-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Markets Tight In Asia, PBoC LNY Liquidity Setup Eyed

- Markets coil in Asia-Pac hours, in typical regional setup for FOMC.

- The PBoC conducts another net drain of liquidity via OMOs as it seeks balance ahead of LNY.

- Familiar block flow seen in TY options.

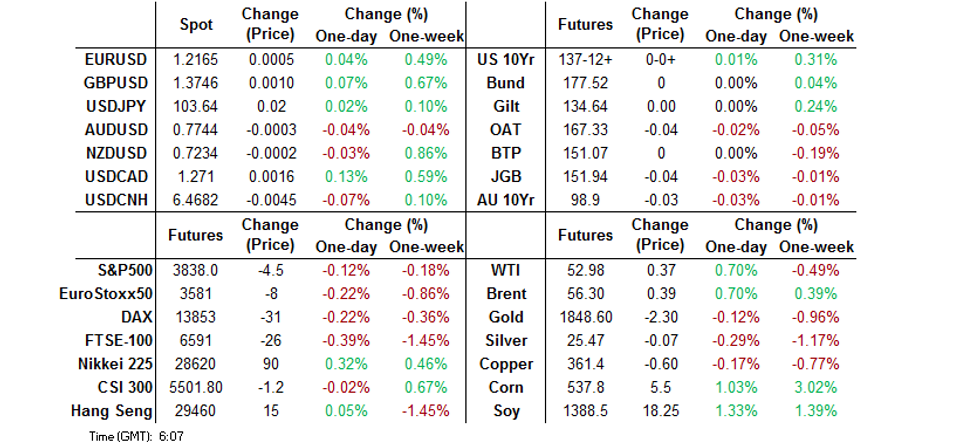

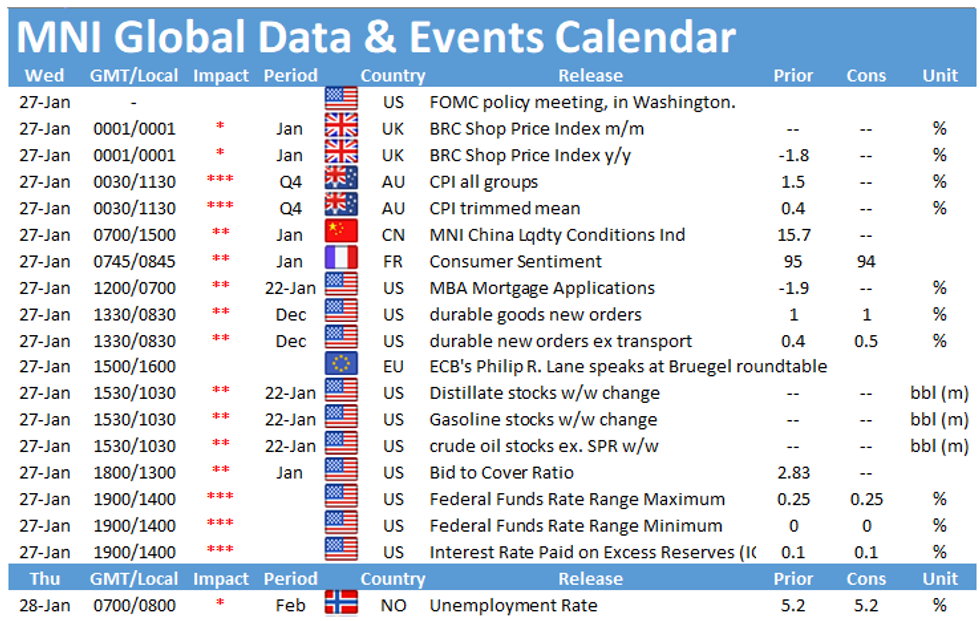

BOND SUMMARY: Coiling Into FOMC

T-Notes coiled in Asia-Pac trade, in typical pre-FOMC decision setup for the timezone, last dealing unch. at 137-12. The modest bear steepening seen after the re-open was unwound with cash Tsys now hovering around unchanged levels across the curve. Eurodollar futures are unchanged through the reds, with volume there particularly light. Flow has been dominated by the now familiar TYJ1 risk reversal block trade (with another 10K of TYJ1 133.50 puts lifted against TYJ1 138.00 calls), which was followed up by 2.0K of screen activity in the strategy, which was in the same direction. The aforementioned FOMC decision headlines the local docket on Wednesday (see our preview for more on that), while prelim. durable goods data and 2-Year FRN supply is also due.

- It was another limited Tokyo session for JGBs, with the cash space little changed out to 10-Years, and slightly softer further out, while swap spreads were a touch wider across the curve. JGB futures stuck to the range established in overnight trade, finishing -4 on the day. The latest round of BoJ Rinban operations saw the purchase sizes held steady, with the following cover ratios observed: 1-3 Year: 3.18x (prev. 3.01x), 10-25 Year: 4.82x (prev. 4.78x). Elsewhere, Japanese FinMin Aso continued to lament the current fiscal situation, but offered nothing in the way of fresh insight, while BoJ Governor Kuroda reaffirmed the general purpose of the Bank's ETF purchase scheme.

- Aussie bond futures added to the early Sydney weakness on the back of the slightly stronger than expected round of domestic Q4 CPI prints, although most of the gains in the headline CPI readings were fuelled by mechanical moves (tax hikes and subsidy rollback) as opposed to demand-side matters, with all 3 of the major Y/Y metrics still some way shy of the magic 2.0% mark. This allowed the longer end to recover from worse levels of the day, with YM unch. and XM -3.0 at the close (cash trade played catch up on the back of Tuesday's local holiday). Elsewhere, NAB business confidence moderated, although the current conditions metric rose. Westpac's RBA watcher, Bill Evans, reiterated his view that the Bank will extend its bond purchase scheme by offering to buy A$100bn worth of ACGBs and semis for another 6 months (when the current round of purchases comes to an end), before scaling back to A$50bn over 6 months when the second A$100bn runs out, with another A$50bn set to come after that. Evans also reaffirmed his view that the YCC policy will need to be adjusted in early 2022. There is also talk of a new '32 deal from QTC, although we haven't seen confirmation of that ourselves.

FOREX: Caution Prevails In Limited Asia Session, FOMC Decision Eyed

Macro headline flow was light in Asia-Pac hours, with G10 FX pairs happy to hug relatively tight ranges as a degree of caution crept in. The DXY edged higher but was nowhere near erasing yesterday's losses, CHF also gained on the back of risk-off feel. JPY failed to appreciate alongside its safe haven peers.

- CAD led commodity-tied FX space lower, even as crude oil inched higher. AUD gave away gains registered in reaction to a beat in Australian CPI data, with main driving factors (tobacco tax hikes, matters surrounding childcare costs) under scrutiny.

- PBOC set USD/CNY reference rate at CNY6.4665, 30 pips above sell side estimates – the second straight day of a significant miss which again underscores the PBOC's asymmetric response function to the yuan. The bank drained a net CNY100bn via OMO's, after a CNY78bn drain yesterday.

- GBP crosses were rangebound amid continued speculation re: the UK's next steps in its fight with coronavirus. The Times reported that the UK gov't will opt for a limited hotel quarantine system, applying it only to travellers arriving from the highest-risk countries.

- Focus turns to the FOMC MonPol decision, flash U.S. durable goods, German & French consumer confidence gauges, Swedish trade balance as well as comments from ECB's Lane & Villeroy and Riksbank's Breman.

FOREX OPTIONS: Expiries for Jan27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E594mln), $1.2100(E714mln), $1.2150(E612mln), $1.2190-00(E1.4bln), $1.2250(E1.45bln), $1.2285-00(E715mln)

- USD/JPY: Y102.00-05($596mln), Y103.25-45($625mln), Y103.95-10($819mln), Y104.50-65($922mln)

- GBP/USD: $1.3690-1.3700(Gbp383mln-GBP puts)

- AUD/USD: $0.7500(A$1.2bln), $0.7640-50(A$543mln), $0.7750-65(A$612mln-AUD puts)

- AUD/NZD: N$1.0665(A$530mln)

- USD/CAD: C$1.2600($940mln-USD puts), C$1.2750-65($845mln-USD puts), C$1.2850-60($925mln)

- USD/CNY: Cny6.42($1.0bln), Cny6.4960($880mln), Cny6.55($525mln)

- USD/MXN: Mxn19.77($635mln)

ASIA FX: Quiet Ahead Of Key Events

A fairly quiet session for Asia EM FX as markets await the FOMC rate announcement. The greenback caught a bid mid-way through the session which saw most USD/Asia crosses bounce off lows.

- CNH: Yuan strengthened after strong industrial profits data. The PBOC drained CNY 100bn, the second day of drain despite LNY approaching. Repo rates increased again. USD/CNH last down 17 pips at 6.4709.

- SGD: Singapore's aims to have one community vaccination centre in every town by the end of March according to Minister for Trade and Industry Chan Chun Sing. USD/SGD last up 8 pips at 1.3254.

- TWD: Some comments from the Chinese government crossed the wires, says hopes US sticks to "one-China" principle, and hopes that the US will proceed on the issue with caution. USD/TWD lower on the day at 27.98.

- KRW: Won is higher after weakening yesterday. Data before the open showed consumer confidence rose in January. The BOK said consumer sentiment improved as new cases of coronavirus infections slowed down amid expectations for vaccinations. USD/KRW last down 1.20 at 1105.10

- IDR: Spot USD/IDR failed to take out its 50-DMA yesterday and continues to trade below that moving average, last virtually unchanged at 14,066. Indonesia's Covid-19 case count has topped 1mn, marking the worst outbreak in Southeast Asia.

- MYR: Gained in early trade amid fading prospects for a hard lockdown after the current Movement Control Order expires. USD/MYR last down 22 pips at 4.044.

- PHP: Data today showed the trade deficit unexpectedly expanded, on the back of a surprise fall in exports, which was coupled with a slightly smaller than exp. decline in imports. USD/PHP sticks to a familiar range, last trades marginally below neutral levels at 48.058

- THB: Thai gov't came under attack from opposition lawmakers for its handling of the coronavirus situation, the country declared a record number of new Covid-19 infections on Tuesday. USD/THB down 20 pips at 29.96

EQUITIES: Mixed, Tech Outperforms Again

A mixed day for stocks in Asia; in China major bourses have drifted lower, as have South Korean and Australian exchanges. Japan, Hong Kong and Taiwan have fared better and are in minor positive territory, but have retreated from highs. Equity markets in the region endured their biggest slide in two months yesterday, which helps explain some of the mixed price action.

- US futures are also mixed, e-minis in the red but once again the Nasdaq is the outperformer after Microsoft and AMD reported strong earnings. Markets await earnings updates from Apple, Facebook and Tesla due today.

GOLD: Rangebound

Gold is a touch softer over the last 24 hours, although bullion has stuck to the range witnessed in recent sessions, even with the DXY marginally lower over that timeframe, while U.S. real yields have seen little net movement. Spot last deals a handful of dollars lower vs. closing levels, last printing $1,845/oz. Known ETF holdings of gold continue to flatline after that metric's pullback from October's all-time high at the back end of 2020, although the measure remains very much elevated in historical terms.

OIL: Inventory Draw Helps Oil Ease Higher

Oil edged higher in Asia on Wednesday; WTI is up $0.26 at $52.87, brent is $0.24 higher at 56.16.

- Markets digest the API stockpile data after-market yesterday which showed headline crude inventories fell by 5.27m bbls last week, while stocks at Cushing fell 3.48m bbls. Upside was tempered by builds in both downstream product measures. Markets will now look towards the more comprehensive DoE inventory data in the US session.

- OPEC Secretary-General Mohammad Barkindo was optimistic yesterday at the Iranian Petroleum and Energy Club Congress and Exhibition.: "With the market currently switching into backwardation, we are hopeful that 2021 will be a good year," he said.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.