-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: COVID News Mixed, Markets Look For Keys To Trade Off

EXECUTIVE SUMMARY

- ECB IS SAID TO ASK STAFF FOR PROPOSALS ON NEW FINANCIAL CONDITIONS GAUGES BY MARCH (BBG)

- EU LEADERS TOLD ASTRAZENECA VACCINE DELIVERIES TO START MID-FEB (BBG)

- FAUCI: J&J VACCINE TRIAL HAS ENOUGH DATA TO ANALYZE SOON (BBG)

- JAPAN AND EVENT ORGANISERS PLAY DOWN RUMOURS OF CANCELLING TOKYO GAMES

- NZ CPI BEATS, RBNZ SECTORAL FACTOR INFLATION MODEL NUDGES HIGHER

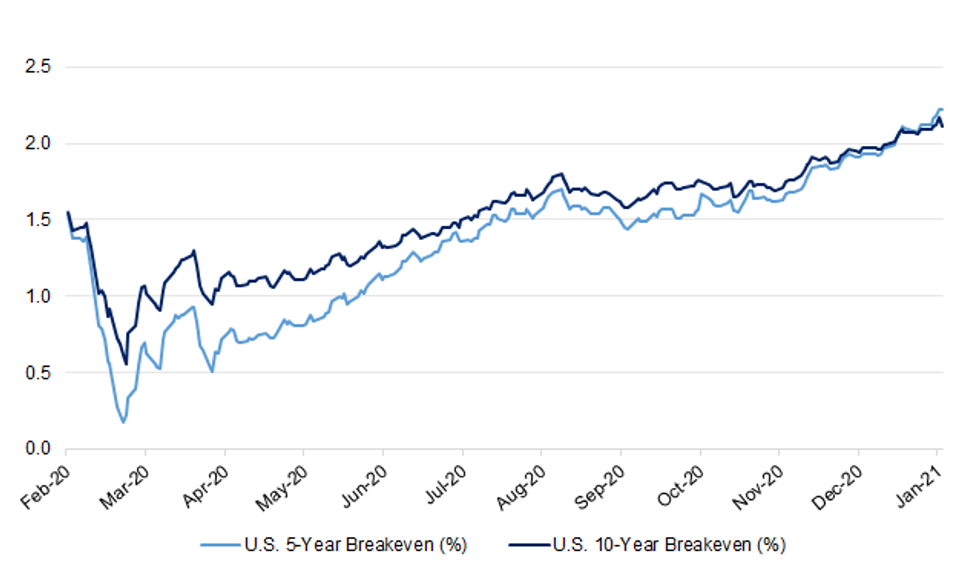

Fig. 1: U.S. 5- & 10-Year Breakevens (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: It is "too early" to say whether England's Covid restrictions will be able to end in the spring, Prime Minister Boris Johnson has said. Once the four priority groups have been vaccinated, by mid-February, "we'll look then at how we're doing," he said. Nearly two million people in the UK have had their first dose of vaccine in the past week, government figures show. Scientist Marc Baguelin, who advises the government, has said restaurants and bars should not reopen before May. (BBC)

CORONAVIRUS: Northern Ireland's executive has extended its coronavirus lockdown by four weeks until March 5 as the region struggles with "peak" pressure on its hospitals. The decision on Thursday comes amid moves to deploy 110 medically-trained British military personnel in hospitals to support frontline healthcare staff. (FT)

CORONAVIRUS: It is a battle over the UK's borders that will pitch the Cabinet "doves" of Matt Hancock, Priti Patel and Michael Gove against the economic "hawks" of the Treasury and Department for Transport. The Cabinet's coronavirus operations committee (Covid O) will see the two sides determine in the coming days how far the Government should go in further tightening the restrictions on international travel to combat the spread of the new highly-infectious Covid strains. (Telegraph)

CORONAVIRUS: Bars and restaurants should stay shut until May, a government adviser has said. They warn that reopening society too quickly could have a "disastrous" effect on the COVID R-rate. A team of experts modelling the pandemic said that even if 90% of people are vaccinated against coronavirus, 10% would still be at risk of serious infection. (Sky)

CORONAVIRUS: Ministers are considering paying £500 to everyone who tests positive for Covid under plans that would cost the state almost £2 billion a month. (Telegraph)

BREXIT: Large companies have complained to ministers that hundreds of millions of pounds of support is being blocked after a decision to stick with certain EU state-aid rules even though the UK has left the trading bloc. Some businesses say they have been locked out of the government's £4.6bn emergency Covid-19 grant scheme announced this month, leaving jobs hanging in the balance as they face an indefinite period of forced closure in the latest national lockdown. (FT)

FISCAL: Chancellor of the Exchequer Rishi Sunak will set out plans in his budget in six weeks' time to start restoring order to the U.K.'s finances, a person familiar said, with the country on course to posting its biggest peacetime budget deficit. While the extent of any measures the chancellor will announce on March 3 is dependent on the evolution of the pandemic between now and then, the Treasury wants to have a plan that looks beyond Covid at how to close the deficit, according to the person, who spoke anonymously because no decisions have been taken. (BBG)

FISCAL: The Treasury's furlough bill could surge as high as £75bn by summer if Rishi Sunak extends the job retention scheme - piling an extra £3bn of costs per month onto taxpayers. (Telegraph)

FISCAL: Britain and France are in talks to rescue Eurostar as officials in Paris fight to keep the struggling rail operator afloat - and insist the UK must also play its part. (Telegraph)

HOUSING: Housing market transactions last month reached their highest level since 2006 as buyers raced to benefit from the stamp duty holiday. There were 137,200 sales in December, 14 per cent higher than in November and 34.2 per cent higher than in the final month of 2019, according to provisional data from HM Revenue & Customs. (The Times)

EUROPE

ECB: European Central Bank officials have asked staff to propose new ways to measure financial conditions in the euro area, potentially assisting future decisions on how much stimulus the region's pandemic-hit economy needs. (BBG)

ECB: During a separate seminar on policy instruments that's part of the ECB's strategic review, officials also discussed the future of its asset-purchase plans, and whether elements of the pandemic emergency purchase program should remain and be applied to an older asset-purchase program. (BBG)

FISCAL: French Finance Minister Bruno Le Maire said he will seek to coordinate European and U.S. fiscal stimulus efforts in talks as soon as next week, indicating unease with President Joe Biden's plans for a massive $1.9 trillion Covid-19 relief plan. "The U.S. has just announced significant sums to stimulate its economy - it's good to coordinate the U.S., European and French recovery plans," Le Maire said on French television channel LCI Thursday. (BBG)

CORONAVIRUS: European Commission president Ursula von der Leyen told EU leaders that AstraZeneca's vaccine is expected to get conditional market authorization in the European Union next week and the company plans to begin deliveries in mid-February, according to people familiar with the discussions. (BBG)

CORONAVIRUS: European Union leaders agreed that borders should remain open and assessed more measures to counter the spread of coronavirus variants during a video summit Thursday as the bloc's top disease control official said urgent action was needed to stave off a new wave of hospitalizations and deaths. Expressing great concern about the virus' mutations, the 27 leaders looked at further border restrictions like limits on all non-essential travel, better tracking of mutations and improving coordination of lockdowns. Though worried that another surge of deaths across the EU was imminent, they could not immediately agree on whether or not to halt non-essential travel. (Associated Press)

CORONAVIRUS: France's president, Emmanuel Macron, has announced new coronavirus rules for travellers from the EU, with the country requiring European visitors as well as those from outside the bloc to have a negative Covid-19 test performed less than three days before they enter the country. The new restrictive measures, to come into effect from Sunday morning, were announced by the Elysée Palace late on Thursday and follow an EU summit by videoconference at which leaders discussed measures to control the pandemic with continuing vaccination programmes and controls on free movement. (FT)

CORONAVIRUS: French President Emmanuel Macron told European Union leaders they shouldn't assume that Covid-19 vaccines will necessarily prove effective in the long run, according to two people with knowledge of his comments. (BBG)

ITALY: Italy's coronavirus vaccination campaign could come to a near standstill next week amid rising anger across Europe over a slowdown in vaccine deliveries. "We received 29% fewer doses this week, and there will be a further 20% decline next week" from Pfizer Inc. and its partner BioNTech SE, the country's virus emergency czar Domenico Arcuri told reporters. Since Saturday, the pace of vaccinations has slowed to 28,000 a day from about 80,000, with shots halted altogether in areas including Rome and the surrounding Lazio region. (BBG)

ITALY: Silvio Berlusconi's party is concerned it will lose senators to a recruitment drive by Italian Prime Minister Giuseppe Conte, who's courting the group in a bid to salvage his coalition. The center-right Forza Italia party of ex-premier Berlusconi worries that three or more senators could succumb to appeals from Conte's camp, according to lawmakers who asked not to be named discussing confidential talks. They said the premier is also approaching centrists and unaffiliated members of the upper house. (BBG)

ITALY/BTPS: Italy plans to sell up to 3 billion euros ($3.6 billion) of zero bonds due Sep 28, 2022 in an auction on Jan 26. The sale is a reopening of previously issued securities with 8.327 billion euros outstanding. (BBG)

PORTUGAL: Portugal will halt flights to and from the U.K. as the government tries to reduce contagion risks associated with a Covid-19 variant that emerged there. The decision will take effect at midnight Friday, Portuguese Prime Minister Antonio Costa said. Flights will be allowed for British and Portuguese citizens wanting to return home. (BBG)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on the Czech Republic (current rating: AA-; Outlook Stable), on the EFSF (current rating: AA, Stable Trend), the ESM (current rating: AAA, Outlook Stable) & Greece (current rating: BB; Outlook Stable)

- Moody's on Cyprus (current rating: Ba2; Outlook Positive)

- S&P on Slovakia (current rating: A+, Outlook Negative)

- DBRS Morningstar on the EFSF (current rating: AAA, Stable Trend), the ESM (current rating: AA) & the Netherlands (current rating: AAA, Stable Trend)

U.S.

FISCAL: The U.S. House of Representatives plans to hold a vote on a Covid relief bill the first week of February, Speaker Nancy Pelosi said according to a report from Reuters. "We will be doing our committee work all next week so that we will be completely ready to go to the floor when we come back," Pelosi said. (CNBC)

FISCAL: Senate Republicans vowed Thursday that President Joe Biden's coronavirus relief bill will not get 60 votes, daring the White House to either compromise with the GOP or use partisan procedural tactics to evade their filibuster. Put simply, the Senate GOP says Biden's proposal spends too much money and comes too soon on the heels of Congress' $900 billion stimulus package from last month. And that unless the proposal has major changes made to it or Democrats use budget reconciliation to pass it with a simple majority, it is doomed on the Senate floor. (POLITICO)

FISCAL: "It's hard for me to see when we just passed $900 billion of assistance why we would have a package that big," Republican Senator Susan Collins says of President Biden's proposed $1.9 trillion Covid-19 relief plan. "I'm not seeing it right now but again I'm happy to listen," Collins Says. (BBG)

FISCAL: President Joe Biden's allies in the business community have been meeting to craft a set of proposals, including a potential carbon tax, to help pay for an expected $2 trillion infrastructure plan. (CNBC)

FISCAL: Treasury Secretary-designate Janet Yellen said she would work with lawmakers to fast-track a series of tax increases on corporations and wealthy Americans as the Biden administration tries to pass spending on infrastructure and expanding the social safety net. (BBG)

FISCAL: A FOX reporter tweeted the following on Thursday: "@JoeBiden advisers signaling to Wall Street donors tax increases will come later in the year and will be likely tied to infrastructure and dependent on economic recovery and Covid's impact on economy." (MNI)

FISCAL: Yellen: hope to work with Congress to avoid debt limit harm. Will comprehensively review debt management practices. Will analyze weighted-average maturity of debt. (BBG)

CORONAVIRUS: The number of people in US hospitals with coronavirus fell below 120,000 on Thursday for the first time in more than three weeks, although the country's death toll rose by almost 3,900. Hospitalisations dropped to 119,927 from 122,700 on Wednesday, according to Covid Tracking Project data. That is the lowest level since December 27, and down from a peak of 132,474 on January 6. (FT)

CORONAVIRUS: President Joe Biden unveiled a national strategy to combat the coronavirus while issuing a sobering warning: The pandemic is likely to claim another 100,000 lives over roughly the next month and will worsen before it improves. (BBG)

CORONAVIRUS: Dr. Anthony Fauci, the top U.S. infectious disease expert, said on Thursday that based on recent seven-day averages, coronavirus infections may be about to hit a plateau in the United States. (RTRS)

CORONAVIRUS: New variants of the coronavirus may make vaccines less effective against the disease, making it even more urgent to quickly inoculate the country and beat back the pandemic, Anthony Fauci said Thursday. (POLITICO)

CORONAVIRUS: Johnson & Johnson board member Dr. Mark McClellan told CNBC that "if the clinical trial works out," the company could significantly increase the nation's Covid vaccine supply availability within the coming weeks. "I do know that J&J is making a very large supply, going all out with its production, both here in the U.S. and elsewhere around the world, with the goal of having perhaps enough vaccines for 100 million Americans by spring, by this April or so," said the former FDA Commissioner in a Thursday evening interview on "The News with Shepard Smith." (CNBC)

CORONAVIRUS: The Biden administration is vowing tough enforcement of new safety measures it is imposing on travelers to curb the spread of the coronavirus even as some in the travel indusry say elements of the plan will be difficult to police. (BBG)

CORONAVIRUS: Wyoming Governor Mark Gordon is easing Covid-19 restrictions as a surge in cases that overwhelmed hospitals last year recedes. Indoor gatherings following health guidelines will be permitted for up to 25% of capacity or 250 people, and outdoor gatherings of as many as 500 people will be allowed, Gordon's office said in a statement. Wyoming, where Donald Trump won 70% of the vote in November's presidential election, was one of the last U.S. states to set statewide rules on face coverings. (BBG)

POLITICS: U.S. Senate Republican leader Mitch McConnell on Thursday proposed a timeline that would delay the start of the Senate impeachment trial of former President Donald Trump until mid-February. In a statement, McConnell said he had sent his proposal to Senate Democratic Leader Chuck Schumer. In it, McConnell proposed that the House of Representatives send the impeachment charge against Trump to the Senate on Jan. 28, and that the former president be given two weeks after that to prepare his pre-trial brief, before the Senate trial begins. (RTRS)

POLITICS: Seven Democratic senators filed a formal complaint Thursday urging the Senate Ethics Committee to investigate GOP Sens. Ted Cruz's and Josh Hawley's efforts to overturn the presidential election results. The complaint comes more than two weeks after the deadly Jan. 6 insurrection at the U.S. Capitol led by supporters of former President Donald Trump. (CNBC)

POLITICS: Senate to meet at 10am Friday with a confirmation vote on Lloyd Austin to lead the Pentagon scheduled for around 10:30am, Senate Majority Leader Chuck Schumer says. Further votes on nominations of Janet Yellen, Antony Blinken are possible on Friday, Schumer says. (BBG)

OTHER

U.S./CHINA: The possibility of US-China cooperation in fighting COVID-19, resolving climate issues and promoting growth should help President Biden's vision for the new administration, the Global Times said in an editorial. The Biden administration should consider restarting a cooperation with China and reverse previous hardline policies, said the newspaper. The two countries will progress together if they stop fighting and focus on resolving their own domestic issues, the Times editorial said. (MNI)

U.S./CHINA: MSCI to delete CNOOC from ACWI, China All Shares indexes. (BBG)

GLOBAL TRADE: The Biden administration will prioritize domestic investments in workers and infrastructure before embarking on any new free trade agreements, Janet Yellen, U.S. President Joe Biden's nominee for Treasury Secretary, told lawmakers. Yellen also promised a comprehensive review of China's implementation of a Phase 1 trade deal, and said Washington would work more closely with allies to address "abusive" practices by the world's second-largest economy. (RTRS)

CORONAVIRUS: Johnson & Johnson has enough data from its late-stage Covid-19 vaccine trial to begin analysis, possibly in a week or two, said Anthony Fauci, the U.S. government's top infectious disease doctor J&J had previously said it would have a first chance to review data from its late-stage trial of 45,000 volunteers in the last week of January or the first week of February, consistent with Fauci's timeline. (BBG)

CORONAVIRUS: Pfizer and BioNTech have agreed to supply their COVID-19 vaccine to the World Health Organization co-led COVAX vaccine access scheme, two sources familiar with the deal said, the latest in a series of shots to be included in the project aimed at lower-income countries. (RTRS)

CORONAVIRUS: Brazil's Health Ministry on Thursday said 2 million doses of the AstraZeneca coronavirus vaccine should arrive on Friday from India, confirming a Reuters report earlier in the day saying the Asian country would begin the shipments. The announcement comes amid delays in receiving the vaccine from India, the latest in a series of miscues surrounding the country's inoculations drive which have embarrassed the government of President Jair Bolsonaro. (RTRS)

CORONAVIRUS: Eli Lilly & Co.'s antibody therapy reduced nursing home residents' risk of symptomatic Covid-19 by as much as 80% when used preventively in a study. The infused treatment, cleared for use in high-risk Covid patients with mild-to-moderate disease who haven't been hospitalized, also significantly reduced the risk of symptomatic disease in nursing home workers, according to a statement from Lilly on Thursday. (BBG)

HONG KONG: Hong Kong will for the first time lock down tens of thousands of city residents in a bid to contain a worsening outbreak in coronavirus-hit Jordan and Sham Shui Po, neighbourhoods filled with ageing, subdivided flats. The lockdown, the most drastic measure yet during the year-long pandemic, is expected to begin this weekend in the two designated mandatory testing areas within Yau Tsim Mong and Sham Shui Po districts. Only residents who showed negative Covid-19 test results would be allowed to leave the areas, sources familiar with the situation said. (SCMP)

JAPAN: Aso: Need spending reform to meet 2025 balanced-budget goal. (BBG)

JAPAN: IOC President Thomas Bach and local organizers are pushing back against reports that the postponed Tokyo Olympics will be canceled. Now set to open July 23, the Tokyo Games were postponed 10 months ago at the outbreak of the coronavirus pandemic, and now the event appears threatened again. The Times of London, citing unidentified government sources, reported that the games will have to be canceled. It quoted an unidentified senior member of the ruling government coalition. "No one wants to be the first to say so but the consensus is that it's too difficult," the source said. "Personally, I don't think it's going to happen." In a statement Friday, the local organizing committee did not address directly The Times story, but said the Olympics were going forward and had the support of Prime Minister Yoshihide Suga. (Associated Press)

RBNZ: The Reserve Bank of New Zealand – Te Pūtea Matua investigation into the malicious illegal breach of a third-party file sharing application has significantly progressed. Governor Adrian Orr says the investigation remains the Bank's highest priority, including supporting stakeholders to help them manage risks and take appropriate action. "With the assistance of New Zealand and international police, and forensic security specialists, the cause of the breach is now understood and resolved. The system is closed. "Significantly, we have a good understanding of the scope of the breach. "Based on the results of our investigation and analysis to date we have been able to tell stakeholders which of their files on the File Transfer Application (FTA) were downloaded illegally during the breach. "This prioritised analysis is continuing and we are supporting stakeholders to manage risks and respond appropriately. (RBNZ)

RBNZ: As previously advised, the Reserve Bank of New Zealand (RBNZ) recently experienced an illegal breach of a the file transfer software application, Accellion FTA. For more detail see Our response to Data Breach page. We advised on Monday 18 January that publication of some of our statistical releases are on hold while we work through the investigation and response to the breach. This Stats Alert is to inform you the RBNZ will be postponing publication of most statistical releases. We will provide an updated release calendar when we can, but we expect delays of 3-4 weeks to most publications (RBNZ)

BOC: MNI INTERVIEW: BOC Taper Easier Than Full Asset Exit: Perrault

- The Bank of Canada will taper QE again after the second pandemic wave passes, while failing to fully slim down the balance sheet even as the economy is restored later on, former central bank official and Scotiabank chief economist Jean-Francois Perrault told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

MEXICO: A battle between one of Mexico's richest men and one of its most respected institutions appears to have ended in a victory for the central bank. President Andres Manuel Lopez Obrador came out Wednesday against a bill that would have forced the monetary authority to buy greenbacks that lenders can't otherwise sell, likely killing its chances of passing the Senate in its current form. Critics said the measure would have exposed the central bank to money laundering allegations by compelling it to buy dollars of dubious origin. Its most prominent proponent was billionaire Ricardo Salinas Pliego, the owner of Banco Azteca and an ally of the president. (BBG)

BRAZIL: Regulatory agency holds extraordinary meeting this Friday at 3pm to assess a second emergency use request filed by Butantan Institute for the Coronavac vaccine produced in partnership with China's Sinovac, according to a statement. (BBG)

RUSSIA: President Joe Biden has decided to accept Russia's offer to extend the last remaining nuclear arms control treaty for the full five years and is proposing that the two sides "explore new verifiable arms control agreements" in the future. The overture could be a bright spot in an otherwise tense relationship in the opening days of the new administration. (POLITICO)

TURKEY/RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- S&P on Turkey (current rating: B+, Outlook

OIL: President Joe Biden is poised to suspend the sale of oil and gas leases on federal land, which accounts for about 10% of U.S. supplies, according to four people familiar with the matter. The moratorium, which would also freeze coal leasing, is set to be unveiled along with a raft of other climate policies next week, according to the people, who asked for anonymity to discuss plans not yet public. (BBG)

CHINA

CORONAVIRUS: Residents of an area of Shanghai have been banned from leaving the city after six Covid cases were found in the finance hub, the first cases there in almost two months. The National Health Commission also reported 47 cases in Heilongjiang province on Friday, as well as three in Beijing, bringing the total number of local infections in China since the year began to 1,434. (BBG)

ECONOMY: The Chinese government will introduce a new round of measures to support the manufacturing industry and strengthen digital information, biomedicine, new materials and intelligent equipment, the Economic Information Daily reported. Local governments with specialist expertise in manufacturing will further expand funding supports to build innovation platforms to boost advanced manufacturing, the newspaper said. The government may stimulate companies' innovative vitality through favorable policies to help with research and development, government procurement, venture capital, tax incentives and patent declaration, the newspaper said. (MNI)

ECONOMY: China will carry out inspections of illegal charges against businesses among industry associations and prevent unauthorized fees and increases, the State Council said on Wednesday in a statement following an executive meeting. The government urges canceling maturing fees levied on enterprises and the reduction of charging standards, said the cabinet. Authorities should rapidly reform penalties for price violations against businesses to allow a freer environment, the government statement said. (MNI)

YUAN: MNI BRIEF: Foreign Investors May Buy More Yuan Assets: SAFE

- Foreign investors are likely to further boost purchases of yuan assets, particularly low-risk sovereign and bank bonds, which have certain safe haven attributes, the State Administration of Foreign Exchange said. "Foreign capital is still at the position-building stage in terms of allocating to yuan bonds and cross-border inflow will be relatively large," spokeswoman Wang Chunying told reporters on Friday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

OVERNIGHT DATA

CHINA DEC FX NET SETTLEMENT - CLIENTS CNY 426.7BN; NOV 23.2BN

JAPAN DEC CPI -1.2% Y/Y; MEDIAN -1.3%; NOV -0.9%

JAPAN DEC CORE CPI -1.0% Y/Y; MEDIAN -1.1%; NOV -0.9%

JAPAN DEC CORE-CORE CPI -0.4% Y/Y; MEDIAN -0.4%; NOV -0.3%

JAPAN JAN, P JIBUN BANK M'FING PMI 49.7; DEC 50.0

JAPAN JAN, P JIBUN BANK SERVICES PMI 45.7; DEC 47.7

JAPAN JAN, P JIBUN BANK COMPOSITE PMI 46.7; DEC 48.5

The Japanese private sector economy entered the new year as it ended the last, with flash PMI survey data signalling a faster deterioration in business activity in January. Demand conditions weakened further, as new business inflows contracted for the twelfth successive month, weighed down by a further fall in export sales. That said, new orders in manufacturing recorded an expansion for the first time in two years. Private sector businesses reported job losses at the start of the year, however the decline was only fractional. Moreover, service sector companies reported broadly unchanged employment levels. Short-term activity will undoubtedly be hampered by rising coronavirus disease 2019 (COVID-19) cases, as the government declared a state of emergency in Tokyo and introduced further measures to curb rising infection rates. As a result, positive sentiment weakened across the private sector. Firms are still predicting growth over the coming 12 months, although concern remains that the impact of the pandemic will be prolonged. (IHS Markit)

JAPAN DEC NATIONWIDE DEPT STORE SALES -13.7% Y/Y; NOV -14.3%

JAPAN DEC TOKYO DEPT STORE SALES -15.9% Y/Y; NOV -17.8%

AUSTRALIA DEC, P RETAIL SALES -4.2% M/M; MEDIAN -1.5%; NOV +7.1%

AUSTRALIA JAN, P MARKIT M'FING PMI 57.2; DEC 55.7

AUSTRALIA JAN, P MARKIT SERVICES PMI 55.8; DEC 57.0

AUSTRALIA JAN, P MARKIT COMPOSITE PMI 56.0; DEC 56.6

The Australian private sector remained resilient at the start of the year, despite the COVID-19 pandemic, with the flash PMI showing sustained growth of new orders, output and employment. Companies suggested that sales were supported by pent-up demand, particularly in the manufacturing industry. While this boost in demand is welcome, inflationary pressures seem to be mounting. Manufacturers saw the sharpest increase in their cost burdens since data collection started in 2016. Material shortages and restricted freight capacity remained key themes of the survey. With pricing power enhanced by recovering demand, selling charges across the private sector rose at the sharpest rate in nearly two-and-a-half years. Businesses were upbeat towards the year-ahead outlook for output, with hopes pinned on vaccine developments and the eventual lifting of restrictions globally. However, optimism weakened in January, dampened by concerns over the long-term effects of the COVID-19 pandemic on the economy. (IHS Markit)

NEW ZEALAND Q4 CPI +1.4% Y/Y; MEDIAN +1.1%; Q3 +1.4%

NEW ZEALAND Q4 CPI +0.5% Q/Q; MEDIAN +0.2%; Q3 +0.7%

NEW ZEALAND DEC BUSINESSNZ M'FING PMI 48.7; NOV 54.7

New Zealand's manufacturing sector experienced contraction for the last month of 2020, according to the latest BNZ - BusinessNZ Performance of Manufacturing Index (PMI). The seasonally adjusted PMI for December was 48.7 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was down 6.0 points from November, and the lowest level of activity since May. BusinessNZ's executive director for manufacturing Catherine Beard said that after six consecutive months in expansion, the December result was a disappointing way to end the year. "While production (51.5) managed to keep its head above water, the other key sub-index of new orders (49.9) failed to record expansion. Employment (49.9) also fell just below the 50.0 point mark, while finished stocks (45.9) and deliveries (44.5) both fell well into contraction." "Interestingly, the December value was the same as the overall average result of 48.7 for 2020. While seven of the twelve months saw expansion in the sector, the effects of COVID-19 and the subsequent lockdown saw a dramatic fall in activity during the first half of 2020 that brought the overall average down." BNZ Senior Economist, Doug Steel said that "the PMI's three-month moving average sits at an expansionary 51.8, albeit below its long-term average of 53.0. This all suggests some expansion in the final quarter of last year, but the softer December month suggests some caution heading into the New Year." (BNZ)

UK JAN GFK CONSUMER CONFIDENCE -28; MEDIAN -30; DEC -26

CHINA MARKETS

PBOC INJECTS CNY2BN VIA OMOS FRI, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged on Friday, leaving liquidity unchanged after the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.4017% at 09:28 am local time from 2.2000% at Thursday's close.

- The CFETS-NEX money-market sentiment index closed at 44 on Thursday vs 66 on Wednesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4617 FRI VS 6.4696

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4617 on Friday. This compares with the 6.4696 set on Thursday.

MARKETS

SNAPSHOT: COVID News Mixed, Markets Look For Keys To Trade Off

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 60.36 points at 28696.5

- ASX 200 down 23.314 points at 6800.4

- Shanghai Comp. down 23.27 points at 3597.994

- JGB 10-Yr future down 12 ticks at 151.86, yield down 0.3bp at 0.040%

- Aussie 10-Yr future down 5.5 ticks at 98.870, yield up 5.8bp at 1.124%

- U.S. 10-Yr future -0-00+ at 136-28, yield up 0.51bp at 1.111%

- WTI crude down $0.69 at $52.44, Gold down $7.17 at $1862.83

- USD/JPY up 7 pips at Y103.57

- ECB IS SAID TO ASK STAFF FOR PROPOSALS ON NEW FINANCIAL CONDITIONS GAUGES BY MARCH (BBG)

- EU LEADERS TOLD ASTRAZENECA VACCINE DELIVERIES TO START MID-FEB (BBG)

- FAUCI: J&J VACCINE TRIAL HAS ENOUGH DATA TO ANALYZE SOON (BBG)

- JAPAN AND EVENT ORGANISERS PLAY DOWN RUMOURS OF CANCELLING TOKYO GAMES

- NZ CPI BEATS, RBNZ SECTORAL FACTOR INFLATION MODEL NUDGES HIGHER

BOND SUMMARY: Flat To Softer For Core FI In Asia

Macro news flow has been mixed since the Tokyo re-open, with some positive vaccine news (albeit some of which was more a case of trials running on schedule) countered by reports of impending partial district lockdowns in Hong Kong. U.S. Tsys held to narrow ranges in Asia-Pac hours, with focus on the large nearby TYG1 option OI at the 137.00 strike ahead of today's February option expiry, with delta hedging plays having the ability to limit price swings on Friday. Elsewhere in the options space, 10-Year Tsy options saw fresh downside interest via the TYJ1 138.00/133.00 risk reversal, buying the puts to sell the calls, targeting a ~32bp uptick in yields over the life of the contract. Remember that we saw a 10.0K block of the TYJ1 138.00/133.50 risk reversal during Asia hours earlier this week, although today's flow saw 4.0K of the FVH1 futures lifted at the same time. T-Notes last -0-00+ at 136-28, holding to a 0-03+ range, with cash Tsy yields little changed. We also saw a 20K screen buyer of EDU1/Z1, with Eurodollar futures running within 0.5 tick of settlement levels through the reds.

- Mixed performance was seen across the JGB curve, with 7s underperforming surrounding paper as futures sold off, with the latter last 13 ticks softer than settlement levels. Little in the way of major news flow has crossed during the Tokyo hours, with most of the local focus falling on speculation surrounding the potential cancellation of this year's Tokyo Olympics. Re: that matter, PM Suga has stressed that he wants the event to go ahead, with various officials also stating that the games will be held. Elsewhere, the major national CPI metrics moved further into deflationary territory in December.

- Aussie bonds traded on the defensive, even with a strong ACGB tender and DV01 light weekly issuance slate from the AOFM becoming apparent. There appeared to be some spill over from across the ditch with the NZGB space seeing some cheapening on the back of firmer than expected NZ CPI data and heavy offer/cover ratios in the latest round of RBNZ NZGB purchases. YM -1.0, XM -5.5.

JGBS AUCTION: Japanese MOF sells Y5.4468tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.4468tn 3-Month Bills:- Average Yield -0.0922% (prev. -0.0926%)

- Average Price 100.0230 (prev. 100.0231)

- High Yield: -0.0882% (prev. -0.0902%)

- Low Price 100.0220 (prev. 100.0225)

- % Allotted At High Yield: 8.7676% (prev. 78.9288%)

- Bid/Cover: 3.164x (prev. 3.358x)

JGBS AUCTION: Japanese MOF sells Y398.5bn of 1-5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y398.5bn of 1-5 Year JGBs in a liquidity enhancement auction:- Average Spread: -0.002% (prev. -0.010%)

- High Spread: +0.002% (prev. -0.008%)

- % Allotted At High Spread: 80.7621% (prev. 14.5200%)

- Bid/Cover: 4.781x (prev. 3.585x)

AUSSIE BONDS: The AOFM sells A$700mn of 3.25% 21 April 2025 Bond, issue #TB139:

The Australian Office of Financial Management (AOFM) sells A$700mn of the 3.25% 21 April 2025 Bond, issue #TB139:- Average Yield: 0.2509% (prev. 0.3707%)

- High Yield: 0.2525% (prev. 0.3725%)

- Bid/Cover: 7.3857x (prev. 5.0900x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 69.4% (prev. 47.5%)

- bidders 37 (prev. 51), successful 7 (prev. 11), allocated in full 2 (prev. 5)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Thursday 28 January it plans to sell A$750mn of the 21 May 2021 Note & A$750mn of the 27 August 2021 Note.

- On Friday 29 January it plans to sell A$2.5bn of the 0.25% 21 November 2024 Bond.

EQUITIES: Risk Aversion Evident, Partial HK Lockdown Pressures Hang Seng

Risk off flows saw equity markets in Asia decline to end the week. The Hang Seng was under pressure, down circa. 1.5% after reports that Hong Kong was to lock down part of the Kowloon district due to a worsening coronavirus outlook. Several other countries in the eastern hemisphere have announced plans to tighten containment measures, even as many in the region prepare to celebrate Lunar New Year.

- Coronavirus concerns are weighing on risk assets globally as Biden inauguration euphoria subsides. There are reports that France will require all visitors to have a negative Covid-19 test, while in the UK ministers are reportedly pushing for Britain's borders to be closed as several countries in Europe report the deadliest day of the pandemic so far. US and European futures have moved lower as risk assets take a beating. E-mini S&P last down around 13 points at 3833.

OIL: Heavy Amid Risk-Off Flows

Commodities were casualties of a risk off session in Asia; WTI last down $0.71 at $52.42, while Brent is down $0.66 at $55.44.

- Coronavirus concerns are weighing on risk assets as Biden inauguration euphoria subsides. There are reports that France will require all visitors to have a negative Covid-19 test, while in the UK ministers are reportedly pushing for Britain's borders to be closed as several countries in Europe report the deadliest day of the pandemic so far.

- The eastern hemisphere has its own set of issues, Hong Kong announced plans to lock down part of the Kowloon district due to a worsening coronavirus outlook. Several cities in mainland China have already imposed travel restrictions ahead of Lunar New Year.

GOLD: Familiar Levels

Gold has stuck to a tight range over the last 24 hours, cushioned by the latest dip in U.S. real yields and a softer DXY, although bulls have failed to extend on the recent gains, leaving spot dealing around $1,865/oz.

FOREX: Risk-Off Feel Pulls Rug From Beneath NZD, Negating Post-CPI Bid

NZD posted a leg higher in the U.S./Asia crossover after a strong Q4 CPI report released out of NZ inspired the unwinding of RBNZ easing bets, with Kiwibank joining Westpac in backpedalling on their earlier calls for OCR reductions this year. Elsewhere, sizeable offers & firm cover ratios at the RBNZ's latest QE operation generated a tailwind for 10-Year NZGB yield, helping keep the kiwi afloat in early Asia-Pac trade. Focus then turned to the RBNZ's Q4 sectoral factor model inflation, which accelerated for the first time in a year, but the kiwi faltered nonetheless as light risk aversion crept in and rendered NZD the worst G10 performer. NZD/USD more than erased its post-CPI jump through the rest of the session, before establishing itself just shy of $0.7200.

- Headline flow focused on Covid-19 mitigation measures, including Hong Kong's decision to lock down part of the city and potential UK/French curbs on inbound international travel.

- AUD lost altitude alongside its Antipodean cousin, with a miss in Australian retail sales adding weight to the currency. AUD/USD snapped a three-day winning streak, but struggled to stage a clean break below prior intraday low.

- CAD & GBP also fell prey to broader risk aversion. USD/CAD advanced after charting a bullish Harami cross candlestick pattern yesterday, while cable pulled back from best levels since 2018.

- USD/JPY wavered within a tight Y103.49-61 range, ahead of the expiry of $1.0bn worth of UST puts with strikes at Y103.40-50 at today's NY cut. Local news flow centred around rumours about potential cancellation of the Tokyo Olympics, with organisers to make the decision by end-March.

- The PBOC fixed USD/CNY at CNY6.4617, the banks liquidity injections matched withdrawals today despite repo rates creeping up. A stronger greenback has helped firm USD/CNH despite the lower fix. The fix was once again above sell side estimates, indicating the PBOC asymmetric response function.

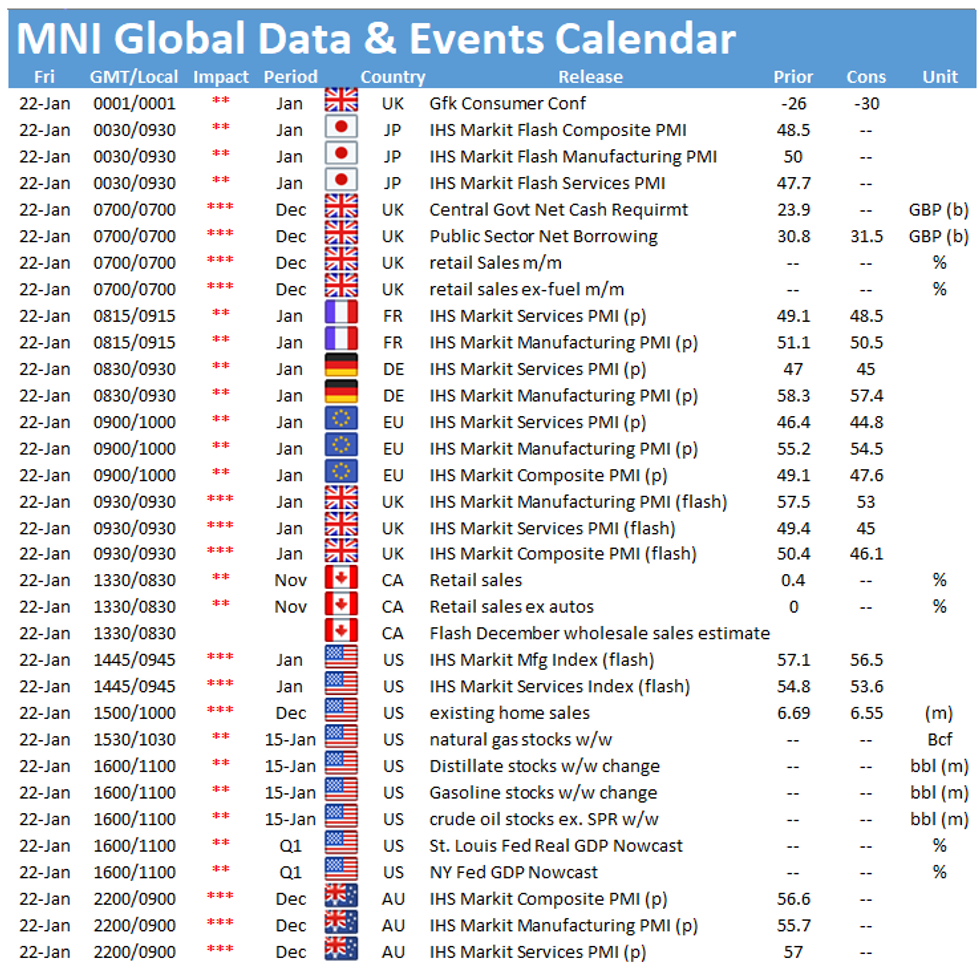

- Focus turns to a slew of PMI surveys, U.S. existing home sales, UK & Canadian retail sales as well as ECB Survey of Professional Forecasters.

FOREX OPTIONS: Expiries for Jan22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E758mln), $1.2160-70(E432mln-EUR puts), $1.2275(E1.95bln)

- USD/JPY: Y103.25-30($801mln), Y103.40-50($1.0bln-USD puts), Y103.80-00($666mln)

- USD/NOK: Nok8.50($660mln-USD puts), Nok8.90($600mln)

- AUD/USD: $0.7630-35(A$820mln-AUD puts), $0.7765-80(A$770mln-AUD puts)

- AUD/JPY: Y78.75(A$660mln-AUD calls), Y79.00(A$456mln-AUD calls)

- USD/CAD: C$1.2600($569mln), C$1.2700($672mln-USD puts), C$1.2900-10($644mln)

- USD/CNY: Cny6.50($655mln-USD puts)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.