-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RESEND: BoJ Nominations Match Reports, Markets Generally Unperturbed

- Core global FI markets firmed a touch in Asia-Pac hours.

- Yen is the strongest performer in the G-10 space at the margins, firming after Ueda was confirmed as the government's nomination for BOJ Governor.

- U.S. Jan CPI provides today's highlight, prior to that UK Labour Market Survey and Eurozone GDP are on the wires. There is also a slew of Fed speakers and the ECB's de Guindos will also cross.

MNI US CPI Preview: Watching If Newfound Strength Sustained

EXECUTIVE SUMMARY

- Core CPI inflation is seen at 0.4% M/M in January with a survey skewed to a miss, holding at its recently revised rate for Dec after what was originally a 0.30% increase before new seasonal adjustment factors.

- Those SA revisions plus (known) revisions to CPI weights might muddy initial market reaction, potentially increasing volatility whilst the report is assessed.

- With some upward monthly drivers seen coming from typically volatile categories such as used cars and airfares, watch other components for a better clue of more sustained market reaction.

- Core services ex housing will continue to get extra attention after Chair Powell’s continued focus, especially after its upward revised 0.39% in December.

- Underlying strength could further stoke an already significant push higher in 2H23 Fed rate expectations whilst a miss in the context of storming payrolls would further downplay wage-price spiral risks.

- PLEASE FIND THE FULL REPORT HERE:USCPIPrevFeb2023.pdf

US TSYS: Marginally Richer in Asia, CPI In View

TYH3 deals at 112-30, +0-05, a touch off the top of a narrow 0-04+ range on volume of ~73K.

- Cash Tsys sit flat ~1bp richer across the major benchmarks.

- Tsys firmed in early trade, the bid was facilitated by screen flow in TY futures and light pressure in e-minis, with the latter ticking away from yesterday's late NY levels.

- Kazuo Ueda was formally nominated for the BOJ position by the Japanese government however there was little reaction in Tsys.

- Macro headline flow remained light through the session, with January CPI print in view activity was limited and the early richening held.

- UK Labour Market Report and Eurozone GDP cross in Europe. However the aforementioned CPI print provides the highlight today. Fedpeak from Richmond Fed President Barkin, Dallas President Logan, Philadelphia Fed President Harker and NY Fed President Williams is also on the wires.

US TSYS: Twos Targeting The Terminal

With the Federal Reserve having lifted the funds rate above the prevailing inflation rate, the next question is how much higher will the funds rate go? 2-Year U.S. Treasuries suggest not much higher.

- Fed-dated OIS has moved terminal rate pricing to 5.20% for July, up 35bp month to date and 10bp above the Fed’s December forecasts.

- An alternative market estimate, however, is less hawkish. The cycle high in the 2-year U.S. Treasury yield has historically tended to correctly predict the terminal rate with a lead time of 5 months.

- A 4.80% peak in the 2-year in November suggests a terminal rate slightly less than 25bp above the current funds rate at the March FOMC meeting.

- While the recent rise in the 2-year yield would appear at be odds with this signal, history suggests a re-test of the yield high, even a small push higher, would be typical in the run-up to the last hike, particularly if accompanied by swings in core inflation.

- With core PCE prices y/y in a disinflationary trend since Sep-22, the 2-year yield peak signal is worth keeping in mind when thinking about the funds rate outlook.

JGBS: BoJ Board Nominations Made Official

There wasn’t any meaningful market reaction to the Japanese government’s formal nominations for the BoJ’s leadership positions in the post-Kuroda era, given that the names (Ueda, Himino & Uchida) were telegraphed in Friday’s Nikkei article. JGB futures saw a modest extension through their morning high and print +20 into the close. Cash JGBs are little changed to 3bp richer across the curve, a touch shy of best levels with a similar dynamic seen in swaps.

- As flagged earlier, this leadership mix is generally seen as more of a centrist platform, as opposed to an outright hawkish or dovish setup, with many suggesting such appointments will cement expectations for a gradual normalisation of monetary policy. Still, we note that the most recent insight piece from our policy team fleshed out their understanding the Ueda will “likely keep interest rates at low levels but may quicken the scrapping of yield curve control to restore functioning in financial markets.”

- Locally, prelim Q4 GDP data was softer than expected, with inventories the major headwind for the headline print.

- Looking ahead, the latest round of BoJ Rinban operations headline on Wednesday.

AUSSIE BONDS: Post-RBA Rise in Rate Hike Expectations Eases

Aussie bond futures traded in a relatively tight range ahead of U.S CPI data. After spending much of the day in negative territory YM and XM eked out gains of +1.0 and +2.0, respectively. Cash bonds were 2-3bp richer with the 3/10 cash curve flat on the day. The AU/U.S. 10-year yield differential was unchanged ~5bp.

- AU swaps rates were 1-3bp lower with the curve a tad steeper.

- Bills were flat to 3bp firmer along the strip.

- After a small push higher in morning trade RBA-dated OIS terminal rate expectations (Sep/Oct-23) reversed course mid-session to close at 4.12%, down 3bp on the day and down 10bp from yesterday’s intraday high of 4.22%.

- Local data delivered divergent paths for consumer and business confidence in January with Westpac’s measure of consumer sentiment declining 6.9% m/m and NAB business confidence rising for the second consecutive month to +6. The market took the data in its stride, instead focusing on U.S. CPI data, slated for NY hours.

- Looking ahead, Wednesday's local docket will be headlined by the appearance of Governor Lowe given the scrutiny surrounding his future in the press, along with speculation re: potential successors if his term is not extended.

NZGBS: Moderating 2-Year Inflation Expectations Deliver A Mid-Session Reversal

NZGBS were a little weaker in morning trade before reversing sharply as the RBNZ's survey of inflation expectations at the 2-year point moderated to 3.30%, declining from the cycle high of 3.62% seen in Q4.

- Short-end benchmark yields swung from being 3bp higher pre-data to being down 6bp at the close. 2-year swaps followed a similar path but outperformed, closing down 9bp.

- In the 10-year zone, bond yields and swap rates were unable to hold their post-data dips, both closing higher on the day, delivering an 8bp and 10bp steepening of their respective curves (vs. 2s).

- RBNZ-dated OIS also responded to the data by reducing the amount of tightening priced for this month’s meeting to less than 60bp for the first time in around a week. The largest mover on the day was pricing for the July meeting, with terminal OCR pricing moderating to just under 5.40% after threatening to break 5.50% yesterday.

- Other economic data of note included the REINZ House Price Index which delivered its fourteenth consecutive monthly decline, albeit with the m/m move moderating. National house prices were down 13.9% y/y in January.

- Tomorrow’s local docket is non-existent, which will leave reaction to the U.S. CPI print at the fore.

FOREX: Yen Firms, NZD Pressured In Asia

Yen is the strongest performer in the G-10 space at the margins, firming after Ueda was confirmed as the government's nomination for BOJ Governor.

- USD/JPY sits ~0.4% softer, extending a touch in recent trade, last printing at ¥131.80/90. In early trading the Yen had seen some moderate pressure as Q4 GDP printed below expectations. Final print of Industrial Production rose in Dec, the MoM measure was up 0.3% from -0.1% prior, however, in YoY terms it fell 2.4%.

- NZD is the weakest performer in G-10, NZD/USD is down ~0.2%. Kiwi was pressured as 2-year inflation expectations moderated from cycle highs to 3.3%. NZD/USD found support below its 50-day EMA and last prints at $0.6345/50.

- AUD/USD is marginally firmer, up ~0.1%. The pair was pressured in early trade before finding support at $0.6950, paring losses to last print at $0.6970/75.

- EUR and GBP are both up ~0.1%.

- Cross asset flows are mixed. E-minis are down ~0.1%, and DDXY is also down ~0.1%. 10 Year US Treasury Yields sit ~1bps lower.

- U.S. Jan CPI provides today's highlight, prior to that UK Labour Market Survey and Eurozone GDP are on the wires. There is also a slew of Fed speakers and the ECB's de Guindos will also cross.

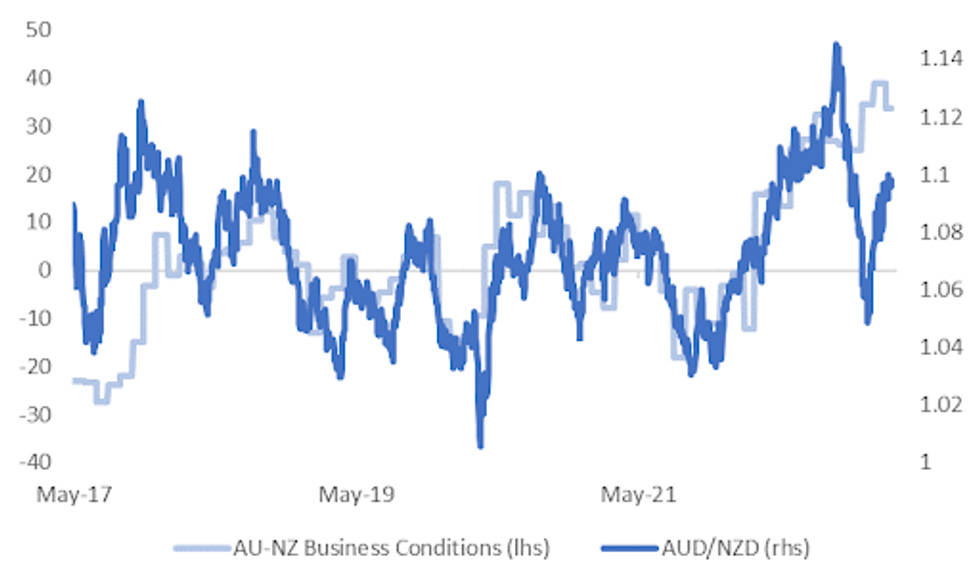

AUDNZD: Further Upside Potential; Business Conditions & Inflation Expectations Diverge

AUD/NZD is ~0.2% firmer in today's trading. The pair found support below $1.0950, before firming as NZ 2 Year Inflation expectations moderated. We now have the $1.10 handle in view.

- Relative business conditions point to further upside potential in the cross. Although the spread moderated a touch today in the latest NAB Business Survey, conditions still remain more favorable in Australia.

- The NAB business survey also pointed to less inflationary pressure, although as we noted last Friday, piece is here, measures of Australia's Core Inflation have surpassed those in NZ.

- Last week the pair was unable to sustain a break through $1.10, bulls will look for a close above the handle to target $1.1045 (11 Nov High) and then $1.1101 the 61.8% retracement of the Sep-Dec downleg.

- Key support is at $1.0881, the low from Jan 31.

Fig 1: Relative Business Conditions vs AUD/NZD

Source: Market News International (MNI)/Bloomberg

FX OPTIONS: Expiries for Feb14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E608mln), $1.1480(E1.1bln)

- USD/JPY: Y116.00($533mln)

- AUD/USD: $0.6900(A$1.0bln), $0.7100-10(A$1.6bln)

ASIA FX: KRW Outperforms, CNH, PHP & INR Lag Softer USD Trend

Most USD/Asia pairs are lower, in line with softer USD indices against the majors. CNH, INR and PHP have lagged broader moves to a degree, while KRW has outperformed. Still to come is India wholesale inflation, which comes after yesterday's firmer CPI outcome. Tomorrow, we have China's 1yr MLF outcome, but no change is expected. India trade figures are also out, along with South Korea trade prices and the unemployment rate.

- USD/CNH couldn't find much traction sub 6.8200 in early trade. We last sat near this level, while the CNY fixing was modestly on the firmer side. Onshore equities have dipped further into the red as the session has progressed, but overall losses remain modest.

- 1 month USD/KRW has seen more downside in comparison. The pair is back to the 1266/67 region, around -0.45% down for the session so far. We are now back close to the 50-day EMA, against highs yesterday around 1279 Lower USD/JPY levels helped this pair, as did the better tone to local equities.

- USD/INR saw little follow through from early softness. The pair is back to the 82.70 level, little changed for the session. Onshore equities are higher, but bonds weaker following yesterday's CPI beat (5yr +4bps to 7.33%). Coming up later is wholesale prices for Jan, the Bloomberg survey median estimate is 4.50% and the prior print was 4.95%.

- USD/IDR is tracking lower in the first part of trade, with the pair back to 15165, -0.20% lower for the session so far. The pair remains wedged between key EMAs for now. On the topside is the 50 and 100 days (between 15260 and 15283 respectively), while on the downside is the 20 and 200 day (15122 and 15130 respectively). We did dip briefly below 15160 in early trade but follow through has been limited. Economic Affairs Minister, Airlangga Hartarto, stated the government will ask exporters to keep 30% of their earnings onshore 3 months, per Bloomberg reports. The policy is expected to yield $40-50bn in reserves in a 12 month period.

- PHP is underperforming the softer USD trend evident elsewhere in the region. Spot USD/PHP is basically unchanged for the session, last near 54.76. Recent dips sub 54.40 have been supported, while resistance was evident last week on the move above 55.00. Tensions with China are evident, with the authorities filing a protest with China over alleged behaviour in the South China Sea. This comes after the Philippines expanded US access to Philippines military bases, while over the weekend closer defense ties were agreed with Japan.

GOLD: Bullion Higher As USD Eases, Watch US CPI Later

Gold prices have been trending higher today and are up 0.3% to $1858.15/oz as the USD DXY is 0.2% lower. Bullion fell 0.65% on Monday despite dollar weakness but analysts expect a rise in the monthly change of headline US inflation in January published later today which may have weighed on the precious metal.

- Gold is currently trading close to its intraday high of $1858.58 and also its 50-day simple moving average. The low earlier was $1853.49. Near-term key support lies at $1855.5, the January 5 low. Given the USD is expected to weaken over the year, bullion should see upward pressure.

- Later US CPI data for January print and the annual rates are expected to ease further but headline could see a pick up in the monthly change to 0.5% m/m from 0.1% the previous month.

OIL: Crude Down But Fundamentals Remain Supportive

Oil prices have been trading in a narrow range during APAC trading but are down on the NY close. Brent is down 0.7% to around $86/bbl close and WTI is down 1.1% to $79.25, both are close to their intraday highs. The USD DXY is down 0.2%.

- Brent is trading above both the 50- and 100-day simple moving averages. The bull trigger is at $89 while support is $83.05, the February 9 low. WTI faces support at $76.52, the February 9 low, and initial resistance of $80.33, the February 10 low.

- Oil had rallied on news of Russia cutting output in response to sanctions but has now dropped again after the US DOE announced that it would sell 26mn barrels from its strategic petroleum reserve to offset the Russian cut. But going forward the market should be supported by improving Chinese demand, improved outlook for OECD growth and the cut to Russian output.

- Later US CPI data for January print and the annual rates are expected to ease further but headline could see a pick up in the monthly change to 0.5% m/m from 0.1% the previous month. The API also releases weekly inventory data and OPEC publishes its monthly market overview.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/02/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 14/02/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 14/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/02/2023 | 1000/1100 | *** |  | EU | GDP (p) |

| 14/02/2023 | 1000/1100 | * |  | EU | Employment |

| 14/02/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/02/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 14/02/2023 | 1330/0830 | *** |  | US | CPI |

| 14/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/02/2023 | 1600/1100 |  | US | Dallas Fed's Lorie Logan | |

| 14/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 14/02/2023 | 1800/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 14/02/2023 | 1905/1405 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.