-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A Year Of Living Dangerously Almost In The Books

EXECUTIVE SUMMARY

- BREXIT DEAL BACKED BY UK PARLIAMENT, RECEIVES ROYAL ASSENT

- WEIDMANN: ECB WILL RAISE INTEREST RATES IF NEEDED, BUT SHIFT CAN TAKE SOME TIME (RTRS)

- MCCONNELL: SENATE WON'T BE "BULLIED" INTO MORE AID CHECKS (BBG)

- U.S. ADJUSTS TARIFFS ON EU GOODS HIT IN AIRBUS, BOEING FIGHT (BBG)

- CHINA DEC M'FING PMI 51.9; MEDIAN 52.0; NOV 52.1

- CHINA'S MAJOR STATE BANKS SEEN PURCHASING USD AT AROUND CNY6.52 IN ONSHORE SPOT MARKET (RTRS)

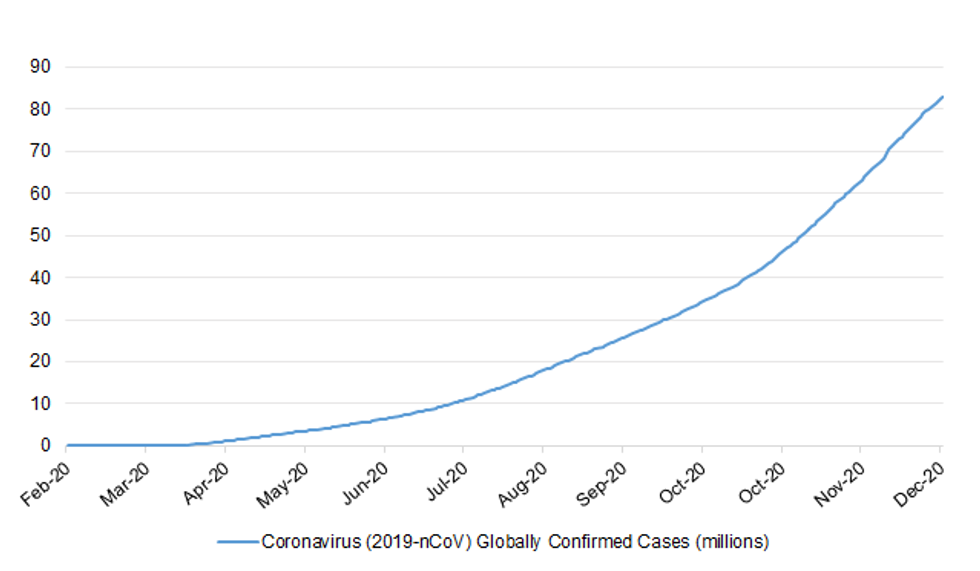

Fig. 1: Coronavirus (2019-nCoV) Globally Confirmed Cases

MNI - Market News/Bloomberg

MNI - Market News/Bloomberg

UK

BREXIT: The post-Brexit trade deal between the UK and EU takes effect at 23:00 GMT on Thursday, after it was signed into law. Parliament overwhelmingly backed the agreement in a high-speed process on Wednesday, following the two sides reaching agreement on Christmas Eve. It takes the UK out of the EU's single market and customs union, but ends the possibility of tariffs on goods. (BBC)

CORONAVIRUS: Critically ill patients are being "evacuated" from the south of England to hospitals hundreds of miles away as NHS bosses in London revealed data showing the capital is set to run out of critical care beds within a week. There were 50,000 positive cases reported across the UK for the second day running on Wednesday, with figures showing London – now the centre of the crisis – with 5,524 patients in hospital, more than its first-wave peak in April. In response to the worsening crisis in London, The Independent has learnt NHS England will announce plans on Thursday to reopen the Nightingale Hospital, at the east London Excel conference centre, on 4 January – initially with around 60 beds for patients who are almost ready to leave hospital. Several patients from across Kent have been taken to Plymouth, Southampton, Bristol and Leeds in recent days as the southeast of England has run out of beds as the numbers of coronavirus patients continues to rise. (Independent)

CORONAVIRUS: More than 500,000 people who have been vaccinated against Covid-19 will have their second dose delayed for up to 12 weeks as the NHS rethinks the rollout that is aimed at halting the surging death toll in the UK. In a change of policy, applying across the UK, the NHS will now prioritise administering to as many people on the priority list as possible the first dose of either the newly approved Oxford/AstraZeneca vaccine or the Pfizer/BioNTech jab, so as to maximise the number of people protected against the disease. Recipients will still get the two doses required to confer full immunity, but now the second will be delayed, in most cases coming 11 to 12 weeks after the first. (Guardian)

CORONAVIRUS: The UK recorded 981 deaths within 28 days of a positive coronavirus test on Wednesday, the highest daily death toll since April. The figure, which is likely to be partially attributable to a lag in reporting deaths over the Christmas period, is the highest since the 1,010 recorded on 24 April, and is an increase of 175% compared with the previous 24 hours. (Guardian)

CORONAVIRUS: British health officials greenlighted the AstraZeneca and Oxford COVID-19 shot on Wednesday but also rebuffed one of their central claims: that a half-dose followed by a standard dose offered more protection against infection. The reassessment of the best dosing regimen for the vaccine was an unexpected move by Britain's medicines regulator based on its own analysis of as-yet-unpublished data and it raised fresh questions about the efficacy of a vaccine which has yet to be approved in other countries. Though cheaper and easier to distribute than rival shots, the Oxford/AstraZeneca vaccine has been plagued with uncertainty about its most effective dosage ever since data published last month showed a half-dose followed by a full dose had a 90% success rate while two full shots were 62% effective. (RTRS)

BREXIT: The EU has secured the ability to shut off gas and electricity supplies if the UK tries to seize control of disputed fish stocks in future, experts are warning. The sanction – which would hike prices and possibly trigger blackouts – makes a mockery of the prime minister's claim to have "taken control" of British waters in his trade agreement, they say. The little-noticed clause in the vast 1,255-page text allows Brussels to kick the UK out of its electricity and gas markets in June 2026, unless a fresh deal is agreed. (Independent)

BREXIT/POLITICS: Three Labour MPs have resigned as junior frontbenchers after defying Keir Starmer and refusing to vote for Boris Johnson's Brexit deal. Tonia Antoniazzi, the MP for Gower, Helen Hayes, the Dulwich and West Norwood MP, and Florence Eshalomi, the MP for Vauxhall, resigned from their junior frontbench posts so as to abstain as MPs voted on the legislation implementing the agreement. (Guardian)

UK/U.S.: A U.K. judge will rule Monday on whether WikiLeaks founder Julian Assange should be extradited to the U.S. to face criminal charges after weeks of talk about a possible pardon from Donald Trump. The decision from a London judge will come after President Trump, whose administration brought the charges, issued a plethora of pardons to political allies. And lawyers say the odds of clemency from Trump are better than a judge buying Assange's arguments that his human rights will be trampled on in America. (BBG)

EUROPE

ECB: Bundesbank President Jens Weidmann warned euro zone governments forced to increase public debt to support their economies during the coronavirus pandemic not to expect the European Central Bank to keep interest rates low forever. "We will not take into consideration sovereign debt servicing costs if price stability mandates higher interest rates," Weidmann, a member of the ECB's Governing Council, told the Rheinische Post newspaper in remarks published on Thursday. "In their own interest, governments should prepare for a rise in interest rates and not pretend that their debt burden can be serviced easily," said Weidmann. (RTRS)

EU/CHINA: The EU and China have announced a long-awaited deal on an investment treaty, in a move that is aimed at opening up lucrative new corporate opportunities but risks antagonising president-elect Joe Biden's incoming US administration. The accord was confirmed by Chinese President Xi Jinping and EU leaders including European Commission president Ursula von der Leyen on Wednesday, bringing seven years of often difficult negotiations to a successful close. Valdis Dombrovskis, the EU's trade commissioner, told the Financial Times that the deal contained the "most ambitious outcomes that China has ever agreed with a third country" in terms of market access, fair competition and sustainable development. "We expect European businesses will have more certainty and predictability for their operations," he said. "We have some very welcome changes to the rules of the game, because for a long period, trade and investment relations with China have been unbalanced." But the accord may create friction with the incoming Biden administration in the US, which has stressed the need for transatlantic co-operation to put pressure on Beijing. (FT)

GERMANY: Germany expects the European Union to give rapid approval to the coronavirus vaccine developed by Oxford University and AstraZeneca that was cleared for use in Britain on Wednesday, its top vaccines official said. (RTRS)

GERMANY: The German health minister on Wednesday said he could not envisage a relaxation of coronavirus measures when the current set of restrictions expires on January 10. Jens Spahn said he could see no end to the lockdown currently in place as the country reported a record number of COVID-19 fatalities for the previous 24 hours. (Deutsche Welle)

FRANCE: The French health ministry reported 26,457 new coronavirus infections over the past 24 hours on Wednesday, up sharply from 11,395 on Tuesday, and a level unseen since Nov. 18. Speaking before the data were released, government spokesman Gabriel Attal said France was not planning local lockdown measures to contain the spread of COVID-19 for now, although he dampened hopes for a quick reopening of cultural attractions and said curfews could be tightened. (France24)

FRANCE: France is to mobilise 100,000 police and gendarmes on New Year's Eve to break up parties and enforce a curfew imposed to combat coronavirus. The extra security also aims at halting the torching of cars that often takes place on the final night of the year. (BBC)

ITALY: Premier Giuseppe Conte on Wednesday vowed a "political synthesis" for Italy's COVID Recovery Plan and said cabinet would meet in early January to ward off a threat from key ally and former premier Matteo Renzi to bring down the government over the way the plan will be implemented. (ANSA)

ITALY: Italy's 2021 budget bill got final approval by parliament on Wednesday. The OK came after a Senate confidence motion passed by 156 votes to 124. (ANSA)

IRELAND: Ireland will return to Level 5 restrictions for a least a month in an effort to limit the spread of the coronavirus, prime minister Micheal Martin has said. Addressing the nation, he described the situation as "extremely serious", saying the new variant of the virus is "spreading at a rate that has surpassed the most pessimistic models available to us". (Sky)

POLAND: Poland's central bank may have lent a helping hand to the government when it unexpectedly intervened to weaken the zloty last week. Policy makers said they want to support exports by stepping into the market to sell the Polish currency for the first time in a decade -- knocking the zloty as much as 1.2% lower against the euro last Friday. But an alternative view has emerged among some analysts suggesting a more likely motivation was to inflate the end-year value of the nation's foreign reserves, counted in zloty, which would help drive up central bank profit and plug the hole in a strained 2021 government budget. (BBG)

BALKANS: Serbia received its first gas from an extension of the TurkStream pipeline via Bulgaria as the Balkan region reduces its reliance on transit through Ukraine but remains dependent on Russia for the fuel. The new supply route is part of Russia's efforts to circumvent its eastern neighbor Ukraine from both the north and south after price disputes caused repeated stoppages for more than a decade. Bulgaria's 474-kilometer (295-mile) stretch and Serbia's 403-kilometer link extending to Hungary cost around $3 billion. It was completed after multiple delays and western pressure against a similar link via the Baltic Sea, the Nord Stream 2, with the goal of pushing Europe to diversify supply away from Russian gas giant Gazprom PJSC. (BBG)

VATICAN: Pope Francis has stripped the Vatican's powerful central administration office of an investment portfolio worth hundreds of millions of euros following a scandal linked to luxury London real estate development in Chelsea. The Vatican said that all of the financial assets of the Secretariat of State, the Holy See's state bureaucracy, would be placed under the control of APSA, the Vatican's existing centralised asset manager, from the start of the new year. (FT)

U.S.

FISCAL: U.S. Senate Republican leader Mitch McConnell on Wednesday said a Democratic bill to raise coronavirus relief checks to $2,000 from $600 was unlikely to clear the Senate anytime soon, likely killing an effort to boost the aid that was championed by President Donald Trump. McConnell said on the Senate floor that a bill passed by the Democratic-controlled House of Representatives, which sought to meet Trump's demands for bigger checks, "has no realistic path to quickly pass the Senate." Republican Senator John Cornyn told reporters that he thought it unlikely that Congress would act to increase the checks given McConnell's remarks. Asked if he expected Republicans to face political blow-back, Cornyn said: "No, not in any normal world," noting that Congress had already approved trillions of dollars in relief for an economy battered by the pandemic. (RTRS)

FISCAL: Speaker Nancy Pelosi (D-Calif.) on Wednesday pressed Senate Majority Leader Mitch McConnell (R-Ky.) to allow the upper chamber to vote on a House-passed bill that would send stimulus checks of up to $2,000 to most Americans. "The Democrats and Republicans in the House have passed that legislation. Who is holding up that distribution to the American people? Mitch McConnell and the Senate Republicans," she said at a press conference. (Hill)

CORONAVIRUS: The US will end the year having vaccinated far fewer people against coronavirus than hoped, senior Trump administration officials have admitted, with states having only used about a fifth of the doses they have been given in the past three weeks. Officials at US public health agencies have said a combination of the holiday season, bad weather and complex vaccine procedures had led to fewer healthcare workers and people in care homes being vaccinated this year than planned. Officials had aimed to distribute enough doses to vaccinate 20m people by the end of the year, but recently admitted they were not likely to hit that target until early January after underestimating how long it would take to carry out quality control checks on manufactured doses. (FT)

CORONAVIRUS: Hundreds of shipments of Moderna Inc.'s Covid-19 vaccine bound for Texas last week weredelayed after several batches showed signs of having strayed from their required temperature range, according toa spokeswoman for the Texas Department of State Health Services.The vaccines, a total of 144,400 doses sent in 421 shipments, were scheduled for delivery last week, before theChristmas holiday. They were delivered early this week instead, spokeswoman Lara Anton said in an emailWednesday evening. The state wasn't given a reason for the delay, she said.Five shipments containing 4,300 doses that had temperature problems were replaced. (BBG)

CORONAVIRUS: The leading U.S. infectious disease specialist, Dr. Anthony Fauci, said on Wednesday he foresees America achieving enough collective COVID-19 immunity through vaccinations to regain "some semblance of normality" by autumn 2021, despite early setbacks in the vaccine rollout. (RTRS)

CORONAVIRUS: The highly infectious coronavirus variant originally discovered in Britain has been detected in California, Governor Gavin Newsom said on Wednesday, a day after the first known U.S. case was documented in Colorado. (RTRS)

POLITICS: President-elect Joe Biden is not expected to name any additional Cabinet nominees until 2021, his transition team said Wednesday, as high profile slots such as attorney general and secretary of Labor remain unfilled. "He is very thoughtful about how he makes the decisions of who he's going to nominate for the Cabinet and any real personnel decisions, and we believe he deserves the time and space to make those decisions," incoming White House press secretary Jen Psaki said during a briefing with reporters. "I would think you can expect we won't have new Cabinet announcements to make until the new year. But that's the timeline," she added. (Hill)

POLITICS: President-elect Joe Biden's transition team said at a press briefing on Wednesday that the Office of Management and Budget has been limiting support to the incoming administration, accusing the agency of "intentionally generated opacity." (Axios)

POLITICS: Republican Senator Josh Hawley said he will object to the certification of the Electoral College votes for Joe Biden as president when Congress convenes on Jan. 6, defying warnings from GOP leaders against staging a doomed-to-fail spectacle. "I cannot vote to certify the electoral college results on January 6 without raising the fact that some states, particularly Pennsylvania, failed to follow their own state election laws," Hawley, of Missouri, said in a statement. "And I cannot vote to certify without pointing out the unprecedented effort of mega corporations, including Facebook and Twitter, to interfere in this election, in support of Joe Biden." (BBG)

POLITICS: More than 2.5 million voters have cast ballots during the early voting period for Georgia's high-stakes runoffs for two U.S. Senate seats, shattering records as both Democrats and Republicans mount unprecedented efforts to get their supporters to the polls. The twin contests between Sen. David Perdue (R) and investigative journalist Jon Ossoff (D) and Sen. Kelly Loeffler (R) and the Rev. Raphael Warnock (D) will determine which party controls the Senate, and they've drawn hundreds of millions in campaign contributions and outside spending. Underscoring just how narrowly divided the state is, the vast majority of that money has been spent trying to mobilize voters, rather than persuading the undecided. (Hill)

OTHER

GLOBAL TRADE: The Trump administration announced additional tariffs on some products from the EU as part of a long-running dispute over subsidies to aircraft makers Airbus SE and Boeing Co. In November, the EU instituted duties on some $4 billion in trade from the U.S. after gaining approval from the World Trade Organization. A year earlier, the U.S. had imposed tariffs -- also authorized by the WTO -- on about $7.5 billion in imports from the EU and U.K. including French wine and Scotch whisky. The U.S. Trade Representative's office on Wednesday said it was amending some of its tariffs because the EU used a time period that affected "substantially more products than would have been covered" otherwise and that the EU "needs to take some measure to compensate for this unfairness." (BBG)

U.S./CHINA: Two U.S. warships sailed through the sensitive Taiwan Strait on Thursday drawing protest from Beijing, the second such mission this month and coming almost two weeks after a Chinese aircraft carrier group used the same waterway. China, which claims democratically run Taiwan as its own territory, has been angered by stepped-up U.S. support for the island, including arms sales and sailing warships through the Taiwan Strait, further souring Beijing-Washington relations. The U.S. Navy said the guided-missile destroyers USS John S. McCain and USS Curtis Wilbur had "conducted a routine Taiwan Strait transit Dec. 31 in accordance with international law". (CNBC)

U.S./CHINA: The Trump administration is declassifying as-yet uncorroborated intelligence, recently briefed to President Trump, that indicates China offered to pay non-state actors in Afghanistan to attack American soldiers, two senior administration officials tell Axios. The big picture: The disclosure of this unconfirmed intelligence comes 21 days before the end of Trump's presidency, after he has vowed to ratchet up pressure on China, and months after news reports indicated that the Russians had secretly offered bounties for Taliban militants to kill U.S. troops in Afghanistan. (Axios)

U.S./CHINA: The United States called on Wednesday for the release of a Uighur Muslim medical doctor who relatives say was sentenced to 20 years jail in China because of family members' human rights activism in the United States. (RTRS)

JAPAN: The Tokyo metropolitan government reported 944 cases of the novel coronavirus on Wednesday, marking the second-highest daily tally on record and prompting Governor Yuriko Koike to warn that the capital is facing "a third wave" of infections of an "unprecedented magnitude". Tokyo had just logged a record 949 infections on December 26, and saw the seven-day rolling average of new cases top 800 for the first time at 815.7. "We are in a very severe and crucial phase," Koike said at a news conference. "It is no surprise that an explosion of infections could occur at any time." Koike said that if the situation continues to worsen, the metropolitan government "may have no choice but to request" that Prime Minister Yoshihide Suga declares a state of emergency over the pandemic. (SCMP)

SOUTH KOREA: South Korea's central bank chief said on Thursday that monetary policy will remain accommodative for some time, given the high uncertainties stemming from the coronavirus pandemic, but added that a buildup of financial imbalances is a worry. Bank of Korea Governor Lee Ju-yeol also said policies should stay expansionary to support an economic recovery, while a targeted approach to help those vulnerable to COVID-19 should be strengthened. "Monetary policy needs to stay accommodative until a stable recovery in our economy is seen, as there are high uncertainties to the growth path, while inflation is also expected to fall below the target level for a while," Lee said in a New Year's message. (RTRS)

SOUTH KOREA: South Korea's new coronavirus cases fell below 1,000 Thursday for the first time in three days as health authorities were set to decide whether to extend tougher virus curbs or raise the social distancing scheme to the highest amid no signs of a letup in the virus resurgence. (Yonhap)

SOUTH KOREA: South Korean prosecutors have sought a nine-year prison sentence for Lee Jae-yong, the head of the Samsung group facing a retrial on charges of bribery. Mr Lee's retrial at the High Court in Seoul centres on allegations that he bribed Park Geun-hye, the former president who was impeached in 2017, in an attempt to secure control of the expansive technology group. (FT)

MALAYSIA: The U.S. said it will ban all shipments of palm oil from one of the world's biggest producers after finding indicators of forced labor and other abuses on plantations that feed into the supply chains of some of America's most famous food and cosmetic companies. The order against Malaysian-owned Sime Darby Plantation Berhad and its local subsidiaries, joint ventures and affiliates followed an intensive months-long investigation by the U.S. Customs and Border Protection's Office of Trade, said Ana Hinojosa, one of the agency's executive directors. (CNBC)

SINGAPORE: Preparation for Singapore's budget 2021 is well underway and the pandemic is contained locally although the outlook remains highly uncertain and "will be the case for some time to come," Finance Minister Heng Swee Keat says in a Facebook post. If trajectory of economic recovery is on track, then Singapore will have a more "traditional" budget year. If the situation takes a turn for worse, "we are ready to respond and adapt." Singapore's FY2021 budget will be presented on Feb. 16. (BBG)

ARGENTINA: Argentina's regulator on Wednesday approved the COVID-19 vaccine developed by AstraZeneca and Oxford University for emergency use, AstraZeneca said in a statement. AstraZeneca said the approval by the National Administrator for Food and Medical Technology (ANMAT) made Argentina "one of the first countries in the world to authorize" the drug, after the UK regulator gave the green light for its widespread roll-out earlier on Wednesday. (RTRS)

ARGENTINA: Argentina on Wednesday became the largest nation in Latin America to legalize elective abortion, a triumph for a feminist movement that overcame a last-minute appeal by Pope Francis to his compatriots and could pave the way for similar actions across the socially conservative, heavily Roman Catholic region. (AP)

IRAN: Iran's Cabinet on Wednesday allocated $150,000 for the families of each of the 176 victims of a Ukrainian plane shot down in Iranian airspace in January, the official IRNA news agency reported. (RTRS)

YEMEN: A large explosion struck the airport in the southern Yemeni city of Aden on Wednesday, shortly after a plane carrying the newly formed Cabinet landed there, security officials said. At least 25 people were killed and 110 wounded in the blast. Yemen's internationally recognized government said Iran-backed Houthi rebels fired four ballistic missiles at the airport. Rebel officials did not answer phone calls from The Associated Press seeking comment. No one on the government plane was hurt. (AP)

CHINA

CHINA/EU: China has demonstrated its determination and confidence in the further opening of its economy with the conclusion of bilateral investment treaty negotiations with the EU, China's Chairman Xi Jinping said at a virtual conference with European leaders on Wednesday. The People's Daily reported comments from Xi, who said the pact, which took seven years to negotiate, provided Chinese and European companies with greater market access and integration. China also hopes to coordinate with the EU on vaccine distribution, the global economic recovery and the development of the green economy, the Daily reported. (MNI)

ECONOMY: China should see a GDP growth of 6% or higher in the last quarter of 2020 based on strong recoveries in exports and the service industry after China's tight control over the pandemic, the 21st Century Business Herald reported citing an interview with Peng Wensheng, chief economist from CICC. GDP growth in 2021 should reach 8%-9%, according to Peng. China will be mindful of rising debt levels while implementing monetary policies, he said. China should also anticipate exports slowing as other exporters regain capacity and as people shift from commodity consumption to services. (MNI)

CORONAVIRUS: China approved a COVID-19 vaccine developed by an affiliate of state-backed pharmaceutical giant Sinopharm on Thursday, its first approved shot for general public use as it braces for increased transmission risks over winter. No detailed efficacy data of the vaccine has been publicly released but its developer, Beijing Biological Products Institute, a unit of Sinopharm subsidiary China National Biotec Group (CNBG), said on Wednesday its vaccine was 79.34% effective in preventing people from developing the disease based on interim data. The approval comes after the United Arab Emirates this month became the first country to roll out the vaccine to the public. (RTRS)

BONDS: China may issue CNY 4.7 trillion in new local government bonds in 2021, the China Securities Journal reported citing analyst Sun Binbin from TF Securities. Infrastructure spending from bond proceeds may be scaled down as the economy normalizes from this year's pandemic, Sun said. Total local debt issuances reached CNY6.4 trillion in 2020, the Journal reported. (MNI)

YUAN: China's major state-owned banks were seen buying U.S. dollars at the level of about 6.52 yuan on Thursday, traders said, in a move viewed as an effort to keep the yuan from rising too fast and breaching a key level. The onshore spot market opened at 6.5204 per dollar and surged to a high of 6.5148 at one point in morning trade, its loftiest since June 22, 2018. The state bank action quickly dragged the yuan to the weaker side of 6.52 per dollar, four traders told Reuters. "Two state banks bid at that level today," said one of the traders. (RTRS)

OVERNIGHT DATA

CHINA DEC M'FING PMI 51.9; MEDIAN 52.0; NOV 52.1

CHINA DEC NON-M'FING PMI 55.7; MEDIAN 56.3; NOV 56.4

CHINA DEC COMPOSITE PMI 55.1; NOV 55.7

MNI DATA IMPACT: China Dec PMI 51.9; Economy Continues Recovery

- China's December manufacturing Purchasing Manager Index slowed to 51.9 from the 3-year high of 52.1 reported in November, but continued to hold above the break-even for the tenth straight month. The non-manufacturing gauge read at 55.7 in December, down from the year peak of 56.4, according to the latest data from the National Bureau of Statistics released on Thursday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

SOUTH KOREA DEC CPI +0.5% Y/Y; MEDIAN +0.5%; NOV +0.6%

SOUTH KOREA DEC CPI +0.2% M/M; MEDIAN +0.1%; NOV -0.1%

SOUTH KOREA DEC CORE CPI +0.9% Y/Y; NOV +1.0%

CHINA MARKETS

PBOC NET INJECTS CNY80BN VIA OMOS THURS

The People's Bank of China (PBOC) injected CNY90 billion via 7-day reverse repos with the rate unchanged on Thursday. This resulted in a net injection of CNY80 billion given the maturity of CNY10 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain stable liquidity at the end of the year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) dropped to 2.2541% at 09:22 am local time from 2.4581% at Wednesday's close.

- The CFETS-NEX money-market sentiment index closed at 46 on Wednesday vs 48 on Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5249 THURS VS 6.5325

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5249 on Thursday, compared with the 6.5325 set on Wednesday.

MARKETS

SNAPSHOT: Asia Markets Await New Year

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 down 95.33 points at 6587.1

- Shanghai Comp. up 28.336 points at 3442.789

- JGBs are closed

- Aussie 10-Yr future up 1 ticks at 98.98, yield down 1bp at 0.97%

- U.S. 10-Yr future -0-00+ at 137-30+, cash Tsys are closed

- WTI crude down $0.09 at $48.31, Gold down $5.15 at $1889.14

- USD/JPY down 3 pips at Y103.16

- BREXIT DEAL BACKED BY UK PARLIAMENT, RECEIVES ROYAL ASSENT

- WEIDMANN: ECB WILL RAISE INTEREST RATES IF NEEDED, BUT SHIFT CAN TAKE SOME TIME (RTRS)

- MCCONNELL: SENATE WON'T BE "BULLIED" INTO MORE AID CHECKS (BBG)

- U.S. ADJUSTS TARIFFS ON EU GOODS HIT IN AIRBUS, BOEING FIGHT (BBG)

- CHINA DEC M'FING PMI 51.9; MEDIAN 52.0; NOV 52.1

- CHINA'S MAJOR STATE BANKS SEEN PURCHASING USD AT AROUND CNY6.52 IN ONSHORE SPOT MARKET (RTRS)

BOND SUMMARY: Core FI Rangebound, No Fireworks In Asia

Core FI struggled for impetus in thin NYE trade. Macro headline flow was subdued and activity limited by several market closures across the region, including in Japan and South Korea. China's PMI figures came in slightly shy of expectations, but remained in expansionary territory, provoking little to no market reaction. T-Notes traded sideways within a very tight range, last sit -0-00+ at 137-30+. Eurodollars last seen +0.5 to -0.5 tick through the reds. Cash Tsys were closed owing to a public holiday in Tokyo. They will re-open in the London morning for shortened trading hours.

- Aussie bonds also closed early after a degree of flattening crept into cash ACGB space. Yields sat +0.2bp to -1.5bp across the curve come the end of play. YM last deals +0.5, XM trades +1.0. Bills run unch. to +1 tick through the reds. Coronavirus matters continued to grab attention in Australia, with outbreaks in Sydney & Melbourne eyed. Victoria acting Premier Allan announced that the state will close its border with NSW from 11:59pm on Jan 1.

EQUITIES: Mixed, Holiday Thinned Session

A mixed session to end the year, Chinese equity markets were the outperformers from the off as participants rode the risk on wave in the region which saw USD/CNH drop below 6.50 and the CSI 300 rise around 1%. Markets shrugged off data that showed China's manufacturing and services PMIs came in slightly weaker than expectations for December.

- Australia underperformed, the ASX 200 fell 1.43% in a holiday shortened session. A surge in coronavirus cases in the region sapped risk sentiment. The cluster in New South Wales continues to grow while 3 new cases were found in Victoria which has led the government to impose stricter containment measures from tomorrow.

- In general Asia-Pac shares are closing out the year near highs. MSCI's gauge of Asia-Pacific shares excluding Japan explored fresh territory repeatedly late in the year. The index is set for a fourth-quarter gain of over 19% which would be its strongest three-month performance since 2009.

- Markets in South Korea and Japan were closed. US futures are slightly higher, while European futures are indicated lower.

OIL: Oil Slips After Inventory Related Gains

Oil has slipped in Asia, WTI last down 0.48% at 48.17, Brent down 0.50% at 51.37. Oil rose around 0.8% yesterday after larger than expected draws in inventories were posted at weekly DOE data.

- Oil markets are fighting the conflicting influences of a spike in coronavirus cases globally and hope that vaccine roll outs can accelerate the return to normality.

- The OPEC+ group looks likely to increase output by 500k bpd from January, while Russia's deputy prime minister said last week Russia would be supportive of additional gradual increases in February. The OPEC+ group will meet next week to make a decision on February output levels.

- Government officials from Saudi Arabia and Russian reiterated commitment to OPEC+ agreement to support oil market stability at a Saudi-Russian Joint Governmental Committee for Commercial, Economic, Scientific and Technical Cooperation.

GOLD: Gold Pulls Back From 1,900 Again

The yellow metal rose through the session on Wednesday, and initially continued the trend higher early in Asia. Gold peaked at 1899.93 before some broad-based US dollar buying saw the yellow metal fall out of favour and drop to session lows of 1888.74, down around 0.3% – still some way off lows of 1876.18 on Wednesday.

- Gold is on track to post the biggest annual gain in a decade, advances this month have been aided by the greenback's decline to the lowest level since April 2018

FOREX: US Dollar Reverses Fortunes In Quiet Session

The greenback was once again the main driver of price action heading into month-, quarter-, year-end. The US dollar initially weakened before some broad-based buying across the board. Thin volumes were evident with many markets including Japan and South Korea closed today, and others truncating their sessions.

- Commodity currencies initially gained on higher agricultural prices and a rebound in oil. Market earlier chewed through AUD/USD offers above 0.7690 taking out the 0.77 handle in the process and touching the highest levels since April 2018. The pair last up 12 pips on the session at 0.7698.

- GBP climbed after the Brexit deal received approval from lawmakers in the UK, clearing another hurdle ahead of the deal becoming law. GBP/USD came off highs as the US dollar strengthened later in the session. GBP/USD last down 7 pips at 1.3617.

- In China December manufacturing PM came in slightly below estimates at 51.9 and down from 52.1 in November, non-manufacturing PMI falls to 55.7 from 56.4. Elsewhere the EU and China announced initial political approval of an agreement to open the Chinese market further to EU investors. USD/CNH is holding lower after another stronger fix for the yuan and briefly foraying below the 6.50 level. The pair last at 6.5017.

- EUR/USD has dropped, last down 10 pips at 1.2288 after being as high as 1.2309. ECB's Wiedmann did cross the wires, saying ECB will raise interest rates if needed, but shift can take some time but these comments have been largely ignored and come a day after ECB's Rehn said the GC were monitoring EUR appreciation.

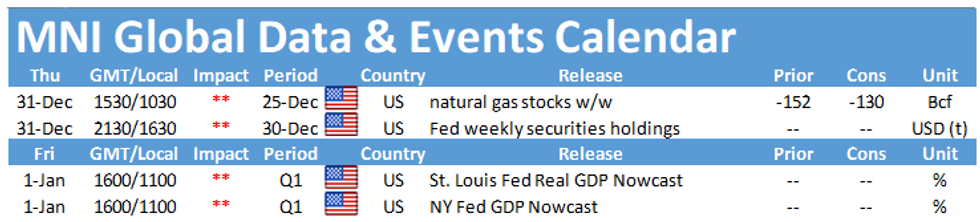

UP TODAY (Times Local/GMT)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.