-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN MARKETS ANALYSIS: NZD Outperforms On Hawkish RBNZ

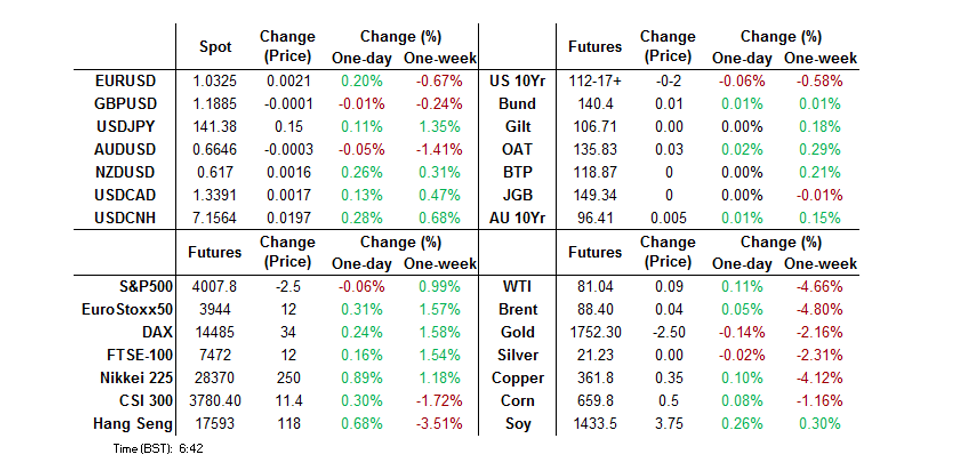

- The BBDXY is back above 1285.00, up from earlier lows near 1282.50. U.S Tsy futures are away from earlier highs, although the tone in regional equities has also turned less supportive this afternoon. These moves have aided the USD from a cross-asset standpoint, although overall moves are modest. NZD/USD has bucked the firmer USD tone, although the pair is off earlier highs, post the RBNZ. We got above 0.6190, as the central raised rates by 75bps and pushed the terminal rate projection significantly higher.

- Tsy futures have held tight ranges in Asia-Pac hours, with liquidity limited by the observance of a Japanese holiday, which also means that cash Tsys are closed until London hours. The early bid linked to regional reaction to Tuesday’s price action and continued COVID worry re: China (deeper restrictions in some of the country’s major cities) faded in the wake of the latest RBNZ decision, which came down on the hawkish side.

- Coming up, flash Eurozone PMIs will be in the spotlight before their US equivalent, durable goods, new home sales and final UMich sentiment data cross. ECB speak is also eyed. The minutes from the latest FOMC meeting cap off Wednesday's docket.

US TSYS: Chinese COVID Vs. Hawkish RBNZ In Limited Futures Trdae, Cash Closed Until London

Tsy futures have held tight ranges in Asia-Pac hours, with liquidity limited by the observance of a Japanese holiday, which also means that cash Tsys are closed until London hours.

- The early bid linked to regional reaction to Tuesday’s price action and continued COVID worry re: China (deeper restrictions in some of the country’s major cities) faded in the wake of the latest RBNZ decision, which came down on the hawkish side.

- News flow was limited elsewhere

- That leaves TYZ2 -0-01 at 112-18+, operating in a narrow 0-05+ range, on sub-standard volume of ~60K (which is even more restricted when you consider that ~22K lots of that came from quarterly roll activity).

- Looking ahead, the minutes from the latest FOMC decision headline the pre-Thanksgiving NY docket. We will also get flash PMI data, durable goods, new home sales, MBA mortgage applications, weekly jobless claims and the final UoM survey for Nov.

AUSSIE BONDS: ACGBs Twist Flatten, Hawkish RBNZ Knocks Space Off Best Levels

Aussie bond futures sat just above session lows at the close, with YM -4.0 & XM +0.5. The broader curve twist flattened, as the major ACGB benchmarks ran 5bp cheaper to 1.5bp richer, pivoting around 10s.

- The early bid derived from the overnight rally in futures, linked to a bid in U.S. Tsys on Tuesday & COVID-related worry re: China, faded in lieu of the hawkish RBNZ decision across the Tasman, with little in the way of fresh impetus observed thereafter (activity was in part limited by a Japanese holiday and lack of meaningful headline flow post-RBNZ).

- Bills finished 3-12bp cheaper through the whites, with the back of the whites and front of the reds leading the weakness. The hawkish noises from across the Tasman allowed RBA dated OIS to tick higher, with terminal cash rate pricing now sitting just above 3.90%, a little over 10bp firmer on the day.

- ACGB May-32 supply was smoothly absorbed.

- Tomorrow’s domestic economic docket is essentially empty, with liquidity in wider global markets set to be sapped by the observance of the Thanksgiving holiday in the U.S.

NZGBS: RBNZ Triggers Hawkish Repricing As It Looks To Fend Off Inflation

The major cash NZGBs finished Wednesday’s session 2-20bp cheaper, with the front end leading the weakness in the wake of the latest RBNZ decision. Swap rates also shunted higher, with swap spreads wider across the term structure. The 2-/10-Year swap curve moved 15bp further into inverted territory vs. levels seen late Tuesday.

- Also note that the OCR now sits above the 10-Year NZGB yield, just.

- To recap, the final RBNZ decision of ’22 saw the Bank deliver the widely expected 75bp OCR hike. Its continued, almost singular, focus on combatting elevated inflation and inflation expectations, punctuated by confirmation that the Bank deliberated re: delivering a 100bp hike, along with a notable shift higher in the projected OCR track, weighed on NZGBs.

- The RBNZ now expects the OCR to peak at 5.50% in ’23 (up from the previous peak of 4.10%). Market pricing adjusted accordingly, with a peak cash rate of just under 5.50% priced into the RBNZ dated OIS strip.

- ANZ provided the most aggressive sell-side call that we have seen, looking for a peak OCR of 5.75%.

- Looking ahead, the weekly round of NZGB auctions headline domestic matters on Thursday.

FOREX: NZD Shines On Hawkish RBNZ, USD Recovers From Early Losses

The BBDXY is back above 1285.00, up from earlier lows near 1282.50. U.S Tsy futures are away from earlier highs, although the tone in regional equities has also turned less supportive this afternoon. These moves have aided the USD from a cross-asset standpoint, although overall moves are modest.

- NZD/USD has bucked the firmer USD tone, although the pair is off earlier highs, post the RBNZ. We got above 0.6190, as the central raised rates by 75bps and pushed the terminal rate projection significantly higher. We are now back at 0.6160/65, but the Kiwi is outperforming on crosses.

- AUD/USD is down slightly for the session, last around 0.6640 (-0.15%), weighed by AUD/NZD selling and China headwinds this afternoon, with reports of protests at China's iphone factory weighing at the margin. The AUD/NZD cross touched 1.0750 post the RBNZ, but is now back close to 1.0780.

- USD/JPY is back near 141.50, with an early session dip sub 141.00 supported. EUR/USD is outperforming modestly, holding close to 1.0315, slightly up for the session.

- Coming up, flash Eurozone PMIs will be in the spotlight before US durable goods, new home sales and UMich sentiment data. The FOMC minutes caps off the Wednesday docket. Sell-side analysts mostly see risks to the minutes as leaning hawkish, at the very least cementing expectations for an upgrade to the median 2023 dot in December's next SEP vs September's editions.

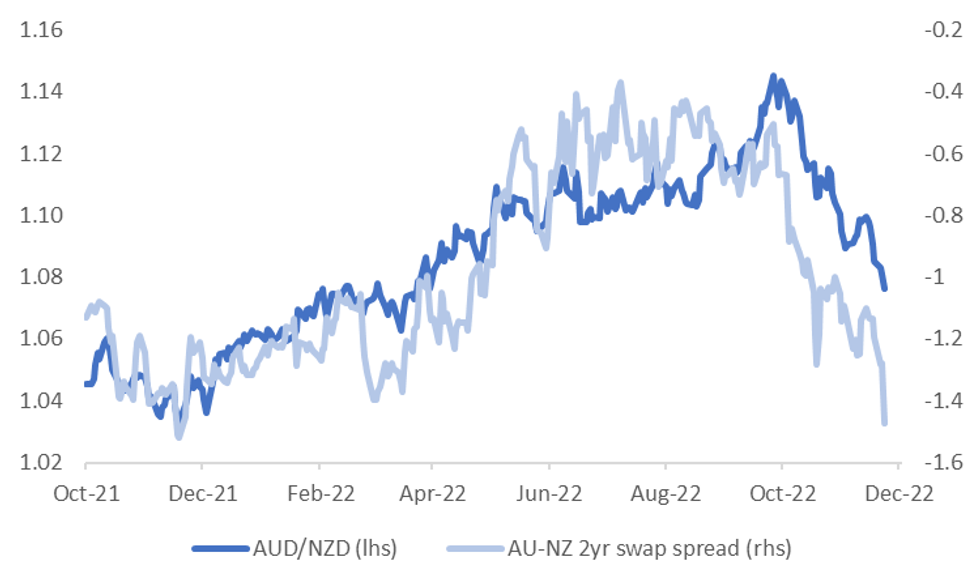

AUDNZD: Downtrend Persists As Hawkish RBNZ Sends Yield Differentials Sharply Lower

AUD/NZD made a fresh low of 1.0750 post the RBNZ, before stabilizing somewhat. The pair was last around 1.0770, which is just above lows back to March from this year. From a technical standpoint NZD bulls target a break of the bear channel support at 1.0690, then the 2022 low from 7 Jan at 1.0571.

- The RBNZ's hawkish 75bps hike, has driven a surge in NZ interest rates. The 2yr swap is around 25bps higher to 5.28%, as the market factors in higher RBNZ rate projections going into 2023.

- The chart below overlays AUD/NZD against the AU-NZ 2yr swap differential. The differential is now close to -150bps. Towards the end of October this spread was closer to -100bps. This differential also continues to point to lower cross levels.

Fig 1: AUD/NZD Versus AU-NZ 2yr Swap Spread

Source: MNI - Market News/Bloomberg

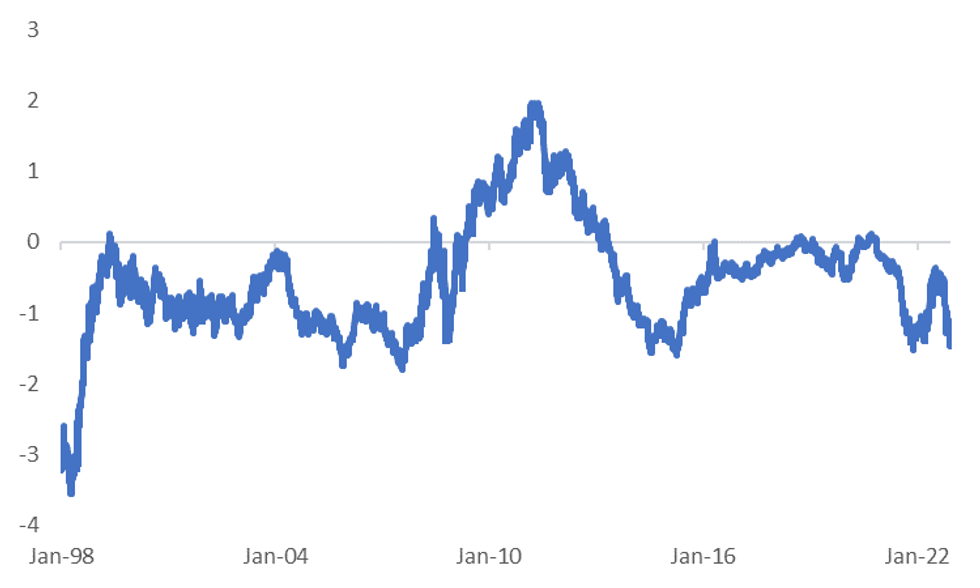

- Interestingly, the 2yr swap spread has spent little time wider than that -150bps level over recent decades, see the second chart below. As monetary policy cycles between the two economies are often correlated.

- Catalysts for a quick turnaround back in AUD's favor are not clear though, at least from a short term standpoint.

Fig 2: AU-NZ 2yr Swap Spread - Long Term Trends

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Nov23 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.5bln), $0.9750(E1.5bln), $1.000-10(E766mln), $1.0050(E1.3bln), $1.0280(E756mln), $1.0300(E1.3bln), $1.0350(E805mln)

- USD/JPY: Y140.00($900mln), Y141.75-00($1.3bln), Y144.50-70($2.7bln)

- USD/CNY: Cny7.05-07($1.2bln)

ASIA FX: USD/Asia Pairs Higher, Singapore CPI Pressures Moderates, BoK Tomorrow

Most USD/Asia pairs have firmed, dragged up by higher USD/CNH levels. PHP has outperformed though. Tomorrow the focus will be on the BoK decision, where a 25bps hike is expected. Otherwise, the data calendar is fairly light. Thailand customs trade data may print. Singapore inflation figures undershot expectations.

- The early impetus in USD/CNH was to the downside, but this proved short lived, the pair troughed below 7.1300. The CNY fixing was neutral, while onshore equities have been softer, as a number of cities ramp up PCR testing to curb the severe current Covid outbreak. This afternoon the pair pushed above 7.1600 following headlines of protests at Foxconn's iphone factory.

- USD/KRW 1 month couldn't sustain early moves sub 1350, the pair last close to 1355. Business sentiment continues to soften, particularly in the manufacturing space, which suggests GDP growth will cool further. Short term external debt levels improved in Q3. The focus tomorrow is on the BoK outcome, +25bps is expected.

- USD/SGD has pushed back above 1.3820, around +0.30% firmer for the session. Q3 GDP revisions were nudged down to +1.1% q/q, and +4.1% y/y (from +1.5% and +4.3% respectively). October inflation figures have just crossed the wires, coming in weaker than expected. Core eased back to 5.1%, from 5.3% last month, while headline fell m/m by -0.4%.

- USD/PHP is back to the 57.30 level (-0.08 figs for the session), bucking the broader stronger USD trend. Philippine equities continue to outperform, last +1.07%.

- USD/IDR spot is holding above 15700, slightly above yesterday's closing level (last 15707). Better sentiment from lower US real yields overnight hasn't seen much follow through USD selling today.

MNI BoK Preview - November 2022: 25bps Hike Likely

EXECUTIVE SUMMARY

- The broad consensus is for the BoK to hike by 25bps at tomorrow’s policy meeting, which is the final one for 2022. This would take the policy rate to 3.25%.

- A downshift from last month’s 50bps hike pace appears warranted on several fronts. Monetary Policy has already been tightened considerably since the middle of last year. Growth risks are intensifying, with external demand weakening and domestic confidence measures softening. The won has also recovered in the FX space, while recent stresses in domestic credit markets may also play into BoK thinking.

- Strong inflation pressures argue for a continued aggressive pace, but are unlikely to be enough of an offset to the factors outlined above. Other focus points will be the terminal rate point. Some sell-side analysts feel we are getting closer to this point or may be there after further tightening on Thursday. The BoK will also update its forecast profile, with most interest in the 2023 growth and inflation projections.

- Click here to view the full preview: BoK Preview - November 2022.pdf

SOUTH KOREA: Manufacturing Sentiment Points To Further Growth Slowdown

South Korean manufacturing sentiment continued to deteriorate, slipping to 69 from 73 prior, according to this morning's BoK survey. This puts the gauge at its lowest levels since late 2020. Note the 2020 trough was just under50.0, so we are still some distance away from those levels. Still, the weaker reading is consistent with a further slowing in South Korean GDP growth, see the first chart below.

- The headline index is consistent with y/y GDP growth easing below 2% as we progress into 2023. The Bloomberg consensus looks for GDP growth next year of 1.8%, so this survey is pointing in that direction.

- Non-manufacturing sentiment also eased, back to 77 from 78 prior. Absolute levels are clearly higher relative to manufacturing, but we still eased back to early 2021 lows.

Fig 1: South Korean Manufacturing Sentiment Points To Further Slowing In GDP Growth

Source: MNI - Market News/Bloomberg

EQUITIES: Protest Reports At China Iphone Factory Weighs On Sentiment

Asia Pac equities are mostly higher, China mainland stocks are underperforming though. US futures have drifted lower as the session has progressed, with Nasdaq futures near -0.25% at the time of writing.

- Bloomberg reported protests at the Foxconn plant in China, due to Covid related conditions. The plant is a large producer of Apple iphones. This has weighed on tech related sentiment in the region and US futures.

- China mainland stocks are lower, the CSI off 0.36%, while the Shanghai Composite is down by 0.20%. Covid developments today have centred on increased PCR testing requirements in major cities. This comes after the health authorities stated late yesterday the country should adhere to the CZS amid a severe outbreak.

- Reuters reported that property company Vanke will receive a 100bn yuan credit line from the Bank of Communications. The Shanghai Property Sub-index is up 0.25% so far today.

- The HSI is in positive territory but is away from best levels, last around +0.4%. The tech sub-index is +1.26%, amid better earnings results. The Kospi and Taiex are also higher, both indices up by a little over 0.5%. Japan markets are shut today.

- The ASX 200 is +0.60%, but NZ shares are down 0.85%, after the RBNZ delivered a hawkish 75bps rate hike and forecast a mild recession next year.

GOLD: Prices Dip On Reports Of Protests In China, Waiting For FOMC Minutes

Gold dipped after reports of violent protests at an iphone factory in China boosted the USD. Before that it had been range trading as it awaits the publication tonight of the minutes from the last FOMC meeting. It is off of the initial low of $1733.38/oz and is around $1734. It reached a high of $1742.97 earlier.

- Bullion continues to trade between its initial resistance of $1786.50 (November high and bull trigger) and support at $1718.60 (20-day EMA). Short-term conditions remain bullish for gold.

- Fed speakers suggesting that they’re open to slowing the pace of tightening supported gold overnight. The market will be look to the November minutes for other signs of a less hawkish Fed. If the Fed pivots and reduces the size of rate hikes, then gold prices are likely to benefit as they tend to move inversely with bonds yields.

- Tonight the Global S&P preliminary PMIs print for Europe and the US. Also, a swathe of US data including unemployment claims, durable goods orders and Michigan consumer sentiment are released ahead of the Thanksgiving holidays.

OIL: Prices Softer, But Waiting For Russian Price Cap Details

Oil prices are at their intraday low following reports of violent protests at an iphone factory in China boosted the USD. WTI is trading around the NY close at around $80.80/bbl after reaching a high of $81.48. Brent is around $88.15 also below its NY close of $88.36 and its high of $88.80. Despite the current dip, crude has been trading in a narrow range.

- WTI continues its retracement from the $92.53 November 7 high and the bearish theme remains. It has been trading close to the bear trigger and support of $80.49, the October 18 low.

- The range trading generally seen today reflects the market waiting for details on the plan to cap the price of Russian crude. There were reports that Europe may soften the plan after a related set of sanctions were diluted. Russia has said it won’t export crude to countries participating in the cap. Apparently, China has reduced oil imports from Russia due to the current uncertainty.

- The API reported another drawdown of US crude inventories of 4.8mn barrels.

- Markets are also awaiting the FOMC minutes published tonight for any signs of a pivot. Global S&P preliminary PMIs print for Europe and the US. Also, a swathe of US data including unemployment claims, durable goods orders and Michigan consumer sentiment are released ahead of the Thanksgiving holidays.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 23/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/11/2022 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/11/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 23/11/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/11/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/11/2022 | 1500/1000 | *** |  | US | New Home Sales |

| 23/11/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 23/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/11/2022 | 1700/1200 | ** |  | US | Natural Gas Stocks |

| 23/11/2022 | 1900/1400 |  | US | FOMC minutes | |

| 23/11/2022 | 1900/1900 |  | UK | BOE Pill Speech at Beesley Lecture Series | |

| 23/11/2022 | 2130/1630 |  | CA | Governor Macklem testifies at House finance committee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.