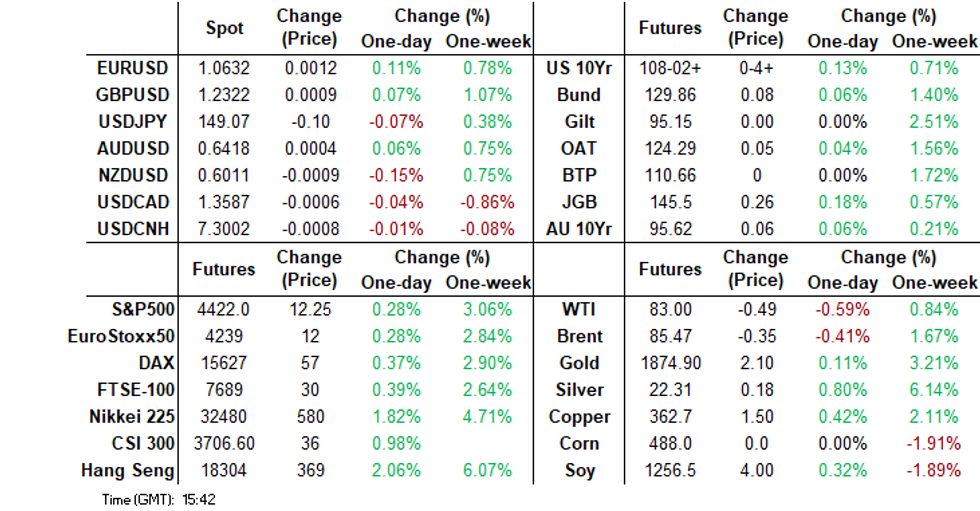

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - GOP Facing One Seat Majority In House

MNI US MARKETS ANALYSIS - USD/JPY Erases Election Rally

MNI US OPEN - RBNZ Cuts 50bps, OCR Forecast Slightly Higher

MNI EUROPEAN MARKETS ANALYSIS: US CPI Coming Up, China Inflation & Trade Out Tomorrow

- The first part of the session saw oil benchmarks drifting lower. WTI got to lows just under $82.80/bbl, which unwound all of the gains post Hamas's surprise attack on Israel over the weekend. WTI recovered some ground from there.

- China's mainland shares have tracked higher, along with the main Hong Kong Bourses. Reports of China's sovereign wealth fund buying local bank stocks has been a source of support. Tomorrow, we get China September inflation and trade figures.

- US Tsys ticked away from early session highs, there was no obvious headline driver for the move lower; perhaps local participants used the recent richening to close long positions ahead of today's CPI print.

- Prior to the CPI print from the US, August GDP print from the UK is due. We also have some Fed speak from Bostic.

MARKETS

US TSYS: Marginally Cheaper In Asia, CPI On Tap

TYZ3 deals at 108-02, +0-04, a 0-05 range has been observed on volume of ~65k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Tsys ticked away from early session highs, there was no obvious headline driver for the move lower; perhaps local participants used the recent richening to close long positions ahead of today's CPI print.

- The move lower didn't follow through with the proximity to todays CPI print limiting activity and tsys held cheaper in narrow ranges for the remainder of the session.

- FOMC dated OIS remain stable pricing a terminal rate of 5.40% in December with ~60bps of cuts by September 2024.

- The highlight of today's session is the aforementioned CPI print, we also have Fedspeak from Logan, Bostic and Collins as well as the latest 30-Year Supply.

JGBS: Futures Richer, Twist-Flattening Of the Curve, Awaiting US CPI Data

JGB futures are richer at 145.51, +27 compared to the settlement levels, slightly below the high of 145.58 set in the Tokyo morning session.

- In addition to the previously outlined domestic data drop, which included PPI data, local participants have had to digest a speech from BOJ Board Member Noguchi. Noguchi stated that “the biggest focus is whether wage hike momentum will be maintained or not.” He added that “Japan needs to shake off the 'zero norm' of prices and wages in order for a nominal wage increase to exceed 2% as a trend” and “3% nominal wage growth would correspond with a 2% inflation target”.

- Local participants have also likely been on US tsys watch ahead of US CPI data later today. Cash US tsys sit ~1bp cheaper across the major benchmarks.

- The cash JGB curve has bull-flattened beyond the 1-year (+1.0bp), with yields 0.5bp to 5.1bps lower. The benchmark 10-year yield is 1.4bps lower at 0.755% versus the cycle high of 0.814% set late last week.

- The swaps curve has twist-flattened, pivoting at the 3s, with rates 0.1bp higher to 1.8bps lower. Swap spreads are generally wider across maturities.

- Tomorrow, the local calendar sees Weekly International Investment and M2 & M3 Money Flows.

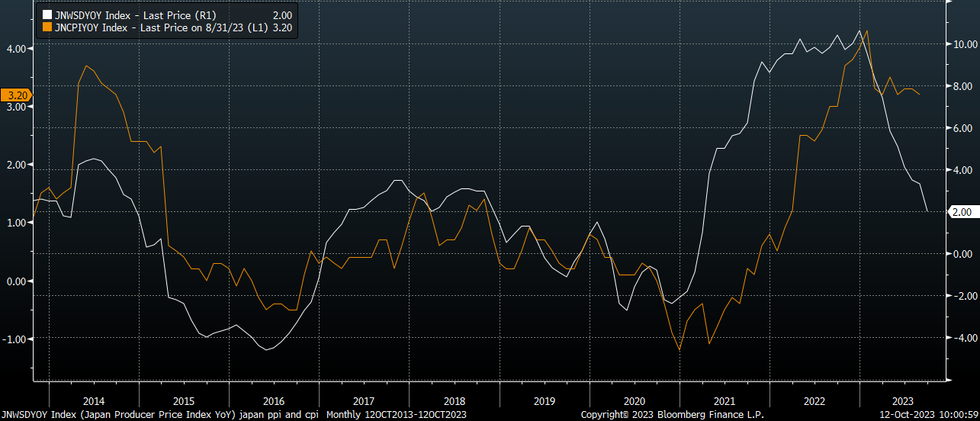

JAPAN DATA: PPI Downtrend Continues

Japan data has printed for PPI, machine orders and bank lending. Most focus is likely to rest on the September PPI, which came in weaker than expected. In m/m terms we fell -0.3%, versus a +0.1% forecast and 0.3% prior. This left y/y momentum at 2.0%, versus 2.4% forecast and 3.3% prior.

- The main drag in m/m terms came from petroleum, coal (-4.1%), and utilities (-2.4%). Manufacturing was also down modestly (-0.3%). In y/y terms it is hard to find many sub-categories with stronger momentum compared to August.

- The chart below overlays the PPI y/y, versus headline CPI for Japan, also in y/y terms.

- Still, import prices rose 2.1% m/m, as petroleum, coal, gas, rose 4.5% for the month. Import prices remain in deep negative territory in y/y terms though.

- August core machine orders were down -0.5% m/m (against a 0.6% forecast rise). In y/y terms, we fell -7.7%, against a -6.7% forecast. We are up from recent cyclical lows but only modestly.

- Bank lending trends for September were similar to August, +2.9% y/y.

Fig 1: Japan PPI & CPI Y/Y

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Richer, Narrow Ranges, AU-US 10Y Differential Too Negative

ACGBs (YM +3.0 & XM +7.0) sit richer after dealing in relatively narrow ranges in the Sydney session. The local calendar was light today, with the previously outlined October Consumer Inflation Expectations as the sole release.

- Hence, local participants have likely eyed US tsy dealings in the Asia-Pac session for guidance ahead of the release of US CPI later today. Cash US tsys sit ~1bp cheaper across the major benchmarks. Bloomberg consensus is expecting core CPI to print +0.3% m/m (4.1% y/y) in September versus +0.3% and 4.3% prior.

- Cash ACGBs are 3-7bps, with the AU-US 10-year yield differential 1bp higher at -21bps.

- A regression of the AU-US cash 10-year yield differential and the AU-US 1Y3M swap differential over the current tightening cycle indicates that the 10-year yield differential is currently 27bps too negative versus its fair value (i.e., -21bp versus +6bp). (See link)

- Swap rates are 2-7bps lower, with the 3s10s curve flatter and EFPs little changed.

- Bills strip pricing is mixed, -1 to +3.

- RBA-dated OIS pricing is flat to 3bps softer across meetings. Terminal rate expectations sit at 4.19%.

- Tomorrow, the local calendar is empty.

AU/US BONDS: AU-US 10-Year Yield Differential Way Too Negative

Today, the AU-US 10-year cash yield differential is 1bp higher at -21bp after the cash US Tsy 10-year finished 10bp richer on Wednesday.

- At -21bp, the cash AU-US 10-year yield differential is currently in the lower part of the range of -30bp to +25bp which has been observed since November.

- The narrowing in the 10-year yield differential from +25bp in mid-June can be attributed to an 80bp narrowing in the AU-US 3-month swap rate 1-year forward (1y3m) over that period. The 1y3m differential is a proxy for the expected relative policy path over the next 12 months.

- However, a simple regression of the AU-US cash 10-year yield differential and the AU-US 1Y3M swap differential over the current tightening cycle indicates that the 10-year yield differential is currently 27bp too negative versus its fair value (i.e., -21bp versus +6bp).

Figure 1: AU-US Cash 10-Year Yield Differential (%) Vs. Regression Fair Value (%)

Source: MNI – Market News / Bloomberg

NZGBS: Richer But Closed At Session Cheaps, Awaiting US CPI Data

NZGBs closed richer but at session cheaps, with benchmark yields 3-5bps higher. Despite a flurry of domestic news, including updates on REINZ house prices, food prices, and the release of the RBNZ annual report, none of these factors significantly impacted the market.

- Local participants seemed to be more attuned to the developments in US tsy dealings during the Asia-Pac session, especially in the wake of yesterday’s twist flattening.

- US tsys have been marginally pressured in recent dealing, although there hasn’t been any headline driver. Perhaps local participants are using the recent richening to close long positions ahead of this evening’s CPI print. Cash US tsys sit ~1bp cheaper across the major benchmarks.

- It's worth noting that NZGBs exhibited a slight underperformance versus US tsys, with the NZ-US 10-year yield differential finishing 1bp wider.

- The relatively low cover ratios, in the 2.5-3.0x range, seen at today’s bond auctions possibly contributed to the weaker relative performance.

- Swap rates closed 1-6bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 2bps softer across meetings. Terminal OCR expectations closed 1bp softer at 5.69%.

- Tomorrow, the local calendar sees Business NZ Mfg PMI and Card Spending data.

- Before that, attention turns to the release of US CPI data for September later today.

FOREX: Narrow Ranges In Asia

There have been narrow ranges across the G-10 space in Asia, with little follow through on moves. US Tsy Yields are a touch firmer across the curve and Oil is lower briefly erasing all the gains seen since the Hamas attack on Israel. US Equity Futures are firmer as are regional equities.

- AUD/USD is marginally firmer and last prints at $0.6415/20. Technically the outlook remains bearish, support comes in at $0.6287 2.00 projection of the Jun 16-Jun 29-Jul 13 price swing. Resistance is at $0.6445, high from Oct 11.

- Kiwi is the weakest performer in the G-10 space. NZD/USD fell ~0.3% from peak to trough, however the move didn't follow through and the pair now sits ~0.1% below opening levels.

- Yen is little changed and is consolidating above ¥149 this morning. USD/JPY is still in an uptrend, key support is at ¥147.43 the low from Oct 3 and resistance is at ¥150.16 high from Oct 3 and bull trigger.

- Elsewhere in G-10 CHF is the strongest performer at the margins however liquidity is generally poor in Asia.

- The highlight of todays session is the September CPI print from the US. Prior to that in Europe the August GDP print from the UK is due.

EQUITIES: Broad Based Gains, China Buying Of State Banks Aids Sentiment

Regional Asia Pac equities are higher pretty much across the board. Strong gains have been evident for Hong Kong and China mainland shares, as well as Japan and South Korea. The follows positive US gains in Wednesday trade, while US futures have maintained positive momentum today. Eminis were last near 4422, back close to both the 50 and 100 day simple MAs. Nasdaq future are up by 0.29%, matching Emini gains.

- Sentiment has likely been aided by a tick down in oil benchmarks, as the risk of escalating Middle East conflict appears to have subsided for now. Still, US yields are a touch higher.

- China's mainland shares have tracked higher into the break, near +1% for the CSI 300. Reports of China's sovereign wealth fund buying local bank stocks has been a source of support (see this BBG link).

- Hong Kong shares are also tracking higher, the HSI near session highs, with gains close to 2%.

- Japan's Topix is +1.3%, while the Nikkei 225 is around 1.6% higher. The tech sensitive electrical appliances sector is leading the move. Bets the Fed is complete in terms of its tightening cycle is aiding broader sentiment in the space.

- Similarly, the Kospi is up 1%, building on yesterday's impressive gain, while the Taiex is up 0.65%.

- In SEA, Singapore's benchmark is up nearly 1%. Thailand stocks are down modestly, but this follows strong gains yesterday.

OIL: Oil Erases Post Weekend Gains Before Stabilizing

The first part of the session saw oil benchmarks drifting lower. WTI got to lows just under $82.80/bbl, which unwound all of the gains post Hamas's surprise attack on Israel over the weekend. WTI recovered some ground from there, the benchmark last near $83.10/bbl. This leaves us down a further 0.45%, following Wednesday's 2.88% loss.

- Brent was last near $85.60/bbl, down modestly from Wednesday closing levels and having followed a similar trajectory to WTI.

- Focus remains on risks of escalation in the Israel/Hamas conflict, particularly in terms of Iran. However, US intelligence agencies have reportedly stated they don't have any evidence Iran directed the Hamas attack (see this BBG link for more details). Still, the US authorities aren't ruling out fresh sanctions against Iran.

- Outside of geopolitics, coming up in the US session is official oil inventory data.

GOLD: Rallies Into 20-Day EMA

Gold is 0.2% higher in the Asia-Pac session, after closing 0.8% higher at 1874.36 on Thursday.

- Lower bond yields, dovish Fedspeak and increased geopolitical risks combined to promote a bid for the yellow metal.

- There is a growing consensus among US policymakers in favour of a more cautious stance regarding further monetary tightening. Recent dovish statements from officials such as Atlanta Fed President Raphael Bostic, Vice Chair Philip Jefferson, and Dallas Fed President Lorie Logan have prompted STIR to reduce their expectations for additional rate hikes this year.

- The focus now turns to US CPI data, which is released later today.

- Bulls will now look to breach the 20-day EMA ($1,878.2/oz), in a bid to turn the technical tide more in their favour, according to MNI’s technicals team.

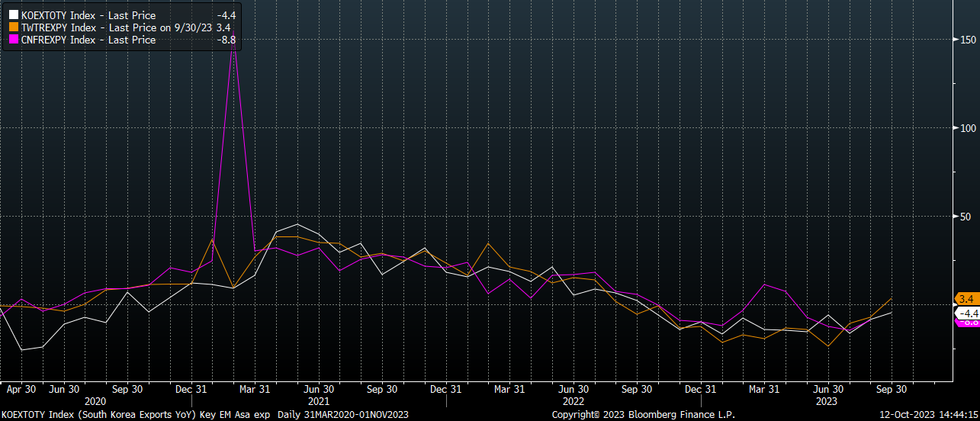

CHINA DATA: Modest Improvement Expected In Price & Trade Trends

A reminder that tomorrow delivers September inflation data and trade figures.

- The market expects CPI y/y at 0.2% (forecast range is -0.1% to 0.3%, prior was 0.1%). The PPI is projected at -2.4% y/y (forecast range is -2.2% to -2.8%, prior was -3.0%).

- The official manufacturing PMI prints for September showed an increase in both input prices (59.4 from 56.5) and output prices (53.5 form 52.0). The non-manufacturing PMI saw price measures rises as well, albeit by a lower magnitude.

- Base effects may also aid the PPI, while energy prices have generally been trending higher.

- CPI may be impacted by volatile pork prices, which surged +11% in August. Some retracement may flow through to the broader food index. Better retail spending trends may aid the non-food basket at the margin.

- On the trade side, exports are expected at -8.0% y/y (forecast range is -6.0% to -12.0%, prior -8.8%). Imports are forecast at -6.3% y/y (forecast range is -1.0% to -7.5%, prior -7.3%). The trade surplus is projected at $70.60bn (prior $68.20bn).

- South Korea and Taiwan export figures have already printed for September, surprising on the upside (particularly for Taiwan). This suggests some modest upside risks for tomorrow's China export print, see the chart below (China is the pink line). Still, there have been divergences in the trends of each series in recent years.

- The manufacturing PMI export sub index rose in September to 47.8, still sub the 50.0 expansion/contraction point, but 0.8ppts higher on levels from a year ago.

Fig 1: North East Asia Export Trends

Source: MNI - Market News/Bloomberg

SINGAPORE: MNI MAS Preview - October 2023: No Change, Focus On Next Policy Step

- The broad sell-side consensus is for no change in the major MAS policy parameters, with the slope of the SGD NEER, band width and mid point all expected to remain unchanged at tomorrow’s policy announcement. This is also our firm bias.

- The focus for the MAS is likely to be on the balance between inflation pressures and a generally softer growth backdrop. Price pressures are cooling, but remain elevated by historical standards. It's likely to be too early for the central bank to be comfortable with the inflation backdrop to reduce the pace of SGD NEER appreciation.

- Current levels of the SGD NEER (based off Goldman Sach estimates) put the index around -0.45% below the top-end of the policy band. If the market was expecting further MAS tightening we would arguably be closer to the end of the policy band ahead of tomorrow's announcement.

- Full preview here:

ASIA FX: Baht Continues To Rally, Mixed USD/Asia Trends Elsewhere

USD/Asia pairs have been mixed today, albeit with baht continuing to recover. Elsewhere, overall moves have been modest. This comes despite generally positive equity tones in the region, although we do have the US CPI print later. Still to come today is Indian CPI and IP figures. Tomorrow, we have the Singapore MAS decision, along with China inflation and trade figures.

- USD/CNH has once again held very tight ranges, last near 7.3000. The CNY fixing was steady, but the error term re-widened, while HK and mainland equities have risen. State buying of local China banks has certainly aided sentiment, but has not benefited the FX.

- 1 Month USD/KRW has remained within recent ranges. The earlier move above 1341 was faded, but moves sub 1336 have been supported. Onshore equities have continued to recover, up a further 0.80%, amid stronger tech related sentiment more broadly. Still, offshore investors are not participating, with a further -$131.4mn in outflows so far today.

- USD/TWD has recovered some ground today, rising 0.12% so far to put the pair back near 32.15. We are down from session highs above 32.20. It comes despite a beat from September exports late yesterday, (+3.4% y/y). All else equal a better export backdrop should aid the TWD outlook. Local equities remain firmer as well (+0.85%), while yesterday saw a chunky +$728.2mn of offshore inflows.

- The baht continues to outperform, rising a further 0.75% in the first part of trade. This puts the pair back into the 36.10/15 region, which is near late September levels. We are comfortably below the 20-day EMA (36.44), with the 50-day back at 35.89 and potentially the next downside target. Outside of the broader USD pull back, the baht is benefiting from local equities on a firmer footing. The local index rose 1.50% yesterday (it is flat in the first part of trade today), while offshore investors bought $80mn of local shares, bringing week to date flows to +$125.5mn. If maintained this would be the strongest pace of inflows since May this year.

- The Rupee has opened dealing in line with yesterday's closing levels, sitting at 83.15/16, in a muted start to Thursdays trading. In yesterdays dealing USD/INR printed a 2 week low before support came in at the 20-Day EMA (83.14) and losses were pared as broader USD trends dominated flows. The pair finished dealing down ~0.1%. On tap today we have September CPI, the figure is expected to tick lower and back into the RBIs target band at 5.40% Y/Y.The prior was 6.83%. August Industrial Production is also due, a rise of 9.1% Y/Y is expected.

- The SGD NEER (per Goldman Sachs estimates) is little changed in early dealing on Thursday and remains well within recent ranges. The measure sits ~0.4% below the top of the band. USD/SGD is holding below the 20-Day EMA ($1.3651), support has come at ahead of $1.36 as the pair consolidates in a narrow range this morning. We sit at $1.3615/20, ~0.1% below opening levels. Due early in tomorrow's session is the latest MAS Monetary Policy Statement, all 18 economists in the Bloomberg survey expect no change to policy and see no change to the $NEER policy band. Also on the wires is the Advance read of Q3 GDP, a 0.4% Y/Y rise is expected.

- USD/MYR continues to consolidate in narrow ranges, there have been little follow through on moves in recent dealing. The pair has trimmed some of yesterday's losses alongside an uptick in US Tsy Yields and last prints at 4.7180/4.7210, ~0.1% higher. Industrial Production fell 0.3% Y/Y in August, a fall of 2% had been expected.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/10/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/10/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 12/10/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 12/10/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/10/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/10/2023 | 0740/0940 |  | EU | ECB's Elderson attends EC Summit | |

| 12/10/2023 | 0900/1000 |  | UK | BoE's Pill speaks in Marrakesh | |

| 12/10/2023 | 1100/1300 |  | EU | ECB's Panetta participates in IMF panel | |

| 12/10/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 12/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 12/10/2023 | 1230/0830 | *** |  | US | CPI |

| 12/10/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 12/10/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 12/10/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 12/10/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 12/10/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/10/2023 | 1700/1300 |  | US | Atlanta Fed's Raphael Bostic | |

| 12/10/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/10/2023 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/10/2023 | 2000/1600 |  | US | Boston Fed's Susan Collins |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.