-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Tax, One Of The Only Certainties

EXECUTIVE SUMMARY

- BIDEN EYEING TAX RATE AS HIGH AS 43.4% IN NEXT ECONOMIC PACKAGE (BBG)

- JAPAN SET TO DECLARE STATE OF EMERGENCY ACROSS SEVERAL PREFECTURES

- PEOPLE IN ENGLAND COULD GET COVID PASSPORTS FOR FOREIGN TRAVEL BY 17 MAY (GUARDIAN)

- ROCKETS HIT U.S. BASE AT BAGHDAD AIRPORT (SUMARIA)

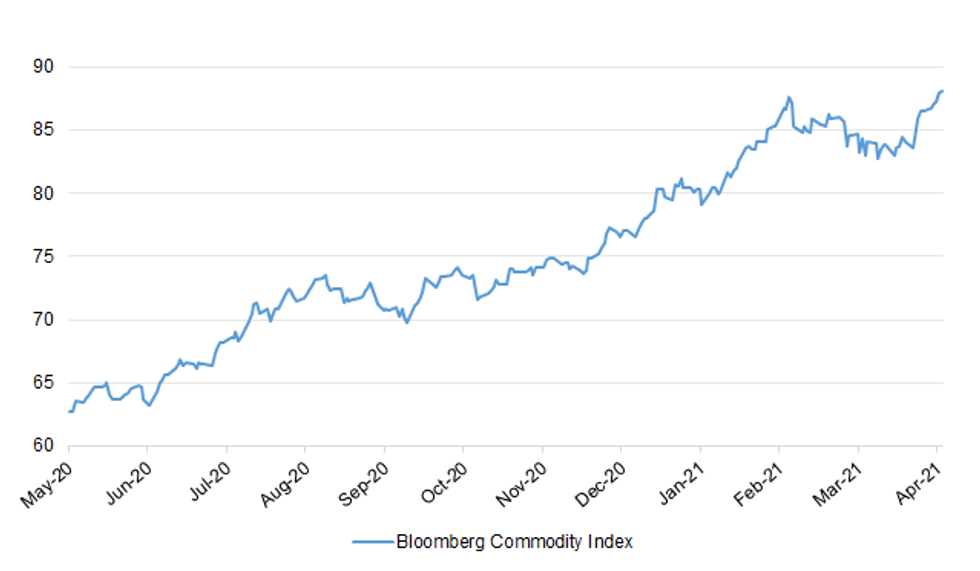

Fig. 1: Bloomberg Commodity Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Millions of people in England could be provided with so-called Covid passports by 17 May to let them take holidays abroad this summer and potentially avoid quarantine when they reach their destination, the Guardian has learned. The documents – likely to be different from domestic Covid certificates, which the government is working on separately – are still under development but should be made available before restrictions on international travel lift next month, sources said. (Guardian)

CORONAVIRUS: UK government scientific advisers are split on whether to recommend that all under-40s should be offered an alternative to the Oxford/AstraZeneca vaccine, as cases of the rare blood-clotting condition linked to it continue to rise. Britain abruptly changed tack last month on the AstraZeneca jab, the mainstay of its vaccination programme, after the Joint Committee on Vaccination and Immunisation (JCVI) advised that all healthy individuals under the age of 30 should be offered an alternative, if available. The move followed growing evidence that the shot could trigger a blood disorder in extremely rare cases and an assessment of the risk it posed in various age groups compared with the benefits. (FT)

ECONOMY: MNI REALITY CHECK: UK Sales Higher On House & Garden Bonanza

- UK retail sales likely topped expectations of a modest rise in March, with industry leaders reporting overwhelming demand for home and garden items during the month, ahead of the relaxation of some social restrictions towards month end. City analysts forecast a modest 1.5% increase for last month after a 2.1% rise in February. However sales are forecast to top March 2020 outturns across the board, after the imposition of a national lockdown on 23 March last year - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: MNI BRIEF: NIESR Urges Scrapping UK Fiscal Rules

- The UK Treasury should scrap its plans to come up with new, detailed fiscal rules, the leading think-tank the National Institute of Economic and Social Research said Friday. The Treasury had planned to unveil new, post-Covid shock rules in the Autumn but NIESR point out that previous self-imposed UK fiscal rules have been short-lived and have been scrapped every time an economic shock hits. They propose instead creating a new fiscal framework, with a Fiscal Council evaluating policy options and the sustainability of the public finances - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLITICS: David Cameron repeatedly lobbied the Bank of England to help grant Greensill Capital access to a state-backed coronavirus support scheme, newly released documents reveal. (Telegraph)

POLITICS: Boris Johnson believes that Dominic Cummings is behind damaging leaks including the disclosure of the prime minister's text messages. A No 10 source claimed that Johnson's former senior adviser was "engaged in systematic leaking" and "bitter about what's happened since he left". (The Times)

RATINGS: Potential rating reviews of note scheduled for after hours on Friday include:

- S&P on the United Kingdom (current rating: AA; Outlook Stable)

EUROPE

GERMANY: German business leaders favor Green Party candidate Annalena Baerbock to succeed Angela Merkel as the country's chancellor, Wirtschaftswoche reported, citing a poll. About 27% of the 1,500 managers surveyed intend to vote for Baerbock in September's election, with around 14% backing Armin Laschet from Merkel's Christian Democratic Union, the magazine said, based on a Civey poll. The Greens selected their chancellor candidate on Monday, a smooth process that drew a contrast with the infighting in Merkel's bloc that dragged on for days before party leaders confirmed Laschet as candidate. (BBG)

GERMANY: German lawmakers accused Finance Minister Olaf Scholz of having caused a security risk by using his private email account to communicate about Wirecard, the payments company that collapsed last year in the biggest auditing scandal in the nation's postwar history. Scholz sent emails related to Wirecard to his ministry and the chancellery via his private account, Hans Michelbach, a lawmaker from the ruling Christian Democratic bloc said at a parliamentary inquiry into the company's downfall. This was a "grave" mistake as it undermined the government's information security, Michelbach said at the hearing where the finance minister testified on Thursday. (BBG)

FRANCE: Prime Minister Jean Castex said France will begin a "cautious" reopening in mid-May, preceded by a gradual easing of domestic travel curbs starting May 3. "The peak of the third wave seems to be behind us," Castex told reporters. The timeline is conditional and not all venues will reopen at once, he said. A 7 p.m. to 6 a.m. curfew, which Castex has called "effective," wouldn't be the first measure to be lifted. France also said travelers from Brazil, India, Chile, South Africa and Argentina would be subject to quarantine to prevent the import of variants. Italy will loosen many restrictions on Monday, Greece will follow in early May and Germany is considering privileges for people who have been immunized. (BBG)

FRANCE: French Interior Minister Gerald Darmanin said on Thursday a 10-day quarantine will be imposed starting from Saturday for travelers from Brazil, Chile, Argentina, South Africa and India. During a press conference, he added there would be strong controls on people from these countries, where the COVID-19 pandemic is still raging, during their quarantine. (RTRS)

ITALY/BTPS: Italy plans to sell up to 3.75 billion euros ($4.5 billion) of 0 percent bonds due Nov 29, 2022 in an auction on Apr 27. The sale is a reopening of previously issued securities with 4.001 billion euros outstanding. Currently the securities are being quoted at a price to yield of -0.333 percent. (BBG)

RATINGS: Potential rating reviews of note scheduled for after hours on Friday include:

- Fitch on Finland (current rating: AA+, Outlook Stable) & the Netherlands (current rating: AAA; Outlook Stable)

- S&P on the European Financial Stability Facility (current rating: AA; Outlook Stable), Greece (current rating: Greece BB-; Outlook Stable) & Italy (current rating: BBB; Outlook Stable)

- DBRS Morningstar on Finland (current rating: AA (high), Stable Trend)

U.S.

FISCAL: President Joe Biden will propose almost doubling the capital gains tax rate for wealthy individuals to 39.6% to help pay for a raft of social spending that addresses long-standing inequality, according to people familiar with the proposal. For those earning $1 million or more, the new top rate, coupled with an existing surtax on investment income, means that federal tax rates for wealthy investors could be as high as 43.4%. The new marginal 39.6% rate would be an increase from the current base rate of 20%, the people said on the condition of anonymity because the plan is not yet public. A 3.8% tax on investment income that funds Obamacare would be kept in place, pushing the tax rate on returns on financial assets higher than rates on some wage and salary income, they said. (BBG)

FISCAL: A group of Senate Republicans led by Sen. Shelley Moore Capito (R-W.Va.) on Thursday unveiled a $568 billion infrastructure proposal, a much smaller counteroffer to President Biden's $2.3 trillion American Jobs Plan. Republicans sent the offer to Biden shortly before noon Thursday. The proposal seeks to define infrastructure more narrowly compared to Biden's expansive view of the issue, focusing on roads and bridges, public transit systems, rail, wastewater infrastructure, airports and broadband infrastructure. (The Hill)

FISCAL: The GOP has forwarded the plan to the White House, said Roger Wicker of Mississippi, the ranking Republican on the Commerce, Science and Transportation Committee and another member of the group. White House Press Secretary Jen Psaki also called the offer a "starting point" for discussions, and said the White House welcomes any good-faith offer. GOP senators backing the plan include John Barrasso of Wyoming, the No. 3 Senate Republican; and Pat Toomey of Pennsylvania, the top Republican on the Banking Committee. (BBG)

FISCAL: Moderate Sen. Joe Manchin, D-W.Va., told reporters in the Capitol the GOP bill is a starting point and he plans to sit down with a bipartisan group to start talking. (NPR)

FISCAL: Some key Republican senators won't rule out raising additional revenue from corporations and told Axios' Kadia Goba and Hans Nichols they're open to closing loopholes that allow big businesses to eliminate their overall tax bill. While Biden's proposal to raise the corporate tax rate from 21% to 28% to pay for his infrastructure plan has been met with near-uniform GOP opposition, there's some appetite to ensure corporations pay more. (Axios)

FISCAL: President Joe Biden will use a speech to Congress next week to outline his "American Families Plan," White House press secretary Jen Psaki said Thursday. The plan is expected to focus on policies including paid family leave, childcare and free community college. Asked about a report that Biden will propose nearly doubling capital gains taxes on wealthy Americans to help pay for the plan, Psaki said she wouldn't get ahead of Biden's final decisions. She reiterated his pledge not to raise taxes on anyone making less than $400,000 a year. (MarketWatch)

CORONAVIRUS: U.S. President Biden tweeted the following on Thursday: "Today, we officially reached our goal of 200 million shots in my first 100 days. Make no mistake: This is an American achievement. It's a powerful demonstration of unity and resolve. And a reminder of what we can accomplish when we come together in pursuit of a common goal." (MNI)

CORONAVIRUS: The University of California and California State University systems are proposing a policy to have students, faculty and staff vaccinated before they return in the fall. (BBG)

OTHER

U.S./CHINA: Two U.S. senators are working to attach legislation to allow automakers to deploy tens of thousands of self-driving vehicles on U.S. roads to a bipartisan China bill, a significant reform that could help speed the commercial use of automated vehicles. (RTRS)

UK/CHINA: The House of Commons has declared for the first time that genocide is taking place against Uyghurs and others in north-west China. More than a million people are estimated to have been detained at camps in the region of Xinjiang The motion approved by MPs does not compel the UK to take action, but is a sign of growing discontent towards the Chinese government in Parliament. Tory Sir Iain Duncan Smith heralded the vote as "a historic moment". He said it brought the UK Parliament in line with Holland, Canada and the United States. Sir Iain was one of five UK parliamentarians sanctioned by China for spreading what it calls "lies and disinformation". (BBC)

UK/CHINA: The Global Times tweeted the following on Friday: "#UK Parliament declaring the so-called genocide against Uygur in Xinjiang is a flat-out lie which violates international law, it's an outrageous smear and a blatant interference which #China strongly opposes." (MNI)

CORONAVIRUS: The head of the World Health Organization called on governments and companies that "control the global supply" to share doses and know-how to increase equitable vaccine distribution. (BBG)

CORONAVIRUS: Pfizer Inc. and Johnson & Johnson officials on Thursday balked at calls from the global community to waive patent rights in favor of broader immunization. Intellectual property rights are critical to ensuring that Covid-19 vaccines can be deployed around the world, said Pfizer's chief patent counsel, Bryan Zielinski. "It would never come out right. It wouldn't taste like Grandma's cookies," said J&J chief intellectual property counsel Robert DeBerardine. U.S. President Joe Biden is facing calls from some lawmakers to back a proposal before the World Trade Organization that seeks a broad waiver of rules on intellectual property right on Covid-19 vaccines. (BBG)

CORONAVIRUS: The Biden administration is weighing an appeal from progressive Democrats to accelerate global access to Covid-19 vaccines by supporting a waiver of intellectual-property protections, a move opposed by big drugmakers. (BBG)

JAPAN: Japan is set to issue a third state of emergency for Tokyo and three western urban prefectures amid skepticism it will be enough to curb a rapid coronavirus resurgence ahead of the Olympics in July. Health and economy ministers in charge of the virus measures were meeting with experts on a government taskforce to obtain their preliminary endorsement for the plan. Prime Minister Yoshihide Suga is set to formally announce later Friday a state of emergency for Tokyo, Osaka and its two western neighbors Kyoto and Hyogo from April 25 through mid-May. Japan's third state of emergency since the pandemic began comes only a month after an earlier emergency ended in the Tokyo area. For days, experts and local leaders said ongoing semi-emergency measures have failed and tougher steps are urgently needed. Past state of emergency measures, issued a year ago and then in January, were toothless and authorized only non-mandatory requests. (AP)

NEW ZEALAND: The New Zealand government is introducing a new category of a "very high risk country" - including India, Brazil, Pakistan and Papua New Guinea - to further bolster the country's defence against Covid-19. These changes come into force at 11.59pm on 28 April. Countries will be initially designated 'very high risk' when there have been more than 50 cases of Covid-19 per 1000 arrivals to New Zealand from those countries in 2021, and where there are more than 15 travellers on average per month. Only New Zealand citizens and their immediate family will be able to travel to New Zealand from these countries. (RNZ)

CANADA: Canada's government said it would temporarily bar passenger flights from India and Pakistan for 30 days starting on Thursday as part of stricter measures to combat the spread of the coronavirus. (RTRS)

TURKEY: Greek Prime Minister Kyriakos Mitsotakis shared his view that a meeting with Turkish President Recep Tayyip Erdogan will take place in the near future, in an interview with Greek TV channel Alpha on Thursday. (Kathimerini)

MEXICO: Mexico's bill to increase government controls over the fuel market won congress approval in the latest blow to the country's historic energy opening to private companies. With 65 lawmakers in favor, 47 opposed, and 6 abstaining, the senate on Thursday passed the proposal from President Andres Manuel Lopez Obrador to expand control over gasoline and diesel distribution, imports and marketing. It also allows the government to suspend permits from fuel-market operators based on national or energy security reasons, and it lets state-owned oil company Petroleos Mexicanos take over their facilities. (BBG)

BRAZIL: Harsh criticism towards Brazil's environmental policies is unjustified, President Jair Bolsonaro said in his weekly live on social media on Thursday. "Deep down, I think there are economic issues at stake": Bolsonaro Environment Minister Ricardo Salles stressed the need to get funds from developed countries to fight deforestation. The development and production of a Brazilian vaccine against Covid-19 depends on the budget, the Minister of Science and Technology, Marcos Pontes, told President Bolsonaro, who promised to help him out while adding that the Economy Minister, Paulo Guedes, is strict when it comes to budget concerns. (BBG)

RUSSIA: President Vladimir Putin said on Thursday that Russia would be prepared to host Ukrainian President Volodymyr Zelenskiy for talks in Moscow at any time convenient for him. (RTRS)

IRAN: Iran has reduced the number of centrifuges enriching uranium to up to 60% purity at an above-ground plant at Natanz to one cluster from two, a report by the U.N. nuclear watchdog seen by Reuters indicated on Thursday. Iran announced the shift to 60%, a big step towards weapons-grade from the 20% it had previously achieved, in response to an explosion and power cut at Natanz last week that Tehran has blamed on Israel. (RTRS)

IRAN: A top U.S. general said on Thursday that Iran had not done anything in its nuclear program that was irreversible. (RTRS)

MIDDLE EAST: At least 3 Katyusha rockets targeted a U.S. military base at Baghdad airport, al-Sumaria News reported, citing security officials. One of the rockets hit the airstrip, al-Sumaria News said without providing further details. (BBG)

MIDDLE EAST: The Saudi-led coalition intercepted two Houthi explosives-laden drones fired at the kingdom's southern region and the city of Khamis Mushait, state TV reported early on Friday. (RTRS)

OIL: a Platts reporter tweeted the following on Thursday: "#OPEC+ will hold to its originally announced plans of holding a full ministerial meeting, in addition to a monitoring committee meeting, on April 28, according to a draft agenda. Exact times still TBD."

OIL: U.S. assets and personnel overseas could be at risk if the country decided to pass a bill against OPEC, known as NOPEC, the head of the Organization of the Petroleum Exporting Countries told member states. In a letter, seen by Reuters, Mohammad Barkindo encouraged member countries to engage with the U.S. administration. "It is essential that member countries reinforce diplomatic bilateral contacts with government officials in the U.S. ... and explain the disadvantages for the U.S. should the NOPEC bill become law". (RTRS)

OIL: California Governor Gavin Newsom is planning to announce a ban on new fracking permits, Politico's energy reporter posted on Twitter. (RTRS)

CHINA

CORONAVIRUS: China will relax its requirements for inbound travelers from Dallas, Tex., allowing those inoculated with a non-Chinese vaccine to apply for the health code required to enter the country, according to a statement from the Chinese Embassy in the U.S. (BBG)

PBOC: The PBOC may expand liquidity in May to fill in a gap of CNY1 trillion due to the upcoming local government special bond issuances and tax remissions, the China Securities Journal reported citing analysts. The PBOC is more likely to use reverse repos than MLFs, the newspaper reported citing analysts. The PBOC has maintained stable liquidity through small daily injections in the scale of CNY10 billion for two months. (MNI)

BOP: Fundamentals of Chinese economy will support foreign investors to keep boosting bond holdings in the country, Wang Chunying, spokeswoman for the State Administration of Foreign Exchange, says at a briefing. Chinese bond yields offer good returns to foreign investors. Yuan-denominated assets are showing safe haven characteristics. 1Q net increase in foreign holdings of Chinese bonds was $63.3b, up 11% from 4Q. China's current-account is expected to post "reasonable" surplus this year; 1Q surplus seen smaller than in 4Q. The increase in China private sectors' foreign assets is a positive sign and the rise can effectively cover foreign debt repayment needs. (BBG)

ECONOMY: Guangdong led Chinese provinces in Q1 in the size of GDP at CNY2.7 trillion yuan and 18.6% growth, followed by Jiangsu's GDP valued at CNY2.6 trillion, China News Service reported. Hubei, where the coronavirus was first reported, bounced back by 58.3% and registered nearly CNY1 trillion, the news agency said. Shandong maintained its rank at CNY1.8 trillion, it said. (MNI)

BANKS: MNI EXCLUSIVE: China To Widen SPB Use To Recapitalise Banks

- China will allow more provinces to use special-purpose bonds to recapitalise regional banks, policy advisors said, a move that could soak up the surplus in such debt, boost lending to small and medium companies and make the banks more attractive for investors - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

OVERNIGHT DATA

CHINA MAR FX NET SETTLEMENT - CLIENTS CNY 132.7BN; FEB 216.8BN

JAPAN MAR CPI -0.2% Y/Y; MEDIAN -0.2%; FEB -0.4%

JAPAN MAR CORE CPI -0.1% Y/Y; MEDIAN -0.2%; FEB -0.4%

JAPAN MAR CORE-CORE CPI +0.3% Y/Y; MEDIAN 0.3%; FEB +0.2%

JAPAN APR, P JIBUN BANK M'FING PMI 53.3; MAR 52.7

JAPAN APR, P JIBUN BANK SERVICES PMI 48.3; MAR 48.3

JAPAN APR, P JIBUN BANK COMPOSITE PMI 50.2; MAR 49.9

The Japanese private sector economy returned to expansion territory for the first time since January 2020, with flash PMI survey data signalling a fractional increase in business activity in April. The improvement in demand conditions was underpinned by growth in new business for the first time in 15 months, as well as a renewed expansion in export sales, which rose at the quickest pace since February 2018. Moreover, employment levels improved for the third month in a row, albeit at a softer pace. That said, the boost in private sector activity was led by the manufacturing sector, as the larger services sector saw business activity deteriorate for the fifteenth month running. While some Japanese private sector businesses noted that a resurgence in COVID-19 cases could dampen prospects in the second quarter of the year, firms remained optimistic that overall business activity would improve in the coming 12 months. That said, there is concern the impact of the pandemic will be prolonged further. (IHS Markit)

AUSTRALIA APR, P MARKIT M'FING PMI 59.6; MAR 56.8

AUSTRALIA APR, P MARKIT SERVICES PMI 58.6; MAR 55.5

AUSTRALIA APR, P MARKIT COMPOSITE PMI 58.8; MAR 55.5

Australia's private sector started the second quarter on a strong footing, with growth of output accelerating for the second time in a row to the steepest on record as sales were boosted by improved market confidence due to a reduction in the negative impact of COVID-19. The stronger growth momentum filtered through to the labour market, with April data showing the fastest increase in private sector jobs since the survey started five years ago. Firms reportedly hired extra staff due to an intensification of capacity pressures, demand strength and optimism towards the outlook. The overall degree of business sentiment improved from March's seven-month low and was above its average. Ongoing supply-chain disruptions continued to exert upward pressure on inflation. The flash results highlighted the steepest increases in both input costs and selling charges since the inception of the survey. (IHS Markit)

NEW ZEALAND MAR CREDIT CARD SPENDING +2.2% Y/Y; FEB -12.6%

NEW ZEALAND MARCREDIT CARD SPENDING +3.1% M/M; FEB -1.5%

UK APR GFK CONSUMER CONFIDENCE -15; MEDIAN -12; MAR -16

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1819% at 09:30 am local time from the close of 2.1267% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 37 on Thursday vs 49 on Wednesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4934 FRI VS 6.4902

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher after eight strengthens at 6.4934 on Friday, compared with the 6.4902 set on Thursday.

MARKETS

SNAPSHOT: Tax, One Of The Only Certainties

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 221.21 points at 28965.95

- ASX 200 down 9.847 points at 7045.6

- Shanghai Comp. up 1.566 points at 3466.68

- JGB 10-Yr future down 2 ticks at 151.57, yield down 0.7bp at 0.065%

- Aussie 10-Yr future down 3.5 ticks at 98.310, yield up 3.6bp at 1.735%

- U.S. 10-Yr future -0-01+ at 132-16, yield up 1.94bp at 1.557%

- WTI crude up $0.46 at $61.89, Gold up $0.94 at $1784.71

- USD/JPY down 8 pips at Y107.89

- BIDEN EYEING TAX RATE AS HIGH AS 43.4% IN NEXT ECONOMIC PACKAGE (BBG)

- JAPAN SET TO DECLARE STATE OF EMERGENCY ACROSS SEVERAL PREFECTURES

- PEOPLE IN ENGLAND COULD GET COVID PASSPORTS FOR FOREIGN TRAVEL BY 17 MAY (GUARDIAN)

- ROCKETS HIT U.S. BASE AT BAGHDAD AIRPORT (SUMARIA)

BOND SUMMARY: Some Light Pressure For Core FI In Asia

An uptick in e-minis (after Thursday's late U.S. tax-related pressure) and some cheapening in the Aussie bond space applied some light pressure to U.S. Tsys overnight. T-Notes last print -0-01 at 132-16+, 0-02 off lows, operating on a modest ~63K lots. Cash Tsys have seen some bear steepening, with 30s cheapening by a little over 2.0bp.

- JGBs have had little to go off, with focus on the impending formal declaration of the state of emergency covering Tokyo, Osaka, Kyoto and Hyogo prefectures, which is set to be in play between April 25 & May 11. Futures -2 at typing, with the early uptick unwound, while yields are little changed across the cash curve.

- Elsewhere, a more upbeat assessment of the Australian economy from Westpac's Bill Evans, which was coupled by a call for 3-Year ACGB yields to hit 0.80% come the end of 2022, applied weight to the space. There may have also been some trans-Tasman pressure, with the RBNZ delivering another (expected) cut to its weekly LSAP purchase target. Elsewhere, we found out that next week's AOFM issuance slate is particularly light.

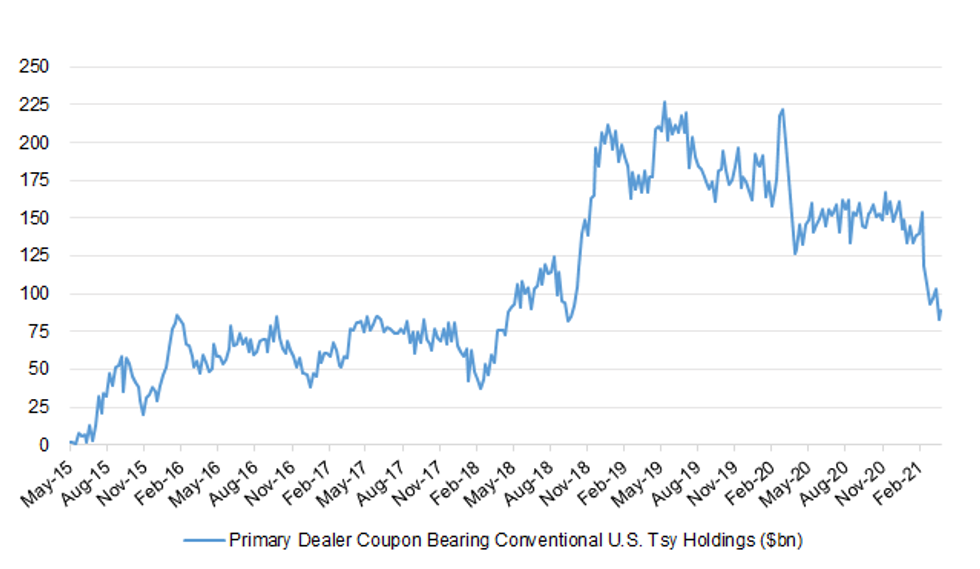

US TSYS: Primary Dealer Holdings Finding A Base?

Cumulative primary dealer holdings of coupon bearing conventional U.S. Tsys ticked higher in the week ending April 14 (rising by $5.961bn), with the 4-week rolling change of the measure now sitting at the most neutral level seen since late February (-$3.763bn), after 3 of the 4 most recent sample weeks saw light growth in primary dealer holdings (although the week previous to the most recent saw their holdings fall by $20.471bn, obviously outweighing the cumulative sum witnessed in the 3 remaining weeks).

Fig. 1: Primary Dealer Coupon Bearing Conventional U.S. Tsy Holdings ($bn)

Source: MNI - Market News/Bloomberg

JGBS AUCTION: Japanese MOF sells Y5.3012tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.3012tn 3-Month Bills:- Average Yield -0.1035% (prev. -0.0990%)

- Average Price 100.0278 (prev. 100.0266)

- High Yield: -0.1023% (prev. -0.0968%)

- Low Price 100.0275 (prev. 100.0260)

- % Allotted At High Yield: 67.8670% (prev. 23.4893%)

- Bid/Cover: 4.266x (prev. 4.133x)

AUSSIE BONDS: The AOFM sells A$800mn of the 3.25% 21 Apr '25 Bond, issue #TB139:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 3.25% 21 April 2025 Bond, issue #TB139:- Average Yield: 0.4620% (prev. 0.2509%)

- High Yield: 0.4650% (prev. 0.2525%)

- Bid/Cover: 3.6063x (prev. 7.3857x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 23.8% (prev. 69.4%)

- bidders 36 (prev. 37), successful 13 (prev. 7), allocated in full 7 (prev. 2)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Friday 30 April it plans to sell A$1.0bn of the 1.50% 21 June 2031 Bond.

EQUITIES: Mixed After Negative Lead From US

A mixed session for equity indices in the Asia-Pac time zone. Markets in Japan lead the way lower, joined by Singapore and several EM bourses. Markets in Hong Kong and mainland China lead the way higher with gains of around 1%. US markets finished in the red after being riled by US President Biden unveiling of his tax plan which contained a provision to tax high earners 43.4% capital gains. Futures are higher though, the boosted by positive after-hours earnings. Intel are likely to weigh though after reporting a drop in gross profit margin.

OIL: Crude Futures Gain, On Track For Weekly Loss

Oil has eked out a small gain, but is off best levels seen shortly after the Asia-Pac open. WTI last up $0.35 from settlement levels at $61.79/bbl, Brent is up $0.27 at $65.67. Despite the small bounce today and yesterday crude is still on track for a weekly decline. A resurgence in virus cases and mixed signals over demand. Yesterday there were reports that Libya's Sirte Oil could have to cut up to 100k bpd of output this week due to its financial situation. Elsewhere there were Reuters reports that OPEC Secretary-General Barkindo told members of the cooperative they could be fined and have assets seized if the US. adopts legislation that authorizes antitrust enforcement against countries in the bloc.

GOLD: Pulling Back From $1,800/oz

Spot deals little changed, hovering around $1,785/oz, with Thursday's uptick in the DXY resulting in a pullback from recent highs for bullion. There is little to really flag up on the U.S. yield front, while ETF holdings of gold remain little changed.

FOREX: USD Falters As Asia Ends The Week On A Quiet Note

The greenback lost ground in thin Asia-Pac trade, as all three e-mini contracts crept higher, while participants moved on after reports on U.S. Pres Biden's tax plan roiled Wall Street. The DXY seems poised to record its third weekly loss in a row.

- NZD failed to catch a bid alongside its commodity-tied peers, even as there was little in the way of fresh headline flow to undermine the kiwi.

- USD/JPY slipped to a new seven-week low over the Tokyo fix, but clawed back initial losses.

- The PBOC set its central USD/CNY mid-point at CNY6.4934, 2 pips above sell-side estimates. USD/CNH held a familiar range and is set to record its third straight weekly loss.

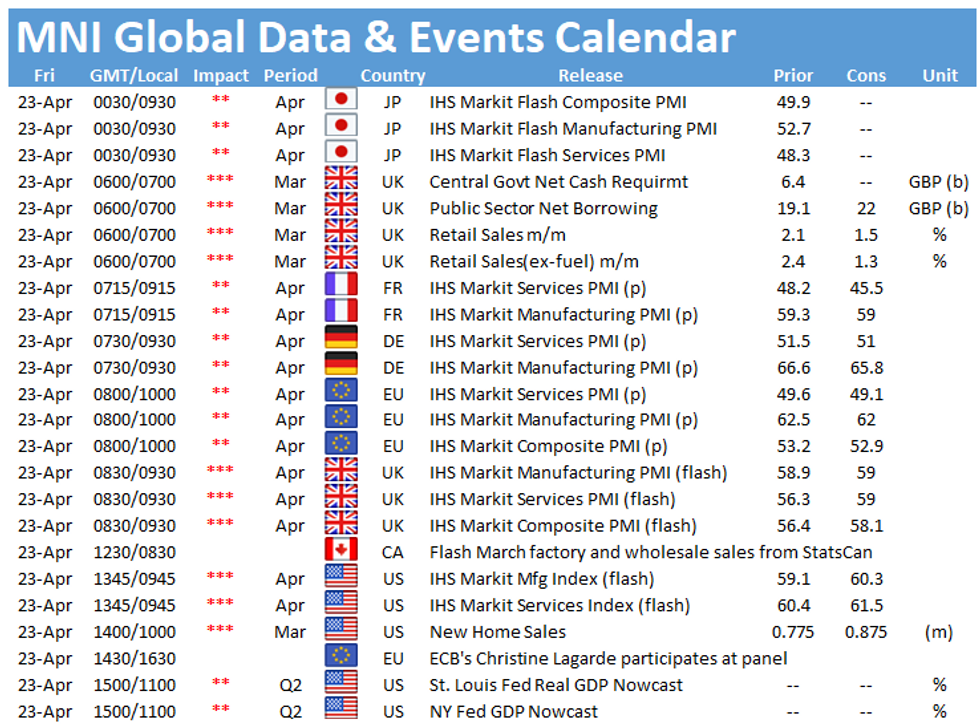

- Preliminary PMI data from across the U.S. & Europe, U.S. new home sales, UK retail sales, ECB's Survey of Professional Forecasters & comments from ECB Pres Lagarde take focus from here.

FOREX OPTIONS: Expiries for Apr23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-05(E714mln), $1.1980-90(E1.2bln-EUR puts)

- GBP/USD: $1.3900(Gbp650mln-GBP puts), $1.4000(Gbp494mln-GBP puts)

- USD/CAD: C$1.2440-50($1.7bln-USD puts), C$1.2500-10($1.2bln-USD puts), C$1.2545-55($575mln), C$1.2580-85($1.3bln-USD puts), C$1.2600-10($786mln)

- USD/CNY: Cny6.65($630mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.