-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: DXY Ticks Lower In Asia

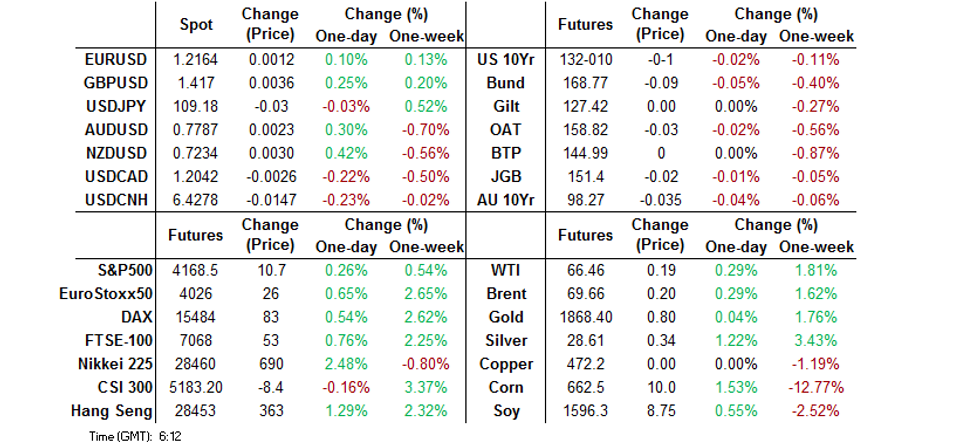

- High beta FX sit atop G10 as DXY ticks lower in Asia.

- Most of the major regional equity indices move higher overnight.

- Iron ore matters continue to catch the eye.

BOND SUMMARY: A Rangebound Asia Session For Core FI

News flow was light at best during Asia-Pac hours, with commentary from Dallas Fed President Kaplan ultimately revealing nothing in the way of fresh information. T-Notes last -0-01 at 132-10, sticking to the confines of a 0-03 range, with cash Tsy yields virtually unchanged across the curve. Building permits and housing starts data headlines the local economic docket on Tuesday. Elsewhere, we will hear from Dallas Fed President Kaplan. There will also be some focus on goings on in Washington DC, with a group of GOP Senators scheduled to table their latest counterproposal to President Biden's infrastructure spending plan, although it isn't clear if the GOP plan will be finalised ahead of the meeting.

- JGB futures nudged lower during the Tokyo morning as domestic participants reacted to the overnight cheapening in U.S. Tsys & EGBs, while the uptick in local/regional equity markets also added some pressure. The contract managed to recover from worst levels, printing 4 ticks below Monday's settlement levels at typing, while yields sit little changed in the cash space. Japan's Q1, P GDP reading was softer than expected, although markets looked through the release. 5-Year JGB supply headlines the local docket on Wednesday.

- YM -1.0, XM -3.5, hovering a little above their respective session lows. There was no tangible reaction in the Aussie bond space on the back of the release of the RBA's May meeting minutes. This wasn't surprising, with the meeting itself already putting focus on the July decision, when the Bank will decide on whether to extend the coverage of its yield targeting scheme to ACGB Nov '24 from ACGB Apr '24. The July meeting will also see the Board consider future bond purchases, with the second A$100bn round of purchases under its government bond purchase program set to be exhausted in September. Elsewhere, Australian Treasury Sec. Kennedy spoke, underlining the country's economic outperformance and fiscal capacity. He also pointed to encouraging signs in the labour market, although he holds a relatively conservative view of NAIRU (somewhere between 4.5-5.0%). Looking to Wednesday, A$1.2bn of ACGB 1.50% 21 June 2031 supply is due, along with the latest monthly Westpac consumer confidence survey and backwards looking quarterly wage price index reading.

FOREX: Better Sentiment, Firmer Commodity Markets Support Antipodeans

Risk-on flows allowed the Antipodeans to outperform in G10 FX space, with BBG trader source flagging corporate demand for the kiwi and noting that AUD appreciated after stops were triggered. Stronger than forecast PBOC fix & firmer commodity markets provided further support, as gains in iron ore & crude oil helped push BBG Commodity Index closer to its multi-year high.

- Offshore yuan caught a bid after the PBOC set its USD/CNY mid-point at CNY6.4357, 50 pips lower than yesterday, 12 pips lower than sell-side estimates.

- Sterling extended gains as cable breached its May 11 high of $1.4166, which reportedly triggered buy-stops above that figure. GBP/USD showed at its strongest levels in three months.

- The bid in most regional equity markets applied some pressure to the USD in Asia-Pac hours. JPY went offered alongside USD amid a broader pick-up in risk appetite.

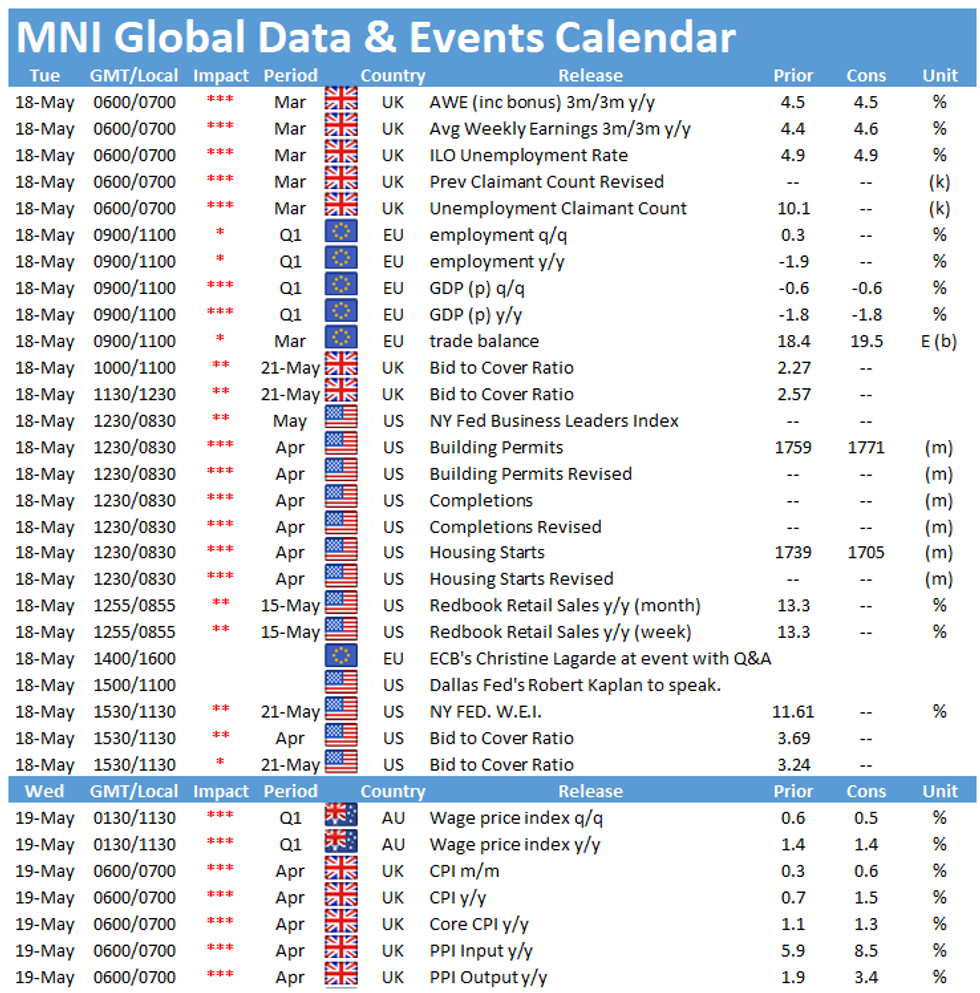

- UK labour mkt report, flash EZ GDP as well as U.S. housing starts & building permits take focus on the data front today. Central bank speaker slate includes ECB's Lagarde & Villeroy, Fed's Kaplan, BoE's Bailey & Riksbank's Ohlsson.

FOREX OPTIONS: Expiries for May18 NY cut 1000ET (Source DTCC)

- USD/CHF: Chf0.9140($420mln)

- AUD/USD: $0.7750(A$1.0bln)

- NZD/USD: $0.7260-70(N$1.4bln-NZD puts)

- USD/CAD: C$1.1945($887mln), C$1.2410-15($1.3bln)

- USD/MXN: Mxn19.82($600mln), Mxn19.90($595mln)

ASIA FX: Risk Appetite Returns

Risk appetite returned as the greenback weakened, though elevated cases of COVID-19 in several countries make the outlook uncertain.

- CNH: Offshore yuan is stronger, USD/CNH had been treading water but found a route lower after the PBOC fixed the midpoint for USD/CNY at 6.4357, 50 pips lower than yesterday, 12 pips lower than sell side estimates.

- SGD: Singapore dollar is stronger, the pair dropped through 100-day moving average. As the number of coronavirus cases in Singapore creeps higher the Hong Kong-Singapore travel bubble has been delayed

- TWD: Taiwan dollar gained alongside the Taiex, the index rose around 4.5% after losing 3% yesterday as the Taiwan Financial Stabilisation Fund said late yesterday that it would closely monitor stock markets and would enact measures if needed. USD/TWD has dropped back below the 28.00 handle.

- KRW: Won is higher, reversing early losses. USD/KRW touched the highest since early March, and came within 10 points of the 2021 high at 1145.20 as well as moving above its 200-day moving average at 1131.97, the first time since July 2020.

- MYR: Ringgit is stronger shrugging off the latest downbeat musings about Malaysia's Covid-19 situation., Malaysia recorded the highest number of deaths from Covid-19 on Monday since the beginning of the pandemic.

- IDR: Rupiah is lower, Indonesian Econ Min Hartarto said that the gov't has spent IDR172.35tn under its recovery budget for this year, which is equivalent to 24.6% of the entire 2021 recovery spending plan. Hartart added that the gov't expects a Q2 GDP growth of ~7% Y/Y.

- PHP: Peso is slightly stronger, Philippine cash overseas remittances grew 4.9% Y/Y in March, which was coupled with a revision of February's reading to +5.0% from +5.1%. The latest reading considerably missed BBG median est. of +8.4%. Over the whole Q1, cash remittances rose 2.6% Y/Y.

- THB: Baht as gained, the BoT warned that we may see an increasing number of non-performing loans of businesses from the tourism sector in Q2, as the third wave of coronavirus has delayed reopening plans.

ASIA RATES: China Repo Rates Remain Elevated

Repo rates rise again in China with Loan Prime Rates in focus later this week, elsewhere coronavirus cases dominate headline flow.

- INDIA: Bonds are lower in early trade. Yields fell yesterday as markets assessed the implications of Friday's cancelled 10-year auction, while the conversion offer and SLTRO also helped subdue yields. Markets will watch for demand at today's INR 105bn state debt sale, though a day of record deaths and over 260k new cases of coronavirus continue to put efforts against the pandemic in focus.

- SOUTH KOREA: Futures are lower, the opening gap wiping out most of yesterday's gains. Equity markets and the won have both strengthened today. South Korea reported 528 daily new coronavirus cases on Tuesday, back below 600 on fewer tests over the weekend, but health authorities remained alert over a potential hike amid continued cluster inflections and spreading variant cases. South Korean markets are closed for a holiday tomorrow.

- CHINA: The PBOC matched maturities with injections today after draining CNY 10bn yesterday. Repo rates are higher again after trending lower through the session yesterday; the overnight repo rate is 46 bps higher at 2.1105% after touching 2.195% yesterday, the seven day repo rate is up 3 bp at 2.1804% having been as high as 2.24% today. Futures are higher, retracing some of yesterday's decline with equities struggling to make progress higher despite gains in other markets in the region. The PBOC is likely to keep the Loan Prime Rate (LPR) unchanged when it issues monthly guidance on May 20, the Securities Daily reported citing analysts.

- INDONESIA: Yields are higher across the curve as worries persist over a jump in COVID-19 infection rates following the holiday last week. Indonesia launched its private vaccination programme using Sinopharm jabs at 20 m'fing sites across greater Jakarta. Over 20,000 companies have registered in the scheme. The Jakarta Post reported that a state-led study suggested that the Sinovac product, which is the cornerstone of nationwide immunisation programme, is 95% effective in preventing hospitalisation and death from Covid-19.

EQUITIES: Rebound

Most major markets in Asia in positive territory, led higher by a rebound in the Taiex. The Taiwanese index is up around 4.5% after closing 3% lower yesterday, and after shedding 9% last week. The Taiwan Financial Stabilisation Fund said late yesterday that it would closely monitor stock markets and would enact measures if needed. Markets in Japan, South Korea, Hong Kong and Australia also seeing decent gains, while upside in mainland China is more muted. US futures are higher, the Nasdaq leading the way higher after tech shares sold off yesterday.

GOLD: Bulls Still In Control

A softer USD continues to lend support to bullion after spot closed above its 200-DMA for the first time since early February on Monday. Spot last deals little changed, just shy of the $1,870/oz mark, with initial resistance now seen at the Jan 29 high ($1,875.7/oz). A sustained break of that level would switch bullish focus to the 76.4% retracement of the Jan 6 to Mar 8 sell off ($1,892.7/oz).

OIL: Brent Approaches $70/bbl

Oil is higher in Asia-Pac trade on Tuesday, building on Monday's gains, with WTI & Brent printing ~$0.20 above their respective settlement levels at typing. Markets are focusing on positive demand cues after the US reported the highest passenger numbers in airports since the pandemic began. Elsewhere Nigeria is seeing slower run rates at three of its main export terminals in May. Flows from Bonny, Forcados and Qua Iboe have all seen rates fall below initial loading programmes.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.