-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Oil Slips On Production Outlook, USD Trims Weekly Gain

- Greenback slips in muted Asia-Pac trade, core FI respect narrow ranges.

- Crude oil extends losses as IEA cuts production outlook, OPEC expect more supply from other producers.

- China's regulatory crackdown continues to weigh on local equity benchmarks.

BOND SUMMARY: Steepening Impetus Spills Over Into ACGB Space Early On, Core FI Tread Water

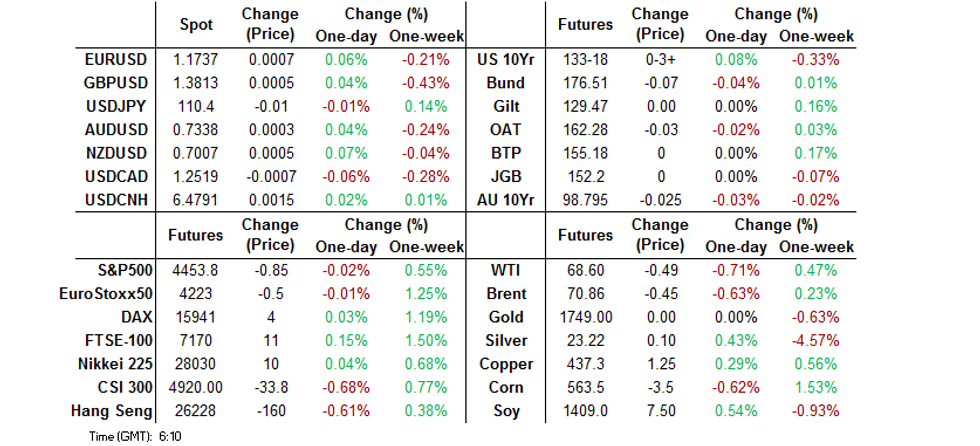

T-Notes established themselves comfortably within yesterday's range and last change hands +0-03+ at 133-18, with overnight headline flow providing little in the way of notable catalysts. Cash Tsy curve bull flattened a tad, with yields last seen unch. to -1.1bp. Eurodollar futures run unch. to +1.0 tick through the reds. Preliminary University of Michigan Sentiment provides the sole point of note on the U.S. economic docket today.

- JGB futures traded sideways after a marginally softer reopen. The contract last deals at 152.17, 3 ticks shy of Thursday's settlement. Cash JGB yield curve runs slightly flatter, with the super-long end outperforming. The MOF held a liquidity enhancement auction for off-the-run JGBs with 5-15.5 Years until maturity, drawing bid/cover ratio of 3.104x.

- The AOGM auctioned A$1.2bn of 4.75% 21 Apr '27 Bond, with bid/cover ratio printing at 3.929x (prev. 2.090x). Cash ACGB curve bear steepened early on, having absorbed Thursday's impetus from U.S. Tsy space. Yields last trade 0.2-3.2bp higher across the curve. Aussie bond futures were rangebound; YM trades -0.5 & XM -2.5 at typing. Bills last seen -1 tick through the reds. The latest MNI INSIGHT piece noted that the RBA could begin to revise its baseline forecasts if the current lockdowns continue into 4Q2021. Meanwhile, NSW declared another record daily Covid-19 case count, while Canberra identified two further infections.

FOREX: Greenback Slips Amid Subdued Volatility

The greenback slipped in muted Asia-Pac trade, with the absence of market moving headlines leaving participants to reflect on familiar themes and resulting in particularly subdued volatility. Safe haven peers JPY and CHF were also weaker, despite continued spread of the Delta variant of coronavirus across the region. Nonetheless, the DXY seems poised for its second straight weekly gain, following the recent rounds of hawkish Fedspeak.

- AUD rose to the top of G10 scoreboard despite Australia's deepening Covid-19 crisis, which saw NSW log another record increase in new infections (390). Canberra confirmed 2 further positive cases after ACT authorities identified 3,900 contacts linked to the outbreak in the capital.

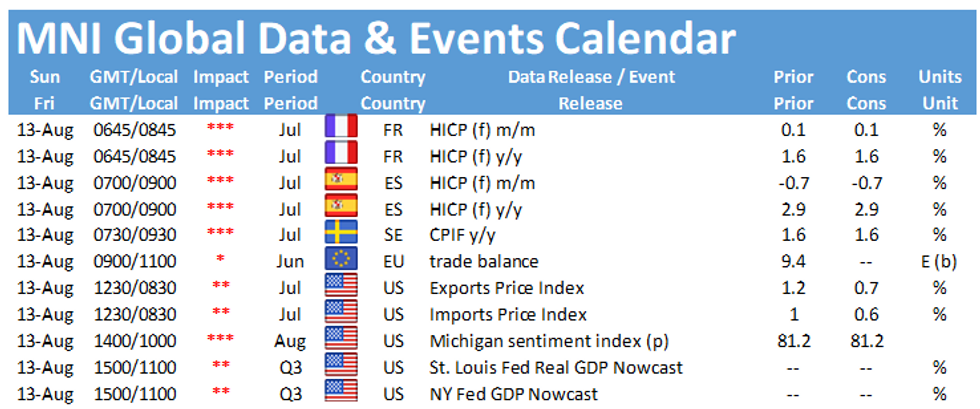

- Monthly University of Michigan survey provides the only point of note on today's global economic docket.

FOREX OPTIONS: Expiries for Aug13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-60(E562mln), $1.1825-35(E926mln)

- USD/JPY: Y110.00($540mln), Y110.45-50($1.7bln), Y111.25($665mln)

- AUD/USD: $0.7600(A$627mln)

- USD/CAD: C$1.2475($612mln), C$1.2600-10($1.2bln), C$1.2650-60($1.1bln)

ASIA FX: Won Tumbles On Covid Numbers While Inflation Comments Receive Scrutiny

Most spot USD/Asia crosses edged higher in the wake of yesterday's greenback strength (albeit the DXY ticked away from yesterday's peak), but some bucked the trend.

- KRW extended its sharp sell-off as South Korea's daily Covid-19 infections remained at worrying levels, inspiring calls for tighter curbs. Meanwhile, South Korean Vice FinMin said that the gov't will make efforts to ease prices of farm products ahead of Sep 20-22 Chuseok holidays amid mounting inflation pressure. Spot USD/KRW reached its highest point since Sep 2020.

- CNH ignored bubbling geopolitical tensions between China and some of its Western partners. The PBOC fix fell in line with expectations.

- Onshore THB started on a firmer footing as Thai markets reopened after a local holiday, but sharply trimmed losses as Thailand reported another record-breaking increase in new Covid-19 infections.

- USD/PHP continued to operate just shy of the PHP50.50 level, but struggled to stage a breach of that figure. BSP yesterday left interest rates unchanged, but revised its 2021 CPI forecast to +4.1% Y/Y from +4.0%.

COMMODITIES: Oil Extends Losses After IEA Lowers Demand Forecast, Gold Up On Softer USD

Crude oil has extended losses in Asia-Pac hours after the IEA warned of a sharp reduction in demand as the spread of the Delta coronavirus variant resulted in the tightening of restrictions across the globe, particularly in Asia. Separately, OPEC maintained its demand growth forecast for 2021, but raised expectations for supply from non-OPEC producers. WTI last down $0.48 from settlement at $68.61/bbl, Brent is down $0.45 at $70.86bbl.

- Gold has edged higher and last trades up $3.40 at $1,756.30 as the greenback has softened across the board. Bullion is narrowing in on yesterday's high of $1,758.2 and a break here would bring Jul 15 high of $1,834.1 into play.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.