-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI European Morning FI Analysis: Soft China GDP Halts Momentum

US TSYS: Early Downside Impetus Stymied By Chinese GDP

A lack of fresh macro headline flow and the weaker than expected Chinese GDP reading has limited the downside impetus that was witnessed in Tsys during early Asia-Pac trade (which was largely driven by the aforementioned uptick in e-minis, as they unwound some of Friday's late option expiry related losses). Contract last -0-04+ at 138-29+, while cash Tsys sit 0.6-1.5bp cheaper across the curve, bear steepening.

- With the ongoing fiscal impasse still evident in DC, House Speaker Pelosi administered a 48-hour deadline re: getting a fiscal support pact done pre-election, this comes due on Tuesday. Meanwhile, Senate Republicans will table a piecemeal support package. Elsewhere, the weekend saw an FT piece do the rounds, in which senior Federal Reserve officials, namely regional Presidents Rosengren & Kashkari, call for tougher financial regulation to prevent the US central bank's low interest-rate policies from giving rise to excessive risk-taking and asset bubbles.

- Eurodollar futures sit unchanged to -1.0 through the reds. Overnight flow saw some steepener interest in the EDU2/U4 spread.

- A raft of Fedspeak headlines the local docket today.

RATINGS: The UK & France Saw One Notch Downgrades On Friday

Sovereign rating reviews of note from Friday included:

- Moody's downgraded the UK to Aa3, Outlook Stable

- DBRS Morningstar downgraded France to AA (high), Stable Trend

- DBRS Morningstar confirmed Norway at AAA, Stable Trend

JGBS: Futures Softer At The Margin, Cash Mixed

The impetus from Tsys/e-minis/the Nikkei 225 weighed on JGB futures in early dealing this week, with the contract shedding its fairly modest overnight gains and more, last -5 ticks vs. Tokyo settlement levels. The swaps curve twist flattened, with receiving seen in 40s, which was an outlier, while cash JGB yields sit either side of unchanged.

- BoJ Governor Kuroda's weekend address offered no fresh insight, as he reaffirmed the Bank's view on the Japanese economy and pushed back against the idea of movement in the Bank's forward guidance and/or inflation target.

- The latest monthly Japanese trade surplus was narrower than expected, as exports missed and imports beat when compared to consensus expectations.

- 20-Year JGB supply headlines locally on Tuesday.

AUSSIE BONDS: A Heavy A$ Supply Slate Seen

The uptick in e-minis provided some light pressure to the space to start the week, although the space was unwilling to really stretch its legs outside of the SYCOM ranges, even before a softer than expected Chinese GDP reading really limited the downside momentum. YM -0.5, XM -3.0, with the cash ACGB curve steeper. The prospect of relatively imminent RBA easing continues to cushion AU 10s vs. their U.S. Tsy counterpart, allowing the AU/U.S. 10-Year yield spread to settle just below 0bp early this week.

- Weekend news flow saw a slight pullback in the COVID restrictions imposed on the state of Victoria, although state Premier Andrews remains under pressure to do more. We also saw NSW relax some restrictions on Monday. Elsewhere on the COVID front, the Aus-NZ travel bubble experienced some early hiccups owing to onward journeys from a pocket of travellers.

- A flurry of A$ semi and corporate issuance was noted at the start of the new week, headlined by NSW launching a new green Nov '30 line.

- Bills sit unchanged to -2 through the reds.

- The minutes from the RBA's most recent meeting headline on locally on Tuesday, although the more up to date address from RBA Governor Lowe has likely watered down the market impact of the release.

AUCTIONS/DEBT SUPPLY

JGBS AUCTION: Japanese MOF sells Y2.8907tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8907tn 1-Year Bills:- Average Yield -0.1348% (prev. -0.1365%)

- Average Price 100.135 (prev. 100.136)

- High Yield: -0.1288% (prev. -0.1365%)

- Low Price: 100.129 (prev. 100.136)

- % Allotted At High Yield: 7.3593% (prev. 96.9742%)

- Bid/Cover: 3.616x (prev. 4.302x)

TECHS

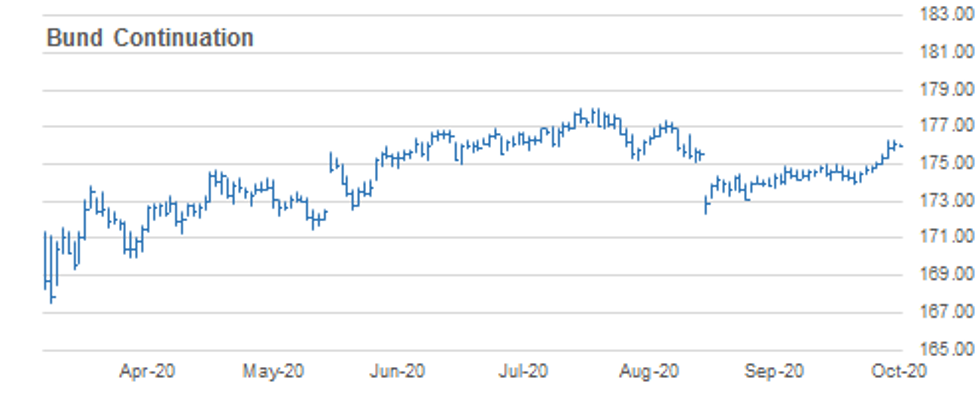

BUND TECHS: (Z0) Heading North

- RES 4: 177.18 High Sep 3 (cont)

- RES 3: 176.94 High Sep 8 (cont)

- RES 2: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 1: 176.32 1.500 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- PRICE: 176.01 @ 04:53 BST Oct 19

- SUP 1: 175.35 Low Oct 15

- SUP 2: 175.04 Low Oct 14

- SUP 3: 174.80 20-day EMA

- SUP 4: 174.32 50-day EMA

Bunds maintain a bullish tone following last week's rally. Futures cleared resistance at 174.97, Oct 2 high and more importantly, the key level at 175.08, Aug 4 high. The breach of 175.08 confirmed a resumption of the broader uptrend setting the scene for further gains. The next objectives and potential resistance levels are at 176.32 and 176.57, both Fibonacci projections. Initial support is at 175.35, Oct 15 low.

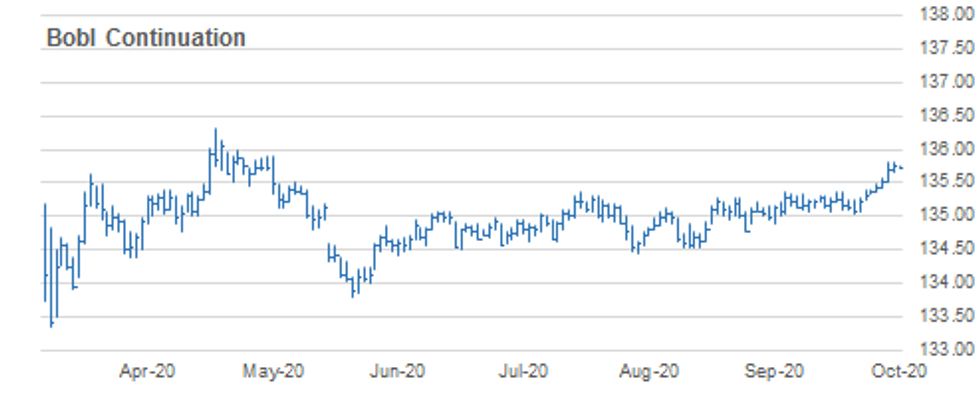

BOBL TECHS: (Z0) Needle Points North

- RES 4: 136.060 2.000 retracement of the May - Jun sell-off (cont)

- RES 3: 136.000 Round number resistance

- RES 2: 135.907 1.764 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 1: 135.820 High Oct 15 / 16 and the bull trigger

- PRICE: 135.740 @ 05:00 BST Oct 19

- SUP 1: 135.510 Low Oct 15

- SUP 2: 135.370 High Sep 21 and Oct 5 and former breakout level

- SUP 3: 135.331 20-day EMA

- SUP 4: 135.030 Low Oct 6 and key trend support

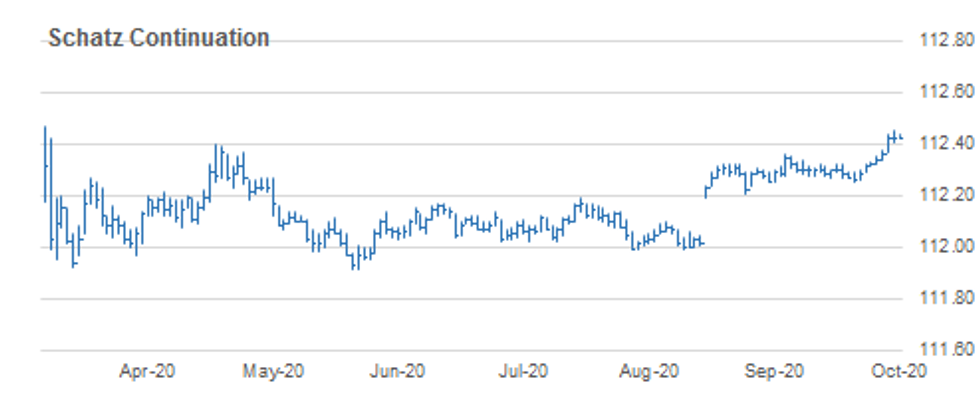

SCHATZ TECHS: (Z0) Bulls In The Driving Seat

- RES 4: 112.505 61.8% retracement of the Mar - Jun sell-off (cont).

- RES 3: 112.490 2.000 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.457 1.764 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 1: 112.450 High Oct 15

- PRICE: 112.425 @ 05:12 BST Oct 19

- SUP 1: 112.365 Low Oct 15

- SUP 2: 112.340 Low Oct 14

- SUP 3: 112.305 20-day EMA

- SUP 4: 112.255 Low Oct 7 and key trend support

Schatz futures outlook remains bullish following last week's accelerated gains. Futures cleared key resistance at 112.360, Sep 21 high, reinforcing the current positive tone, confirming a resumption of the broader uptrend. The move higher has opened 112.457 next, a Fibonacci projection. Moving average studies are in a bull mode too, reinforcing current trend conditions. Initial support is at 112.365, Oct 15 low.

GILT TECHS: (Z0) Attention Is On Key Resistance

- RES 4: 137.44 High Aug 7

- RES 3: 137.14 0.764 proj of Aug 28 - Sep 21 rally from Oct 7 low

- RES 2: 137.04 High Sep 21 and a key resistance

- RES 1: 136.97 High Oct 16

- PRICE: 136.61 @ Close Oct 16

- SUP 1: 136.27 Low Oct 15

- SUP 2: 135.50 Low Oct 14

- SUP 3: 135.06 Low Oct 7 and the bear trigger

- SUP 4: 134.96 76.4% retracement of the Aug 28 - Sep 28 rally

Gilts spiked Friday to register a high print of 136.97. Friday's gains confirm an extension of last week's strong rally and reinforce current bullish conditions. The contract is approaching the next key resistance at 137.04, Sep 21 high. Clearance of this hurdle would reinforce last week's bullish reversal and open 137.14 and potentially 137.78 further out, both Fibonacci projection levels. Initial support lies at 136.27, Oct 15 low.

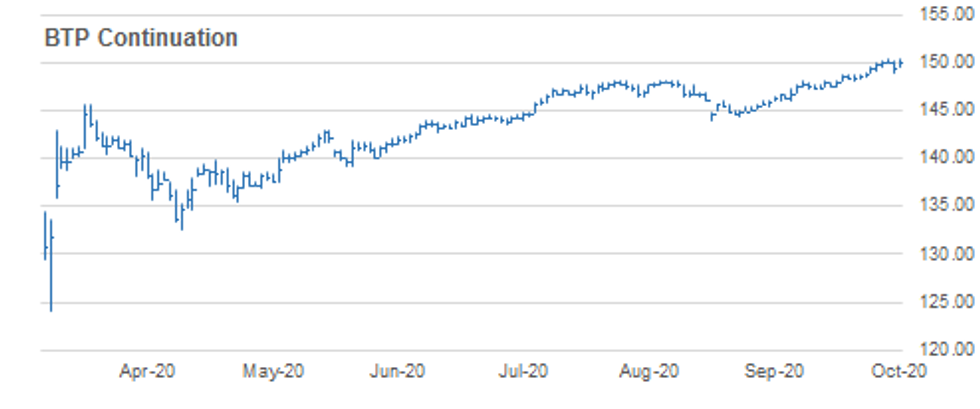

BTPS TECHS: (Z0) Bullish Outlook Remains Intact

- RES 4: 152.00 Round number resistance

- RES 3: 151.47 Bull channel top drawn off the Sep 8 low

- RES 2: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 1: 150.43 High Oct 13

- PRICE: 149.22 @ Close Oct 16

- SUP 1: 149.01 Low Oct 15

- SUP 2: 148.64 20-day EMA

- SUP 3: 147.32 Low Sep 28 and key near-term support

- SUP 4: 146.98 Low Sep 22

BTPS outlook remains bullish. Last week's gains resulted in the contract extending further into uncharted territory, maintaining the bullish price sequence of higher highs and higher lows that defines an uptrend. Resistance and the bull trigger is located at 150.43, Oct 14 high. Initial support has been defined at 149.01, Oct 15 low. A break of this level is required to signal scope for a deeper corrective pullback.

EUROSTOXX50 TECHS: Focus Is On Support

- RES 4: 3326.79 High Sep 18

- RES 3: 3305.77 High Oct 12 and key near-term resistance

- RES 2: 3269.87 High Oct 15

- RES 1: 3258.93 High Oct 16

- PRICE: 3245.47 @ Close Oct 16

- SUP 1: 3174.64 Low Oct 15

- SUP 2: 3147.28 Low Oct 2 and key support

- SUP 3: 3097.67 Low Sep 25 and the bear trigger

- SUP 4: 3054.11 Low June 15

EUROSTOXX 50 suffered a sharp setback Thursday extending the pullback from 3305.77, Oct 12 high. The index did find support on Friday though. The move lower potentially reverses the recent recovery since Sep 25. Attention is on 3147.28, Oct 2 low where a break would expose the key support handle at 3097.67, Sep 25 low. Clearance of this level would represent an important bearish break. The bull trigger is at 3269.87, Oct 12 high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.