-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Choppy Trade Witnessed On Rehash Of Old Vaccine Story

EXECUTIVE SUMMARY

- TOP SENATE DEMOCRAT DIRECTS LAWMAKERS TO CRAFT BILL TO COUNTER CHINA (RTRS)

- HOYER: HOUSE WILL VOTE ON U.S. COVID-19 RELIEF BILL FRIDAY

- BIDEN: STIMULUS BILL ISN'T GOING TO GET PASSED `BY A LOT' (BBG)

- RBNZ RETAINS NEGATIVE RATE OPTION

- GBP SURGES IN ASIA, AS RECENT RALLY EXTENDS

- FT REHASHING AN OLD COVID VACCINE STORY CREATED SOME VOL.

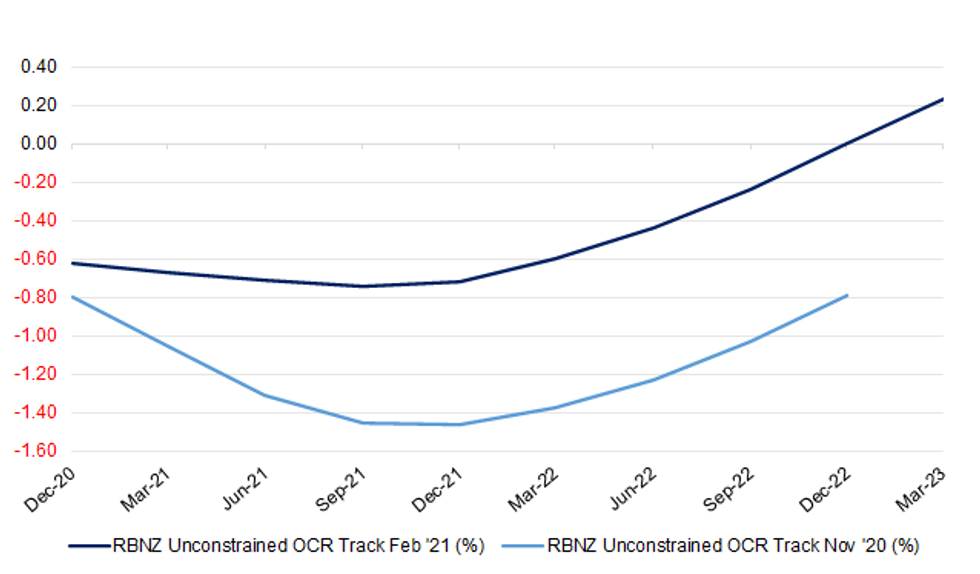

Fig. 1: RBNZ Unconstrained OCR Track

Source: MNI - Market News/RBNZ

Source: MNI - Market News/RBNZ

UK

CORONAVIRUS: Boris Johnson's roadmap out of lockdown could be accelerated if real world data on the effect of vaccines is better than expected, Government sources have told The Telegraph. On Monday, Mr Johnson set out a four-step plan that would see all restrictions lifted by June 21, but emphasised that the dates attached to the lifting of measures were the earliest possible on which they could be eased. However, The Telegraph has been told by others in the Government that better than anticipated data about the vaccine could allow some of the roadmap timings to be reviewed. A senior government source said that if the positive results from an early Public Health Scotland study on vaccines were replicated in England "that would change the calculations" on the timings. (Telegraph)

CORONAVIRUS: Covid passports could include positive test results under plans being considered by ministers. Michael Gove, who will head the review into the potential development of Covid status certificates, will study similar schemes in other countries including Israel, which has introduced a "green pass" for vaccinated citizens. Israel's launch of a Covid certificate contained in an app, and its success in already vaccinating half its population, has allowed it to open synagogues, gyms and hotels to those who have been inoculated. (Telegraph)

CORONAVIRUS: Scotland's first minister Nicola Sturgeon on Tuesday set out a framework for easing coronavirus restrictions that was markedly more cautious than the UK government's route map for England but aims to move Scotland out of national lockdown by the last week in April. The plan makes clear that there is unlikely to be any easing of restrictions on the retail sector before the second week of April, with further "graduated opening up of economic and social activity" only expected at least three weeks after that. (FT)

FISCAL: Millions of self-employed workers are due to be offered grants of up to £7,500 in next week's Budget, but the Chancellor is considering dropping the scheme from May. The Telegraph understands that people who meet the criteria can claim 80 per cent of average monthly profits up to a maximum of £2,500 a month. The terms for the fourth round of grants, run through the Self-Employment Income Support Scheme (SEISS), are yet to be announced but have been pencilled in by the Treasury. (Telegraph)

FISCAL: More than two dozen Tory MPs have written to Rishi Sunak urging him not to raise fuel tax in his Budget. They say Boris Johnson made a pledge in 2019 not to increase the hated levy and breaking the vow would betray voters. (The Sun)

BREXIT: The UK has agreed to give the European Union more time to approve the Brexit trade deal struck between the two sides. The agreement was struck on Christmas Eve, just days before it came into effect on 1 January. MPs ratified the deal in a single day - on 30 December. (Sky)

PROPERTY: Rishi Sunak is preparing to extend the stamp duty holiday by three months until the end of June in an attempt to keep the property market firing as Britain emerges from lockdown. In July last year the government exempted most buyers from the levy if they completed their purchase before March 31, 2021. The holiday enables people to save up to £15,000 in tax. The chancellor has faced pressure to extend the deadline amid concerns that it would create a "cliff-edge", jeopardising hundreds of thousands of sales. (The Times)

EUROPE

CORONAVIRUS: AstraZeneca expects to deliver less than half the COVID-19 vaccines it was contracted to supply the European Union in the second quarter, an EU official told Reuters on Tuesday. The expected shortfall, which has not previously been reported, comes after a big reduction in supplies in the first quarter and could hit the EU's ability to meet its target of vaccinating 70% of adults by the summer. The EU official, who is directly involved in talks with the Anglo-Swedish drugmaker, said the company had told the bloc during internal meetings that it "would deliver less than 90 million doses in the second quarter". (RTRS)

CORONAVIRUS: The European Union's most senior administrator said she would happily receive AstraZeneca's coronavirus vaccine as officials rushed to find ways of ensuring doses refused by skittish Germans did not go to waste. President of the European Commission Ursula von der Leyen's remarks came amid growing concerns that unfavourable comments by top European officials including French President Emmanuel Macron had slowed take-up of one of only three vaccines currently approved EU-wide. (RTRS)

CORONAVIRUS: Non-essential travel in the European Union will have to remain restricted for the time being because the epidemiological situation remains serious and new coronavirus variants pose additional challenges, EU leaders will agree on Thursday. Draft conclusions of the leaders video-conference, seen by Reuters, said that travel restrictions should be introduced proportionally, in a non-discriminatory way and taking into account specific cross-border situations of local communities. They will also agree to continue work on a common EU vaccination certificate which would allow individuals more freedom of travel and help resurrect tourism, which is key for southern EU countries, that has been destroyed by the pandemic. (RTRS)

GERMANY: Chancellor Angela Merkel warned that Germany is in the midst of a third wave of coronavirus infections and that moves to reopen schools and businesses should be weighed with caution as the country debates how to exit its lockdown and relieve its ailing economy. Ending restrictions on personal contact must be accompanied by more testing and vaccinations, Merkel told lawmakers of the Christian Democratic Union-led conservative bloc Tuesday in a video conference, according to a participant on the call. The chancellor warned that the virus's U.K. variant is already spreading in Germany, threatening the success of the country's containment efforts to date. (BBG)

GREECE: Greece is examining whether it can break with the European Union and open its borders to vaccinated British tourists as early as May. Under plans being discussed in Athens, British visitors who can prove that they have had the jab will be allowed in for the summer. The Greek government is also mapping out the logistics of vaccinating airport workers and hotel employees at resorts. Such a move could push Greece into conflict with the EU, which is insisting on a united approach to allowing non- essential foreign travel from outside the bloc to resume. (The Times)

NETHERLANDS: The Dutch government will take "a little bit more risk" in relaxing a few lockdown measures as Prime Minister Mark Rutte seeks to balance the battle against the outbreak with a pandemic-weary public and frustrated closed businesses. Secondary schools will partly reopen, shopping with an appointment will be allowed and barbers and other so-called contact jobs can reopen. The government announced the new measures hours after case numbers showed an increase in the week ending Feb. 23. A much debated nighttime curfew will be extended until March 15. (BBG)

IRELAND: Ireland's government will maintain its strict lockdown regime until at least April 5, Prime Minister Micheal Martin said in a national address. Non-essential stores, bars and personal services -- which have been closed for over six weeks -- will remain shuttered, and people will have to stay within 5 kilometers (3.1 miles) from home. In one change, schools will reopen on a phased basis next month. Offering some hope, Martin said over 80% of adults will have been given at least a first vaccine dose by the end of June. (BBG)

U.S.

FED: Fed Chair Jerome Powell said on Tuesday that the U.S. central bank has tools to keep the fed funds rate in its target range, which is the primary focus. He added that these tools should limit the extent to which bill yields continue to drop, or turn negative. (RTRS)

FED: "Overall, directors remained generally positive about the outlook, particularly for the second half of 2021 when vaccine distribution is expected to be more widespread," Fed says in minutes of discount rate meetings on Jan. 19 and Jan. 27. "But they also expressed ongoing uncertainty about the course of the pandemic and vaccine developments". (BBG)

FISCAL: Biden met in a virtual roundtable with Black essential workers on Tuesday, continuing the administration's outreach as it aims to build support for the $1.9 trillion pandemic-relief plan. The president acknowledged that the vote in Congress will be close. "If we get this bill passed -- which we're not going to pass by a lot, but we're optimistic -- we're going to make some real changes," Biden said Tuesday at the White House during the roundtable. (BBG)

FISCAL: The House will vote on President Biden's $1.9 trillion COVID-19 relief package on Friday, Majority Leader Steny Hoyer (D-Md.) said on Tuesday night. "The House will vote on Friday on @POTUS' #AmericanRescuePlan to end this pandemic and deliver urgently needed relief to America's families and small businesses. The American people strongly support this bill, and we are moving swiftly to see it enacted into law," Hoyer tweeted. (The Hill)

FISCAL: Sen. Susan Collins (R-Maine) says that President Biden's $1.9 trillion COVID-19 relief package likely won't get any Republican votes on the Senate floor. And she pointed to Senate Majority Leader Charles Schumer (D-N.Y.) and White House chief of staff Ron Klain as a major reason why bipartisan talks on the relief bill fell apart. Collins said Tuesday that Biden's senior advisers have refused to come down from their $1.9 trillion proposal, which GOP moderates say is far too expensive given their preference for what they call "targeted" relief. (The Hill)

FISCAL: Sens. Tom Cotton (R-Ark.) and Mitt Romney (R-Utah) on Tuesday unveiled the details of their proposal to raise the minimum wage to $10 an hour by 2025. The Republican proposal comes as Congressional Democrats are pushing for a bill, backed by President Joe Biden and included in the broader $1.9 trillion stimulus package, that would increase the federal minimum wage to $15 an hour by 2025. (Axios)

FISCAL: California Governor Gavin Newsom signed a $7.6 billion coronavirus relief package on Tuesday that will give at least $600 one-time payments to 5.7 million people while setting aside more than $2 billion in grants for struggling small businesses. (CBS)

CORONAVIRUS: US coronavirus cases and deaths on Tuesday recorded their biggest daily increases in several days due in part to higher tallies from Texas. States reported an additional 67,879 infections, according to Covid Tracking Project data, the biggest one-day increase since Saturday. The latest figure was up from 52,530 on Monday, which was the smallest daily increase since mid-October. (FT)

CORONAVIRUS: The Biden administration will now supply states with 14.5 million doses of coronavirus vaccine per week, marking another gradual increase in supply., "Today on his weekly governors call with America's governors, our Covid coordinator Jeff Zients announced the fifth consecutive week of supply increases," White House press secretary Jen Psaki said during a press briefing. "States will now receive 14.5 million doses this week, up from 8.6 million doses per week when the president took office." (CNBC)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention's Advisory Committee on Immunization Practices has scheduled an emergency meeting for Sunday and Monday, according to the agency's website. The meeting will come after a Food and Drug Administration advisory meeting on Friday where outside advisers will discuss Johnson & Johnson's application for emergency use of its Covid-19 vaccine candidate. An authorization could swiftly follow the meeting. CDC's ACIP must then vote on guidelines for administering the vaccine. (BBG)

CORONAVIRUS: Despite President Joe Biden's plan to help kindergarten-to-eighth-grade schools reopened as soon as possible, crowded classrooms, a shortage of available teachers and aging buildings with poor ventilation systems are just some of the challenges delaying the shift. (CNBC)

EQUITIES: Robinhood Markets Chief Executive Officer Vlad Tenev said short selling the same shares multiple times is creating a chaotic dynamic for markets and investors. When a stock is being borrowed over and over it "creates some sort of runaway chain reaction," Tenev said at the New York Times DealBook DC Policy Project virtual conference Tuesday. "How many times should we let the same share be shorted? I think there's an argument that the answer should be one." It's worth looking at "how things would be different if there was some limitation," he said. Tenev was joined in the session by former U.S. Securities and Exchange Commission Chairman Jay Clayton, who called for real time disclosure of shorts. (BBG)

EQUITIES: U.S. aviation regulators on Tuesday issued stringent new inspection requirements to ensure Pratt & Whitney engines like the one that broke apart over a Denver suburb on Saturday are safe. The Federal Aviation Administration's airworthiness directive mandates that the titanium fan blades on certain Pratt & Whitney engines be examined with a special test to essentially peer inside the surface before they can return to service. The action was prompted by the violent failure of a fan blade on one of two engines mounted on a United Airlines plane, a Boeing Co. 777-200. After the 40.5-inch (103-centimeter) blade snapped, it tore off another blade and the front structure of the engine, pelting a suburban neighborhood with metal and other debris. (BBG)

OTHER

U.S./CHINA: U.S. Senate Majority Leader Chuck Schumer said on Tuesday he has directed lawmakers to craft a package of measures to counter China's rise, capitalizing on bipartisan hardline sentiment on Beijing in Congress to strengthen the U.S. tech sector and counter unfair practices. (RTRS)

GLOBAL TRADE: French antitrust investigators have accused Alphabet Inc's Google of failing to comply with the state competition authority's orders on how to conduct negotiations with news publishers over copyright, two sources who read the investigators' report said. In the 93-page report, known as a statement of objections, the investigators wrote that Google's failure to comply was of an exceptionally serious nature, the sources said. (RTRS)

CORONAVIRUS: Global coronavirus cases fell for a sixth week and the number of fatalities declined by a fifth, according to the World Health Organization. There were almost 2.5m new coronavirus cases reported around the world in the seven days to 21 February, down 11 per cent on the previous period, the health body said. Countries and territories recorded 66,000 new fatalities linked to Covid-19, a fall of 20 per cent. (FT)

CORONAVIRUS: Pfizer says it is discussing a clinical trial for a booster for new Covid-19 variants with the Food and Drug Administration, after the US regulator urged vaccine makers to prepare to adapt their shots. In testimony to a congressional committee, John Young, chief business officer of Pfizer, said the company was "laser focused" on the potential impact the emergent variants could have on its vaccine's ability to protect against Covid-19. (FT)

CORONAVIRUS: A randomized, placebo-controlled Phase 1 clinical trial of two monoclonal antibodies (mAbs) directed against the coronavirus that causes Middle East respiratory syndrome (MERS) found that they were well tolerated and generally safe when administered simultaneously to healthy adults. The experimental mAbs, REGN3048 and REGN3051, target the MERS coronavirus (MERS CoV) spike protein used by the virus to attach to and infect target cells. The mAbs were discovered and developed by scientists at the biopharmaceutical company Regeneron, located in Tarrytown, New York. The trial was sponsored by the National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health. (NIH)

HONG KONG: Each permanent resident over the age of 18 will get coupons of HK$5,000 designed to be spent in shops, bars and restaurants, which have been badly hit by the pandemic and enforced closures. Financial Secretary Paul Chan's budget also includes reductions to salaries tax and electricity subsidies. The budget "aims to alleviate the hardship and pressure caused by the economic downturn and the epidemic through the introduction of counter-cyclical measures costing over HK$120 billion," Chan said. He also said Hong Kong would continue discussing travel bubbles with countries. (BBG)

JAPAN: Japan's economy will likely deteriorate this quarter compared with the previous three-month period, Finance Minister Taro Aso said on Wednesday, stressing the need to swiftly carry out planned stimulus measures. Speaking to reporters after a cabinet meeting, Aso said the government was not currently considering adopting any fresh stimulus. (RTRS)

JAPAN: Japan eyes gradual resumption of Go To travel campaign. (FNN)

AUSTRALIA: Australian authorities said on Wednesday they would investigate the accidental overdose of two elderly patients with the Pfizer Covid-19 vaccine. A doctor administered as much as four times the recommended doses to an 88-year-old man and 94-year-old woman in an elderly care facility in suburban Brisbane. (FT)

RBNZ: MNI STATE OF PLAY: RBNZ Retains Negative Rate Option

- The Reserve Bank of New Zealand has an increasingly positive assessment of the domestic economy, but stands prepared to use easier monetary policy tools, including negative interest rates, if required, with the banking system now "operationally ready" for such a move. "We have always talked about negative rates as an option that should be available to us, not an immediate expectation to have to use," RBNZ Governor Adrian Orr said at a press conference following the release of the bank's quarterly monetary policy statement, which showed that the economic rebound has been stronger than expected - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

NEW ZEALAND: New Zealand authorities on Tuesday reported three new Covid-19 cases linked to an Auckland high school. The Ministry of Health said two siblings of an earlier case from Papatoetoe High School have also tested positive. The siblings are a teenager and an infant. The teenager also

SOUTH KOREA: South Korea to submit bill for extra budget to the parliament March 4 after discussing the issue at the March 2 Cabinet meeting, Finance Minister Hong Nam-ki says. (BBG)

TAIWAN: The accusation that China is blocking Taiwan's purchase of vaccines is groundless, China's Taiwan Affairs Office spokesman Ma Xiaoguang tells regular briefing in Beijing on Wednesday. (BBG)

CANADA: President Joe Biden unveiled a new "roadmap" with Canada during his meeting Tuesday with Prime Minister Justin Trudeau, as the two allies agreed to cooperate on combating the coronavirus pandemic and climate change. The meeting was Biden's first bilateral meeting with a foreign leader as president. The two leaders made brief remarks at the opening of the meeting, which was held virtually due to the pandemic. "I look forward to seeing you in person in the future," Biden said, reading from an iPad. "The United States has no closer friend than Canada," the president told Trudeau, according to a White House pool report. (MarketWatch)

BOC: MNI BRIEF: BOC Says Rising Yields Reflect Vaccine,Policy Gains

- Bank of Canada Governor Tiff Macklem said Tuesday rising bond yields reflect the success of monetary and fiscal stimulus and the vaccine rollout and reiterated his view that QE will be needed until the economic recovery is well advanced - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

TURKEY: Turkey central bank raises reserve requirement ratios 2 percentage points for the lira liabilities, according to decree on official gazette. Ratio for Turkish lira deposit and participation funds with maturities of 3 months or less is raised to 8% Ratio is raised to 6% for maturities up to 6 months, to 4% for maturities up to 1 year, and to 3% for 1-year and longer maturities. (BBG)

TURKEY: U.S. Defense Department urged Turkey to declined new delivery of Russian S-400 missiles, Pentagon spokesman John Kirby says at a briefing. (BBG)

MEXICO: A senior Mexican legislator has floated the idea of making the mega rich pay a one-off Covid-19 contribution as "an act of social justice and solidarity" that could raise nearly $5bn. (FT)

BRAZIL: The board of Brazil's state-run oil company Petrobras on Tuesday authorized an extraordinary shareholder meeting to begin the process of replacing Chief Executive Roberto Castello Branco with former Defense Minister Joaquim Silva e Luna. The company, known formally as Petroleo Brasileiro SA, added that the board said it "will continue to rigorously abide by the governance standards of Petrobras, including with respect to the company's pricing policy." (RTRS)

RUSSIA: The Biden administration is preparing sanctions and other measures to punish Moscow for actions that go beyond the sprawling SolarWinds cyber espionage campaign to include a range of malign cyber activity and the near-fatal poisoning of a Russian opposition leader, said U.S. officials familiar with the matter. The administration is casting the SolarWinds operation, which hacked government agencies and private companies, as "indiscriminate" and potentially "disruptive." That would allow officials to claim that the Russian hacking was not equivalent to the kind of espionage the U.S. also conducts, and to sanction those responsible for the operation. (Washington Post)

RUSSIA: European Union foreign ministers have agreed this week to impose new sanctions against Russian officials linked to the jailing of opposition leader Alexei Navalny and expressed concern that the government in Moscow appears to see the 27-nation bloc as an adversary. (AP)

RUSSIA: The European Union does not need the Nord Stream 2 pipeline for its energy security but any decision to stop the project carrying Russian natural gas to Germany would have to come from Berlin, a senior European Commission official said on Tuesday. (RTRS)

IRAN: An Iranian state newspaper, taking aim at hardline lawmakers' intervention in Tehran's nuclear row with the West, warned on Tuesday that overly radical actions may lead to Iran's isolation after a new law ended snap inspections by U.N. inspectors. (RTRS)

IRAN: Iran is producing roughly 15 kg (33 pounds) a month of uranium enriched to 20% purity at its underground Fordow plant, a senior diplomat said on Tuesday. A recent Iranian law requires Tehran to produce 120 kg (265 pounds) a year of uranium enriched to 20%, a process that Iran started last month. That works out to about 10 kg a month. (RTRS)

EQUITIES: SoftBank Group Corp. plans to expand its investments in the biotech and health-care sector, opening up a new front in its growing asset management strategy, according to people familiar with the matter. SoftBank has already made a clutch of equity investments in the sector, including a $312 million stake in Pacific Biosciences of California Inc., a U.S. DNA-sequencing company whose stock has risen almost 9-fold in the last year. The Japanese firm is now planning to spend billions investing in public biotech companies, the people said, who asked not to speak publicly because the strategy is private. (BBG)

EQUITIES: Hong Kong Exchanges & Clearing Ltd. shares plunged as the city unveiled its first increase to the stamp duty on stock trades since 1993. The shares lost as much as 9.3% on Wednesday, the biggest decline since a bubble in China's stock market was bursting in 2015. The Hong Kong Economic Times said in a since-deleted report that the duty would be raised to 0.13% from 0.1%. The news was widely circulated among the city's trading desks, and came ahead of Financial Secretary Paul Chan later confirming the increase as he presented the city's budget. (BBG)

OIL: U.S. drillers have restored about 80% of crude production in parts of oil-rich Texas after last week's deep freeze shuttered operations. The Permian Basin in Texas is producing about 2.9 million barrels a day of crude after an Arctic blast disrupted power supply and operations, causing output to plummet to 600,000-700,000 barrels a day, according to industry data-analytics firm OilX. The region typically produces about 3.5 million barrels a day. Occidental Petroleum Corp., the Permian's second-largest producer, said Tuesday that 90% of its output is back online, while Marathon Oil Corp. is still in the process of getting wells up and running. At the same time, major pipeline operators including Plains All American Pipeline LP are also restarting operations to enable oil flows to reach broader markets. (BBG)

CHINA

ECONOMY/NPC: China is likely to de-emphasize quantitative growth targets and instead focus on major reform measures and nurturing new growth drivers, the Securities Times said in a preview of the National People's Congress (NPC) beginning next week. Citing Yang Weimin, the vice chairman of the Economics Committee of the Chinese People's Political Consultative Conference and former deputy head of the Central Economic Work Group, the Times report said that most regional governments have defined this year's growth targets more broadly, in another sign that the Government Work Paper will downplay quantities given last year's pandemic-hit comparison base. The NPC next week will seek to pursue new growth drivers, and the government will support new energy and environmental protection industries, the report said. (MNI)

PBOC: China should stick to its prudential monetary policy to avoid asset bubbles, such as Bitcoin, which resulted from excess liquidity which disrupted markets, hurt the real economy and increased financial risks, the 21st Century Business Herald said in an editorial. Excess liquidity unleashed by the U.S. reflected the instability of the U.S. financial system, and China authorities must prevent a spillover effect and the imported inflationary pressure, the Herald said. (MNI)

OVERNIGHT DATA

AUSTRALIA Q4 CONSTRUCTION WORK DONE -0.9% Q/Q; MEDIAN +1.0%; Q3 -1.8%

AUSTRALIA Q4 WAGE PRICE INDEX +1.4% Y/Y; MEDIAN +1.1%; Q3 +1.4%

AUSTRALIA Q4 WAGE PRICE INDEX +0.6% Q/Q; MEDIAN +0.3%; Q3 +0.1%

SOUTH KOREA MAR BUSINESS SURVEY M'FING 85; FEB 81

SOUTH KOREA MAR BUSINESS SURVEY NON-M'FING 73; FEB 70

CHINA MARKETS

PBOC NET INJECTS CNY10BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged on Wednesday. This resulted in a net injection of CNY10 billion given no maturity of reverse repos today, according to Wind Information.

- The operation aims to maintain reasonable and ample liquidity in the banking system, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) declined to 2.2000% at 09:22 AM local time from the close of 2.2770% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 33 on Tuesday vs 48 on Monday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4615 WEDS VS 6.4516

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4615 on Wednesday. This compares with the 6.4516 set on Tuesday.

MARKETS

SNAPSHOT: Choppy Trade Witnessed On Rehash Of Old Vaccine Story

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 340.44 points at 29812.43

- ASX 200 down 57.87 points at 6781.3

- Shanghai Comp. down 56.403 points at 3579.954

- JGB 10-Yr future up 3 ticks at 151.09, yield down 0.3bp at 0.122%

- Aussie 10-Yr future down 2.5 ticks at 98.410, yield up 2.9bp at 1.592%

- U.S. 10-Yr future +0-06 at 135-19+, yield down 0.51bp at 1.337%

- WTI crude down $0.51 at $61.16, Gold up $3.54 at $1809.14

- USD/JPY up 26 pips at Y105.51

- TOP SENATE DEMOCRAT DIRECTS LAWMAKERS TO CRAFT BILL TO COUNTER CHINA (RTRS)

- HOYER: HOUSE WILL VOTE ON U.S. COVID-19 RELIEF BILL FRIDAY

- BIDEN: STIMULUS BILL ISN'T GOING TO GET PASSED `BY A LOT' (BBG)

- RBNZ RETAINS NEGATIVE RATE OPTION

- GBP SURGES IN ASIA, AS RECENT RALLY EXTENDS

- FT REHASHING AN OLD COVID VACCINE STORY CREATED SOME VOL.

BOND SUMMARY: Choppy Overnight

T-Notes traded firmer at the re-open, printing through Tuesday's high. There was some early focus on the FT re-hashing a week-old study questioning the efficacy of the Pfizer vaccine vs. some COVID mutations, with the ensuing move retracing as it became more widely apparent that the story represented old news. T-Notes last +0-05+ at 135-19, with further choppy trade briefly in play alongside some dollar weakness. Flow wise, 20.0K of the FVJ1 125.50/124.50 risk reversal was blocked, buying the puts to sell the calls, building on recent Asia-Pac exposure to downside FV structures

- JGB futures lacked any real direction after Tuesday's Tokyo holiday, last +3. Cash trade saw mixed performance out to 10-Years, with some underperformance for the super-long end, resulting in bear steepening, while longer dated swap spreads are now a touch wider on the day. Japanese Finance Minister Aso provided plenty of headline fodder, although none of it was new. Aso once again pointed to the COVID-driven deterioration in Japan's fiscal situation, while deploying some well-trodden rhetoric re: JGBs. A liquidity enhancement auction for off-the-run 5-15.5 Year JGBs saw the bid/cover ratio firm above 5.00x, which may have provided light support in the afternoon.

- Aussie bonds looked through local matters, with the overnight underperformance holding, while the space was subjected to aforementioned chop. YM -1.0, XM -3.0, with growing interest in Aussie/U.S. 10-Year tighteners evident.

JGBS AUCTION: Japanese MOF sells Y2.7716tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7716tn 6-Month Bills:- Average Yield -0.1088% (prev. -0.1048%)

- Average 100.054 (prev. 100.052)

- High Yield: -0.1068% (prev. -0.1027%)

- Low Price 100.053 (prev. 100.051)

- % Allotted At High Yield: 28.2398% (prev. 22.9064%)

- Bid/Cover: 4.470x (prev. 4.560x)

JGBS AUCTION: Japanese MOF sells Y498.5bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.5bn of 5-15.5 Year JGBs in a liquidity enhancement auction:- Average Spread: 0.000% (prev. -0.008%)

- High Spread: +0.002% (prev. -0.008%)

- % Allotted At High Spread: 36.3391% (prev. 57.7176%)

- Bid/Cover: 5.060x (prev. 4.597x)

AUSSIE BONDS: The AOFM sells A$2.0bn of the 1.25% 21 May '32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$2.0bn of the 1.25% 21 May 2032 Bond, issue #TB158:- Average Yield: 1.6900% (prev. 1.0446%)

- High Yield: 1.6950% (prev. 1.0475%)

- Bid/Cover: 2.5825x (prev. 2.5235x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 26.1% (prev. 23.0%)

- bidders 47 (prev. 46), successful 27 (prev. 25), allocated in full 21 (prev. 16)

EQUITIES: Initial Positivity Wiped Out

A positive start quickly gave way to further declines in most Asia-Pac markets, the Nikkei and the ASX 200 were initially higher after US equity markets recovered into the close but the move higher was quickly erased.

- Shares in mainland China ground lower from the open and negative sentiment seeped into other markets. The Hang Seng fell up to 2.5%, the main culprit was a report in the Hong Kong Economic Times that stamp duty on stock trading will be increased. The article has now been removed. HKEX were down as much as 9.3%, weighing on the index, after gaining over 30% this year with mainland inflows elevated.

- US futures are lower, moving in a narrow range having recovered the bulk of their losses into the close yesterday after US Fed Chair Powell indicated that the FOMC had no intention of tightening policy in the foreseeable future.

OIL: Inventory Rise Weighs On Crude

Crude futures have slipped in Asia-Pac trade on Wednesday, both benchmarks sustained some losses early on and have seen rangebound trade since. WTI is down around $0.56 at $61.11/bbl, brent is down $0.37 at $65.00/bbl.

- Oil has come under pressure after API inventories yesterday showed a gain in crude stockpiles, the first build in five weeks, while there is also some concern that oil is entering overbought territory. Headline crude inventories saw a 1m/bbl increase which surprised the market against an expected decline on account of severe weather in southern US states shuttering production. In downstream markets the data showed a 66,000 bbl increase in gasoline and a 4.5m bbl decrease in distillate. Market participants will now be looking toward more comprehensive inventory data from the US DOE.

GOLD: We've Been Here Before

Spot gold has stuck to the confines of Monday's range during Asia-Pac hours, trading just shy of $1,808/oz at typing, with Fed Chair Powell striking a balance between reiterating the Fed's dovish leaning and not pushing back against recent market moves. The DXY Is a touch higher than it was 24 hours ago, but continues to operate within the recently observed range, while U.S. real yields are softer to flat vs. Friday's closing levels.

FOREX: Kiwi Bounces After RBNZ Decision, Sterling Gains On UK Reopening Plans

Kiwi dipped in the immediate wake of the RBNZ's monetary policy announcement but hit support at $0.7315 (a former breakout level/Jan 6 high) and swung back with renewed impetus just minutes thereafter, as participants digested the Reserve Bank's rhetoric. New Zealand's central bank left its main MonPol settings unchanged, while stressing that it remains ready to add stimulus if needed, amid uneven recovery and persistent uncertainties. It upgraded the economic projections but refrained from publishing the forecast for the OCR beyond the current quarter. The kiwi is the best G10 performer alongside GBP as we type. NZD/USD implied volatilities fell across the curve with the event risk behind.

- Sterling was on a tear amid continued enthusiasm about the UK's plans for gradually unwinding Covid-19 restrictions over the coming months. The bid in sterling was accompanied by the usual stops and thinner liquidity lines being thrown around by participants. EUR/GBP extended its losing streak to nine days hitting worst levels in a year, while cable had a look above $1.4200.

- Safe havens JPY & CHF comfortably underperformed their G10 peers despite a poor showing from most regional equity benchmarks. USD/JPY crept higher with $3.2bn worth of options with strikes at Y105.65-80 due to roll off at the NY cut.

- The PBOC fixed its USD/CNY mid-point at CNY6.4615, 10 pips above sell side estimates. The bank injected CNY 10bn via reverse repos, another small injection by historical standards. USD/CNH slipped initially, but recouped losses.

- The data docket is fairly light today, with final German GDP & U.S new home sales coming up. Central bank speaker slate includes Fed's Powell, Clarida & Brainard as well as BoE's Bailey, Broadbent, Vlieghe, Haskel & Haldane.

FOREX OPTIONS: Expiries for Feb24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-05(E627mln), $1.2035-50(E768mln), $1.2090-1.2100(E1.2bln), $1.2130-35(E1.1bln-EUR puts), $1.2150-60(E1.6bln), $1.2170-90(E2.0bln-EUR puts), $1.2200-10(E728mln)

- USD/JPY: Y103.70-80($1.6bln), Y103.95-15($1.2bln), Y105.00(E1.7bln-USD puts), Y105.65-80($3.4bln), Y105.95-15($1.3bln), Y106.70-75($580mln), Y107.00-05($1.0bln)

- EUR/GBP: Gbp0.8650(E534mln), Gbp.0.8700-20(E614mln)

- AUD/USD: $0.7700-15(A$1.2bln), $0.7800(A$1.4bln), $0.7850(A$529mln), $0.7865-75(A$1.8bln), $0.7910(A$1.2bln), $0.7950(A$604mln)

- USD/CAD: C$1.2690-1.2700($1.3bln)

- USD/CNY: Cny6.50($784mln-USD puts)

- USD/MXN: Mxn20.50($714mln), Mxn20.64-65($556mln)

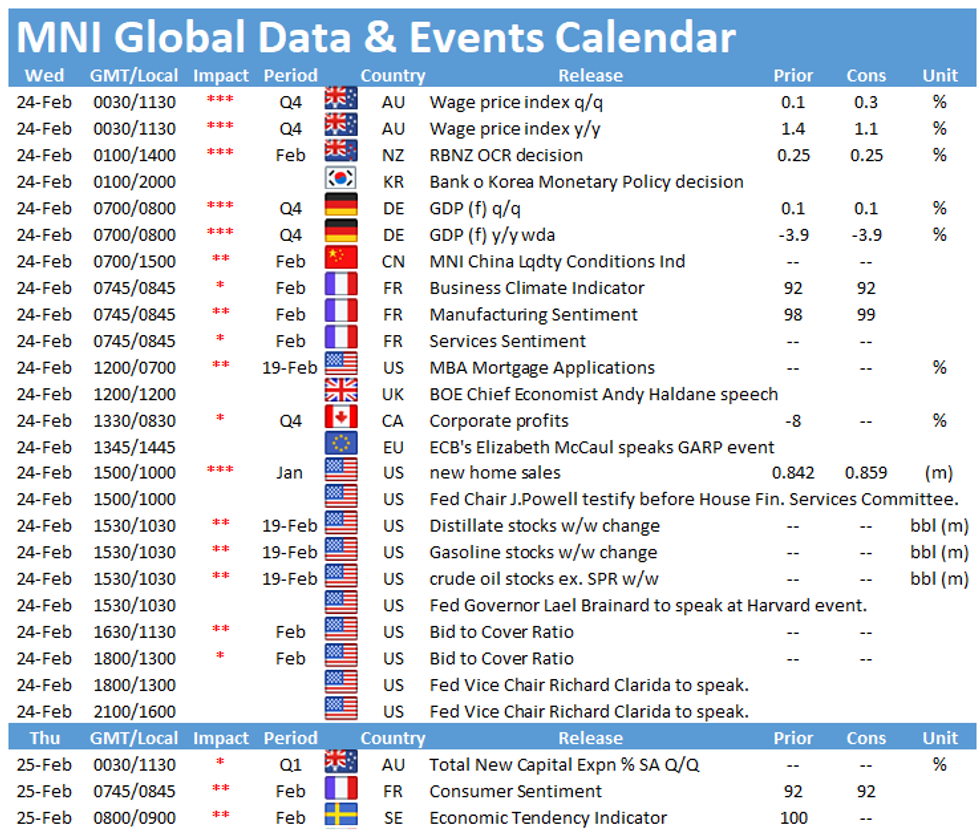

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.