-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Headline Flow Ahead Of The Weekend

EXECUTIVE SUMMARY

- FED'S KAPLAN CITES REAL ESTATE EXCESSES AS ONE REASON TO START TAPERING PURCHASES (CNBC)

- RBNZ GOVERNOR ORR: INFLATION TODAY IS NOT LIKE THE 1970S (BBG)

- CHINA COMMODITY FIRMS CUT BULLISH BETS ON PRESSURE FROM BEIJING (BBG)

- HEDGE FUND THAT BEAT EXXONMOBIL SAYS IT WILL HAVE TO CUT OIL OUTPUT (FT)

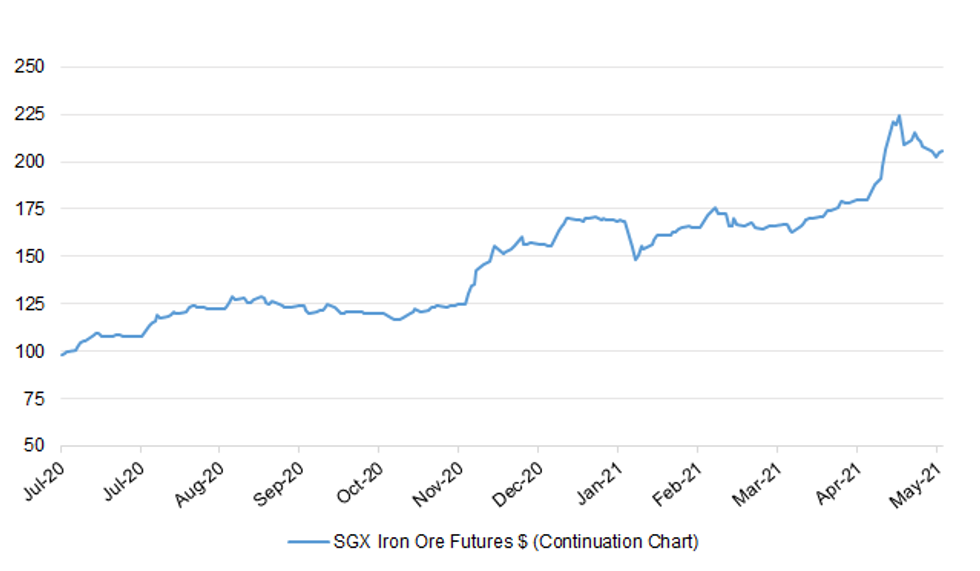

Fig. 1: SGX Iron Ore Futures $ (Continuation Chart)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: UK health secretary Matt Hancock said on Thursday that as many as three quarters of all new coronavirus infections across the UK involved the variant first identified in India. Speaking at a Downing Street briefing, Hancock said that coronavirus infections were rising throughout the country, with 3,542 new cases identified on Wednesday. More than half of all new cases and "potentially as many as three quarters" involved the new B1.617.2 variant, the health secretary said, with the bulk of new infections identified within emerging hotspots such as Bolton and Leicester. (FT)

FISCAL: Boris Johnson has been warned by business leaders that a fresh package of economic support would be required if rising Covid-19 infections prevent the further relaxation of pandemic restrictions next month. After the reopening of hospitality venues indoors across all four nations of the UK, the Guardian's latest monthly assessment of economic developments suggests the country is on course for a short-term growth boom this summer. (Guardian)

BOE: MNI BRIEF: BOE Appoints New Financial Stability Director

- The Bank of England has appointed Sarah Breeden as Executive Director for Financial Stability Strategy, along with a place on the Financial Policy Committee. She will move from her current role as Executive Director for UK Deposit Takers Supervision where she has overseen UK firms through the Covid-19 crisis and shaped the Bank's work on climate change - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

EUROPE

ECB: MNI INTERVIEW: ECB's Toolbox Sufficient-Austria's Holzmann

- The outlook for the eurozone economy is improving sufficiently for the European Central Bank's existing toolbox to provide any necessary stimulus once net purchases under the Pandemic Emergency Purchase Programme conclude in March, the governor of the Central Bank of Austria told MNI. Barring any significant setback there would be no reason to continue PEPP beyond its agreed horizon, after which tools such as the Asset Purchase Programme, cheap loans for banks via Targeted Longer-Term Refinancing Operations, negative interest rates and forward guidance could be adjusted according to prevailing economic conditions, Robert Holzmann said in an interview - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GERMANY: Germany plans to expand Covid-19 inoculations to children aged 12 and older starting June 7 as Europe's largest economy seeks a way out of the pandemic. Chancellor Angela Merkel emphasized that immunizations for children would be voluntary and wouldn't impact school participation. The vaccine made by Pfizer Inc. and BioNTech SE would likely be approved for this age group in the coming days, she said Thursday after a meeting with leaders of Germany's 16 states. "We will be able to make every citizen including children a vaccination offer by the end of the summer," Merkel said. She added that a digital European vaccination certificate would be ready by early July. (BBG)

PORTUGAL: Portugal's government approved a series of measures to contain a surge in the number of cases in Lisbon and the Tagus valley, Minister Mariana Vieira da Silva said after a cabinet meeting on Thursday. These measures include increasing the number of tests to detect and isolate people infected with the coronavirus in order to control the pandemic, Vieira da Silva said. (BBG)

PORTUGAL: Portugal's Resolution Fund will seek a loan from a group of private banks to finance a capital injection in lender Novo Banco, Finance Minister Joao Leao says. The government approved a resolution to allow the state-backed fund to seek financing from banks instead of obtaining a loan from the state, Leao says after a cabinet meeting on Thursday. The value of the capital injection in Novo Banco is still being analyzed. The impact of this operation on Portugal's budget deficit and debt is expected to be lower than what was initially forecast in the state budget, says Leao. (BBG)

IRELAND: Foreign travel for holidays is to be permitted from July 19, under plans agreed by the Cabinet Committee on Covid-19. Taoiseach Micheál Martin and his ministers signed off on a plan which see the return of non-essential travel in July. The Government will introduce the EU's Digital Green Certificate scheme on this date and people who are fully vaccinated will be free to travel abroad without producing a negative Covid-19 test on their return. They will also avoid hotel or home quarantining. Vaccinated passengers will be able to visit Ireland without a negative test and will also be exempt from any quarantining measures. (Irish Independent)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody's on Belgium (current rating: Aa3; Outlook Stable) & Switzerland (current rating: AAA; Outlook Stable)

- S&P on Ireland (current rating: AA-; Outlook Stable) & Turkey (current rating: B+; Outlook Stable)

- DBRS Morningstar on Poland (current rating: A, Stable Trend)

U.S.

FED: Dallas Federal Reserve President Robert Kaplan cited potential excesses in the housing market and other inflation signs as an indication that the central bank should start slowly pulling back on its asset purchase program. With the Fed still buying at least $120 billion in bonds each month, a total that includes $40 billion in mortgage-backed securities, several officials have said it's time to at least start discussing easing off the historically aggressive injections into the fixed income market. In an interview Thursday afternoon with CNBC, Kaplan reiterated his call for a gradual change in policy. (CNBC)

FED: MNI BRIEF: Fed Plans to Hold Jackson Hole Conference in Person

- The Federal Reserve Bank of Kansas City announced Thursday it is proceeding with plans to host a modified, in-person program at this year's Jackson Hole Symposium August 26-28 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI BRIEF: Higher Inflation Could Last to Year-end: Yellen

- Treasury Secretary Janet Yellen Thursday said higher annual inflation readings could last into year-end, but ultimately should be temporary even as White House and Treasury officials are watching inflationary trends very closely. In testimony before Congress, Yellen said she expects it to last "for several more months, and to see high annual rates of inflation through the end of this year." Yellen said data will remain "bumpy" with supply chain bottlenecks, a shortage of semiconductors, and unusual used car price rises, but there remains "a lot of slack" in the economy with millions of job openings. "I don't believe that will be inflationary, but we're watching that carefully and have tools to address it," the former Fed Chair said when asked whether Biden's USD1.9 trillion relief package that passed the Congress earlier this year will overheat the economy - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI DATA BRIEF: US Apr PCE Seen Higher, Above Fed Comfort Zone

- The total PCE price index and core PCE price index -- a pair closely watched by Fed officials -- should both tick up to 0.6% in April, while a year earlier, the PCE price index should increase to 3.5% from 2.3% in March, while the y/y core PCE price index should jump to 2.9% from 1.8% in March, to record the highest level since 1993. Both sets of data will raise eyebrows at the Fed, but are unlikely to lead to any snap policy shifts. U.S. personal income is set to fall sharply in April as the effects of stimulus checks sent earlier in the spring fade, with markets expecting a decline of more than 14% following March's outsized 21.1% gain - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI:US May Job Growth Seen Slowing Further- St Louis Fed Model

- U.S. employers added between 19,000 and 865,000 jobs in May, according to a St. Louis Fed model using high frequency data from scheduling software companies Kronos and Homebase, far lower than the 618,000 to 1.3 million range forecast last month. Job gains through May are likely better represented by the lower end of the Fed model's forecast. Data from Homebase, which reflects the forecast's upper end, has a larger concentration of small businesses, particularly in retail and leisure and hospitality, St. Louis Fed economist Max Dvorkin told MNI in an email - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The White House responded to Senate Republicans' latest offer for an infrastructure deal Thursday, with press secretary Jen Psaki calling the additions "constructive" but saying the administration remains "worried" about how Republicans plan to pay for it. "We note several constructive additions to the group's previous proposals, including on roads, bridges and rail," Psaki said in a statement shortly after Republicans unveiled their latest proposal. (CNBC)

CORONAVIRUS: The Food and Drug Administration and vaccine maker Johnson & Johnson expect to announce as early as Friday that contamination problems at a Covid-19 vaccine plant in Baltimore are resolved, clearing the way for millions more doses to become available. Vaccine production at the plant run by contract manufacturer Emergent BioSolutions Inc. was halted after unsanitary conditions led to contamination of J&J vaccines. The facility made vaccine substance and finished vaccine doses for J&J and AstraZeneca PLC. Emergent chief executive Robert Kramer told a House committee last week that the company had produced enough of a key ingredient to yield more than 100 million doses of the J&J vaccine. (Dow Jones)

CORONAVIRUS: Most people in the U.S. plan to spend the Memorial Day weekend much like before the pandemic, while about one in four adults say they don't plan to get vaccinated, according to a Quinnipiac University poll published Thursday. Those planning to get a Covid shot or already vaccinated rose to 72% compared to 68% in a poll published April 14. The share saying they don't plan to get immunized declined to 23% from 27%, according to Quinnipiac. Asked if they'll spend the Memorial Day weekend much the same way as before the pandemic, 73% agreed. President Joe Biden said Thursday that 50% of adults in the U.S. are fully vaccinated. (BBG)

OTHER

GLOBAL TRADE: President Joe Biden said on Thursday that his administration will take new steps to ease supply chain issues, transportation bottlenecks and anti-competitive practices in the economy. Biden said the measures would be announced in the "days ahead." (RTRS)

GLOBAL TRADE: Commerce Secretary Gina Raimondo says the U.S. could build six or seven new semiconductor plants to help combat a global chip shortage. "It would be our plan to build another six or seven manufacturing operations in America over time so we won't be so vulnerable to relying overly on one company or one country, Raimondo says in a Bloomberg Television interview. Says U.S. is heavily dependent on Taiwan's TSMC for a high percentage of semiconductors. (BBG)

U.S./CHINA: China Vice Premier Liu He's talk with USTR Katherine Tai showed that economic and trade cooperation remains stable and helps ensure that bilateral relations don't "fall out of the track," according to Taoran Notes, a WeChat blog reposted on China.com.cn, an official government portal. Even the controversial Phase 1 agreement last year helped serve as a foundation stabilizing relations amid the growing differences, although that the latest talk didn't mention the agreement was worth noting, said the blog. China and the U.S. should improve understanding of each other's capabilities and intentions and optimize ways to deal with each other, it said. (MNI)

U.S./CHINA: Senate Majority Leader Charles Schumer (D-N.Y.) has struck a gentlemen's agreement with Sen. Mike Crapo (R-Idaho) to allow a vote on his trade deal with Senate Finance Committee Chairman Ron Wyden (D-Ore.) as an amendment to a China competitiveness bill. The amendment has a good chance of passing, and the breakthrough between Schumer and Crapo means there's now a chance the competitiveness bill, which has been renamed the Innovation and Competition Act, could pass Thursday. "Crapo is very happy with the deal," one GOP senator said in reference to the gentlemen's agreement between Schumer and Crapo to allow a vote on bipartisan language to extend trade preferences and tariff relief. (The Hill)

U.S./CHINA/CORONAVIRUS: Joe Biden's decision to expand the US investigation into the origins of the Covid-19 pandemic, with one intelligence agency leaning towards the theory that it escaped from a Wuhan laboratory, has opened a new divide in his administration's already tense relationship with China. Biden said on Thursday that he would publish the results of the 90-day inquiry, which has made a priority for the intelligence agencies. The move represents a dramatic turnaround from the administration's policy until now of leaving the investigation to the World Health Organisation. The US on Thursday called on the WHO to carry out a second phase of its investigation into the origins of the coronavirus, with independent experts given full access to original data and samples in China. (Guardian)

U.S./CHINA/HONG KONG: The Global Times tweeted the following on Thursday: "Such condemnation is nothing and China will ignore it. In China-US arm wrestling over Hong Kong, the US has lost." (MNI)

JAPAN: Japan is looking to extend a state of emergency in Tokyo and other areas by about three weeks to June 20, a cabinet minister said on Friday, as the COVID-19 pandemic shows no signs of easing less than two months before the Summer Olympics open. (RTRS)

JAPAN: Japan may lower minimum age for Pfizer COVID shot next week. (Kyodo)

BOJ: Japan's expected extension of state of emergency curbs to combat COVID-19 heightens the chance the central bank will push back the current September deadline for a package of measures to cushion the economic blow from the health crisis. Bank of Japan officials, including Governor Haruhiko Kuroda, have repeatedly said they will extend the pandemic-relief programme if needed to underpin a fragile recovery as the country struggles with a resurgence in infections. The BOJ may decide on an extension as early as its rate review in June, as the government looks to extend the curbs by three weeks, the Nikkei newspaper reported. (RTRS)

AUSTRALIA: Australia underlying cash deficit A$131.8bn in 10 months to April. (BBG)

RBNZ: Inflation is a very different beast today than it was in the 1970s, giving central banks the confidence to look through a short-term spike in prices, Reserve Bank of New Zealand Governor Adrian Orr said. "The fear of the 70s, the 80s, stagflation, it is such a different world," Orr said in an interview with Bloomberg Television on Friday. "There is a single global price for so many of the raw materials, the intermediate inputs and the final consumer goods. We google that, we are prepared to wait. We don't go to the shop, we have it imported." (BBG)

NEW ZEALAND: Statistics New Zealand publishes monthly employment indicators for April, on website. Seasonally adjusted filled jobs rise 0.3% m/m to record 2,221,008 following a 0.2% gain in March. Actual filled jobs rise ~9,300 from March when they increased ~16,700. Actual filled jobs climb 2.5% y/y. (BBG)

MEXICO: Mexico's health regulator COFEPRIS has granted emergency use authorization to Johnson & Johnson's vaccine against COVID-19, Deputy Health Minister Hugo Lopez-Gatell said on Thursday. (RTRS)

BRAZIL/RATINGS: Fitch affirmed Brazil at BB-; Outlook Negative

RUSSIA: The Biden administration informed Russia on Thursday that it will not rejoin a key arms control pact, even as the two sides prepare for a summit next month between their leaders, the State Department said. U.S. officials said Deputy Secretary of State Wendy Sherman told the Russians that the administration had decided not to reenter the Open Skies Treaty, which had allowed surveillance flights over military facilities in both countries before President Donald Trump withdrew from the pact. As a presidential candidate, Biden had criticized Trump's withdrawal as "short-sighted." Thursday's decision means only one major arms control treaty between the nuclear powers — the New START treaty — will remain in place. Trump had done nothing to extend New START, which would have expired earlier this year, but after taking office, the Biden administration moved quickly to extend it for five years and opened a review into Trump's Open Skies Treaty withdrawal. (AP)

ISRAEL: Secretary of State Tony Blinken warned Israeli leaders on his visit to Jerusalem this week that evictions of Palestinian families from East Jerusalem or further unrest on the Temple Mount could spark renewed "tension, conflict and war," he told me in a phone interview. (Axios)

COMMODITIES: Several Chinese commodity firms pared back their bullish futures bets at the request of the government, according to people with knowledge of the matter, a sign of Beijing's increasing concern over soaring raw material prices. Over the last two weeks, at least four major firms, including steel mills and commodity merchants, reduced their long positions in locally traded products including iron ore and coal after attending meetings with government officials, said the people, who asked not to be identified discussing a sensitive matter. At least two major futures brokerages were also advised by China's exchanges to cap positions and trading volumes in contracts that are highly volatile, said two of the people. In addition to the firms who were urged by Beijing to reduce commodity holdings, officials at several other Chinese raw material producers, traders and investment firms cut down bets without being asked, partly on concerns over potential criticism from regulators, according to interviews with 20 trading managers at state-owned and private firms in the past two weeks. These officials asked to remain anonymous as they aren't authorized to speak publicly. (BBG)

OIL: OPEC+ is likely to stick to the existing pace of gradually easing oil supply curbs at a meeting on Tuesday, OPEC sources said, as producers balance expectations of a recovery in demand against a possible increase in Iranian supply. The Organization of the Petroleum Exporting Countries and allies decided in April to return 2.1 million barrels per day (bpd) of supply to the market from May to July, as it anticipated global demand would rise despite surging coronavirus cases in India. (RTRS)

OIL: The activist investors who invoked the perils of climate change to win a stunning proxy battle against ExxonMobil this week said the supermajor would need to cut oil production, indicating they would keep pressing management to shift strategy in response to the shareholder vote. "They need to position themselves for success," said Charlie Penner, who ran hedge fund Engine No 1's campaign against the company. "You would certainly believe that would mean less oil and gas production going forward." (FT)

OIL: The Biden administration has decided it will not renew a waiver that allowed a politically connected U.S. oil company to operate in northeast Syria under President Donald Trump's pledge to "keep the oil" produced in the region, according to a U.S. official familiar with the decision. (AP)

CHINA

YUAN: The People's Bank of China hasn't set targets for the yuan and will instead let the market decide its trade, the Securities Times reported citing analyst Zhang Yu with Huachuang Securities. Zhang commented after a forex industry meeting in Beijing on Thursday, which urged participants not to make one-way bets on the yuan's movement. The central bank may further boost the yuan's flexibility and will only provide appropriate guidance when "excessive trading momentum" exists, Zhang was cited as saying. The meeting on Thursday also indicated that China won't use the yuan's appreciation to counter rising commodity prices, the newspaper said. (MNI)

YUAN: MNI INTERVIEW: PBOC To Tolerate Yuan Strength Unless Excessive

- The People's Bank of China is likely to continue to tolerate market-driven volatility of the yuan, though it could move against any sentiment-driven excessive strength in the currency if necessary, a senior policy advisor told MNI, pointing to tools such as the PBOC's countercyclical factor used to adjust daily fixing levels, as well as its foreign exchange reserves or adjustments to capital controls - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

PBOC: MNI INTERVIEW: PBOC Needs To Be Ready For H2 Slowdown

- The People's Bank of China should be prepared to respond flexibly to a likely economic slowdown in the second half of the year, as credit risks rise and inflation peaks, a senior advisor told MNI in an interview, saying current policy settings may be on the tight side - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

OVERNIGHT DATA

JAPAN APR UNEMPLOYMENT 2.8%; MEDIAN 2.7%; MAR 2.6%

JAPAN APR JOB-TO-APPLICANT RATIO 1.09; MEDIAN 1.10; MAR 1.10

JAPAN MAY TOKYO CPI -0.4% Y/Y; MEDIAN -0.5%; APR -0.6%

JAPAN MAY TOKYO CORE CPI -0.2% Y/Y; MEDIAN -0.2%; APR -0.2%

JAPAN MAY TOKYO CORE-CORE CPI -0.1% Y/Y; MEDIAN -0.1%; APR 0.0%

NEW ZEALAND MAY ANZ CONSUMER CONFIDENCE INDEX 114.0; APR 115.4

NEW ZEALAND MAY ANZ CONSUMER CONFIDENCE -1.2% M/M; APR +4.2%

UK MAY LLOYDS BUSINESS BAROMETER 33; APR 29

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2550% at 09:39 am local time from the close of 2.2564% on Thursday.

- The CFETS-NEX money-market sentiment index closed at on 37 Thursday vs 47 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3858 FRI VS 6.4030

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a second day at 6.3858 on Friday, compared with the 6.4030 set on Thursday, marking the strongest fixing since May 24, 2018.

MARKETS

SNAPSHOT: Familiar Headline Flow Ahead Of The Weekend

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 619.25 points at 29166.91

- ASX 200 up 89.024 points at 7185

- Shanghai Comp. up 0.177 points at 3609.028

- JGB 10-Yr future down 15 ticks at 151.43, yield up 0.3bp at 0.084%

- Aussie 10-Yr future down 6.5 ticks at 98.36, yield up 6.7bp at 1.696%

- U.S. 10-Yr future -0-03 at 131-22, yield up 1.03bp at 1.617%

- WTI crude up $0.35 at $67.19, Gold down $3.8 at $1892.74

- USD/JPY up 5 pips at Y109.86

- FED'S KAPLAN CITES REAL ESTATE EXCESSES AS ONE REASON TO START TAPERING PURCHASES (CNBC)

- RBNZ GOVERNOR ORR: INFLATION TODAY IS NOT LIKE THE 1970S (BBG)

- CHINA COMMODITY FIRMS CUT BULLISH BETS ON PRESSURE FROM BEIJING (BBG)

- HEDGE FUND THAT BEAT EXXONMOBIL SAYS IT WILL HAVE TO CUT OIL OUTPUT (FT)

BOND SUMMARY: Core FI Biased Lower In Asia

The U.S. Tsy space has cheapened a little overnight, TYU1 last deals -0-03 at 131-22, with cash Tsys bear steepening a little, as 30s cheapen by just over 1.0bp. There hasn't been much in the way of regional willingness to push back against Thursday's cheapening during Asia dealing, with the proximity to the elongated Memorial Day weekend and today's U.S. PCE reading perhaps keeping some sidelined, even with estimates pointing to an above average round of month-end extensions for the space.

- JGB futures print -15 vs. yesterday's settlement, with the belly of the curve leading the way lower in cash trade. There has been little in the way of meaningful news flow, with onshore investors playing catch up to overnight movements in the broader core global FI space. Local data was broadly in line with expectations, with nothing in the way of notable movement in the latest round of Tokyo CPI & labour market data. A quick look at the latest round of BoJ Rinban operations, which saw purchase sizes remain unchanged across the buckets in play, with steady to lower offer to cover ratios across the 3- to 5- and 5- to 10-Year buckets. Elsewhere, corporate supply saw SoftBank price Y100bn of paper across 5-, 7- & 10-Year tranches.

- The Aussie bond space continues to hold weaker on the day, with 3-Year EFPs pushing out levels not witnessed since the Mar '20 vol. YM -2.5, XM -7.0. While there has been little in the way of overt headline triggers, it is worth flagging the widening in the ACGB Apr '24/Nov '24 yield spread, which has now unwound 2/3rds of the recent 6-7bp of tightening over just 2 sessions, as markets swing back to pricing a lower chance of the RBA extending its yield targeting mechanism out to cover ACGB Nov '24 in July. There has also been some focus on local mortgage rate dynamics, after local press flagged that NAB cut two of its variable investment home loans by 30bp this morning. The pricing side of the latest round of ACGB Apr '27 supply was firm enough, with the weighted average yield printing 0.94bp through prevailing mids at the time of supply (per Yieldbroker pricing), although the cover ratio wasn't anywhere near as firm, printing just above 2.00x. Participants were perhaps a little wary in the wake of the recent richening and may have one eye on the RBA's July's decision, which may have kept overall bidding subdued (also resulting in a slightly wider high to average yield differential this time out). Finally, the AOFM released its weekly issuance slate, which is a little light on duration.

JGBS AUCTION: Japanese MOF sells Y5.1438tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.1438tn 3-Month Bills:- Average Yield -0.1122% (prev. -0.1046%)

- Average Price 100.0280 (prev. 100.0261)

- High Yield: -0.1062% (prev. -0.1042%)

- Low Price 100.0265 (prev. 100.0260)

- % Allotted At High Yield: 17.6715% (prev. 86.2636%)

- Bid/Cover: 3.542x (prev. 4.705x)

BOJ: Rinban Conducted

The BoJ offers to buy a total of Y960bn of JGBs from the market, sizes unchanged from the previous operations:

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y450bn worth of JGBs with 5-10 Years until maturity

- Y60bn worth of JGBIs

AUSSIE BONDS: The AOFM sells A$1.0bn of the 4.75% 21 Apr '27 Bond, issue #TB136:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 4.75% 21 April 2027 Bond, issue #TB136:- Average Yield: 0.8948% (prev. 0.4439%)

- High Yield: 0.8975% (prev. 0.4450%)

- Bid/Cover: 2.0900x (prev. 5.6970x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 65.0% (prev. 77.9%)

- bidders 34 (prev. 51), successful 15 (prev. 15), allocated in full 9 (prev. 6)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Thursday 3 June it plans to sell A$1.0bn of the 24 September 2021 Note & A$500mn of the 26 November 2021 Note.

- On Friday 4 June it plans to sell A$1.0bn of the 0.25% 21 November 2025 Bond.

EQUITIES: China Lags Regional Gains

Positive risk sentiment in Asia has seen most major markets in the green, Japan leading the way higher with gains around 2% as the yen weakens on a trade weighted basis, even as Japan extends its State of Emergency in Tokyo and other areas through to June 20, just five weeks before the Olympics is due to start. In Taiwan the Taiex is up around 1.5%, boosted by foreign inflows which resumed yesterday after four days of outflows. The ASX 200 is up over 1%, buoyed by miners after metals prices rose as China said it could reduce output in a pollution crackdown. Markets in mainland China are struggling though, just about keeping their head above water. The yuan weakened today as the PBOC set the fix higher than sell-side estimates, indicating a preference for a weaker yuan, there is speculation that this is a signal the bank sees the currencies recent appreciation as too fast. In the US futures are higher, building on yesterday's gains after a rally inspired by US President Biden's spending plans.

OIL: Crude Futures On Track For Weekly & Monthly Gain

Oil is higher again on Friday, on track for a sixth straight day of gains and upside of almost 6% this week and over 7.5% on the month, the fifth gain in the last six months. WTI is $0.38 up from settlement levels at $67.23/bbl, while Brent is up $0.18 at $69.64/bbl. The benchmarks are slightly below yesterday's highs which denoted the highest in two years. Markets look ahead to the OPEC_ meeting next week, and the outcome of negotiations between Iran and world powers which could result in an increase in Iranian supply.

GOLD: Taking A Breather

Bullion struggled for air above $1,900/oz on Thursday, with steady to higher U.S. real yields keeping a lid on prices. Spot has coiled in Asia & last trades just shy of $1,895/oz, with nothing changing from a technical perspective.

FOREX: Greenback Gains Into Month-End, Yuan Remains Buoyant

The greenback firmed during the final Asia-Pac session of the week, as musings surrounding U.S. Pres Biden's budget proposal took focus. Usual chatter about the impact of month-end flows also did the rounds, with the U.S. about to observe a long weekend. Headline flow in the Asia-Pac timezone failed to provide much in the way of notable catalysts.

- The yuan caught a bid, ignoring a softer than expected PBOC fix, which came in at CNY6.3858 (21 pips above sell-side estimate). BBG tracker of broader yuan strength against a basket of currencies extended gains to a new three-year high.

- NZD went offered across the board, losing its post-RBNZ shine and snapping a four-day winning streak. A hawkish surprise provided by the Reserve Bank on Wednesday has allowed the kiwi to become the best G10 performer this week.

- U.S. PCE takes centre stage today, on top of Chicago PMI survey, final UoM sentiment & inventories data. Elsewhere, GDP data from France & Sweden are also due. ECB's Villeroy speaks at an ACPR meeting.

FOREX OPTIONS: Expiries for May28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1985-1.2000(E1.0bln), $1.2100-15(E552mln), $1.2185-1.2200(E1.8bln-EUR puts), $1.2210-20(E1.2bln-EUR puts), $1.2250-65(E1.2bln-EUR puts), $1.2275(E722mln-EUR puts), $1.2300(E672mln-EUR puts)

- USD/JPY: Y108.50-60($895mln-USD puts), Y110.00($2.0bln-USD puts), Y110.50($976mln)

- GBP/USD: $1.4200(Gbp817mln-GBP puts)

- EUR/JPY: Y132.80-00(E723mln)

- EUR/CHF: Chf1.1000(E960mln-EUR puts)

- AUD/USD: $0.7750(A$553mln)

- USD/CAD: C$1.2000($640mln-USD puts), C$1.2050($C420mln), $1.2100($1.3bln), C$1.2150($612mln-USD puts)

- USD/MXN: Mxn19.75($1.3bln-USD puts), Mxn20.25($689mln)

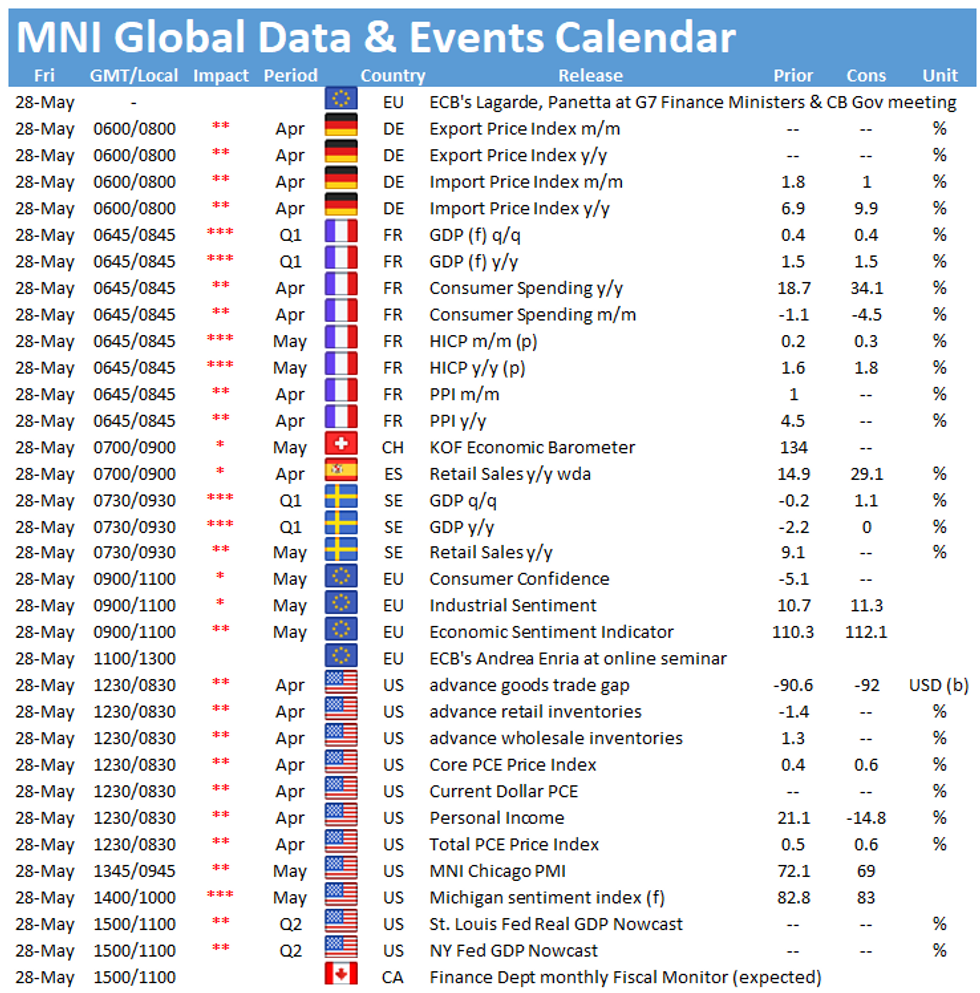

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.