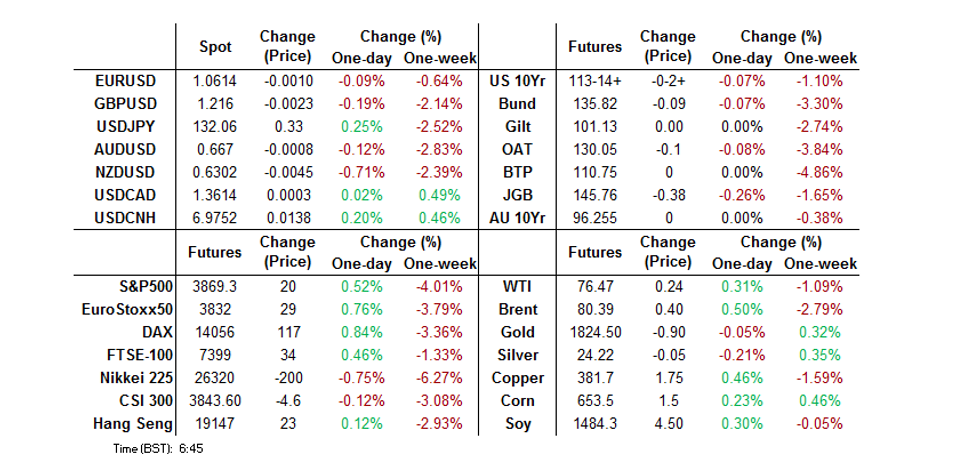

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN MARKETS ANALYSIS: Market Sets Up Fresh Test Of BoJ's Will

- 10-Year JGB yields moved towards the new YCC cap, last ~0.485%, as the kink in the curve and recent breaking of the BoJ’s will emboldened participants.

- The USD regained some ground today, with the BBDXY index back near 1256. USD/JPY has been the main focus point, moving back above 132.00, but NZD has been on backfoot for much of the session, last near 0.6300.

- Coming up is German consumer confidence, Canadian CPI and in the US, consumer confidence and existing home sales.

US TSYS: JGB Spill Over Weighs

The previously alluded to Tokyo morning weakness in broader JGBs (and continued pressure for JGBs out to 10s in late Tokyo trade) provided a cheapening impulse for U.S Tsys in a news light Asia-Pac session.

- The space heads into London a little off worst levels, with the wider cash Tsy benchmarks running 1.0-3.0bp cheaper across the curve, with 10s leading the weakness, while TYH3 is -0-05+ a 113-11+, 0-02 off the base of its 0-07+ range with volume sitting at ~63K.

- The early cheapening impulse ran out of steam as bears only failed to force an incremental and short-lived look below Tuesday’s base in TYH3. Some oscillation has been seen thereafter, albeit within contained ranges after 7+-Year paper bested Tuesday’s highs in yield terms.

- There wasn’t anything to note in the way of major market flow during Asia-Pac hours, given the proximity to the Christmas break and lack of meaningful headline drivers.

- Looking ahead, consumer confidence and existing home sales data headlines in NY hours, with 20-Year Tsy supply also due.

JGBS: Post-BoJ Pressure Continues, Market Moves Toward Test Of BoJ’s Resolve After YCC Reset

Tokyo faded the overnight uptick in JGB futures from the off, with the contract closing -38, at worst levels, with the post-BoJ impulse still being felt.

- A lack of unscheduled BoJ Rinban operations helped the space to cheapen beyond the initial bias lower during the morning session.

- The BoJ did step in with some paltry purchases in the 3- to 10-Year zone, but is more and more cognisant of market functioning issues, given that it now owns over 50% of outstanding JGBs and is set to upsize Rinban purchases in Q123. The limited size of the off-schedule operations meant that the relief rally in paper out to 10s was very shallow and short lived, with futures going on to make fresh session lows later in the day (albeit failing to test yesterday’s post-BoJ base).

- The cheapening wasn’t uniform, with the narrowing of the spreads at the latest liquidity enhancement auction covering off-the-run 15.5- to 39-Year JGBs supporting the long end.

- The broader cash JGB curve twist flattened as a result, with 5s & 7s leading the weakness, running ~8.5bp cheaper, while 20s through 40s firmed by ~1.5bp. 10-Year JGB yields moved towards the new YCC cap, last ~0.485%, as the kink in the curve and recent breaking of the BoJ’s will emboldened participants.

- There hasn’t been much in the way of domestic headline flow to note, outside of Economy Minister Goto trying to reaffirm the message provided by BoJ Governor Kuroda, in that yesterday’s YCC adjustment doesn’t represent a tweak, nor an exit from monetary easing.

- Weekly international security flow prints and lower tier data headline locally on Thursday, with the outdated minutes from the BoJ’s Oct meeting also slated.

AUSSIE BONDS: Steeper On The Day, Front End Underpinned

Follow through from a bit of an overnight session recovery in futures aided ACGB bulls in early Sydney trade, with notable screen lifts in YM futures further underpinning the front end.

- Still, the post-Sydney high in YM futures provided some resistance, halting the richening, before a subsequent round of cheapening in broader core global FI markets applied some pressure to ACGBs.

- That pushed the space away from best levels of the Sydney session, with some oscillation observed thereafter.

- YM finished +7.0 as a result, while XM was flat, with the steepening theme ever present through Wednesday dealing (whether it was in bull or twist fashion), leaving wider cash ACGBs running flat to 8.5bp richer at the bell.

- Bills finished 4-10bp richer through the reds, with some bull flattening apparent, while RBA dated OIS was little changed to a touch softer vs. late Tuesday levels, pricing 18bp of tightening for the Feb ’23 meeting and a terminal cash rate of ~3.70%.

- Local headline flow didn’t move the needle, with the continued thawing of Sino-Aussie relations and a soft Westpac leading index print observed.

- The domestic docket is now empty in the run up to Christmas.

NZGBS: Curve Steeper On Global Spill Over, Soft Data Noted

Post-BoJ catch up and spill over from Wednesday’s global core FI impulse (at least that observed during Asia-Pac hours) biased NZGB yields higher, leaving the major benchmarks sitting 4-12bp cheaper at the close.

- Swap rates were 3bp lower to 4bp higher, with the curve twist steepening, once again dragging the 2-/10-Year swap spread further away from its post-GFC lows.

- RBNZ dated OIS was essentially unchanged on the day.

- Local data wasn’t reassuring, as the expedited RBNZ tightening cycle continues to heap pressure on the economy (by design). M/M credit card spending was on the soft side, while there was another record low in the monthly ANZ consumer confidence headline print. The collator of the latter noted that “just like our Business Outlook survey, there appears to some post-MPS shock value in these figures. The RBNZ came out guns blazing in the November MPS, signalling further aggressive OCR hikes in 2023 and a technical recession. That’s clearly spooked the horses, but it’s not yet clear exactly how far they have bolted. All eyes are now on the degree of follow-through from businesses reporting negative employment intentions, and consumers saying they will significantly tighten their belts.”

- The soft data domestic probably aided the steepening impulse.

- The domestic docket is now empty into the Christmas break.

FOREX: USD Finds Some Support, NZD Testing Uptrend Channel Support Again

The USD regained some ground today, with the BBDXY index back near 1256. USD/JPY has been the main focus point, moving back above 132.00, but NZD has been on backfoot for much of the session, last near 0.6300.

- Firmer US cash Tsy yields have supported the USD, although there hasn't been much follow through to earlier moves. The 10yr last close to 3.71% (+2.5bps for the session). Equities are more mixed, while US/EU futures are higher this hasn't done much to support risk appetite.

- USD/JPY tried to break sub 131.50 close to the Tokyo fix but ran out of momentum and climbed back above 132.00, touching a high of 132.37, before settling back at 132.20.

- NZD/USD is off 0.75% for the session, last near 0.6300. This is below uptrend channel support and the 20-day EMA (0.6311). NZ survey data has been quite poor this week, with ANZ's consumer sentiment index falling sharply in December. The trade position also remain comfortably in deficit.

- AUD/USD is off 0.25% to 0.6660, outperforming the NZD. Support is evident sub 0.6660 at this stage, while the AUD/NZD cross climbed back to 1.0575. Higher iron ore prices, back above $110/tonne, has helped A$ sentiment at the margin.

- Coming up is German consumer confidence, Canadian CPI and in the US, consumer confidence and existing home sales.

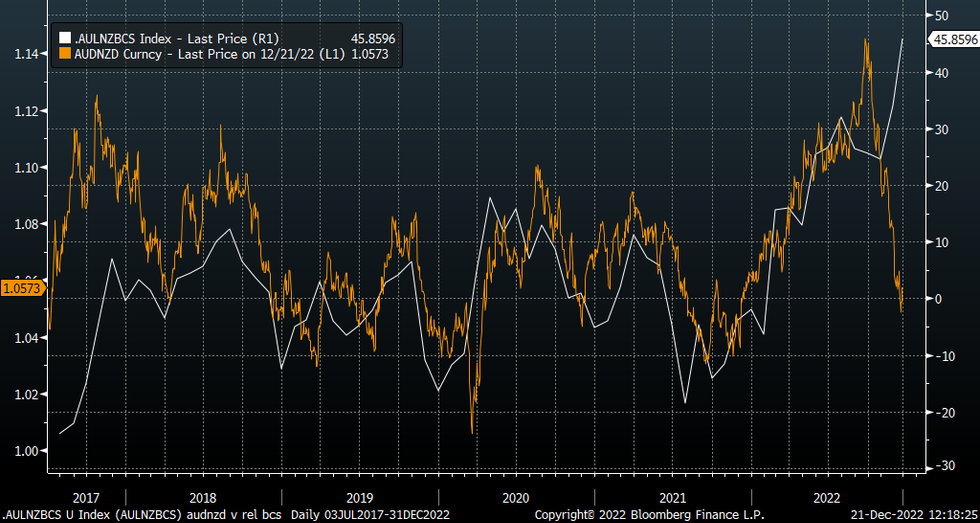

AUDNZD: Poor NZ Sentiment Readings Boost AUD/NZD, But Downtrend Channel Still Intact

The AUD/NZD cross continues to maintain positive momentum. We touched highs from last week close to 1.0575 earlier. Dips back towards the 1.0500 level have also been supported in recent sessions.

- NZ sentiment readings across both the consumer and business segments have been very weak. The first chart below plots the differential between the AU NAB business conditions index and the NZ ANZ business own activity indicator.

- Note the latest reading assumes no change in NAB business conditions (last at +20, while the ANZ NZ reading fell to -25.6 for Dec earlier this week). The AUD/NZD cross should be considerably higher based off this relationship.

Fig 1: AUD/NZD Versus Relative AU-NZ Business Conditions

Source: MNI - Market News/Bloomberg

- The RBNZ's intent on bringing down inflation, even at the expense of growth, which is driving multi-year wides in the respective central bank rate policy outlooks, is clearly working the other way and weighing on AUD/NZD. It's also noteworthy, the differentials in consumer sentiment readings are much lower.

- Still, this week has seen yield momentum shift back in AUD's favor. Arguably though a more significant shift will materialize when the RBNZ sees evidence of inflation cooling and we get closer to peak rates in NZ.

- The second chart below shows the cross still remains in a bearish downtrend channel. We can still correct higher from here, but arguably A$ bulls will be encouraged if we see a break above the 20-day EMA (1.0640 currently), which also roughly coincides with the top-side of the downtrend channel.

Fig 2: AUD/NZD Downtrend Channel

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Dec21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0400-10(E890mln), $1.0450(E726mln), $1.0660-75(E744mln), $1.0700(E655mln)

- USD/JPY: Y132.00-25($696mln), Y134.00-05($560mln), Y134.84-00($555mln)), Y136.00-15($1.1bln), Y140.00($1.1bln)

- AUD/USD: $0.6800(A$613mln), $0.6900(A$1.2bln)

- USD/CNY: Cny6.9500($675mln), Cny7.0100($789mln), Cny7.1500($930mln)

ASIA FX: Mixed Performances, BI Decision Tomorrow

USD/Asia pairs are mixed, CNH is softer, but remains within recent ranges. Upticks in USD/KRW continue to be sold, while USD/PHP is threatening to close below its simple 200-day MA. The high yielders have traded tight ranges. The focus tomorrow will largely rest on the BI decision, +25bps expected. South Korea's PPI also prints, along with Thailand trade figures.

- USD/CNH moves towards 6.9600 remain supported, with the pair last at 6.9755/60, which is in line with a slightly firmer USD trend against the majors. The fixing bias remained skewed against depreciation pressures.

- 1 month USD/KRW hasn't broken below yesterday's lows near 1280, but upticks remain sold by the market. The pair has had a 1288.6 to 1282.2 range for the session. Onshore equities have edged lower (last -0.15%), but the first 20-days of trade data for December could have been worse. The government's GDP growth projection for next year was pulled back to 1.6%, from 2.5% in June, while CPI was revised up to 3.5% from 3%.

- USD/IDR has edged back down sub 15600, but remains within recent ranges. We sit close to the 20-day EMA (15611), while the 50-day comes in at 15537. Tomorrow delivers the big event risk for the week with the BI decision. Our expectation is for a 25bps hike, see the preview here, but risks are somewhat skewed to the upside (i.e. a 50bps move). A more hawkish surprise may be needed to shake out IDR's underperforming trend.

- USD/PHP is up from earlier lows. We got to 55.075 before USD bids emerged. The pair is last around 55.15, with the simple 200-day MA at 55.128. The pair is already below the 200-day EMA though, which comes in at 55.364. The currency also remains the best performer within the Asian FX space in December to date, just shading the Korean won. Still hawkish central bank rhetoric from the BSP, (more hikes in the first part of 2023), coupled with year-end remittance inflows are likely supports.

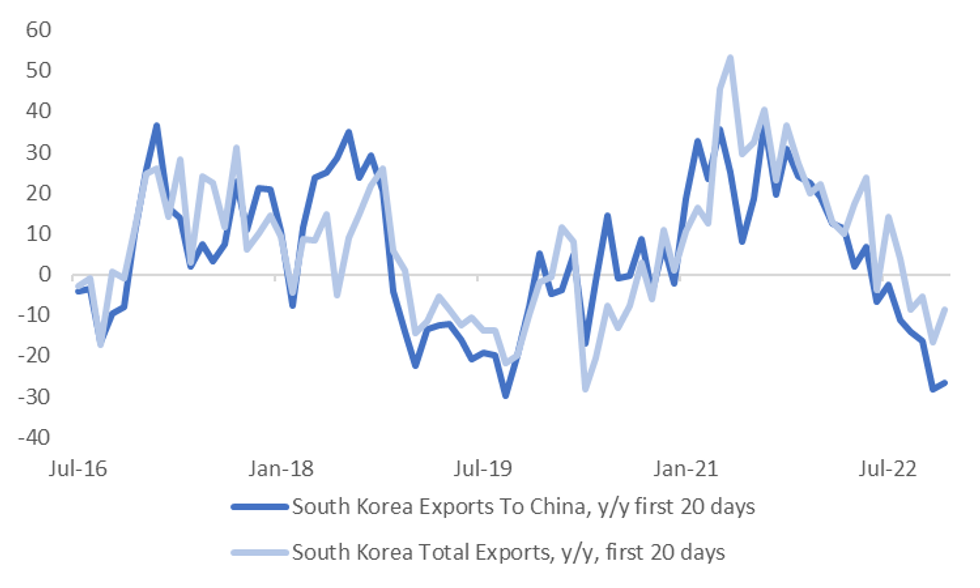

SOUTH KOREA: Weaker Export Growth Persists, But Perhaps Not As Bad As Feared

The first 20-days trade data for December was not as bad as likely feared. Exports were down -8.8% y/y, versus -16.7% for the first 20-days of November (note full month export growth for November was -14.0% y/y). There was no difference for daily average exports, -8.8%. Chip exports were still weak at -24.3% y/y.

- Exports to China remained weak, down -26.6% y/y, although this was slightly better than the prior month (-28.3%). Exports to the US though recovered further, up 16.1% y/y, versus +11% in November.

- This has helped the overall export trend look a little better relative to exports to China, see the chart below.

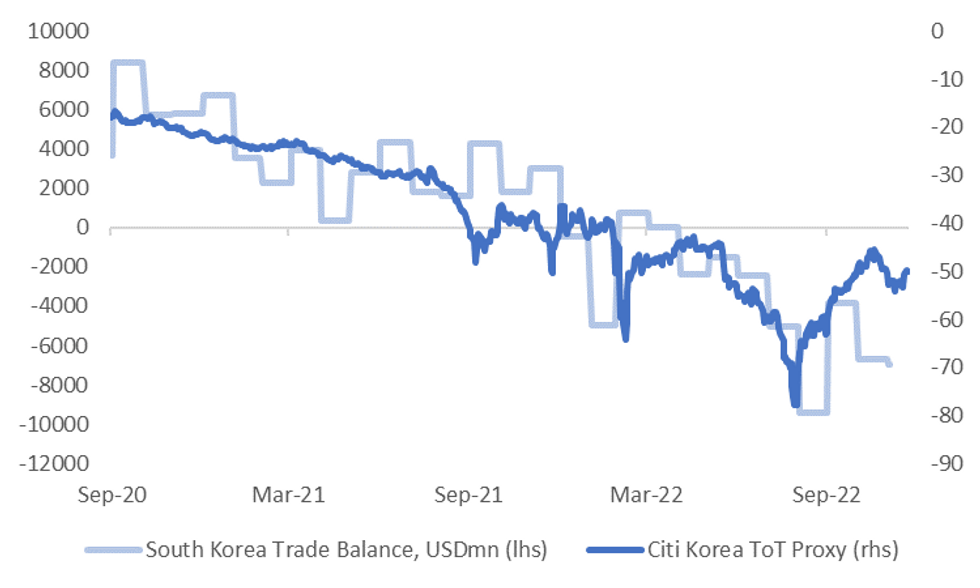

- Imports rose +1.9%, versus -5.5% last month. This kept the trade deficit wide at -$6.43bn. The trade position still appears to be lagging the improvement seen in the Citi terms of trade proxy since late August.

- So, we may see further improvement in the underlying trade balance position as we progress through the early stages of Q123, see the second chart below.

Fig 1: South Korea Export Trend Shows Modest Improvement

Source: MNI - Market News/Bloomberg

Fig 2: South Korea Trade Balance & Citi ToT Proxy

Source: Citi/MNI - Market News/Bloomberg

MNI Bank Indonesia Preview - December 2022: BI To Slow To 25bp Hike

EXECUTIVE SUMMARY

- Bank Indonesia is likely to hike rates a smaller 25bp in December bringing the total this cycle to 200bp and one of the highest rates in the region. This is widely expected by economists but the risk is to the upside with some still expecting a 50bp move.

- The stabilisation of USDIDR and further moderation in headline inflation allows the central bank to pivot but another hike is still needed as core inflation is yet to turn down, headline remains above target and the effective exchange rate is lower.

- Another 25bp hike is likely at the January meeting to bring inflation back to the target band and to ensure FX stabilisation.

- For the full piece, see here:BI Preview - December 2022.pdf

EQUITIES: Mixed Trends, Japan Markets Continue To Correct Lower

Asia Pac equity trends are mixed. Japan stocks continued to weaken, but sentiment was somewhat more positive elsewhere. US equity futures have spent much of the day in the green, last around +0.30/+0.35%.

- The Nikkei 225 is off a further 0.65%, which comes after yesterday's 2.46% drop in the aftermath of the BoJ YCC shift. The index has now weakened for the past 5 sessions. Dips below 26000 have been supported in the Index since April of this year (last levels 26392).

- The HSI is a touch higher, last around +0.10%, while onshore China shares are mixed. The Shanghai property sub-index is down a touch further after yesterday's 2.86% fall. The CSI aggregate index is a touch higher though.

- The ASX 200 is +1.20% higher, led by resource names. A firmer commodity price backdrop has helped, particularly firmer base metal and gold prices over the past 24 hours.

- The Kospi is down slightly (-0.15%), but the Taiex is up 0.30% at this stage. Philippine equities are +0.84%, continuing to recover from the sharp pull back at the start of the week.

GOLD: Bullion Holds Onto Its Tuesday’s Gains, Watch Friday’s PCE Price Data

Gold prices rose 1.7% on Tuesday to close to its December 13 high, as the JPY rallied and the USD fell after the surprise BoJ YCC adjustment. It has held onto those gains only falling 0.2% during today’s session. Bullion is now trading around $1814.90/oz.

- Gold has been in a very narrow range today reaching a high of $1819.82 and a low of $1813.79. If it clears the December 13 high of $1824.50, then it would be at its highest since the end of June.

- In the US today, December consumer confidence and existing home sales for November print. The focus is likely to be on Friday’s personal consumption data which includes the Fed’s preferred measure of inflation for November, the core PCE – price index.

OIL: Range Trading In Thin Liquidity

Oil prices have continued range trading today in a band of close to half a dollar in thin liquidity as we approach year end. Brent is trading around $80/bbl and WTI $76.20.

- US API data showed a 3.1mn bbl drawdown in crude inventories after a 7.82mn build the week before, which has helped to support prices during the APAC session. There was a 4.5mn bbl build in gasoline stocks and 3.4mn of distillate. US EIA inventory data is released later today.

- US inventory data added to supply concerns after Russia’s seaborne oil exports sank in the first week after the G7 price cap came into effect. But recession fears continue to weigh on crude prices.

- The focus later is on Canadian inflation and US consumer confidence and home sales. US EIA inventory data is also released. On Friday, US personal consumption data which includes the Fed’s preferred measure of inflation for November, the core PCE – price index, prints.

UP TODAY (TIMES GMT/LOCAL

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/12/2022 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 21/12/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/12/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 21/12/2022 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 21/12/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/12/2022 | 1330/0830 | *** |  | CA | CPI |

| 21/12/2022 | 1330/0830 | * |  | US | Current Account Balance |

| 21/12/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 21/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 21/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.