-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: DXY & U.S. Real Yields Consolidate

- U.S. real yields and the DXY consolidate around recent lows.

- Major headline flow absent.

- Hong Kong holiday sucks liquidity.

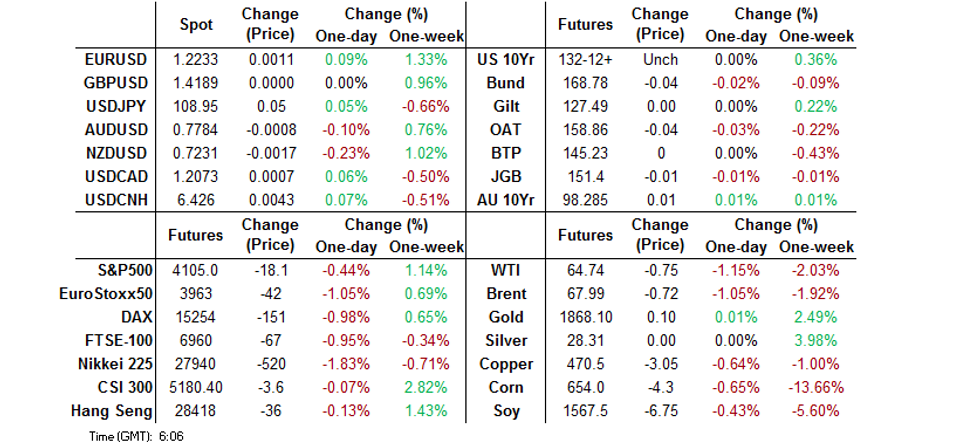

BOND SUMMARY: Core FI Coils Overnight

The U.S. Tsy space traded in a confined manner overnight. T-Notes -0-00+ last at 132-12, while cash Tsys trade little changed to 1.0bp cheaper across the curve, with 20s providing the weak point on the curve ahead of today's Tsy auction covering that tenor. Several desks point to the need for further concession to allow smooth digestion of the auction, even after the recent cheapening on the 10-/20-/30-Year fly, with a slower recovery in liquidity vs. longer dated Tsys & the recent refinement of Fed purchases in that area of the curve cited. There has been nothing in the way of meaningful headlines, while the holiday in Hong Kong has removed liquidity from the Asia-Pac region. Flow has been dominated by a 10K block sale of the FVN1 124.00 calls.

- The latest 5-Year JGB auction was on the softer side, with the issues highlighted in our auction preview (namely a lack of pre-auction concession, little in the way of relative value and more desirable carry & roll propositions further out the curve) likely weighing on demand. The yield tail was steady and relatively narrow, although the cover ratio cratered back towards the levels seen at March's 5-Year auction. Elsewhere, the low and average prices that prevailed at auction missed broader dealer expectations for the low price (just). Futures are back from best levels but still in a contained range, last -1, while the belly has moved away from richest levels, unwinding its early outperformance vs. longer dated paper.

- The latest round of ACGB supply (in the form of A$1.2bn of ACGB Jun '31) wasn't the firmest, with the cover ratio on the softer side, albeit not as soft when adjusted for the size differential vs. the prev. auction, while the weighted average yield "only" printed 0.17bp through prevailing mids at the time of supply (per Yieldbroker prices). Still, no real reaction was seen in futures, which held to narrow ranges. YM -0.5, XM +1.0 on the day at typing.

FOREX: Caution Prevails, Commodity FX Falter

A mild sense of caution prevailed in Asia, applying pressure to high-beta FX. Headline flow was relatively light, but a decline in BBG Commodity Index dragged the Antipodeans as well as CAD & NOK lower. Regional liquidity was limited by market holidays in Hong Kong & South Korea.

- The PBOC set the central USD/CNY mid-point at CNY6.4255, just 4 pips above sell-side estimate. USD/CNH crept higher amid simmering Sino-U.S. tensions.

- EUR topped G10 pile but the DXY managed to add a handful of pips nonetheless. The greenback remained resilient ahead of today's publication of minutes from the FOMC's latest MonPol meeting.

- Other than that, focus turns to inflation data from the EZ, UK & Canada as well as comments from Fed's Quarles, Bullard & Bostic and ECB's Lane, de Cos, Panetta & Rehn.

FOREX OPTIONS: Expiries for May19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2035-50(E1.2bln), $1.2150(E1.5bln-EUR puts), $1.2170-80(E715mln), $1.2200(E498mln)

- USD/JPY: Y108.00-10($712mln), Y108.90-109.00($844mln), Y109.50($905mln-USD puts)

- AUD/USD: $0.7857-80(A$545mln)

- USD/MXN: Mxn19.40($500mln)

ASIA FX: Risk Appetite Retreats

The greenback rose marginally from yesterday's lows as equity markets declined. Liquidity was slightly thinner than usual with markets in South Korea and Hong Kong away for public holidays.

- CNH: Offshore yuan is weaker, USD/CNH accelerating its move higher from the lowest since May 11 after the PBOC fixed USD/CNH above sell side estimates, indicating a preference for a weaker yuan.

- SGD: Singapore dollar is slightly weaker. Coronavirus concerns continue to dominate headlines. The health ministry said late yesterday that virus measures could be tightened further if needed, adding that the vaccination efforts were constrained by low supply.

- TWD: Taiwan dollar is stronger, moving back below 28.00. The gains come even as the Taiex lost ground after gaining over 5% yesterday.

- MYR: Ringgit is weaker, FinMin Zafrul insisted that there is no need to return to MCO 1.0, i.e. strict lockdown imposed at the beginning of the local Covid-19 outbreak, as targeted measures employed this year allowed to reduce infections at a lower economic cost. Zafrul estimated that shutting down the economy would lead to the loss of 1mn jobs and affect the incomes of 2.8mn people in the informal sector.

- IDR: Rupiah is lower, later SOE Min Thorir will provide an update on the private-funded Covid-19 vaccination programme, which kicked off yesterday.

- PHP: Peso has gained, Philippine Development Budget Coordination Committee lowered the 2021 growth outlook to +6.0%-7.0% Y/Y from +6.5%-7.5% Tuesday, while also cutting the 2022 GDP forecast to +7.0%-9.0% from +8.0-10.0%. Budget Sec Avisado sought to downplay the significance of the revisions.

- THB: Baht is stronger, BOT released minutes from its latest mon pol meeting. Domestically, "the Thai economy would expand at a much lower rate due to more severe impacts of the third-wave outbreak relative to the second. Domestic spending and the recovery of foreign tourist figures would be restrained by containment measures," the MPC said. As a reminder, the latest meeting saw them cut 2021 GDP outlook.

ASIA RATES: China Futures Hit Contract High

China futures hit a fresh contract high after strong auctions, while Indian bonds benefitted from the decline in crude.

- INDIA: Yields are lower in early trade after rising slightly yesterday. Oil lost ground yesterday which should ease some concerns over inflation overshoots for India as net importers. India reported a record number of coronavirus deaths in the past 24 hours, though case numbers have declined from their peak. The government now sees COVID-19 positivity rate falling to 2% by the end of May. Markets look ahead to a bill sale later today, as well as the latest GSAP operation tomorrow.

- CHINA: The PBOC matched injections with maturities today, repo rates are higher but significantly lower than highs seen this week. The overnight repo rate up 3.2bps at 2.022%, this week's high at 2.20%, while the seven day repo rate is at 2.11% from highs of 2.25% earlier this week. Futures climbed from the open, playing catch up with some gains in UST's, while Chinese equity markets are also lower. The 10-year future hit a fresh contract high. 2-year and 5-year auctions were strong which put a fresh bid in futures. Markets look ahead to LPR announcement tomorrow.

- INDONESIA: Yields are higher again as the sell-off continues. The Indonesian DMO said in a report that the government will maximise bond issuance for the remainder of the year in order to address capital outflows, as well as use the Bank Indonesia's support as standby buyer at auctions.

EQUITIES: Markets Lower

Equity markets in Asia are mostly lower after a negative lead from the US. bourses in Australia lead the way, nursing losses of almost 2% pressured by losses in the commodity complex as iron ore declines 3%. Markets in Japan have also sustained heavy losses, the Nikkei 225 down around 1.5% as further areas declare a state of emergency. In Taiwan the Taiex is in minor negative territory after gaining 5% yesterday. Bourses in China hovered between small gains and losses. US equity futures are in the red, the Nasdaq leading the way lower, AT7T declined after the company announced intentions to spin off its media operations.

GOLD: Bull Still In Charge With Key Resistance Levels In View

A narrow Asia-Pac session for spot, last dealing little changed just shy of the $1,870/oz mark after bulls failed to force a break of resistance in the form of the Jan 29 high ($1,875.7/oz) on Tuesday. However, bulls still remain in the ascendancy from a technical perspective, and a sustained break of that level would switch bullish focus to the 76.4% retracement of the Jan 6 to Mar 8 sell off ($1,892.7/oz). Please see MNI MARKETS ANALYSIS: Gold Bulls Continue To Shine (published on May 18) for a more detailed technical overview.

- The DXY is operating around multi month lows, while a weighted average of U.S. real yields (based on the weights deployed in the ICE-Bank of America MOVE Index) has consolidated at the lowest levels witnessed since Feb in recent days.

- ETF holdings of gold have started to tick back up in recent weeks after finding a base in late April, although that metric still sits ~16% off of its all-time high, which was registered back in October.

OIL: Crude Futures Extend Losses

After dropping on Tuesday oil is lower in the Asia-Pac time zone on Wednesday, though is holding above yesterday's lows. WTI & Brent sit $0.65 below settlement levels. Data late yesterday showed headline crude stocks rose 620k bbls while stocks at Cushing rose 52k bbls. The downstream report was more bullish with gasoline stockpiles declining 2.84m bbls, distillate dropping 2.58m bbls. Elsewhere focus in negotiations over Iran's nuclear deal. A Russian representative to the UN IAEA said that while progress had been made, unresolved issues remain. If a deal is reached waivers for Iranian crude are expected to be reinstated which would bring significant supply back to market.

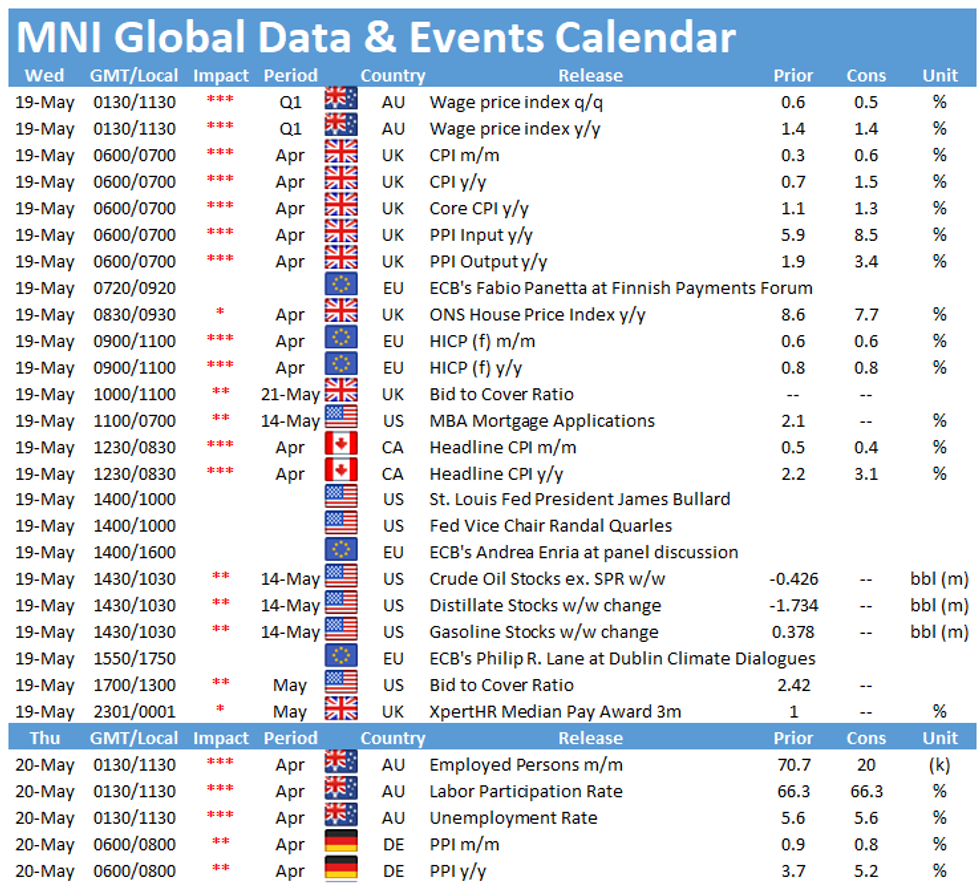

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.