-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessChicago Business Barometer™ - Increases to 45.5 in February

Chicago Business Barometer™ - Increases to 45.5 in February

MNI EUROPEAN OPEN: Fed QE Tweaks Flagged

EXECUTIVE SUMMARY

- FED CHAIR POWELL: LOOKING FOR SERIES OF STRONG JOB REPORTS (MNI)

- FED'S DALY: MUST SEE, NOT JUST EXPECT, SUBSTANTIAL PROGRESS (BBG)

- NY FED'S LOGAN FLAGS POTENTIAL TWEAKS TO QE PURCHASES

- NORTH CAROLINA SITES HALT J&J SHOTS AFTER ADVERSE REACTIONS (AP)

- CREDIT SUISSE TIGHTENS HEDGE FUND LIMITS AMID ARCHEGOS FALLOUT (BBG)

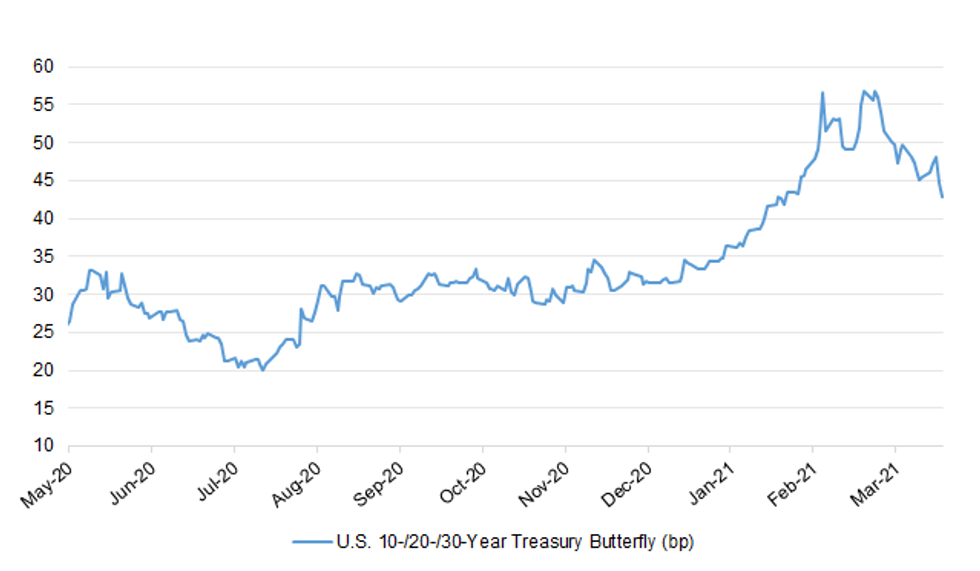

Fig. 1: U.S. 10-/20-/30-Year Treasury Butterfly (bp)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Britons overwhelmingly trust the Oxford-AstraZeneca coronavirus jab despite concerns about blood clots, according to a Times poll that shows the vaccine programme is still on track. Healthy under-30s are being advised to have alternative vaccines after regulators said there was a "strong possibility" that the Oxford vaccine had caused fatal clots. However, ministers and government scientists have begun a campaign to retain public confidence, highlighting that the type of clot involved is "vanishingly rare". The poll by YouGov, carried out after the change in the official guidance on Wednesday, found 75 per cent of people considered the Oxford vaccine safe — down only two percentage points since March. The level of public confidence was similar to that for the Pfizer/BioNTech vaccine, which was considered safe by 78 per cent of those polled. (The Times)

CORONAVIRUS: Top UK sports leagues and governing bodies have backed the use of Covid-19 certificates to enable fans to return to stadiums without the need for social distancing, in a bid to ease their financial crises. The sports bodies, including the English Premier League, the Lawn Tennis Association, the Rugby Football Union and the England and Wales Cricket Board, backed the government's review into whether such certificates could be used to open up the economy and reduce limits on social contact. In a letter to party leaders in Westminster, including prime minister Boris Johnson and Labour leader Sir Keir Starmer, the sports bodies advocated, as well as vaccination certificates, technology to verify tests for the virus or for antibodies that suggest people are more resistant to infection. (FT)

ECONOMY: MNI BRIEF: UK Retail Footfall Up Slightly Ahead of Reopening

- UK retail footfall improved marginally ahead of the planned reopening of non-essential businesses, helped by an earlier Easter, the BRC said Friday, with the BRC-Shoppertrak footfall monitor falling by 68.7% in March compared to March 2019*. Warmer weather and consumers feeling more confident about visiting shops provided a small boost to footfall to open retail sites across the month Helen Dickinson CEO of the British Retail Consortium said. Retailers are looking forward to April 12 when non-essential shops reopen. "Non-food retail stores will have lost £30bn in foregone sales over the three lockdowns. It is essential they are able to trade effectively from April 12, and remain open." Dickinson added - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

NORTHERN IRELAND: Rioters have been blasted with water cannon in fresh unrest on the streets of west Belfast. It comes after Northern Secretary Secretary Brandon Lewis admitted Brexit had created "real issues" in the country, but said violence was not the answer. Mr Lewis travelled to the city following riots across Northern Ireland that have involved children as young as 12 and left 55 police officers injured.

EUROPE

FISCAL: MNI SOURCES: EU Covid Funds Seen On Time, At Long-Term Risk

- Germany's Constitutional Court is likely to allow ratification of an EU law underpinning the European Union's EUR750 billion Recovery and Resilience Fund fairly soon, but while European officials say the legislation has been designed with court challenges in mind, they acknowledge a risk that a legal question mark could hang over the post-Covid reconstruction programme into next year - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GERMANY: Russian Direct Investment Fund has started discussions with German government representatives on advanced purchase agreement of Sputnik V vaccine for Germany, Sputnik V said in a tweet on Thursday. (RTRS)

FRANCE: France met its target of inoculating 10 million people with a first dose of vaccine on Thursday, a week ahead of schedule, as the country endures its third lockdown. France opened mass vaccination centers across the country this week in a bid to further accelerate the roll-out of the shots, in a campaign that started sluggishly after the first vaccine was administered on Dec. 27. (BBG)

FRANCE: France's top health body will on Friday say that recipients of a first dose of AstraZeneca's traditional COVID-19 vaccine who are under 55 should get a second shot with a new-style messenger-RNA vaccine, two sources aware of the plans said on Thursday. Reuters had reported on Wednesday that the Haute Autorite de la Sante (HAS), in charge of setting out how vaccines approved by the European Medicines Agency (EMA) should be used in France, was contemplating this possibility. The HAS has now decided to proceed with the plan, the two sources said. Two mRNA vaccines, one from Pfizer and BioNTech and one from Moderna, are approved for use in France. (RTRS)

FRANCE: France will only gradually repair the damage to its public finances from the pandemic, avoiding austerity measures that would hurt economic growth, according to a long-term fiscal plan published late Thursday. The budget deficit won't fall below 3% of gross domestic product until 2027, the finance ministry said. While progress could have been faster, targeting a drop below 3% in 2025, that would have involved major spending cuts and tax increases, an official at the ministry said. The plan will be presented to the European Commission later this month. (BBG)

ITALY: Italy's government is preparing a new stimulus package that will probably be worth more than 32 billion euros ($38.14 billion) to support the economy, Prime Minister Mario Draghi said on Thursday. A senior Treasury official told Reuters earlier that the measures would fund additional grants to businesses forced to close due to coronavirus restrictions and extend an existing debt moratorium for small and medium-sized companies. The extra borrowing will probably push this year's fiscal gap above 10% of gross domestic product (GDP), up from 9.5% in 2020 when the economy shrank by 8.9%, a government source told Reuters on condition of anonymity. (RTRS)

ITALY: Italian Prime Minister Mario Draghi said on Thursday vaccines should for now on only be given to the elderly and appealed to regional governments and individuals not to flout his guidelines. Unlike many other European countries, when Italy launched its vaccination campaign at the end of December, its army of pensioners were not given automatic precedence, despite the fact that they have borne the brunt of the killer disease. The failure to provide swifter protection has cost thousands of lives, experts say. (RTRS)

NETHERLANDS: The Netherlands won't administer the AstraZeneca Covid-19 vaccine to people under the age of 60 for the time being, Health Minister Hugo de Jonge said, according to a report on Dutch news agency ANP. (BBG)

PORTUGAL: Portugal's Directorate-General for Health says it now recommends that AstraZeneca's Covid-19 vaccine be used by people over 60 years old. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody's on Slovenia (current rating: A3; Outlook Stable)

U.S.

FED: MNI BRIEF: Powell Looking For Series of Strong Job Reports

- Federal Reserve Chair Jay Powell said Thursday he's looking for several more strong job reports like the one from March before judging the economic recovery has shown progress toward full employment, adding that conditions remain uneven. We got a taste of what faster progress will look like with the March employment report -- close to a million jobs, particularly if you add in the revisions for January and February -- and we want to see a string of ones like that so we can really begin to show progress toward our goals," he said at an IMF forum - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Bullard - Keep Policy Steady Until Recovery

- St. Louis Fed President James Bullard said the Federal Reserve should wait for a more fullsome economic recovery before considering any tightening of monetary policy. "We have a great policy in place for right now," he told a webinar. "We are looking forward for the end of the pandemic but it hasn't happened yet" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Minneapolis Fed President Neel Kashkari said Thursday he wouldn't have a knee-jerk panic attack if inflation heats up to a 4% annual rate. "It would depend on why" inflation had hit 4%, Kashkari said in a discussion with Harvard University economist Greg Mankiw sponsored by the Economic Club of New York. It would be important to ascertain whether the high inflation was due to something temporary – like a blockage in the Suez Canal – or something more that was more long-lasting, he said. (MarketWatch)

FED: Federal Reserve Bank of San Francisco President Mary Daly said she's "bullish" on the rebound of the U.S. economy, but there is still a long way before the recovery is complete and will wait for the data to show it. "We said substantial further progress, we have to see it, we don't have to expect it, we have to see it," Daly said during an interview on Bloomberg television with Kathleen Hays. "You still see real pockets of weakness, real pockets of concern." (BBG)

FED: New York Fed Executive Vice President Logan noted the following on Thursday: "the introduction of the 20-year Treasury bond has increased amounts outstanding around the 20-year maturity point. In addition, the pace of increase in TIPS issuance has been slower relative to nominal coupon securities. With net issuance expected to remain high in the near term, we anticipate that the composition of outstanding supply will continue to evolve. As a result, we plan to make minor technical adjustments to our purchase sectors and increase the frequency at which we update purchase allocations to remain roughly proportional to the outstanding supply of nominal coupon securities and TIPS. We expect to announce these as a part of a normal purchase calendar release in coming months." (MNI)

FED: MNI POLICY: Fed Expects to Expand ONRRP Eligibility -- Logan

- The Federal Reserve will offset downward pressure on money market rates by focusing policy adjustments on its overnight reverse repo facility including possibly expanding counterparty eligibility in coming months, and if undue downward pressure were to lower the fed funds rate more than the central bank would hike policy rates, New York Fed's market chief Lorie Logan said Thursday. The Fed's benchmark rate, the effective federal funds rate, and other overnight unsecured rates have "softened modestly," said Logan in a speech at the Annual Primary Dealer Meeting, but downward pressure on overnight repo rates have been "more pronounced" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: President Joe Biden plans to request $715 billion for his first Pentagon budget, a decrease from Trump-era spending trends, according to three people familiar with the plans. The White House plans to release an outline Friday of Biden's spending priorities, including defense. The plan had been widely expected last week, but its release was delayed in part because of disagreements over defense spending. The three people asked not to be named because the budget isn't yet public. The $715 billion Pentagon "topline" is likely to be presented as a compromise to Democrats pressing for cuts in defense spending, as some of the money would be slated for the Pentagon's environmental initiatives, two of the people said. (BBG)

FISCAL: MNI BRIEF: US Treasury Aims for June Cash Balance of $500B

- The U.S. Treasury Department will continue to aim to end the month of June with a cash balance of USD500 billion, Deputy Assistant Secretary for Federal Finance Brian Smith said Thursday. The Treasury Department announced in early February it would aim to lower its cash holdings to USD800 by the end of March and to USD500 by the end of June. But Treasury missed the March goal, currently holding just under USD1 trillion, even as a debt limit nears requiring the cash balance to be lowered to USD133 by August 1 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: Wisconsin reported 1,046 new cases on Thursday, the most in almost two months. At least half the recent samples sequenced are one of five virus variants, and cases are growing fastest among those under 18 years old, said Ryan Westergaard, a chief medical officer of the state Department of Health Services, the Wisconsin State Journal reported. "We are in a new phase of the epidemic that is clearly worse than we were before, and it's transmission among young people who are driving the change in the curve," he said. One-third of the state has received at least one dose of vaccine, and all people 16 and older became eligible on Monday. (BBG)

CORONAVIRUS: Governor Mike DeWine said that new infections in Ohio are "moving in the wrong direction" but "we can still turn this around" if more people get vaccinated. "We're in a race. It's a life and death race," the Republican governor said at press briefing on Thursday. (BBG)

CORONAVIRUS: Florida on Thursday filed a federal lawsuit to force the Biden administration to scrap regulations that are blocking the cruise industry from resuming operations. Gov. Ron DeSantis announced the lawsuit in Miami, where he sharply criticized federal authorities because they have "mothballed" cruise ships for the past year due to the Covid-19 pandemic. (POLITICO)

CORONAVIRUS: The U.S. stockpile of the controversial AstraZeneca coronavirus vaccine has grown to more than 20 million doses, according to people familiar with the matter, even as the shot looks increasingly unlikely to factor into President Joe Biden's domestic vaccination campaign. AstraZeneca has yet to request Food and Drug Administration authorization for the two-dose vaccine, and the company faces safety questions abroad and scrutiny from U.S. regulators who've already rebuked it for missteps during clinical trials and partial data releases. (BBG)

CORONAVIRUS: The U.S. government will allocate 85% fewer Johnson & Johnson doses to states next week, according to data from the Centers for Disease Control and Prevention, due to uneven production related in part to problems at a Baltimore manufacturing plant. Allocations will fall to 785,500 doses from 4.95 million this week. (Nikkei)

CORONAVIRUS: North Carolina health officials said on Thursday that they stopped administering Johnson & Johnson doses at a mass vaccination site in Raleigh and at clinics in Hillsborough and Chapel Hill after at least 26 people experienced adverse reactions, including fainting. Four people were taken to hospitals for further examination, and state and federal health officials are reviewing the matter. The U.S. Centers for Disease Control and Prevention noted that reactions like fainting are not uncommon after someone is vaccinated, though it is reviewing reports of adverse reactions in North Carolina and three other states. All those taken to hospitals are expected to recover, local health officials said. (AP)

CORONAVIRUS: A community vaccination site in a Denver suburb that closed Wednesday after 11 people who received Johnson & Johnson jabs fell ill has reopened. Colorado Governor Jared Polis said there "weren't any issues" with the vaccines. "Maybe they were dehydrated or scared of needles," Polis said at a Thursday news conference. Two people were taken to a hospital for observation. The others received first aid at the site, including swigs of orange juice and water. (BBG)

OTHER

U.S./CHINA: The Biden administration took its first trade action against China on Thursday, adding seven Chinese supercomputing developers to an export blacklist for assisting Chinese military efforts in a move that will likely further escalate frosty tensions between the world's two largest economies. (Nikkei)

GEOPOLITICS: The EU should increase dialogue with China to build trust and not become a "grunt" in a Cold War against China led by the U.S., said China Daily in an editorial. China's plans to pursue green development, upgrade consumption and further open up its market complement the EU's recovery plan, the Daily said, commenting after President Xi Jinping told Chancellor Angela Merkel to maintain EU "strategic independence." The EU has seemingly "jumped into bed" with the new U.S. administration by imposing unilateral sanctions on China for alleged human rights abuses in Xinjiang, and calling off a meeting on the concluded investment treaty, the Daily said. (MNI)

GLOBAL TRADE: The Biden administration has put a big focus on addressing an ongoing shortage of semiconductors that are used in a range of devices from cars to computers, White House Press Secretary Jen Psaki said on Thursday. She said national security adviser Jake Sullivan and National Economic Council director Brian Deese would lead a meeting on the issue next week as part of the ongoing efforts. "I wouldn't say I'm predicting an outcome or an announcement immediately coming out of it," Psaki said, referring to the April 12 meeting. (RTRS)

GLOBAL TRADE: World Trade Organization Director General Ngozi Okonjo-Iweala said on Thursday that trade has been more resilient than expected during the coronavirus pandemic and is forecast to grow 8% this year, helping to support a recovery in economic growth. "Trade, we hope, can contribute more," Ngozi told an economic forum during the International Monetary Fund and World Bank meetings. "First, by making vaccines, more available, by lowering export restrictions, working with manufacturers to offer volumes and getting more of the vaccines around the world. And secondly, I think a strong multilateral trading system can contribute so much to the international recovery." (RTRS)

GLOBAL TRADE: China will review anti-dumping duty over unbleached sack paper from the U.S., EU and Japan for a year from Saturday, the Ministry of Commerce says in a statement. The duties will continue to be collected during the review. (BBG)

CORONAVIRUS: The EU has exported more than 80 million vaccine doses since the beginning of February, a document with updated data circulated among the bloc's governments and seen by Bloomberg shows. A total of 112 million doses had been delivered to EU member states as of April 5, according to the memo circulated to diplomats in Brussels. Japan has overtaken the U.K as the main export destination, getting 17.7 million shots produced in the EU, versus 13.3 million for shipment to Britain. European governments have been under pressure to curb exports as their rollout lags behind vaccination rates in the U.S and the U.K. However, out of the 534 export requests submitted by drugmakers so far, only one has been refused and two are pending, according to the memo dated April 8. (BBG)

JAPAN: The Japanese government on Friday is set to designate Tokyo and two other prefectures as requiring stronger measures to fight COVID-19 amid a resurgence in infections, less than three weeks after lifting a state of emergency. The measures, expected to include bringing forward the closing time for restaurants and bars by one hour to 8 p.m. in densely populated areas, will come into effect on Monday and last through May 5 for Kyoto and Okinawa prefectures, and May 11 for Tokyo, government officials said. Tokyo, which will stage the Olympics in less than four months, has reported more than 500 new coronavirus cases for two days in a row, its worst streak since early February. Prime Minister Yoshihide Suga will finalize the decision at a COVID-19 task force meeting in the evening. (Nikkei)

AUSTRALIA: New South Wales has temporarily halted the rollout of the AstraZeneca coronavirus vaccine amid its links to blood clots. The rollout has been paused on Friday morning after health advice recommended that people under the age of 50 should get the Pfizer vaccine instead. The advice came following links between a blood clotting disorder and the AstraZeneca vaccine globally. (7 News)

AUSTRALIA: Australia has secured another 20 million doses of the Pfizer coronavirus vaccine as the federal government overhauls its COVID-19 vaccination plans. (ABC)

RBA: MNI BRIEF: RBA Sees Benefits From Home Prices, Risk In Retail

- The booming Australian housing market has reduced near term risks to household balance sheets and more than halved the number of mortgage holders facing negative home equity to just 1.25% but the withdrawal of fiscal stimulus could slow income growth and challenge housing affordability for low income households, according to the Reserve Bank of Australia's quarterly Financial Stability Review released Friday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SOUTH KOREA: South Korea will retain its current social distancing measures, including the ban on the gatherings of five or more people nationwide, the prime minister said Friday. The curfew on businesses, such as cafes and karaoke rooms, currently at 10 p.m., however, can be readjusted to 9 p.m. at any time, Prime Minister Chung Sye-kyun said during a regular COVID-19 response meeting in Seoul. The remarks came as the country's health authorities were planning to announce details of new distancing guidelines, which will be implemented starting next week, later in the morning. (Yonhap)

CANADA: MNI REALITY CHECK: Canada Job Mkt Seen Lukewarm Amid Shutdowns

- Canadian firms are looking to hire as they rebuild production but a full recovery is unlikely in 2021 as pandemic restrictions temper demand and make it difficult to recruit workers, industry sources told MNI. Canadian payrolls are seen rising by 90,000 in March, lowering the unemployment rate to 8% from 8.2%, according to an economist consensus ahead of a Statistics Canada report due Friday at 8:30 EST. That's a slowdown from the gain of 259,200 jobs in February when governments were relaxing health restrictions. Even with renewed curfews and stay-at-home orders this month, firms still expressed optimism about continued hiring gains - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

TURKEY: The Turkish Foreign Ministry summoned the Italian ambassador while Foreign Minister Mevlüt Çavuşoğlu strongly condemned Italian Prime Minister Mario Draghi's "unacceptable statements" about President Recep Tayyip Erdoğan. Ambassador Massimo Gaiani, who has been serving as the Italian ambassador in Turkey since January 2019, was summoned over Draghi's remarks, in which he called President Erdoğan a "dictator." (Daily Sabah)

BRAZIL: Brazil registered a record 4,249 deaths on Thursday, pushing the total to 345,025, the Health Ministry said. Confirmed cases rose by 86,652, totaling almost 13.3 million as the pandemic continues to worsen in Latin America's largest country. Butantan Institute, which is responsible for producing Sinovac vaccine in the country, had issues importing raw material from China, forcing it to temporarily halt its output. The material for the shot will arrive about 10 days later than initially expected, the institute said in a statement. Sinovac's vaccine is the most used in the country. President Jair Bolsonaro has argued against lockdowns, suggesting on Wednesday there's little point because the virus is "here to stay." A poll last week reported a 48% disapproval rating for his government, compared with 31% in October. (BBG)

BRAZIL: Congress will carry out Brazil Supreme Court Justice Luis Roberto Barroso's decision to start a special congressional inquiry on the President Jair Bolsonaro administration's handling of the pandemic, but it is a mistake that may affect the debate around the 2022 elections, Senate President Rodrigo Pacheco said during a press conference this Thursday. Decision disregards Brazil's ongoing moment. Investigation may generate legal uncertainty and interfere with vaccine purchases. (BBG)

BRAZIL: A political agreement on country's annual budget had been reached, the problem is "how to deliver it", Economy Minister Paulo Guedes says during an online event. It's normal to have mistakes made here and there, the expectation is that all ends well, minister says. (BBG)

BRAZIL: Brazil's government coffers will be boosted by 160 billion reais ($29 billion) in cash returned by public banks by the end of next year, Treasury Secretary Bruno Funchal said on Thursday, which should lower the government's debt by two percentage points of gross domestic product. In a live online event hosted by the Broadcast real-time news outlet, Funchal also said the Treasury's liquidity cushion covering more than six months of debt maturities is "extremely robust," and Brazil wants to extend its debt profile. (RTRS)

BRAZIL: Brazil's benchmark Selic interest rate is set to reach its neutral level next year, a central bank director said on Thursday, adding that policymakers' baseline scenario is for a Selic of 3% in real terms, or 6%-6.5% in nominal terms. In one of the first times a policymaker has offered specific estimates of the so-called neutral rate, economic policy director Fabio Kanczuk said current information and forecasts suggest it would be "very weird" for the Selic to reach its neutral level this year. "If (we) increase the Selic rate in all the meetings, reaching the neutral rate, I get inflation that is too low in the relevant horizon. So it looks like it's too much tightening, so I have to go slower than that," he said in an online event hosted by BNY Mellon. (RTRS)

BRAZIL: The dynamics driving Brazil's currency are improving and the market is now more balanced, despite lingering fiscal uncertainty, central bank monetary policy director Bruno Serra said on Thursday. In an online debate hosted by event management company Consulting House, Serra said the central bank's market interventions earlier this year have helped greatly, while the capital flows picture for the real is also brighter. "The trend for the foreign exchange market is for a much better flow in 2021 and 2022 than 2019 and 2020," Serra said, noting the $9 billion FX inflow in the first quarter of this year was the highest since 2012. (RTRS)

RUSSIA: Russia has more troops on Ukraine's eastern border than at any time since 2014, when it annexed Crimea and backed separatist territory seizures, and the United States is concerned by growing "Russian aggressions," the White House said on Thursday. The United States is discussing its concerns with its NATO allies, White House Press Secretary Jen Psaki told a briefing. (RTRS)

RUSSIA: The United States is considering sending warships into the Black Sea in the next few weeks in a show of support for Ukraine amid Russia's increased military presence on Ukraine's eastern border, a US defense official told CNN Thursday. The US Navy routinely operates in the Black Sea, but a deployment of warships now would send a specific message to Moscow that the US is closely watching, the official said. The US is required to give 14 days notice of its intention to enter the Black Sea under a 1936 treaty giving Turkey control of the straits to enter the sea. It is unclear if a notice has yet been sent. (CNN)

IRAN: Iran's chief negotiator at nuclear talks in Vienna said the sides were focusing on removing U.S. sanctions in a single step, in a statement of progress that didn't specify what Tehran was offering in return. "We are negotiating the removal of sanctions all at once, specifying which sanctions and how, their details. All of these have to be precisely clarified," Abbas Araghchi, who's leading Iran's team of negotiators, said on Thursday. The U.S. has so far ruled out unilaterally removing sanctions in order to get Iran to return to enrichment parameters set by the 2015 agreement. The Islamic Republic says Washington must move first as it was the party that abrogated the deal. (BBG)

IRAN: A South Korean-flagged tanker and its captain detained in Iran in January have been released, the foreign ministry in Seoul says. Iran seized the Hankuk Chemi near the strategic Strait of Hormuz, accusing it of violating pollution rules. All the 20 crew members were set free in February, apart from the captain. (BBC)

MIDDLE EAST: The Saudi-led coalition destroyed a Houthi explosives-laden drone fired in the direction of the southern Saudi city of Jazan, state TV reported on Thursday. Houthi military spokesman Yahya Sarea said on Twitter that Houthis targeted warplane hangars in the Jazan airport with a drone. He said the "hit was precise". The coalition, which intervened in Yemen in March 2015, has often retaliated to cross-border attacks on Saudi Arabia with air strikes in Yemen. (RTRS)

MARKETS: Credit Suisse Group AG is tightening the financing terms it gives hedge funds and family offices, in a potential harbinger of new industry practices after the Archegos Capital Management blowup cost the Swiss bank $4.7 billion. Credit Suisse has been calling clients to change margin requirements in swap agreements so they match the more restrictive terms of its prime- brokerage agreements, people with direct knowledge of the matter said. Specifically, Credit Suisse is shifting from static margining to dynamic margining, which may force clients to post more collateral and could reduce the profitability of some trades. A spokeswoman for Credit Suisse had no comment. (BBG)

OIL: Saudi Arabia remains confident that the OPEC+ agreement to increase output over the next three months was the right move, said its energy minister. "It's still a good decision," Prince Abdulaziz bin Salman said in an interview in Riyadh on Thursday. "I don't see anything yet that disturbs us, me or my colleagues at OPEC. (BBG)

OIL: The fate of the Dakota Access pipeline could be decided at a U.S. court hearing Friday, where federal regulators could set in motion a months-long shutdown of the line while the Biden Administration completes an environmental review. The market has been increasingly worried about a possible shutdown as the White House aims to reduce the nation's reliance on fossil fuels and address concerns of minority communities harmed by carbon emissions. Biden's administration has restricted oil-and-gas leasing on federal lands and cancelled permits for the proposed Canada-to-U.S. Keystone XL line and a U.S. Virgin Islands refinery expansion. (RTRS)

CHINA

CORONAVIRUS: China's ambitious efforts to vaccinate 560 million people by the end of June is running into a supply shortage, forcing health authorities to extend the intervals between doses, and leaving some people unable to book second shots. The supply bottleneck comes as China's vaccination roll out accelerates to nearly 5 million doses a day, the fastest in the world, though the proportion of its vast population covered still lags behind the U.S., Israel and other leading inoculating nations. While China gets its vaccine supply from domestic manufacturers, thus giving it more control than most countries which are struggling to secure doses, the accelerated pace is pushing the limits of what its homegrown makers can churn out, said people familiar with the matter.

CURRENT ACCOUNT: China sees little risk of large-scale capital outflows despite the rise in U.S. Treasury yields and the appreciation of the dollar, the China Securities Journal said. China's economic fundamentals are solid with the growth forecast at 8.4% in 2021 according to the IMF, and its stable debt structure along with normal monetary policy will enhance the advantage of CNY assets, it said. China's opening policies will also overshadow any marginal capital flow pressure, the Journal said citing Zhang Yu, Huachuang Securities' macro chief analyst. (MNI)

REGULATORY: China will enhance the governance and regulation of local financial institutions to improve the regional financial environment, said the Financial Stability and Development Commission headed by Vice Premier Liu He in a statement on Gov.cn. Local financial institutions should better serve small businesses and local residents to maintain a balance between financial supply and demand, the statement read. The Commission also urged the better use of IT to improve efficiency, and punishment for those failing to carry out their duties and avoid improper government interventions to stimulate the innovation of local financial institutions. (MNI)

NPLS: MNI EXCLUSIVE: China's Big Banks To See More Bad Loans

- China's big national banks will face a rise in bad loans and greater pressure to sell distressed debt this year due to the overhang from the massive covid-driven lending spree and defaults that are likely as credit tightens, policy advisors told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

OVERNIGHT DATA

CHINA MAR CPI +0.4% Y/Y; MEDIAN +0.3%; FEB -0.2%

CHINA MAR PPI +4.4% Y/Y; MEDIAN +3.6%; FEB +1.7%

AUSTRALIA MAR AIG SERVICES PMI 58.7; FEB 55.8

The Australian Industry Group Australian Performance of Services Index (Australian PSI®) rose by 2.9 points to 58.7 points (seasonally adjusted) in March 2021 indicating a stronger pace of recovery following the COVID-19 recession of 2020. This was the highest monthly result in the Australian PSI® since June 2018. Results above 50 points indicate expansion in the Australian PSI®, with higher numbers indicating a stronger expansion. All five of the services sectors available in the Australian PSI® in March indicated strong rates of recovery, with monthly results well above 50 points (seasonally adjusted). Four activity indicators - sales, new orders, stocks and deliveries - showed robust recovery in the month but the employment index indicated stable or mildly decreasing employment in March. (AiG)

NEW ZEALAND MAR ANZ TRUCKOMETER HEAVY +2.8% M/M; FEB +3.3%

Heavy traffic (trucks and buses) primarily reflects the movement of goods, while light traffic is all about the movement of people. In March, both types of traffic increased (seasonally adjusted). The Light Traffic Index rose 1.7% versus February, while the Heavy Traffic lifted 2.8%. The data will be hard to interpret over the next couple of months due to both the regionalised snap lockdowns last month, and as the seasonal adjustment process struggles to make sense of the plunge a year ago. The spike in annual growth this month is due to the lockdown in March-April 2020, and it's also causing larger-than-normal revisions in the seasonally adjusted data. We'll wait and see where things settle. But in the big picture, traffic seems to be back on trend. (ANZ)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This keeps liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.0999% at 09:22 am local time from the close of 1.9752% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 35 on Thursday vs 37 on Wednesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5409 FRI VS 6.5463

People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5409 on Friday, compared with the 6.5463 set on Thursday.

MARKETS

SNAPSHOT: Fed QE Tweaks Flagged

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 226.13 points at 29935.11

- ASX 200 down 12.77 points at 6986

- Shanghai Comp. down 25.815 points at 3456.74

- JGB 10-Yr future unch. at 151.30, yield up 0.2bp at 0.100%

- Aussie 10-Yr future up 0.5 ticks at 98.3, yield down 0.7bp at 1.734%

- US 10-Yr future unch. at 132-00, yield up 1.23bp at 1.632%

- WTI crude up $0.09 at $59.69, Gold down $3.91 at $1751.94

- USD/JPY up 8 pips at Y109.34

- FED CHAIR POWELL: LOOKING FOR SERIES OF STRONG JOB REPORTS (MNI)

- FED'S DALY: MUST SEE, NOT JUST EXPECT, SUBSTANTIAL PROGRESS (BBG)

- NY FED'S LOGAN FLAGS POTENTIAL TWEAKS TO QE PURCHASES

- NORTH CAROLINA SITES HALT J&J SHOTS AFTER ADVERSE REACTIONS (AP)

- CREDIT SUISSE TIGHTENS HEDGE FUND LIMITS AMID ARCHEGOS FALLOUT (BBG)

BOND SUMMARY: Little Changed, Fed Purchase Tweaks & ACGB Syndication Headline

A pocket of TYM1 futures buying allowed an uptick from lows in early Asia dealing, before some light pressure for Aussie bonds resulted in some (very modest) pressure for Tsys. T-Notes last -0-00+ at 131-31+, holding to a narrow 0-04 range. Cash Tsys sit little changed to 1.5bp cheaper. A reminder that late NY trade saw some outperformance for 20s on the back of comments made by NY Fed's Logan, as she pointed to the likelihood of an uptick in 20-Year Tsy purchases from the Fed, as well as a downtick in TIPS purchases given the recent issuance trends. Flow was headlined by a 5.0K block buyer of the TYM1 132.00 calls.

- There was very little to report for JGBs, with the cash market lacking a clear sense of direction, the major benchmarks generally trade within 0.5bp of unchanged at typing. Futures +1. There was a steady trickle of pricing of JPY corporate supply today, with the pipeline also building.

- YM last printing at unchanged levels in Sydney, while XM has given back its overnight gains in the wake of the AOFM announcement re: the syndication of the new ACGB Nov '32, +0.5 at typing. As a reminder, some had suggested that the syndication may be delayed until FY21/22, given the government's better than expected fiscal standing, while others had suggested that April provided the best issuance window for the syndication in the remainder of the current FY. Elsewhere, the pricing witnessed at the latest round of ACGB Nov '25 supply was particularly firm, with the weighted average yield printing a little over 1.1bp through prevailing mids at the time of supply (supportive factors were outlined in our auction preview), although the cover ratio wasn't quite as aggressive as what was seen at the previous auction of the line (even when auction size is adjusted for). The RBA's Financial Stability Review & questions re: the local COVID vaccination drive had little, if any, impact on the space.

JGBS AUCTION: Japanese MOF sells Y5.2982tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.2982tn 3-Month Bills:- Average Yield -0.0945% (prev. -0.0930%)

- Average Price 100.0254 (prev. 100.0250)

- High Yield: -0.0930% (prev. -0.0893%)

- Low Price 100.0250 (prev. 100.0240)

- % Allotted At High Yield: 77.2783% (prev. 47.1065%)

- Bid/Cover: 3.825x (prev. 3.089x)

AUSSIE BONDS: The AOFM sells A$800mn of the 0.25% 21 Nov '25 Bond, issue TB#161:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 0.25% 21 November 2025 Bond, issue TB#161:- Average Yield: 0.5614% (prev. 0.4531%)

- High Yield: 0.5625% (prev. 0.4550%)

- Bid/Cover: 4.1750x (prev. 8.1167x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 66.9% (prev. 12.9%)

- bidders 50 (prev. 36), successful 12 (prev. 11), allocated in full 6 (prev. 3)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- Subject to market conditions, a new 21 November 2032 Treasury Bond is planned to be issued via syndication in the week beginning 12 April 2021. The Joint Lead Managers for the planned syndication of the new 21 November 2032 Treasury Bond in the week beginning 12 April 2021 are Commonwealth Bank of Australia; Deutsche Bank; UBS AG, Australia Branch; and Westpac Banking Corporation.

- On Tuesday 13 April it plans to sell A$150mn of the 0.75% 21 November 2027 Indexed Bond.

- On Thursday 15 April it plans to sell A$500mn of the 23 July 2021 Note & A$500mn of the 24 September 2021 Note.

EQUITIES: Mixed

Another mixed picture for equity markets to end the week. Markets in mainland China lost ground after robust inflation figures prompted speculation the PBOC could be forced into tightening monetary policy sooner than expected. Japanese indices were in positive territory but off highs as the government is set to impose virus restrictions in Tokyo, Kyoto and Okinawa. Markets in South Korea struggled as officials said the country may be on the brink of a fourth wave of coronavirus and extended social distancing measures for three weeks, with the potential for extra measures.US futures are higher, building on another record close yesterday after reassurances from a number of Fed speakers including FOMC Chairman Powell.

OIL: Treading Water In Asia

Crude futures struggled for direction on Friday; WTI is up $0.08 from settlement levels at $59.68/bbl, while Brent is $0.05 lower at $63.15/bbl. The benchmarks are on track for a weekly decline, tracking losses of 2.9%. Crude is treading water, buffeted by the competing influences of additional lockdowns in Europe and a weaker greenback. Yesterday Saudi Arabia's energy minister Prince Abdulaziz bin Salman said he was confident in the OPEC+ decision to gradually increase output over the next three months, adding that output decisions can be adjusted if needed.

GOLD: Bulls Look To Clear Next Hurdle

Unchanged U.S. real yields and a softer DXY have combined over the last 24 hours, allowing bullion to nudge higher over that horizon, although gold has held to a confined range during Asia-Pac hours, last dealing little changed, just below $1,755/oz. Yesterday's high and the 50-Day EMA provide the immediate points of resistance.

FOREX: Caution Prevails In Lacklustre Asia-Pac Trade

A degree of caution crept into G10 FX space, with most currency pairs happy to hold tight ranges amid little in the way of fresh catalysts crossing the wires. The DXY moved away from its monthly low of 92.00, but remains poised for a weekly loss after crossing below its 200-DMA a couple of days back.

- USD/JPY wavered around neutral levels, ahead of today's expiry of $1.55bn of options with strikes at Y109.15 & $1.1bn of USD puts with strikes at Y109.25-50.

- AUD brought up the rear in the G10 basket as the gov't released guidance advising against inoculating under 50s with the AstraZeneca product & NSW temporarily suspended vaccinations with the jab. Elsewhere, the RBA's FSR flagged that regulators are closely monitoring house-price growth.

- The PBOC set its central USD/CNY mid-point at CNY6.5409, 14 pips below sell side estimates. The redback looked through China's above-forecast CPI & PPI prints. USD/CNH oscillated around neutral levels, sticking to yesterday's range. Implied USD/CNH volatilities fell across the curve, with 1-month tenor seen at its lowest levels since Jul 2020.

- German industrial output, Canadian unemployment, Norwegian CPI and central bank speak from Riksbank's Ingves & Breman, ECB's de Guindos & Fed's Kaplan take focus today.

FOREX OPTIONS: Expiries for Apr09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E904mln), $1.1780(E789mln), $1.1800-05(E1.0bln), $1.1850(E1.2bln-EUR puts), $1.1885-00(E954mln), $1.2000(E583mln)

- USD/JPY: Y109.15($1.55bln), Y109.25-50($1.1bln-USD puts), Y109.75($632mln-USD puts), Y110.45-55($765mln), Y111.00($605mln)

- AUD/USD: $0.7600-20(A$975mln-AUD puts)

- AUD/JPY: Y83.25(A$450mln-AUD puts)

- NZD/USD: $0.6948-50(N$1.35bln-NZD puts), $0.7050(N$521mln-NZD puts)

- USD/CAD: C$1.2540-50($705mln), C$1.2600 ($1.36bln-USD puts), C$1.2635-50($734mln)

- USD/CNY: Cny6.40($800mln), Cny6.4450-65($759mln)

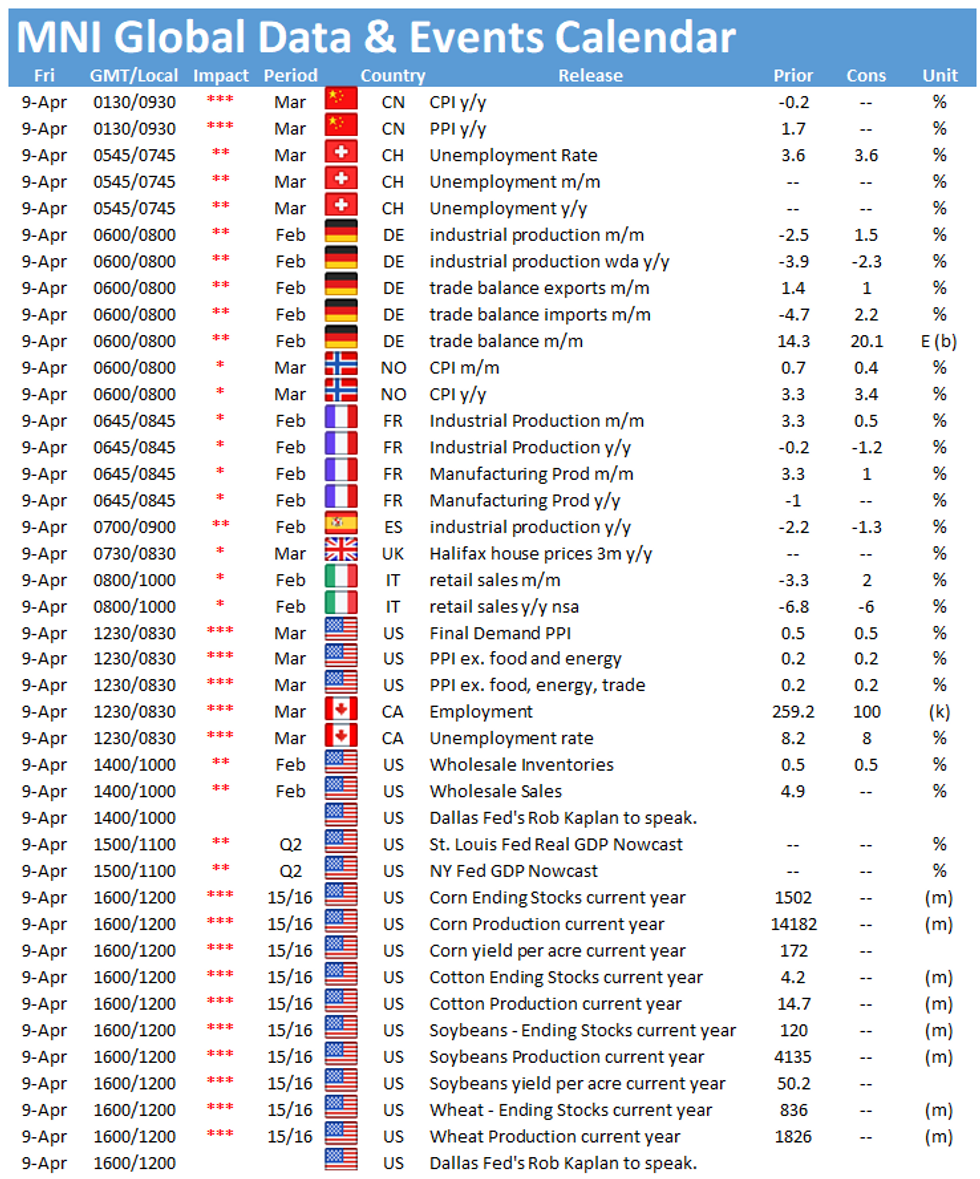

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.