-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Bid, Bank Deposit Speculation Headlines

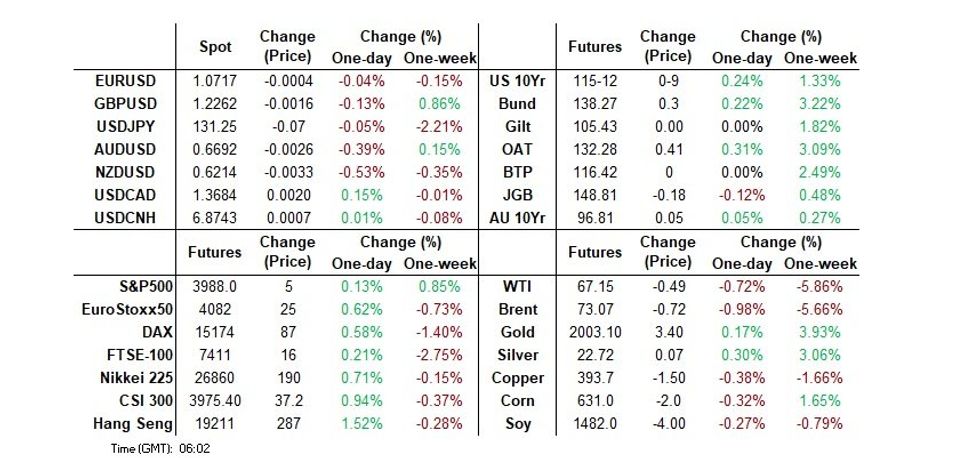

- U.S. Tsy futures nudge higher overnight, with cash markets closed until London hours owing to a Japanese holiday.

- The USD is marginally firmer in Asia today, in the wake of reports which suggested that the U.S. is studying ways to guarantee all bank deposits.

- The latest German ZEW survey and Canadian CPI headline the wider data docket on Tuesday, while comments from ECB's Lagarde will also cross.

MACRO: Supply Chain Pressures Have Eased, But Core Inflation Remains Sticky

The Federal Reserve Bank of New York’s measure of global supply chain pressures eased further in February and is not only consistent with the peak in G20 CPI inflation but is also signalling a considerable easing in the months ahead but core inflation is looking more stubborn. G20 inflation moderated slightly in January to 8.4%y/y from 8.5%.

- OECD headline inflation moderated to 9.2% y/y in January from 9.4% but core held at 7.2% y/y. In February so far, headline inflation eased in the euro area and the US but rose in Sweden. But core continued to look sticky with it steady in the US but higher in the euro area and Sweden. Underlying inflation is proving to be a problem for central banks.

- Headline inflation moderated in February in non-Japan Asia to 3.1% from 3.8% and to 5.6% from 5.7% excluding China based on our estimates. Unlike in the OECD, it looks like core eased further to 1.6% from 1.9% and 4% from 4.2% respectively. Both headline and underlying CPI rates remain well below the OECD’s. Thus generally there is less pressure on Asian central banks, except the Philippines, to tighten monetary policy significantly further.

Source: MNI - Market News/Refinitiv

Fig. 2: OECD vs non-Japan Asia core CPI y/y%

Source: MNI - Market News/Refinitiv

US TSYS: Futures Firmer, Cash Closed Until London

TYM3 deals at 115-13, +0-10, marginally off the top of the 0-19 range on volume of 70k.

- Cash tsys remain closed due to the observance of a national holiday in Japan and will re-open in the London session.

- TYM3 see-sawed in early dealing, there was no obvious headline driver, however there was some possible pre-Fed position squaring in early flows.

- Futures were briefly pressured as reports crossed of the US studying ways to guarantee all bank deposits, link here. The move in tsys was limited, with TYM3 not challenging daily lows, as the move to guarantee deposits is not seen as not yet necessary.

- A rally in ACGBs, post the minutes of the March RBA policy, provided support to the wider FI space.

- A fresh bid saw tsys marginally extend highs, again there was no obvious headline driver. Regional and US Equities paring gains may have added a level of support.

- In Europe today the German ZEW Survey is the highlight. Further out Canadian CPI, Philadelphia Fed Non-Manufacturing Index and Existing Home Sales headline the docket. We also have the latest 20-Year Supply.

AUSSIE BONDS: Stronger But Off Bests As Minutes Impetus Fades

ACGBs close richer (YM +2.0 & XM +5.0) in line with stronger U.S Tsy futures but off bests as the RBA Minutes failed to provide a fresh impetus for the market.

- The Minutes suggested the Board was considering the case for a pause while recognizing that further tightening of monetary policy would likely be required to reign in inflation. An emphasis was placed on the data releases ahead of the April meeting, but that pre-dated recent adverse credit developments.

- Cash ACGBs closed 2-5bp richer with the 3/10 curve 3bp flatter.

- Swaps were 1-5bp stronger with the curve 4bp flatter and EFPs +1bp.

- Bills strip twist flattened with pricing -3 to +4.

- RBA dated OIS pricing closed mixed with meetings out to July 3-4bp firmer and meetings beyond flat. April meeting closes at -2bp with 40bp of easing priced for year-end.

- The local calendar is light until next week’s releases of February Retail Sales (Tue) and Monthly CPI (Wed). Both releases were highlighted in today’s RBA Minutes as key to the April decision.

- Abroad, the calendar is also relatively light today, with Philly Fed and U.S. Existing Home Sales the highlights, ahead of the FOMC decision on Wednesday. BBG consensus expects a 25bp hike, although some analysts expect no move.

RBA: Economics Point To Further Rate Hikes

In the minutes from the March meeting, the RBA said that it would discuss a pause on April 4 as policy is now restrictive and there has a been a lot of tightening since May. It is likely to be a difficult meeting given that so far the economics point to further hikes but recent overseas banking collapses will also be factored into the decision, although Australia’s banks are in a solid position.

- Our policy reaction function, which estimates the cash rate using the inflation and output gaps, indicates that based on these variables rates have further to go, including if house prices are considered.

- Our policy reaction function is signalling a further 50bp of tightening over the next 6 months, down from 100bp in February, and doesn’t suggest a cut over the time horizon. However, when house prices are included, around 35bp is implied with a terminal rate around 4.1% in Q4 and the first cut in Q1 2024.

- The results of both of these equations are well above AUD OIS market pricing, which took out any further rate hikes following the collapse of SVB and is implying RBA cuts from June 2023.

Source: MNI - Market News/Refinitiv/Bloomberg

NZGBS: Closes At Bests With Stronger U.S. Tsys & ACGBs

NZGBs strengthen over the session to close at bests in sympathy with a richening in U.S. Tsy futures and ACGBs (post-RBA Minutes) in Asia-Pac trade. By the close, the 2- and 10-year benchmarks were respectively 9bp and 10bp richer with the strengthening garnering support from a narrowing in the trade deficit in February (-NZ$714mn versus a negatively revised -NZ2.113bn in January). The fact that the annual deficit remained close to record levels is however noteworthy given last week’s worse-than-expected current account deficit and S&P’s bond rating guidance.

- 2s10s swaps curve bull steepened 4bp with rates 2-6bp lower, implying wider swap spreads particularly at the long end.

- RBNZ dated OIS softened 2-8bp for meetings beyond April with terminal OCR pricing dropping to 5.17%. April meeting pricing closed with 21bp of tightening.

- The local calendar is light for the remainder of the week with RBNZ Chief Economist Conway’s speech, “The path back to low inflation in NZ”, at the KangaNews DCM forum on Thursday the highlight.

- Abroad, the calendar is also relatively light today, with Philly Fed and U.S. Existing Home Sales the highlights, ahead of the FOMC decision on Wednesday.

FOREX: USD Firms In Asia, Antipodeans Pressured

The greenback is marginally firmer in Asia today, BBDXY is up ~0.1%. The USD firmed in the wake of reports crossed of the US studying ways to guarantee all bank deposits, link here.

- Kiwi is pressured and is the weakest performer in the G-10 space at the margins. The pair prints at $0.6210/15, down ~0.5%, and has broken through the 20-Day EMA. New Zealand trade deficit narrowed in February printing at -$700mn after a deficit of ~$1.9bn in January.

- AUD/USD is also pressured, the pair is dealing below $0.67 handle and is down ~0.4% today. Support in the pair comes in at $0.6590 the low from 15 March. The RBA minutes showed that the board is getting closer to pausing their tightening cycle, with upcoming retail sales and inflation data emerging as key inputs to the decision.

- Yen is little changed, USD/JPY has observed narrow ranges today with little follow through on moves.

- Elsewhere the broad based USD gains have EUR and GBP both down ~0.2%.

- E-minis have pared gains to sit unchanged on the day, the Hang Seng is ~0.3% having been up over 1% shortly after the open.

- In Europe today the German ZEW Survey is the highlight. Further out Canadian CPI, Philadelphia Fed Non-Manufacturing Index and Existing Home Sales headline the docket.

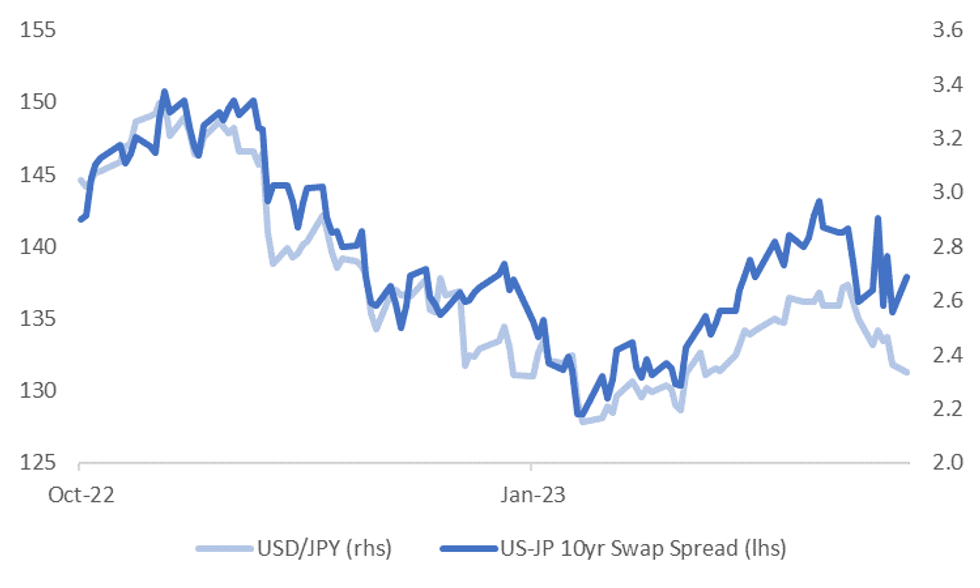

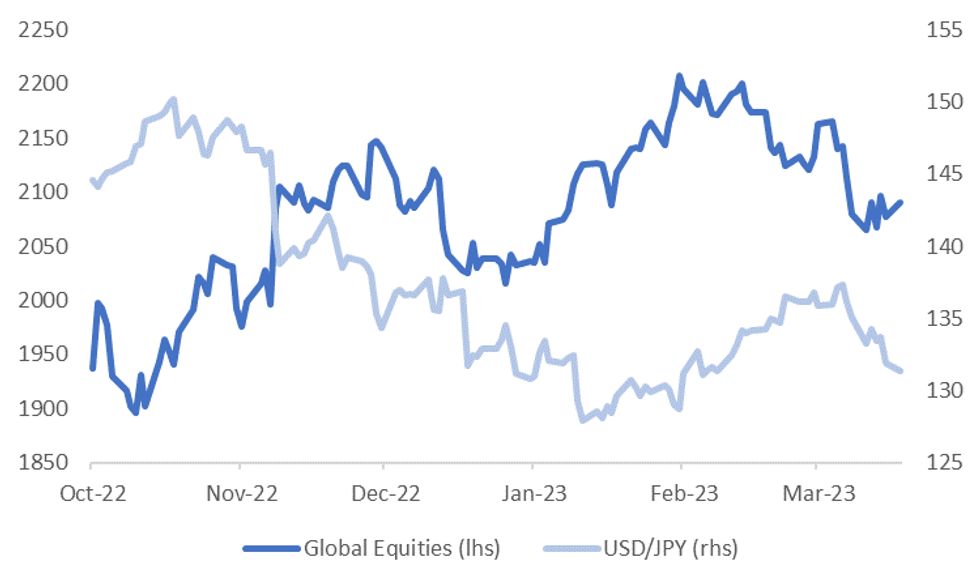

JPY: Outperforming Yield Differentials & Improved Equity Sentiment

A modest wedge has emerged between USD/JPY and the US-JP 10yr swap differential, see the chart below. The yen looks too firm relative to the recent moves in spreads. As we noted in the earlier yen bullet, the currency outperformed the rebound in US yields through Monday's NY session.

- One factor that has helped drive the wedge has been the recent correction lower in global equities, see the second chart below.

- USD/JPY is no doubt seen as a good downside hedge in the event of a deeper correction in equities, particularly in the event of a global recession scenario. The second chart below plots USD/JPY versus global equities.

- Correlations have fallen with relative swap spreads, back to 70%, versus around 97% in early March on a rolling monthly basis (in levels terms). The correlation with global equities has rebounded over the same time period, back to +60%, after being negative earlier in the month.

- Again though, USD/JPY looks a little low versus the recent stability in global equities. USD/JPY downside could still be viewed as an attractive hedge given the current global climate. The currency tends to perform well during global recessionary periods and at current levels is still viewed as cheap on some metrics (REER very low relative to long term averages).

- The other focus point for the market will be risks of a BoJ policy shift (in some form) during 2023.

- The USD/JPY risk reversal remains close to recent lows, last under -2.10, which is still indicative of downside USD/JPY demand. Note today is Japan holiday, which will be impacting liquidity to a degree.

Fig 1: USD/JPY Versus US-JP 10yr Swap Spread

Source: MNI - Market News/Bloomberg

Fig 2: USD/JPY Versus Global Equities

Source: MNI - Market News/Bloomberg

AUD: Correlations With Global Risk Sentiment Variables Rise

A$ correlations have moved lower with yield differentials over the past week. Correlations with risk metrics have risen but remain below historical norms. The table below presents AUD/USD correlations with traditional macro drivers for the past week and month (in level terms). Note correlations with yield differentials are based off government bond yield spreads.

- Yield differentials have been volatile in recent weeks, but without a strong trend. The two year AU-US 2yr spread is last around -114bps, up from early March lows near -163bps, but we did get as high as -72bps in recent weeks. The 10yr spread is closer to recent lows though, around -28bps.

- Correlations for the past week are back to negative territory, but remain positive for the past month in terms of yield differentials.

- With global commodities, correlations have risen, particularly in terms of base metals, but we remain below historical averages. The correlation with iron ore is back in negative territory.

- Correlations with global equities/risk gauges have also normalized somewhat, but remain below historical averages, much like global commodity indices.

Table 1: AUD/USD Correlations

| 1wk | 1mth | |

| AU-US 2yr Spread | -0.27 | 0.23 |

| AU-US 5yr Spread | -0.27 | 0.46 |

| AU-US 10yr Spread | -0.42 | 0.47 |

| Global Commodities | 0.27 | 0.55 |

| Global Base Metals | 0.51 | 0.72 |

| Iron ore | -0.71 | -0.14 |

| Global equities | 0.48 | 0.55 |

| US VIX index | -0.31 | -0.24 |

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Mar21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E565mln), $1.0665-75(E797mln), $1.0690-10(E2.0bln)

- USD/JPY: Y133.25-50($805mln)

- GBP/USD: $1.2100(Gbp504mln), $1.2150-70(Gbp570mln)

- USD/CAD: C$1.3690-10($945mln)

- USD/CNY: Cny6.9225($918mln), Cny6.9300($501mln), Cny6.9500($574mln)

ASIA FX: Positive Equity Tone Helps Limit USD Upside

USD/Asia pairs have traded in a mixed fashion, with a positive tone for the USD against most the majors spilling over into Asia FX to some extent. Most regional equities are higher, which has helped limit USD gains. The data calendar is very light tomorrow, with market focus also resting on events outside the region - US/EU banking issues and the upcoming Fed meeting.

- USD/CNH is back under 6.8800 this afternoon, aided by better online stock trends (following fresh gaming approvals), while the USD/CNY fix was also lower than expected. Still, we remain well within recent ranges for the pair.

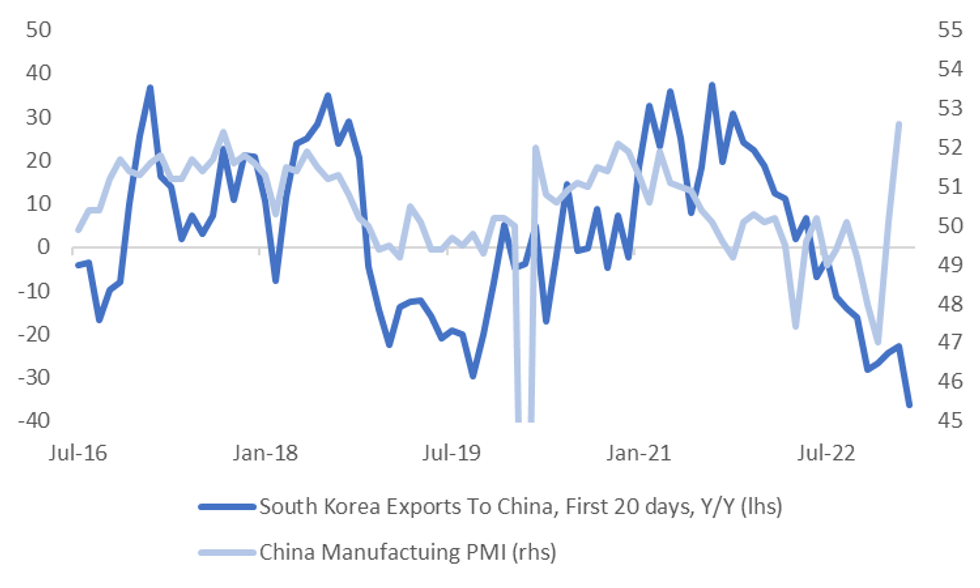

- 1 month USD/KRW is slightly higher, despite a generally positive equity tone for the region. We are back to 1306 currently, around +0.25% above NY closing levels. Ranges for the session have been just under 1300 to 1307.50. First 20 days trade data for March continued to suggest headwinds in terms of external demand.

- USD/PHP sank to a low near 54.27 in the first part of trade, which is levels not seen since early Feb. We sit slightly higher now, last around 54.40/45. Still, this is +0.45% firmer in PHP terms versus closing levels from yesterday. The pair is sub all key EMAs, while the simple 50-day MA comes in at 54.80. The paring back of global rate hike expectations in recent weeks has boosted the carry appeal of the currency and probably helped offset some the negative impacts of global banking worries, particularly for a current account deficit economy like the Philippines.

- The SGD NEER (per Goldman Sachs estimates) is little changed today and has recovered a large portion of its SVB-inspired losses as it ticks away from recent lows, as shown in the chart below. We now sit ~0.8% below the top of the band. USD/SGD fell ~0.4% in yesterday's trade, the USD was pressured as risk sentiment grew after coordinated intervention by global central banks in funding markets. The pair now sits below its 20-Day EMA as it consolidates its recent losses as the broader USD trends dominate flows, last printing $1.3385/95.

- The rupiah couldn't hold earlier gains, with USD/IDR back to 15360 (we were closer to 15340 in earlier dealings). The 20-day EMA sits nearby, around the 15320/25 level, while the 50 and 100 sit in the 15290/95 range. We haven't been below these support points since late Feb/early Mar. We are well below recent highs around 15480. A more enduring rally is likely to require a more concerted pick up from offshore flows into local bonds. Foreign holdings trended down through Feb and the first half of Mar, before rebounding late last week, see the chart below (last Friday saw +$255.7mn in inflows).

SOUTH KOREA: Export Growth Remains Weak on Tech & China Headwinds

(MNI Australia) Recent trends were mostly maintained in terms of South Korean first 20-days trade data for March. Export growth was -17.4% y/y, while imports were -5.7% y/y. This is a down step in import growth (the prior read was 9.3% y/y for the first 20-days of Feb), but the trade deficit persisted at $6.323bn.

- Looking at the detail showed average daily exports were -23.1% y/y, so still quite depressed as well. Chip exports remain a weak point, -44.7% y/y. This is consistent with what officials have said in terms of external headwinds persisting in the first half. They are more optimistic around better export trends in the second half of the year.

- By country, China exports remained depressed, down -36.2% y/y. As we progress further into 2023 base effects should support some recovery. Still, this weakness is at odds with recent indicators like the China manufacturing PMI, see the chart below.

- One possibility is the PMI is overstating the strength of the recovery in China. Activity indicators for Jan-Feb didn't paint as upbeat picture as implied by the PMI. Trade tensions with the US, particularly in the tech space, may also be leading China buyers to shy away from South Korea, given broader strategic alliances.

- It could also be the case the China recovery will show up in firmer exports from South Korea with a lag.

- Note exports to US, for the first 20-days of March, remained resilient at +4.6% y/y.

Fig 1: South Korean Exports To China Still Struggling

Source: MNI - Market News/Bloomberg

EQUITIES: Firmer, Aided By China/HK Gains

Regional equities are mostly tracking with a firmer bias, although gains are mostly under 1% at this stage. Markets have taken a positive cue from EU/US gains on Monday, particularly in the financials space. US futures are a touch firmer at this stage (around +0.10% for Eminis and Nasdaq futures), while EU futures are comfortably higher.

- US futures did firm on headlines that the US is studying guaranteeing all bank deposits, but we didn't see much follow through. Presumably because it is only under consideration at this stage rather than being enacted.

- China and Hong Kong stock indices have extended gains this afternoon. Both the CSI 300 and HSI are up 1%. Gaming/tech related stocks have risen, after China regulators approved 27 foreign games late yesterday.

- This is the first fresh round of approvals since late last year and is giving the market optimism that regulatory oversight of the sector won't be as strong as it was in 2022.

- Japan markets are closed today, while South Korea is +0.40% for the Kospi and +0.55% for the Taiex. In Singapore the STI is near +1%, with bank names enjoying a better session today. The ASX 200 has climbed 0.82%, with similar drivers in play.

GOLD: Bullion Stabilises Awaiting Wednesday’s FOMC Announcement

Gold has been trading in a $10 range today and is currently 0.3% higher after easing 0.5% on Monday, as fears of a banking crisis eased. It is around $1983.85/oz, close to the intraday high of $1985.22 following the $1975.49 low earlier. The USD index is up 0.1%.

- Bullion broke through the important $2000/oz level but couldn’t sustain it once Treasury yields rose again. This move strengthened the current uptrend though and opened $2034.

- Later ECB President Lagarde speaks and on the data front there are only Canadian CPI and US existing home sales for February. The focus of the week is Wednesday’s FOMC meeting. Currently a 25bp rate rise is expected by economists but there’s the possibility of a pause given recent banking troubles and this would be positive for gold prices.

OIL: Crude Awaiting Wednesday’s Fed Decision, Market Needs Banking Stabilisation

Oil prices have been unwinding Monday’s gains during APAC trading. Brent is down 1.0% after rising 1.2% yesterday to be around $73.02/bbl, close to the intraday low of $72.85 and off the high of $74.04 earlier. WTI is down 0.8% to below $67 at $66.83. The USD index is up 0.1%.

- While global central banks and regulators have put measures in place to ease banking concerns, oil markets are still nervous about the implications for demand. The risks to crude are to the upside once the banking sector stabilises, given the 15% correction in March.

- Later ECB President Lagarde speaks and on the data front there are only Canadian CPI and US existing home sales for February. The focus of the week is Wednesday’s FOMC meeting. Currently a 25bp rate rise is expected by economists but there’s the possibility of a pause given recent banking troubles and this would be positive for oil prices as a weaker USD makes it cheaper for non-US purchases.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/03/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 21/03/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 21/03/2023 | 1230/0830 | *** |  | CA | CPI |

| 21/03/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/03/2023 | 1230/1330 |  | EU | ECB Lagarde Panellist at BIS Summit | |

| 21/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/03/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.