- Looking ahead, inflation data from Germany (state & national) and Spain will provide some interesting reference points in European hours. Further out, weekly jobless claims data and final Q4 GDP & PCE prints provide the highlights of a limited NY data docket, while Fedspeak will come from Kashkari, Collins & Barkin.

US TSYS: Modest Cheapening In Asia, Tight Ranges In Play Alongside Low Volume

Cash Tsys are marginally cheaper on the day as we work towards the end of the Asia-Pac session, running 0.5-2.0bp cheaper across the cash curve, with the belly leading the weakness at the margin. TYM3 is -0-05 at 114-12, on light volume of ~51K, printing just above the base of its contained 0-06+ Asia-Pac range.

- Wednesday’s (relatively limited) weakness in the front end of the Tsy & UK Gilt curves, as well as the wider pressure seen on the German curve and general bid for broader equities (the major Asia-Pac benchmark indices are mixed) since Wednesday’s Asia-Pac close were the likely sources of underlying pressure for the space, while a leg of cheapening in JGBs (which moderated from extremes) will have done the move no harm.

- There wasn’t anything in the way of tier 1 event risk slated during Asia-Pac hours and we didn’t get any meaningful macro news flow.

- Looking ahead, inflation data from Germany (state & national) and Spain will provide some interesting reference points in European hours. Further out, weekly jobless claims data and final Q4 GDP & PCE prints provide the highlights of a limited NY data docket, while Fedspeak will come from Kashkari, Collins & Barkin.

JGBS: Futures Lower & Swap Spreads Wider, Although Moves Back From Extremes

JGB futures sit 10 ticks away from their Tokyo session low, -33, with some light weakness seen as we head into the last hour of trade. Cash JGBs are mixed, with 7s running ~2.5bp cheaper given the weakness in futures since yesterday’s close (related to moves in wider core global FI markets), while the remainder of the curve sits little changed to 1.5bp richer.

- This comes after solid enough pricing at the latest 2-Year JGB auction built on a light late morning rebound for the space, allowing it to regain some ground after a pick-up in cheapening momentum related to futures breaching their overnight low was seen.

- Elsewhere, swap spreads are wider across the curve, as they have been all day, albeit with swap rates back from session highs.

- There haven’t been any signs of meaningful repatriation of Japanese capital ahead of the turn of the Japanese FY, at least via the weekly MoF flow statistics (although Dai-Ichi Life recently outlined their intention to reshore capital, with a preference for deployment in the super-long end of the JGB curve). Meanwhile, last week saw international investors register the largest round of net weekly sales of Japanese bonds since the run up to the BoJ’s January meeting, although they got nowhere near reversing the prior week’s record net purchases.

- Tokyo CPI data headlines tomorrow’s month-end data deluge, with the monthly labour market report, retail sales and industrial production prints also slated for release ahead of the weekend. Elsewhere, the BoJ will release its quarterly bond purchase plan after the close on Friday.

JAPAN: Japan Continues Net Buying Of International Bonds, Even With FY Turn Nearing

Weekly international security flow data from the Japanese MoF revealed that Japanese investors continued to deploy net purchases of foreign bonds last week, in what we assume to be FX-unhedged positions (owing to elevated FX hedging costs & subsequent impact on FX-hedged yields) in reaction to the worry re: the global banking sphere, although the pace of net purchases saw a notable step down from that seen in the previous week (which is understandable given that last week’s net purchases have only ever been surpassed by one week of net purchases registered in the depths of the initial COVID outbreak). There hasn’t been any signs of meaningful repatriation of Japanese capital ahead of the turn of the Japanese FY (although Dai-Ichi Life recently outlined their intention to reshore capital, with a preference for deployment in the super-long end of the JGB curve).

- Elsewhere, Japanese investors were small net sellers of international equities last week.

- International investors registered the largest round of net weekly sales of Japanese bonds since the run up to the BoJ’s January meeting, although got nowhere near reversing the prior week’s record net purchases.

- Meanwhile, international investors stepped up the net selling pace wen it came to Japanese equities, registering the sharpest round of net sales observed since September ’20, in what was the fifth straight week of net sales.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1182.0 | 3337.9 | 5274.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -42.2 | 118.2 | -141.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -1682.6 | 4095.7 | 1466.6 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -1285.8 | -1080.2 | -3796.2 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

AUSSIE BONDS: At Cheaps, Underperforming U.S. Tsys

ACGBs sit near session cheaps (YM -9.0 & XM -7.5) ahead of the bell with local headlines light and U.S Tsys modestly softer in Asia-Pac trade. Cash benchmark yields are 7-8bp higher with the 3/10 curve 1bp flatter and the AU/US 10-year yield differential +4bp at -22bp.

- Swaps are 4-6bp cheaper with EFPs 2-3bp tighter.

- Bills strip pricing is -7 to -11 with late whites/early reds leading.

- With the local focus likely to have already shifted to next Tuesday’s RBA decision the question for the market is whether this week’s CPI and retail sales data has been enough to offset resilient business conditions and robust jobs data and deliver a pause.

- RBA dated OIS pricing suggests it is with only an 18% chance of a 25bp hike priced. Interestingly, May meeting pricing hit its highest level since 15 March with cumulative tightening over April and May meetings at 10bp.

- The local calendar is light tomorrow with Private Sector Credit (Feb) as the highlight.

- Elsewhere, Treasurer Chalmers announced that he will release the findings from the independent review of the RBA in mid-April.

- With the global calendar relatively light today, the markets will be closely watching to see if the recent improvement in risk sentiment can extend further.

AUSSIE BONDS: AU/US 10-Year Yield Differential Holds Range

The onset of global banking concerns in mid-March saw a plunge in U.S. STIR pricing and dramatic realignment in 1-year forward 1-month (1Y1M) OIS in the U.S. versus Australia. Since then, the AU/US 1Y1M differential has consolidated around that post-banking crisis level.

- In sharp contrast to relative price movements at the short-end, the AU-US cash 10-year yield differential has traded in a comparatively narrow range of -32bp to -12bp.

- While there can be many variables at play in a cross-market differential, a simple regression of the AU/US cash 10-year yield differential versus the AU/US 1Y1M OIS differential over the current tightening cycle suggests that the 10-year yield differential is currently around 25bp too negative (i.e. -24bp Vs. fair value at +1bp).

- With banking concerns receding, however, it may be the short-end differential that ends up correcting the abovementioned mispricing. The AU/US 1Y1M has narrowed 30bp over the past week.

Fig. 1: AU/US Cash 10-Year Yield Differential (%) Vs. AU/US 1Y1M OIS Differential (%)

Source: MNI – Market News / Bloomberg

NZGBS: Closed At Cheaps, Led By Short-End

NZGBs closed at cheaps, underperforming its $-Bloc peers. NZGB supply appeared to weigh relatively on short-end pricing with yields 3bp higher post-auction versus unchanged to lower for longer-dated bonds. Cash benchmark yields closed 6-12bp higher with the 2/10 curve 6bp flatter.

- Swaps weaken through the session to close with rates 7-9bp higher, implying tighter short-end but wider long-end swap spreads.

- On the local data front, building consents printed a weak -9.0% M/M in February after a downwardly revised -5.2% in January. The ANZ Business Confidence Survey, however, delivered a modestly more favourable message of slightly improved confidence and lower inflationary pressures. For the RBNZ, today’s data shouldn’t move the dial with respect to next week’s rate decision.

- RBNZ dated OIS closed 1-6bp firmer across meetings with April priced for a 25bp hike. Terminal OCR expectations firmed to 5.26%.

- The Antipodean calendar is light until next week with Australian Private Sector Credit tomorrow as the highlight.

- Further afield, regional European CPI data is out today ahead of the Eurozone CPI tomorrow. U.S. PCE deflator is also released tomorrow.

- Until then, the market’s focus will be on risk appetite and equity indices, especially banking indices, to see if recent gains can be extended.

FOREX: USD Can't Maintain Early Gains

USD indices are back close too flat to the session. The BBDXY is not too far away from 1232.00, the DXY is under 102.70. Dollar gains earlier in the session had little follow through.

- JPY has generally traded on a firmer footing, we currently close to the bottom end of the range for the session so far, last near 132.55/60 (range 132.46-132.86). The 20-day EMA sits at 132.82, so may be acting as a constraint on the topside.

- NZD/USD has slightly underperformed, down 0.15% to 0.6215/20, but we saw some demand evident ahead of the 0.6200 level. Earlier data showed a further slump in building permits and business confidence levels still consistent with a challenging demand backdrop.

- The A$ has followed a similar trajectory, although slightly outperformed NZD. AUD/USD was last around 0.6685, unchanged for the session (earlier lows were at 0.6662) with the AUD/NZD cross a touch higher, around 1.0750/55 currently. AU Job vacancies fell -1.5% (-4.6% prior)

- Elsewhere EUR/USD is a touch lower for the session, under 1.0840 currently. USD/NOK is up by 0.20%, but away from highs above 10.4500.

- Looking ahead, inflation data from Germany (state & national) and Spain will provide some interesting reference points in European hours. Further out, weekly jobless claims data and final Q4 GDP & PCE prints provide the highlights of a limited NY data docket, while Fedspeak will come from Kashkari, Collins & Barkin.

FX OPTIONS: Expiries for Mar30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-80(E1.3bln), $1.0700(E2.8bln), $1.0825-40(E784mln), $1.0950(E1.5bln), $1.1000(E1.9bln)

- USD/JPY: Y130.00($1.1bln), Y130.40-50($658mln), Y131.00($1.6bln), Y131.50($1.2bln), Y132.00($1.4bln), Y132.90-10($1.1bln), Y134.19-20($647mln)

- AUD/USD: $0.6600(A$834mln), $0.6650(A$850mln), $0.6745(A$530mln)

- USD/CAD: C$1.3312($1bln)

- USD/CNY: Cny6.8630($601mln), Cny6.8805($568mln)

ASIA FX: USD/Asia Pairs Off Session Highs, China PMIs On Tap Tomorrow

USD/Asia pairs are comfortably away from earlier session highs. USD/CNH got to 6.9122, but is now back close to 6.8900. Other pairs have shown a similar trajectory. Cross asset signals have been muted, with US equity futures close to flat, while yields are up a touch (1.1-2.4bps across the curve). Regional equities are mixed and underperforming the positive lead from US/EU markets on Wednesday. Tomorrow, the focus will be on official China PMI prints for March. South Korean IP also prints, along with Taiwan's PMI and Thailand trade figures.

- USD/CNH breached the 6.9100 level amid broad based USD gains and not long after the onshore open. The neutral CNY fix may have been a factor, but we saw little upside from there. The pair is now back to 6.8900/30, little changed for the session. China Premier Li gave a wide ranging speech at the Boao forum, stating China's economic momentum remains firm (March is even better than January/February).

- 1 month USD/KRW remains within recent ranges, finding selling interest closer to 1305 at the start of the session. We were last around 1301 for the pair. Onshore equities have outperformed, up 0.7% so far today. Earlier manufacturing and non-manufacturing sentiment readings for April showed further improvement.

- Spot USD/TWD is a touch higher, last above 30.48, highs back to the 22nd of March. USD/SGD has also drifted a touch higher, last near 1.3300, although this is down from session highs near 1.3315.

- USD/THB has been the strongest gainer for the session, up +0.60% at one stage. Form highs though of 34.34, we now sit back at 34.25 (+0.35% for the session). Still, the baht comfortably remains the best performer within Asia FX March to date. Tourism remains key for the baht. For the period Jan 1 to March 27, the country saw 6.15mln visitors, slightly above the government's 6mln target. Annualizing this rate for 2023 leaves us at the bottom end of the 25-30mil forecast, but no doubt the authorities are hopeful for a further pick up in arrivals as we progress through the year. Trade figures for Feb were a touch better than expected, -4.7% y/y exports (-7.00% forecast), while the trade deficit came in at -$1113mn, -$1414mn forecast.

- USD/IDR upticks have been faded, with the pair printed fresh lows under 15060 in recent dealings.

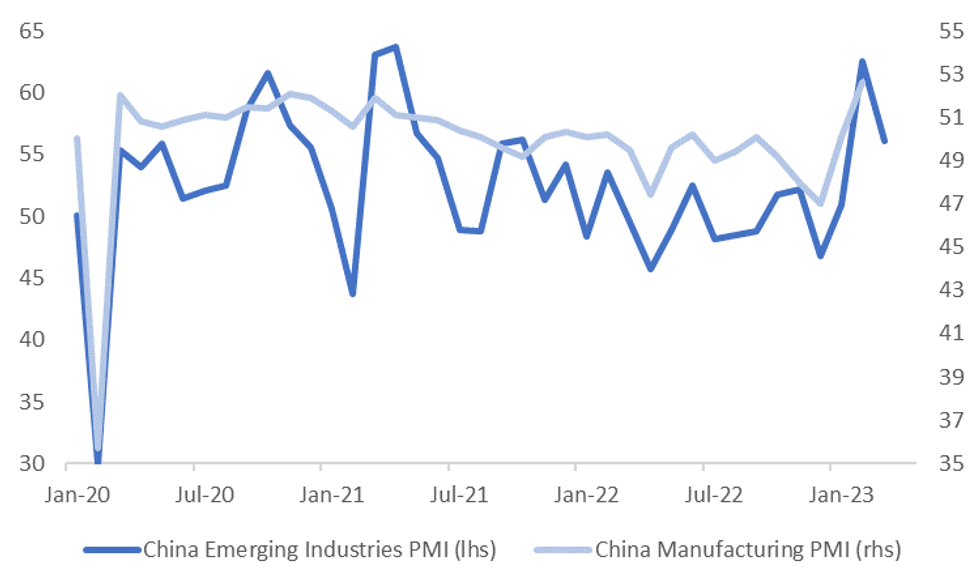

CHINA: PMIs Expected To Move Down Off February Highs

A reminder that official China PMIs for March print tomorrow. The market expects a pull back in both readings, with manufacturing forecast at 51.6 (prior 52.6, forecast range 50.5-53.0). For non-manufacturing or services, the market expects a 55.0 reading (prior 56.3, forecast range 53.0-57.0).

- Recall that at the start of March, the Feb PMI prints surprised on the upside and kicked off a wave positive China asset related sentiment, albeit which was fairly short lived.

- A pull back in the manufacturing PMI is in line with the down tick in the emerging industries PMI, which has already printed for March (see the first chart below). The emerging industries PMI tracks China's high tech sector.

- If the consensus is right it would still leave the manufacturing sector comfortably in expansion territory. Also note that China Premier Li stated at the Boao forum today that the economic situation in March is even better than January/February.

Fig 1: China Manufacturing PMI Versus Emerging Industries PMI

Source: MNI - Market News/Bloomberg

- On the services side, some pull back from the heady Feb levels arguably wouldn't be a surprise. The Standard Chartered China SME index continued to recover in March, although the non-manufacturing sector PMI is already at levels higher than implied by this index.

Fig 2: China Non-Manufacturing PMI Versus Standard Chartered China SME Index

Source: Standard Chartered, MNI - Market News/Bloomberg

SOUTH KOREA: Headline Business Sentiment Readings Improve, But Details Mixed

Earlier today, South Korean manufacturing and non-manufacturing sentiment edged higher for April. The manufacturing reading firmed to 69 from 66, while the most recent trough was in Feb at 65. For non-manufacturing we are now back at 75, with the Feb trough being at 70. For both indices we are still well below average levels seen in 2022, but the recent moves higher will be welcomed by the authorities.

- These prints come after yesterday's improvement in consumer sentiment to 92.0 (a 9 month high).

- Today's manufacturing sentiment reading tends to align closely with y/y GDP momentum for South Korea, see the first chart below.

- It may be too early to call a definitive turn around though, as manufacturing new orders slipped further to 73 (from 75), while inventory levels also remained high. The export outlook improved, but only modestly, see the second chart below.

- There was more evidence of an improvement in domestically orientated manufacturers.

Fig 1: South Korean Manufacturing Sentiment Versus Y/Y GDP

Source: MNI - Market News/Bloomberg

Fig 2: South Korean Manufacturers Export Expectations Versus Export Growth

Source: MNI - Market News/Bloomberg

EQUITIES: Mixed Trends Despite Positive Offshore Lead, Japan & HK Underperform

Asia Pac equities are mixed, underperforming the better trend from US/EU equities seen through Wednesday's session. US futures have been slightly negative during today's session, but haven't been a strong negative headwind. Eminis sit close to highs for the week. Weakness has been notable in Japan and Hong Kong stocks today.

- The Japan Topix is off around 1% at this stage, although part of this appears technical in nature. The majority of stocks traded on the index have gone ex-dividend.

- The HSI is down around 0.70% at the stage, despite further gains by Alibaba. The Tech index is off by 1.1%, unwinding some of the recent outperformance.

- China stocks are modestly lower (CSI 300 -0.18% at this stage), even Premier Li delivered an upbeat speech (economy better in March compared to January/February).

- The Kospi and Taiex are both higher, following the positive tech lead from Wednesday's US session.

- The ASX 200 has outperformed, up close to 1%, while NZ stocks gained 1.67%.

GOLD: Tracking Lower As The USD Edges Higher

Gold has tracked lower through the first part of Thursday's session. The precious metal is off a further 0.25% at this stage. We were last around $1960, albeit above session lows near $1955.50. Gold continues to take its cues from broader USD sentiment, with today's trough roughly coinciding with USD indices peaking.

- We remain some distance away from key MA and EMA levels. On Tuesday we saw a low close to $1950, while on Monday it was around the $1945 region. On the topside recent highs sit between $1975 and $1980, beyond that is the $2000 level.

OIL: Edging Away From Recent Highs

Brent crude has continued to edge away from recent highs. We were last just under $78/bbl, down -0.41% for the session so far, which comes after Wednesday's -0.47% drop. We have lost some momentum over the past 24 hours, but remain comfortably above recent lows. WTI is following a similar trajectory, last near $72.70/bbl.

- Focus remains on the supply side, amid the on-going dispute in Iraq, involving the Kurdistan regional government and Turkey, which is reportedly disrupting around 400k barrels per day from the Turkish Ceyhan terminal.

- US inventory data showed a sharp drop during Wednesday's session, but this didn't provide a boost to crude sentiment. Some focus has been on weakness in terms of distillates demand from the report, as a sign of lackluster overall demand conditions in the US.

- Tomorrow, note we get official China PMI prints, which will provide an update on the demand picture.

- For Brent, resistance is set at the intraday high of $79.64 after which sits the 50-day EMA of $80.81, whilst support is seen at $72.68 (Mar 24 low).

UP TODAY (TIMES GMT/LOCAL

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/03/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 30/03/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/03/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/03/2023 | 0800/1000 |  | DE | CPI Hesse | |

| 30/03/2023 | 0900/1100 | ** |  | IT | PPI |

| 30/03/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/03/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/03/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/03/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 30/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 30/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/03/2023 | 1230/0830 | *** |  | US | GDP |

| 30/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/03/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/03/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/03/2023 | 1645/1245 |  | US | Richmond Fed's Tom Barkin | |

| 30/03/2023 | 1645/1245 |  | US | Boston Fed's Susan Collins | |

| 30/03/2023 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 30/03/2023 | 1945/1545 |  | US | Treasury Secretary Janet Yellen |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.