-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Weak Global Trade And Output Unlikely To Improve Soon

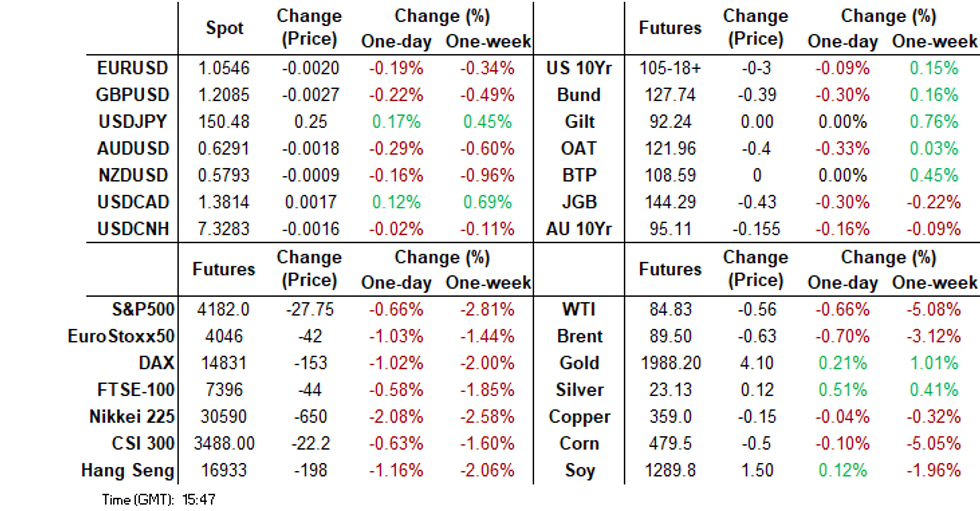

- Regional equity sentiment has faltered sharply. This follows sharp US losses in Wednesday trade, particularly in the tech space. These trends have continued today, with US Nasdaq futures down sharply, off over 1%. Higher US yields and earnings concerns weighing. The USD is higher supported against all the majors, with AUD breaking its bear trigger.

- Reuters headlines crossed a short while ago which stated Israel ground forces had conducted a 'relatively large' incursion into Gaza overnight, although subsequent details indicated the forces have withdrawn.

- Elsewhere, global data for August released by the Dutch CPB showed that global trade continued to contract and industrial output to stagnate, see below for more details.

- The ECB meets and is expected to leave rates unchanged (see MNI ECB Preview). The decision will be followed by President Lagarde’s press conference. Later Fed’s Waller gives opening remarks and in terms of data there is Q3 GDP which is expected to be strong, September durable orders and jobless claims.

MARKETS

GLOBAL: Weak Global Trade And Output Unlikely To Improve Soon

Global data for August released by the Dutch CPB showed that global trade continued to contract and industrial output to stagnate. In line with the S&P Global manufacturing PMI at 49.0 in August and September’s 49.1 suggests that global IP/trade should be as lacklustre at the end of Q3 as they were in the middle.

- Global trade volumes fell 3.8% y/y in August after -3.3% and seem to be trending down. With import volumes contracting 5.3% y/y but exports doing better down 2.3% y/y due to positive growth from emerging economies driven by China (+5.5% y/y) and eastern Europe (+17.5% y/y). Apart from China, export growth from the rest of Asia remains weak with advanced Asia ex Japan down 4.2% y/y and emerging Asia ex China -7.7%.

- IP growth was steady at 0.4% y/y in August and has been hovering just above zero since December last year and with the global manufacturing PMI continuing to signal contracting activity, output growth is unlikely to improve any time soon. The PMI has been below 50 for the last year.

Source: MNI - Market News/Bloomberg/Refinitiv

Cross-Asset: Israel Ground Forces Attacked Hamas Positions In Gaza

Reuters headlines crossed a short while ago which stated Israel ground forces had conducted a 'relatively large' incursion into Gaza. This was reported by Israeli Army Radio. The raid was reportedly carried out overnight, with Hamas positions attacked. The incursion was described as larger than those previously carried out.

- The market impact has been relatively muted so far. US equity futures sit near session lows (Eminis near 4180.5, -0.70%), while the USD is around session highs (1278.80 for BBDXY). Oil, in terms of Brent, steady near $89.90/bbl. For US Yields there has been little reaction the Tsy curve remains little changed from opening level and is marginally steeper. TYZ3 deals at 105-19+, -0-02, as a narrow 0-06 range persists.

- This is likely to be a watch point for markets given market reaction on Wednesday to comments from Israel Prime Minister Netanyahu stating the country was preparing for a ground invasion of Gaza.

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 105-20+, -0-01, a 0-06 range has been observed on volume of ~105k. Technically TY trend condition is bearish, support comes in at 105-10+ the Oct 19 low and bear trigger.

- Cash tsys sit 1bp richer to 1bp cheaper across the major benchmarks, light twist steepening is apparent.

- Tsys have observed narrow ranges in Asia with little follow through on moves.

- A retreat from early session highs was seen as US Equity futures extended losses. TY saw support ahead of yesterday's lows and the early range persisted.

- The latest monetary policy decision from the ECB provides the highlight in the European session today. Further out we have US wholesale inventories, GDP, US durable goods, initial jobless claims and pending home sales. We also have the latest 7-Year Supply.

JGBS: Futures At Session Lows, Fresh Cycle High For 10YY

In the Tokyo afternoon session, JGB futures are weaker and at session lows, -47 compared to settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined PPI services and international investment flow data. Later, the docket shows Machine Tool Orders (final) for September.

- Bloomberg reported that Daiwa Securities believed the BOJ needed to review its “exceptional” policy of buying corporate bonds at the first opportunity. It is problematic that the bond purchase program, which started in response to the 2008 global financial crisis, hasn’t been discussed much, said Toshiyasu Ohashi, chief credit analyst at Daiwa, one of the top arrangers of corporate bonds in Japan. (See link)

- Cash JGBs are cheaper out to the 20-year, with the belly of the curve underperforming. The benchmark 10-year yield is 3.2bps higher at 0.891%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also a fresh cycle high.

- The swaps curve has twist-steepened, pivoting at the 2s, with rates 0.1bp lower to 2.3bps higher. Swap spreads are tighter out the 10-year and wider beyond.

- Tomorrow, the local calendar sees Tokyo CPI and BOJ Rinban operations covering 3- to 25-year+ JGBs.

AUSSIE BONDS: Holding Cheaper, Near Session Lows, Q3 PPI & Sep-26 Supply Tomorrow

ACGBs (YM -7.0 & XM -14.0) are sharply weaker and near Sydney session lows. With the data calendar being relatively light today, the focus was on RBA Governor Bullock’s appearance before the Senate Economics Committee. Unfortunately, for a market that was looking for clues on the outlook for policy following yesterday’s higher-than-expected CPI data, Bullock didn’t give anything away regarding the likely outcome of the November 7 meeting. She said the bank’s forecasts will be altered in November but it’s too early to say whether there will be a “material” change in the inflation outlook and thus the return to target.

- Cash US tsys' twist-steepening in today’s Asia-Pac session, pivoting at the 10s, also likely weighed on longer-dated ACGBs.

- Cash ACGBs are 6-14bps cheaper on the day, with the AU-US 10-year yield differential 6bps higher at -10bps.

- The swaps curve has bear-steepened, with rates 5-13bps higher.

- The bills strip has twist-steepened, with pricing +2 to -7.

- RBA-dated OIS pricing is flat to 4bps softer across meetings, but remains 6-12bps firmer from pre-CPI levels.

- Tomorrow, the local calendar shows Q3 PPI data.

- Tomorrow, the AOFM plans to sell A$800mn of the 0.50% 21 September 2026 bond.

- Fitch Ratings has affirmed the 'AAA' Ratings for NSW and TCorp. The Outlook is Stable.

RBA: Q3 CPI As Expected, Not Sure If “Job Done Yet”

RBA Governor Bullock didn’t give anything away re the likely outcome of the November 7 meeting at her Senate committee appearance. She said the bank’s forecasts will be altered in November but it’s too early to say whether there will be a “material” change in the inflation outlook and thus the return to target. With Q3 CPI in line with RBA expectations, this outlook will be key to whether it hikes next month. The RBA remains “wary” and doesn’t know if “job done yet”.

- Q3 CPI was in line with RBA expectations but was higher than the forecasts in the August Statement of Monetary Policy. The RBA will now take this information and “reflect” on it and what it means for monetary policy.

- The key remains the timing of the return of inflation to target, which has been gradually shifted out. She reiterated that the return to target within a “reasonable timeframe” is important in keeping a lid on inflation expectations. Currently Q2 2025 inflation forecast is at 3.1% and once the Board has updated forecasts it will judge how long we can stay outside the band and if monetary policy needs to “react”.

- Services inflation showed that it is “fairly persistent” and while it moderated it is still higher than the RBA is “comfortable” with. Higher input costs including wages and electricity are driving higher services prices. Bullock noted that there isn’t a price-wage spiral though but that total compensation growth is ahead of the WPI.

AU STIR: RBA Dated OIS Westpac Joins Hike Camp, Post-Bullock Senate Appearance Softening Pared

The announcement that Westpac had joined the other three major banks in advocating for a 25bp rate increase at the November meeting has led to a partial reversal of the earlier softening in RBA OIS pricing. This softening had occurred during RBA Governor Bullock's during testimony before the Senate Economics Committee.

- Governor Bullock's cautious and non-committal stance in response to questions regarding the implications of yesterday's higher-than-anticipated Q3 CPI print had initially caused pricing to soften, with reductions ranging from 4 to 6bps across meetings.

- Nonetheless, a notable shift in perspective from Westpac's Chief Economist, Luci Ellis, who previously served as an assistant governor at the RBA, with regards to a potential November rate hike, prompted the OIS market to retrace some of its earlier declines. As a result, today's softening has been pared to 1-2bps.

- Bloomberg reported Ellis's statement, where she noted, "I've gathered sufficient evidence to make my inaugural rate prediction, and it points toward an impending hike." (See link)

Figure 1: RBA-Dated OIS – Today Vs. Pre-CPI

Source: Bloomberg / MNI - Market News

NZGBS: Bear Steepening, Tracking Tsys, ECB Expected To Hold Policy Steady

NZGBs closed 1-8bps cheaper, with the 2/10 curve steeper. NZGBs traded in relatively narrow ranges during the local session after gapping cheaper at the open following US tsys' weak lead-in.

- In the realm of weekly supply, demand metrics were rather lacklustre, with cover ratios for the various lines falling in the range of 2.6 to 2.9 times.

- With the local data calendar light again today, local participants have likely taken their directional cues from US tsy dealings in the Asia-Pac session. Cash US tsys have twist-steepened, pivoting at the 10s, with yield movement bounded by +/-1.5bps.

- Swap rates closed 6-11bps higher, with the 2s10s curve steeper and implied swaps spreads wider.

- RBNZ dated OIS pricing closed slightly firmer across meetings, with terminal OCR expectations at 5.61%.

- Tomorrow, the local calendar sees ANZ Consumer Confidence.

- Later today, the ECB is widely expected to hold policy steady at 4%. Even though the Eurozone economy is at risk of a potential recession and facing a downside skew in terms of risks, the ECB is unlikely to waver and will likely reiterate the necessity of maintaining restrictive measures.

- Further out, we have US wholesale inventories, GDP, durable goods, initial jobless claims and pending home sales. There is also 7-year supply.

FOREX: AUD Breaks Bear Trigger

AUD/USD has been pressured in today's Asian session, the pair has broken $0.6286, low from Oct 3/13 and bear trigger. AUD was pressured after RBA Gov Bullock's senate testimony, extending losses as US Equity futures ticked lower through the session.

- AUD/USD sits at $0.6275/80 down ~0.5% today. The next support level is $0.6215, 2.236 proj of Jun 16-Jun 29-Jul 13 price swing.

- Kiwi is also pressured, NZD/USD printed a fresh 2023 low today before marginally paring losses in recent trade. NZD/USD is down ~0.4% and last prints at $0.5775/80.

- USD/JPY has ticked higher and breached ¥150.40, 2.618 projection of the Jan16-Mar 8-Mar 24 price swing. The next target for bulls is ¥151.09, 2.764 projection of the Jan16-Mar 8-Mar 24 price swing.

- Elsewhere in G-10 EUR and GBP are reflecting the broader USD move and are down ~0.2%. The Scandies are pressured however liquidity is generally poor in Asia./

- Cross asset wise; BBDXY is up ~0.2% and e-minis are ~0.6% lower. US Tsy Yields are little changed across the curve.

- The latest monetary policy decision from the ECB provides the highlight in the European session today.

JAPAN DATA: Offshore Flows Into Local Stocks Continue, Bond Flows Remain Volatile

Weekly investment flow data showed a continued inflow into local stocks from offshore investors. The pace of inflows did slow to ¥214.7bn yen, which was down from the prior week, but still marked the fourth straight week of inflows into local equities. It was a different story in terms of bond flows. Offshore investors reversed nearly all of the prior week's inflow, with an outflow of -¥904.2bn. The general trend since mid September has been for outflows (a cumulative -¥2594.9bn), which fits with a firmer Japan yield backdrop over this period.

- In terms of Japan domestic outflows, local investors sold foreign bonds (-¥151.7bn) Still, the general trend in recent months has been to purchase offshore bonds. Also note Nippon Life stated it would buy/sell foreign bonds flexibly as yields and FX shift (see this link).

- Japan outflows to offshore stocks were positive, but remained modest at ¥82.7bn.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending October 20 | Prior Week |

| Foreign Buying Japan Stocks | 214.7 | 1263.9 |

| Foreign Buying Japan Bonds | -904.2 | 947.8 |

| Japan Buying Foreign Bonds | -151.7 | 808.1 |

| Japan Buying Foreign Stocks | 82.7 | 178.6 |

EQUITIES: Broad Based Weakness As Tech Earning Fear/Higher US Yields Weigh

Regional equity sentiment has faltered sharply in Thursday trade to date. This follows sharp US losses in Wednesday trade, particularly in the tech space. These trends have continued today, with US Nasdaq futures down sharply, off over 1%. Eminis are also weaker, down 0.65% at this stage. Weakness in Meta, which highlighted an uncertain economic backdrop and its impact on the AI sector, has weighed (see this BBG link). Elevated US yields remains the other headwind.

- Not surprisingly, tech sensitive bourses have seen the largest percentage losses. The South Korean Kospi is off 2.23%. Offshore investors have sold local shares, although institutional and retail investors have been buyers.

- The Topix is off nearly 1.40%, with Toyota losses dragging the index down. The Taiex is down by 1.5%, following a sharp loss for the SOX in Wednesday US trade.

- Losses are more modest for Hong Kong and mainland China shares. At the break the HSI is down by around 0.55%, with the CSI 300 off by the same amount. For the HSI this offsets yesterday's gain, which was aided in part by Hong Kong Executive efforts to aid the property market and boost stock trading.

- In SEA all markets are weaker, with Indonesia's JCI the worst performer, down 1.6%. Thailand and Philippine stocks are also off by a little over 1%.

OIL: Crude Range Trading While Watching And Waiting

Crude has held onto most of Wednesday’s gains during today’s APAC session. After rising around 2% prices are down around 0.3% today. Brent is down to $89.87/bbl, close to the intraday low of $89.78 after rising to $90.33 early in the session. WTI is at $85.22, close to the low of $85.08, after a high of $85.59. The stronger dollar has weighed on prices with the USD index +0.2%.

- The market remains nervous re events in the Middle East after Israeli PM Netanyahu said there would still be a Gaza ground offensive. Such a move could see the conflict spread outside of Israel/Gaza and world leaders are trying to change Netanyahu’s mind.

- Events in the Middle East have added a “war premium” to crude but Bloomberg is reporting that physical prices are easing as refiners reduce gasoline production ahead of the northern hemisphere winter.

- Later Fed’s Waller gives opening remarks and in terms of data there is Q3 GDP which is expected to be strong, September durable orders and jobless claims. The ECB meets and is expected to leave rates unchanged (see MNI ECB Preview). The decision will be followed by President Lagarde’s press conference.

GOLD: Extends Wednesday’s Gain In Asia-Pac Dealings

Gold is +0.2% in the Asia-Pac session, after closing +0.4% at $1979.72 on Wednesday following headlines that Israeli PM Benjamin Netanyahu suggested that a ground invasion will be conducted and a report that the US was deploying missiles in the region.

- Wednesday’s move in bullion came despite gains in the USD and Treasury yields.

- The rise in the USD and yields were fueled by unexpectedly robust data on new home sales, which added to concerns that the ongoing strength of the US economy will keep a Fed rate hike on the agenda later in the year or early 2024. It has also added to expectations of a significant increase in Q3 GDP later today.

- Weakness in US Treasuries was also driven by expectations of next week's announcements regarding larger auction sizes, coupled with lacklustre demand metrics witnessed at the US$52bn 5-year note auction.

- Higher yields are typically negative for non-interest-bearing gold.

- According to MNI’s technicals team, yesterday’s gain maintains the yellow metal’s bullish outlook. It was also a step closer to resistance at $1997.2 (Oct 20 high).

SOUTH KOREA: Q3 Growth Slightly Firmer Than Expected

South Korean Q3 GDP came in a touch stronger than expected. Q/Q growth was 0.6%, versus 0.5% forecast and 0.6% prior. Y/Y growth was 1.4%, versus 1.1% forecast and 0.9% prior.

- The detail showed private consumption up 0.3% in the quarter, while construction rebounded 2.4% from -3.9% in Q2. Facilities investment was weaker though -2.7% q/q.

- Manufacturing activity rose 1.3% q/q, down from the 2.5% pace seen in Q2. In y/y terms we recovered though to 1.2% from -0.8%. Services activity was relatively steady (+0.2% q/q and 1.7% y/y).

- Exports rose 3.5% q/q, and early Q4 indicators suggests some further improvement in the external demand backdrop.

- Overall, the data points to a resilient growth backdrop, albeit coming from a low base.

SOUTH KOREA: Business Sentiment On Export Improves, But Non-Manufacturing Side Falters

Earlier South Korean business sentiment data pointed to a mixed outlook. Manufacturing sentiment rose for November to 69 from 67. This is the first rise in the index since mid-year. In terms of the detail, the improvement was more so with large manufacturers, conditions at smaller firms deteriorated. There was a notable improvement in the export outlook. The chart below overlays this sub-index against South Korean y/y export growth. Domestic conditions were modestly softer though.

- On the non-manufacturing there was a sharp pull back in sentiment. The headline index falling to 69 from 77.

- This is fresh lows back to early 2021. Weakness was particularly evident in terms of sales expectations.

- This data comes after the slightly better than expected Q3 GDP print earlier. The improving external backdrop will be welcome but signs of softer domestic conditions will be a BOK watch point.

Fig 1: South Korean Manufacturers Export Expectations & Export Growth Y/Y

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Higher, CNH Outperforms, BSP Press Conference Coming Up

Outside of CNH, USD/Asia pairs have pushed higher across the board. Equity market weakness has been firm, particularly for tech sensitive countries. The won, the baht and IDR have been the weakest performers. Note BSP has a press conference scheduled for around 1.5 hours. This follows earlier reports in the week where Governor Remolona stated an off cycle rate hike may be considered today. Tomorrow, we have China industrial profits as the main focus.

- USD/CNH hold steady under 7.3300, showing no beta with respect to the higher USD trends elsewhere. Local equities are weaker, but the 0.65% dip in the CSI 300 is more modest compared to losses for other regional bourses.

- 1 month USD/KRW is not too far off YTD highs above 1360. The pair last near 1357.50. The sharply weaker onshore equity tone (Kospi -2.65%) has weighed and offset a modest Q3 GDP beat earlier. Tech equity winds are elevated from an earnings standpoint and high US yields.

- USD/THB sits near 36.34 in recent dealings, around 0.40% weaker in baht terms versus closing levels from yesterday. Earlier highs were at 36.385, which was just above the 20-day EMA, but we couldn't sustain this move. This keeps us well within recent ranges for the pair, with support evident ahead of 36.00, while recent highs at 36.55 remain intact. Baht weakness is line with broader regional trends, although the THB is outperforming a weaker equity backdrop.

- USD/INR is a touch above earlier lows, last near 83.25. The pair continues to see-saw in a narrow range around the 20-Day EMA (83.1880), there has been little follow through on moves. A 83.00/25 range has persisted for the most part since late September. Technically the pair remains in an uptrend, bulls target the high from 20 October 2022 (83.2975). Bears immediate focus is the 83 handle, a break of the handle opens low from 22 Sep (82.8325).

- USD/IDR is back above the 15900 level, and got close to Monday session highs, which prompted intervention from the BI. We last tracked near 15930.

- The Ringgit has pared early losses, USD/MYR again faced resistance ahead of the 4.80 handle.• USD/MYR prints at 4.7855/80, ~0.1% above opening levels. On the downside bears look to first break the 20-Day EMA (4.7454) which opens the low from 2 Oct (4.6900). The pair remains in an uptrend and bulls target a break of the 4.80 handle.

- The SGD NEER (per Goldman Sachs estimates) sits marginally firmer this morning and remains well within recent ranges. The measure is ~0.6% below the top of the band. USD/SGD has ticked higher this morning after breaching the $1.37 handle in yesterday's session as broader USD trends dominate flows. In early trade on Thursday we are ~0.2% above opening levels at $1.3725/30. IP data was stronger than expected for Sep 10.7% m/m, versus 8.1% forecast).

- USD/PHP holds steady near 56.94 in recent dealings. We haven't tested 57.00 resistance. Focus in the upcoming BSP press conference.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/10/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 26/10/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 26/10/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 26/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/10/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 26/10/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/10/2023 | 1230/0830 | *** |  | US | GDP |

| 26/10/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/10/2023 | 1245/1445 |  | EU | Press conference post- governing council meeting of ECB | |

| 26/10/2023 | 1300/0900 |  | US | Fed Governor Christopher Waller | |

| 26/10/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 26/10/2023 | 1415/1615 |  | EU | ECB's Lagarde presents monetary policy decisions via Podcast | |

| 26/10/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 26/10/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 26/10/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/10/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/10/2023 | 1645/1745 |  | UK | BoE's Cunliffe Speaks at Fed Conference | |

| 26/10/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.