-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Searching For Direction, Looking Ahead To U.S. CPI

- Tsys firmed in early trade as Asia-Pac participants seemingly paid more attention to the well-received 3-Year Tsy auction results and lack of fresh monetary policy steer from Fed Chair Powell, fading Tuesdays issuance-driven cheapening.

- Early USD resilience has given way to weakness. The BBDXY currently back sub 1237, -0.10/0.15% off NY closing levels. AUD has led the way, first boosted by positive data and then later rising commodity prices.

- Looking ahead, the data calendar is light ahead of tomorrow's US CPI print. Several ECB speakers will fill the void left by the lack of meaningful data.

US TSYS: Bull Flattening, Early Asia Richening Holds

TYH3 deals at 114-07, +0-07, a touch off the top of its 0-08+ range on volume of ~71K.

- Cash Tsys have bull flattened, dealing 2-4bp firmer across the major benchmarks.

- Tsys firmed in early trade as Asia-Pac participants seemingly paid more attention to the well-received 3-Year Tsy auction results and lack of fresh monetary policy steer from Fed Chair Powell, fading Tuesdays issuance-driven cheapening.

- Potential for easing of PBoCs monetary policy in H1 2023, via RRR and LPR cuts, in a bid to ensure “reasonably abundant liquidity” and lower financing costs for the real economy and property sector (via analysts commenting in a major state-run media outlet), may also have aided the bid at the margin.

- Tsys saw some brief pressure as weakness in Australian FI after stronger than expected Australian CPI and Retail Sales prints spilled over into the wider space, before paring losses.

- The richening marginally extended late in the session as the USD unwound its modest gains to trade softer.

- We have a thin docket in Europe today, further out MBA Mortgage Applications provides the only domestic data point of note. Participants will have one eye on the Dec CPI print tomorrow (see our full preview of the CPI release here). On the supply side we have the latest 10-Year auction.

JGBS: Futures Cheapen Into Close, Long End Leads After Decent Demand At Auction

JGB futures pull away from best levels to print -15 ahead of the bell. There hasn’t been much in the way of meaningful headline flow to tout, with ex-BoJ board member Shirai pointing to the benefits of a more flexible inflation target (a matter that is already being considered by the BoJ and government, per recent press reports), while suggesting that a fundamental shift in monetary policy is unlikely, stressing that the recent YCC tweak was based on promoting sustainable monetary policy.

- Cash JGBs sit 0.5-4.5bp richer across the curve, with the long end leading and intermediates lagging.

- A fairly well-received round of 30-Year JGB supply, coupled with a bounce from Tuesday’s lows in U.S. Tsys and an unscheduled round of 1- to 25+-Year BoJ Rinban purchases (in addition to unscheduled fixed rate 1- to 5-Year JGB purchases) helped support JGBs before the aforementioned pullback in futures into the close.

- That came after news that the Japanese MoF is looking at extending the average duration of JGBs on issue, coupled with pre-auction concession promoted some twist steepening of the curve in the Tokyo morning.

- Looking ahead, BoP data & BoJ Rinban purchases headline domestically on Thursday.

AUSSIE BONDS: Early Weakness Unwound

Futures pared their overnight/early Sydney losses losses, with YM finishing -1.0 & XM settling flat, while cash ACGBs were little changed to 1bp richer. Offshore cures shaped the general direction of travel throughout the day.

- Slightly firmer than expected monthly CPI data (+7.3 Y/Y headline and +5.6% trimmed mean vs. BBG survey expectations of +7.2% & +5.5%, respectively), coupled with a firmer than expected retail sales print (+1.4% M/M vs. BBG median +0.6%, alongside a revision to the prior month with the surprise -0.2% print adjusted to +0.4%), applied some brief pressure to the ACGB space, which pared back from extremes relatively quickly.

- The ABS noted that the CPI data is “indicating ongoing inflationary pressures.” Meanwhile, the retail sales print saw the data collator note that “the rise in turnover was driven by Black Friday sales, which boosted spending on clothing, footwear, furniture, and electronic goods.”

- The net message from this is that inflation/cost-of-living pressures remain acute in Australia, a matter the RBA is well aware of.

- Still RBA dated OIS did not move meaningfully on the back of the data, with terminal rate pricing continuing to hover a little below 3.90% come the close, a touch softer on the day, while the strip still prices 20bp of tightening for next month’s gathering.

- Bills finished flat to +4.

- EFPs were narrower on the day, suggesting support from swap flows.

- Offshore & supra issuers bought A$ paper in the 3- to 10-Year zone to market.

- Looking ahead, monthly trade balance data headlines the domestic docket on Thursday.

NZGBS: Back To Flat Come The Close, Particularly Tight Ranges Noted

NZGBs stuck to particularly narrow ranges on Wednesday, initially shifting cheaper at the margins in sympathy with Tuesday’s weakness in U.S. Tsys and Bunds, before closing at essentially neutral levels after Tsys moved away from session lows. This came as Asia-Pac participants looked to some of the more FI-supportive factors that were apparent during Tuesday’s wider session.

- The moves in NZGBs were much more muted than that seen in wider core global FI markets, including ACGBs and JGBs.

- Major swap rates were ~1.5bp lower across the curve, which meant that swap spreads were a touch tighter on the day, providing another supportive factor after swap rates tracked the early, modest cheapening in bonds.

- The major near-term RBNZ dated OIS measures were flat come the end of the local session, with 66bp of tightening priced for the Feb ’23 meeting, alongside a terminal OCR of ~5.50%.

- Lower tier local data saw an eighth straight M/M gain for filled jobs, while the ANZ commodity price index experienced an incremental dip in M/M terms.

- Looking ahead, building permits data headlines the domestic docket during the remainder of the week.

FOREX: USD Resilience Not Sustained

Early USD resilience has given way to weakness. The BBDXY currently back sub 1237, -0.10/0.15% off NY closing levels. AUD has led the way, first boosted by positive data and then later rising commodity prices.

- The AUD/USD currently sits above 0.6920, close to Tuesday highs, while on Monday we capped out around the 0.6950 level. We are 0.50% higher for the session. Better retail sales and CPI data boosted the AUD, but this didn't last, with little follow through response in the fixed income space. Iron ore above $120/ton and rising copper ($409 for CMX) have aided sentiment this afternoon, as optimism around firmer China demand remains a key theme.

- A firmer tone to regional equities has also helped.

- NZD/USD is next best at 0.6380/85, +0.20% for the session.

- USD/JPY found selling interest above 132.50 and last tracks under 132.20, still lagging the broader USD move at the margins. Lower US cash Tsy yields likely helped cap gains in the pair.

- EUR/USD is back to 1.0750, the pair not too far off recent highs around 1.0760.

- Looking ahead, the data calendar is light ahead of tomorrow's US CPI print.

NZD: Global Equity, Commodity & 2-Year Yield Correlations Firm

NZD/USD correlations with yield differentials have strengthened over the past week, standing out as a key macro driver in recent dealings. The table below presents levels correlations between NZD and key macro drivers (note the yield differential reflects swap rates).

- Recent strength in NZD, up ~3% off lows last week, looks to be associated with the continued recovery off December lows in global equities and global commodity prices. As well as the recent momentum of the 2-year yield differential.

- The easing in the VIX in recent dealing has also aided NZD/USD at the margin.

- Conversely, the recent weakness in Milk Futures hasn't weighed on the Kiwi, although the monthly correlation does remain relatively strong.

| 1wk | 1mth | |

| 2yr yield differential | 0.94 | 0.36 |

| 5yr yield differential | 0.61 | 0.22 |

| 10yr yield differential | 0.41 | -0.23 |

| Global commodity prices | 0.83 | 0.48 |

| Agriculture | 0.25 | -0.37 |

| Milk Futures | -0.61 | 0.59 |

| Global equities | 0.94 | 0.69 |

| US VIX index | -0.62 | -0.20 |

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Jan11 NY cut 1000ET (Source DTCC)

ASIA FX: USD/Asia Upticks Faded

Asian FX weakness hasn't persisted, with upticks in USD/Asia pairs sold into by the market. 6.8000 remains a resistance point for USD/CNH, while USD/CNY continues to track 100pips lower compared with offshore spot. The high yielders have also played some catch up over the past few sessions. Tomorrow focus is likely to rest on China inflation prints, while Indian CPI is also due.

- USD/CNH got above 6.7970 before selling interest emerged, as broader USD sentiment softened. The pair dipped towards 6.7700 before support emerged. The CNY fixing remains close to neutral from a trend standpoint.

- 1 month USD/KRW got near 1248, but the weaker USD against higher beta plays and resilient onshore equities helped sentiment. The pair last tracked at 1243. Employment growth continues to ease, while the first 10-days of trade data for January showed still soft export growth on an average daily basis.

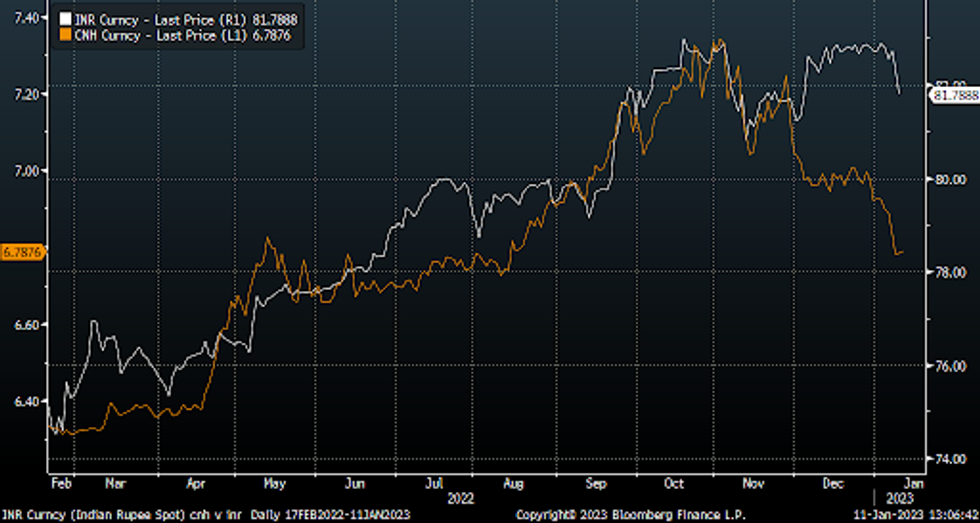

- USD/INR opened lower towards 81.60, before rebounding back to 81.80, but upticks have been sold by the market. The rupee outperformed yesterday, USD/INR had its largest single day gain since 11 Nov, down ~0.7%. In the past 2 sessions the Rupee has strengthened by ~94 paise, breaking below its 50-day EMA in the process, as it finally plays some catch up with the lower USD trade. Note the 100-day EMA sits just under 81.50. We haven't been below this level since early 2022, see the second chart below. On the wires tomorrow we have Nov Industrial Production and Dec CPI, before Dec Trade Balance on Friday.

- USD/IDR has also lost ground. The pair last at 15485, -0.57% lower for the session. Rupiah bulls will eye a test sub 15400, lows from early Dec. The authorities are considering expanding a regulation that requires export earnings to be kept in special bank accounts. This rule already applies for resource exports but could be expanded to the manufacturing sector.

CHINA DATA: Dec CPI & PPI On Tap Tomorrow

(MNI Australia) China Dec CPI and PPI print tomorrow. The market expects CPI to pick up to 1.8% y/y from 1.6% prior (forecast range is 1.4% to 2.2%). PPI disinflation is expected to moderate to -0.1% y/y from -1.3% prior (forecast range is -1.7% to 0.8%).

- Services related inflation likely remained under pressure/benign given the spike in domestic covid cases in the month and dampening of related activity/spending. This was suggested by the weaker official services PMI print for the month (although the Caixin services PMI was more resilient).

- This should keep the core inflation trend quite modest with the prior 3 months showing a 0.60% y/y outcome.

- Headline price pressures may be more influenced by food prices, although they looked more modest in December compared to November.

- The PPI rebound is largely expected to reflect base effects.

- Whilst the data is backward looking, particularly post the shift from CZS. However, with some onshore analysts, as reported by the Securities Journal today, still looking for easier policy settings (RRR and rate cuts) this year, tomorrow's data can still be informative from that standpoint.

INR: Rupee Firms, Can We Test 100-Day EMA?

USD/INR opened lower towards 81.60, before rebounding back to 81.70/75, slightly below yesterday's closing levels. The rupee outperformed yesterday, USD/INR had its largest single day gain since 11 Nov, down ~0.7%.

- In the past 2 sessions the Rupee has strengthened by ~94 paise, breaking below its 50-day EMA in the process, as it finally plays some catch up with the lower USD trade. The chart below overlays spot USD/INR versus USD/CNH.

- Flows related to Adani Enterprises R20,000 crore public offer, as well as Caryles purchase of a majority stake in VLCC may have also boosted demand for the INR (see this link for more details). A decline in demand for USD from oil importers also weighed on the pair.

- The near term technical outlook for the pair looks bearish, it is currently dealing below its 20 and (82.465) 50-day EMAs (82.22).

- Note the 100-day EMA sits just under 81.50. We haven't been below this level since early 2022, see the second chart below.

- On the wires tomorrow we have Nov Industrial Production and Dec CPI, before Dec Trade Balance on Friday. The inflation print will be more important in terms of the RBI outlook (see this link for some sell-side views).

Source: MNI - Market News/Bloomberg

Fig 2: USD/INR & Key EMAs

Source: MNI - Market News/Bloomberg

EQUITIES: Back On A Positive Footing

Regional equity sentiment has improved as the session progressed. Most of the major indices are tracking higher, while US futures haven't deviated too far away from flat, with eminis holding close to 3942 for now.

- Familiar themes still look to be in play. The HSI is up +1.3%, with the tech index +1.40%. In NY trade the Golden Dragon index rose over 1.7%. Signs of less regulatory overhang continue to benefit the tech related space.

- Mainland shares are also up, but only by a modest 0.15% for the CSI 300.

- Japan shares continue to recover, the Nikkei 225 up 1% at this stage. Positive earnings news supported in the electronics sector.

- The Kospi (+0.65%) has outperformed the Taiex (-0.35%), with offshore investors adding +$131.2mn to local Korean shares.

- The ASX200 is up nearly 15, as commodity prices (led by iron ore and copper) continue to gain on China recovery hopes.

- Indonesian stocks remain underperformers, down a further 0.5%.

GOLD: Holding Steady

Gold has remained within recent ranges during today's session. We dipped earlier towards the $1872 level before recovering. We now sit back near $1878, little change versus NY closing levels. As has been the case since the start of the week, gold is largely holding a $1870/$1880 range. The market is waiting for fresh impetus, no doubt with an eye on Thursday's US CPI print.

OIL: Edges Lower, US Inventory Numbers Eyed Later

Brent is lower, currently sitting not too far from lows for the week. We were last around $79.35/bbl. We remain comfortably within recent ranges, with resistance at $81.74 (20-day EMA) and support at $77.61 (Jan 5 low). WTI is following a similar trajectory, last around $74.35/bbl.

- Sentiment may have been weighed by the surge in US oil inventories reported by the API survey during Tuesday's US session. The EIA numbers later today in the US will likely carry more weight. If they confirm a strong inventory build it may weigh more on current spot momentum.

- Prompt spreads continue to signal a comfortable supply backdrop, although the sell-side consensus remains bullish in terms of the 2023 oil outlook. ING was the latest to join the bullish ranks, forecasting Brent crude will average more than $100/bbl in 2023.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/01/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 11/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/01/2023 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 11/01/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.