-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: COVID, Fiscal & Geopolitical Matters Dominate In Asia

EXECUTIVE SUMMARY

- ECB'S LAGARDE: 'NO DOUBT' ECB WILL PRESERVE FINANCING CONDITIONS (BBG)

- ITALY'S CONTE WILL HAND IN RESIGNATION TUESDAY TO PLOT COMEBACK (BBG)

- BIDEN WILLING TO NEGOTIATE PARAMETERS OF CORONAVIRUS DEAL, BUT 'TIME IS OF THE ESSENCE' (WASHINGTON POST)

- WHITE HOUSE: BIDEN TO APPROACH CHINA RELATIONSHIP WITH 'PATIENCE' (BBG)

- CHINA TO CONDUCT MILITARY DRILLS IN SOUTH CHINA SEA AMID TENSIONS WITH U.S. (RTRS)

- ASTRAZENECA DENIES REPORT VACCINE LESS EFFECTIVE IN ELDERLY (RTRS)

- EU DISSATISFIED WITH ASTRAZENECA EXPLANATIONS ON VACCINE DELAYS (RTRS)

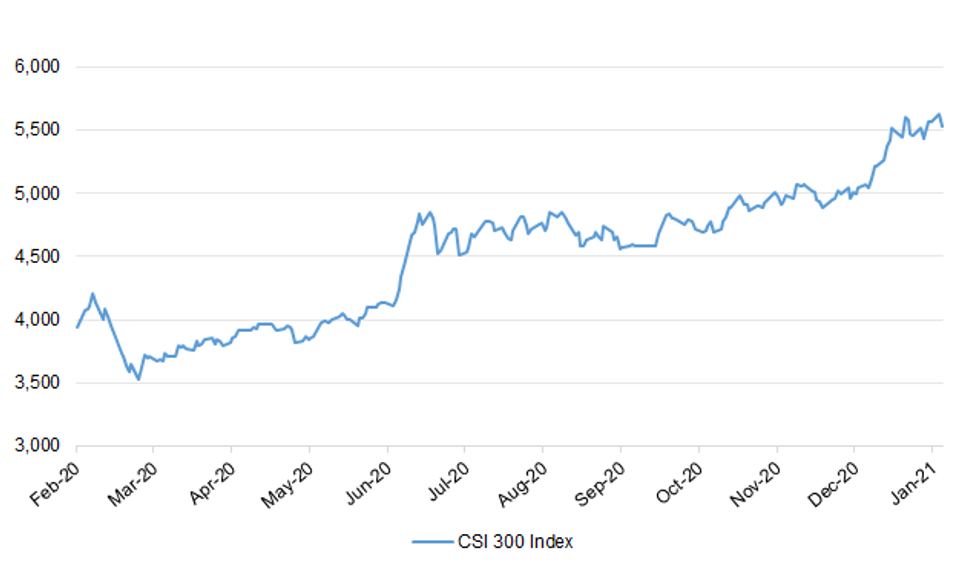

Fig. 1: CSI 300 Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Britain's health minister Matt Hancock said on Monday a new more infectious coronavirus variant means the government needs to be more cautious in lifting lockdown restrictions. The government said on Friday that the new variant may be 30% more deadly than the original strain. "There is no question the new variant made this fight a whole lot tougher," Hancock told a press conference. "The critical message is we must be cautious. For all of us, our response must be extra careful." (RTRS)

CORONAVIRUS: Britain's Covid vaccine supply is in jeopardy after the EU threatened to block exports of the Belgian-made Pfizer jabs amid a row with UK-based AstraZeneca. (Telegraph)

BREXIT: Infrastructure development for the UK's new post-Brexit border is falling behind because of a shortage of government funding and Whitehall bureaucracy, leading British ports have warned. As a result the government is facing calls to further delay its plans to introduce full border checks from July, or to show significant flexibility for business in the way the new rules are applied. (FT)

BREXIT: The former minister leading the UK government's review into the City has warned that Brussels is targeting London's position as a global financial services centre and has predicted the EU will not grant British-based firms the highly prized access they are seeking to the European market. Jonathan Hill, also a former EU financial services commissioner, said it was not in Brussels' interests to allow London to continue to dominate the European financial market in the way it did before Brexit. "Given that their strategy is to build up the EU, why on earth would they?" said Lord Hill, who is drawing up a series of reforms to the City's stock market listings regime aimed at attracting more fast-growth and founder-led tech businesses. "The EU will not do us any favours." (FT)

FISCAL: The end of January is usually crunch time for British taxpayers. This year, they got a bit of breathing room. Less than a week before the Jan. 31 deadline to file taxes online, the U.K. Treasury said Monday that it won't fine people who file their digital returns by Feb. 28. Taxpayers are still "obliged" to pay whatever they owe by the end of January — and they will be charged interest past that date. Still, they won't face the usual fine of £100 ($136) if they wait a month. (BBG)

SCOTLAND: Boris Johnson is to launch a charm offensive in Scotland later this week as part of his plan to save the United Kingdom. (Telegraph)

EUROPE

ECB: The European Central Bank will be in the market "for an extended period of time" to ensure the economy has ample access to affordable funding to cope with the pandemic and its aftermath, President Christine Lagarde said. "The ECB will make sure that financing conditions are preserved at a favorable level," she said at a Davos Agenda panel discussion on Monday. The central bank is pumping money into the euro-area economy with bond purchases and long-term bank loans to keep borrowing costs down, allowing governments to keep companies and households afloat with massive fiscal stimulus. That's prompted debate over whether the ECB is effectively shifting toward a form of yield curve control -- deliberately managing bond yields. (BBG)

CORONAVIRUS: The European Commission's second round of discussions on Monday with pharmaceutical firm AstraZeneca on delays in vaccine deliveries ended in "dissatisfaction with the lack of clarity and insufficient explanations", the Commission said. "Discussions with AstraZeneca today resulted in dissatisfaction with the lack of clarity and insufficient explanations. EU Member States are united: vaccine developers have societal and contractual responsibilities they need to uphold," EU Health Commissioner Stella Kyriakides said on Twitter. "With our Member States, we have requested from AstraZeneca a detailed planning of vaccine deliveries and when distribution will take place to Member States. Another meeting will be convened on Wednesday to discuss the matter further," she said. (RTRS)

GERMANY: Germany faces huge fiscal challenges following the COVID-19 pandemic and won't be able to stick to its strict debt limits for years, Chancellor Angela Merkel's chief of staff was quoted as saying on Monday. The comments by Helge Braun are the clearest sign yet that Berlin is set to continue its fiscal splurge by taking on new debt even if the coronavirus crisis should be overcome. "The debt brake cannot be adhered to in the coming years even with otherwise strict spending discipline", Braun wrote in an op-ed piece for business daily Handelsblatt to be published in its Tuesday edition. (RTRS)

FRANCE: France will miss its economic growth target this year if another nationwide lockdown is imposed to contain the spread of the coronavirus, Finance Minister Bruno Le Maire said Monday in an interview with Bloomberg Television. (BBG)

ITALY: Italian Prime Minister Giuseppe Conte will resign on Tuesday morning to avoid a damaging defeat in the Senate and maneuver to return at the head of a new government. Conte will preside over a cabinet meeting at 9 a.m. in Rome and then head to President Sergio Mattarella's office to formally step down, according to a government statement. The idea is that by preemptively offering his resignation to Mattarella, who oversees the formation of ruling coalitions, Conte will then be asked to take another shot at putting together a government, according to officials who asked not to be named discussing confidential deliberations. (BBG)

ITALY: The Italian Treasury is starting to factor in a bigger hit to the country's battered public finances this year as another extended lockdown holds back the recovery, a senior government official said. Treasury models suggest the budget deficit may reach as much as 9.2% of output this year, the official said. The government is also looking at a deteriorating outlook for growth and could see the economy expand as little as 4.5% in its worst-case scenario, according to the official. The government recently said the deficit would run to 8.8% and, in October, forecast growth of 6% for this year, banking on European Union recovery funds to help activity rebound after a hammering in 2020. Under the bleaker picture set out by the official, who asked not to be named discussing private calculations, government debt is also set to end the year higher than forecast, at 158.5% of output instead of the 155.6% projection published in October. (BBG)

ITALY: The Italian government on Monday sent a letter of formal notice to Pfizer calling on the drug company to respect its contractual commitments over its COVID-19 vaccine deliveries, the government special commissioner said. The letter adds to tension between the European Union and the U.S. drug-maker, which announced last week a temporary slowdown in deliveries to the bloc. (RTRS)

ITALY/BTPS: Italy plans to sell up to 3.5 billion euros of 0.5 percent bonds due Feb 1, 2026 in an auction on Jan 28. Italy plans to sell up to 3.75 billion euros of 0.9 percent bonds due Apr 1, 2031 in an auction on Jan 28. Italy plans to sell up to 1.5 billion euros of floating bonds due Apr 15, 2026 in an auction on Jan 28. (BBG)

NETHERLANDS: Groups of rioters confronted police for a third consecutive evening in Dutch cities including Amsterdam, Rotterdam and Zwolle in incidents that started Saturday when a curfew began. Dutch Prime Minister Mark Rutte earlier on Monday condemned the unrest, labeling it "criminal violence." The curfew runs between 9 p.m. and 4:30 a.m. in coming weeks and is on top of existing lockdown measures in place until at least Feb. 9. (BBG)

IRELAND: Ireland is seeing "continued rapid improvement" in the incidence of the coronavirus, a top government adviser said, as the nation reported a further drop in new cases. (BBG)

U.S.

FISCAL: President Biden said Monday that he's open to negotiations on his $1.9 trillion coronavirus relief proposal — including the structure of a new round of stimulus checks — but insisted that "time is of the essence" in moving the package forward. Biden insisted at an event at the White House that he is courting Republican support for his proposal, saying, "I prefer these things to be bipartisan." He specifically referenced a 16-member bipartisan group of senators that conferred with top White House officials Sunday and raised a variety of concerns, including asking whether a new round of $1,400 stimulus checks in the proposal could be targeted to those most in need. As structured by House Democrats, some portion of the checks could end up going to families making more than $300,000 a year who have not suffered income loss during the pandemic. "I proposed that because it was bipartisan, I thought it would increase the prospects of passage, the additional $1,400 in direct cash payments to folks," Biden said at the White House event. "Well, there's legitimate reasons for people to say: 'Do you have the lines drawn the exact right way? Should it go to anybody making X number of dollars or Y?' I'm open to negotiate those things." Biden said that "this is just the process beginning" on negotiations over his relief package, which he unveiled before his inauguration. But he also laid out a tight time frame, suggesting that the process would end "probably in a couple weeks," which might not allow for the kind of protracted negotiations necessary to produce a bipartisan bill, especially in light of growing opposition from a number of Republicans saying it is too expensive. (Washington Post)

FISCAL: Senate Minority Leader Mitch McConnell (R-Ky.) weighed in on the proposal for the first time Monday, saying it "misses the mark." Noting that Congress just approved an additional $900 billion in pandemic relief in December, McConnell said, "Any further action should be smart and targeted, not just an imprecise deluge of borrowed money that would direct huge sums toward those who don't need it." (Washington Post)

FISCAL: Multiple centrist senators who met with White House officials about President Joe Biden's coronavirus relief plan are pushing the administration to scale back its proposal. The president put forward a $1.9 trillion aid package to boost the economy and health-care system while the U.S. tries to vaccinate a significant share of its population. Several senators who spoke to Biden advisors are pushing the president to reduce the scope of his plan, calling instead for a smaller bill based around money to streamline Covid-19 vaccine distribution. (CNBC)

FISCAL: Sen. Susan Collins (Maine), a key Republican moderate, said Monday that President Biden and Democratic lawmakers should set aside a proposal to increase the minimum wage from a new COVID-19 relief proposal. (The Hill)

FISCAL: Manchin: lawmakers got more info on Biden aid proposal Monday. Senator group is considering the new details. (BBG)

FISCAL: Janet Yellen cleared her final hurdle Monday on her historic path to secretary of the Treasury Department, gaining overwhelming Senate confirmation for the position. The 84-15 vote made Yellen the first female to the lead the department, a feat she matched as chair of the Federal Reserve. (CNBC)

CORONAVIRUS: US coronavirus hospitalisations on Monday dipped below 110,000 for the first time in six weeks, with a majority of states exhibiting downward trends in patients being treated. (FT)

CORONAVIRUS: The Minnesota Department of Health said Monday it has confirmed the first known U.S. case of a more contagious coronavirus variant originally found in Brazil. The variant was found through the health department's variant surveillance program, according to a press release. The department collects 50 random samples each week for genome sequencing. The patient with the Brazil variant is a resident of the Twin Cities metro area who recently traveled to Brazil, according to state health officials. The person became ill during the first week of January and the specimen was collected Jan. 9, the state said. (CNBC)

CORONAVIRUS: President Joe Biden banned most non-U.S. citizens from entering the United States from South Africa and extended travel restrictions for Europe, the U.K. and Brazil, in an effort to curb the spread of Covid-19 and new strains. (CNBC)

CORONAVIRUS: President Biden said on Monday that he believes America will be on track for 1 million vaccinations a day within the next three weeks, with the possibility of soon upping that number to 1.5 million vaccinations a day. (Axios)

CORONAVIRUS: California, which trails other states in distributing the vaccine, is creating a new procedure. The state will allow residents to be notified when they are eligible for inoculation and to schedule appointments, Governor Gavin Newsom said Monday. The state will continue to focus on distributing the vaccine to residents over 65, health-care staff and other essential workers, and from there will transition to age-based availability. California has already tripled the number of vaccines it administers to about 120,000 per weekday, Newsom said. Harris County, Texas, is abandoning its first-come, first- served online vaccine sign-ups effective Tuesday in favor of a new system that will evaluate recipients according to age, medical history and other factors. The third-largest U.S. county plans to launch a "smart wait list" that will be accessible through a web link or via phone, according to an announcement on Monday. About 27,000 people have received vaccinations from county health officials, whose territory includes Houston. (BBG)

CORONAVIRUS: New York is at the end of its "post-holiday spike" and could begin rolling back restrictions on some businesses as early as this week if the trends continue, Gov. Andrew Cuomo said. (CNBC)

CORONAVIRUS: California will lift its stay-at-home order across the state on Monday, paving the way for restaurants and personal care services to reopen with modified operations for the first time in weeks, according to a statement from the state's health department. (CNBC)

CORONAVIRUS: Beginning Wednesday, the White House will hold regular briefings "for the foreseeable future" to update the public on the federal response to the coronavirus, White House press secretary Jen Psaki said Monday. (CNBC)

POLITICS: House managers on Monday delivered the article of impeachment against former President Trump for "incitement of insurrection" to the Senate. The expected move formally triggers preparations for the trial. Senate Majority Leader Chuck Schumer announced last week that the trial will begin the week of Feb. 8. (Axios)

POLITICS: President Biden just did a brief one-on-one interview with CNN in the halls of the West Wing and offered his most extensive comments since taking office on former President Trump's impeachment trial. "I think it has to happen," Biden said regarding Trump's impeachment trial. He acknowledged the effect it could have on his legislative agenda and Cabinet nominees but said there would be "a worse effect if it didn't happen." Biden told CNN he believed the outcome would be different if Trump had six months left in his term, but said he doesn't think 17 Republican senators will vote to convict Trump. "The Senate has changed since I was there, but it hasn't changed that much," Biden said. (CNN)

POLITICS: The Justice Department's inspector general said Monday his office will investigate whether department officials "engaged in an improper attempt" to overturn President Biden's victory in the 2020 election. The announcement comes after news reports that former President Donald Trump considered moving to replace the acting attorney general with another official ready to pursue unsubstantiated claims of election fraud. The Wall Street Journal also reported that Mr. Trump pushed the Justice Department to ask the Supreme Court to invalidate Mr. Biden's win. (WSJ)

POLITICS: Donald Trump's still-active presidential campaign committee officially disavowed political groups affiliated with the nascent "Patriot Party" on Monday. Trump briefly floated the possibility of creating a new political party to compete with the GOP — with him at the helm. But others have formed their own "Patriot Party" entities during the past week, and Trump's team wants to make clear it has nothing to do with them. (Axios)

POLITICS: Former President Trump on Monday established an official post-presidency office in Palm Beach County, Fla., setting up a vehicle for future public appearances and statements. "The Office of the Former President" will manage Trump's correspondence, public statements, appearance and official activities, according to a press release from the office. "President Trump will always and forever be a champion for the American People," the release said. (The Hill)

FUNDS: Citadel LLC and Point72 Asset Management are investing $2.75 billion into hedge fund Melvin Capital Management, which has been hard hit by a series of short bets to start the year. The influx of cash is expected to help stabilize Melvin, which in 2021 has lost 30% through Friday, said people familiar with the firm. Melvin started the year with $12.5 billion and had been one of the best performing hedge funds on Wall Street in recent years. The losses stem from Melvin's array of short bets against companies and have stunned clients and other traders. Among other short positions, Melvin bet against the surging stock of videogame retailer GameStop Corp. (WSJ)

OTHER

U.S./CHINA: President Joe Biden's administration is approaching its relationship with Beijing with "patience" and plans to review hard-line policies that were a hallmark of Donald Trump's presidency, Press Secretary Jen Psaki said. The Biden administration plans an interagency review of measures including trade tariffs and the delisting of certain Chinese companies that were enacted by Trump, Psaki said. "We're starting from an approach of patience as it relates to our relationship with China," Psaki said. "So that means we're going to have consultations with our allies, we're going to have consultations with Democrats and Republicans, and we're going to allow the interagency process to work its way through to review and assess how we should move forward with our relationship," she added. (BBG)

U.S./CHINA: The Biden administration is looking at "a range of regulatory actions and a range of relationships with companies, as it relates to Chinese investments, and other issues as well," Psaki said. (BBG)

U.S./CHINA: President Joe Biden is committed to making sure that Chinese companies cannot misuse and misappropriate American data and will ensure that U.S. technology does not end up supporting China's "malign activities," a State Department spokesperson said on Monday. "We need a comprehensive strategy and a more systematic approach that actually addresses the full range of these issues, rather than the piecemeal approach of the past few years," the State Department spokesperson said in emailed comments. (RTRS)

U.S./CHINA: MSCI Inc said it will delete securities of five Chinese companies from its MSCI ACWI Indexes, as well as its relevant non-market capitalization weighted indexes and custom indexes as of the close of Jan. 27 in the absence of any guidance. The five companies include CGN Power Co, China National Chem, China National Nuclear Power, China Shipbuilding Industry and Inspur International, MSCI said in a statement on Monday. (RTRS)

U.S./CHINA/TAIWAN: China said on Tuesday it will conduct military exercises in the South China Sea this week, just days after Beijing bristled at a U.S. aircraft carrier group's entry into the disputed waters. A notice issued by the country's Maritime Safety Administration prohibited entry into a portion of waters in the Gulf of Tonkin to the west of the Leizhou peninsula in southwestern China from Jan. 27 to Jan. 30, but it did not offer details on when the drills would take place or at what scale. A U.S. carrier group led by the USS Theodore Roosevelt entered the South China Sea on Saturday to promote "freedom of the seas," the U.S. military said, days after Joe Biden began his term as president. (RTRS)

INDIA/CHINA: The Indian ministry of electronics and information technology (MeitY) has issued fresh notices to TikTok and 58 other Chinese apps to impose a permanent ban on these apps in India, a person aware of the development said. "The government is not satisfied with the response/explanation given by these companies. Hence, the ban for these 59 apps is permanent now," the person cited above said, adding that the noticed was issued last week. (Mint)

GEOPOLITICS: German Chancellor Angela Merkel and U.S. President Joe Biden agreed in a phone call on Monday that the COVID-19 pandemic and other global challenges could only be tackled through closer cooperation, a government spokesman in Berlin said on Monday. (RTRS)

GLOBAL TRADE: President Joe Biden vowed on Monday to leverage the purchasing power of the U.S. government, the world's biggest single buyer of goods and services, to strengthen domestic manufacturing and create markets for new technologies. The Democratic president signed an executive order aimed at closing loopholes in existing "Buy American" provisions, which apply to about a third of the $600 billion in goods and services the federal government buys each year. The order will make any waivers more transparent and create a senior White House role to oversee the process. (RTRS)

GLOBAL TRADE: French Finance Minister Bruno Le Maire on Monday welcomed the support of President Joe Biden's administration over a proposed global tax on tech giants, saying a multilateral agreement could come into force as soon as this spring. It comes shortly after Biden's nominee for Treasury Secretary, Janet Yellen, voiced her support over calls for tech companies to pay a larger share of their revenues in the countries where they operate. (CNBC)

GLOBAL TRADE: New Zealand has signed an upgrade to the China free trade agreement, offering some New Zealand goods faster access to Chinese markets and a reduction in tariffs for paper and wood products. Trade Minister Damien O'Connor and China's Commerce Minister Wang Wentao inked the deal in a video-link meeting on Tuesday afternoon, more than a year after the deal was first settled by the countries. (Stuff NZ)

CORONAVIRUS: Fewer than 0.01% of people who received Pfizer's COVID-19 vaccine have contracted the virus more than a week after receiving the second dose, a leading Israeli healthcare provider said on Monday. The preliminary results shared by Israeli HMO Maccabi showed that only 20 people out of some 128,600 who received both shots have since been infected with the COVID-19 virus. (RTRS)

CORONAVIRUS: AstraZeneca denied on Monday its COVID-19 vaccine is not very effective for people over 65, after German media reports said officials fear the vaccine may not be approved in the European Union for use in the elderly. German daily papers Handelsblatt and Bild said in separate reports the vaccine - co-developed by AstraZeneca and Oxford University - had an efficacy of 8% or less than 10%, respectively, in those over 65. German officials were concerned that the vaccine may not receive approval from the EU's medicines authority EMA for use in those over 65, Bild said in its online edition. (RTRS)

CORONAVIRUS: Moderna Inc. said its Covid-19 vaccine appeared to protect against emerging variants of the coronavirus in laboratory tests, but as a precaution it would test whether a booster shot improves immune responses and develop a new vaccine targeting the strain first identified in South Africa. The company said Monday its vaccine produced immune-system agents known as neutralizing antibodies that worked against the emerging virus variants tested, including strains first evident in the U.K. and South Africa. (WSJ)

CORONAVIRUS: Vaccine coverage won't reach a point that would stop transmission in the foreseeable future, according to Mike Ryan, head of the World Health Organization's emergencies program. Looking at eradication of the virus as the measure of success will mean the world is going to struggle, he added. "The bar for success is reducing the capacity of this virus to kill, to put people in hospital, to destroy our economic and social lives," he said. He said there's not enough vaccines right now to even serve those who are most at risk. (BBG)

CORONAVIRUS: If the rich world doesn't act urgently to help developing countries get their populations vaccinated, more virus mutations could render the current shots ineffective, United Nations Secretary-General Antonio Guterres said. (BBG)

CORONAVIRUS: The UK will offer its genomics expertise to other countries to help spot and contain new strains of Covid-19, the government will announce on Tuesday. (FT)

HONG KONG: Hong Kong Chief Executive Carrie Lam said she had asked Beijing to supply China-produced vaccines to the Asian financial hub due to a "hiccup" in the other three vaccines it procured in advance, in response to a question on requesting Sinopharm vaccines from the mainland. (BBG)

BOJ: MNI POLICY: BOJ Minutes: No Need to Change Guidance

- A majority of Bank of Japan board members agreed there is no need to change the BOJ's current commitments, such as achieving a 2% inflation target and forward guidance on the policy rate, according to minutes from the December 17-18 meeting released on Tuesday. The BOJ board kept monetary policy unchanged at the meeting but announced it would assess further effective and sustainable easy policy measures and release the results of the assessment at the March 18-19 meeting. The minutes also said: "A few members commented that it was necessary for the Bank to enhance its sustainability through the flexible conduct and be prepared, so that it could respond effectively to possible changes in economic activity and prices as well as financial conditions." Another member said: "It was necessary to take into account the possibility that, along with the increase in issuance of JGBs, supply-demand conditions would be eased in the bond market; meanwhile, with a view to simultaneously achieving prolonged monetary easing and financial system stability, it was desirable, in a sense, for the yield curve to become steeper at a moderate pace" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN: Suga: Not thinking of across-the-board cash handouts. (BBG)

JAPAN: Aso: Cabinet approved tax reform bills at today's meeting (BBG)

JAPAN: Japan's ruling Liberal Democratic Party plans to pass a resolution calling on organizers to outline how they plan to hold the summer Olympics in Tokyo as scheduled, Kyodo reports, citing an unidentified party official. Resolution will ask that organizers present scenarios under which the games can be held supported by scientific evidence including testing protocols for spectators, athletes and organizers. (BBG)

NEW ZEALAND: New Zealand is likely to keep its border closed to the world through most of 2021 amid uncertainty over the rollout of Covid-19 vaccines, Prime Minister Jacinda Ardern said. "We can expect our borders to be impacted for much of this year," Ardern told a news conference Tuesday in Wellington. "We will continue to pursue travel bubbles with Australia and the Pacific, but the rest of the world simply poses too great a risk to our health and our economy to take a risk at this stage." New Zealand's success in combating the virus has allowed it to lift restrictions and get its economy moving again much sooner than initially expected, but the closed border is decimating its tourism industry. (BBG)

NEW ZEALAND: Prime Minister Jacinda Ardern says the Government could green-light a Covid-19 vaccine as soon as next Wednesday, and says New Zealand is keeping pace with Australia's vaccine rollout. The first batch of the Pfizer vaccine is due to arrive before the end of March in order to vaccinate those working at the border, but the country's medicine regulator MedSafe has not yet approved it. (Stuff NZ)

SOUTH KOREA: South Korea may decide on adjusting social distancing measures on Jan. 29. (BBG)

TURKEY: Turkey's economy will grow by about 6% in 2021, before settling back to a growth rate of about 3.5% annually from 2022, International Monetary Fund staff said on Monday, but they urged Ankara to deploy additional targeted stimulus to address COVID-19 pandemic needs. The 6% GDP growth projection in the preliminary findings of the IMF's annual review of Turkey's economy compare with a previous 2021 growth projection of 5% for Turkey issued in October as part of the IMF's last World Economic Outlook. The IMF plans on Tuesday to issue new projections for the WEO, which had previously estimated that Turkey's economy would shrink 5.0% in 2020. (RTRS)

BRAZIL: Top Court Justice Ricardo Lewandowski ordered an investigation into Health Minister Eduardo Pazuello's decisions during the collapse of Manaus public health system, Folha de S.Paulo reports. The probe request was made by the Prosecutor General Augusto Aras, following representations from political parties that criticize the conduct of the minister and his assistants in the crisis that was installed in Amazonas state hospitals. (BBG)

RUSSIA: U.S. President Joe Biden will keep all options on the table as it considers responses to Russia's detention of opposition leader Alexei Navalny, press secretary Jen Psaki said on Monday. Police detained more than 3,700 people and used force to break up rallies across Russia on Saturday as tens of thousands of protesters ignored extreme cold and police warnings to demand Navalny be freed from jail where he is serving out a 30-day stint for alleged parole violations he denies. The Biden administration has called on Russian President Vladimir Putin to immediately release Navalny, along with the protestors. (RTRS)

RUSSIA: European Union foreign-policy chief Josep Borrell said he would travel to Moscow next week and express objections to the jailing of Russian opposition leader Alexey Navalny. (BBG)

MEXICO: Mexican lawmakers agreed on Monday to hold a public forum next week on a bill that would force the central bank to purchase bulk cash from local lenders who can't sell it elsewhere. The public forum will be held next Monday and Tuesday and include the input of finance officials, lawmakers said in a virtual meeting. (BBG)

MIDDLE EAST: The United States on Monday approved all transactions involving Yemen's Houthi movement for the next month as Washington reviews a Trump administration designation of the Iran-aligned group as a foreign terrorist organization. The move appeared designed to allay fears of companies and banks involved in commercial trade to Yemen, which relies almost solely on imports. The Treasury Department in a Frequently Asked Question specifically stated that foreign banks will not be exposed to sanctions "if they knowingly conduct or facilitate a transaction" for the Houthis. (RTRS)

OIL: President Biden on Wednesday will direct federal agencies to determine how expansive a ban on new oil and gas leasing on federal land should be, part of a suite of executive orders that will effectively launch his agenda to combat climate change, two people with knowledge of the president's plans said Monday. An eventual ban on new drilling leases would fulfill a campaign promise that infuriated the oil industry and became a central theme in the fight for the critical battleground state of Pennsylvania, where the natural gas extraction method known as hydraulic fracturing, or fracking, has become big business. (New York Times)

OIL: New York City's largest pension funds have voted in favor of dumping fossil fuel investments, selling off an estimated $4 billion in holdings. The move is expected to be one of the largest divestments from oil and gas corporations in the world. The city's pension funds have a combined value of $239bn. (Independent)

CHINA

CORONAVIRUS: China reported 69 new locally-transmitted Covid-19 cases on Tuesday morning, down from 117 cases a day earlier, as infections in Hebei slowed further. The new cases take the tally of local infections since the beginning of the month to 1,775 following a series of outbreaks in the north of the country. (FT)

PBOC: MNI POLICY: China Should Abandon GDP Target: PBOC Advisor

- China should permanently abolish the GDP growth target and focus on stabilizing employment and controlling inflation as the main goals for its macroeconomic policies, Ma Jun, a member of the Monetary Policy Committee of the People's Bank of China, said in a recent China Wealth Management 50 forum. GDP should not be used as an indicator for evaluating the performance of local officials, even if it is useful for forecasting revenue and expenditure or projecting investment, said Ma. He warned that continuing to set GDP growth target could increase the risk of implicit local debts as local authorities may keep borrowing to drive investment. China needs to carefully adjust its monetary policy given the fast-rising macro leverage ratios, and there are signs that bubbles have emerged as evidenced by stock market and housing price gains, Ma said. Inflation will be modest this year, leaving room for a slow adjustment in monetary policy, he said. M2 growth should be controlled at about 9% this year - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

POLICY: China should maintain its fiscal expenditure including maintaining the scale of local government special bonds, according to a report by the China Finance 40 Forum. Monetary policy should be maintained at the current neutral level, while the central bank should pay close attention to exposure to credit risks, the report noted. China should also promote structural reform in medical care and education, and increase housing and land supply in big cities, the report urged. (MNI)

POLICY: Official: China is drafting rules to support SMEs in 2021-2025. (BBG)

POLICY: MIIT: China to speed up R&D of 5G chips, components and devices. (BBG)

ECONOMY: China's recovery picked up speed this month, putting it further ahead of rivals after recent data showed it was likely the only major economy to have grown in 2020. An aggregate index combining eight early indicators tracked by Bloomberg increased by one step from last month, led by strong performances in exports, property and the stock market. (BBG)

ECONOMY: China's local governments should focus on expanding domestic consumption and encouraging innovation so the economy can reach GDP growth targets of 6%-10%, the state-run Economic Information Daily reported. Local governments should adapt to the normalization of epidemic prevention, focus on developing the digital economy and boost investment through infrastructure programs, the newspaper reported citing Gao Ruidong, chief economist from Everbright Securities. The consumption potential of rural areas should be raised through increasing employment, public consumption and social security, Gao told the newspaper. (MNI)

ECONOMY: The GDP of China's southern Guangdong province rose 2.3% last year to CNY 11 trillion, ahead of the economies of Russia and South Korea, The Paper reported citing local statistics. Eastern Jiangsu was the second province to exceed CNY10 billion in 2020, the newspaper said. China's total GDP last year was CNY101 trillion, an increase of 2.3% over 2019 in comparable prices, the newspaper reported. (MNI)

OVERNIGHT DATA

JAPAN DEC PPI SERVICES -0.4% Y/Y; MEDIAN -0.6%; NOV -0.5%

NEW ZEALAND DEC SERVICES PMI 49.2; NOV 46.7

Activity in New Zealand's services sector improved from the previous month, but still recorded contraction, according to the BNZ - BusinessNZ Performance of Services Index (PSI). The PSI for December was 49.2, which was up 2.5 points from November (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). The PSI averaged 47.0 over 2020. BusinessNZ chief executive Kirk Hope said that the December result typified a difficult year for the sector, with half the year spent in contraction. "While June and July showed a post-lockdown recovery, the remainder of 2020 displayed either soft expansion or contraction. The two key sub-indices of activity/sales and new orders/business failed to show any consistent pattern of expansion, while the remaining sub-indices spent a significant proportion of time under the key 50.0 mark". BNZ Senior Economist Craig Ebert said that "activity indicators such as these have had their work cut out lately, in trying to nail GDP to the nearest percent. In any case, the composite index is consistent with our view that NZ real GDP will be broadly flat over the six months to March 2021". (BNZ)

SOUTH KOREA Q4, P GDP -1.4% Y/Y; MEDIAN -1.6%; Q3 -1.1%

SOUTH KOREA Q4, P GDP +1.1% Q/Q; MEDIAN +0.9%; Q3 +2.1%

CHINA MARKETS

PBOC NET DRAINS CNY78BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net drain of CNY78 billion given the maturity of CNY80 billion of reverse repos today, according to Wind Information.

- The operation aims to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.6648% at 09:26 am local time from 2.4218% at Monday's close.

- The CFETS-NEX money-market sentiment index closed at 65 on Monday vs 37 on Friday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4847 TUES VS 6.4819

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4847 on Tuesday. This compares with the 6.4819 set on Monday.

MARKETS

SNAPSHOT: COVID, Fiscal & Geopolitical Matters Dominate In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 241.13 points at 28581.18

- ASX 200 is closed

- Shanghai Comp. down 43.408 points at 3580.83

- JGB 10-Yr future up 10 ticks at 151.98, yield down 1.6bp at 0.034%

- Aussie bonds are closed

- U.S. 10-Yr future unch. at 137-12, yield up 0.68bp at 1.036%

- WTI crude down $0.34 at $52.43, Gold up $0.29 at $1856.23

- USD/JPY unch. at Y103.75

- LAGARDE: 'NO DOUBT' ECB WILL PRESERVE FINANCING CONDITIONS (BBG)

- ITALY'S CONTE WILL HAND IN RESIGNATION TUESDAY TO PLOT COMEBACK (BBG)

- BIDEN WILLING TO NEGOTIATE PARAMETERS OF CORONAVIRUS DEAL, BUT 'TIME IS OF THE ESSENCE' (WASHINGTON POST)

- WHITE HOUSE: BIDEN TO APPROACH CHINA RELATIONSHIP WITH 'PATIENCE' (BBG)

- CHINA TO CONDUCT MILITARY DRILLS IN SOUTH CHINA SEA AMID TENSIONS WITH U.S. (RTRS)

- ASTRAZENECA DENIES REPORT VACCINE LESS EFFECTIVE IN ELDERLY (RTRS)

- EU DISSATISFIED WITH ASTRAZENECA EXPLANATIONS ON VACCINE DELAYS (RTRS)

BOND SUMMARY: TY Options Flow Headlines A Limited Asia Session

T-Notes continue to hold to a narrow 0-02+ range, last +0-00+ at 137-12+, with volume hampered by an Australian market holiday. Cash Tsys across the curve trade unchanged to a touch cheaper on the day, but currently sit within 1.0bp of Monday's closing levels. Still, there was plenty of interesting rounds of flow to note from the space:

- A 10K block of the TYJ1 138.00/133.50 risk reversals, buying the puts to sell the calls in the 4th round of 10K Asia-Pac TYJ1 risk reversal block trade in that direction over the last week or so. A 5K block of the TYH1 138.25/136.50 risk reversals (once again buying the puts to sell the calls). A 10.0K block buyer of the TYH1 138.00 calls at 0-13, which was followed up by screen lifts 5.0K of 3.0K, which paid 0-12 and 0-14 respectively, before another 10.0K block buyer paid 0-15. There was also a 5,585 block seller of TYH1 futures, as well as a 1,425 block seller of USH1 futures.

- JGB futures stuck to a narrow range, with futures last +11, although bulls still haven't forced their way through the 152.00 marker. The cash curve saw some light bull steepening, aided by the setup ahead and realisation of a sub-par round of 40-Year JGB issuance. The minutes from the BoJ's December meeting revealed some dialogue surrounding the future of the Bank's YCC and ETF purchase schemes, although they provided nothing in the way outright surprises, resulting in no tangible market impact (these matters will be central pillars of discussion in the Bank's monetary policy review, which is set to be released in March).

JGBS AUCTION: Japanese MOF sells Y499.2bn 40-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y499.2bn 40-Year JGBs:- High Yield: 0.685% (prev. 0.665%)

- Low Price 93.66 (prev. 94.30)

- % Allotted At High Yield: 19.0130% (prev. 21.4007%)

- Bid/Cover: 2.865x (prev. 2.670x)

EQUITIES: Red On The Screens

Asia-Pac equities pressured lower on Tuesday as risk off sentiment takes hold in the region. Investors are considering delays to the proposed stimulus package in the US which has impacted risk tone. The Hang Seng led the way lower in the region, losing around 2.4% after rallying last week. Tencent added some downward pressure on profit taking after the firm's market value rose to the cusp of $1tn for the first time yesterday. The PBOC unexpectedly withdrew CNY 278bn of liquidity from the system and a PBOC adviser said he saw a stock bubble which exacerbated downward pressure.

- US futures are lower on the prevarication over the stimulus package and as US health official expressed concern about vaccination delays. Nasdaq 100 contracts also pointed lower, several key earnings are due after-market including Microsoft, AMD and Starbucks. European futures are slightly higher, key earnings today include LVMH, Novartis and UBS.

OIL: Risk Off Pressures Oil In Asia

Oil is lower in Asia-Pac trade on Tuesday; WTI is down $0.21 at $52.56, while brent is $0.29 lower at $55.59.

Markets adopted a broadly risk off tone in Asia as a resurgence in Covid-19 and tighter lockdowns dent the demand outlook.

- The downside is tempered as markets weigh lower supply; Iraq is reducing production to compensate for exceeding its quota in 2020, it will pump 3.6m BPD in January and February, some 250k BPD lower than December and the lowest since 2015. Supply from Libya could also be disrupted as strikes over pay disputes go ahead.

- Attention will turn to how strict travel restrictions are in China over the LNY period, and API inventory data late on Tuesday.

GOLD: Within Familiar Lines

Lower U.S. real yields have competed with the uptick in the DXY over the last 24 hours, although the respective moves have edged away from extremes, with spot gold a touch higher over that timeframe, but ultimately little changed after dealing either side of where we sit now, $1,860/oz in spot trade. The technical parameters flagged in recent days remain in play.

FOREX: Caution Creeps In

Light risk aversion crept in amid concerns over potential delay to the U.S. Covid-19 relief package, spread of new variants of the virus and questions surrounding the pace of vaccine rollouts. Participants shied away from the Antipodeans with regional liquidity thinned by a market holiday in Australia. New Zealand confirmed that its latest Covid-19 patient was infected with the South African strain, but stopped short of changing national alert levels. AUD/NZD was poised to extend its four-day losing streak, but struggled to move through support from the NZ$1.0700 figure/100-DMA.

- JPY & USD firmed up a tad on the back of safe haven demand. The DXY edged higher but failed to test yesterday's peak.

- The PBOC fixed USD/CNY mid-point at CNY6.4847, around 19 pips higher than sell side estimates, as demonstrating its asymmetric response to yuan strength. It also withdrew CNY 278bn of liquidity from the system, even as LNY and tax payments loom, with a PBoC advisor signalling the need to curb asset bubbles.

- EUR/USD was stable and continued to rest upon its 50-DMA. Italian PM Conte is expected to hand in resignation today, hoping to return at the helm of a new Cabinet.

- Cable slipped past yesterday's trough with markets awaiting UK gov't's decision on tighter border controls. Ministers are expected to sign off on plans to force some inbound travellers to quarantine in hotels upon arrival.

- UK labour market report, U.S. Conf. Board Consumer Confidence and comments from ECB's Centeno & de Cos will grab attention today.

FOREX OPTIONS: Expiries for Jan26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E727mln), $1.2230-50(E625mln), $1.2300(E514mln)

- USD/JPY: Y105.00($510mln)

- AUD/USD: $0.7700-15(A$873mln-AUD puts)

- USD/CNY: Cny6.4600($500mln)

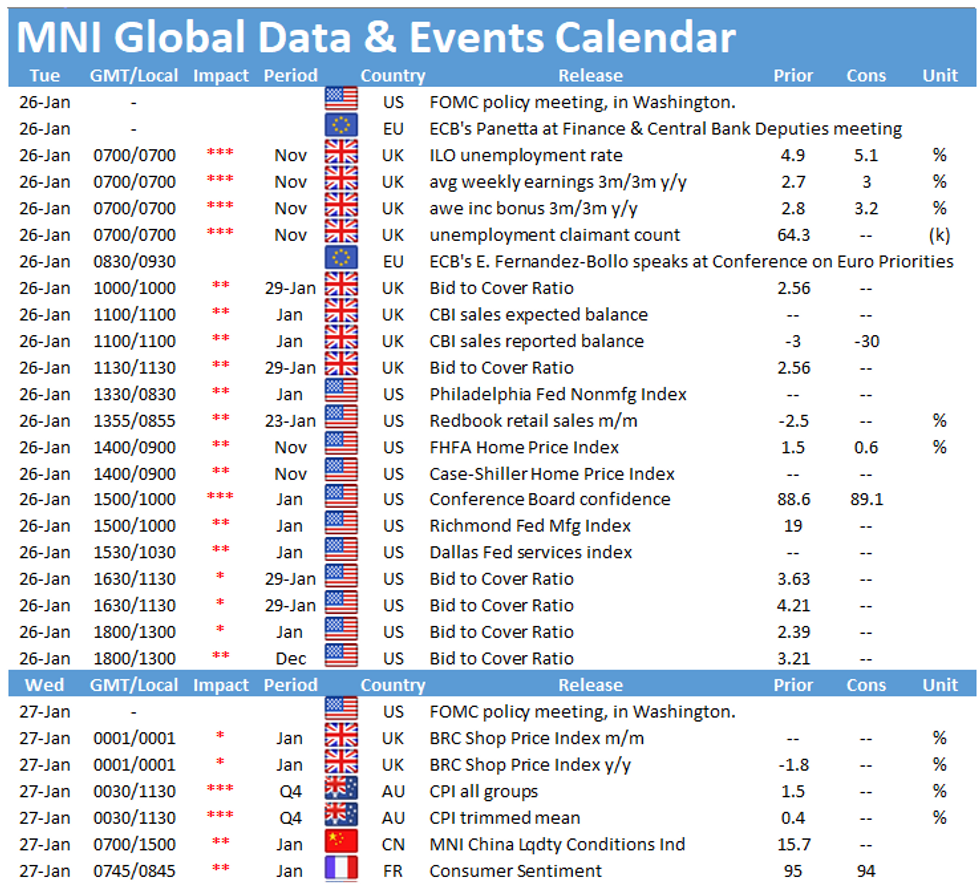

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.