-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Initial Risk-Off Partially Unwound

- Negatives surrounding Russian tensions outweigh some apparent thawing in the Iranian situation, but early risk-off impetus fades through Asia-Pac trade.

- U.S. fiscal questions remain evident.

- A light docket to start the week, with the Fed now in its blackout period.

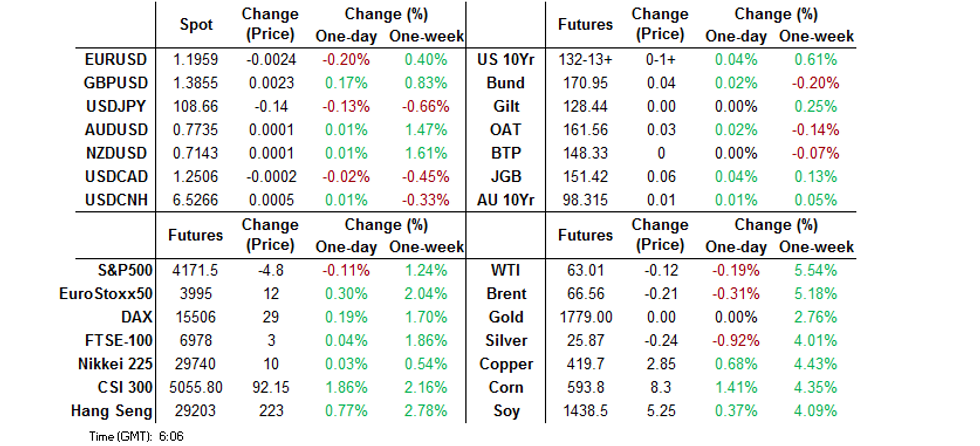

BOND SUMMARY: Core FI Marginally Firmer To Start The Week

Overnight trade saw Tsys draw some early support from geopolitical tensions surrounding Russia, while there may have also been some focus on an Axios source piece which noted that "the universe of Democratic senators concerned about raising the corporate tax rate to 28% is broader than Sen. Joe Manchin, and the rate will likely land at 25%," which could pose some hurdles for the broader fiscal impetus in the U.S. T-Notes edged away from highs as e-minis pared their early losses, with the former last trading +0-01+ at 132-13+. The belly outperforms in cash trade with 5- to 10-Year paper richening by ~1.5bp vs. settlement levels as of typing. Asia-Pac flow was headlined by a 20.0K block lift of the TYM1 131.00/130.00 put spread, which saw paper pay 0-11. Monday's local docket is sparse with Fed officials now in the pre-meeting blackout period, leaving broader headline flow in the driving seat at the start of a new week.

- The cash JGB space trades flat to 1.0bp richer at typing, with futures last +7, just shy of best levels. The previously flagged Tokyo state of emergency questions and the broader (modest) risk aversion evident in early trade this week provided initial support for the space, which held even as the Nikkei 225 unwound its early losses. The lunch break saw the Governor of Osaka note that the region will request the implementation of a state of emergency, with Chief Cab. Sec. Kato noting that prompt consideration is required re: the Tokyo & Osaka state of emergency situations, although this round of headline flow failed to drive anything in the way of a notable market reaction. A quick look at the offer/cover ratios witnessed in today's BoJ Rinban operations (note that the 25+ Year operations represented the first round of re-sized operations in that bucket since the well-documented tweaks announced at the back end of March) revealed steady cover for 25+ Year ops and an uptick for the 3- to 5-Year ops. 20-Year JGB supply headlines the local docket on Tuesday.

- The broader defensive feel also fed into the Aussie bond space during early Sydney trade, allowing futures to unwind their overnight losses, while yields sit unchanged to ~1.0bp lower across the major benchmarks in the cash ACGB space. YM +0.5, XM +1.0. at typing. The only real point of note on the local front came in the form of A$ issuance matters, with the launch of TCV's new '33 line headlining there (the deal is set to price on Tuesday). The minutes from the RBA's most recent monetary policy decision headline the local docket on Tuesday.

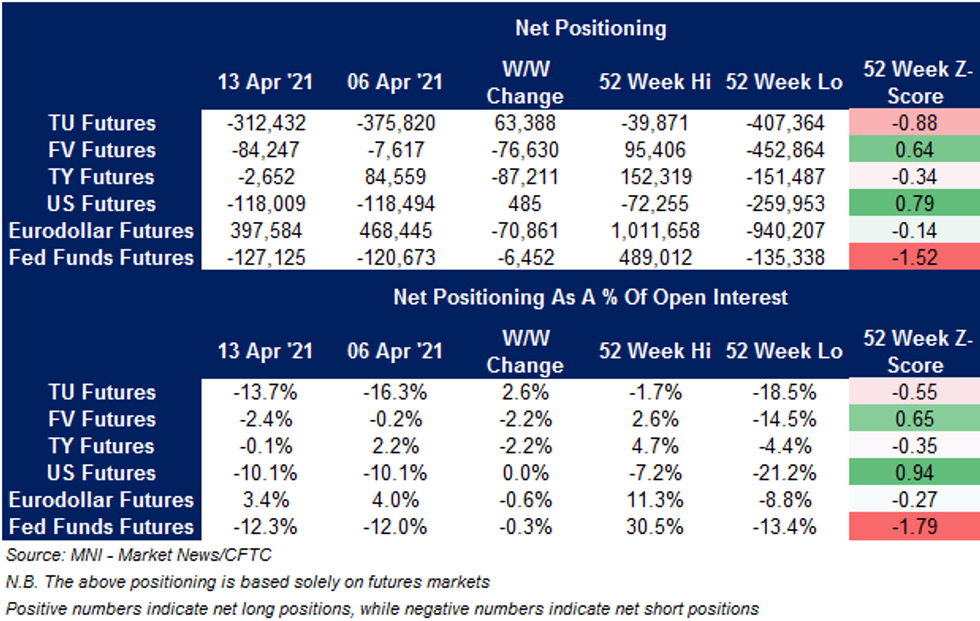

US TSY FUTURES: Mixed Position Adjustments In CFTC CoT

Net positioning swings (per the latest CFTC report) among the major Tsy futures contracts lacked anything in the way of uniform movement, with TU & US seeing reductions in net shorts (although the moves in US were limited), while net FV shorts extended and TY positioning flipped back to net short.

- Eurodollar net longs were trimmed, while net shorts in Fed Funds futures extended.

- We should highlight that the positioning only covers the week to 13 April, so doesn't capture any adjustments to the richening seen in Tsys during the latter part of last week.

FOREX: Geopolitical Angst Inspires Risk-Off Start To The Week

Geopolitical tensions centring on Russia inspired a sense of caution at the start of the week, as the U.S. warned Moscow of "consequences" if Alexey Navalny dies. Risk-off mood dominated Asia-Pac trade, with little in the way of fresh news flow to alter the broader picture. The yen picked up a bid as a result and outperformed in the G10 basket. USD/JPY fell to its lowest levels since Mar 24, while a BBG trader source flagged AUD/JPY sales amid a slide in e-minis.

- The Scandies were the worst G10 performers, with EUR also pressured, as focus remained on Russia. NOK was wounded by slightly softer crude oil prices, although CAD was resilient.

- The PBOC set the central USD/CNY mid-point at CNY6.5233, just shy of sell-side estimate of CNY6.5235. USD/CNY staged a round trip from CNH6.5346.

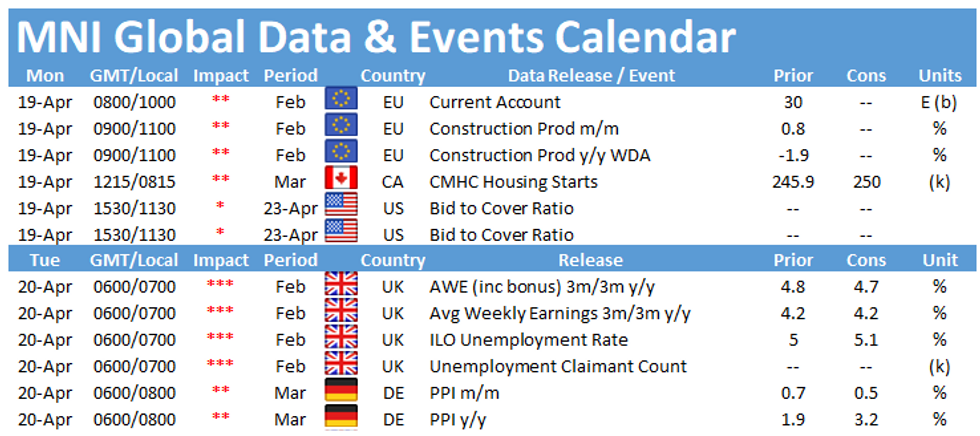

- Today's thin economic docket features Canadian housing starts & comments from Riksbank's Breman.

FOREX OPTIONS: Expiries for Apr19 NY cut 1000ET (Source DTCC)

- USD/JPY: Y108.50($565mln-USD puts), Y108.60-64($1.2bln-USD puts), Y110.00($1.2bln)

- EUR/GBP: Gbp0.8700-10(E519mln-EUR puts)

- AUD/USD: $0.7620-40(A$705mln), $0.7720-30(A$871mln)

- USD/CAD: C$1.2485-90($735mln-USD puts), C$1.2500-10($625mln-USD puts), C$1.2615-25($600mln-USD puts), C$1.2715-25($1.1bln)

EQUITIES: In The Green

Bourses in the Asia-Pac time zone rose on Monday; markets in Hong Kong and mainland China led the gains, with the CSI 300 up over 2%. Markets got boost after China's financial regulator said the bad-debt manager Huarong was operating normally and had ample liquidity. In South Korea markets hit a record high. In the US futures are mixed, Nasdaq futures are in the green, buoyed by the tech sector rally in China, while S&P500 futures and Dow Jones futures are both lower, but off worst levels

GOLD: Testing Resistance

The broader defensive feel witnessed in Asia-Pac trade has resulted in a firmer DXY and lower U.S. Tsy yields, creating cross currents for bullion, with spot last dealing little changed, just shy of $1,780/oz. Last week's high ($1,783.9/oz) capped gains early on this week and provides initial resistance just ahead of the 38.2% retracement of the Jan 6 to Mar 8 sell off ($1,784.8/oz). A break through the latter would allow bulls to focus on $1,800/oz, with any break there exposing the late Feb highs. ETF holdings of gold continue to trend lower, and now sit ~11% shy of the record level of holdings posted back in October, but remain elevated in historical terms.

OIL: Crude Futures Softer But off Worst Levels

Oil is softer to start the week, on track for the second straight session of decline; as WTI & Brent sit $0.20 lower on the day. Oil dropped sharply at the open as risk aversion took hold in Asia, but gradually recovered from worst levels amid thin news flow. Markets assess progress made in US and Iran nuclear talks, with both sides saying talks were constructive and indicting movement in the right direction. The US still insists that the removal of any sanctions will only come once the US has "clarity and confidence" that the Islamic Republic will reduce its nuclear work, heavily curtail enrichment and atomic activity. Elsewhere, senior officials from Saudi Arabia and Iran are said to have been holding talks to repair relations.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.