-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Brexit & UK COVID Headlines Dominate

EXECUTIVE SUMMARY

- CAPITO WON'T GIVE BIDEN NEW INFRASTRUCTURE OFFER ON TUESDAY (BBG)

- UK'S JUNE 21 LOCKDOWN LIFTING SET TO BE DELAYED BY FORTNIGHT (THE TIMES)

- EU COMPROMISES ON NORTHERN IRELAND (THE TIMES)

- EU THREATENS SAUSAGE TRADE WAR WITH UK (TELEGRAPH)

- ANALYSTS SAY PBOC MAY INJECT LIQUIDITY AT APPROPRIATE TIME (CSJ)

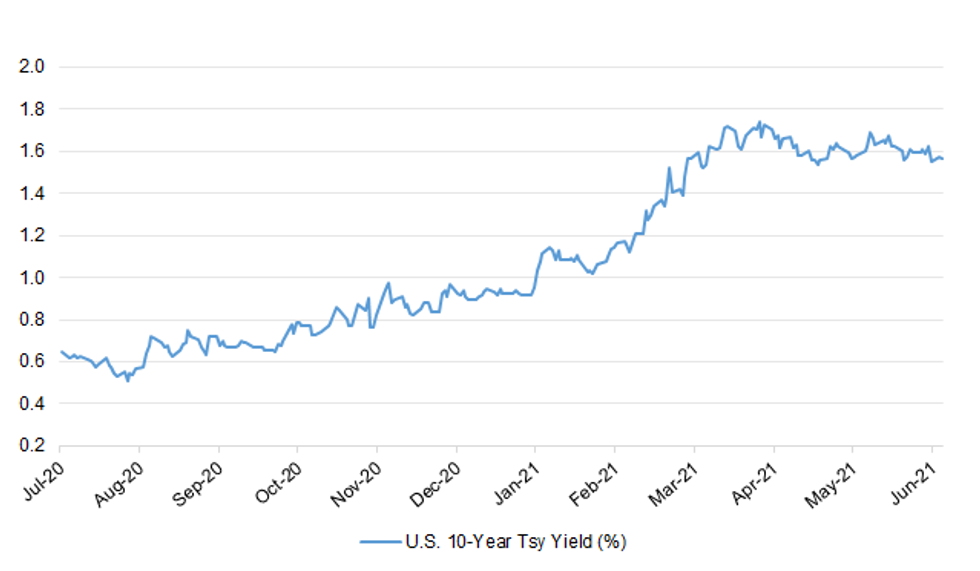

Fig. 1: U.S. 10-Year Tsy Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Britain's roadmap for easing lockdown could be delayed by a fortnight with cabinet ministers increasingly pessimistic after a "downbeat" briefing from Chris Whitty and Sir Patrick Vallance. The delay would enable all over-50s to be fully vaccinated and leave sufficient time for jabs to take effect before restrictions are lifted. Whitty, the chief medical officer for England, and Vallance, the chief scientific adviser, yesterday gave a briefing to ministers on the latest data that was described as "fairly grim". They emphasised concerns about the rate of transmission of new strains of coronavirus, such as the Indian variant, and that vaccinations did not provide 100 per cent protection. Millions of Britons remain unvaccinated. (The Times)

CORONAVIRUS: Only a handful of patients admitted to hospital with the Indian variant have had both doses of a coronavirus vaccine, the health secretary said yesterday. Matt Hancock told MPs that the vaccine was breaking what had been a "rock-solid link" between infections and hospital admissions. He said that as of last Thursday, out of 12,383 cases of the Delta variant first discovered in India, 464 had gone to A&E and 126 were admitted to hospital. (The Times)

CORONAVIRUS: Matt Hancock has warned Britons that summer holidays abroad are off for the "medium term" because of the need to protect domestic freedoms "at all costs". (Telegraph)

BREXIT: The EU will table concessions on Northern Ireland tomorrow but will warn Lord Frost that "patience is wearing thin" in Brussels over the government's "confrontational" attitude. Maros Sefcovic, a European Commission vice-president and the EU's lead negotiator, will meet the Brexit minister in London for talks. He will offer compromises aimed at avoiding a confrontation over the Northern Ireland protocol, which could threaten peace and British relations with Europe. Sefcovic, from Slovakia, will tell Frost that in return for the concessions, which are viewed by the EU as substantial, the government must implement the protocol "in good faith". "Unfortunately we cannot exclude that the UK will choose the more confrontational route," an EU official said. (The Times)

BREXIT: Brussels will start a trade war with Britain if Boris Johnson overrides the Brexit treaty so that Northern Irish shops can keep selling British sausages, a vice-president of the European Commission has warned. In an article for The Telegraph – published below – Maros Sefcovic said the EU would react "swiftly, firmly and resolutely" if Britain unilaterally extended the grace period in the Northern Ireland Protocol, which expires at the end of June. Britain has already unilaterally extended grace periods – on supermarket goods and parcels – earlier this year. The Telegraph understands that ministers are now considering, as a last resort, another unilateral extension for chilled meats, including sausages and mince. Any such action would enrage the EU, which hit the UK with legal action after the move on supermarket goods. (Telegraph)

BREXIT: The European Union is ready to consider tougher retaliatory measures if the U.K. government fails to implement its post-Brexit obligations over Northern Ireland, according to an EU official. The EU's patience is running thin and it could use all the tools at its disposal if the U.K. fails to put a stop to unilateral actions and threats, said the official who asked not to be named discussing confidential matters. The official declined to detail which tools could be used, saying that earlier infringement and arbitration procedures were not working. (BBG)

BREXIT: Rishi Sunak, the Chancellor, has vowed that the City will remain "competitive and dynamic" despite Brussels bid to steal its crown, in a private call with bank bosses. (Telegraph)

ECONOMY: Payment processor Barclaycard, which sees almost half of credit and debit card transactions, said consumer spending was 7.6% higher than in May two years ago. Pubs and restaurants were able to serve customers indoors from May 17, though only at reduced capacity. Barclaycard said spending at restaurants last month was still 54% below its level two years ago, while spending at pubs and bars was 19% lower. But this was an improvement from April when sales were down 74% and 67% respectively. Foreign travel remains highly restricted. Spending with airlines was 74% lower than in May 2019, little better than April. (RTRS)

EUROPE

ITALY/BTPS: Italy to sell the following at Jun 10 auction:

- E3.00-3.50bln of 3Y 0.00% Apr-24 BTP

- E2.00-2.50bln of 7Y 0.50% Jul-28 BTP

- E1.25-1.75bln of 20Y 1.80% Mar-41 BTP

SWEDEN: Swedish apartment prices rose by 13% in May from a year earlier, while house prices increased by 20%, according to statement from Svensk Maklarstatistik. Apartment prices rose 3% on a 3-month basis and 1% m/m. House prices rose 7% on a 3-month basis and by 2% m/m. (BBG)

U.S.

FED: The Federal Reserve announced Monday that it would publish the results of its annual stress test of the nation's largest banks on June 24. (RTRS)

FISCAL: The White House on Monday said it sees multiple paths forward to passing infrastructure legislation, even as talks have stalled between President Biden and Sen. Shelley Moore Capito (W.Va.), the top Republican negotiator in the Senate. Biden is expected to speak with Capito before leaving for Europe on Wednesday for a week, White House press secretary Jen Psaki said. The two last spoke on Friday, after which the administration said Biden was underwhelmed by the senator's latest proposal. "The time is not unlimited here ... nor is the president's willingness to compromise," Psaki said at a briefing Monday. "He made clear that the proposal the offer put on the table didn't meet his own bar. But we're very open to where the discussion goes from here." (The Hill)

FISCAL: Republican Senator Shelley Moore Capito says she will speak to President Biden on Tuesday but she is not planning another infrastructure counteroffer. Capito says that Republicans offered a "robust" infrastructure package. Separately, Republican Senator Roger Wicker says he doesn't see the GOP going much higher on infrastructure spending. (BBG)

CORONAVIRUS: Governor Andrew Cuomo said New York schools will no longer require children to wear masks outside, including during recess. He said any outside mask mandates will be left up to a local school district, a policy he said was approved by Centers for Disease Control and Prevention. The governor said lifting the outdoor mask mandate would allow the state to align camp and school guidance. (BBG)

CORONAVIRUS: Wall Street is getting more optimistic about persuading workers to come back to the office. Employers in the financial-services industry expect 61% of staff to be back by the end of September, up from 50% in March, according to a survey by the Partnership for New York City. About 14% of finance workers have already made their way back, the second-highest occupancy among industries surveyed, but still well behind real estate at 70%. Wall Street's biggest employers have begun to debut plans for cajoling their staff back to the office more than a year after the pandemic forced them to send workers home in droves. Bank of America Corp. has encouraged top managers in New York to begin returning to the office, while Goldman Sachs Group Inc. has told workers to plan to start coming in next week. (BBG)

POLITICS: Senate Minority Leader Mitch McConnell on Monday accused Senate Democrats of pushing a legislative agenda that's "designed to fail" in order to push senators wavering on eliminating the filibuster to get on board with the idea. (Forbes)

OTHER

GLOBAL TRADE: Global policy makers are crafting their international tax plan to make sure Amazon.com Inc. is included, even though the U.S. company's profit margin is below the 10% proposed threshold that would give other countries rights to collect revenue. Group of Seven finance ministers on Saturday voiced support for proposed rules reallocating a portion of profits above a 10% margin to be taxed in other countries, but Amazon has estimated a global operating margin of 7.1% this year. Two people familiar with the negotiations said Amazon will be included, with the particulars of how to design the policy to capture the company still being discussed. (BBG)

GLOBAL TRADE: A global shortage of semiconductors will continue to strain markets for months to come, Commerce Secretary Gina Raimondo said Monday. "For the next year or so, this will be a daily challenge," Raimondo said on CNBC's "Closing Bell." The scarcity of chips, which are required for an ever-growing variety of products, has already taken a heavy toll on American manufacturing, especially in the automobile industry. (CNBC)

GLOBAL TRADE: Industry groups from Japan and Finland will conduct joint research and development of sixth-generation communications technology, looking to lead the creation of 6G standards in a field increasingly influenced by Chinese companies. (Nikkei)

U.S./CHINA: A report on the origins of Covid-19 by a U.S. government national laboratory concluded that the hypothesis claiming the virus leaked from a Chinese lab in Wuhan is plausible and deserves further investigation, according to people familiar with the classified document. The study was prepared in May 2020 by the Lawrence Livermore National Laboratory in California and was drawn on by the State Department when it conducted an inquiry into the pandemic's origins during the final months of the Trump administration. (WSJ)

U.S./CHINA: China's top legislative body is set to pass a new anti-sanction law on Thursday, giving substantive legal backing and protection to the country's retaliatory measures against punitive actions by Western governments on Chinese officials and companies. State media announced on Monday night the latest move by the National People's Congress Standing Committee to counter the United States and its allies who have been piling pressure on Beijing over such issues as Hong Kong's freedoms and the treatment of the Uygur minority in Xinjiang. State broadcaster CCTV reported that the new law was aimed at offering a legal basis for the central government to take retaliatory measures against foreign sanctions, but stopped short of fleshing out details of the legislation. Monday's announcement of the new law appeared to build upon and give legal teeth to the "blocking rules" revealed in January which allow aggrieved parties to report damages to the commerce ministry and sue for compensation in Chinese courts. (SCMP)

U.S./CHINA/TAIWAN: The Biden administration is launching trade and investment talks with Taiwan, advancing U.S. ties with Taipei and likely adding to frictions with the island's nemesis, Beijing. Secretary of State Antony Blinken told a House committee on Monday about the plans for trade talks. "We are engaged in conversations with Taiwan, or soon will be—on some kind of framework agreement," Mr. Blinken said in response to a question from Rep. Andy Barr (R., Ky.) during the virtual hearing. Mr. Blinken declined to elaborate and referred questions about details to Katherine Tai, the U.S. trade representative, who wasn't at the hearing. Ms. Tai's office didn't respond to requests for comment. (WSJ)

GEOPOLITICS: Discussions are underway on including a reference to the Taiwan Strait in the joint statement to be issued after this month's Group of Seven summit as the U.S. and Japan seek a united front to counter Chinese pressure on the island, Nikkei has learned. Dealing with China-related issues -- including not only Taiwan, but also Hong Kong and alleged abuses in Xinjiang -- will be high on the agenda at the three-day event in the U.K. starting Friday, the first face-to-face meeting of leaders from the seven major economies since August 2019. Washington and Tokyo look to persuade other members to follow the communique from May's meeting of G-7 foreign ministers, which said members "underscore the importance of peace and stability across the Taiwan Strait, and encourage the peaceful resolution of cross-Strait issues." Doing so would mark the first explicit mention of the strait in a G-7 summit statement. The document is also expected to express "concern" about human rights abuses against China's Uyghur Muslim minority and the crackdown on pro-democracy activism in Hong Kong. (Nikkei)

CORONAVIRUS: China is discussing cooperating to produce Covid-19 vaccines with 10 countries while encouraging vaccine manufacturers to transfer technology to developing countries, according to state media Xinhua, citing an interview with the Ministry of Industry and Information Technology. Currently, three Chinese vaccine makers have carried out joint production with eight countries, MIIT's official Mao Junfeng said. The World Health Organization has called for the boosting of domestic vaccine production in low-income countries so they don't rely on importing shots from wealthier nations in an emergency. (BBG)

JAPAN: The biggest Covid-19 danger to the Tokyo Olympics is not the thousands of athletes and officials coming from abroad but whether it leads to greater mobility and socialising among local people, according to experts studying the event. Although public anxiety in Japan focuses on the 100,000 athletes, trainers, officials and reporters who have begun to arrive seven weeks before the games, epidemiologists said the greatest risk was a change in public behaviour. Their analysis helps to explain why Japan has pushed ahead with the Olympics despite widespread opposition, because Tokyo can limit public mixing if it ultimately decides to hold the games without spectators. "More than the number of people, it's how they behave. That's the issue," said a Japanese health administrator who has seen the official epidemiological advice. (FT)

AUSTRALIA: The Queensland government has launched a new flagship program, bringing together A$1.84 billion in measures designed to boost job creation in the state. Premier Annastacia Palaszczuk said the Queensland Jobs Fund gives industry the support they need to establish and grow their businesses in Queensland. "This will support new jobs across the state as we keep delivering Queensland's plan for economic recovery from COVID-19," she said. The Queensland Jobs Fund includes a new A$350 million Industry Partnership Program and existing programs that support job-creating industries like renewable energy, hydrogen, resource recovery, business, manufacturing and catalytic infrastructure. (BBG)

CANADA: Prime Minister Justin Trudeau is preparing to ease Canada's border restrictions for travelers who have been fully vaccinated against Covid- 19, according to people familiar with the discussions. The government is crafting plans to loosen the current 14-day isolation period for border-crossers who've had two vaccine doses, said the people, speaking on condition they not be identified. Travelers entering Canada would still be tested for the virus and may be required to quarantine for a shorter period. The plan is expected be announced within days, though the timing could shift, according to the people. It isn't clear when the changes would be implemented or whether Canada will open up its borders to non-U.S. travelers at the same time. (BBG)

CANADA: Ontario will loosen COVID-19 restrictions starting June 11, three days ahead of schedule, Premier Doug Ford announced on Monday, as infection rates continue to drift lower after a punishing third wave while vaccinations pick up pace. The province will enter step one of its reopening plan, allowing non-essential retail to operate at 15% capacity, outdoor dining with a maximum of four people per table, and outdoor gatherings of up to 10 people to take place. (RTRS)

TURKEY: U.S. President Joe Biden and Turkish President Tayyip Erdogan will meet to discuss Syria, Afghanistan and other regional issues next week and will also look at the "significant differences" between Washington and Ankara, the U.S. national security advisor said on Monday. (RTRS)

MEXICO: Mexico's central bank launches consultation to change rules for foreign exchange hedge auctions, Banxico said in statement on Monday. Amendment to rules seeks to establish daily settlement of forex hedges instead of current format of daily valuation of forex hedges Banxico will also seek to incorporate U.S. holiday calendar so that participating credit institutions improve their chances of adequately hedging currency risk. Consultation open at Banxico website until June 18. (BBG)

BRAZIL: Brazil Govt to Pay Emergency Aid Until July or August. "I don't think the best solution is to postpone it," Lower House speaker Arthur Lira told about the emergency aid payments at the opening of a London conference hosted by investment bank Bradesco BBI. Lira defended voting on a new permanent income program to replace the existing Bolsa Familia before the end of emergency aid payments. "We must have a viable project to be voted on before mid-year recess", he said. Congress wants administrative and tax reforms to move forward this week, the speaker added. (BBG)

BRAZIL: Brazil's lower house is expected to vote on the presidential decree on the privatization of state power utility Eletrobras this week or next week at the latest, the chamber's speaker Arthur Lira said on Monday. In an event hosted by the bank Bradesco BBI, Lira also said the lower house should vote on privatization of the Post Office at the end of this month or early in the second half of the year after lawmakers return from recess. (RTRS)

RUSSIA: Russia's annual consumer inflation accelerated to 6.0% in May, overshooting expectations and adding arguments for tighter monetary policy days before the central bank's rate-setting meeting, data showed on Monday. Inflation, the central bank's main area of responsibility, accelerated to its highest since October 2016 when the central bank's key interest rate was at 10%. The data from the statistics service Rosstat comes ahead of the bank's board meeting due on Friday where it is expected to raise the key rate for the third time in a row, by 25 or even 50 basis points from 5%. The year-on-year increase in the consumer price index was above analysts' expectations for a rise of 5.8% in a Reuters poll. (RTRS)

RUSSIA: Secretary of State Antony Blinken said on Monday the completion of the Russian Nord Stream 2 natural gas pipeline was a "fait accompli", defending the U.S. decision to waive some sanctions and vowing a response if Moscow tries to use gas as a weapon. A State Department report sent to Congress in May concluded that Nord Stream 2 AG - the company behind the pipeline to Germany - and its CEO, Matthias Warnig, an ally of Russian President Vladimir Putin, engaged in sanctionable activity. But Blinken waived those sanctions, saying that this was in the U.S. national interest. (RTRS)

RUSSIA: Joe Biden's national security adviser, Jake Sullivan, defended the U.S. president's decision to meet next week with Russian President Vladimir Putin, saying it's the best way to ascertain the Kremlin's intentions. Biden will meet June 16 with Putin in Geneva, following summits with Group of Seven and NATO allies beginning Thursday, where the U.S. president plans to consult on his meeting with the Russian leader, Sullivan said. Biden "will go into this meeting with the wind at his back," Sullivan said Monday during a White House press briefing. (BBG)

RUSSIA: President Joe Biden has invited Ukrainian President Volodymyr Zelensky to visit the White House later this summer, national security adviser Jake Sullivan said on Monday. Sullivan said Biden discussed the upcoming visit during a call with Zelensky earlier Monday afternoon as part of a planned discussion ahead of Biden's upcoming trip to Europe. Zelensky confirmed the invitation, tweeting, "Thank you @POTUS @JoeBiden for inviting me to visit the @WhiteHouse in July during our phone conversation. I look forward to this meeting to discuss ways to expand strategic cooperation between Ukraine and #USA." Monday's call came days after Zelensky told Axios he was imploring Biden to meet with him in-person before the President meets with Russian President Vladimir Putin in Geneva next week. The White House appears to have turned down Zelensky's request for an in-person meeting ahead of the summit. (CNN)

RUSSIA: Russia's space chief threatened Monday to withdraw from the International Space Station program if U.S. sanctions against Moscow's space entities are "not lifted in the near future." "If the sanctions against Progress and TsNIIMash remain and are not lifted in the near future, the issue of Russia's withdrawal from the ISS will be the responsibility of the American partners," Roscosmos Director General Dmitry Rogozin said during a Russian parliament hearing on Monday, according to an NBC translation. (CNBC)

RUSSIA: Russia, in response to Canadian sanctions imposed in March, has decided to ban nine Canadian citizens from entering its territory indefinitely, the Russian foreign ministry said on Monday. Canada on March 24 imposed new sanctions on nine Russian officials over "gross and systematic violations of human rights in Russia," prompting the Kremlin to vow a response. (RTRS)

OIL: The U.S. Department of Transportation's pipeline regulator on Monday sent an advisory to oil and gas pipeline operators directing them to update their inspection and maintenance plans for curbing the release of potent greenhouse gas methane, as part of the Biden administration's broader effort to combat climate change. The DOT's Pipeline and Hazardous Materials Safety Administration (PHMSA) submitted the advisory bulletin to prod companies to begin to comply with the PIPES Act, a law signed at the end of 2020, that created dozens of new regulatory mandates for the agency including the oversight of methane leaks by natural gas pipelines and transmission systems. (RTRS)

CHINA

PBOC: The PBOC may increase liquidity injection to offset a possible gap resulting from government bond issuances, companies buying forex for paying dividends and quarter-end regulatory compliances, the China Securities Journal reported citing analysts. The planned issuance of China Government Bonds and local government bonds this week exceeded CNY470 billion, a record high this year, while Chinese companies listed overseas will be in peak season for paying dividends, the newspaper said citing Xie Yaxuan, the chief analyst at China Merchants Securities. The PBOC may release more reverse repos or roll over the maturing MLFs with excess added, the newspaper said citing Song Xuetao, chief analyst of Tianfeng Securities. (MNI)

FOREX RESERVES: China's forex reserves stood at USD3.2218 trillion at the end of May, an increase of 0.74% from the previous month, driven by the recent appreciation of non-U.S. currencies, the rise in major financial asset prices and the rapid growth in exports, the Economic Information Daily reported citing the State Administration of Foreign Exchange. Looking forward, the country's forex supply and demand will be basically balanced as the yuan fluctuates, while the continued recovery supports the stability of forex reserves, the daily said citing Wen Bin, chief researcher of China Minsheng Bank. (MNI)

ECONOMY: China's surging imports and exports last month showed the laws of economics are stronger than the will of U.S. politicians who advocate decoupling, and that its manufacturing cannot be suppressed by increasing tariffs, the Global Times said in an editorial. Exports to the U.S. rose 38.9% in the first five months while trade with India expanded by 70%, despite strained political relations, the newspaper said. China has become the most stable global production center as other capacities and commodities became more volatile, the newspaper said. If countries weaken cooperation with China for political purposes, they will only give away opportunities to others and incur more losses, the newspaper said. (MNI)

ECONOMY: Despite China's quick recovery from the pandemic, many local graduates are choosing state-backed jobs, or postponing their entry into the workforce. China was the only major economy to grow in 2020. But more than one year since the pandemic began, the class of 2021 still faces pressure from high housing costs, international travel restrictions and an intensely competitive environment. In the last month, CNBC spoke with more than ten local and international students of mainland China-based higher education programs. Many of the sources requested anonymity so their names would not be associated with a foreign news organization. While these anecdotes don't equate qualitative research, they reflect general employment trends for what is expected to be a record 9.09 million graduates in China this year. (CNBC)

OVERNIGHT DATA

JAPAN Q1, F GDP -1.0% Q/Q; MEDIAN -1.2%; FLASH -1.3%

JAPAN Q1, F GDP ANNUALISED -3.9% Q/Q; MEDIAN -5.0%; FLASH -5.1%

JAPAN Q1, F GDP NOMINAL -1.3% Q/Q; MEDIAN -1.6%; FLASH -1.6%

JAPAN Q1, F GDP DEFLATOR -0.1% Y/Y; MEDIAN -0.2%; FLASH -0.2%

JAPAN Q1, F GDP PRIVATE CONSUMPTION -1.5% Q/Q; MEDIAN -1.4%; FLASH -1.4%

JAPAN Q1, F GDP BUSINESS SPENDING -1.2% Q/Q; MEDIAN -1.2%; FLASH -1.4%

JAPAN Q1, F INVENTORY CONTRIBUTION % GDP 0.4%; MEDIAN 0.3%; FLASH 0.3%

JAPAN Q1, F NET EXPORTS CONTRIBUTION % GDP -0.2%; MEDIAN -0.2%; FLASH -0.2%

JAPAN APR BOP CURRENT ACCOUNT BALANCE +Y1.3218TN; MEDIAN +Y1.5006TN; MAR +Y2.6501TN

JAPAN APR BOP CURRENT ACCOUNT BALANCE ADJ +Y1.5528TN; MEDIAN +Y1.5690TN; MAR +Y1.6965TN

JAPAN APR TRADE BALANCE BOP BASIS +Y289.5BN; MEDIAN +Y389.6BN; MAR +Y983.1BN

JAPAN APR LABOUR CASH EARNINGS +1.6% Y/Y; MEDIAN +0.8%; MAR +0.6%

JAPAN APR REAL CASH EARNINGS +2.1% Y/Y; MEDIAN +1.4%; MAR +0.8%

JAPAN MAY BANK LENDING INCL-TRUSTS +2.9% Y/Y; APR +4.8%

JAPAN MAY BANK LENDING EX-TRUSTS +2.2% Y/Y; MEDIAN +4.3%

AUSTRALIA MAY NAB BUSINESS CONFIDENCE 20; APR 23

AUSTRALIA MAY NAB BUSINESS CONDITIONS 37; APR 32

The survey continues to point to strong outcomes in the business sector, with business conditions resetting their record high for the second month in a row and forward orders also holding at a record level. The employment, profitability and trading sub-components all also reset last month's highs – with trading conditions now at exceptional levels. By state and industry, the strength in activity is evident everywhere. While business confidence edged lower, it too remains elevated after reaching a record high last month. The survey measure of reported capex rose further suggesting that the strong rise over 2021 is more than just a rebound from disruptions to activity and uncertainty during 2020 and that high rates of capacity utilisation, alongside healthy cashflow and a strong outlook, is flowing through to investment decisions. Indeed, capacity utilisation stayed near its record high set last month. Taken together the survey results over the past two months point to further growth in the economy in Q2, following last week's national accounts which showed GDP has now risen above its pre-COVID level. The breadth of the strength in the survey is encouraging, as it points to ongoing recovery in the sectors that continue to lag in the national accounts, as well as further growth in those areas that have already recovered. (NAB)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 110.7; PREV. 111.4

Consumer confidence fell another 0.6% as the lockdown in Melbourne was extended until at least 10 June. Confidence fell by 2.4% in Melbourne and by 0.6% in Brisbane, but it was up 4.3%in Sydney. The emergence of a more infectious strain of COVID is raising concerns that the lockdown could be extended again. This could have a more lasting impact on confidence than we have seen with recent snap lockdowns. Still, the fact that consumers became more confident about future financial and economic conditions suggests even a longer shutdown may not have a permanently dampening effect on overall sentiment. (ANZ)

SOUTH KOREA APR BOP CURRENT ACCOUNT BALANCE +$1.9099BN; MAR +$7.8160BN

SOUTH KOREA APR BOP GOODS BALANCE +$4.5593BN; MAR +$7.9204BN

UK MAY BRC SALES LIKE-FOR-LIKE +18.5% Y/Y; APR +39.6%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUES; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2553% at 09:31 am local time from the close of 2.2790% on Monday.

- The CFETS-NEX money-market sentiment index closed at 37 on Monday vs 43 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3909 TUES VS 6.3963

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a second day at 6.3909 on Tuesday, compared with the 6.3963 set on Monday.

MARKETS

SNAPSHOT: Brexit & UK COVID Headlines Dominate

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 40.09 points at 28979.15

- ASX 200 up 11.908 points at 7293.8

- Shanghai Comp. down 18.291 points at 3581.25

- JGB 10-Yr future up 7 ticks at 151.61, yield down 0.8bp at 0.075%

- Aussie 10-Yr future up 1.5 ticks at 98.440, yield down 1.3bp at 1.625%

- U.S. 10-Yr future +0-01+ at 132-05, yield down 0.85bp at 1.560%

- WTI crude down $0.59 at $68.64, Gold down $2.79 at $1896.51

- USD/JPY up 15 pips at Y109.40

- CAPITO WON'T GIVE BIDEN NEW INFRASTRUCTURE OFFER ON TUESDAY (BBG)

- UK'S JUNE 21 LOCKDOWN LIFTING SET TO BE DELAYED BY FORTNIGHT (THE TIMES)

- EU COMPROMISES ON NORTHERN IRELAND (THE TIMES)

- EU THREATENS SAUSAGE TRADE WAR WITH UK (TELEGRAPH)

- ANALYSTS SAY PBOC MAY INJECT LIQUIDITY AT APPROPRIATE TIME (CSJ)

BOND SUMMARY: Core FI A Touch Firmer In Asia

A lack of meaningful headlines and nothing in the way of notable broader market flow has allowed T-Notes to trade within the confines of a 0-02 range overnight, with the contract last dealing +0-01 at 132-04+. Cash Tsys print unchanged to 1.0bp richer across the curve, with some light bull flattening evident. We should highlight that the NY-Asia crossover saw GOP Senator Capito stress that the GOP is not going to present a further counter-offer to President Biden's fiscal spending proposals ahead of another meeting on Tuesday.

- JGB futures held a narrow range during the Tokyo morning, dealing either side of unchanged, before nudging a little higher in the afternoon to last deal +6. The major cash JGB benchmarks mostly trade 0.5bp to 1.0bp richer across the curve, although the very extremes of the curve (the wings) are little changed. A light bid crept into the space despite a less than inspiring round of 30-Year supply all told, as there wasn't any signs of deterioration vs. last month's 30-Year JGB auction. The low price topped broader dealer estimates. The tail width was relatively steady when compared to the previous round of 30-Year supply. The cover ratio nudged higher when compared to last month's offering but remains somewhat low (a reminder that last month's cover represented a multi-year low for 30-Year JGB supply). Elsewhere, domestic wage & final Q1 GDP data comfortably topped expectations this morning.

- Aussie bond futures have held to very narrow ranges thus far, with YM +0.5 at typing and XM +1.0. Cash ACGBs have twist flattened, with 30s running 3.0bp richer on the day. The latest NAB business survey saw a modest downtick in the confidence component, while conditions moved to a fresh record high. The details of the release revealed that "the survey continues to point to strong outcomes in the business sector, with business conditions resetting their record high for the second month in a row and forward orders also holding at a record level. The employment, profitability and trading sub-components all also reset last month's highs - with trading conditions now at exceptional levels." AOFM CEO Nicholl spoke at a private event, with BBG noting that the AOFM will be paring back the information it provides to the market on issuance plans, in order to gain more flexibility as the economy recovers from the pandemic.

JGBS AUCTION: Japanese MOF sells Y731.8bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y731.8bn 30-Year JGBs:- Average Yield 0.693% (prev. 0.645%)

- Average Price 100.15 (prev. 101.36)

- High Yield: 0.697% (prev. 0.649%)

- Low Price 100.05 (prev. 101.25)

- % Allotted At High Yield: 5.8287% (prev. 67.9449%)

- Bid/Cover: 3.388x (prev. 3.117x)

AUSSIE BONDS: The AOFM sells A$150mn of the 2.50% 20 Sep '30 I/L Bond, issue #CAIN408

The Australian Office of Financial Management (AOFM) sells A$150mn of the 2.50% 20 September 2030 I/L Bond, issue #CAIN408:- Average Yield: -0.6452% (prev. -0.4381%)

- High Yield: -0.6400% (prev. -0.4325%)

- Bid/Cover: 3.6067x (prev. 4.7067x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 60.8% (prev. 100%)

- bidders 42 (prev. 34), successful 7 (prev. 10), allocated in full 4 (prev. 10)

EQUITIES: Lacking Direction

Another mixed session for equities in the Asia-Pac region after a mixed finish for US equities. In Japan major indices are hovering around neutral levels after giving back early gains, Q1 GDP beat expectations earlier today, falling at a slower pace than expected. Markets in China in minor negative territory, while in Taiwan the Taiex is flat ahead of trade and inflation data. In the US futures are higher, the Nasdaq leading the way thanks to a boost from Biogen after its Alzheimer's drug was approved, while gains are moderated by international corporation tax plans.

OIL: Crude Futures Retreat From 2018 High

Oil slipped in Asia-Pac trade on Tuesday after posting declines on Monday as markets push pause on the recent rally; WTI is down $0.58 from settlement levels at $68.65 while Brent is down $0.62 at $70.87. There were some positive comments from OPEC SecGen Barkindo yesterday, he said the group expected to see further inventory drawdowns in the months ahead and noted that vaccine rollouts and the "massive fiscal stimulus" aided an upbeat outlook, but that uneven global vaccine availability, high inflation and continued COVID-19 outbreaks were continued risks to oil demand. Markets will watch for any progress in talks with Iran, discussions are said to be at a decisive point, as well as US API stockpile data.

GOLD: Testing $1,900/oz

Spot gold last deals little changed at $1,895/oz after adding roughly $10/oz on Monday. Our weighted U.S. real yield metric nudged higher on Monday, while the broader DXY softened a touch, providing conflicting inputs for bullion, although the latter has ticked away from Monday's lows. Bulls have ultimately failed to force a fresh, sustained break above $1,900/oz, despite a couple of shallow looks above. The technical picture remains unchanged as a result.

FOREX: GBP Slips In Quiet Asia-Pac Trade

Sterling underperformed its G10 peers in a lacklustre Asia-Pac session as the Times suggested that the UK might have to delay lifting Covid-19 restrictions by a fortnight, following a "downbeat" briefing on the local Covid-19 situation from chief medical officers. Bubbling trade tensions between London and Brussels provided another source of worry. Cable clawed back Monday's losses, with the greenback's buoyance helping the move.

- USD and CHF were broadly higher, but JPY lagged behind its safe haven peers, as Japan's final Q1 GDP numbers were revised higher, beating consensus forecasts.

- NOK traded on a softer footing as crude oil slipped, but CAD was unfazed.

- The PBOC set the central USD/CNY mid-point at CNY6.3909, 6 pips above sell-side estimate. Offshore yuan was happy to hug a narrow range.

- German ZEW Survey & industrial output, final EZ GDP as well as speeches from BoE's Haldane & BoJ's Amamiya headline the global economic docket today.

FOREX OPTIONS: Expiries for Jun08 NY cut 1000ET (Source DTCC)

- EUR/USD: E$1.2055-70(E1.6bln-EUR puts), $1.2175-85(E827mln-EUR puts), $1.2200(E952mln)$1.2225-35(E626mln), $1.2265-75(E631mln-EUR puts), $1.2300(E759mln-EUR puts)

- USD/JPY: Y108.45-50($1.3bln), Y109.00-05($867mln-USD puts), Y109.50($1.1bln-USD puts)

- AUD/USD: $0.7700-10(A$617mln-AUD puts), $0.7745-50(A$893mln)

- NZD/USD: $0.7150(N$601mln-NZD puts), $0.7260(N$1.2bln-NZD puts)

- USD/MXN: Mxn19.87($575mln-USD puts)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.