-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBA August Hike Odds Close To 50/50 Post CPI Beat

- Australia's May monthly CPI was stronger than expected. RBA Dated OIS has shunted 6-19bps firmer following today’s CPI data, with late 2024 and 2025 meetings leading. The market gives a 25bp hike in August a 44% chance.

- AUD/USD spiked higher and is targeting a test above 0.6700. AUD/JPY got to fresh highs back to 2007. The USD was mostly supported elsewhere, although more so against Asia FX. Other G10 trends were steady. US Treasury futures are slightly lower.

- Regional equity markets are mostly higher, although China markets still lag, while Australian markets faltered post the CPI print.

- Looking ahead, we have German consumer confidence and US home sales data out later.

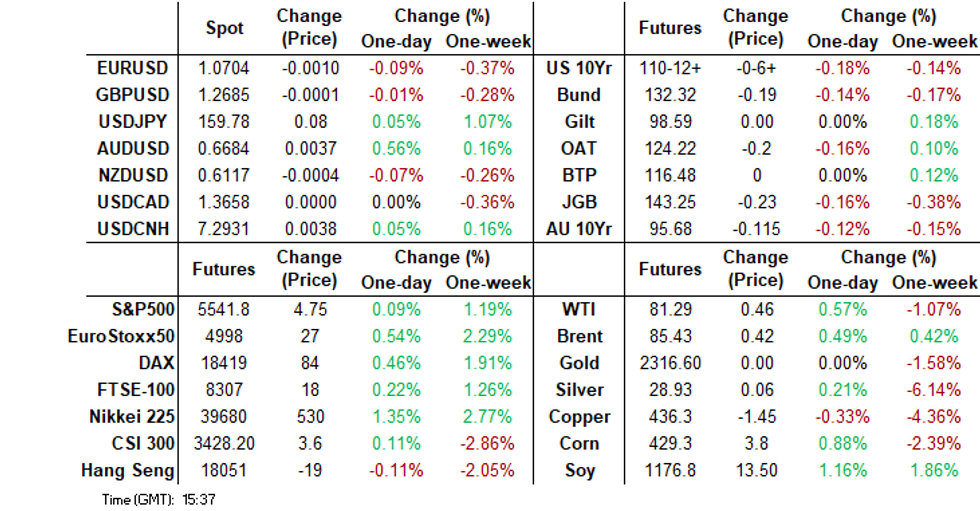

MARKETS

US TSYS: Treasury Futures Slip, AU CPI Above Estimates, US Home Sales Later

- Treasury futures are lower today, with the curve slightly flatter. The TUU4 at -0-02⅛ at 102-03+ breaking below the overnight lows with the June 18th lows now in play, while TYU4 is -0-06+ at 110-12+ and now testing Monday's lows.

- Volumes: TU 49k, FV 71k, TY122k slightly up on Tuesdays volumes

- Tsys flows: Earlier there was a Block Fly, buyer belly, DV01 310k - similar to prior days blocks

- Cash treasury curve is slightly flatter today, yields are 1-2bps higher with the 2Y +1.5bps at 4.757%, 5Y +1.6bps at 4.291% while the 10Y is -1.2bps at 4.259%, the 2y10y gapped higher earlier and is now +3.789 at -45.892.

- APAC markets have been focused on Australia where CPI came in above expectations, ACGBs are 8-18bps higher, with the curve bear flattening, the 2Y is +17.3bps at 4.187%, NZGBs have also bear-flattened, yields are 3-6bps higher, while in Japan the curve has bear-steepened, yields are flat to 4bps higher.

- Looking ahead, New Home Sales, 5Y Auction on Wednesday, main focus on PCE inflation data in the latter half of the week.

JGBS: Futures Near Session’s Worst Levels, Retail Sales & 2Y Supply Tomorrow

JGB futures were weaker and near Tokyo session lows, -19 compared to the settlement levels.

- The local calendar is empty today, ahead of Retail Sales and weekly International Investment Flow data tomorrow. Thursday also sees 2-year supply.

- Cash JGBs are dealing mixed, with yield changes bounded by -0.5bp (4-year) to +2.9bps (40-year). The benchmark 10-year yield is 1.1bp higher at 1.015% versus the cycle high of 1.101%. This is the first time the 10-year yield has pushed above 1% since June 12 as traders continue to mull the central bank’s plan to cut its debt purchases.

- (Bloomberg) “The supply dynamics favor a steeper yield curve for Japan’s government bonds and for super-long tenors to underperform relative to swaps. The nervousness of JGB investors about planned reductions in the Bank of Japan’s bond purchases can be easily understood when we look into the supply of debt.” (See link)

- The swaps curve has bear-steepened, with rates flat to 5bps higher. Swap spreads are mostly wider.

- Tomorrow, the local calendar will see Retail Sales and weekly International Investment Flow data alongside 2-year supply.

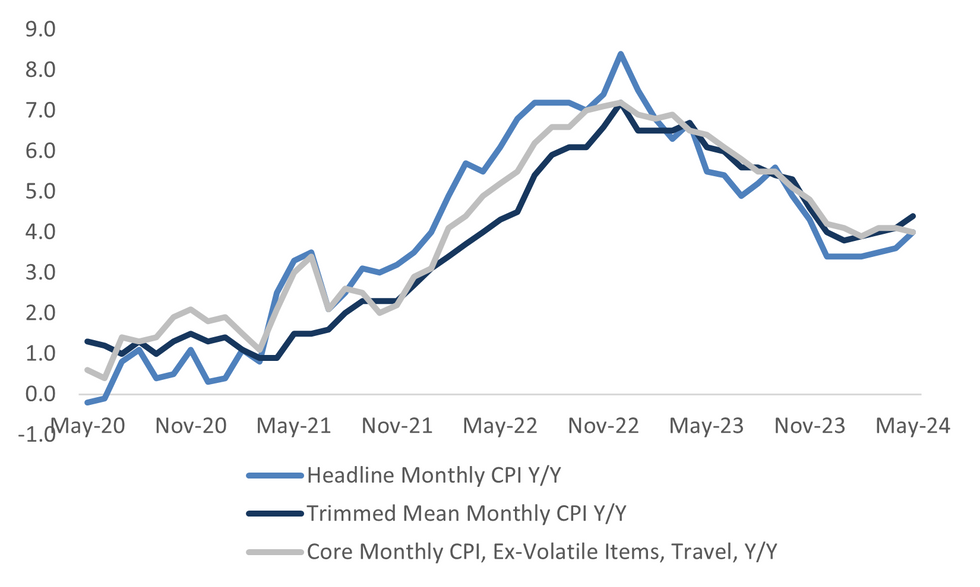

AUSTRALIAN DATA: Monthly CPI Firmer In Y/Y Terms, Core Measure Mixed

Australia's May monthly CPI was stronger than expected. It printed at 4.0% y/y, versus 3.8% forecast and 3.6% prior. This is the firmest y/y print since Nov last year. Base effects played a role given the May y/y 2023 read eased to 5.5% from 6.7%. Still, underlying inflation trends aren't favorable for a near term dovish RBA policy pivot. Indeed, the market will remain wary of renewed tightening risks. We get the full Q2 CPI print at the end of July ahead of the next RBA meeting on Aug 6.

- The chart below plots the headline monthly CPI, the core CPI, which the ABS defines as excluding volatile items and holiday travel, as well as the trimmed mean.

- Whilst one month data point doesn't make a trend, as the chart suggests, underlying trends aren't gravitating towards the RBA's 2-3% target band.

- In terms of the detail, the ABS noted: "The most significant contributors to the annual rise to May were Housing (+5.2 per cent), Food and non-alcoholic beverages (+3.3 per cent), Transport (+4.9 per cent), and Alcohol and tobacco (+6.7 per cent)."

- The only negative category was household furnishings at -1.1%y/y (versus -0.8% in April).

Fig 1: Australian Monthly CPI Trends - Y/Y

Source: ABS/MNI - Market News

AU STIR: RBA Dated OIS Shunts Firmer Following CPI Monthly’s Beat

RBA Dated OIS has shunted 6-19bps firmer following today’s CPI data, with late 2024 and 2025 meetings leading.

- The market gives a 25bp hike in August a 44% chance.

- Terminal rate expectations have also shifted to 4.46% from 4.37% before the data.

Figure 1: RBA-Dated OIS – Pre- Vs. Post-CPI

Source: MNI – Market News / Bloomberg

RBA: Restrictive Financial Conditions Needed To Bring Inflation Pressures Down

RBA Assistant Governor Kent (Financial Markets) has delivered a speech focused on financial conditions. See this link here.

- Kent notes current financial conditions are restrictive in Australia, which is line with the RBA's cumulative tightening efforts since 2022.

- Households are facing more pressure relative to businesses, particularly large ones. Such pressures are weighing on aggregate domestic demand, but this is needed to bring demand and supply back closer to balance and bring lower inflation outcomes. Households with mortgages are feeling pressure, although most are meeting their debt obligations.

- Kent states that from a policy standpoint: "While recent economic data have been mixed, they have reinforced the need to remain vigilant to upside risks to inflation. Hence, with regards to the path of interest rates, the Reserve Bank Board is not ruling anything in or out."

- On estimates of the neutral cash rate, the RBA chart appears to suggest its rests around 3.5% based off the average of the RBA model estimates of the neutral rate), Indeed none of the model estimates appear above 4%. This compares to the current target cash rate level of 4.35%.

- Still, Kent stresses that there is considerable uncertainty with estimating the neutral rate and that it can change over time.

AUSSIE BONDS: Holding Sharply Cheaper After Higher-Than-Expected CPI Data

ACGBs (YM -18.0 & XM -12.0) are sharply cheaper after a higher-than-expected CPI Monthly print.

- May CPI printed +4.0% versus +3.8% est. and +3.6% prior. This was the firmest y/y print since Nov last year. While base effects played a role in May’s reading, the underlying inflation trend isn’t favourable for a near-term dovish RBA policy pivot. Annual trimmed mean inflation was 4.4% in May, up from 4.1% in April.

- In terms of detail, the ABS noted: "The most significant contributors to the annual rise to May were Housing (+5.2%), Food and non-alcoholic beverages (+3.3%), Transport (+4.9%), and Alcohol and tobacco (+6.7%)."

- Cash ACGBs are 12-18bps cheaper on the day, with the AU-US 10-year yield differential at +6bps. This is the first time the differential has been positive since early February.

- Swap rates are 10-17bps higher on the day, with the 3s10s curve flatter.

- The bills strip has shunted cheaper, with pricing -13 to -22.

- RBA-dated OIS pricing is 7-21bps firmer across meetings after the data, with 2025 meetings leading. A cumulative 5bps of easing is priced by year-end from an expected terminal rate of 4.48%. Terminal rate expectations were 4.37% before the data.

- Tomorrow, the local calendar will see Consumer Inflation Expectations and Job Vacancies data, and a speech from RBA Hauser aftermarket.

NZGBS: Closed On A Weak Note, Negative Spillover From ACGBs

NZGBs closed near the session’s worst levels, 4-6bps cheaper, after negative spillover from a post-CPI sell-off in ACGBs.

- ACGB benchmarks are 11-17bps cheaper after May’s CPI Monthly printed +4.0% y/y versus +3.8% est. and +3.6% prior. Annual trimmed mean inflation was 4.4% in May, up from 4.1% in April. RBA Dated OIS shunted 7-21bps firmer across meetings, with the market giving a 25bp hike in August a 47% chance.

- Cash US tsys are also ~2bps cheaper in today’s Asia-Pac session after a similar-sized move yesterday.

- The local calendar was empty today, although NZ Treasury’s Secretary Caralee McLiesh said the department is “examining further measures to reduce government spending and increase revenue as the weak economy continues to erode tax receipts” (as per BBG).

- Swap rates closed 4-5bps.

- RBNZ dated OIS pricing closed 1-2bps firmer for 2025 meetings. A cumulative 30bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Consumer and Business Confidence data alongside NZ Treasury’s planned sale of NZ$250mn of the 4.5% May-30 bond, NZ$200mn of the 3.5% Apr-33 bond and NZ$50mn of the 2.75% Apr-37 bond.

FOREX: A$ Dominates Post May CPI Beat

The BBDXY USD index sits little changed, last around 1266.50. Earlier we got above 1267, but couldn't sustain these levels. This also left us short of intra-session highs from Tuesday's session. The main focus today has been the sharp rise in AUD following the May CPI beat.

- The headline CPI printed at 4.0%y/y above market expectations (3.8%) (and versus 3.6%y/y prior), while a core trimmed mean measure also firmed in y/y terms. Earlier comments from RBA Assistant Governor Kent reiterated the central bank's mantra that nothing is being ruled in or out. Kent added they wanted to see softer underlying core inflation momentum before easing (note the remarks were made before the May CPI print).

- From 0.6645, AUD/USD got to 0.6679 post the print. We hold near these levels in latest trade. Market pricing for the August RBA meeting is now close to 50/50 in terms of a 25bps hike. The A$ has outperformed on crosses. AUD/JPY got to fresh highs back to 2007, printing 106.77. USD/JPY has firmed a touch but didn't breach Monday highs above 159.90.

- AUD/NZD gapped higher on stronger-than-expected AU CPI. The cross hit a low of 1.0852 before surging to 1.0917 and back to May 22 levels. The AU-NZ 2yr swap is 11bps higher at -54bps and is now at the tightest levels since Sept 2022.

- NZD/USD is down a touch, last near 0.6115.

- Looking ahead, we have German consumer confidence and US home sales data out later.

ASIA STOCKS: Hong Kong & China Equities Mixed, Yuan Continues Its Slide

Hong Kong and China equity markets traded mixed today, with HSI edging slightly lower and the CSI300 slipping 0.25%. Chinese shares were weighed down by persistent trade tensions and a lack of new stimulus measures, with traders awaiting the upcoming Communist Party's third plenary session for potential economic reform announcements. Meanwhile, Chinese weight loss-related stocks saw gains after Novo Nordisk received approval for its Wegovy weight management drug. China loosened its grip on the yuan, trading near its lowest against the dollar since November.

- Hong Kong equities are mixed today as investors keep their eye on the release of key US data at the end of the week. The wider HSI is little changed, while the HSTech Index is 0.29% higher, property Indices are mixed with the Mainland Property Index down 0.33% and the HS Property Index is 0.18% higher.

- Chinese stocks opened lower, influenced by the Fed’s cautious stance on interest rates. The yuan is trading near its weakest level against the dollar since November, but there is optimism about the improvement in China’s export outlook. Beijing's more constructive approach to real estate is expected to bolster domestic confidence. HSBC maintains an overweight position on Chinese stocks, predicting that they could benefit from policy adjustments aimed at stimulating growth. The CSI 300 is 0.25% lower, the small-cap indices CSI 1000 is 0.29% higher, the CSI 2000 is 0.42% higher, the CSI 300 Real Estate Index is 1.80% lower while the ChiNext is 0.45% higher

- Property space, Shimao Group Holdings Ltd is set to defend against a creditor's liquidation demand in Hong Kong court, a crucial moment in its ongoing debt struggles, following a winding-up petition by China Construction Bank over a HK$1.6 billion obligation. The outcome hinges on Shimao's progress in debt negotiations, including lowering the conversion price for convertible bonds, amidst broader industry turmoil and other liquidation hearings this week. China’s Ministry of Natural Resources is exploring ways to support local governments in buying back unused land with special bonds to help real estate companies reduce debt and promote more efficient land use.

- OpenAI is taking steps to block access to its AI tools in unsupported regions, including China, starting in July, amidst growing US pressure to restrict Chinese access to advanced AI technology. This move follows the company's actions against covert influence operations and aligns with broader US efforts to limit China's development of critical technologies.

- Looking ahead, calendar is empty this week

ASIA PAC STOCKS: Equities Mostly Higher, Aus Equities Lower On Higher CPI

Asian markets are mostly higher today, influenced by a rotation into value stocks and the ongoing sell-off in US tech shares. The MSCI Asia Pacific Index is fluctuating as investors await key economic data and assess the impact of global economic trends on regional markets. While sectors like banking and energy are seeing gains, technology shares are under pressure, reflecting broader market uncertainties and investor sentiment.

- Japanese equities are mostly higher today with the Nikkei 225 index rising by 1.25%, bolstered by gains in chip-related stocks like Disco and Tokyo Electron. The Topix index has underperformed the Nikkei and trade up 0.35%, as automakers weighed down the gauge. Investors are adjusting portfolios at the end of June, with expectations of profit-taking as the Nikkei approaches 39,500. The BoJ is expected to raise interest rates in July and introduce quantitative tightening. This shift is in response to rising inflation risks and the need to adjust the current monetary policy.

- South Korean stocks are slightly higher this morning, small-cap stocks are underperforming with the Kosdaq is little changed, while the Kospi is up 0.60%. This was attributed to weak starts from major tech and auto companies, including Samsung Electronics, which fell 0.87%, and SK Hynix, which gained 3.33% following Nvidia's positive performance. HSBC recently upgraded South Korean stocks to overweight, citing growth opportunities in the memory sector and the "Value-Up" program.

- Taiwanese stocks experienced a rise in early trading, following gains in the tech sector and influenced by Nvidia’s rebound. Despite this, HSBC remains underweight on Taiwan, citing limited comfort in valuations after the AI-led rally. The overall market sentiment is cautious, reflecting global economic uncertainties and valuation concerns. The Taiex is up 0.26%.

- Australian shares fell 0.85%, driven by concerns over the Fed’s interest rate stance and a faster-than-expected inflation reading in May. This inflation data supports the case for the Reserve Bank of Australia to resume raising interest rates. The Australian market is also reacting to global economic trends and local economic data, which together create a cautious investment environment.

- Elsewhere, New Zealand equities are 0.56% higher, Indonesian equities are 0.57% higher today although HSBC downgraded stocks to neutral due to high interest rates, weak foreign exchange, and uncertainty around government policies amid potential cabinet changes, Singapore & Indian equities are little changed, Malaysian equities are 0.20% higher, Philippines are 0.16% lower.

Asian Equity Flows Positive, Indonesia See largest Inflow For Years

- South Korean equities experienced inflows of $101 million yesterday. Over the past 5 trading sessions, the net inflow totaled $135 million. This aligns with the 5-day average inflow of $26.98 million, which is lower than the 20-day average of $59.01 million and the longer-term 100-day average of $149.29 million. Year-to-date, South Korean equities have seen a substantial inflow of $16.499 billion.

- Taiwanese equities saw outflows of $214 million yesterday. However, the past 5 trading sessions recorded a net inflow of $155 million. The 5-day average inflow of $30.92 million contrasts with the 20-day average outflow of $71.27 million, though it is below the 100-day average inflow of $65.90 million. Year-to-date, Taiwan has accumulated a total inflow of $4.754 billion.

- Indian equities attracted inflows of $103 million yesterday, contributing to a robust 5-day total inflow of $1.756 billion. The 5-day average inflow of $351.23 million is significantly higher than the 20-day average of $73.46 million. Despite this, the 100-day average shows a slight outflow of $18.52 million. Year-to-date, India has seen outflows amounting to $1.243 billion.

- Indonesian equities experienced inflows of $485 million yesterday, the largest inflow since April 2022. Over the past 5 trading days, Indonesia recorded a total net inflow of $503 million. The 5-day average inflow of $100.64 million is a marked improvement compared to the 20-day average inflow of $3.19 million and the 100-day average outflow of $2.38 million. Year-to-date, Indonesia has experienced inflows totaling $26 million.

- Thai equities had outflows of $50 million yesterday, bringing the 5-day total to a net outflow of $250 million. The 5-day average outflow of $49.92 million is close to the 20-day average of $54.13 million and more than double the 100-day average outflow of $23.99 million. Year-to-date, Thailand has seen significant outflows amounting to $3.072 billion.

- Malaysian equities recorded outflows of $35 million yesterday. The past 5 trading days have seen a total net outflow of $129 million. The 5-day average outflow of $25.7 million is higher than the 20-day average outflow of $12.58 million and the 100-day average outflow of $2.38 million. Year-to-date, Malaysia has experienced outflows totaling $132 million.

- Philippine equities saw no change yesterday. Over the past 5 trading days, the total outflow was $48.7 million. The 5-day average outflow of $9.75 million is less than the 20-day average outflow of $12.44 million but higher than the 100-day average outflow of $5.99 million. Year-to-date, the Philippines has seen outflows totaling $534 million.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 101 | 135 | 16499 |

| Taiwan (USDmn) | -214 | 155 | 4754 |

| India (USDmn)* | 103 | 1756 | -1243 |

| Indonesia (USDmn) | 485 | 503 | 26 |

| Thailand (USDmn) | -50 | -250 | -3072 |

| Malaysia (USDmn) | -35 | -129 | -132 |

| Philippines (USDmn) | 0 | -48.7 | -534 |

| Total | 391 | 2122 | 16300 |

| * Up to 24th June |

OIL: Reversing Some Of Tuesday's Losses, US EIA Inventory Data Coming Up Later

Oil benchmarks have spent the first part of Wednesday trade paring some of Tuesday's losses. Brent was last near $85.40/bbl in terms of the front month contract, up nearly 0.50%, after Tuesday's 1.16% dip. More broadly we remain little changed versus end levels from last week. WTI front month was last around $81.20/bbl, having followed a similar trajectory.

- Looking ahead, focus will rest on the EIA energy inventory data, released later on Wednesday. Bloomberg notes API data pointed to a 900k build in terms of US crude inventories.

- Otherwise, even with Monday's pullback the broader supply/demand balance is seen as supportive of prices. Notably, the OPEC production cut extension into Q3 and a potential summer boost to fuel demand are supporting prices despite the disappointing early summer demand data.

- For WTI, the recent move higher has resulted in a break of $80.11, the May 29 high and a key resistance. This paves the way for $82.24, a Fibonacci retracement point. Initial firm support to watch is $78.87, the 20-day EMA.

GOLD: Hawkish Fedspeak & Canadian CPI Weigh

Gold is flat in the Asia-Pac session, after closing 0.6% lower at $2319.62 on Tuesday.

- Yesterday’s drop in bullion appeared driven by the latest hawkish Fedspeak. Federal Reserve Governor Michelle Bowman indicated it would likely be "some time" before the FOMC could begin lowering interest rates and warned that U.S. monetary policy might diverge from that of other advanced economies in the coming months.

- Additionally, Canadian CPI inflation data for May came in higher than expected, ending a four-month streak of declining figures. Annual headline inflation rose by 0.2 percentage points to 2.9%, while the average of the median and trim core measures increased by 0.1 percentage points to 2.85%.

- Higher rates are typically negative for gold, which doesn’t pay interest.

- According to MNI’s technicals team, gold continues to trade below resistance and a bear threat remains. The yellow metal has pierced the 50-day EMA at $2,318.3, below which a clear break would open $2,277.4, the May 3 low. Initial firm resistance is $2,387.8, the Jun 7 high.

- Meanwhile, silver underperformed on the day, with the gold-silver cross rising to its highest level since May 17.

PHILIPPINES: MNI BSP Preview - June 2024: Still On Hold, Uncertainty Around Easing Timing

- None of the economists surveyed by Bloomberg see a policy change tomorrow. This is also our strong bias, which if realized, will see the policy rate held steady at 6.50%. This is where the policy rate has been since October last year. Much of the focus for this meeting is likely to be around where the BSP’s policy bias rests.

- Various remarks in recent weeks/months from BSP and government officials has suggested the central bank could ease policy settings in the second half. Critically such a move could come before the Fed’ starts its easing cycle. Our sense is that the BSP will still exhibit some degree of caution around the timing of rate cuts.

- Recent comments from Finance Secretary Recto suggested as much and appeared to push back on the notion of the BSP moving before the Fed.

- Click to view the full preview here:

ASIA FX: USD/Asia Pairs Mostly Higher, CNH Weighed By Lower Yields

USD/Asia pairs are higher, pretty much across the board. Spot weakness has been strongest for THB and IDR. USD/CNH has climbed back above 7.2900, following another uptick in the USD/CNY fixing. Tomorrow, we have South Korean business sentiment readings, followed by China industrial profits. The BSP decision is due later on Thursday in the Philippines, although no change is expected by us or the consensus.

- USD/CNH tracks near 7.2925 in latest dealings, just short of recent highs (7.2946). Beyond that lies the 7.3000 figure level. Mid November highs from last year were just under 7.3110. The USD/CNY fix was again set higher, near 7.1250. Onshore spot is close to the upper daily trading limit (7.2670). CNH implied yields sit off recent highs., while government bond yields have slipped further, with 2yr yields under 1.70%, the 10yr towards 2.20%, fresh lows back to the early 2000s. Local equities were softer in the first part of trade, but have pushed into the green post the lunchtime break.

- 1 month USD/KRW sits away from earlier highs, last near 1386.50. Earlier highs were close to 1390, where there appears to be some resistance to a fresh break higher through. Helping at the margins is a slightly better equity backdrop, while the A$ bounce has also likely spilled over to some degree. The 1 month NDF is the only firmer currency within the region so far today.

- USD/THB is firmer, last near 36.75/80, around 0.35% weaker in baht terms for the session. Cyclical highs in the pair come in at 37.175. BoT minutes from the last policy meeting noted that baht weakness and capital outflow pressures in part reflected domestic factors. Elsewhere, the central bank didn't sound too dovish, stating a sharp rebound in inflation will work against the economic recovery.

- USD/IDR is back to 16430, weaker in IDR terms by a little over 0.30%. This is just shy of recent highs of 16478 recorded last week. Comments from a BI official stated they are ensuring supply and demand is balanced in the FX market and that exporter supply of USDs is still evident. Note early 2020 highs in the pair came in at 16625.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/06/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 26/06/2024 | 0600/1400 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 26/06/2024 | 0600/0800 | ** |  | SE | PPI |

| 26/06/2024 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/06/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/06/2024 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/06/2024 | 1040/1240 |  | EU | ECB's Lane speech at Bank of Finland MonPol conference | |

| 26/06/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/06/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 26/06/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/06/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/06/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/06/2024 | 2000/2100 |  | UK | BBC Leaders Head-to-Head debate |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.