-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN MARKETS ANALYSIS: USD Trims Wednesday's Gain

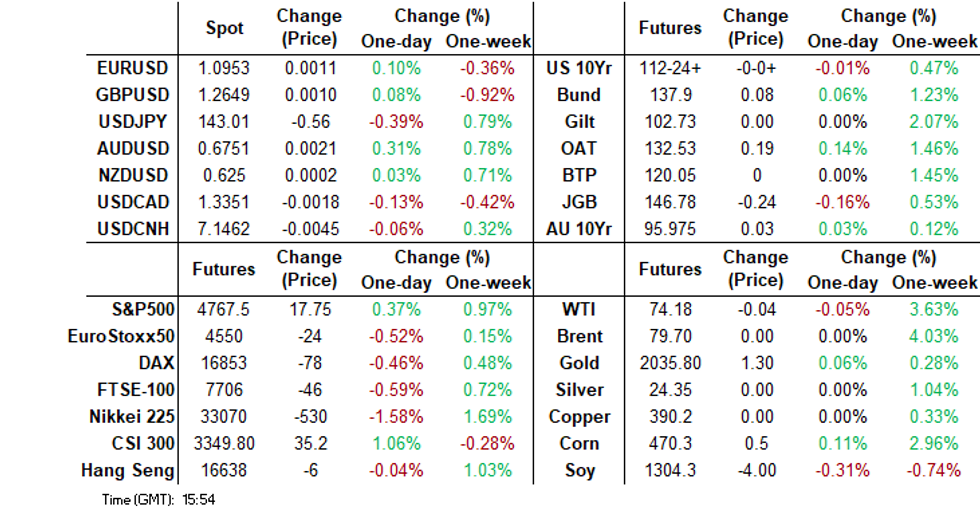

- Against the majors, the USD has trimmed part of Wednesday's gain. This comes despite a slightly higher US yield backdrop. JPY and AUD have been the strongest performers. Gold and oil have also looked to recoup late US Wednesday session losses.

- Headlines crossed from the WSJ that the US may raise tariffs on some China products, including EVs. Fallout for CNH has been limited, while China equities are up from recent cyclical lows.

- South Korean preliminary Dec trade figures point to a further improvement in global trade trends.

- Looking ahead, the docket is thin in Europe today, further out we have Weekly Jobless Claims and the third read of Q3 GDP.

MARKETS

US TSYS: Muted Session In Asia

TYH4 deals at 112-28, +0-03, a 0-04+ range has been observed on volume of ~64k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Tsys have had a muted session in Asia on Thursday, there has been little follow through on moves and no meaningful macro headline flow.

- A slight downtick at the open was observed as Asia-Pac participants perhaps used Wednesday's richening as an opportunity to close long positions/add fresh shorts. Losses were pared and Tsys sat in narrow ranges for the remainder of the session.

- The docket is thin in Europe today, further out we have Weekly Jobless Claims and the third read of Q3 GDP.

JGBS: Futures Hold Sub Recent Highs, National CPI Out Tomorrow

JGB futures have mostly been range bound this session. We sit comfortably off recent highs (147.00), but dips have also been supported. We currently track at 146.82, -.21 in terms of JBH4. Lows for the session rest at 146.74.

- The impulse from US Tsy futures has been limited, with range bound trends and remaining sub Wednesday highs.

- The Japan government nudged higher its growth and inflation projections for next year, but its inflation forecast remains below the BoJ's outlook. The government also expects income growth to beat inflation next year (see this BBG link).

- Headlines also crossed earlier of trade union minimum wage demands out to 2035 at ¥1600 per hour. This is above the government's target (NHK/BBG).

- Cash JGB yields sit higher for the most part. The 10yr yield is back at 0.574%, +2bps for the session. This puts us back close to the 200-day MA. 10yr swap rates are back near 0.80%.

- Tomorrow, we have the Nov National CPI print on tap, as well as a 3 month bill sale and an enhanced liquidity auction.

BOJ: MNI BoJ Review December 2023: No Hints Of Early 2024 Policy Shift

- The BoJ December meeting delivered few surprises. All policy parameters were left unchanged, while forward guidance remained dovish. Arguably the latter was more important, as forward guidance may need to change before the BOJ delivers a major policy shift. Hence such a move is unlikely at the January policy meeting.

- The BoJ statement and Governor Ueda's press conference suggested confidence in hitting the 2% inflation target in a stable and sustainable manner for fiscal year 2025 had risen versus the November policy meeting. However, it still needs to see more evidence around the strength of the wage-price cycle before shifting policy.

- See the full review here:

AUSSIE BONDS: Richer, Curve Marginally Steeper

ACGBs sit 1-4bps richer across the major benchmarks, the curve has bull steepened. The support seen early in the session from Wednesday's US Tsy rally gradually faded through the session however ACGBs did hold richer.

- Futures have trimmed gains through the session, dealing in narrow ranges for the most part. XM sits +0.02 and YM +0.04.

- RBA dated futures see the cash rate steady in Feb 24 at 4.35%, there are ~60bps of cuts by Dec 24.

- There was little domestic news flow today.

- Looking ahead, due tomorrow November Private Sector Credit rounds off the week's docket.

NZGBS: Richer, Narrow Ranges On Thursday

NZGBs have finished dealing 2-8bps richer across the major benchmarks, the belly lead the bid. The support to the space seen early in the session, from Wednesday's bid in US Tsys, marginally extended through the session however narrow ranges persisted for the most part.

- 10-Year NZ US Swaps have been stable today and sit at +57bps, as have RBNZ dated OIS. There are ~100bps of cuts in the OCR priced by Nov 24.

- NZ Tsy plans two bond auctions in January, each auction will offer NZ$500m bonds and the dates are 18 and 25 Jan (BBG).

- A reminder that the local data docket is empty tomorrow.

FOREX: USD Trims Wednesday's Gain

The greenback has trimmed some of Wednesday's gain in Asia today, the risk-off move seen in the NY session has moderated. US Equities are higher and US Tsys a touch lower.

- The Yen is the strongest performer in the G-10 space today as post BOJ losses continue to be trimmed, USD/JPY is ~0.5% lower and sits below the ¥143 handle. The pair does remain well within recent ranges. Technically support comes in at ¥142.25 Low Dec 19, resistance is at ¥145.26 76.4% retracement of the Dec 11 - 14 sell-off.

- AUD/USD is up ~0.3%, the pair last prints at $0.6750/55. Technically the uptrend remains intact, resistance is at $0.6776 High Dec 20 and $0.6821 High Jul 27. Support comes in at $0.6655 Low Dec 14.

- AUD/NZD has firmed above the $1.08 handle as Trans-Tasman technical flows come to the fore. NZD/USD has observed narrow ranges for the most part and is a touch firmer than opening levels.

- Elsewhere in G-10 there have been no moves of note in Asia.

- The docket is thin in Europe today.

JAPAN DATA: Japan Purchases Of Offshore Bonds Surges

Offshore investors returned to Japan stocks last week, albeit only partially unwinding the outflows seen in the previous two weeks. We had ¥273.8bn in net inflows. Foreign purchases of local bonds rose to ¥971.5bn, which is the biggest weekly inflow since mid August.

- The standout though was Japan buying of offshore bonds, which surged to ¥2286.1bn. This is the highest net weekly since the first part of September. It fits with post Fed price action in global fixed income markets last week. It also more than offset net sales from the prior week.

- Japan investors sold offshore stocks for the fourth straight week (-¥437.5bn).

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending Dec 15 | Prior Week |

| Foreign Buying Japan Stocks | 273.8 | -992 |

| Foreign Buying Japan Bonds | 971.5 | 628.2 |

| Japan Buying Foreign Bonds | 2286.1 | -1079.5 |

| Japan Buying Foreign Stocks | -437.5 | -500.8 |

Source: MNI - Market News/Bloomberg

EQUITIES: Asia Pac Markets Mostly Lower, Japan Equities Underperform

Regional Asia Pac equities are mostly in the red for Thursday trade. Japan markets have been the weakest performers. This follows strong US cash losses late in Wednesday trade. US futures have crept higher through the first part of Thursday trade. Eminis last +0.30% to 4764, but this is still nearly 1.4% off intra-session highs from Wednesday. Nasdaq futures are +0.40% higher.

- At this stage the Topix is off by 1%, while the Nikkei 225 is down nearly 1.6%. US losses from Wednesday have weighed, while a vehicle recall (on safety concerns) from Toyota has also been a weight on aggregate performance. Shares in the company down the most since May 2022 at one stage.

- China markets are higher at the break, the CSI 300 up nearly 0.50% and back above the 3300 level. This has bucked the broader trends in Asia Pac markets. Headlines crossed from the WSJ that the US is considering raising some tariffs on some China products, including EVs, so that may impact sentiment after the break.

- In HK, the HSI is off 0.24% at the break.

- Tech sensitive plays South Korea (Kospi -0.80%) and Taiwan (-0.60%) are both weaker as well.

- In SEA trends are mixed, but only the Singapore bourse and Thailand are modestly positive at this stage.

OIL: Edges Up From Recent Lows

Brent crude sits a touch above recent session lows (near $79/bbl). The benchmark last near $79.35/bbl. Oil wasn't immune from the risk off in equity markets late in US trade on Wednesday. Earlier highs came in at $80.60/bbl. For WTI we last tracked near $73.85/bbl, down from earlier session highs above $74/bbl, but also above Wednesday lows. Some USD weakness has helped at the margins (BBDXY -0.18%).

- Outside of equity market risk jitters on Wednesday we saw US supply temper bullish oil sentiment.

- EIA Weekly US Petroleum Summary - w/w change week ending Dec 15: Crude stocks +2,909 vs Exp -2,355, Crude production +200, SPR stocks +629, Cushing stocks +1,686

- Still, oil benchmarks are comfortably tracking higher for the week at this stage.

- Elsewhere, focus will remain on tensions in the Red Sea. Yemen’s Houthi rebels have vowed to continue targeting ships in the Red Sea despite the planned US-led naval task force to secure the area, according to Bloomberg.

GOLD: Pares Wednesday Losses On USD Weakness

Gold is tracking higher in the first part of Thursday trade. The precious metal currently sits near $2037, clos to session highs. This puts us +0.30% firmer versus end Wednesday levels in NY, not quite unwinding the -0.44% pull back for that session.

- The gold rebound is in line with weaker USD trends against the majors. The BBDXY is off close to 0.2% at this stage, unwinding part of Wednesday's risk induced bounce.

- We are sub highs above $2045 this week, while resistance at $2054.3 (50% retrace of Dec 4-13 bear leg) or support at $1973.2 (Dec 13 low), remain comfortably in tact.

US-CHINA: US Considering Raising Tariffs On Some China Products - Including EVs

Headlines have crossed from the WSJ that the US Biden Administration is considering raising tariffs on some China goods, including EVs (see this link for mroe details).

- The article notes no decisions have been made yet but that officials have started discussing the tariff issue again, with an aim of wrapping up a long running tariff review early next year.

- The Biden Administration has maintained the $300bn tariffs introduced by the previous Trump Administration.

- The article notes US officials are concerned around China clean energy products and penetration into the US market. China EVs are already subject to a 25% tariff.

- Tariffs may also be reduced on lower end or less strategically important product areas according to the article.

- The market impact has been limited so far. USD/CNH has risen but remains sub 7.1500 at this stage.

- In the equity space at the break, the CSI 300 is up 0.48%, while in Hong Kong the HSI is down 0.24%.

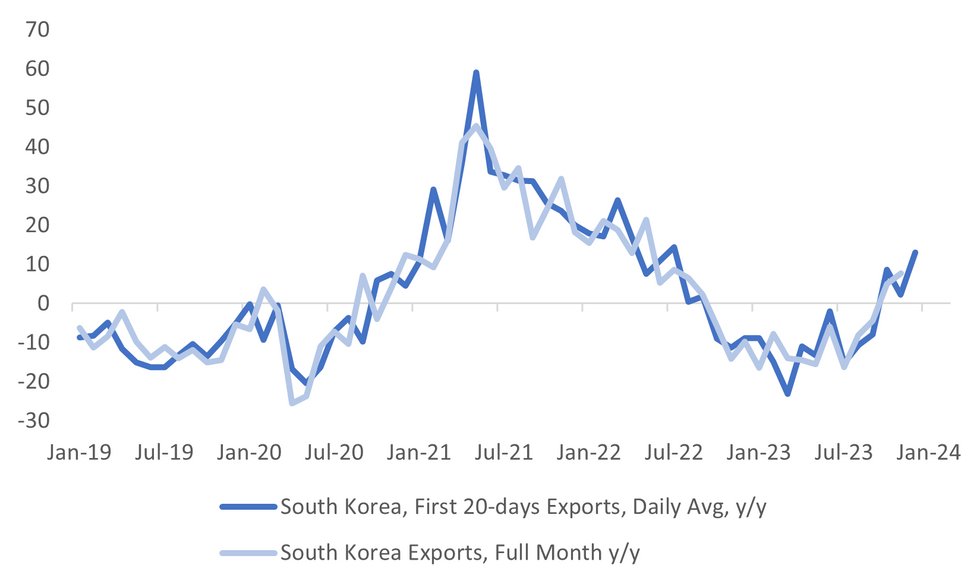

SOUTH KOREA DATA: A Further Improvement In Export Growth, Demand From The US Strong

The first 20-days of Dec trade data suggested a further improvement in the external demand backdrop. Exports rose 13% in y/y terms, with day count affects not evident, as daily average exports also rose 13% y/y. The first chart below overlays the first 20-day exports (daily average) against full month export growth.

- The details showed chip exports continuing to recover, now up 19.2% y/y. We were at 2.4% for the first 20-days of Nov. Base effects will be playing a role in this recovery.

- By country, exports were up to the US by 30.2% in the first 20-days, this compares with 15.7% y/y for the same period in Nov. While this series can be volatile, we have seen positive y/y growth in exports to the US for the past 4 months.

- Exports to China were -0.4% y/y, but continue to improve from a momentum standpoint.

- Imports fell -9.2% y/y, slightly weaker than the Nov -6.2%y/y dip. The trade surplus was $1.62bn and this should improve before the end of the month.

Fig 1: South Korean Export Trend Continues To Recover

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Mixed, BI Decision Still To Come

USD/Asia pairs are mixed. CNH has been relatively steady, while IDR has softened a touch on equity risk aversion. Most other pairs are down modestly, in line with USD retracement against the majors (BBDXY -0.20%). Still to come today is the BI decision, no change is expected. Tomorrow's data calendar is light with Malaysia CPI on tap and then Taiwan unemployment figures.

- USD/CNH sits close to unchanged for the session, last near 7.1475. Earlier lows were at 7.1427, but we saw modest USD demand post headlines that the US was considering raising tariffs on certain China goods, including EVs. We couldn't get beyond 7.1500 though. Local equities are tracking higher, which is likely providing some support.

- 1 month USD/KRW sits near 1301 in recent dealings, having been largely range bound for Thursday trade to date. A won headwind has come from local equity weakness (-0.80% for the Kospi), while positives have been in terms of further improvement in export trends and a firmer yen.

- Spot USD/IDR has drifted higher through trade today, last near 15530. We still have the BI decision to come, which is expected to deliver an on hold outcome. Risk aversion in the equity global equity space has likely weighed on IDR, offsetting a further decline in US real yields. Indonesia 5yr CDS is up from recent lows a touch, last near 72bps.

- The SGD NEER (per Goldman Sachs estimates) is steady this morning, we remain well within recent ranges. The measure sits ~0.4% below the top of the band. USD/SGD continues to see-saw around the $1.33 handle as broader greenback trends dominate flows. A reminder that the data docket is empty for the remainder of the week.

- The Ringgit has ticked higher on as the downtick in US Tsy Yields seen yesterday provides a level of support. USD/MYR print at 4.6480/4.6520, ~0.2% lower today. The remains well within the recent 4.63/4.70 which has persisted for the most part recently. Looking ahead; the local data docket is empty today, tomorrow November CPI is due. A downtick in CPI to 1.7% Y/Y from 1.8% Y/Y is expected.

- USD/PHP has continued to drift lower, last near 55.4, around 0.20% stronger in PHP terms. We remain within recent ranges. Headlines that have crossed today have mainly focused on tensions with China over the South China Sea.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/12/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/12/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 21/12/2023 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 21/12/2023 | 0900/1000 | ** |  | IT | PPI |

| 21/12/2023 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 21/12/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 21/12/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/12/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 21/12/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/12/2023 | 1330/0830 | *** |  | US | GDP |

| 21/12/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/12/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 21/12/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 21/12/2023 | 1600/1700 |  | EU | ECB Lane Participates In Workshop Panel | |

| 21/12/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/12/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/12/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 22/12/2023 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.