-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Nudges Lower In Asia

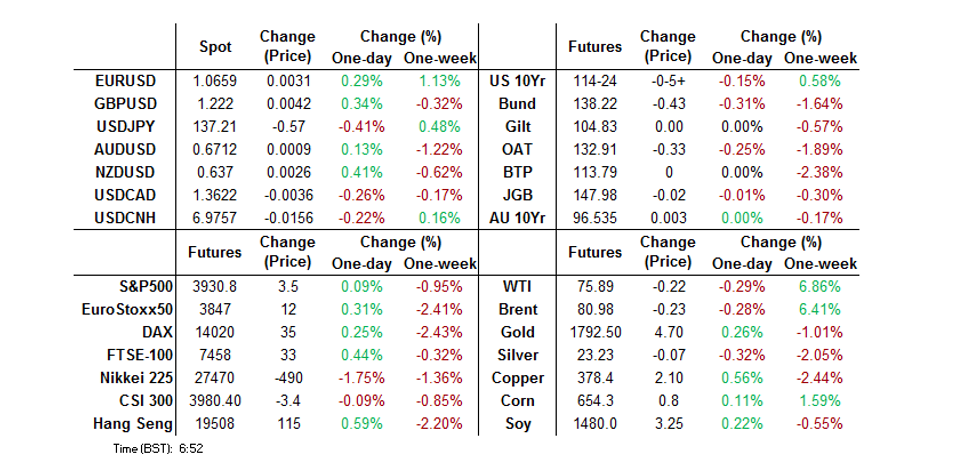

- The broader Asia-Pac reaction to the hawkish guidance that accompanied the latest ECB monetary policy decision applied moderate pressure to Tsys in early trading.

- The USD is away from lows for the session, the BBDXY index last around 1261.50, against lows near 1259. Cross asset signals have mostly supported the USD in the form of higher UST yields and lower regional equities and commodities. Still, outside of the AUD, the rest of the G10 complex is firmer against the USD.

- Coming up is UK retail sales, along with a host of PMI prints for the UK, EU and US. Fed's Williams & Mester will speak with BBG, while the Fed's Daly is also scheduled to speak.

US TSYS: Bear Steepening As Light Cheapening Holds In Asia

TYH3 deals at 114-25+, -0-04, a little off the base of its 0-06+ range on light volume of ~57k.

- Cash Tsys bear steepened, with the major benchmarks 0.5-3.0bp cheaper into London.

- The broader Asia-Pac reaction to the hawkish guidance that accompanied the latest ECB monetary policy decision applied moderate pressure to Tsys in early trading.

- Continued concern surrounding the Chinese bond market, resulting in PBOC liquidity injections in recent days (via short- and medium-term facilities), may have helped to modestly extend the cheapening.

- The space looked through a pullback in the USD as cross-asset inputs were mixed, with e-minis little changed and the DXY down ~0.2%.

- Pre-NY we will see final Eurozone CPI readings and PMI data from Europe & the UK. Later on, San Francisco Fed President Daly will speak on inflation and the economy while NY Fed President Williams & Cleveland Fed President Mester will appear on BBG TV. We will also get flash Markit PMI data during NY hours.

JGBS: Notable Twist Steepening Into the Weekend

The early twist steepening impulse has developed further during the Tokyo afternoon.

- The bid out to 10s was perhaps aided by reports of gradual tweaks to tax settings in a bid to fund Japanese increased defense spending (slthough the space had already firmed ahead of that news), while 20+-Year paper seemed to fall afoul of ECB-related weakness as domestic participants turned their focus to next week’s BoJ meeting.

- That left futures hovering around neutral levels, operating in a narrow range, while the major cash JGB benchmarks run 1.5bp richer to 6.0bp cheaper, with a pivot around 10s.

- The swap curve has also twist steepened as the day wore on, albeit in a more muted manner than JGBs, taking cues from bonds.

- Next week’s local docket is headlined by the aforementioned BoJ monetary policy decision.

AUSSIE BONDS: Winding Into The Weekend

Aussie bonds meandered through the final session of the week, initially showing lower as Sydney reacted to the hawkish ECB rhetoric that accompanied Thursday’s monetary policy decision, before pulling back from worst levels after both YM & XM failed to breach their overnight lows (XM didn’t get anywhere near testing post-Sydney session cheaps), with a lack of meaningful headline catalysts evident in onshore hours. That left YM +1.4 at the bell, while XM was +0.3. Cash ACGBs were flat to 4bp richer, with the 7- to 12-Year zone lagging the wider bid as 10s failed to widen further vs. their U.S. counterpart, as the 0bp zone limited the recent move in that spread.

- Bills were flat to -4 through the reds, with RBA dated OIS little changed on the day.

- The latest round of domestic flash PMI readings saw a slower rate of expansion for the manufacturing sector and a sharper rate of contraction in both the services and composite readings. Survey sponsor Judo Bank noted that "what we are seeing could be the first signs of a desired soft landing for the Australian economy in 2023.”

- Next week’s local docket thins out ahead of the Christmas break, with the minutes from the latest RBA decision and latest Westpac leading index print providing the only real points of note.

NZGBS: Modest Cheapening, Swaps Twist Steepen

Cash NZGBs finished flat to 2.5bp cheaper cross the curve, with the belly leading the weakness. Friday trade was relatively limited, with the early, modest cheapening adjustment holding.

- Swap rates were 5bp lower to 2bp higher as that curve twist steepened. 2s were unwilling to force a test of cycle highs after yesterday’s GDP-inspired shunt higher, which made for mixed direction on the curve. This came as RBNZ dated OIS pricing eased at the margin (after yesterday’s push higher), with just over 70bp of tightening now priced for the Bank’s Feb ’23 meeting alongside a terminal OCR of 5.55%, which probably aided the easing in 2-Year swap rates.

- BusinessNZ manufacturing PMI data saw a deeper move into contractionary territory, while Nov non-resident bond holding data saw the % of NZGBs held offshore move to the highest level seen since ’18.

- Next week’s local docket is busy, and somewhat front-loaded in the runup to Christmas, with the monthly ANZ business & consumer confidence readings, trade balance data, monthly credit card spending prints, PSI survey and quarterly Westpac consumer confidence data all slated.

FOREX: USD Up From Lows, A$ Underperforms On China Iron Ore News

The USD is away from lows for the session, the BBDXY index last around 1261.50, against lows near 1259. Cross asset signals have mostly supported the USD in the form of higher UST yields and lower regional equities and commodities. Still, outside of the AUD, the rest of the G10 complex is firmer against the USD.

- JPY strength has been notable for much of the session. USD/JPY sits above session lows sub 137.00, last at 137.30/35, but this is still 0.3% since the open for the yen.

- AUD/USD has underperformed, likely weighed by lower iron ore prices, after China announced a new state run buyer will launch in 2023 and that it will seek a discount from miners. The active Singapore iron ore contract is off by over 3% (last under $108/tonne). AUD/USD is back to 0.6700, versus highs for the day of 0.6736.

- NZD/USD is also away from session highs, last around 0.6350/55, but is outperforming the AUD. The AUD/NZD cross was last around 1.0545/50, with lows for day at 1.0541. The pair remains in a downtrend channel.

- Coming up is UK retail sales, along with a host of PMI print for the UK, EU and US. The Fed's Mester will do a Bloomberg TV interview., while the Fed's Daly is also scheduled to speak.

AUD/NZD: Consolidating In Bear Channel

AUD/NZD has continued to consolidate in its bear channel that it has been in since 28 Sep, with the cross trading a touch above 2022 lows printed 7 Dec.

- NZD bulls look to break the base of the channel, moving down through 2022 lows opening up a target at the 2021 low of 1.0280.

- To reverse the bearish trend, the pair will have to break the 20-day EMA at 1.0683, which sits on the bear channel resistance.

- We published a piece yesterday on the fundamentals outlook for the pair in 2023, linked here. Rate differentials continue to point to further downside in the cross, but relative commodity prices are providing some offset.

Fig 1: AUD/NZD Spot Remains In A Bear Channel

Source: MNI - Market News/Bloomberg

ASIA FX: Resilience In The Face Of Cross-Asset Headwinds

Asian FX has traded fairly resiliently despite cross asset headwinds (lower regional equities/firmer UST yields). Some NDF pairs have seen a noticeable recovery from closing NY levels, although INR and IDR remain underperformers. As we move into next week the focus is likely to rest with China LPR rates (no change expected), the first 20-days of trade data for South Korea, the BI decision (+25bps expected) and Singapore inflation.

- USD/CNH is down around 0.15% from opening levels, last tracking close to 6.9800. We did touch a low of 6.9658, but the pair quickly recovered. The fixing bias was close to neutral. The authorities expect growth to pick up further, while UBS cut this year's growth forecast but raised the 2023 outlook.

- 1 month USD/KRW is back to a 1308 handle, 0.75% sub NY closing levels (around 1318). This comes despite a weaker equity lead onshore, although offshore investors haven't sold local shares today.

- In Singapore November export data surprised on the downside. Exports fell -9.2% m/m (-2.0% forecast), while the y/y printed at -14.6% y/y (-6.5%) forecast. This suggests the best of SGD NEER gains are now behind us. USD/SGD is lower for the session, in line with weaker majors. The pair last at 1.3565, offers appear above 1.3600, while moves towards 1.3430/40 are drawing buying interest.

- The 1-month USD/PHP NDF has moved away from resistance at 56.00, last tracking just under 55.80. The 56.00 level has been a resistance point in recent weeks, while the past week has seen dips towards 55.50 supported. Below that is simple 200-day MA at 55.39. Earlier comments from the BSP Governor suggested the tightening cycle will extend into 2023.

- USD/INR is at multi week highs, last around the 82.80 level. INR continues to underperform. Recent record highs sit above 83.00 in the pair, so be mindful of intervention risks if we approach these levels.

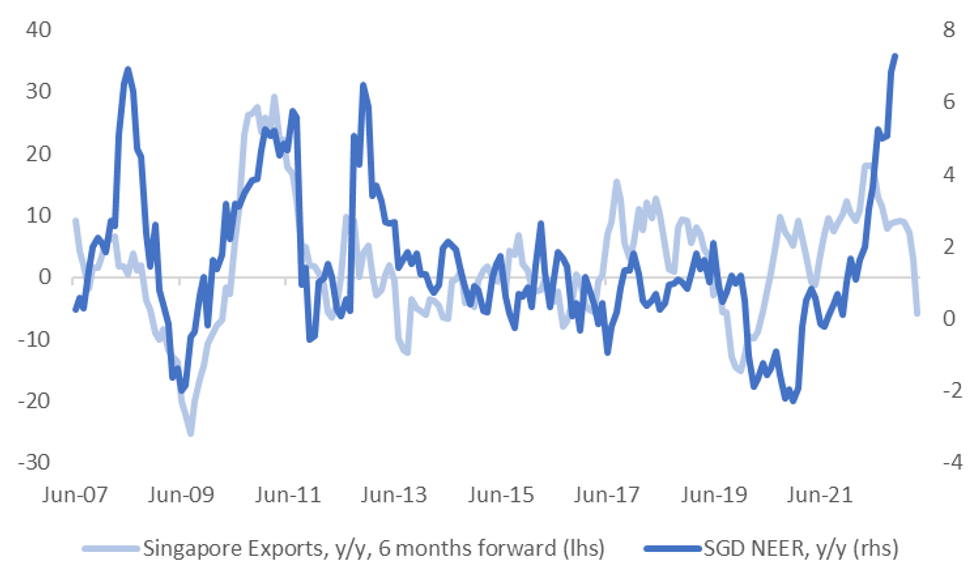

ASIA FX: Best NEER FX Gains May Be Behind Us

Earlier released November export data surprised on the downside. Exports fell -9.2% m/m (-2.0% forecast), with October revised down a touch, while the y/y printed at -14.6% y/y (-6.5%) forecast. Electronic exports were noticeably weaker at -20.2% y/y, although other major components of exports recorded y/y falls.

- Weakness in Singapore exports brings it into line with trends in other heavily export orientated economies such as South Korea and Taiwan.

- The chart below plots y/y Singapore export growth (smoothed), pushed forward 6 months, against y/y change in SGD NEER. At face value this suggests the best part of NEER gains may be behind us.

Fig 1: SGD NEER Y/Y Versus Singapore Export Growth Y/Y (6 Months Forward)

Source: MAS/MNI - Market News/Bloomberg

- Of course, future MAS policy decisions will also be heavily influenced by inflation outcomes. Next Friday November CPI prints. The October print came in below expectations, with some signs of a peak in inflation emerging. Note y/y SGD NEER gains, last around +7% is now above the y/y pace for both headline and core inflation.

- If the November print shows further signs that the worst of the inflation uptrend is behind us, the market may speculate the MAS leaves policy settings on hold at the next meeting (which is in April next year).

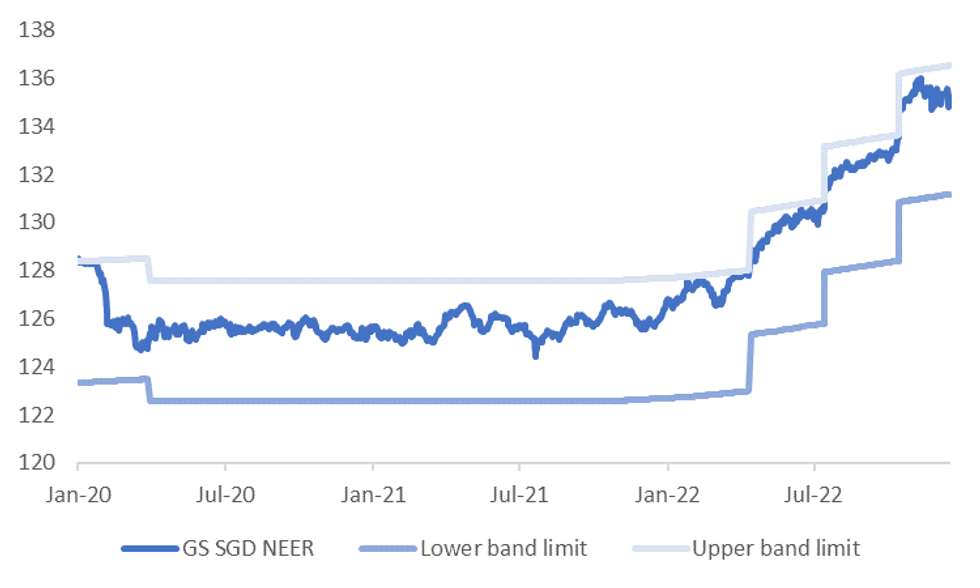

- Although the market may already be starting to price this. The SGD NEER has been drifting away from the top-end of the policy band, according to Goldman Sachs estimates, following the most recent policy tightening, see the chart below.

Fig 2: Goldman Sachs SGD NEER Estimate

Source: Goldman Sachs/MNI - Market News/Bloomberg

EQUITIES: Positive China News Can't Offset Negative Global Leads

Regional equities are mostly lower, in line with weakness in major US/EU bourses through Thursday's session. Sentiment has been volatile though, particularly for HK indices. US futures tried to push higher mid-way through the session, but this move faltered, and we are now back slightly lower on opening levels.

- The HSI is close to flat at this stage, having had a 2.5% range for the session. Supports in the form of comments late yesterday from China Vice Premier Liu He that the authorities are considering new measures to boost financial conditions and confidence in the housing market have aided property shares, although we are off earlier session highs (+2.36% from earlier highs of +3.6%).

- US delisting risks for tech related names also appear to have subsided in the near term, although this was arguably already priced by the market. The HS China Enterprise Index is firmer, +0.30%, but was up as much as 1.7% earlier.

- Mainland shares are modestly lower, the CSI 300 down by 0.33% at this stage.

- Tech sensitive bourses have fallen, following the lead from major global indices. The Nikkei 225 is down by 1.9%, the Taiex -1.60%. The Kospi is down by 0.50%, although up from earlier session lows. The ASX 200 is down 0.80%.

GOLD: Stabilizes But Still Tracking Lower For The Week On Hawkish CB Rhetoric

Gold is tracking slightly above yesterday's lows, last close to $1779. This is in line with some pullback in USD sentiment, although gold's early run above $1784 quickly ran out of steam. Note the simple 200-day MA comes in at $1787, with the precious metal unable to hold gains above this resistance point through December. Near term support is evident around $1774 and beyond that around the $1766/67 region.

- The hawkish central bank tone this week, from both the Fed and ECB has weighed on gold. At this stage we are tracking 1% lower for the week.

- Gold ETF holdings have maintained a relatively flat trend this past week.

OIL: Momentum Wanes, 20-Day EMA Capping Brent Upside

Brent crude's early rally fizzled out, as we attempted a move towards $82/bbl. We last tracked close to $81/bbl, down slightly for the session. We remain above Thursday's lows, while further support should be evident ahead of $75/bbl. On the top side, resistance is evident above $83/bbl, which also coincides with the 20-day EMA ($82.87/bbl).

- Brent is still tracking higher for the week, +6.60% at this stage. Momentum has faltered though in recent sessions, likely owing to hawkish ECB rhetoric and concerns around the near term demand outlook from China.

- Still, there is a sense of underlying support from the supply side. Bloomberg reports that Russia supply to Asian markets has slowed since the introduction of the price cap, while the IEA earlier this week, stated prices should rise in 2023 on supply issues.

- Looking ahead next week sees EU energy ministers meet Monday to discuss the gas price cap level. Tuesday and Wednesday deliver the weekly US oil inventory reports.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/12/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 16/12/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 16/12/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 16/12/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 16/12/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 16/12/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 16/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 16/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 16/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 16/12/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 16/12/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 16/12/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 16/12/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 16/12/2022 | 1000/1100 | ** |  | IT | Italy Final HICP |

| 16/12/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 16/12/2022 | 1030/1330 |  | RU | Russia Central Bank Key Rate Decision | |

| 16/12/2022 | - |  | US | 'Continuing Resolution On US Government Funding Expires | |

| 16/12/2022 | - |  | UK | BOE Announce Q1 Active Gilt Sales Schedule | |

| 16/12/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 16/12/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 16/12/2022 | 1700/1200 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.