-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Pockets Of News Eyed

EXECUTIVE SUMMARY

- REPUBLICAN WICKER: WILLING TO DO $1TN INFRASTRUCTURE DEAL WITH BIDEN (BBG)

- EU: TENSIONS WITH UK STEM FROM BREXIT, NOT NORTHERN IRELAND PROTOCOL (RTRS)

- CHINA VOWS TO BETTER HANDLE ABNORMAL COMMODITY PRICE CHANGES (BBG)

- CHINA STEPS UP FINANCIAL SUPPORT FOR FAMILY FARMS, COOPERATIVES (BBG)

- TURKEY REMOVES ONE OF FOUR DEPUTY CENTRAL BANK GOVERNORS (RTRS)

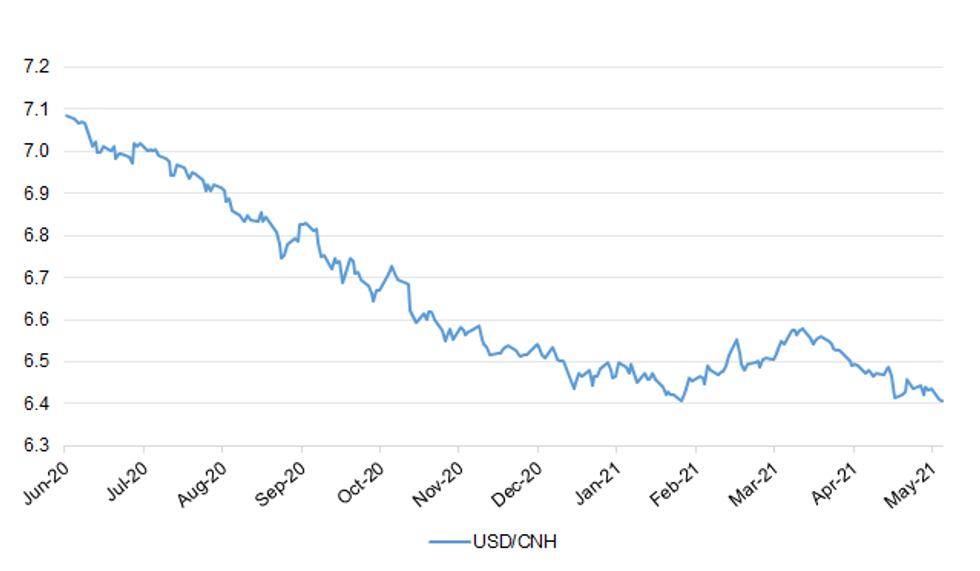

Fig. 1: USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The public will likely have to wait longer for details of the government's review of social distancing rules and its proposals for COVID certification due to the growth in cases of the Indian variant. Downing Street signalled Boris Johnson would wait longer to unveil the plans, despite the prime minister having previously promised to provide details by the end of this month. Mr Johnson's official spokesman on Monday said the review of social distancing rules would be published "as soon as possible based on the latest data, which will help inform us what measures we can take around certification". (Sky)

CORONAVIRUS: The government has advised people not to travel into and out of areas hardest hit by the Indian variant of Covid-19 unless necessary, it has emerged. Health officials said it was spreading fastest in Bolton, Blackburn, Kirklees, Bedford, Burnley, Leicester, Hounslow and North Tyneside. Bolton in Greater Manchester recorded 451 cases per 100,000 people in the week to 20 May, the highest in England. People living in the affected areas are also asked not to meet indoors. (BBC)

BREXIT: The European Union's tensions with former member Britain are not due to problems with the Northern Ireland protocol agreed by both sides, but Brexit itself, the head of the bloc's executive said on Tuesday. Ursula von der Leyen told a news conference after the first day of an EU summit in Brussels that all 27 member states of the bloc agreed that there can be no alternative to a full and correct implementation of the protocol. "There should be no doubt that there is no alternative to the full and correct implementation of the protocol, she said. "It is important to reiterate that the protocol is the only possible solution to ensure peace and stability in Northern Ireland while protecting the integrity of the European Union single market," von der Leyen added. "If we see problems today we should not forget that they do not come from the protocol but result from Brexit, that is the reason why the problems are there." (RTRS)

BREXIT: Ministers are set to target India's middle classes and young people in a trade deal with a focus on whisky, British-made cars and services. International Trade Secretary Liz Truss hopes to start talks over a free trade agreement with India in the autumn. She has launched a 14-week consultation to gather views from the public and businesses before talks begin. (Belfast Telegraph)

BOE: MNI BRIEF: BOE Saunders: Might Need Modest Tightening Ahead

- UK financial market assumption of 50 basis points of tightening over the next three years on the MPC's central forecast showed inflation around target, suggesting that the yield curve was "in a reasonable place," Bank of England Monetary Policy Committee member Michael Saunders told the Treasury Select Committee Monday. A modest tightening, of 50 basis points, may be justified down the line, he said, although he rejected the view of Chief Economist Andy Haldane that higher near-term inflation was more likely than not to become embedded, saying that he did "not see evidence the economy is moving into sustained excess demand" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOE: Bank of England Chief Economist Andy Haldane, who cast a lone vote for the central bank to scale back its asset-purchase program, comments in evidence to the House of Commons Treasury Committee. "There's no necessary reason why you need to scare the horses or cause a tantrum, provided you communicate early, you communicate gradually and you communicate clearly," Haldane says. "As and when the time comes for the MPC to turn off the tap, I'm very confident it will abide by those lessons and avoid any sort of tantrum." (BBG)

BOE: Bank of England Deputy Governor Jon Cunliffe said Britain's exit from the European Union is playing out for banks roughly as expected, although "the dust hasn't really settled yet." "We've seen what we expected to see," Cunliffe said in testimony to Parliament in London on Monday. "The wholesale banks and players in the U.K. established subsidiaries in the EU euro-area. The interactions of the U.K. regime with the EU regime has had the effect of moving some business to the U.S. We'll only see over time what the impact is. At the moment, one's seeing what one would expect to see." (BBG)

EUROPE

FRANCE: French President Emmanuel Macron's approval rating increased 3 points in May to 41% from April, a poll by Odoxa-Dentsu-Consulting released on Monday shows. (BBG)

ITALY/BTPS: Italy to sell EUR6bn 6-month bills on May 27. (BBG)

U.S.

FED: MNI BRIEF: Fed's Bostic Not Seeing 'Enduring' Price Pressures

- Atlanta Fed President Raphael Bostic said Monday he does not see signs that recent price increases will lead to a sustained spike in inflation but added he will watch those trends closely given high uncertainty. "There are reasons why we should be seeing prices rise right now. Right now, I'm not seeing that it's going to be enduring," Bostic said, citing his conversations with businesses in his district - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's George Warns of Structural Shift in Economy

- Kansas City Fed President Esther George said Monday that with a tremendous amount of fiscal stimulus flowing through the U.S. economy, the economic landscape could unfold quite differently going forward than the one that shaped the thinking around the central bank's revised monetary policy framework unveiled last August. "The structure of the economy changes over time, and it will be important to adapt to new circumstances rather than adhere to a rigid formulation of policy reactions," she said in a speech at an agricultural symposium, not dismissing the risk of higher inflation and adding that policymakers should remain "nimble and attentive to these dynamics." George's comments echo those of Boston Fed President Eric Rosengren who has also suggested that inflationary dynamics could change - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's George Says MBS-Led Taper to be Considered

- Kansas City Fed President Esther George said Monday there will come a time for the central bank to begin talking about the reduction of its asset purchase program, and given the hot housing market the central bank will discuss the option of reducing its USD40 billion monthly MBS purchases at a faster rate than Treasuries. "That will have to be part of the discussion as we get into that and really think about what effect our purchases are having on broader financial markets, as we begin to think about shifting gears," said George, in a question-and-answer session at an agricultural symposium. "In thinking about the mix of assets and how those reductions take place, it's really premature for me to speculate on that. I understand the question though, which is to say, we're an influence in those mortgage markets, and given that we see the housing market in particular, experiencing a lot of heating up" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of St. Louis President James Bullard said Monday that the central bank is not yet ready to pull back on its aggressive monetary stimulus, but could be ready soon. "We're not quite there yet, I think we will get there in the months ahead," Bullard told Yahoo Finance in an exclusive interview. With the economy still re-opening and over 8 million people still out of jobs relative to pre-pandemic levels, Bullard said the Fed should not yet pare back on its so-called quantitative easing program. (Yahoo Finance)

FED: The Federal Reserve's ongoing asset purchases could lead the central bank's portfolio to grow to $9.0 trillion by the end of 2022, according to projections released by the New York Fed on Monday. Reserve balances could peak at $6.2 trillion by the end of 2022 and then steadily decline, according to the forecasts, issued as part of an annual report conducted by the markets team at the New York Fed. The Fed's portfolio could hold steady through 2025 if proceeds from maturing securities are reinvested. "After that point, the path of the portfolio will depend on choices made regarding the portfolio as the FOMC normalizes the stance of monetary policy," the report says. The projections assume that the U.S. central bank will continue buying Treasury securities and mortgage-backed securities at the current pace of $120 billion a month through the end of 2021, before those purchases will slowly decline to zero by the end of 2022. Those assumptions on future asset purchases and interest rates are based on the New York Fed's surveys of market participants and primary dealers. (RTRS)

FED: The New York Fed undertakes small value open market transactions for the purpose of testing operational readiness to implement existing and potential policy directives from the Federal Open Market Committee (FOMC). The FOMC authorizes the New York Fed's Open Market Trading Desk (the Desk) to conduct these exercises to test its operational readiness in the Authorization for Domestic Open Market Operations and Authorization for Foreign Currency Operations. In connection with these authorizations, the Desk intends to conduct a small value overnight repo operation with Primary Dealers to test its contingency operation infrastructure. The bid submission process will be conducted from 9:45 AM ET to 10:00 AM ET on Wednesday, May 26. (New York Fed)

FISCAL: U.S. Senate Republicans are due to meet on Tuesday to determine their next steps on bipartisan infrastructure talks following last week's White House offer to pare down President Joe Biden's sweeping $2.25 trillion proposal to $1.7 trillion. One of the lawmakers, Senate Republican Conference Chairman John Barrasso, said on Monday the group of six lawmakers would hold a Tuesday morning meeting, as they approach an unofficial end-of-May White House deadline to show progress in the talks. Senator Shelley Moore Capito, of West Virginia, who is leading the Republican infrastructure effort, said her negotiating team would discuss possible next steps but offered no details about options. "I'm not ready to call it quits, I can tell you that," Capito told reporters. Senator Roy Blunt, another member of Capito's team, spoke favorably about making a new offer to the Biden administration. "I think there'd be merit to that," Blunt, of Missouri, told reporters. (RTRS)

FISCAL: Republicans are willing to work on a $1 trillion infrastructure plan over eight years with President Joe Biden, who called the number a "mandatory figure," according to GOP Senator Roger Wicker of Mississippi. "He said a trillion," Wicker said, describing a meeting between his colleagues and the president earlier this month. "We can get there." (BBG)

FISCAL: Senate Democrats are settling on an endgame for their bipartisan infrastructure negotiations: let them continue through the week after their Memorial Day recess, then forge ahead on their own if there's no deal. (Axios)

OTHER

GLOBAL TRADE: U.S. Deputy Treasury Secretary Wally Adeyemo said he anticipates strong support from the G7 industrial democracies for the Biden Administration's proposed 15%-plus global minimum corporate tax, which in turn should help solidify support in the U.S. Congress for domestic corporate tax legislation. "My sense is that you're going to see a lot of unified support amongst the G7 moving forward," Adeyemo told Reuters on Monday after supportive comments about the Treasury's proposal from France, Germany, Italy and Japan. That support may be voiced at an in-person meeting of G7 finance ministers in London on June 4-5, Adeyemo said. (RTRS)

GLOBAL TRADE: UK Ministers are refusing to back a global overhaul of corporation tax championed by Joe Biden unless the White House supports their demands to crack down on US tech titans. (Telegraph)

GEOPOLITICS: European Union leaders on Monday agreed on a set of sanctions against Belarus, including a ban on the use of the 27-nation bloc's airspace and airports amid fury over the forced diversion of a passenger jet flying between two EU countries in order to arrest an opposition journalist. (AP)

GEOPOLITICS: President Biden said in a statement Monday his administration is developing "appropriate options" in coordination with the EU to hold Belarus accountable following the country's diversion of a flight to arrest an opposition leader. (Axios)

CORONAVIRUS: White House Press Secretary Jen Psaki said on Monday the United States could not confirm a Wall Street Journal report on the origins of COVID-19 and needed more information. Three researchers from China's Wuhan Institute of Virology (WIV) sought hospital care in November 2019, a month before China reported the first cases of COVID-19, the Wall Street Journal reported on Sunday, citing a U.S. intelligence report. (RTRS)

JAPAN: The U.S. State Department on Monday urged against travel to Japan due to a new wave of COVID-19 infections, issuing a "Do Not Travel" advisory just two months before the Tokyo Olympics are set to take place. (RTRS)

JAPAN: MNI BRIEF: Japan To Extend No-Interest Rate Loans To end-2021

- The Japanese government will extend its no-interest rate and no collateral loans to smaller firms, which were expire at the end of June, to the end of this year, local newspapers reported on Tuesday. The government will continue to support corporate financing as it has decided to declare a third state of emergency. The government's decision will increase pressure on the Bank of Japan to extend its lending facility, which is set to end on September 30, and the BOJ board may decide to extend the facility as early as the June policy-setting meeting. BOJ Governor Haruhiko Kuroda has said that the BOJ will extend the facility if necessary - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Group restrictions will be imposed in Melbourne as authorities race to clamp down a small cluster of Covid-19 cases in Australia's second-most-populous city. Private gatherings in homes will be limited to five visitors per day from 6 p.m. Melbourne time on Tuesday, while public gatherings will be restricted to 30 people, Acting Premier James Merlino told reporters in Melbourne. Masks will be mandatory when indoors in public spaces for peopleaged 12 and older, including in workplaces. (BBG)

AUSTRALIA: Payroll jobs fell by 0.5% in the fortnight to 8 May 2021, following a 0.2% rise in the previous fortnight. In early May, payroll jobs were 1.5% above pre-pandemic levels and 1.5% lower than the end of March 2021. The end of JobKeeper, seasonality in the labour market around Easter and short-term restrictions in some states may influence payroll job levels in the weeks between the end of March and 8 May 2021. Across the states and territories, payroll jobs also remain above pre-pandemic levels, ranging from 4.4% above in the Northern Territory to 0.7% above in Queensland. Changes in payroll jobs continued to vary by industry. Since the end of March 2021, there were increases in payroll jobs for two of the five largest employing industries; Education and training and Retail trade (up 0.9% and 0.4%). There were decreases across the three other large employing industries; Accommodation and food services, Professional, scientific and technical services and Health care and social services (down 3.8%, 2.8% and 2.0%). (ABS)

AUSTRALIA/NEW ZEALAND: New Zealand to pause travel with the Australian state of Victoria for 72 hours initially, Covid-19 Response Minister Chris Hipkins says in emailed statement. Paused while the source of infection of the five cases announced in Melbourne in the last two days is investigated. Pause will come into force from 7.59pm Tuesday and be in place for 72 hours initially. (BBG)

NEW ZEALAND/CHINA: New Zealand could find itself at the heart of a "storm" of anger from China, foreign minister Nanaia Mahuta has warned, saying exporters needed to diversify to ensure they could survive deteriorating relations with Beijing. Mahuta's comments come as the New Zealand government faces increasing pressure to take a firmer stance on human rights violations and crackdowns by China, putting the spotlight on the potential repercussions for countries who provoke Beijing's ire. Neighbouring Australia is in a deepening trade war with China, which Mahuta likened to being at the centre of a storm – one which could easily engulf New Zealand. (Guardian)

RBNZ: Reserve Bank of New Zealand confirms the Term Lending Facility will close following the completion of the final scheduled facility window on July 28. (BBG)

BOC: Bank of Canada Governor Tiff Macklem said he is comfortable with pulling back on the extraordinary stimulus extended during the pandemic because of the domestic economy's resilience, including a strong bounce back from a second wave of Covid-19 infections at the beginning of the year. Canada's central bank last month slowed the pace of its bond-buying program from 4 billion Canadian dollars, or the equivalent of $3.31 billion, each week, to C$3 billion dollars, making it the first Group of Seven central bank to start reducing the level of stimulus flowing into the economy. It also moved up its guidance on when it might start raising its benchmark overnight interest rate from the current near-zero level. (Dow Jones)

TURKEY: Public support for President Recep Tayyip Erdogan's AK Party hit an all-time low last month amid disenchantment with the Turkish government's handling of the economy, prominent pollsters said. A sizable group of Erdogan supporters have now given up on his party but opposition parties have so far failed to provide a home for these voters, who will likely decide the future of Turkey. "The breaking point for Erdogan supporters was the dismissal of central bank governor Naci Agbal in March triggering another sell-off in the lira," said Can Selcuki, head of Istanbul-based pollster Turkiye Raporu. "People started to realize that Erdogan's radical changes in the economy are not making things better." (BBG)

TURKEY: President Tayyip Erdogan will meet executives from some 20 large U.S. companies on Wednesday to discuss investing in Turkey, three sources told Reuters, with one saying it was meant as a prelude to a June meeting with U.S. President Joe Biden. The sources, with knowledge of the May 26 conference call, said it was organised by the U.S. Chamber of Commerce, the Turkish presidency's investment office, the Turkish Embassy and the Union of Chambers and Commodity Exchanges of Turkey (TOBB). (RTRS)

TURKEY: Turkey removed one of four central bank deputy governors in an overnight decree published in the official gazette on Tuesday, after changing the governor of the bank in the same way two months ago. Oguzhan Ozbas was removed from his post, and Semih Tumen was appointed to replace him, the decree said. (RTRS)

MEXICO: Mexico's central bank will hold two auctions for $400m each from its swap line with the federal reserve, according to a currency commission statement. Auctions to take place May 26 and 28. May 26 operation to have 84-day term; May 28 operation to have 79- day term. (BBG)

BRAZIL: Brazil's central bank will revise up its 3.5% economic growth forecast for this year towards 4%, bank president Roberto Campos Neto said on Monday, following a surprisingly strong performance in the first quarter. In an online event hosted by private equity firm EB Capital, Campos Neto also said he anticipates a huge acceleration in Brazil's COVID-19 vaccination program in June, and noted that inflation expectations are rising due to a mix of fiscal, political and technical factors. (RTRS)

RUSSIA: President Joe Biden and Russian leader Vladimir Putin are likely to hold their first summit next month in Geneva, Switzerland, according to a U.S. official familiar with the issue. The exact date of the summit was not immediately clear, but it is expected to be held around the same time that Biden is visiting Europe in mid-June to meet with NATO and European Union leaders. (POLITICO)

IRAN: U.S. Special Envoy for Iran Robert Malley tweeted the following on Monday: "The latest round of talks was constructive and saw meaningful progress. But much work still needs to be done. On our way to Vienna for a fifth round where we hope we can further advance toward a mutual return to compliance." (MNI)

MIDDLE EAST: Israel may act on its own to counter the Iranian nuclear threat, Prime Minister Benjamin Netanyahu warned on Monday night, as US Secretary of State Antony Blinken headed to the region. (Jerusalem Post)

COMMODITIES: China top economic planning agency stepped up efforts to rein in "abnormal" fluctuations in commodities such as iron ore, copper and corn, part of a broader five-year plan to overhaul various pricing mechanisms. The National Development and Reform Commission will make timely suggestions on more comprehensive price controls, and strengthen management of market pricing expectations. (BBG)

COMMODITIES: China should boost domestic supplies of commodities, better coordinate with demand, and strengthen price controls to reduce the costs for producers and exporters, the Economic Information Daily said in a commentary. Global commodity prices have drawn increasing concerns by the central government, said the newspaper owned by the Xinhua News Agency. The rallies and their impacts on PPI may still stay for some time, it said. While rising prices may limit monetary policy room, for now, the central bank isn't likely to tighten, the daily said. (MNI)

COPPER: Codelco reaches wage deal with headquarters staff in Chile. (BBG)

OIL: Iran is starting to build its offshore oil storage as chances of a new nuclear deal grow higher, which will enable it to reclaim its lost oil market share, trading and shipping sources said May 24. Iran is preparing for a quick ramp-up of its output and exports as the US, Iranian and European negotiators kick off the fifth round of indirect talks this week in Vienna over the deal, known as the Joint Comprehensive Plan of Action. Iranian oil on floating storage has more than doubled since mid-January when Joe Biden became US president. (Platts)

CHINA

PBOC: China supports banks boosting loans to new types of businesses including family farms and farmers' cooperatives, according to a statement on PBOC's website. Banks are told to be more lenient on bad loans of such entities and are encouraged to issue special bonds to support the agricultural sector Authorities express support for such agricultural businesses raising money via bond or stock offerings. (BBG)

YUAN: China policymakers see no need to strengthen the yuan to tame rising imported inflation, the 21st Century Business Herald said citing an unnamed domestic economist, who studied remarks over the weekend by the PBOC Deputy Governor Liu Guoqiang aiming to discourage a one-way bet on the Chinese currency. The current commodity price gains may only be short-term, the U.S. Federal Reserve is likely to tighten liquidity, and commodity supplies can increase, the newspaper said. The yuan may not continue to appreciate significantly as other countries catch up to China in terms of restoring their manufacturing, the newspaper said. (MNI)

BONDS: The interest rates on 10-year and longer-term Chinese government bonds will likely drop below 3% in the near term and stay slightly over 3% in H2, said China International Capital Corp. The biggest uncertainty facing CGBs is how much local government bonds China will allow to be issued this year, and it's quite possible that financial authorities decide against using the full CNY7.22 trillion quotas approved in March, CICC said. (MNI)

OVERNIGHT DATA

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 114.2; PREV. 112.5

Consumer confidence gained 1.5%last week. The gain was driven in a large part by the improvement in the 'financial conditions'. The labour market numbers might have had a positive influence, with unemployment dropping to 5.5%and underemployment dropping to 7.8%. Consumer confidence may be challenged by the emergence of new COVID-19 cases in Melbourne. However, we know the impact on sentiment is temporary if the outbreak is quickly brought under control. (ANZ)

SOUTH KOREA MAY CONSUMER CONFIDENCE 105.2; APR 102.2

SOUTH KOREA Q1 HOUSEHOLD CREDIT KRW1,765.0TN; Q4 KRW1,727.4TN

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUES; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2122% at 09:38 am local time from the close of 2.1348% on Monday.

- The CFETS-NEX money-market sentiment index closed at 53 on Monday vs 36 on Friday. A higher index indicates stronger expectation for a tighten liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4283 TUES VS 6.4408

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4283 on Tuesday, compared with the 6.4408 set on Monday.

MARKETS

SNAPSHOT: Familiar Pockets Of News Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 134.64 points at 28499.61

- ASX 200 up 44.67 points at 7090.6

- Shanghai Comp. up 55.931 points at 3553.213

- JGB 10-Yr future up 2 ticks at 151.48, yield down 0.5bp at 0.075%

- Aussie 10-Yr future up 0.5 ticks at 98.365, yield down 0.6bp at 1.693%

- U.S. 10-Yr future +0-00+ at 132-20+, yield up 0.17bp at 1.603%

- WTI crude up $0.16 at $66.21, Gold down $1.29 at $1879.82

- USD/JPY down 1 pip at Y108.74

- REPUBLICAN WICKER: WILLING TO DO $1TN INFRASTRUCTURE DEAL WITH BIDEN (BBG)

- EU: TENSIONS WITH UK STEM FROM BREXIT, NOT NORTHERN IRELAND PROTOCOL (RTRS)

- CHINA VOWS TO BETTER HANDLE ABNORMAL COMMODITY PRICE CHANGES (BBG)

- CHINA STEPS UP FINANCIAL SUPPORT FOR FAMILY FARMS, COOPERATIVES (BBG)

- TURKEY REMOVES ONE OF FOUR DEPUTY CENTRAL BANK GOVERNORS (RTRS)

BOND SUMMARY: Very Tight Ranges For Core FI Markets

T-Notes have operated in a very narrow 0-01+ thus far, last printing +0-00+ at 132-20+, with yields little changed across the cash Tsy curve. There has been nothing of note on the broader macro headline front. Comments from Kansas City Fed President George ('21 non-voter) had no impact on the space, while the limited round of COVID cases evident in China & Australia have failed to generate a reaction given the the respective track records in containing the virus.

- JGB futures nudged higher early on in Tokyo, but bulls failed to force a notable break through the overnight session peak, with the contract now only +2 on the day, operating within the confines of a narrow range. The major benchmarks in the cash JGB space trade little changed to 0.5bp richer. There was little in the way of meaningful headline flow for participants to trade off.

- Aussie bond futures have stuck to tight ranges, leaving YM -0.5 and XM +0.5 on the day. The Greater Melbourne area has re-introduced some COVID restrictions given the 5 cases discovered over the past 24 hours or so, with the cases being linked back to the South Australian hotel quarantine outbreak. The restrictions are not as draconian as a full-scale lockdown. The restrictions go into play this evening, remaining in place until at least 4 June. On the domestic front, the latest round of ABS payrolls data saw a modest downtick in the headline figures, with the ABS noting that "in early May, payroll jobs were 1.5% above pre-pandemic levels and 1.5% lower than the end of March 2021." No real surprises there given the downtick in the headline reading in April's labour market report. The ABS noted that "the end of JobKeeper, seasonality in the labour market around Easter and short-term restrictions in some states may influence payroll job levels in the weeks between the end of March and 8 May 2021," once again providing no surprises. Elsewhere, the preliminary round of trade data pointed to stable Australian exports in the month of April, although imports fell by the best part of A$2.0bn vs. March, per the release. The pricing of A$500mn of SAFA '32 paper had no impact on the space.

JGBS AUCTION: Japanese MOF sells Y495.4bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y495.4bn of 5-15.5 Year JGBs in a liquidity enhancement auction:- Average Spread: -0.003% (prev. -0.004%)

- High Spread: -0.003% (prev. -0.003%)

- % Allotted At High Spread: 49.2781% (prev. 47.1379%)

- Bid/Cover: 4.282x (prev. 4.703x)

AUSSIE BONDS: The AOFM sells A$150mn of the 1.25% 21 Aug '40 I/L Bond, issue #CAIN413:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 1.25% 21 August 2040 I/L Bond, issue #CAIN413:- Average Yield: 0.1663% (prev. 0.2184%)

- High Yield: 0.1700% (prev. 0.2275%)

- Bid/Cover: 5.5333x (prev. 3.2800x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 50.0% (prev. 68.2%)

- bidders 47 (prev. 41), successful 12 (prev. 14), allocated in full 7 (prev. 9)

EQUITIES: Green Across The Board

A positive day for equities in the Asia-Pac region, markets in mainland China lead the way higher after muted gains yesterday, the CSI 300 is up over 2%. Tech shares are outperforming after a rally in the US with Apple and Tesla both posting strong gains. In Japan markets the Nikkei 225 is up around 0.6%, there were reports in the Yomiuri have noted that Japan will extend the life of its zero-interest loan programme. In Taiwan the Taiex is up over 1.5% driven by the tech rally, shares in Australia are supported by a bounce in iron ore. Futures higher in the US, Fed's George spoke late on Monday and said she is not dismissing the risk of higher inflation, she was positive on the outlook for the economy but noted that progress still needed to be made in the recovery.

OIL: Crude Futures Set For Third Straight Gain

Oil is higher in Asia, on track for the third day of gains. The surge over the previous two sessions equates to 6%. WTI is up $0.14 from settlement levels at $66.14/bbl, Brent is up $0.23 at $68.69/bbl. Talks between Iran and the international community are set to continue this week with chatter that a deal can be reached soon, which would pave the way for a return of Iranian crude to the market. Iranian President Rouhani spoke with Chinese President Xi yesterday with talks centering around deeper trade ties and energy. Markets look ahead to the API US stockpile report later in the day.

GOLD: Watching, Waiting

Little to add for gold over the last 24 hours, with spot dealing around the $1,880/oz mark at typing. The DXY continues to operate around the lower end of its recent range, while U.S. real yields ticked lower around on Monday. The previously defined technical setup remains in play.

FOREX: USD Extends Losses, NZD Marginally Outperforms

The greenback remained heavy as regional players assessed recent Fedspeak, which poured cold water on inflation concerns. The absence of notable news/data flow helped make this the main talking point in Asia-Pac hours. The DXY extended yesterday's losses, while USD underperformed all of its G10 peers.

- NZD outperformed at the margin, amid chatter that buy stops were cut above May 21 high of $0.7222 (per BBG). The kiwi's relative strength failed to translate into any notable bid into commodity FX space, even as BBG Commodity Index edged higher.

- JPY lagged all G10 currencies save for USD, as regional equity benchmarks firmed a tad. Gotobi Day flows may have applied some pressure to the yen.

- The PBOC set their USD/CNY mid-point at CNY6.4283, 20 pips above sell-side estimate. BBG fixing survey had a narrow range, which added to its significance. That being said, the weaker than expected fixing failed to lend support to USD/CNH, which slipped into negative territory.

- German GDP (f) & Ifo Business Survey, U.S. Conf. Board Consumer Confidence & new home sales as well as comments from Fed's Barkin, Evans & Quarles, ECB's Lane & Villeroy and BoE's Tenreyro take focus from here.

FOREX OPTIONS: Expiries for May25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2095-1.2105(E1.3bln-E1.2bln of EUR puts), $1.2150-60(E518mln), $1.2215-25(E629mln-EUR puts),

$1.2260-75(E1.2bln-EUR puts), $1.2325-45(E679mln-EUR puts) - USD/JPY: Y107.50-60($1.1bln), Y107.85-108.05($1.5bln), Y108.85-109.00($657mln)

- USD/NOK: Nok8.40($410mln-USD puts)

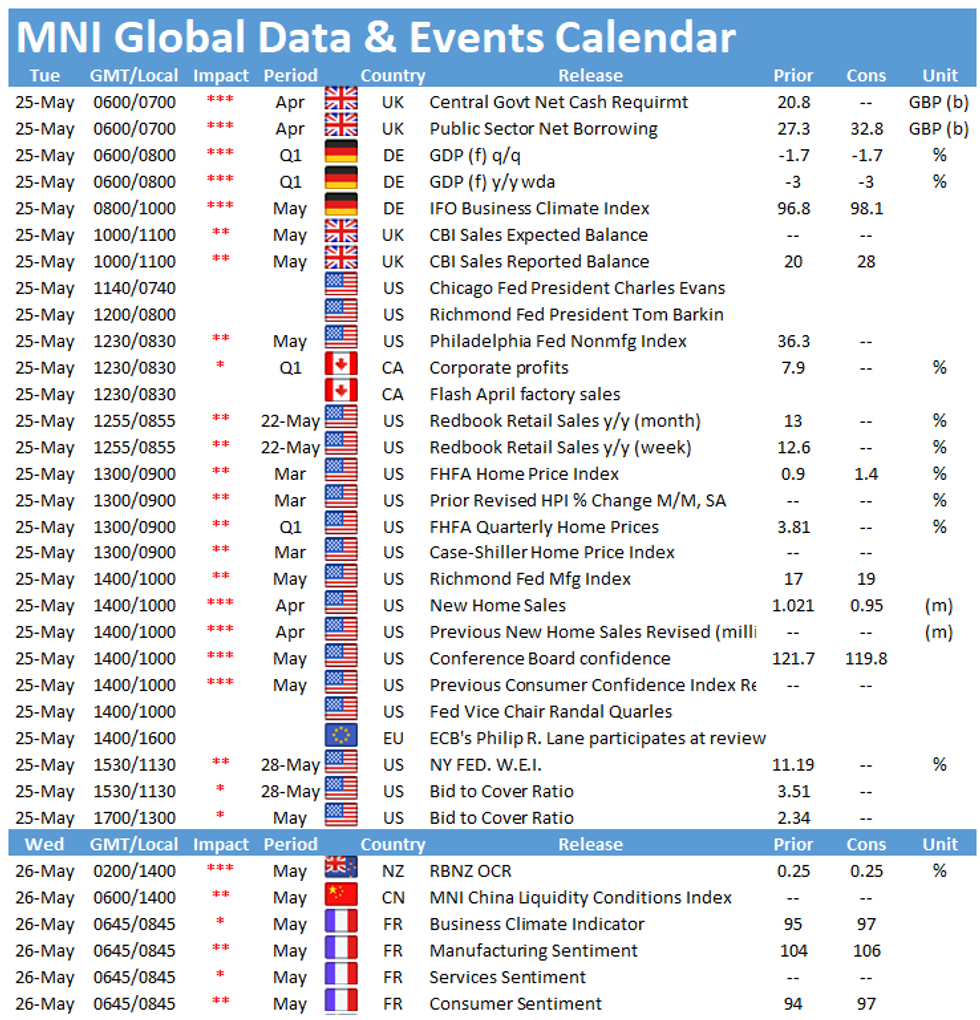

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.