-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Matters Dominate Ahead Of Year-End

EXECUTIVE SUMMARY

- MCCONNELL BLOCKS VOTE ON $2,000 CHECKS, SIGNALS NEW PACKAGE (Hill)

- NEW CORONAVIRUS VARIANT FOUND IN COLORADO, U.S. VACCINATIONS LAG BEHIND TARGETS

- MILLIONS IN UK TO FACE TIER 4 CURBS AMID SURGE IN CORONAVIRUS CASES (Times)

- SINOPHARM SAYS SHOT 79% EFFECTIVE; SEEKS GENERAL USE IN CHINA (BBG)

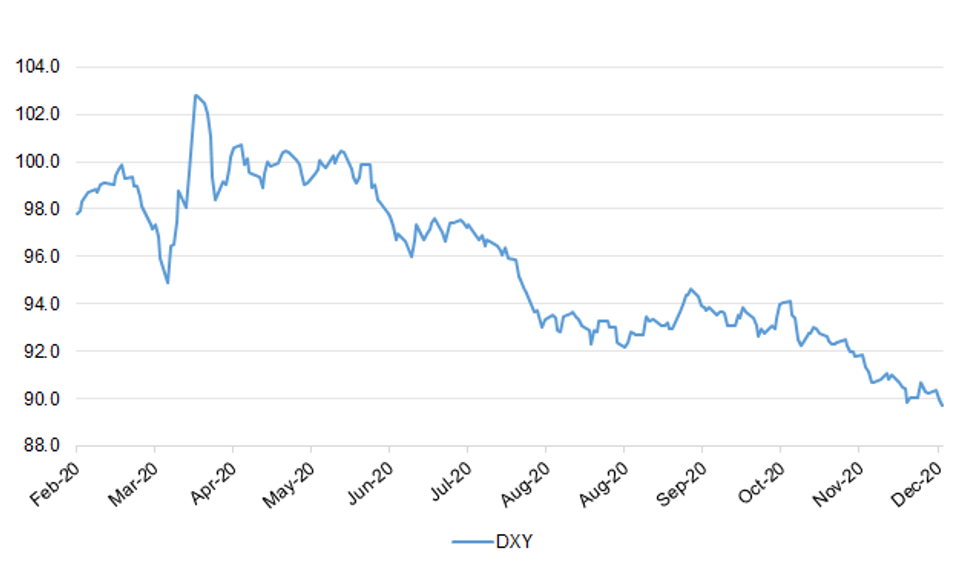

Fig. 1: DXY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Boris Johnson has persuaded the most hardline Tory Brexiteer MPs to back his deal with the EU as he prepares to bring it before the Commons for approval tomorrow. The European Research Group (ERG) declared its support, saying that the agreement "reaffirms UK sovereignty". The group delivered its verdict this afternoon after poring over the 1,246-page document with legal advisers over the weekend. It concluded that the agreement "preserves the UK's sovereignty as a matter of law and fully respects the norms of international sovereign-to-sovereign treaties". (Times)

BREXIT: Boris Johnson will claim to have achieved a "resolution" of decades-long clashes between the UK and the rest of Europe, when MPs back his Brexit trade and security bill in the Commons. The prime minister will shrug off warnings of huge gaps in the agreement and future battles to come by arguing that it has secured – at record speed – something "which we were told was impossible". "Namely, that we could trade and cooperate with our European neighbours on the closest terms of friendship and good will, whilst retaining sovereign control of our laws and our national destiny," he will tell MPs. (Independent)

CORONAVIRUS: Millions more people will be placed under stay-at-home orders today after a record high of more than 53,000 Covid cases were confirmed yesterday. Boris Johnson approved the placing of further swathes of the country into Tier 4 restrictions as the government became increasingly alarmed by the speed at which a new variant of the virus was spreading. Hospitals in London were running out of intensive care beds and drawing up plans to send Covid-19 patients to other parts of the country after doctors expressed fears about how the health service would cope in the coming weeks. Matt Hancock, the health secretary, will tell MPs today which extra areas will be placed in Tier 4 as NHS chiefs press the case for tougher restrictions. (Times)

CORONAVIRUS: Secondary schools are on course not to open as planned next week as ministers prepare to push "far more areas" into a Tier 4 lockdown on Wednesday. Boris Johnson held a key Covid-O committee meeting that will pave the way for a major expansion of Tier 4 restrictions and for school reopenings to be delayed for at least a week. It came as Covid cases surged to a record daily high of 53,135, with 414 deaths, piling pressure on the Prime Minister for a full national lockdown to combat the spread of the new and highly infectious strain of the virus. Most Government scientists are now saying a national lockdown will be needed next month if schools are to reopen before the February half-term. Mr Johnson is expected to chair a meeting on Wednesday to decide whether delaying the opening of secondary schools to all pupils for just a week until January 18 will be sufficient to stem the virus. (Telegraph)

CORONAVIRUS: Contacts of people with the new coronavirus variant are 54 per cent more likely to develop the disease, according to new analysis from Public Health England. They found, however, that it did not appear likely to cause more severe disease or higher death rates. (Times)

CORONAVIRUS: A surge in coronavirus cases in the UK is of "extreme concern", a health boss says, as a record number of cases was reported for the second day running. On Tuesday, 53,135 new Covid cases were recorded as well as 414 more deaths within 28 days of a positive test. Not all data was reported in full over the Christmas period, leading to a lag in some data, but Public Health England said there had been a "real increase". The health secretary said the NHS was facing "unprecedented pressures". (BBC)

BREXIT: Spain's government approved a decree on Tuesday regulating parts of its relationship with the citizens of the British overseas territory of Gibraltar after the Brexit transition period ends on January 1. The measures approved by the cabinet of Spain's socialist prime minister, Pedro Sánchez, allow Gibraltarians to continue to hold Spanish public sector jobs, work in professions that require EU residency and study in Spanish universities, among other issues. But the announcement comes as Madrid warns that it will toughen border checks with Gibraltar if it cannot reach a deal with the UK on free movement between Spain and the territory before the end of the transition period. (FT)

EUROPE

EU: European Commission President Ursula von der Leyen tweeted the following on Tuesday: "We decided to take an additional 100 million doses of the #BioNTech / @Pfizer vaccine, which is already being used to vaccinate people across the EU. We will therefore have 300 million doses of this vaccine, which was assessed as safe and effective. More vaccines will follow!" (MNI)

EU: The European Medicines Authority (EMA) will most likely not be able to approve the COVID-19 vaccine developed by drug maker AstraZeneca and the University of Oxford in January, the watchdog's Deputy Executive Director Noel Wathion said. "They have not even filed an application with us yet", Wathion said in an interview with Belgian newspaper Het Nieuwsblad published on Tuesday. (RTSR)

FRANCE: France will not enforce a new lockdown for the time being to curb the spread of the coronavirus but it could soon impose an earlier curfew in eastern areas of the country, the worst-hit by infections, the health minister said on Tuesday. "We're ruling out the idea of a lockdown for now, whether it be nationally or locally", Olivier Veran said on France 2 public TV channel. "But we will propose an extension of the curfew that could start at 6 p.m. instead of 8 p.m. in all the areas where it will be deemed necessary", Veran said. (RTRS)

SPAIN: Spain is now nearing 1.9 million total infections and will be taking a strong stance against those refusing to receive their vaccination, the country's health minister announced. In an interview with La Sexta, Health Minister Salvador Illa said there will be records showing those "who have been offered [the vaccine] and have simply rejected it." The registry will be shared among European partners, but "[will not] be made public and it will be done with the utmost respect for data protection," he added, noting it will not be available to employers or members of the public. (Politico)

DENMARK: Denmark is extending a lockdown imposed before Christmas to fight the spread of the pandemic, which the government says is now more dangerous than during the spring. Shops, restaurants, gyms and schools will stay closed until Jan. 17, two weeks longer than initially planned, Prime Minister Mette Frederiksen said in Copenhagen on Tuesday. Danes should continue to work from home to the extent they can, she said. (BBG)

GREECE: The Greek government is facing a backlash from doctors and opposition parties after dozens of senior government officials received a coronavirus vaccine before most health care workers. The government's vaccination plan, which was released last week, states that "priority staff critical for the government functions" would be included in the first priority group for getting the vaccine, together with doctors, nurses and those living in nursing houses. The government published an initial list of 45 officials who would be included in this group, including Cabinet ministers, general secretaries, the heads of the health agencies, and the leaders of the Greek armed forces. (Politico)

CROATIA: At least seven people have been killed and dozens injured after a strong earthquake hit central Croatia, destroying buildings and sending panicked people fleeing into rubble-covered streets in a town south-east of the capital Zagreb. The European Mediterranean Seismological Center said an earthquake of 6.4 magnitude hit 28 miles (46km) from Zagreb at 12.19pm, at a depth of 10km. Initial reports said the earthquake caused extensive damage, causing roofs, building facades and entire buildings to collapse. Croatia's prime minister, Andrej Plenkovic, said late on Tuesday that seven victims had been found so far and that there would "probably be more". (Guardian)

POLAND: Poland's central bank is analyzing the potential for further interest rate cuts, which could take place in 1Q 2021, Governor Adam Glapinski said in an excerpt of an interview published by the monetary authority's portal obserwatorfinansowy.pl. (BBG)

U.S.

FISCAL: Senate Majority Leader Mitch McConnell (R-Ky.) on Tuesday blocked an attempt by Democrats to set up a stand-alone vote on increasing the amount of recently passed stimulus checks from $600 to $2,000. Senate Democratic Leader Charles Schumer (D-N.Y.) and Sen. Bernie Sanders (I-Vt.) both tried to get consent for the Senate to bring up legislation that passed the House in a 273-134 vote on Monday. The GOP leader did not directly address why he objected, but under the Senate's rules any one senator can block efforts to set up votes or pass bills. McConnell signaled separately that he could package the increase in direct stimulus checks, with a repeal of a tech shield that has emerged as a top target for Trump and election-related investigations. Trump, in his statement on signing the $2.3 trillion package, said the Senate would "start the process for a vote" that tackles the three issues. "During this process, the president highlighted three additional issues of national significance he would like to see Congress tackle together," McConnell said. (Hill)

FISCAL: Donald Trump challenged Senate Republicans to approve an increase in US stimulus cheques to $2,000 a person, throwing the upper chamber of Congress into turmoil as leaders of president's party scrambled to set the course for his final days in office. The appeal from Mr Trump in a series of tweets on Tuesday was met with a muddied response from Mitch McConnell, the Senate majority leader, as Republicans in the upper chamber split on the merits of a larger economic relief package. (FT)

FISCAL: U.S. Treasury Secretary Steven Mnuchin tweeted the following on Tuesday: "@USTreasury has delivered a payment file to the @FederalReserve for Americans' Economic Impact Payments. These payments may begin to arrive in some accounts by direct deposit as early as tonight and will continue into next week. Paper checks will begin to be mailed tomorrow. Later this week, you can check the status of your payment at http://IRS.gov/GetMyPayment." (MNI)

CORONAVIRUS: Colorado officials on Tuesday confirmed the first case of a new coronavirus strain in the U.S. as the same variant hurtles across the United Kingdom. Gov. Jared Polis (D-Colo.) said in a statement that the Colorado State Laboratory notified the Centers for Disease Control (CDC) of the case, which involves a male in his 20s who is currently in isolation. The patient has no travel history. (Hill)

CORONAVIRUS: Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, told CNN's Jim Sciutto Tuesday that the US is "certainly not at the numbers that we wanted to be at the end of December," when it comes to the number of Covid-19 vaccines administered. The administration had said that the goal was for 20 million people to be vaccinated by the end of the year. As of Monday morning, the US Centers for Disease Control and Prevention's Covid Data Tracker reported just over two million people receiving their first dose. "Even if you undercount, two million as an undercount, how much undercount could it be," Fauci said. "So, we are below where we want to be." (CNN)

CORONAVIRUS: Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, told CNN's Jim Sciutto Tuesday that the US is in a coronavirus surge that has "just gotten...out of control in many respects." He said the recent holiday travel period could make January even worse than December. Asked how much worse things could get, Fauci said that different models say different things, but "I think we just have to assume that it's going to get worse." He said that he hopes things don't get to the level of continually seeing over 200,000 new infections a day, because hospitalizations and deaths will then follow. (CNN)

CORONAVIRUS: Texas posted a record 26,990 new Covid-19 cases on Tuesday, shattering the previous all-time high established less than a week ago. The tally was 41% higher than the previous record reached on Dec. 23, state health department figures showed. The figure may include some cases that local health authorities failed to report over the holidays, the state said. Hospitalizations, meanwhile, climbed to 11,775, breaking the record set a day earlier, according to the state's online dashboard. (BBG)

CORONAVIRUS: As the second wave of coronavirus sweeps New York, the state's governor has threatened legal action not only against a Brooklyn-based network of medical clinics that allegedly distributed the Moderna coronavirus vaccine out of sequence with state guidelines but those who received the first shot before their eligibility. (Fox)

CORONAVIRUS: Rep.-elect Luke Letlow (R-La.) has died from coronavirus, multiple sources confirmed Tuesday evening. He was 41. Letlow, who announced on Dec. 18 that he tested positive for Covid-19, had been in the intensive care unit at Ochsner LSU Health in Shreveport. (Politico)

EQUITIES: Boeing's 737 MAX resumed passenger flights in the United States for the first time on Tuesday after a 20-month safety ban was lifted last month. (RTRS)

OTHER

CORONAVIRUS: State-backed vaccine developer China National Biotec Group Co. said one of its shots is effective in preventing Covid-19 in 79.3% of people, allowing it to apply for authorization to market the inoculation for use in the general population. The interim data shows the vaccine, which is already authorized for emergency use in China, is safe and people who took the shots in the trial all generated high levels of antibodies, according to a statement posted on the website of Beijing Biological Products Institute Co., a subsidiary of CNBG's parent Sinopharm. The rate for the vaccine -- one of two developed by CNBG -- meets the minimum standard of 50% efficacy set by U.S. regulators for emergency authorization of Covid vaccines. However, vaccines using cutting-edge messenger RNA technology from Moderna Inc. and Pfizer Inc. have produced far better results, reducing symptomatic Covid cases by well over 90% in giant trials. The rate announced Wednesday for the CNBG shot is also lower than what was reported from trials in the United Arab Emirates, which put the protection level at 86%. (BBG)

U.S./CHINA: President-elect Joe Biden is unlikely to reverse President Donald Trump's challenge to China's technology industry and companies — but Biden will likely be more targeted in his approach and collaborate with allies, experts told CNBC. During his presidency, Trump has looked to challenge China's technology industry through sanctions, executive orders and other actions. Biden will likely continue such a policy. "The bullet has left the chamber. Trump has completely disrupted the status quo that existed between the U.S. and China for decades," Abishur Prakash, a geopolitical specialist at the Center for Innovating the Future (CIF), a Toronto-based consulting firm, told CNBC by email. (CNBC)

JAPAN: Japan will issue government-backed green bonds for the first time, Nikkei reports, without attribution. Japan Housing Finance Agency will raise ~200b yen in fiscal 2021 and use for low-interest loans to energy-saving housings. (BBG)

JAPAN: A member of a Tokyo panel monitoring the coronavirus outbreak in Japan's capital warned that the medical system there could collapse given the pace at which the virus is spreading. Speaking at the panel meeting Wednesday, vice chair of the Tokyo Medical Association Masataka Inokuchi says chances are "very high" that the medical system could face a collapse at this rate. Citing that the number of patients in hospitals is increasing at a rate of 123%, Inokuchi says 4,000 beds secured could be full within 2 weeks. (BBG)

AUSTRALIA: New health restrictions have been introduced for Sydney after a sudden jump in coronavirus cases overnight. Aged care facilities were also being asked to bar any visitors unless they were essential to caring or it was an end of life situation. (AFR)

SOUTH KOREA: South Korea's new coronavirus cases stayed above 1,000 for a second straight day Wednesday as the government is mulling the toughest distancing rules to curb the pandemic. The country added 1,050 more COVID-19 cases, including 1,025 locally transmitted infections, bringing the total caseload to 59,773, according to the Korea Disease Control and Prevention Agency (KDCA). (Yonhap)

HONG KONG: China sentenced Hong Kong activists detained on the mainland to up to three years in prison over a dramatic attempt to flee by boat, a verdict that defied international calls for their release. Activist Tang Kai-yin was sentenced to three years while Quinn Moon was jailed for two years over their roles in organizing an illegal border crossing, the Yantian District People's Court in Shenzhen said in a statement Wednesday. Eight other activists who participated in the attempt were handed lighter terms of seven months, the court said. Yantian prosecutors said they won't charge two other minors in the group after they admitted to illegal border crossing. The two had been deported Wednesday, according to a statement by the Shenzhen police. Hong Kong police were scheduled to hold a briefing at 12 p.m. local time on the return of two suspects from China. The group of 12 Hong Kong activists were captured in August by coast guard authorities from neighboring Guangdong province as they attempted to flee to the democratic-run island of Taiwan. Their ages range from 16 to 33 and include 11 men and one woman. One person is a Portuguese national. (BBG)

RUSSIA: Russia is stepping up work on the Nord Stream 2 pipeline before the U.S. tightens sanctions against the controversial project designed to feed more natural gas into Germany. Construction of the 1,230-kilometer (764-mile) pipeline reached a milestone on Monday with the completion of pipe-laying in German's exclusive economic zone, the project operator said. Among the next steps resuming work in Denmark's part of the Baltic Sea, where the bulk of the remaining sections of the 157 kilometer link will be located. "There are approximately 120 kilometres in Danish waters and approximately 30 kilometres in German EEZ to be laid," Nord Stream 2 said in an emailed reply to questions on Tuesday. "We are not in a position to deliver further construction details. We will inform about further offshore construction activities in due time." (BBG)

RUSSIA: Russian state investigators said on Tuesday they had opened a new criminal case against Kremlin critic Alexei Navalny, accusing him of fraudulently spending public donations to organisations he controls on his personal needs. (RTRS)

ARGENTINA: Argentina became the third country worldwide to begin inoculating its citizens against Covid-19 with the Sputnik V vaccine outside of trials, providing a boost to Russia's attempts to push the shot into developing nations. Vaccinations began simultaneously in the capital Buenos Aires and other provinces around 9 a.m. local time on Tuesday with some 300,000 people expected to be given the shot. Argentina's health regulator gave swift emergency approval for the vaccine last week, following earlier clearances from Russia and Belarus. "I think people have a lot of faith in the vaccine," President Alberto Fernandez said on state television, according to Telam. "They aren't paying attention to attempts to scare them." (BBG)

CHILE: AstraZeneca has filed data with Chilean regulators for the emergency roll-out of its COVID-19 vaccine in the country and could get a green light "weeks or even days" after approval by European or American regulators, the government's point person for vaccine procurement told Reuters. (RTRS)

SYRIA: Israel carried out a wave of missile attacks targeting a Syrian army air defense unit in the Damascus suburbs, Syria's state-run SANA reports. (BBG)

BANKING: Investment banks across the world generated a record $124.5bn in fees this year as companies raced to raise cash in order to survive the pandemic. The windfall came as lenders earned high fees underwriting debt and equity offerings for clients such as aerospace group Boeing, property rental site Airbnb and telecoms group SoftBank, according to data provider Refinitiv. It was a "very robust year for underwriting both debt and equity", said Jason Goldberg, an analyst at Barclays. "You saw a bump this year as companies looked to access capital markets to shore up their balance sheets in the face of pandemic-related uncertainty." Companies have raised more than $5tn in debt this year, setting another record. While multinationals first moved to draw down credit lines in March, they quickly shifted to the bond market to lock in longer term funding. (FT)

COMMODITIES: Iron ore took a heavy hit as China vowed to rein in steel output next year, threatening demand close to the end of what's been a stellar year for the commodity. That blow coincided with further signals of robust supply, with futures in Singapore set for the lowest close in two weeks. China will ensure crude-steel production falls next year, the Xinhua News Agency said, citing Industry Minister Xiao Yaqing. There will be new guidelines for steel-capacity replacement and a push for lower carbon emissions, it said. (BBG)

CHINA

EQUITIES: Chinese regulators' two discussions with the Ant Group on financial regulation since Nov. 2 showed they are determined to break up monopolies by fintech giants and regain control of the financial market, the Economic Daily wrote in an editorial. The control of personal and transactional data by large fintech platforms poses systemic risks, as many users are connected to commercial banks through third-party payment options without oversight, wrote the newspaper. Fintech platforms may also provide illegal lending using technological advantages to bypass geographical and licensing restrictions, the Daily's editorial said. (MNI)

CHINA/U.S.: Over 70% of respondents in a recent survey conducted by the Global Times, a newspaper owned by the Chinese Communist Party, support the aggressive stance adopted by the Ministry of Foreign Affairs, the so-called Wolf-Warrior diplomacy. About 80% of the survey respondents believe the image of China has improved this year, despite western media suggesting growing mistrust or negative views of China in western countries, the newspaper said. Nearly 30% of respondents said the new cold war between U.S. and China is highly likely or has already begun, according to the Global Times survey. (MNI)

PBOC: China will employ targeted policy tools as it maintains the continuity of monetary policies and the stability of yuan, the Securities Times reported citing the Q4 meeting of the PBOC monetary policy committee held on Dec. 25. The meeting stressed financial support for technology innovation to help reduce foreign reliance, the newspaper reported citing Ming Ming, the deputy director of CITIC Securities Research Institute. China may not cut policy rates in the short term as the meeting minutes focused on consolidating the reduction of real interest rate on loans, the newspaper said. The committee urged companies and banks to beware of risks and emphasized stable expectations for the yuan following its surge in recent months, according to the report. (MNI)

PBOC: China's central bank reiterated its pledge to avoid a sudden shift in monetary policy while it maintains necessary support for the economy's recovery. The main priority is stability, the People's Bank of China said in a statement late Tuesday after its quarterly policy meeting, vowing to "make no sharp turn" on policy. Monetary policy should be flexible, targeted, reasonable and appropriate, it said, reiterating comments from the Communist Party's recent Central Economic Work Conference. The PBOC has been signaling a gradual withdrawal of monetary stimulus as business activity returns to normal and debt levels soar. The recent statements from authorities suggest a "more moderate" stance compared with previous calls on stimulus exit, according to Huachuang Securities analysts, including Zhou Guannan. The central bank said it will use various policy tools to keep liquidity reasonably ample and keep the growth of money supply and credit in line with nominal economic growth. The macro leverage ratio should also be kept stable, it said. A key goal is to strike a balance between supporting the recovery and preventing financial risks, the PBOC said. The central bank will also deepen market-based reforms of the interest-rate and exchange-rate systems and guide financial institutions and other companies to stick with "risk-neutral" thinking, it said. (BBG)

OVERNIGHT DATA

SOUTH KOREA NOV INDUSTRIAL OUTPUT +0.5% Y/Y; MEDIAN -0.5%; OCT -2.0%

SOUTH KOREA NOV INDUSTRIAL OUTPUT +0.3% M/M; MEDIAN +0.8%; OCT -1.1%

SOUTH KOREA NOV CYCLICAL LEADING INDEX CHANGE +0.7; OCT +0.4

SOUTH KOREA JAN BUSINESS SURVEY M'FING 77; DEC 81

SOUTH KOREA JAN BUSINESS SURVEY NON-M'FING 64; DEC 72

CHINA MARKETS

PBOC NET INJECTS CNY30BN VIA OMOS WEDS

The People's Bank of China (PBOC) injected CNY40 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net injection of CNY30 billion given the maturity of CNY10 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain stable liquidity at the end of the year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2441% at 09:33 am local time from 2.2322 at Tuesday's close.

- The CFETS-NEX money-market sentiment index closed at 48 on Tuesday vs 37 on Monday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5325 WEDS VS 6.5451

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5325 on Wednesday, compared with the 6.5451 set on Tuesday.

MARKETS

SNAPSHOT: Familiar Matters Dominate Ahead Of Year-End

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 81.3 points at 27486.85

- ASX 200 down 17.893 points at 6682.4

- Shanghai Comp. up 31.714 points at 3410.499

- JGB 10-Yr future down 3 ticks at 151.92, yield down 0.4bp at 0.021%

- Aussie 10-Yr future down 1 ticks at 98.975, yield up 0.9bp at 0.973%

- U.S. 10-Yr future -0-00+ at 137-29, yield down 0.33bp at 0.933%

- WTI crude up $0.26 at $48.26, Gold up $6.92 at $1885.08

- USD/JPY down 28 pips at Y103.3

- MCCONNELL BLOCKS VOTE ON $2,000 CHECKS, SIGNALS NEW PACKAGE (Hill)

- NEW CORONAVIRUS VARIANT FOUND IN COLORADO, U.S. VACCINATIONS LAG BEHIND TARGETS

- MILLIONS IN UK TO FACE TIER 4 CURBS AMID SURGE IN CORONAVIRUS CASES (Times)

- SINOPHARM SAYS SHOT 79% EFFECTIVE; SEEKS GENERAL USE IN CHINA (BBG)

BOND SUMMARY: Festive Season Lull Continues

T-Notes meandered within a tight range through a distinctly uneventful Asia-Pac session and last trade -0-00+ at 137-29. Cash Tsy yields are little changed vs. neutral levels. Eurodollar futures trade -0.5 to +0.5 tick through the reds. The latest fiscal developments on the Hill were easily digested, after Senate Majority Leader McConnell blocked an attempts by Democratic lawmakers to fast-track a vote on boosting stimulus checks. Focus in the U.S. turns to MNI Chicago PMI, pending home sales & flash wholesale inventories.

- JGB futures went offered in the morning session before consolidating after the lunch break. The contract last sits at 151.90, 5 ticks below last settlement. Cash JGB yields are marginally mixed across the curve as we head towards the London morning. Japanese Ibaraki prefecture experienced a magnitude 5.1 earthquake, but there was no tsunami risk and authorities found no abnormalities at nearby nuclear reactors. Elsewhere, the Nikkei reported that Japan will issue gov't-backed green bonds for the first time.

- The latest Covid-19 outbreak in NSW continued to be the main talking point in Australia. Local authorities tightened social restrictions in a bid to contain the spread of infections. YM trades +0.5, with XM -0.5 as we type. Cash ACGB curve twist steepened a tad, with yields last seen -0.5bp to +0.8bp. Bills run -1 to +1 tick through the reds.

EQUITIES: Markets Mixed Into Year End

Asia-Pac equity indices are mixed on Wednesday amid thin volumes heading into year end.

- US markets pulled back from record highs as optimism re: approval of the U.S. House for increasing stimulus checks was moderated by Senate Majority Leader McConnell's objection to a motion to pass the bill unanimously. It now seems unlikely the Senate will have chance to consider the deal before Congress adjourns Sunday. Attention will now turn to Senate elections in Georgia on Jan. 5. US Futures have ticked slightly higher in Asia, while European bourses are indicated lower.

- Coronavirus concerns continue to weigh globally. The Covid-19 strain discovered in the U.K. has been found in the U.S., a second cluster of infections is emerging in Sydney and the UK looks set to tighten containment measures.

- In Japan the Nikkei 225 pulled back after hitting the highest levels for 30 years yesterday, participants will watch the index for a close above 27,000 today – the last trading day of 2020. Nikkei 225 last down 0.5% at 27,430.

- Markets in China and South Korea have been outperformers, up over 1%. South Korea is seeing equity markets hit record highs as retail investors park cash on the final trading day of 2020.

OIL: Oil Extends Gains On Stockpile Draw

Oil has risen again in Asia trade on Wednesday, extending its gains this week. WTI last up $0.29 at 48.28, while Brent is up $0.25 at 51.34.

- Oil is supported by stockpile data showing inventories fell for the third consecutive week. API data showed headline crude stocks fell 4.79m bbls, which if matched by official data later this week would be the biggest decline in 3 months.

- Upside in oil is tempered by global coronavirus concerns. The Covid-19 strain discovered in the U.K. has been found in the U.S., a second cluster of infections is emerging in Sydney and the UK looks set to tighten containment measures.

- Optimism re: approval of the U.S. House for increasing stimulus checks was moderated by Senate Majority Leader McConnell's objection to a motion to pass the bill unanimously. It now seems unlikely the Senate will have chance to consider the deal before Congress adjourns Sunday. Attention will now turn to Senate elections in Georgia on Jan. 5.

- The OPEC+ group looks likely to increase output by 500k bpd from January, while Russia's deputy prime minister said last week Russia would be supportive of additional gradual increases in February. The OPEC+ group will meet next week to make a decision on February output levels.

- Government officials from Saudi Arabia and Russian reiterated commitment to OPEC+ agreement to support oil market stability at a Saudi-Russian Joint Governmental Committee for Commercial, Economic, Scientific and Technical Cooperation.

GOLD: Bullion Gains As Greenback Recedes

The yellow metal moved higher in Asia on Wednesday, but is still just below yesterday's high of 1886.52, last up $6.20 at 1884.35.

- Optimism re: approval of the U.S. House for increasing stimulus checks was moderated by Senate Majority Leader McConnell's objection to a motion to pass the bill unanimously. It now seems unlikely the Senate will have chance to consider the deal before Congress adjourns Sunday. Attention will now turn to Senate elections in Georgia on Jan. 5.

- Gold is on track is for its best annual gain in 10 years as the U.S. dollar declines. The yellow metal is up over 25% for the year, while DXY languishes at the lowest levels since 2018.

FOREX: Greenback Retreats

Another thin day of volumes and news flow; broad-based greenback sales into the end of the month, quarter and year were a driving force. Focus fell on U.S. fiscal affairs, with optimism re: approval of the U.S. House for increasing stimulus checks tempered by Senate Majority Leader McConnell's objection to a motion to pass the bill unanimously. It now seems unlikely the Senate will have chance to consider the deal before Congress adjourns Sunday. Attention will now turn to Senate elections in Georgia on Jan. 5.

- JPY has inched higher, USD/JPY last down 25 pips at 103.34, though the main driver of the move appears to be greenback weakness.

- AUD/USD up 39 pips at 0.7645. Some strength in the commodity complex has supported AUD & NZD, despite some headwinds. Upside may be tempered by weaker iron ore prices and coronavirus concerns after New South Wales Premier Gladys Berejiklian reported 18 new local cases of covid-19 in a briefing.

- Oil has risen ahead of the OPEC+ meeting on a stockpile drawdown, the dual influences of weaker U.S. dollar and stronger oil saw USD/CAD drop. The pair briefly touched a low of 1.2780 on Tuesday, last trades down 25 pips on the session at 1.2794.

- EUR/USD is having a good session, thin volumes pushing the pair to 1.2295, the highest since April 2018.

- The PBOC fixed dollar/yuan midpoint at 6.5325, around 126 pips stronger for the yuan than yesterday. The bank continues to inject liquidity into the system as we close in on year end. The stronger fix helped accelerate a downside move in USD/CNH, last at session lows of 6.5038.

FOREX OPTIONS: Expiries for Dec30 NY cut 1000ET (Source DTCC)

- EURUSD: 1.2166 (358mln), 1.2250 (662mln), 1.2275 (407mln), 1.2300 (206mln), 1.2400 (880mln)

- GBPUSD: 1.3400 (523mln), 1.3600 (976mln)

- USDJPY: 103.00 (200mln)

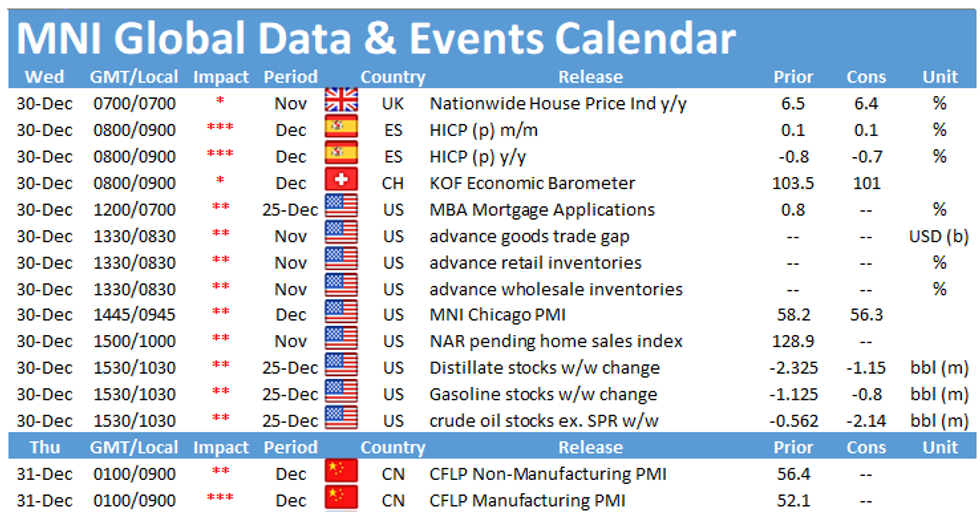

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.