-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: US Strikes Iranian-Linked Targets In Syria

- Market fallout following reports that the US military has conducted strikes against Iranian-linked facilities in Syria has been fairly limited so far. Oil prices are pushing higher, but US equity futures remains close to session highs following bellwether earning beats late on Thursday US time. The USD is also modestly softer.

- Elsewhere, JGB futures are richer and at session highs, +21 compared to settlement levels, after initially cheapening on the back of higher-than-expected Tokyo CPI data. US Cash tsys sit ~1bp cheaper across the major benchmarks.

- In Europe today the docket is thin, further out we have US PCE deflator, personal spending and income and University of Michigan consumer sentiment.

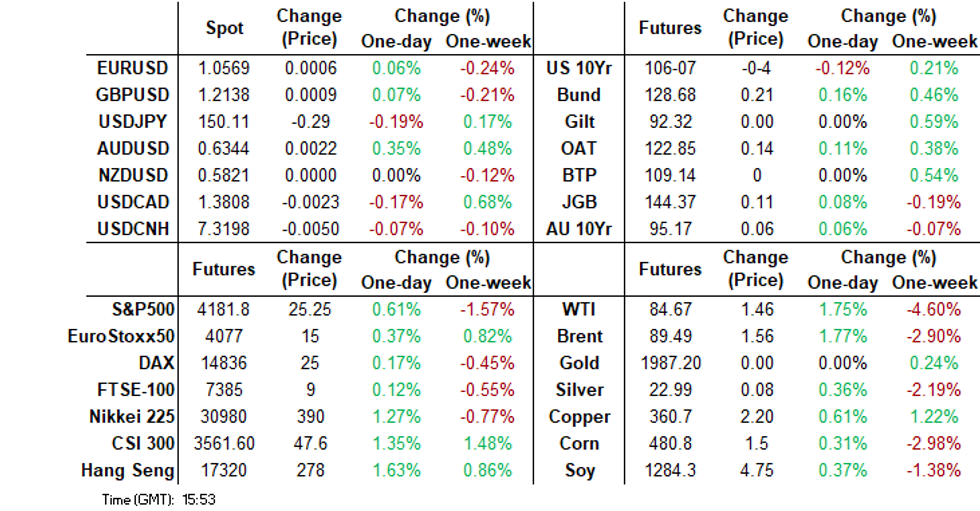

MARKETS

MIDEAST: US Military Strikes Iran-Linked Targets In Syria

Headlines have crossed that the US military has conducted strikes against Iranian-linked facilities in Syria (see this BBG link). Defence Secretary Austin stated that two facilities in eastern Syrian were struck and that these were described as self defence strikes. This follows attacks against US service personnel in Iraq and Syria in recent weeks.

- Austin added that the US does not seek to escalate the conflict but that the US will defend itself. The strikes should also be seen as separate to this current Israel- Hamas conflict.

- These strikes come after an earlier Washington Post report that the Biden Administration was considering such action (see this link).

US TSYS: Marginally Cheaper In Asia

TYZ3 deals at 106-08+, -0-02+, a 0-05 range has been observed on volume of ~84k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Tsys have observed narrow ranges in Asia today, there was a brief move lower in early dealing. There was no headline driver as participants perhaps focused on Thursday GDP print.

- The move lower didn't follow through and Tsys dealt in narrow ranges for the remainder of the session.

- In Europe today the docket is thin, further out we have US PCE deflator, personal spending and income and University of Michigan consumer sentiment.

JGBS: Futures At Session Highs Despite Tokyo CPI Beat, BOJ Policy Decision On Tuesday

JGB futures are richer and at session highs, +21 compared to settlement levels, after initially cheapening on the back of higher-than-expected Tokyo CPI data.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Tokyo October CPI data.

- Bloomberg reports that Japan’s life insurers plan to boost holdings of unhedged foreign debt while approaching purchases of yen-denominated bonds with caution as they seek clarity on when the central bank may adjust policy. (See link)

- The cash JGB curve has slightly twist-flattened, pivoting at the 5s, with yields 0.7bp higher to 1.5bps lower. The benchmark 10-year yield is 0.4bp lower at 0.871%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also lower than the cycle high of 0.892% set yesterday.

- Swap rates are also slightly mixed, with swap spreads mixed.

- On Monday, the local calendar sees Jobless Rate, Retail Sales, Dept. Store and Supermarket Sales and Industrial Production data, along with 2-year supply.

- The BOJ’s Policy Decision is due on Tuesday, with the prevailing consensus anticipating that the BOJ will uphold its existing policies. In a Reuters survey of economists conducted between October 17-25, 25 out of 28 economists expected no change in policy.

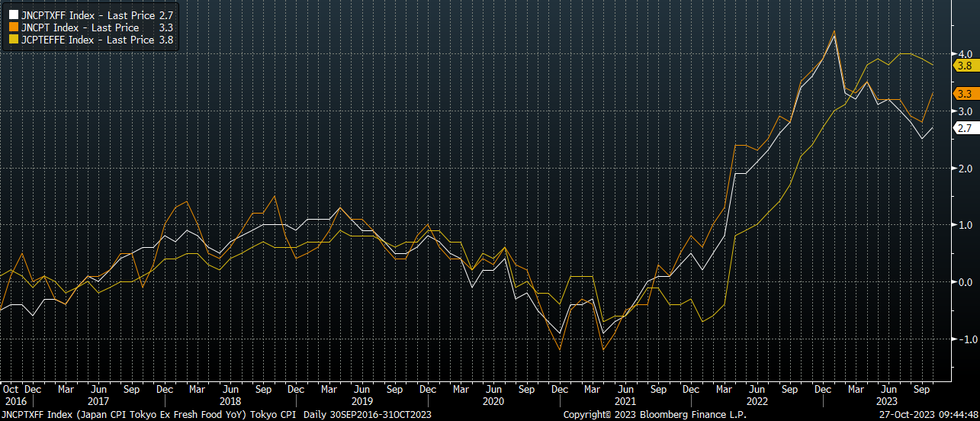

JAPAN DATA: Tokyo CPI Headline Comfortably Above Expectations, As Utility Prices Rebound

The Tokyo October CPI print comfortably beat expectations in terms of the headline. We printed at 3.3% y/y, versus 2.8% forecast (prior was 2.8%). The ex fresh food (core) measure was 2.7%y/y, versus 2.5% forecast (2.5% prior). The core measure which excludes fresh food and energy came in at 3.8%y/y, versus 3.7% expected (prior was 3.9%). See the chart below.

- In terms of the detail, prices were up 0.9% m/m (seasonally adjusted). The core measure rose 0.7%m/m, versus flat in September. The core measure excluding energy as well was also firmer at 0.3% m/m, but only modestly above the September 0.1% pace.

- Goods inflation rose 1.6% m/m (0.4% prior), while services inflation rose 0.4% m/m (flat prior).

- The upside headline surprise was mainly driven by utilities (+7.4% m/m, versus -2.6% in September). Food price gains remained solid as well. Parts of services also picked up - transport, communication (+0.5%), entertainment (1.5%) and medical (+0.1%). These sub-indices were negative in September.

- At the margin the data should be a hawkish development for the BoJ, particularly with core inflation barely off cyclical highs (although base effects become more favorable in months ahead). Note next Tuesday sees the BoJ meeting outcome.

- USD/JPY has been relatively steady post the data though, only down marginally, the pair last near 150.35.

Fig 1: Tokyo CPI Y/Y

AUSSIE BONDS: Richer, Narrow Ranges, Retail Sales On Monday

ACGBs (YM +4.0 & XM +7.5) are richer, mid-range, after subdued dealings in the Sydney session. With the domestic data docket light today (Q3 PPI the only release), local participants have been on headlines and US tsys watch. US tsys ~1bp cheaper in today’s Asia-Pac session, after yesterday’s strong rally.

- Cash ACGBs are 4-7bps richer, with the AU-US 10-year yield differential 4bps higher at -6bps.

- Swap rates are 2-6bps lower, with the 3s10s curve flatter.

- The bills strip is slightly richer, with pricing flat to +3.

- RBA-dated OIS pricing is 1-4bps softer across meetings. The market currently attaches a 67% chance of a 25bp hike at November’s policy meeting. Terminal rate expectations sit at 4.45%, the highest level since late July.

- Next week, the local calendar sees Retail Sales on Monday, followed by Private Sector Credit, CoreLogic House Prices and Judo Bank PMIs on Tuesday.

- On Wednesday, the AOFM plans to sell A$800mn of the 4.50% Apr-33 bond.

- AFR reports that “Investments managed by the Future Fund slid a half percentage point in the September quarter to $205.2 billion as Australia’s sovereign wealth fund readied itself for further inflation and the potential for the Middle East conflict to escalate into a regional war.” (See link)

AUSSIE BONDS: Firm Pricing For ACGB Sep-26 Supply

The latest round of ACGB Sep-26 supply sees the weighted average yield print 1.76bps through prevailing mids (per Yieldbroker), extending the recent trend of firm pricing at ACGB auctions.

- While our anticipation of sustained strong pricing at auctions held true, it's noteworthy that the cover ratio saw a noticeable decline to 4.0312x, down from the previous 5.24x. It's essential to recognise, however, that market conditions now differ from those in early March.

- The attainment of cycle yield highs for this particular bond line appears to have provided some sort of offset for uncertainty around the RBA policy outlook stemming from this week's CPI data release. Moreover, the line's hedgability, thanks to its inclusion in the YM futures basket, and its status as a 3-year benchmark, looks to have contributed positively to demand.

- Nonetheless, the more than 50bp steepening of the yield curve since mid-June may have exerted some constraints on today's bidding.

- Following the supply, there has been a modest weakening observed in YM futures. It's possible that the slight cheapening in US tsys during the Asia-Pacific session may have played a role in this move. The April 2026 bond is trading 0.5bp cheaper compared to pre-auction levels.

NZGBS: Slightly Richer, Close At Cheaps, Heavy Local Calendar Next Week

NZGBs closed flat to 2bps richer after dealing in relatively narrow ranges for today’s local session. Nevertheless, NZGBs did close at or near session cheaps.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined ANZ consumer confidence data. To recap, ANZ believed the survey was “another mixed bag for the RBNZ - willingness to spend is low, as the RBNZ requires, but consumers’ inflation expectations are still inconsistent with the inflation target, and there hasn’t been much progress on that front in recent months.''

- Swap rates closed flat to 2bps lower, with the 2s10s curve steeper. The implied swap spread box steepened by 4bps.

- RBNZ dated OIS pricing closed flat to 2bps softer across meetings, with terminal OCR expectations at 5.61%.

- Looking ahead to next week, the local calendar presents a rather light schedule on Monday, with Building Permits and ANZ Business Confidence set for Tuesday. Wednesday is expected to bring significant releases, featuring CoreLogic House Prices, Employment, and Wages data, along with the publication of the RBNZ's Financial Stability Report.

- Next Thursday, the NZ Treasury plans to sell NZ$225mn of the 4.5% May-30 bond, NZ$175mn of the 4.25% May-34 bond and NZ$100mn of the 2.75% May-51 bond.

FOREX: USD Marginally Lower In Asia

The greenback ticked lower in Asia on Friday, BBDXY is down ~0.1%. US Equity Futures have pared some of Thursday's losses, e-minis are up ~0.5%, and US Tsy Yields are a touch firmer.

- The AUD is leading the bid in the G-10 space, AUD/USD is up ~0.2% at $0.6335/40. Technically The bearish outlook for AUD/USD is intact, support comes in at $0.6270 the Oct 26 low and key support. Resistance is at $0.6414, 50-Day EMA.

- Kiwi is little changed today, a narrow $0.5820/30 range has persisted for the most part. AUD/NZD has ticked higher, the pair continues to consolidate between the 200-Day EMA and the $1.09 handle.

- Yen is a touch firmer today. The uptrend remains intact, resistance now comes in at ¥151.09, 2.674 proj of the Jul 14-21-28 price swing. Support is at ¥149.37, the 20-Day EMA.

- Elsewhere there have been little moves of note in G-10 space.

- The docket is light in Europe today.

FX VOL: Implied Volatility Remains Stable

1-Month Implied volatility in FX markets, measured using the JP Morgan G-10 Volatility Index, sits well within recent ranges and has been ticking lower in recent dealing.

- The index sits at 7.71%, well within the range observed since April, we did print as high as 8.67% in early October.

- Implied volatility across G-10 FX remains relatively stable despite the Israel/Hamas conflict, rising US Tsy Yields and falling US Equities.

Fig 1: JPMorgan 1-Month G10 FX Volatility

Source: JP Morgan/MNI/Bloomberg

EQUITIES: Sentiment More Positive, Aided By Nasdaq Future Gains

Regional equities are mostly higher in Asia Pac Friday trade to date. All the major indices are firmer, albeit away from best levels. Some parts of SEA are tracking weaker though (Philippines and Thailand). Weakness in Thursday US and EU cash trading has been offset by a better tone to US futures today, led by Nasdaq gains (0.80%). Eminis are also higher, last near 4180, +0.55% for the session.

- Better momentum for Amazon and Intel who posted positive earnings updates in late in US trade on Thursday has aided the futures backdrop.

- Japan's Nikkei 225 is +1.2% higher, the Topix near +1.1% firmer. The electrical appliances sector is leading gains, while BBG notes Japan equity short bets may be close to a peak (see this link).

- Other markets in NEA are more muted. The Kospi opened higher, but is now back to flat. Foreign selling continues to outpace institutional and retail buying. The Taiex is around 0.50% higher.

- In Hong Kong the HSI is up 1% at the break, while the CSI 300 also continues to firm, up 0.60%.

- In SEA, the Philippines PCOMP is off a further 0.80% to sub 6000. Fallout from yesterday's off-cycle rate hike weighing. In Thailand, the MoF has revised down its 2023 growth forecast to 2.7% (from 3.5%, RTRS), with the SET down by around 0.30% at this stage.

OIL: Benchmarks Recoup Some Of Thursday's Losses

Brent crude has spent most of the session tracking higher, last just above $89/bbl. This puts us +1.25% above Thursday closing levels in NY. We are still tracking comfortably lower for the week, at this stage -3.40%. The WTI benchmark has tracked a similar trajectory, last near $84.30/bbl, but this benchmark is down a little over 5% for the week.

- Oil's rise today is line with a firmer risk-on tone in other asset markets. Most notably US equity futures are higher, led by better earning results in the tech space. The USD is also down a touch.

- In the Middle East, the US military struck two targets in Syria in response to earlier attacks on US military personnel in both Iraq and Syria. The targets were linked to Iran, but the US stated they weren't linked to the Israel/Hama conflict.

- Iran stated the US won't be spared if the Israel-Hamas conflict spreads (see this BBG link for more details).

- Still, concerns around a wider Middle East conflict, coupled with tight supply, have been overshadowed this week by a firmer USD/weaker equity backdrop, which has driven oil benchmarks to weekly losses.

GOLD: Thursday’s Gains Supported By The Middle East Conflict, A Weaker USD & Lower US Yields.

Gold is +0.2% in the Asia-Pac session, after closing 0.25% higher at $1984.71 on Thursday.

- This precious metal rebounded from a low of $1,971.87, driven by a weakening USD.

- Furthermore, gold continues to reap the benefits of the ongoing Middle East conflict, although the somewhat erratic trading in US Treasuries has added a level of uncertainty to the outlook.

- However, on Thursday, we observed a significant decline in yields across the US Treasury curve following the release of the latest round of US data. Participants appeared to focus on the weaker-than-forecast Core PCE Price Index (+2.4% q/q versus +2.5% est. and +3.7% prior) and Jobless Claims (210k versus 207k est. and 198k prior), which were at their highest in 5 months.

- Additional support was seen in the US Treasury space after solid demand metrics for the latest 7-year auction.

- Resistance for bullion is seen at $1997.2 (Oct 20 high), according to MNI’s technicals team.

ASIA FX: USD Modestly Softer, IDR Struggles To Find Traction

USD/Asia pairs are mostly lower, but away from lows for the session (IDR has been the exception, weakening modestly). Positive regional equity market sentiment, for the most part, has helped, while the USD has slipped modestly against most of the majors. The data calendar is light at the start of next week. Note that China PMIs print on Tuesday.

- USD/CNH sits lower, last near 7.3200, but remains well within recent ranges. Onshore equities continue to recover (+1% for the CSI 300), while industrial profit growth slowed in September but remains above +10% y/y. Foreign Minister Wang is scheduled to meet US President Biden later today.

- Spot USD/HKD has drifted back sub 7.8200, in line with some broader USD softness in Friday dealings. Some signs of stability in Hong Kong equities are also likely helping at the margin. The pair was last near 7.8195, with earlier lows close to 7.8180. We have spent most of the week drifting lower, although mid October lows near 7.8160 haven't been tested yet. On the upside, all the key EMAs rest between 7.8240 and 7.8300. The 20-day, near 7.8240, has presented a cap in recent sessions.

- The SGD NEER (per Goldman Sachs estimates) sits little changed this morning and remains well within recent ranges. The measure is ~0.5% below the top of the band. USD/SGD fell ~0.1% yesterday as broader USD trends dominated flows, the pair is below the $1.37 handle and testing the 20-Day EMA ($1.3685) today. The final read of Q3 URA Home Prices crossed this morning rising 0.8% Q/Q, ticking high from the prior 0.5% Q/Q.

- The Ringgit has firmed on Friday as onshore participants digest lower US Tsy Yields on Thursday. USD/MYR is ~0.3% lower and last prints at 4.7720/60. Looking ahead, the next release of note is next Wednesday's S&P Global October Mfg PMI. Next Thursday we have the latest BNM monetary policy decision, no change is expected.

- On Thursday USD/INR rose ~0.1% and finished dealing above the 20-Day EMA (83.1916) as broader USD flows dominated yesterday's dealing. At the open on Friday the pair sits in line with yesterday's closing levels at 83.22/23. Looking ahead, the next release of note is on 31 Oct which is Sep Fiscal Deficit and Eight Infrastructure Industry Survey. Next week also seeing S&P Global Mfg & Services PMI cross.

- USD/IDR hasn't enjoyed the softer USD sentiment seen elsewhere in Asian FX and in the majors so far in Friday trade. The pair was last near 15945, around 0.15% weaker in IDR terms and close to Monday highs (above 15960), which came before intervention headlines crossed. A BI spokesperson said earlier that an off cycle tightening by the central bank is unlikely (albeit not a 0% probability, see this BBG link). The next central bank meeting is on the 23rd Of November.

- USD/PHP is tracking lower in the first part of Friday dealing, last near 56.88. Note we closed yesterday at 56.97, so very close to the 57.00 resistance point. There was little positive follow through for the local currency follow yesterday's off-cycle rate hike by the central bank. A further BSP hike is likely given the hawkish rhetoric BSP Governor delivered ("feel a little bit behind", when they decided not to hike in September). The 2024 inflation forecast was also revised higher by the central bank.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/10/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 27/10/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/10/2023 | 0700/0900 | *** |  | ES | GDP (p) |

| 27/10/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/10/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/10/2023 | - |  | EU | ECB's Lagarde Participates in Euro Summit | |

| 27/10/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 27/10/2023 | 1300/0900 |  | US | Fed's Michael Barr | |

| 27/10/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 27/10/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.