-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: House Backs Trump's Call For Stimulus Checks Boost

EXECUTIVE SUMMARY

- U.S. HOUSE BACKS TRUMP'S PROPOSAL TO INCREASE STIMULUS CHECKS TO $2,000

- U.S. HOUSE OVERRIDES TRUMP'S VETO OF DEFENCE BILL

- EU AND CHINA POISED TO AGREE INVESTMENT PACT (FT)

- ANT IS SAID TO MULL HOLDING CO WITH REGULATION SIMILAR TO BANK (BBG)

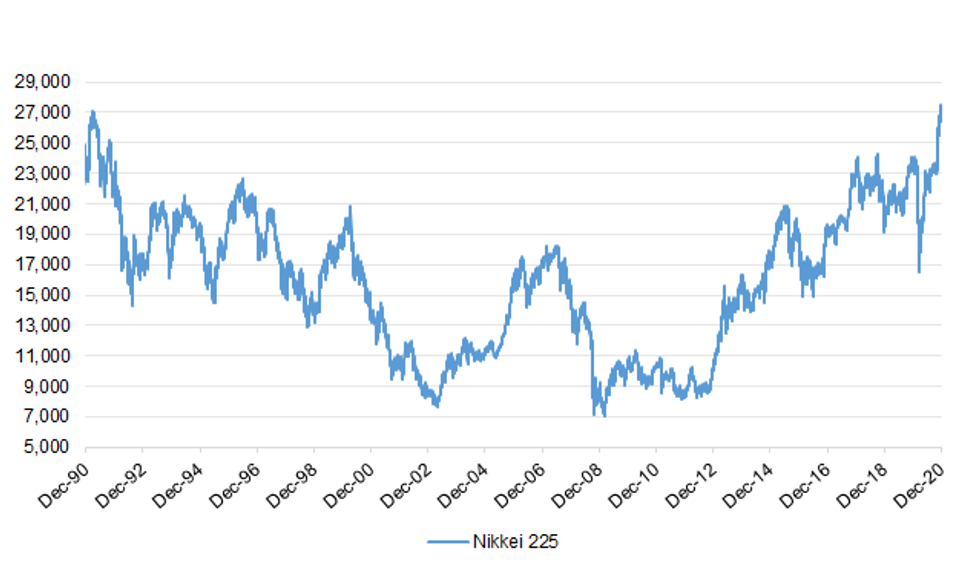

- NIKKEI 225 BREAKS ABOVE 27,000 FOR FIRST TIME SINCE 1991

Fig. 1: Nikkei 225

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: The post-Brexit trade and security deal has been unanimously backed by EU member states, paving the way for the new arrangements to come into force on 1 January. At a meeting of ambassadors in Brussels, the 27 member states gave their support for the 1,246-page treaty to be "provisionally applied" at the end of the year. The decision will be formally completed by written procedure at 3pm central European time (1400 GMT) on Tuesday. A spokesman for the German presidency of the EU, organising the bloc's affairs, said the treaty had been given the green light. The only obstacles standing in the way of the deal coming into force are votes by MPs and peers in the House of Commons and the House of Lords. The UK parliament has been recalled to sit on Wednesday 30 December to debate and vote on the legislation. (Guardian)

BREXIT: The fishing industry is to get a £100 million funding package in the "near future", Michael Gove pledged as ministers were accused of "betrayal" over the compromise Brexit deal with the EU on fishing rights. Cabinet Office minister Mr Gove said the money, to modernise the fleet and fish processing industry, would enable it to take "full advantage of the riches flowing back" to the UK and build "sustainable" operations and healthy stocks. The move comes ahead of Wednesday's vote on the Brexit trade deal in Parliament, where some Tory backbenchers are expected to raise concerns over the impact on the fishing industry. (Telegraph)

BREXIT: The trade deal that both sides of the English Channel say reflects a new era of cooperation is essentially a sideshow for the City of London, which is still awaiting its own seal of approval from the European Union. EU officials must rule separately that British financial regulations and oversight are strong enough to create a level playing field. Without that, a steady leakage of business -- already underway in some areas -- may become a daily reality for the U.K.'s finance industry. Boris Johnson has already said in an interview with the Sunday Telegraph that, when it comes to financial services, the treaty "perhaps does not go as far as we would like." Chancellor of the Exchequer Rishi Sunak said that discussions with Brussels over access for financial services will continue. While there's been progress in preventing Brexit from upending financial markets in the short term, there's little consensus on the ultimate nature of the U.K. finance industry's relationship with the EU, just days before it loses much of its longstanding access to the bloc. (BBG)

BREXIT: Holidaymakers or online shoppers who buy items from the EU that are valued at more than £390 will have to pay customs duties, the government has revealed. VAT and handling fees may also apply on some items, while parcels may be held up in post offices until all duties and fees have been cleared by the recipient in the UK. The additional red tape and charges from 1 January will be one of the most visible consequences of Brexit for consumers, hitting them in just the same way as business, albeit on a smaller scale, with implications for online shopping. (Guardian)

BREXIT: Keir Starmer is facing a high-profile rebellion against Labour's Brexit position on the eve of the vote in parliament, as prominent MPs including John McDonnell and Clive Lewis accused him of "falling into the trap of rallying around this rotten deal". Labour is likely to contain a major rebellion of frontbench MPs but an increasing number of prominent supporters are urging Starmer to change course. Backbenchers have also raised concerns on private WhatsApp groups that Labour's endorsement for the deal has been given without the legislation being published. Tory Brexiters who are studying the trade deal will deliver their verdict on Tuesday afternoon. (Guardian)

BREXIT: Eurosceptic Tory MPs in the influential European Research Group are poised to give their seal of approval to the EU-UK trade deal within hours, in a fresh boost for prime minister Boris Johnson. Although some senior Eurosceptics have called for more time to scrutinise the legislation, the ERG is expected to give its formal approval on Tuesday, subject to a final meeting. (FT)

BREXIT: Northern Ireland's political parties that take their seats at Westminster are set to vote against the UK-EU post-Brexit deal this week. The Commons will be recalled on Wednesday to allow MPs to vote on the agreement reached on Christmas Eve. The DUP, the Alliance Party and the SDLP have indicated that they will not support the plan. It comes as the Stormont Executive met virtually to discuss the deal in detail for the first time. The DUP's Brexit spokesman Sammy Wilson told BBC Newsline that because the agreement did not address "many issues that are damaging to Northern Ireland" his party's eight MPs would vote against it. (BBC)

BREXIT: Spain warned of major disruption if no separate deal is agreed with the UK over Gibraltar's border before 31 December. Foreign minister Arancha Gonzalez Laya said she fears the "scenes of chaos" seen at the English Channel could be repeated in Gibraltar. (Independent)

CORONAVIRUS: The U.K. is poised to approve the Covid-19 vaccine produced by AstraZeneca Plc and the University of Oxford, giving the country another powerful tool to fight the pandemic as concern mounts over rising infections. Britain's drug regulator could clear the shot for use as early as this week, according to a person familiar with the matter, who asked not to be identified because the deliberations are confidential. AstraZeneca Chief Executive Officer Pascal Soriot and U.K. health officials had previously said they hoped for approval by the end of the year. (BBG)

CORONAVIRUS: Vaccines will have to be delivered at a rate of two million a week – double the current target – to avoid a devastating third Covid wave, ministers have been warned. The projection has been made by the London School of Hygiene and Tropical Medicine (LSHTM) in a new paper shared with the Government's Scientific Advisory Group for Emergencies (Sage), which is understood to be circulating in Whitehall. It comes as the Oxford-AstraZeneca vaccine, which has been hailed as a "game-changer", is expected to be approved by Medicines and Healthcare products Regulatory Agency imminently. The vaccine offers the hope of a rapid expansion of the roll-out of jabs because it does not require special storage, and the Government has ordered 100 million doses. (Telegraph)

CORONAVIRUS: England's hospitals now have more coronavirus patients than at any other point in the pandemic, leaked NHS figures have revealed. It means the health service is now under more strain from Covid-19 than at any other point as the new, more transmissible strain of the virus has sent infections soaring to record levels. More than 41,000 new infections were reported on Monday, ahead of a decision expected on Thursday on whether tier restrictions should be tightened further. The latest NHS England data, shared among NHS bosses, and seen by The Independent, reveals that across all NHS settings, there were 20,407 coronavirus patients being treated by the NHS on Monday, compared to a 12 April peak of 18,974. (Independent)

CORONAVIRUS: The head of drugmaker AstraZeneca, which is developing a coronavirus vaccine widely expected to be approved by U.K. authorities this week, said Sunday that researchers believe the shot will be effective against a new variant of the virus driving a rapid surge in infections in Britain. AstraZeneca chief executive Pascal Soriot also told the Sunday Times that researchers developing its vaccine have figured out a "winning formula" making the jab as effective as rival candidates. (AP)

CORONAVIRUS: Ministers are formally reviewing plans to reopen schools next week after scientific advisers warned that Britain needed another national lockdown to stop the spread of coronavirus. Gavin Williamson, the education secretary, is seeking to ensure that the government goes ahead with plans for primary schools to reopen along with years 11 and 13. (Times)

UK/TURKEY: The UK is set to sign a trade agreement with Turkey Dec. 29 aimed at ensuring the tariff-free flow of goods and protecting vital UK-Turkey supply chains in the automotive, manufacturing and steel industries, sources close to the UK Department for International Trade told S&P Global Platts Dec. 28. (City am)

EUROPE

GERMANY: Germany is pushing to ramp up production of Covid-19 vaccines as Europe faces pressure to close the gap with Britain and the U.S. in a bid to end the pandemic. With inoculations gradually getting started across the region, authorities are concerned the slow pace of the rollout could force longer lockdowns and cause more economic damage for months to come. Across Europe, more than 400,000 people have died from the virus, which has infected 16.2 million and continues to spread. "We're working intensely on having additional production here in Germany soon," Jens Spahn, the country's health minister, said Monday on ZDF television, adding that more capacity could be available at a facility in Marburg as soon as February. "That would increase the amount considerably." (BBG)

FRANCE: France has not ruled out imposing a third nationwide lockdown if coronavirus cases continue to rise, its health minister said Sunday, as the country braces for a possible post-Christmas spike. ADVERTISING "We will never exclude measures that are necessary to protect the public," Olivier Veran told the Journal du Dimanche. "That is not to say we have made a decision, but that we are watching the situation hour by hour." (France24)

SPAIN: Spain became the fourth European country to record more than 50,000 coronavirus deaths as nations across the region start to roll out a vaccine. Fatalities from the disease rose to 50,122 on Monday, according to Health Ministry figures. Some 408 people have died from the virus in the past week. Cases diagnosed over the last 24 hours amounted to 2,822, bringing the total to 1.88 million. (BBG)

NETHERLANDS: The Dutch public health service says it has confirmed 11 cases of the new, more contagious variant of the coronavirus that was first found in Britain, including five cases in a cluster linked to an elementary school in the port city of Rotterdam. Health Minister Hugo de Jonge said in a letter to lawmakers Monday that authorities are further investigating the school cluster in an attempt to learn more about the spread of the new variant. (AP)

U.S.

FISCAL: The House voted 275-134 on Monday to increase direct payments from its coronavirus relief package to $2,000 per person, up from the $600 checks that Congress had previously approved. Why it matters: The measure is unlikely to pass the GOP-controlled Senate, but could further divide President Trump and Republicans ahead of the crucial Senate runoffs in Georgia next week. (Axios)

POLITICS: The House voted Monday to override President Trump's veto of a must-pass defense policy bill, the first successful override vote of Trump's presidency. The House voted 322-87 to override Trump, easily surpassing the two-thirds majority needed to overcome a veto. The action now moves to the Senate, which also needs to muster two-thirds support in order for Trump's veto of the National Defense Authorization Act (NDAA) to be overridden. (Hill)

FISCAL: Senate Minority Leader Charles Schumer (D-N.Y.) will try to pass legislation on Tuesday to increase the amount of the stimulus checks included in a recently signed coronavirus package from $600 to $2,000. Schumer's effort, which he announced on Monday night, comes after the House passed the legislation in a bipartisan 275-134 vote, kicking the bill to the GOP-controlled Senate. "Tomorrow I will move to pass the legislation in the Senate to quickly deliver Americans with $2,000 emergency checks. Every Senate Democrat is for this much-needed increase in emergency financial relief, which can be approved tomorrow if no Republican blocks it – there is no good reason for Senate Republicans to stand in the way," Schumer said in a statement. (Hill)

FISCAL: Sen. Bernie Sanders will filibuster an override of President Donald Trump's defense bill veto unless the Senate holds a vote on providing $2,000 direct payments to Americans. "McConnell and the Senate want to expedite the override vote and I understand that. But I'm not going to allow that to happen unless there is a vote, no matter how long that takes, on the $2,000 direct payment," Sanders said in an interview on Monday night. The Vermont independent can't ultimately stop the veto override vote, but he can delay it until New Year's Day and make things more difficult for the GOP. (Politico)

FISCAL: The U.S. Treasury Department is anticipating sending the first wave of $600 stimulus checks to U.S. individuals and households as early as this week, as previously planned, a senior Treasury official said on Monday. (RTRS)

POLITICS: Vice President Pence was sued Sunday by Rep. Louie Gohmert (R-Texas) and several other Republicans in a far-fetched bid that appeared aimed at overturning President-elect Joe Biden's election win. The lawsuit focuses on Pence's role in an upcoming Jan. 6 meeting of Congress to count states' electoral votes and finalize Biden's victory over President Trump. Typically, the vice president's role in presiding over the meeting is a largely ceremonial one governed by an 1887 federal law known as the Electoral Count Act. But the Republican lawsuit, which was filed against Pence in his official capacity as vice president, asks a federal judge in Texas to strike down the law as unconstitutional. The GOP plaintiffs go further: They ask the court to grant Pence the authority on Jan. 6 to effectively overturn Trump's defeat in key battleground states. Election law experts were dismissive of the lawsuit's prospects for success. (Hill)

POLITICS: President-elect Joe Biden said on Monday many of America's security agencies had been "hollowed out" under President Donald Trump and the lack of information being provided to his transition team by the outgoing administration was an "irresponsibility." "We've encountered roadblocks from the political leadership at the Department of Defense and the Office of Management and Budget," Biden said after a meeting with his foreign policy team. "Right now we just aren't getting all of the information that we need from the outgoing administration in key national security areas. It's nothing short, in my view, of irresponsibility," he added. (RTRS)

OTHER

GLOBAL TRADE: The EU and China are close to reaching a long-awaited business investment deal as Brussels seeks to level the playing field for European companies operating in the Chinese market. During a meeting with national ambassadors in Brussels on Monday, the European Commission reported progress on talks with Beijing, including on the core remaining issue of workers' rights in China. No objections were raised and a formal announcement by the commission that the deal has been reached is expected this week, according to EU diplomats. "The commission reported on recent positive developments in the negotiations with China including on labour standards," said one EU diplomat. "Ambassadors broadly welcomed the latest progress in the EU-China talks." (FT)

CORONAVIRUS: A huge study of another COVID-19 vaccine candidate is getting underway Monday as states continue to roll out scarce supplies of the nation's first shots. The candidate made by Novavax Inc. is the fifth to reach final-stage testing in the U.S. Some 30,000 volunteers are needed to prove if this vaccine — a different kind than its Pfizer and Moderna competitors — really works and is safe. (AP)

U.S./CHINA: The Trump administration on Monday strengthened an executive order barring U.S. investors from buying securities of alleged Chinese military-controlled companies, following disagreement among U.S. agencies about how tough to make the directive. The Treasury Department published guidance clarifying that the executive order, released in November, would apply to exchange-traded funds and index funds as well as subsidiaries of Chinese companies designated as owned or controlled by the Chinese military. (RTRS)

AUSTRALIA: Australia's most populous state of New South Wales (NSW) maintained its downward trend of new COVID-19 infections on Tuesday but authorities asked people to be on "high alert" after cases were detected outside the current virus cluster. A cluster detected in Sydney's northern beachside suburbs in mid-December has now grown to 129 cases and about a quarter of a million residents have been put under lockdown until Jan. 9 as authorities battle to stamp out the virus. (RTRS)

SOUTH KOREA: South Korea has confirmed its first cases of a more contagious variant of COVID-19 that was first identified in the United Kingdom. The Korea Disease Control and Prevention Agency said Monday the cases have been confirmed in a family of three people who came to South Korea on Dec. 22. (AP)

SOUTH KOREA: South Korea's daily coronavirus cases bounced back to over 1,000 on Tuesday after three days despite tougher virus curbs that have been extended for another week, and daily virus deaths hit another high of 40 amid a looming medical system crisis. (Yonhap)

SOUTH KOREA: South Korea will provide 9.3t won of third cash handout to small businesses, mom-and-pop stores and people hit by coronavirus outbreak from early Jan., President Moon Jae-in says in cabinet meeting. The financial support includes rental relief for small businesses. Moon says South Korean economy will return to normal trajectory in 1H next year, recovering from virus fallout. (BBG)

SOUTH KOREA: President Moon Jae-in said Tuesday the government will swiftly provide the country's third round of emergency relief handouts worth around 9.3 trillion won (US$8.5 billion) to small business owners facing economic difficulties due to the new coronavirus pandemic. "As custom measures to help out small business owners and those disenfranchised in terms of labor, we will swiftly execute the handouts from early January, as time is of the essence," Moon said during the last weekly Cabinet meeting of the year at Cheong Wa Dae. (Yonhap)

RUSSIA: Russia's prison service on Monday gave Kremlin critic Alexei Navalny a last minute ultimatum: Fly back from Germany at once and report at a Moscow office early on Tuesday morning, or be jailed if you return after that deadline. The Federal Prison Service (FSIN) on Monday accused Navalny of violating the terms of a suspended prison sentence he is still serving out over a conviction dating from 2014, and of evading the supervision of Russia's criminal inspection authority. Citing an article in the British medical publication The Lancet about his treatment, it said Navalny had been discharged from hospital in Berlin on Sept. 20 and that all symptoms of what it called his illness had vanished by Oct. 12. "Therefore the convicted man is not fulfilling all of the obligations placed on him by the court, and is evading the supervision of the Criminal Inspectorate," it said. (RTRS)

MEXICO: Mexican President Andrés Manuel López Obrador said Monday he is not opposed to private companies buying coronavirus vaccines to distribute to patients who want to pay for the shots. But he noted there isn't much existing supply and warned companies not to try to buy vaccines already promised to the Mexican government. "We are not opposed to commercializing the vaccine, to companies importing it and selling it to those who can pay," López Obrador said. "The catch is the supply of vaccines in the world markets, because there still isn't enough production." (AP)

SOUTH AFRICA: South Africa's Covid-19 surge has taken the country to more than 1 million confirmed cases as president Cyril Ramaphosa called an emergency meeting of the national coronavirus command council. The country's new variant of the coronavirus, 501.V2, is more contagious and has quickly become dominant in many areas of the resurgence, according to experts. (Guardian)

SAUDI ARABIA: Saudi Arabia has decided to extend its weeklong closure of all official ports of entry over fears of the new fast-spreading variant of the coronavirus. The kingdom's Interior Ministry announced on Monday that borders will remain shut and international commercial flights suspended for at least another week. Cargo flights and shipping routes will not be affected. (AP)

INDIA: The Narendra Modi government has invited 40 representatives from protesting farmer unions for another round of talks on Wednesday to end the impasse over new agricultural laws, Dharmendra Malik, spokesman for farmers' group Bhartiya Kisan Union, said. The government is committed to find a logical solution to all relevant issues with a clear intention and an open mind, Malik said by phone, citing a letter written by federal farm secretary Sanjay Agarwal. (BBG)

INDONESIA: President Joko Widodo is planning to raise his target for Indonesia's new wealth fund to as much as $100 billion in funding next year, according to people familiar with the matter. Jokowi discussed the new goal, raised from the previously announced 225 trillion rupiah ($16 billion), in meetings with government officials and political allies as recently as early December, said the people, who asked not to be named as they're not authorized to speak on the matter. Southeast Asia's largest economy is betting on big-ticket projects to drive a turnaround in the economy next year, with the fund named Nusantara Investment Authority set to play a key role in financing them. After the government kickstarts it with 15 trillion rupiah of assets, the fund will offer global and local investors the chance to put their money in its sub-funds spanning infrastructure, healthcare, tourism, technology and the development of the new capital city. (BBG)

PHILIPPINES: The Philippines will ban travellers from 19 countries and territories until mid-January as a measure to keep out a new variant of the coronavirus, its transport ministry said on Tuesday. The regulation will be in effect from midnight of Dec. 29 to Jan. 15, covers Filipinos and foreigners arriving from the "flagged countries", the transport ministry told reporters in a group text message. (RTRS)

THAILAND: As a new wave of Covid infections bites, the Bangkok Metropolitan Administration (BMA) has ordered the closure of all entertainment venues from Tuesday until Jan 4. (Bangkok Post)

CHINA

EQUITIES: Jack Ma's under-siege Ant Group Co. is planning to fold its financial operations into a holding company that could be regulated more like a bank, according to people familiar with the situation, potentiallycrippling the growth of its most-profitable units. The fintech giant is planning to move any unit that would require a financial license into the holding company, pending regulatory approval, said the people, who asked not be named because the matter is private. The plans are still under discussion and subject to change, the people said. Ant declined to comment. The operations that Ant is looking to fold into the holding company include wealth management services, consumer lending, insurance, payments and MYbank, an online lender in which Ant is the largest shareholder, the people said. Under the financial holding company structure, Ant's businesses would likely be subject to more capital restrictions, potentially curbing its ability to lend more and expand at the pace of the last few years. (BBG)

EQUITIES: China will continue to allow more share offerings as a greater source of capital raising and reduce the reliance on debt, the Financial News reported on Monday citing Yi Huiman, chairman of the China Securities Regulatory Commission. China will also promote competition and access to the stock market, said Yi. He said that China would support capital market innovation and the use of long-term incentives, according to the report. (MNI)

INFRASTRUCTURE: China will accelerate 5G coverage in major cities, while orderly pushing forward construction and applications of 5G network, Xinhua reports, citing Industry Minister Xiao Yaqing's speech at an industry event on Monday. (BBG)

ECONOMY: Three provinces in southern China have been ordered to remove power usage restrictions, according to the China Securities Journal citing an unnamed official from the National Development and Reform Committee. The government has ordered coal mines to increase production and is asking plants to stock coal, as about half of China prepares for a cold spell with temperatures dropping more than 10 degrees. (MNI)

CORONAVIRUS: Chinese authorities are canceling gatherings and restricting the operating capacity of entertainment facilities to contain rising cases of Covid-19, the China Daily reported on Monday. Fifteen local cases were reported on Dec. 28, including seven in Beijing and eight in Liaoning province, according to data from the National Health Commission. China has banned flights from the U.K. after reports of a virus variant, the China Daily said. China plans to inoculate 50 million people with its domestically developed vaccines by mid-February, the newspaper reported. (MNI)

OVERNIGHT DATA

SOUTH KOREA DEC CONSUMER CONFIDENCE 89.8; NOV 97.9

CHINA MARKETS

PBOC NET INJECTS CNY10BN VIA OMOS TUES

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net injection of CNY10 billion given the maturity of CNY10 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain stable liquidity at the end of the year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:24 am local time from 2.0772% at Monday's close.

- The CFETS-NEX money-market sentiment index closed at 37 on Monday vs 36 on last Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5451 TUES VS 6.5236

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5451 on Tuesday, compared with the 6.5236 set on Monday.

MARKETS

SNAPSHOT: House Backs Trump's Call For Stimulus Checks Boost

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 655.65 points at 27508.57

- ASX 200 up 35.528 points at 6700.3

- Shanghai Comp. down 8.443 points at 3388.842

- JGB 10-Yr future up 1 tick at 151.95, yield down 0.4bp at 0.021%

- Aussie 10-Yr future up 2.5 ticks at 98.985, yield down 2.9bp at 0.965%

- U.S. 10-Yr future -0-02 at 137-27+, yield up 1.5bp at 0.938%

- WTI crude up $0.25 at $47.87, Gold up $4.79 at $1878.42

- USD/JPY down 12 pips at Y103.69

- U.S. HOUSE BACKS TRUMP'S PROPOSAL TO INCREASE STIMULUS CHECKS TO $2,000

- U.S. HOUSE OVERRIDES TRUMP'S VETO OF DEFENCE BILL

- EU AND CHINA POISED TO AGREE INVESTMENT PACT (FT)

- ANT IS SAID TO MULL HOLDING CO WITH REGULATION SIMILAR TO BANK (BBG)

- NIKKEI 225 BREAKS ABOVE 27,000 FOR FIRST TIME SINCE 1991

BOND SUMMARY: U.S. Fiscal Matters Dominate, Weigh On Core FI

The U.S. House backed U.S. Pres Trump's call for boosting stimulus checks to $2,000 from $600, lending support to risk sentiment amid lingering optimism seen since the POTUS signed off on the Covid-19 relief bill. The vote created a loyalty dilemma for GOP Senators, who will have to decide between sticking to party line and supporting the outgoing Republican President. Most expect the bill to face headwinds in the upper chamber, while Democratic Senators pushed for a vote as soon as Tuesday. After passing legislation re: stimulus checks, the House voted to override Pres Trump's veto of the Defence Bill, which enjoys broad, bipartisan support in both chambers. T-Notes sold off albeit uncertainty re: fate of the stimulus checks proposal in the Senate likely cushioned losses, while markets continued to eye familiar coronavirus worry. When this is being typed, T-Notes trade -0-01+ at 137-28, off session low located at 137-26+. Cash Tsy curve runs steeper, with yields last seen -0.2bp to +1.5bp. Eurodollar futures trade unch. to +0.5 tick through the reds.

- JGB futures slipped into the lunch break but managed to claw back marginal losses and last trade at 151.98, 4 ticks above last settlement. Cash JGB yields mostly sit marginally below neutral levels. 2-Year JGBs were limited after the BoJ lowered the purchase range for 1-3 Year JGBs in its Rinban plan for Jan. Local equity markets provided some interest, as the Nikkei 225 hit multi-decade highs.

- In Australia, YM trades unch., XM +2.5. Cash ACGB curve bull flattened, though 10s outperformed. Bills trade -1 to +1 tick through the reds.

EQUITIES: Equity Markets Take Positive Lead From Record Highs In US

Asia-Pac equity indices took their lead from the U.S., rising on Tuesday amid broad risk on sentiment after the US coronavirus relief bill progressed. Major bourses in the US hit record highs on Monday.

- Risk on sentiment was boosted after U.S. President Trump signed off on the coronavirus relief bill, with liquidity thinned out in the festive season. The news that U.S. Pres-elect Biden is planning to invoke the Defense Production Act to boost the production of Covid-19 jabs lent further support to risk appetite.

- Markets are now assessing the chances of the coronavirus relief package making it through the Senate. Current indications are that the Republican controlled Senate will not support the increased amount, casting further uncertainty on the process.

- Despite this uncertainty most Asia stock markets posted decent gains, the Nikkei outperforming as the bourse hits the highest levels in 30 years and climbs over 27,000.Optimism is tempered by coronavirus concerns. Hospitalisations in the U.S. reached new highs, while other countries including Indonesia and Taiwan have increased containment measures and Germany is seeking to expand vaccine production to help the inoculation programme in Europe. This was evident in South Korea where the Kospi fell 0.29% after South Korea reported the biggest daily death toll so far.

- Markets in China have struggled compared to peers, some caution in the region evident after China said it opposed the U.S.'s Taiwan assurance act which was signed on Sunday.

OIL: Oil Slightly Higher On The Session As US Dollar Slips

Oil has risen in Asia trade on Tuesday, WTI last up $0.23 at 47.85, while Brent is up $0.20 at 51.06. WTI has risen off lows seen late in the session on Monday, but is still within yesterday's range. Oil slipped to start the week as renewed coronavirus concerns globally clouded the demand picture for oil.

- Risk on sentiment was boosted after U.S. President Trump signed off on the coronavirus relief bill, with liquidity thinned out in the festive season. The news that U.S. Pres-elect Biden is planning to invoke the Defense Production Act to boost the production of Covid-19 jabs lent further support to risk appetite.

- The U.S. dollar has slipped in Asia, which has helped support the slight uptick in oil prices. Markets are assessing the chances of the coronavirus relief package making it through the Senate. Current indications are that the Republican controlled Senate will not support the increased amount, casting further uncertainty on the process

- The OPEC+ group looks likely to increase output by 500k bpd from January, while Russia's deputy prime minister said last week Russia would be supportive of additional gradual increases in February. The alliance will meet next week to make a decision on February output levels.

GOLD: Yellow Metal Rises As Monday's Move Reversed

The yellow metal has seen rangebound trade in Asia-Pac hours on Tuesday, last up $4.22 at 1877.92. Gold finished lower on Monday, slipping as risk on sentiment took hold even as the U.S. dollar gained into year end.

- Risk appetite was boosted after U.S. President Trump signed off on the coronavirus relief bill, with liquidity thinned out in the festive season. The news that U.S. Pres-elect Biden is planning to invoke the Defense Production Act to boost the production of Covid-19 jabs lent further support to risk appetite.

- Gold rose in Asia as markets assess the chances of the coronavirus relief package making it through the Senate. Current indications are that the Republican controlled Senate will not support the increased amount, casting further uncertainty on the process. If the measure does pass, the increased measures will add a further $400bn to the bill. As a result the U.S. dollar receded while gold gained slightly.

FOREX: Risk On In Asia As US House Passes Stimulus Bill, Goes To Senate

Risk appetite was boosted after U.S. President Trump signed off on the coronavirus relief bill. The news that U.S. Pres-elect Biden is planning to invoke the Defense Production Act to boost the production of Covid-19 jabs lent further support to risk appetite. The U.S dollar initially gained into year-end despite the risk on sentiment, but the move has reversed in Asia and a weaker DXY is driving most price action in the region.

- Markets are now assessing the chances of the coronavirus relief package making it through the Senate. Current indications are that the Republican controlled Senate will not support the increased amount, casting further uncertainty on the process.

- GBP/USD last up 42 pips at 1.3493. However, the move higher barely makes up any of the drop from Monday after the pair fell from highs of 1.3581. GBP has taken a hit and snapped a three-day winning streak in the process, concerns over the impact of the last minute Brexit trade deal are weighing

- Commodity currencies have made up some of the drop from Monday, AUD/USD and NZD/USD both around 18 pips higher, but still some way off highs seen in Monday's session. The move lower on Monday tracked a decline in oil prices as markets weigh reduced future demand on renewed Covid concerns. The commodity complex has gained on Tuesday which has helped support AUD & NZD.

- USD/JPY is seeing rangebound trade, last down 15 pips at 103.66.

- The PBOC set dollar/yuan midpoint at 6.5451. A higher fix initially saw yuan weaken, but USD/CNH has dropped as the U.S. dollar gives back its move higher from Monday. Equity markets in China were tempered by some geopolitical tensions after China said it opposed the U.S.'s Taiwan assurance act which was signed on Sunday, but the yuan shrugged this off.

FOREX OPTIONS: Expiries for Dec29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E1.2bln)

- GBP/USD: $1.3400(Gbp689mln-GBP puts), $1.3600(Gbp520mln-GBP puts)

- AUD/USD: $0.7350(A$662mln)

- USD/CAD: C$1.3000-20($500mln-USD puts)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.