-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: European COVID Worry Dominates Ahead Of ECB

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

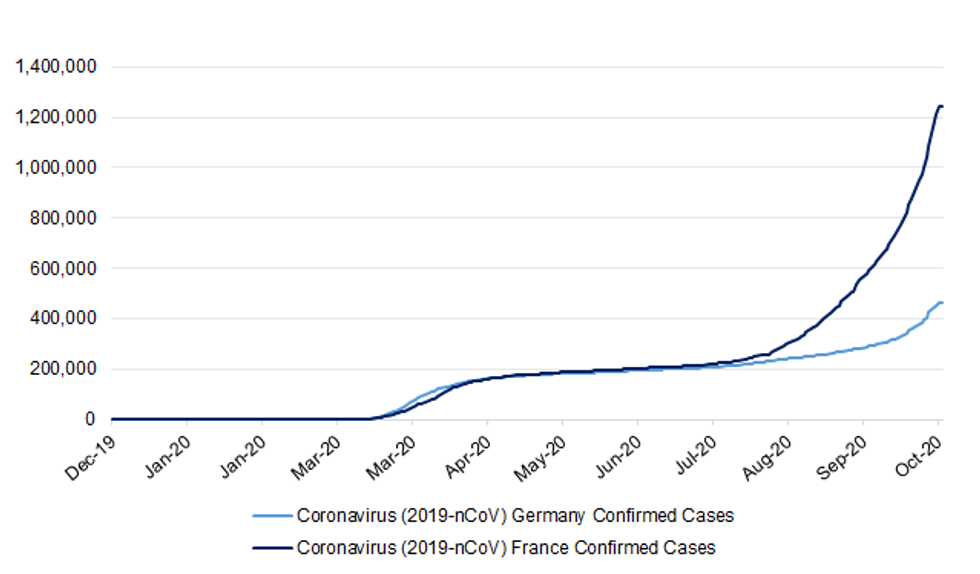

* GERMANY SET TO IMPOSE STRICT NEW VIRUS MEASURES AS INFECTIONS SOAR (DPA)

* FRANCE MULLING MONTH-LONG NATIONAL LOCKDOWN TO COMBAT COVID-19 CRISIS (BFM TV)

* DOJ & FBI TO HOLD WEDNESDAY BRIEFING ON CHINA SECURITY MATTER (BBG)

* BREXIT DEAL HANGS IN THE BALANCE, SAYS EU COUNCIL PRESIDENT (GUARDIAN)

* RBA BOARD MEMBER SAYS CENTRAL BANK NOT LACKING IN FIREPOWER (WSJ)

Fig. 1: Total Confirmed Coronavirus Cases In Germany & France

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The U.K. reported the most new deaths from coronavirus since the end of May, as public health officials warned the number of deaths will continue to rise. Some 367 new deaths were reported within 28 days of a positive test, compared with 102 on the day before. The number of deaths is often higher in the two days following a weekend, but Tuesday's figure is the highest since the country experienced a second rise in the number of cases. Dr. Yvonne Doyle, medical director of Public Health England, said she expects the number of deaths to continue rising for some time in an emailed statement. "Each day we see more people testing positive and hospital admissions increasing," Doyle said. (BBG)

CORONAVIRUS: Downing Street is privately working on the assumption that the second wave of coronavirus will be more deadly than the first, with the death toll remaining high throughout the winter. An internal analysis of the projected course of the second wave is understood to show deaths peaking at a lower level than in the spring but remaining at that level for weeks or even months. It is understood that the projection – provided by the Scientific Advisory Group for Emergencies (Sage) – has led to intense lobbying from Sir Patrick Vallance and other Government advisers for Boris Johnson to take more drastic action. "It's going to be worse this time, more deaths," said one well-placed source. "That is the projection that has been put in front of the Prime Minister, and he is now being put under a lot of pressure to lock down again." It comes as countries across Europe battle rapidly rising case numbers and prepare to introduce new measures. (Telegraph)

CORONAVIRUS: Rishi Sunak has told northern MPs that he shares their frustration with coronavirus restrictions and said that people needed to know when they would come to an end. (The Times)

CORONAVIRUS: Pubs and restaurants in many areas of Scotland will be able to serve alcohol indoors again from next week, the first minister has announced. (BBC)

BREXIT: Brexit negotiations have hit their most difficult stage, with Brussels still unsure whether a deal with Boris Johnson is possible within the next two crucial weeks, the European council president, Charles Michel, has said. The former prime minister of Belgium, who leads the summit of EU leaders, said in an interview with the Guardian that the result still was still hanging in the balance with what he suggested was a further fortnight of talks to come. (Guardian)

BREXIT: Britain must spell out how far it wants to diverge from European Union rules if it wants access to the bloc's financial market from January, a top European Commission official said on Tuesday. Britain has left the EU and access under transition arrangements ends on Dec. 31. Future access for the City of London hinges on UK financial rules staying aligned or "equivalent" to regulation in the bloc. John Berrigan, head of the European Commission's financial services unit, said Brussels has asked London for more clarification on Britain's intentions to work out what is an "acceptable level" of divergence. (RTRS)

BREXIT: Essential post-Brexit freight software is unlikely to be ready on time for 1 January, those building it have warned. A delay could hinder efforts to get products on to shop shelves and might push up prices. The Association of Freight Software Suppliers (AFSS) said its members could not guarantee delivery because officials had failed to give it details and direction for the project. But the government insisted the work was still "on track" for 1 January. (BBC)

BREXIT: Business leaders and government officials plan to set up a task force to help companies adapt to life outside the EU next year, according to Carolyn Fairbairn, CBI director-general. In her last interview before standing down from the employers' organisation next week, Dame Carolyn said the initiative showed that ties between government and business had largely mended after several years of frosty relations after the 2016 EU referendum. (FT)

FISCAL: Almost half a million self-employed workers have banked an extra £1.3 billion from the taxpayer, despite suffering no loss of income during the pandemic, according to an analysis. In a survey of more than 6,000 people, the Resolution Foundation found that 17 per cent of applicants who applied for the self-employed income support scheme did so despite suffering no hit to their incomes. This amounts to 435,000 workers. (The Times)

POLITICS: Boris Johnson won the 2019 general election in large part thanks to Labour voters in northern England defecting to the Conservatives. Now Tory MPs who represent Labour's once impregnable "red wall" of northern constituencies are demanding payback from the prime minister for the people who sent them to Westminster. A total of 54 Conservative MPs from the newly formed Northern Research Group of Tories at Westminster on Monday wrote a letter to Mr Johnson urging him to fulfil his promise to "level up" Britain, in a move some in the party saw as a sign of dangerous times ahead for the prime minister. (FT)

EUROPE

GERMANY: Bars and pubs will shut and social gatherings will be severely limited in Germany under a raft of strict new coronavirus measures set out in draft plans seen by dpa, as Berlin seeks to halt soaring infection rates. The plans will be presented on Wednesday when Chancellor Angela Merkel is scheduled to hold a video conference with the premiers of the country's 16 states. Under the new regulations, which would come into force on November 4 and remain in place until the end of the month, people would only be allowed to meet in public with members of their own household and one other household. (DPA)

FRANCE: The French government is envisaging a month-long national lockdown to combat a rise in coronavirus infections which could take effect from midnight on Thursday, France's BFM TV reported on Tuesday. French President Emmanuel Macron is due to make a televised address on Wednesday. His office did not comment on whether Macron would announce such a measure then. BFM TV added the lockdown under consideration would be "more flexible" than the strict restrictions on movement imposed in France in March this year. (RTRS)

ITALY: Italy approved a package of measures on Tuesday to support businesses hit by new restrictions aimed at reining in the coronavirus, hours after daily infections hit a new record high and COVID-19-related deaths jumped. The measures will cost 5.4 billion euros ($6.38 billion) and include grants, tax breaks and additional funds for temporary lay-off schemes, Prime Minister Giuseppe Conte and Economy Minister Roberto Gualtieri said at a news conference. "The Cabinet has approved a decree which will ensure immediate compensation for the sectors which are in greatest difficulty in this moment," Conte said. (RTRS)

ITALY: Italy's coronavirus cases reached a new daily record on Tuesday, rising to 21,994, compared with 17,012 the previous day. About 174,000 tests were carried out, and 221 deaths related to Covid-19 were reported. Patients in intensive-care units rose by 127, to 1,411. Hospitalizations reached 15,366, compared with April peak of 29,000. (BBG)

NETHERLANDS: The Netherlands' current partial lockdown, introduced two weeks ago amid sharply rising coronavirus infections, will likely remain in place until December, the Dutch prime minister and health minister said Tuesday, but they did not announce any new restrictions. (Associated Press)

BELGIUM: Dutch-speaking Flanders became the latest Belgian region to tighten restrictions, ordering theaters, cinemas, gyms and swimming pools to shut down starting Friday for an undetermined period. Indoor sports are banned for all people age 12 and up. Unlike the Brussels capital district and the southern French-speaking region of Wallonia, Flanders didn't extend the nationwide curfew that begins at midnight.

GREECE: Greece reported 1,259 new coronavirus cases Tuesday, the highest daily increase since the beginning of the pandemic, bringing the total to 32,752. (BBG)

EQUITIES: Tiffany Co. and LVMH are in discussions to reduce the price of the French luxury giant's contested deal to buy the U.S. jeweler, according to people familiar with the matter. (BBG)

U.S.

FISCAL: President Trump acknowledged Tuesday that an agreement on a coronavirus relief stimulus package would not materialize until after Election Day, but predicted that a deal would be reached. Speaking to reporters at the White House, Trump insisted his administration would still be willing to negotiate with House Speaker Nancy Pelosi (D-Calif.) following the election on Nov. 3. At the same time, Trump targeted Pelosi, claiming the top Democrat was seeking "bailouts" for states and cities run by Democrats and predicting boldly that the failed negotiations would cost Democrats the House majority. (The Hill)

FISCAL: House Speaker Nancy Pelosi ended any hopes of a Covid-19 relief bill before the Election Day, blaming the White House for failing "miserably" in a letter to House Democrats on Tuesday. (NBC)

CORONAVIRUS: The seven-day average of new coronavirus cases in the US topped 70,000 for the first time on Tuesday, with hospitalisations also rising to their highest since mid-August. A further 73,096 positive tests were reported by states over the past 24 hours, according to Covid Tracking Project data, up from 62,274 on Monday and compared with 60,558 on Tuesday last week. The latest figure is about 10,000 cases shy of Friday's record one-day increase and has also pulled the national seven-day average of cases to 71,531 a day, according to Financial Times analysis of Covid Tracking Project data. (FT)

CORONAVIRUS: New York City Mayor Bill de Blasio told residents on Tuesday to avoid traveling out of state during the holidays as the city responds to the "real threat" of a second wave of coronavirus infections. (CNBC)

CORONAVIRUS: New York Governor Andrew Cuomo is seeking to keep 95% of the U.S. out of New York as the coronavirus rages across the nation. The governor on Tuesday added California, the most populous U.S. state, to a list of 39 states whose residents must quarantine 14 days if they visit New York. Massachusetts, meanwhile, joins three other neighboring states that technically qualify for the quarantine, but instead are being asked to discourage travel to the Big Apple. (BBG)

CORONAVIRUS: Chicago restaurants and bars will no longer be allowed to serve customers inside beginning Friday in an effort to control the coronavirus' spread in the region, Illinois Gov. Jay Pritzker said in a statement. Gatherings will also be limited to 25 people or 25% of overall room capacity, the statement said. The order does not apply to schools or polling places. (CNBC)

CORONAVIRUS: Denver Mayor Michael Hancock expanded restrictions Tuesday, ordering most businesses to limit capacity to 25%, effective immediately. "This is what we get when we don't have a national strategy," Hancock said. Denver reported a one-day record of 327 news cases Sunday. The Colorado capital could reimpose stay-at- home-orders, officials said. (BBG)

POLITICS: Democratic presidential candidate Joe Biden's lead over President Donald Trump in Michigan is looking increasingly comfortable but the two remain neck and neck in North Carolina, Reuters/Ipsos opinion polls showed on Tuesday. (RTRS)

POLITICS: Democrats are calling a last-minute audible on mail-in voting after last night's Supreme Court ruling on Wisconsin. Wisconsin Democrats and the Democratic secretary of state of Michigan are urging voters to return absentee ballots to election clerks' offices or drop boxes. They are warning that the USPS may not be able to deliver ballots by the Election Day deadline. (Axios)

POLITICS: Texas counties won't have multiple ballot drop boxes ahead of the Nov. 3 national election. The state can restrict counties to just one drop box for voters who want to hand-deliver mail ballots for fear they won't arrive in time to be counted if sent by post, the all-Republican Texas Supreme Court ruled Tuesday. That means whether it's Harris County, where Houston is located with more than 4 million people, or Loving County, population 169, each gets one drop box. (BBG)

POLITICS: President Trump's campaign website was briefly and partially hacked Tuesday afternoon as unknown adversaries took over the "About" page and replaced it with what appeared to be a scam to collect cryptocurrency. There is no indication, despite the hackers' claims, that "full access to trump and relatives" was achieved or "most internal and secret conversations strictly classified information" were exposed. (Tech Crunch)

SOCIETY: Philadelphia police have said hundreds of looters are ransacking businesses in the city in a second night of unrest after police fatally shot a black man. Police reinforcements as well as the National Guard have been deployed. Officials say 30 officers were hurt in the first night of clashes. Police say officers opened fire on Walter Wallace, 27, when he ignored orders to drop a knife he was holding. (BBC)

OTHER

GLOBAL TRADE/CORONAVIRUS: China's customs will suspend accepting products from three Russian fishing vessels and one warehouse in the Netherlands for a week after the province of Shandong detected coronavirus on the outer packaging of imported aquatic products. The suspension will automatically lift after a week, China's customs authority said in a statement on its website. (RTRS)

U.S./CHINA: Assistant Attorney General for National Security John Demers, FBI Director Christopher Wray and other senior Justice Dept leaders will hold a virtual press briefing "on a China related national security matter" on Wednesday, DOJ says in statement. Briefing to be held at 11am. (BBG)

U.S./CHINA: A cadre of bipartisan senators introduced a resolution on Tuesday to formally label the Chinese government's human rights abuses against Uighur Muslims and other ethnic minorities in the region of Xinjiang as "genocide." (Axios)

U.S./CHINA: U.S. politicians who smear China, including creating the so-called China Working Group, are blatantly intervening in Chinese internal affairs, the People's Daily said in an editorial. Actions such as this, the Daily said, attempt to subvert foreign regimes as a tool of policy, and will pose a threat to global politics. Peaceful development and mutual cooperation are the only way forward, as past history has shown that the U.S. has exported war under the cover of humanitarianism and this had made it a destructive force, the Daily said. The U.S. obsession with hegemony and bullying must be stopped, said the newspaper. (MNI)

CORONAVIRUS: The chair of the UK's vaccine taskforce has warned that the first generation of Covid-19 vaccines are "likely to be imperfect" if a successful vaccine is developed at all. Writing in The Lancet, Kate Bingham, who heads efforts to find and manufacture a vaccine for Covid-19, cautioned against "complacency and over-optimism" about the process. (FT)

JAPAN: The Japanese government plans to extend the period of "Go To Travel" campaign aimed at boosting the nation's tourism industry beyond the planned expiration date of end-Jan., Yomiuri reports, without attribution. Details, including the length of the extension, will be determined after deliberation. (BBG)

RBA: The Reserve Bank of Australia has scope to ease monetary policy settings further if it wants, and any suggestion that its firepower has run out can be dismissed, Ian Harper, a member of the central bank's policy-setting board, told the Wall Street Journal. "There is certainly capacity for the Reserve Bank to do some more if the board judges that that is appropriate. This idea that the bank has run out of ammunition is false," he said. (WSJ)

AUSTRALIA: Australia's Prime Minister Scott Morrison has downplayed talk that the economy is out of recession, saying there is a long road back for the economy. Regardless of what the data might show for 3Q GDP in December, the job market will still require a lot of government support, he says. (Dow Jones)

SOUTH KOREA: South Korean President Moon Jae-in said his country has contained the coronavirus as he sought a budget increase to help the pandemic-hit economy recover. Speaking in parliament on Wednesday, Moon also vowed to make South Korea carbon-neutral by 2050, putting a date on the goal in line with one proposed by his progressive ruling party. It also aligns the country with commitments made by other major economies including the European Union, China and Japan. (BBG)

NORTH KOREA: The U.S. government is warning of an advanced North Korean hacking group that has targeted the U.S., South Korea and Japan with cyber-intrusions to collect intelligence on issues including nuclear policy and sanctions. (BBG)

BOC: MNI ANALYSIS: OCTOBER 2020 BOC POLICY PREVIEW

- MNI has published our October 2020 BOC Meeting Preview that includes a summary of 15 sell-side analysts' opinions and exclusive policy analysis. All 15 analysts expect the Bank of Canada to keep its target rate on hold at 0.25% Wednesday through 2021, with a minority going out as far as 2023. Markets will be alert to any changes in asset purchases via QE and/or mortgage lending via Canada Mortgage Bonds (CMB) Program. From the Monetary Policy Report (MPR), GDP growth expectations are widely expected to be positive after pessimistic estimates made in July - for more details please contact sales@marketnews.com.

CANADA: U.S. President Donald Trump issued a proclamation on Tuesday formally removing tariffs on raw aluminum imports from Canada but threatening to reinstate them if there was a surge in imports of the metal across the northern U.S. border. The proclamation follows an agreement with Canada announced last month by the U.S. Trade Representative's office to reinstate an exclusion for Canadian imports from 10% "Section 232" national security tariffs, retroactive to Sept. 1. (RTRS)

CANADA: Through five new agreements, Boeing [NYSE: BA] and its Canadian aerospace partners are preparing to deliver C$61 billion and nearly 250,000 jobs to the Canadian economy. (Boeing)

SOUTH AFRICA: World Bank officials have told South Africa's government it will need to reduce its wage bill to secure a loan and that it doesn't want the money to be used to bail out insolvent state companies, a person familiar with the situation said. (BBG)

EQUITIES: Korea Exchange is inspecting transaction data of all 22 market makers on whether they violated short-selling rules, the bourse operator says in statement. (BBG)

OIL: Gulf of Mexico operators shut 914,811 b/d of oil production ahead of Tropical Storm Zeta, BSEE says in notice. (BBG)

OIL: President Trump is considering issuing an executive order mandating an economic analysis of fracking, according to senior administration officials, who say the initiative is aimed at highlighting his support for the energy industry in election battleground states such as Pennsylvania. The proposed order would ask government agencies to perform an analysis of fracking's impact on the economy and trade, and the consequences if the oil-and-gas extraction technique was banned, the officials said. It also would order those agencies to evaluate what more they can do to expand its use, possibly through land management or support of developing technology, they said. (Dow Jones)

CHINA

ECONOMY: China is likely to de-emphasise the GDP growth rate while mapping out its 14th Five-year Plan and pursue the "dual circulation" model as it continues to open up the economy, Yicai reported. China will focus more on economic balance and high quality development rather than a specific GDP growth goal, the newspaper said citing Wang Tao, an economist from UBS Securities. China's future GDP increase should rely more on domestic demand and consumption potential, YiCai reported citing comments by CICC. The opening up of capital accounts and capital movement will stoke external demand, YiCai said. (MNI)

YUAN: MNI ANALYSIS: USD/CNY: A Less Managed Float

- We have published a quick primer on recent moves from the PBoC re: CNY market mechanics:

- A RTRS sources piece hit the wires after Beijing hours on Tuesday suggesting that "the PBoC has neutralized the counter-cyclical factor in its daily yuan midpoint fixing… The PBoC has asked some of the 14 midpoint contributing banks to submit and adjust their models to better reflect flexibility in the exchange rate and let the currency become more market-driven."

- The move was subsequently confirmed by CFETS, as the body noted that the adjustment will improve the transparency and efficiency of the CNY fixing and the market's role in the FX self-discipline mechanism.

- Recent PBoC action surrounding FX market mechanics, in addition to the rhetoric that it has chosen to deploy, has highlighted/promoted the need for 2-way market activity, while justifying the multi month yuan rally as fundamentally driven - for more details please contact sales@marketnews.com.

YUAN: China has gradually eased the use of countercyclical factors in some of its recent daily fixing against the dollar to increase transparency and efficiency and allow the market a bigger role, the Economic Information Daily reported citing the Secretariat of the China Foreign Exchange Self-Regulatory Mechanism. The move has corresponded to the recent gains in corporate settlement and decreases in sales exchange rates and wider foreign exchange movements, the Daily cited Wang Youxin, a researcher from the BOC Research Institute. The yuan should remain strong given current economic fundamentals and China's interest spreads against those of other nations, but uncertainties exist in Q4 given a possible second recession and financial market volatilities in Europe and America, and the unknown regulatory intentions of Chinese regulators, Wang said. (MNI)

PBOC: China's tight inter-bank liquidity is seen easing next month as less government bonds are on offer and tax remissions fall, the Shanghai Securities News reported citing Ming Ming, analyst at CITIC Securities. About CNY550 billion in China Government Bonds and CNY400 billion in local debt will be issued in November, Ming said. Fiscal disbursements may accelerate in November, adding CNY210 billion in liquidity while revenue is likely to dip on seasonal trends, which puts less pressure on tax remission, Ming said. (MNI)

OVERNIGHT DATA

AUSTRALIA Q3 CPI +0.7% Y/Y; MEDIAN +0.6%; Q2 -0.3%

AUSTRALIA Q3 CPI +1.6% Q/Q; MEDIAN +1.5%; Q2 -1.9%

AUSTRALIA Q3 CPI TRIMMED MEAN +1.2% Y/Y; MEDIAN +1.1%; Q2 +1.2%

AUSTRALIA Q3 CPI TRIMMED MEAN +0.4% Q/Q; MEDIAN +0.3%; Q2 -0.1%

AUSTRALIA Q3 CPI WEIGHTED MEDIAN +1.3% Y/Y; MEDIAN +1.3%; Q2 +1.3%

AUSTRALIA Q3 CPI WEIGHTED MEDIAN +0.3% Q/Q; MEDIAN +0.3%; Q2 +0.1%

SOUTH KOREA OCT CONSUMER CONFIDENCE 91.6; SEP 79.4

MNI DATA IMPACT: South Korea Consumer Sentiment Rises

- South Korea's consumer sentiment broadly improved in October from the previous month as economic activities resumed, according to data released on Wednesday by the Bank of Korea - for more details please contact sales@marketnews.com.

UK OCT BRC SHOP PRICE INDEX -1.2% Y/Y; SEP -1.6%

CHINA MARKETS

PBOC NET INJECTS CNY40BN VIA OMOS

The People's Bank of China (PBOC) injected CNY120 billion via 7-day reverse repos with the rate unchanged on Wednesday. This resulted in a net injection of CNY40 billion after the maturity of CNY80 billion of reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2000% at 09:27 am local time from the close of 2.5270% on Tuesday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 48 on Tuesday vs 65 on Monday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.7195 WEDS VS 7.6989

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a forth trading day at 6.7195 on Wednesday, compared with the 6.6989 set on Tuesday.

MARKETS

SNAPSHOT: European COVID Worry Dominates Ahead Of ECB

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 86.01 points at 23399.17

- ASX 200 up 6.679 points at 6057.7

- Shanghai Comp. up 9.465 points at 3263.781

- JGB 10-Yr future up 11 ticks at 152.11, yield down 0.6bp at 0.025%

- Aussie 10-Yr future up 2.0 ticks at 99.215, yield down 1.8bp at 0.785%

- U.S. 10-Yr future +0-01 at 138-28, yield up 0.17bp at 0.769%

- WTI crude down $0.87 at $38.71, Gold unch. at $1907.98

- USD/JPY down 17 pips at Y104.25

- GERMANY SET TO IMPOSE STRICT NEW VIRUS MEASURES AS INFECTIONS SOAR (DPA)

- FRANCE MULLING MONTH-LONG NATIONAL LOCKDOWN TO COMBAT COVID-19 CRISIS (BFM TV)

- DOJ & FBI TO HOLD WEDNESDAY BRIEFING ON CHINA SECURITY MATTER (BBG)

- BREXIT DEAL HANGS IN THE BALANCE, SAYS EU COUNCIL PRESIDENT (GUARDIAN)

- RBA BOARD MEMBER SAYS CENTRAL BANK NOT LACKING IN FIREPOWER (WSJ)

BOND SUMMARY: Eyes On Flows After Flattening

After a flurry of headlines in the NY/Asia-Pac crossover, covering everything from probable lockdown measures being implemented in Germany and France to a Wednesday briefing from the FBI & U.S. DoJ on security matters surrounding China, headline flow cooled, leaving core FI markets within the ranges they established in early Asia-Pac dealing. T-Notes stuck to a 0-02+ range, last +0-01+ at 138-28+, with cash yields sitting little changed across the curve. Market flow provided the highlight, with downside expression noted, via block trades in both the TYZ0 137.50 and 137.00 puts.

- JGB futures had a look through their overnight high in early Tokyo trade, but the move was fleeting, and the contract faded from best levels. Futures last +12, with 7s outperforming on the cash JGB curve, owing to the uptick in futures. Swaps marginally wider vs. cash, excluding 30s and 40s. Local headline flow has been light.

- Aussie bonds were willing to operate in narrow ranges, even as RBA board member Harper flagged the potential for further easing (although the rhetoric deployed was in tune with what we have heard from RBA Governor Lowe, among others), while domestic Q3 CPI was never going to move the goal posts for the RBA. YM -1.0, XM +2.5, holding flatter, while swaps were generally biased marginally wider across the curve again (expectations re: the outline of a broader round of bond buying at next week's RBA decision is likely the explanatory factor here). Bills sit unchanged to -1.

EQUITIES: A Mixed Bag

The major regional equity markets traded mixed in Asia-Pac hours, with no real developments surrounding the major risk factors in play at present, while regional focus continues to fall on matters surrounding China's 5-Year plan amid the ongoing meeting between the nation's top policymakers.

- Elsewhere, there was little regional reaction to the PBoC's removal of the counter-cyclical adjustment factor from its PBoC fixing mechanism.

- COVID-19 matters in Europe pressured e-minis ahead of the NY bell and in post settlement trade.

- Nikkei 225 -0.5%, Hang Seng -0.2%, CSI 300 +0.6%, ASX 200 +0.3%.

- S&P 500 futures -20, DJIA futures -166, NASDAQ 100 futures -49.

OIL: European Demand Worry Weighs

Worry surrounding the COVID-19 situation in Europe (and the impact on demand of probable deeper COVID-19 mitigation measures in both Germany & France) weighed on crude in post settlement trade, with Brent & WTI both sitting ~$0.80 softer on the day at typing, unwinding most of Tuesday's gains.

- A larger than expected headline crude build in the weekly API inventory estimates, coupled with a surprise build in gasoline stocks, did little to help bulls, although the larger than expected drawdown in distillates may have provided a modest cushion.

- The latest weather developments in the Gulf of Mexico provided some support for the space on Tuesday, with ~50% of U.S. gulf crude production in the region now shut in, per the latest BSEE daily tally.

- Weekly DoE inventory data is due to be released later today.

GOLD: Not Much To Add

There really isn't much to add to the gold narrative, given what we have mentioned before. The dominating fundamental forces are U.S. real yields and the level of the USD. On the technical side, the recent ranges and technical parameters remain well and truly intact.

FOREX: Lacking Clear Direction

AUD climbed at a steady pace, with neither in-line to marginally above-forecast Australian CPI figures nor comments from RBA's Harper altering its trajectory in any meaningful way. Harper told the WSJ that the RBA has firepower to add monetary stimulus if needed, but his comments didn't really move the needle. Cross-flows may have bolstered broader AUD strength, as decent demand for AUD/NZD allowed it to return above the support area from 38.2% Fibo retracement of YtD range/200-DMA breached yesterday.

- JPY rallied amid lingering concerns over spiralling coronavirus case counts in Europe and upcoming security briefing from the FBI & U.S. DoJ. The Eurozone's shared currency was dented by regional Covid-19 situation and landed at the bottom of the G10 pile. EUR/JPY sank through key support zone at Y123.03/02, charting a double top pattern.

- NOK was among the worst performers in G10 FX space, as oil extended yesterday's losses registered after the release of the latest API report, which revealed a larger than expected increase in U.S. crude stockpiles.

- Focus turns to BoC MonPol decision, French consumer confidence, Spanish & Swedish retail sales, flash U.S. wholesale inventories as well as comments from Fed's Kaplan, BoC's Macklem & ECB's de Cos.

FOREX OPTIONS: Expiries for Oct28 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1650-55(E521mln), $1.1675-78(E516mln), $1.1745-60(E1.3bln), $1.1780-85(E703mln), $1.1800-05(E1.8bln), $1.1830(E555mln), $1.1850-65(E832mln), $1.1870-75(E553mln), $1.1900(E958mln), $1.1950(E806mln)

- USD/JPY: Y103.00($764mln), Y103.50($519mln), Y103.90-00($607mln), Y104.50($822mln), Y104.70-80($771mln), Y104.85-00($3.0bln), Y105.10-15($541mln), Y105.25-30($1.2bln), Y105.40($810mln)

- GBP/USD: $1.3100(Gbp779mln)

- EUR/GBP: Gbp0.9085-00(E1.1bln)

- EUR/JPY: Y122.85(E843mln)

- AUD/NZD: N$1.0800(A$685mln)

- USD/CAD: C$1.3550($500mln)

- USD/CNY: Cny6.68($550mln-USD puts)

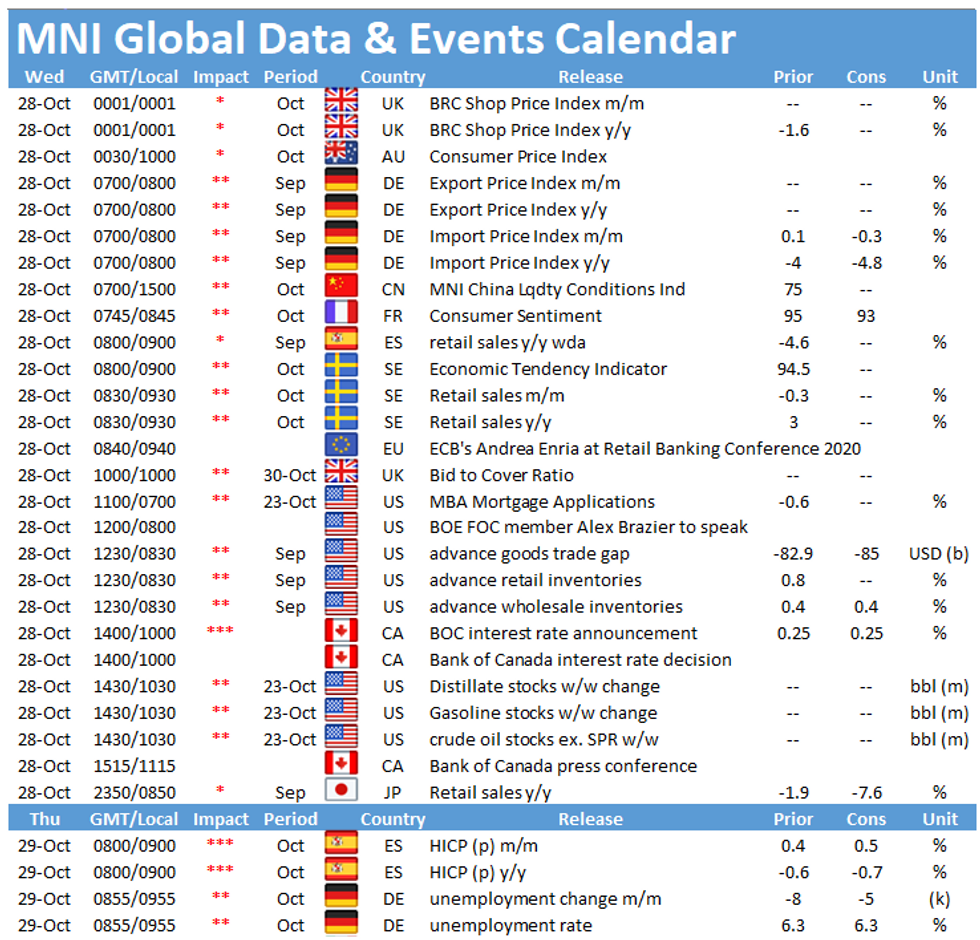

UP TODAY (Time GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.