-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI EUROPEAN MARKETS ANALYSIS: US Yields/USD Off Thursday Highs, Powell Speaks Next Week

- US Tsys have ticked higher through today's Asian session as Thursday's post CPI losses are trimmed with gains extending a touch in recent trade.

- This has seen the USD move off Thursday highs, although losses are modest at this stage. NZD has underperformed on softer local data.

- On the data front, China CPI was weighed down by lower food prices, while exports were slightly better than forecast. Imports were close to expectations, but commodity import volumes were down in the month. China and Hong Kong equities ticked higher on headlines (BBG) the authorities are considering launching a state backed market stabilization fund, but there was little positive follow through.

- In Europe today the docket is thin, further out we have Terms of Trade and UofMich Consumer Sentiment. Fedspeak from Philadelphia Fed President Harker crosses.

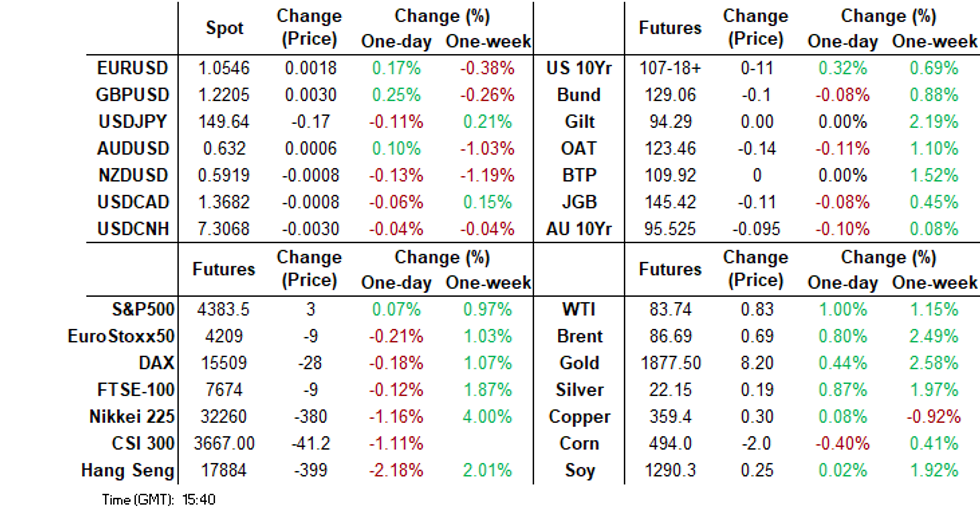

MARKETS

US TSYS: Marginally Richer In Asia

TYZ3 deals at 107-16+, +0-08+, a 0-07+ range has been observed on volume of ~77K.

- Cash tsys sit 2-3bps richer across the major benchmarks, the belly is marginally outperforming.

- Tsys have ticked higher through today's Asian session as Thursday's post CPI losses are trimmed with gains extending a touch in recent trade.

- The move higher in tsys has been seen alongside the USD trimming Thursday's gains and e-minis ticking higher.

- Reuters have reported early in the session that "Fed Chair Powell will deliver prepared remarks and respond to questions from a moderator at the midday event in New York, according to senior Fed officials' weekly event schedule updated each Thursday."

- In Europe today the docket is thin, further out we have Terms of Trade and UofMich Consumer Sentiment. Fedspeak from Philadelphia Fed President Harker crosses.

JGBS: Futures Cheaper But At Tokyo Session Bests

JGB futures remain weaker, -16 compared to settlement levels, but are at Tokyo session highs.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined offshore M2 & M3 money stock and international investor flows.

- Given that, local participants appear to have been also interested in Asia-Pac dealings for US tsys after yesterday's heavy post-CPI NY session. US tsys have moved away from lows seen in yesterday's NY session in Asia-Pac dealings. This leaves cash tsys 2-3bps richer across the major benchmarks.

- The cash JGB curve has seen a twist-steepening, pivoting at the 3s, with yields 0.5bp lower to 1.1bps higher. The benchmark 10-year yield is 0.5bps higher at 0.763%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also lower than the cycle high of 0.814% set late last week.

- The swaps curve is dealing mixed, with rate movement bounded by 0.1bp lower (10-year) and 2.5bps higher (40-year). Swap spreads are tighter out to the 30-year.

- On Monday, the local calendar sees Industrial Production and Capacity Utilisation for August, along with BOJ Rinban Operations covering 1-10-year and 25-year+ JGBs.

AUSSIE BONDS: Dealing Near Session Cheaps, New Jun-54 Bond Via Syndication Next Week

ACGBs (YM -7.0 & XM -12.0) are trading weaker and are either at or close to the lowest levels of the Sydney session. Given the limited domestic events on the calendar today, it's likely that local participants have been primarily monitoring news headlines and observing developments in US tsys.

- US tsys have moved away from lows seen in yesterday's NY session in Asia-Pac dealings. This leaves cash tsys 1-3bps richer across the major benchmarks.

- Cash ACGBs are 6-12bps cheaper, with the AU-US 10-year yield differential 1bp higher at -19bps.

- Swap rates are 4-10bps higher, with the 3s10s curve steeper and EFPS ~2bps tighter.

- The bills strip has bear-steepened, with pricing -2 to -5.

- RBA-dated OIS pricing is 1-4bp firmer across meetings, with Nov’24 leading.

- On Monday, the local calendar sees a speech by RBA Assistant Governor (Financial System) Jones at the AFR Cryptocurrency Summit, ahead of the RBA Minutes for the October meeting on Tuesday.

- Today the AOFM announced that a new 21 June 2054 Treasury Bond is planned to be issued via syndication in the week beginning 16 October 2023, subject to market conditions. Joint lead managers are: Barrenjoey Markets; Commonwealth Bank of Australia; J.P. Morgan Securities Australia; UBS Australia and Westpac.

AU STIR: RBA Dated OIS Still Sharply Softer Versus Pre-RBA Decision Levels

RBA-dated OIS pricing is flat to 3bps firmer today, reflecting the strengthened expectations for Fed tightening, spurred by the release of the US CPI data for September.

- Furthermore, comments made by former RBA Governor Ian Macfarlane, suggesting that bond traders might be incorrect in anticipating interest rate cuts by the central bank before the end of the next year, also appeared to have an impact. However, this influence has somewhat diminished over time.

- Despite today’s firming, RBA-dated OIS pricing remains 7-20bps softer across meetings versus pre-RBA decision levels in early October.

Figure 1: RBA-Dated OIS – Today Vs. Pre-RBA

Source: MNI – Market News / Bloomberg

NZGBS: Closed Cheaper, Election Tomorrow, Q3 CPI On Tuesday

NZGBs closed 5-9bps cheaper but off the session’s worst levels. The previously outlined manufacturing PMI and card spending data failed to provide a market-moving event. Indeed, local participants appeared to be more interested in Asia-Pac dealings for US tsys after yesterday's heavy post-CPI NY session.

- US tsys have moved away from lows seen in yesterday's NY session as losses are trimmed in Asia-Pac trade on Friday. Perhaps participants are using the opportunity to close short positions. This leaves cash tsys 1-2bps richer across the major benchmarks. TYZ3 deals at 107-13+, +0-06 versus NY closing levels.

- Swap rates are 3-9bps higher, with the 2s10s curve steeper and implied swap spreads tighter at the short end.

- RBNZ dated OIS is flat to 3bps firmer across meetings, with Oct’24 leading. Terminal OCR expectations sit at 5.70%.

- Tomorrow, NZ holds a general election, with opinion polls indicating the main opposition National Party will be best placed to form a centre-right government with the support of the libertarian ACT Party and the nationalist NZ First Party.

- Next week, the local calendar is empty on Monday, ahead of Q3 CPI on Tuesday. Bloomberg consensus expects +1.9% q/q and +5.9% y/y versus +1.1% and +6.0% in Q2.

FOREX: Greenback Trims Post-CPI Gains

The USD has trimmed some of its post CPI gains in Asia, BBDXY is down ~0.1%. US Tsy Yields are 1-2bps lower across the major benchmarks and E-minis are a touch firmer.

- AUD/USD is up ~0.2%, the pair has ticked higher through the session trimming some of yesterdays ~1.5% loss. Technically The trend remains bearish, support comes in at $0.6287 2.00 projection of the Jun 16-Jun 29-Jul 13 price swing. Resistance is at $0.6445, high from Oct 11.

- Kiwi is the weakest performer in the G-10 space at the margins and is down ~0.2%, last printing at $0.5915/20 the lowest level since 5 Oct. Business NZ PMI ticked lower to 45.3 in September, this was the lowest print since August 2021.

- Yen is little changed and USD/JPY is consolidating yesterday's gains this morning. The pair is still in an uptrend, key support is at ¥147.43 the low from Oct 3 and resistance is at ¥150.16 high from Oct 3 and bull trigger.

- Elsewhere in G-10 the Scandies are leading the bid however liquidity is generally poor in Asia.

- The docket is thin for the remainder of Friday's session.

FX VOL: Implied Volatility Remains Stable

1-Month Implied volatility in FX markets, measured using the JP Morgan G-10 Volatility Index, sits well within recent ranges and has been stable in recent dealing.

- The index sits at 7.89%, well within the range observed since April, we did print as high as 8.67% in early October.

- Implied volatility across G-10 FX remains relatively stable despite yesterday's firmer than forecast US CPI print, November's FOMC meeting coming into view and the USD sitting a touch off 2023 highs.

Fig 1: JPMorgan 1-Month G10 FX Volatility

Source: JP Morgan/MNI/Bloomberg

JAPAN DATA: Offshore Investors Return To Local Stocks, Sell Local Bonds

Offshore investor flows were mixed in the week ending October 6. Inflows into Japan stocks rebounded, rising ¥1436.1bn. This follows modest inflows in the week prior and generally firm selling trends from mid August through to the later parts of September. In contrast, foreign investors resumed selling local bonds. We saw

-¥643.6bn in outflows last week.

- Japan investors were modest purchasers of offshore bonds for the second straight week (¥183.4bn). We should get more details on lifer investment plans for the second half of the fiscal year next week. Foreign bond selling could remain part of the mix given unattractive (FX hedged) offshore returns (see this BBG link for more details).

- Japan buying of foreign stocks cooled noticeably, although remained positive.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending October 6 | Prior Week |

| Foreign Buying Japan Stocks | 1436.1 | 71 |

| Foreign Buying Japan Bonds | -643.6 | 25.8 |

| Japan Buying Foreign Bonds | 183.4 | 297.1 |

| Japan Buying Foreign Stocks | 45.2 | 721 |

Source: MNI - Market News/Bloomberg

EQUITIES: Regional Markets Lower, China Stabilization Headlines Only Briefly Aid Sentiment

Regional Asia Pac equity sentiment is weaker across the board in terms of the major indices. This follows weakness in US equity markets during Thursday trade, as US yields spiked following the US CPI print. We have seen some modest retracement in US yields today, but this hasn't imparted positive sentiment on the region. US equity futures sit a touch higher at this stage, albeit away from best levels. Eminis last near 4386, +0.12% higher for the session.

- There was a brief round of positive impetus as headlines crossed that China is considering launching a market stabilization fund (see this BBG link). However, this hasn't had a lasting impact on sentiment.

- At the break, the HSI is off by over 2%, while the mainland's CSI 300 is down 1.1% (these losses were curbed to -0.70% when the above headlines crossed). This puts the index back sub the 3700 level.

- On the data front, China CPI was weighed down by lower food prices, while exports were slightly better than forecast. Imports were close to expectations, but commodity import volumes were down in the month.

- Elsewhere, tech sensitive plays are mostly down, despite related indices doing better in Thursday US trade. The Topix is off ~1.40%, the Taiex 0.50%, and the Kospi around 0.90%.

- In SEA, we are seeing modest outperformance from the Philippines (+0.25%) and Indonesia (+0.15%). Losses are evident elsewhere, although are under 1%.

OIL: Tracking Higher For The Week

Brent crude is tracking modestly higher in the first part of Friday trade. The benchmark last near $86.50/bbl, +0.60% higher versus NY closing levels on Thursday. At this stage we are ~2.30% higher for the week. WTI was last near $83.60/bbl, up 0.80% so far today and nearly +1% for the past week.

- Market focus is likely to rest on Israel/Gaza developments. Fears of a broader Middle East conflict have receded somewhat, but the UN has reported that Israel has advised the people in Northern Gaza to relocate in the next 24 hours, which could be a precursor to an escalation in the conflict (see this BBG link).

- Earlier highs in Brent were near $86.70/bbl. Support has been evident in the benchmark on moves sub $85.50/bbl in recent sessions. Thursday highs were around $87.65/bbl. Sentiment was weighed down on Thursday by rising inventory levels. EIA Weekly US Petroleum Summary - w/w change week ending Oct 06: Crude stocks +10,176 vs Exp -431, Crude production +300.

- The IEA Monthly Oil Market Report revised up global oil demand growth for this year by 100kbpd to 2.3mbpd to reach 101.9mbpd in 2023, driven by growth in China, India and Brazil.

- China September trade data showed oil imports down in the month, but still remain 14% higher in y/y terms.

GOLD: Weaker On Thursday As Market Reassesses Fed Tightening After US CPI Data

Gold is 0.3% higher in the Asia-Pac session, after closing 0.3% lower at 1868.90 on Thursday.

- Thursday’s weakness, after solid multi-day gains earlier in the week, can be attributed to higher US Treasury yields following the release of US CPI data for September.

- While headline CPI beat by only 0.1% and core printed in line, the services component, excluding housing and energy, rose 0.6% m/m. Moreover, the Cleveland Fed’s mean and trimmed mean measures and the Atlanta Fed’s sticky CPI measure all showed a pick-up for the second consecutive month.

- US Treasuries bear steepened, with yields finishing 9-16bps higher. Meanwhile, US STIR saw the odds of another 25bp hike back to around 40% from 30% yesterday.

- According to MNI’s technicals team, the bearish theme in gold was put on pause Monday after a second session of gains. Monday’s bounce put prices back above $1850. Nonetheless, the recent sell-off resulted in a break of support at $1901.1 and this was followed by a breach of $1884.9, the Aug 21 low. This confirmed a resumption of the downtrend that started in early May. The focus is on $1804.9, the Feb 28 low and a key support. On the upside, firm resistance is at $1878.2, the 20-day EMA.

CHINA DATA: Food Drags Headline CPI Lower, PPI Trend Improves Modestly

China September inflation prints were a touch weaker than expected. Headline CPI printed at flat in y/y terms, versus a 0.2% forecast and 0.1% prior. Core CPI was steady at 0.8% y/y. The PPI was -2.5% y/y, against a -2.4% forecast and -3.0% prior.

- For CPI this was towards the bottom end of estimates, although the lowest forecast was -0.1% y/y. The m/m rise was 0.2%for headline, down slightly from the August pace of 0.3%, but still above the average pace seen in the first half of 2023.

- Consumer goods inflation was -0.9% y/y, while services held steady at 1.3% y/y. Non-food inflation rose to 0.7% y/y, from 0.5% in August. The drag from food got larger, -3.2% y/y from -1.7%.

- Outside of food, we saw either the same y/y print or slight improvement in terms of the sub-categories. Household items and transport saw reduced disinflation. Hence outside of the drag from food the result is not that weak, which is consistent with core inflation holding steady at 0.8% y/y.

Fig 1: China Core CPI Y/Y & 10yr CGB Yield

Source: MNI - Market News/Bloomberg

- On the PPI saw we saw modest further improvement in the headline, led by less drags from the mining sector (-7.4% y/y, from -9.9%) and raw materials (-2.8% y/y from -4.0%). This is consistent with improved commodity prices, although that trend has stabilized somewhat in recent weeks.

- Manufacturing was -2.8% y/y (from 3.1% y/y), but consumer goods dipped slightly further to -0.3%y/y (-0.2% prior), led by durables -1.2% y/y.

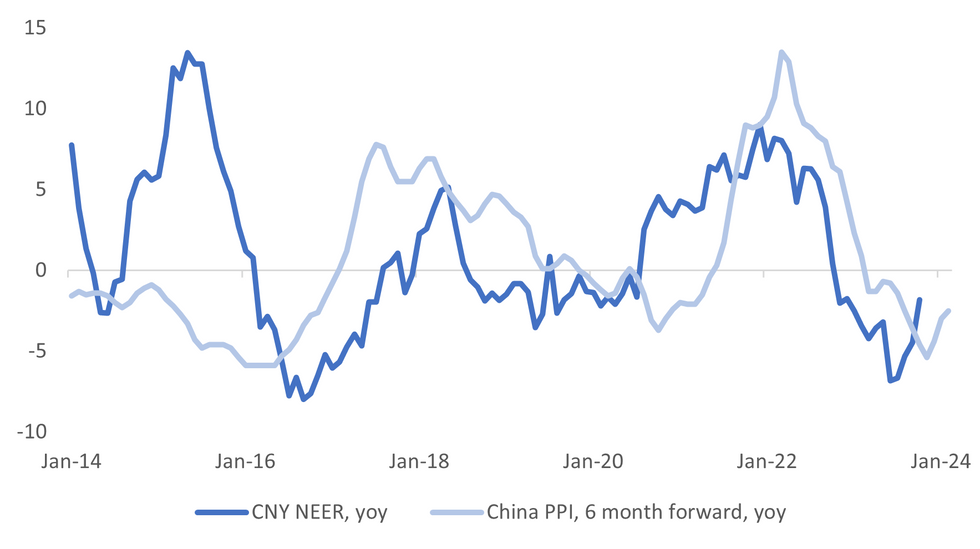

- Still, less negative PPI momentum y/y is consistent with a modestly improving CNY NEER trend, see the second chart below.

Fig 2: China PPI Y/Y Versus J.P. Morgan CNY NEER (Y/Y)

Source: J.P. Morgan/MNI - Market News/Bloomberg

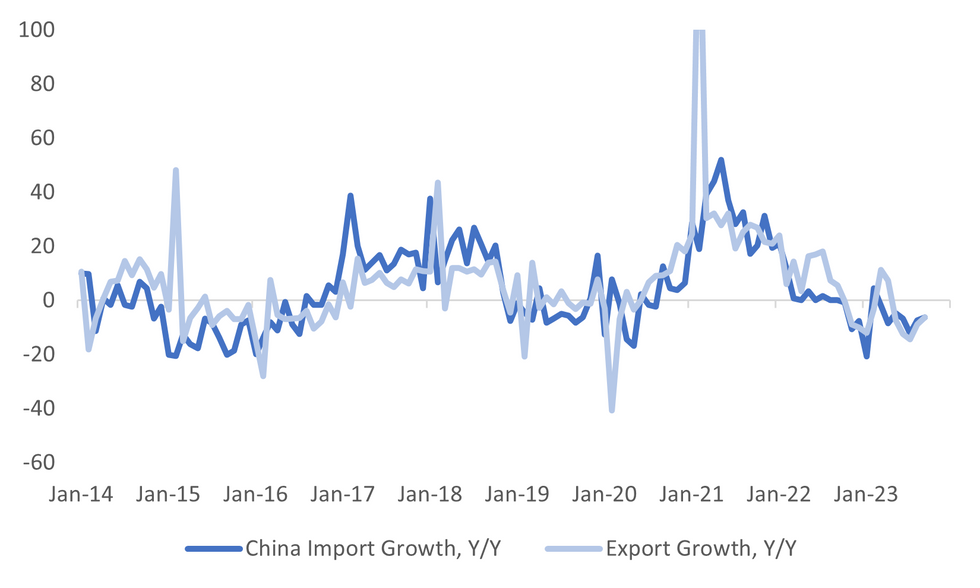

CHINA DATA: September Trade Data Slightly Better Than Expected

China September trade figures were slightly better than expected, although most of the upside surprise rested with exports. We came in at -6.2% y/y for September, versus -8.0% expected and -8.8% prior. Imports were at -6.2% y/y, versus -6.3% expected and -7.3% prior. The trade surplus improved to $77.7bn from a revised $68.2bn in August.

- The marginal export beat was hinted at by the Taiwan and South Korean prints for the same month.

- At -6.2%y/y we are only marginally above recent lows though. By country, most of the improvement reflected stronger exports to Asian economies. We were higher in terms of exports to the US and EU on a m/m basis, but still down on levels of a year ago.

- Officials still described the external backdrop as complex and challenging (per Reuters), but the Q4 situation is expected to improve.

- On the import side, we are also away from recent trough points, but the recovery pace still appears modest at this stage.

- Key commodity import volumes were generally down in the month - for coal, crude oil, natural gas and iron ore, but remain comfortably positive in y/y terms.

Fig 1: China Export & Imports Y/Y - Above Recent Lows

Source: MNI - Market News/Bloomberg

SINGAPORE: MAS Unchanged, Core Inflation Expected To Decline Further, GDP To Gradually Improve

As widely expected, the MAS left its major policy settings unchanged at the October meeting. The slope, width and mid-point of the policy band were all held steady. The central bank noted "... the current appreciating path of the S$NEER policy band is assessed to be sufficiently tight. A sustained appreciation of the policy band is necessary to dampen imported inflation and curb domestic cost pressures, thus ensuring medium-term price stability."

- The central bank expects GDP growth to gradually in 2024, although it notes much uncertainty around the global outlook. Growth is expected to be close to potential, with a slightly negative output gap. This is after 2023 growth is expected to be near the lower end of the 0.5-1.5% forecast range.

- Also note Q3 GDP was released at the same time, coming in better than expected (1.0% q/q, versus 0.6% forecast, 0.7% y/y, 0.4% forecast).

- On inflation, the central bank said "MAS Core Inflation is projected to slow to an average of 2.5–3.5% for the year as a whole. Excluding the impact of the increase in the GST rate in January, core inflation is forecast at 1.5–2.5%. CPI-All Items inflation is projected to average between 3.0–4.0% in 2024."

ASIA FX: CNH Holds Steady Amid Mixed Inflation& Trade Trends

USD/Asia pairs sit modestly off Thursday NY session highs, but downside is proving to be fairly limited at this stage. The MAS held steady as expected, while China data showed flat inflation, but export growth up off recent lows. Early next week in China we have the 1yr MLF decision and we still await the September aggregate finance/new loans data. Next week also delivers the BoK and BI decisions.

- Spot USD/CNH sits down a touch from NY closing levels on Thursday, the pair last near 7.3070. We saw a brief dip towards 7.3000 as headlines crossed around a state backed equity market stabilization fund, but there was little positive follow through. Data wise, Headline CPI was weighed by lower food prices, while exports were slightly better than expected but still down in y/y terms.

- Spot USD/KRW has found resistance on moves above 13550. The pair last near 1349. This has kept the 1 month NDF close to NY closing levels from Thursday, last around 1347. The September unemployment rate ticked up to 2.6%, in line with expectations. However, employment growth also improved. local equities are under pressure, off 1% at this stage.

- USD/SGD has sits modestly lower, last under 1.3690. Lows were around 1.3680, while we tracked closer to 1.3700 prior to the MAS announcement. The policy decision was largely as expected. MAS is likely to stay on hold, but the bar for a further tightening is high. The central bank is moving to 4 meetings per year, with the next in January. The NEER (Goldman Sachs estimate) is a touch higher post the MAS. Q3 GDP surprised on the uspide.

- The Ringgit has been pressured this morning as local participants digest yesterday's US CPI print. CPI rose more than expected in September however the Y/Y increase was the lowest since 2021. USD/MYR prints at 4.7315/55 the pair is ~0.5% higher this morning and sits a touch off the top of its recent range. Looking ahead the local docket is empty until next Thursday when September Trade Balance is due. September CPI crosses next Friday (20 Oct).

- The Rupee has opened dealing little changed from Wednesday's closing levels. USD/INR sits at 82.24/25. Participants are digesting yesterday weaker than forecast India CPI print of 5.02% and the marginally higher than expected US CPI print. Due today we have September Trade Balance, a deficit of $23.2bn is expected.

- USD/PHP has firmed in the first part of today's trade. The pair was last at 56.815, down slightly from highs of 56.855. We closed yesterday at 56.67, losing around 0.25% in PHP terms so far today. This keeps the pair comfortably within the rough 56.50/57.00 range seen the early part of August. The focus domestically will remain on interest rate risks, with BSP eyeing the early Nov Fed meeting. Even if the BSP matches any Fed renewed hawkishness it may not be enough to curb PHP weakness, although 57.00 remains a firm resistance point at this stage.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/10/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 13/10/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/10/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/10/2023 | 0800/0900 |  | UK | BoE's Bailey speaks at Institute of International Finance Annual Membership Meeting | |

| 13/10/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/10/2023 | - | *** |  | CN | Trade |

| 13/10/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 13/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/10/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 13/10/2023 | 1300/0900 |  | US | Philadelphia Fed's Pat Harker | |

| 13/10/2023 | 1300/1500 |  | EU | ECB's Lagarde participates in IMF seminar | |

| 13/10/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 13/10/2023 | 1630/1730 |  | UK | BoE's Cunliffe speaks at Institute of International Finance |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.