-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Powell Up

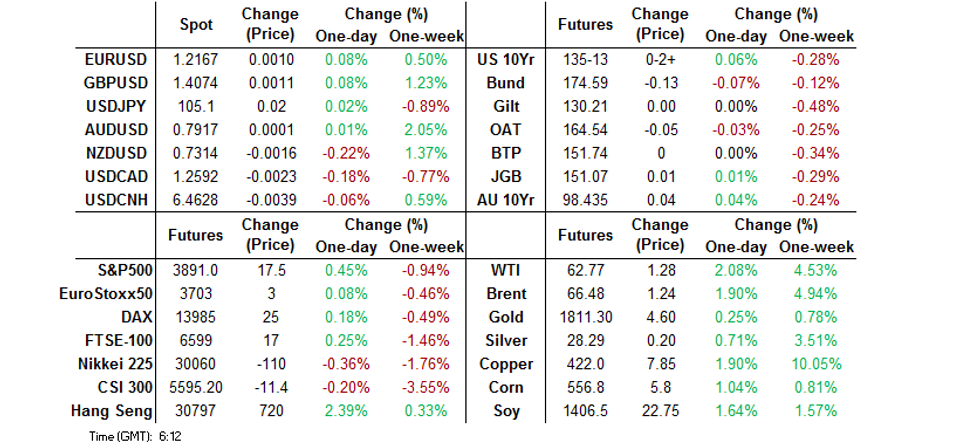

- Equities tick higher in Asia, USD trades mixed among G10 FX.

- A lack of headline catalysts were evident, while liquidity was thinned by a Japanese holiday, allowing participants to fully digest the current landscape.

- Focus moves to Fed Chair Powell's appearance on the Hill.

BOND SUMMARY: Core FI Supported In Asia, Liquidity Thinned By Japanese Holiday

Core FI was better bid during Asia-Pac trade, although there was little in the way of headline flow to support the move. T-Notes +0-02+ at 135-13 heading into European hours, holding to 0-05 range overnight, with some looking to month-end extensions that are a shade above average, while there may have been a limited degree of spillover from the bid in Aussie bonds (although the potential for cross market plays vs. the U.S. would have limited any impulse from that source). Cash Tsys are closed until London hours owing to the observance of a Japanese holiday. Day 1 of Fed Chair Powell's testimony on the Hill headlines the local docket on Tuesday, with consumer confidence data and 2-Year Tsy supply also due.

- We suggested that the early bid in the longer end of the ACGB curve could have been a result of cross-market plays vs. the U.S., while the bid in the shorter maturity ACGBs/red bill contracts may suggest that participants believe that the recent move lower has gone too far, too fast, meaning that some may be establishing fresh longs after the recent flush out. YM +2.0, XM +4.0 at the close, with the overnight steepening more than unwound. Elsewhere, speculation did the rounds re: the potential for the RBA to become more active with its ACGB purchases in coming days, given the recent sell off and steepening seen between ACGB Apr '24 & Nov '24. Australian PM Morrison confirmed that the JobKeeper/Seeker schemes will come to an end in March, while also confirming some modest, permanent tweaks to the unemployment support package (which were widely expected). Credit rating news came in the form of Moody's downgrading Victoria to Aa1 from Aaa, with the state's outlook set to negative. Moody's noted that the move reflects "a marked erosion in Victoria's governance of its public finances, at a time when the state faces substantial operating deficits as it responds to the pandemic-induced economic disruptions and embarks on a significant capital spending program." Wednesday's local docket will be headlined by Q4 completed construction work and wage data, while the AOFM will come to market with A$2.0bn of ACGB 1.25% 21 May 2032 supply.

US TSYS: ICE-Bank of America MOVE Index Away From Lows, But Still Suppressed

The well-documented recent run of curve steepening/re-pricing of Fed expectations has resulted in an uptick in the ICE-Bank of America MOVE Index, although that measure of volatility continues to operate at historically suppressed levels.

Fig. 1: ICE-Bank of America MOVE Index

Source: Bloomberg

FOREX: Firmer Crude Supports Oil-Tied FX Albeit Antipodeans Lag

Oil-tied NOK and CAD caught a modest bid on the back of firmer crude oil prices, but the Antipodeans failed to follow suit. AUD/USD had a brief look above yesterday's multi-year highs as a BBG trader source pointed to AUD purchases linked to short-covering/demand from leveraged funds ahead of $0.7900 put strikes. That said, the currency failed to cling onto its initial gains and pulled back later in the session.

- AUD/CAD turned its tail just ahead of a key psychological barrier, with a contact flagging suspected profit taking ahead of C$1.0000. The rate's RSI pulled back below 70, with a bearish divergence taking shape.

- NZD struggled from the off amid positioning in the lead-up to the upcoming RBNZ MonPol decision and following the release of worse than expected NZ retail sales data.

- USD/JPY traded on a slightly softer note, extending its four-day losing streak. Japanese markets were closed for the Emperor's birthday.

- The PBOC fixed its central USD/CNY mid-point at CNY6.4516, 23 pips below sell side estimates, the second lower fix in three days. Offshore yuan strengthened but respected yesterday's range.

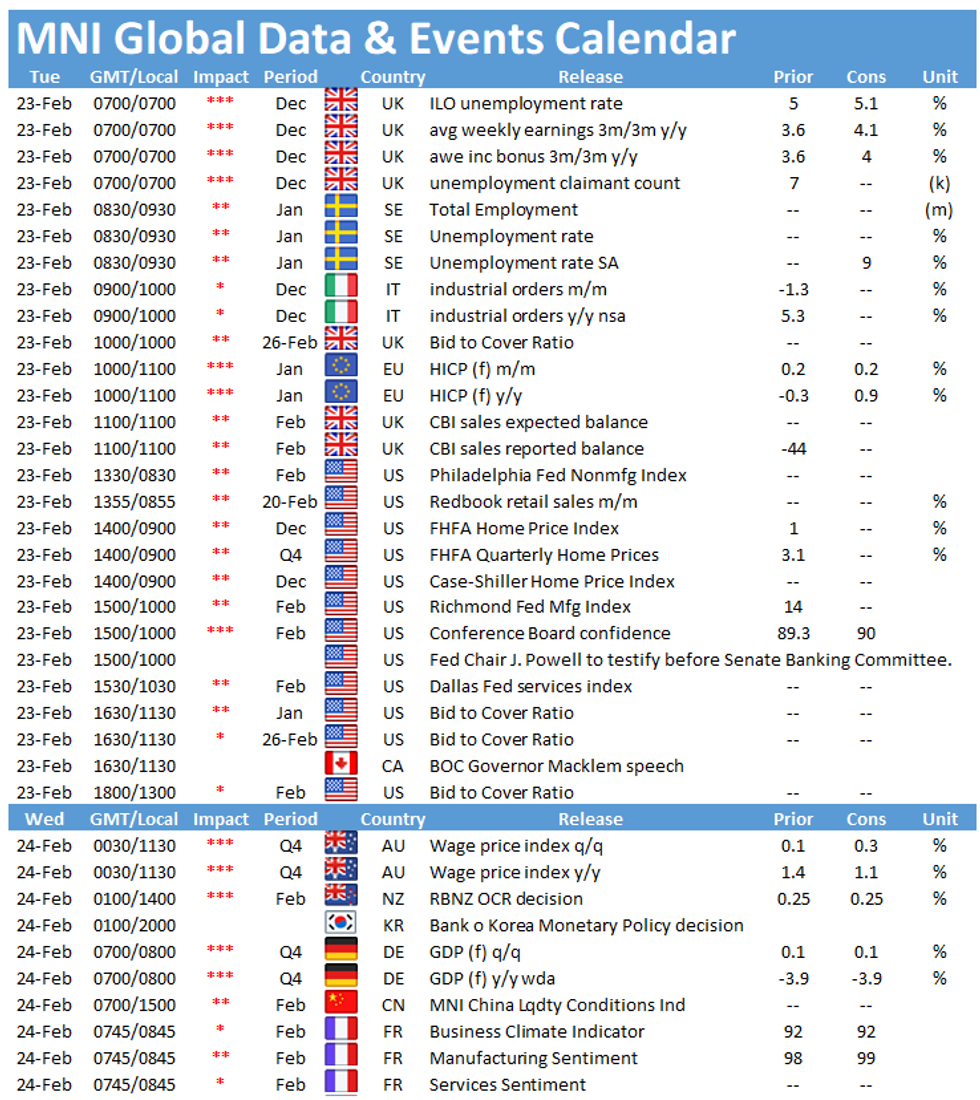

- Today's key data releases include final EZ CPI, UK labour market report, U.S. Conf. Board Consumer Confidence and Swedish unemployment.

- Elsewhere, all eyes are on Fed Chair Powell's semi-annual MonPol Report. BoC Gov Macklem & Riksbank's Bremak are also due to speak today.

FOREX OPTIONS: Expiries for Feb23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2135-55(E2.4bln-EUR puts), $1.2195-00(E1.0bln-EUR puts), $1.2300(E788mln-EUR puts)

- USD/JPY: Y103.50-55($772mln), Y104.70-80($760mln), Y104.90-105.00($1.0bln), Y105.75($735mln), Y105.95-00($769mln)

- EUR/GBP: Gbp0.8750(E551mln-EUR puts)

- USD/CHF: Chf0.8870-80($610mln-USD puts)

- AUD/USD: $0.7770-75(A$642mln), $0.7900(A$622mln)

- AUD/JPY: Y83.00(A$494mln)

- USD/CNY: Cny6.42($505mln)

- USD/MXN: Mxn20.60($500mln)

ASIA FX: Rebounds From Early Losses As Greenback Offered

Asia-Pac markets managed to shrug off a risk off lead from the US, while the greenback also shed a handful more pips.

- CNH: Offshore yuan is stronger, retracing yesterday's move after the PBOC fixed USD/CNY lower than expected. A piece in China's Economic Information Daily will have also given yuan bulls some encouragement, the frontpage commentary predicted China's economy will grow 8% in 2021 after posting 2.3% growth in 2020.

- SGD: Singapore dollar stronger, breaking through key support at 1.3210, inflation data was inline with the Y/Y print at 0.2%, with NSA CPI was flat M/M against expectations of -0.2%.

- TWD: Taiwan dollar has strengthened in Asia on Tuesday and is one of the best performers among its peers, still buoyed by upgraded forecasts for growth, exports and inflation from DGAS.

- KRW: The won has oscillated around neutral, the BoK statement to parliament adopted a cautious tone saying there were still COVID-19 risks, as well as risks to the vaccination programme, while the bank pledged to retain its accommodative stance.

- INR: The rupee gained, the RBI minutes release yesterday shows the bank is concerned by inflation readings, the minutes showed that most members cautioned on upside risks.

- IDR: Rupiah made some small gains, USD/IDR was subdued ahead of the budget update later in the session.

- MYR: Ringgitt is higher but off best levels, oil palm growers expressed a sense of surprise with the gov't's decision to hike cess on crude palm oil and crude palm kernel oil.

- THB: Baht is higher but has retreated from highs of the day after trade data showed exports rose less than expected. PM Prayuth pushed back against press speculation surrounding potential for a cabinet reshuffle in the wake of the recent no-confidence vote against the premier and nine ministers. Prayuth insisted that no minister will lose his post owing to the results of the vote.

- PHP: The peso reversed early losses to head into the close with gains, Pres Duterte resisted mounting pressure from economic officials to relax Covid-19 curbs, with his spokesman noting that the president won't authorise such a move before the rollout of vaccines.

ASIA RATES: Reflation Stumbles

A mixed session with a higher open generally reversed amid a recovery in sentiment as the reflation trade stumbles, local dynamics see buying in India and selling in Indonesia.

- CHINA: The PBOC injected CNY 10bn of liquidity via 7-day reverse repos today, the overnight repo rate has increased 46bps, last 1.9745%, but the move looks tame when compared to the 3.55% seen at the end of January, the 7-day repo rate is steady. A piece in China's Economic Information Daily could add fuel to the fire in terms of tightening speculation, there was a frontpage commentary that predicted China's economy will grow 8% in 2021 after posting 2.3% growth in 2020. The piece also stated steady improvement in China's economic fundamentals is creating conditions for the country to normalize its monetary policy. China brings supply to market tomorrow which saw cash yields rise, futures opened higher but dropped as equities gathered pace.

- SOUTH KOREA: Futures in South Korea are flat, 10-year at 128.02, having given back earlier gains as equity markets picked up steam. 10-year future bounced off support at 127.96, matching yesterdays low. 20-year auction was fairly weak, cover dropping despite a healthy yield concession. BoK Gov Lee said the bank would support the bond market, but only make direct purchases as a last resort.

- INDIA: Yields are lower across the curve in India, retracing a sharp move higher yesterday – 10-year yield is still some 15bps higher than the start of trade on Friday. There have been calls for the RBI to disincentivise shorting bonds, Soumya Kanti Ghosh of State Bank of India wrote in a client note that the RBI should increase both implicit and explicit costs of shorting through asking sellers to cover the sale in 30 days instead of the current 90 days and by introducing negative interest rates.

- INDONESIA: Yields higher across the curve, adding to sharp gains yesterday. Yields off highs following a successful sukuk auction, the IDR 12tn issue saw bids of IDR 24.2tn. Markets await the release of the budget later today.

EQUITIES: Asia-Pac Bourses Reverse Early Losses

Stocks in Asia have meandered their way into positive territory, shrugging off a negative lead from the US and reversing the trend after dropping for three consecutive days. Markets in mainland China opened in negative territory but reversed losses as the Hang Seng gained led by casinos. In general risk assets were boosted as the greenback retreated and oil gained. Japanese markets were closed for a public holiday.

- Markets in Taiwan were under pressure, losses in the US were led by the Nasdaq today which has seen some pessimism around demand for tech products. Losses in Taiwan were limited though after Taiwan announced it would relax rules for foreigners visiting the US from March 1.

- Futures in the US and Europe are higher, reversing some of the decline from yesterday, markets look ahead to clues on Fed policy in a speech from FOMC Chair Powell.

GOLD: Softer DXY Supports, Powell On Deck

A softer DXY has supported bullion over the last 24 hours or so, with the bounce gaining traction after technical support held on Friday. Spot last deals a handful of dollars higher on the day at ~$1,815/oz.

- Some focus on physical buying out of India has been evident.

- Still, ETF holdings of gold have been on a steady downtrend during the month of February, and now sit at the lowest level seen since July '20, although the measure remains elevated in historical terms.

- The impending round of rhetoric from Fed Chair Powell is set to shape gold's fortunes over the coming couple of sessions.

OIL: Banks Boost Forecasts

Crude futures have extended gains in Asia; with WTI & Brent both adding more than $1.00 to settlement levels.

- The gains come as around 15% of U.S. crude output remains offline, despite a rebound in production after adverse weather.

- Flows to the U.S. from Asia have increased, data compiled by Bloomberg shows at least three tankers were booked to ship gasoline and jet fuel from Asia to the West Coast last week, up from just one in the whole of January.

- Banks have been boosting forecasts for crude in the midst of the rally, Morgan Stanley increased its Q3 Brent forecast to $70/bbl citing under supply in 2021 of 2.8m bpd, while Goldman Sachs raised Q3 estimates to $73/bbl.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.